- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

What CEOs Are Saying About the Economy презентация

Содержание

- 1. What CEOs Are Saying About the Economy

- 2. Is a recession coming? Stock markets

- 3. Vail Resorts: The U.S. consumer remains strong

- 4. Vail Resorts is seeing solid demand “The

- 5. Paychex is seeing healthy hiring trends

- 6. Paychex thinks small business formation is improving

- 7. PepsiCo is facing volatility in international markets

- 8. Main questions for investors Volatility is

- 9. Main questions for investors Yum! Brands

- 10. Main questions for investors But China

- 11. Key takeaways Vail Resorts is seeing continued

- 12. 3 Companies Poised to Explode When Cable

Слайд 2Is a recession coming?

Stock markets have been particularly volatile lately. This

is mostly due to economic uncertainty coming from emerging markets in general and China in particular. Many analysts are concerned about the possibility of a global recession in the coming months.

Let’s listen to what top executives from Vail Resorts (NYSE:MTN), Paychex (NASDAQ:PAYX), PepsiCo (NYSE:PEP), and Yum! Brands (NYSE:YUM) have to say about the health of the global economy.

Let’s listen to what top executives from Vail Resorts (NYSE:MTN), Paychex (NASDAQ:PAYX), PepsiCo (NYSE:PEP), and Yum! Brands (NYSE:YUM) have to say about the health of the global economy.

Слайд 3Vail Resorts: The U.S. consumer remains strong

“We are not seeing any

softening in consumer interest. I think we had a fairly strong summer season as well.”

Rob Katz - CEO - Vail Resorts

Rob Katz - CEO - Vail Resorts

Слайд 4Vail Resorts is seeing solid demand

“The U.S. economy remains robust, particularly

for domestic upper income vacation travelers who produce over 85% of our destination visitation. We have seen strong demand for the upcoming season with the successful season pass sales to-date and from lodging bookings, which have been strong across our resorts.”

“These factors combined create an environment where we expect to drive visitation, pricing, and yield growth across our business.”

Michael Barkin - CFO - Vail Resorts

“These factors combined create an environment where we expect to drive visitation, pricing, and yield growth across our business.”

Michael Barkin - CFO - Vail Resorts

Слайд 5Paychex is seeing healthy hiring trends

“Particularly among small businesses under

50 employees, we’re seeing continued better employment growth than pre-recession levels of 2004 and so -- and it’s down a little bit from last year, but it’s consistently above that level.”

Martin Mucci - President and CEO - Paychex

.

Martin Mucci - President and CEO - Paychex

.

Слайд 6Paychex thinks small business formation is improving

“So we’re feeling like a

steady improvement in small business formation and employment hiring and I would say the sales folks certainly felt that way.”

Martin Mucci - President and CEO - Paychex

Martin Mucci - President and CEO - Paychex

Слайд 7PepsiCo is facing volatility in international markets

“Now turning to our international

market. In our developing and emerging markets, although we continue to face volatile and challenging macros in a number of these markets, we’re managing what we can control to stay competitive in this marketplace, and we continue to see good growth in a number of these markets.”

Indra Nooyi - Chairman and CEO - PepsiCo

Indra Nooyi - Chairman and CEO - PepsiCo

Слайд 8Main questions for investors

Volatility is here to stay

“Whenever there is volatility

in the marketplace, the consumer behavior does reflect some of this volatility. The good news is that we’re not luxury items or high ticket items; we are basic food and beverage items. So, we see a slowdown but not significant. Having said that, I think the most important thing is we have a portfolio that we can play between developed, and developing, and emerging markets, and somehow we balance the portfolio to deliver the results, but the macro volatility is here to stay.”

Indra Nooyi - Chairman and CEO - PepsiCO

Indra Nooyi - Chairman and CEO - PepsiCO

Слайд 9Main questions for investors

Yum! Brands is facing heavy headwinds in China

“Extraordinary

volatility in financial markets, the surprise currency devaluation, and overall softer economic conditions are weighing more heavily on the higher ticket casual dining sector in China.”

Pat Grismer - CFO - Yum! Brands

Pat Grismer - CFO - Yum! Brands

Слайд 10Main questions for investors

But China is still growing

“Let me start by

being really clear. We all and I personally take full accountability for our results in China. And while there is clearly a macro softening going on including headwinds from unexpected foreign exchange pressures...the simple facts are that the economy there is still growing and there is every reason and no excuses to why we should not perform better.”

Greg Creed - Chief Executive Officer - Yum! Brands

Greg Creed - Chief Executive Officer - Yum! Brands

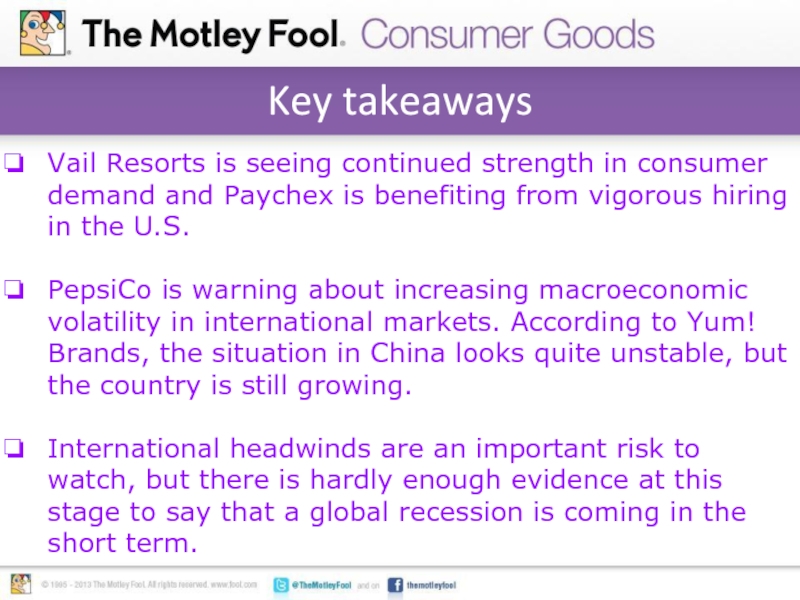

Слайд 11Key takeaways

Vail Resorts is seeing continued strength in consumer demand and

Paychex is benefiting from vigorous hiring in the U.S.

PepsiCo is warning about increasing macroeconomic volatility in international markets. According to Yum! Brands, the situation in China looks quite unstable, but the country is still growing.

International headwinds are an important risk to watch, but there is hardly enough evidence at this stage to say that a global recession is coming in the short term.

PepsiCo is warning about increasing macroeconomic volatility in international markets. According to Yum! Brands, the situation in China looks quite unstable, but the country is still growing.

International headwinds are an important risk to watch, but there is hardly enough evidence at this stage to say that a global recession is coming in the short term.

Слайд 123 Companies Poised to Explode When Cable Dies Cable is dying. And

there are 3 stocks that are poised to explode when this faltering $2.2 trillion industry finally bites the dust. Just like newspaper publishers, telephone utilities, stockbrokers, record companies, bookstores, travel agencies, and big box retailers did when the Internet swept away their business models. And when cable falters, you don't want to miss out on these 3 companies that are positioned to benefit. Click here for their names. Hint: They're not the ones you'd think!