- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Why Huntington Ingalls, Orbital ATK, and TransDigm All Surged This Week презентация

Содержание

- 1. Why Huntington Ingalls, Orbital ATK, and TransDigm All Surged This Week

- 2. Three Aerospace & Defense Stocks – Three

- 3. What: Huntington Ingalls (NYSE: HII) spiked

- 4. So What: Fiscal Q2 revenues eked out

- 5. Now What: Now here’s the best part:

- 6. What: Text Orbital ATK (NYSE: OA) also

- 7. So What: Sales for the quarter grew

- 8. Now What: Orbital ATK even raised guidance.

- 9. What: TransDigm (NYSE: TDG) was trickier,

- 10. So What: Fiscal Q3 sales grew 13%,

- 11. Now What: TransDigm’s numbers fell short of

- 12. This $19 trillion industry could destroy the

Слайд 2Three Aerospace & Defense Stocks – Three Winners

Three of America’s biggest

names in aerospace and defense reported earnings this week.

The crowd went wild.

The crowd went wild.

Слайд 3What:

Huntington Ingalls (NYSE: HII) spiked after reporting earnings Thursday, rising as

much as 9.5% before settling down to a 4.4% gain.

Слайд 4So What:

Fiscal Q2 revenues eked out a 1.5% gain, rising to

$1.75 billion and matching expectations

Profitability widened dramatically. Operating profit margins rose 490 basis points, to land at 15.4%

Earnings, as a result, shot 57% higher, hitting $3.20 per share, and beating expectations with a stick

Profitability widened dramatically. Operating profit margins rose 490 basis points, to land at 15.4%

Earnings, as a result, shot 57% higher, hitting $3.20 per share, and beating expectations with a stick

Слайд 5Now What:

Now here’s the best part:

For every $1 of revenue Huntington

collected last quarter, it added $2.60 in new contracts.

Today, Huntington boasts $24.3 billion worth of backlogged work.

At its new-and-improved 15.4% profit margin, that should yield beaucoup profits for years to come.

Today, Huntington boasts $24.3 billion worth of backlogged work.

At its new-and-improved 15.4% profit margin, that should yield beaucoup profits for years to come.

Слайд 6What:

Text

Orbital ATK (NYSE: OA) also reported earnings Thursday. Orbital stock’s 6.9%

gain eclipsed even Huntington’s strong performance.

Слайд 7So What:

Sales for the quarter grew 58%, to $1.13 billion

Operating profits

on those sales leapt 75%, to $126 million

Earnings per diluted share grew 27%, to $1.22

Earnings per diluted share grew 27%, to $1.22

Слайд 8Now What:

Orbital ATK even raised guidance.

By year-end management expects to have

produced:

Revenues of up to $4.5 billion

And earnings per share of $4.70

If it hits those targets, the stock is selling for a 16 P/E right now – nearly 20% cheaper than the average aerospace stock.

Revenues of up to $4.5 billion

And earnings per share of $4.70

If it hits those targets, the stock is selling for a 16 P/E right now – nearly 20% cheaper than the average aerospace stock.

Text

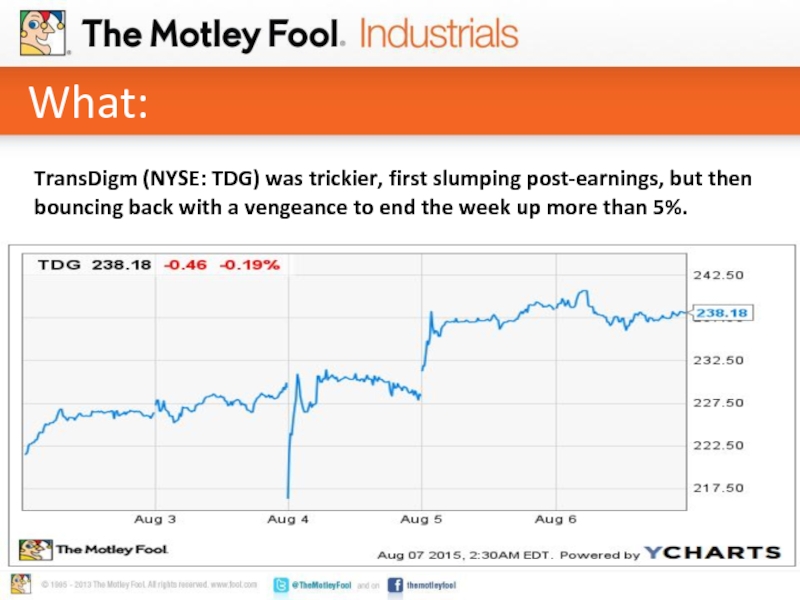

Слайд 9What:

TransDigm (NYSE: TDG) was trickier, first slumping post-earnings, but then bouncing

back with a vengeance to end the week up more than 5%.

Слайд 10So What:

Fiscal Q3 sales grew 13%, to $691 million

Cash flow increased

7%, to $373.4 million

And profitability returned after last year’s Q3 net loss. TransDigm earned $1.75 per share

And profitability returned after last year’s Q3 net loss. TransDigm earned $1.75 per share

Text

Слайд 11Now What:

TransDigm’s numbers fell short of analyst targets (explaining the initial

share price slump).

But management quickly raised guidance on revenues and earnings, allaying investor concerns – and helping TransDigm to bounce back quickly.

But management quickly raised guidance on revenues and earnings, allaying investor concerns – and helping TransDigm to bounce back quickly.

Text

Слайд 12This $19 trillion industry could destroy the Internet One bleeding-edge technology is

about to put the World Wide Web to bed. And if you act quickly, you could be among the savvy investors who enjoy the profits from this stunning change. Experts are calling it the single largest business opportunity in the history of capitalism... The Economist is calling it "transformative"... But you'll probably just call it "how I made my millions." Don't be too late to the party -- click here for one stock to own when the Web goes dark.