- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

The equity. Implications of taxation. Tax incidence. (Lecture 11-19) презентация

Содержание

- 1. The equity. Implications of taxation. Tax incidence. (Lecture 11-19)

- 2. The Three Rules of Tax Incidence

- 3. The Statutory Burden of a Tax Does

- 4. Consumer and producer tax burden b.samojlik 2015

- 5. Discription of panels (a) &(b) On the

- 6. Burden of the Tax on Consumers and

- 7. II.The Side of the Market on Which

- 8. Parties with Inelastic Demand Bear Taxes; b.samojlik 2015

- 9. Parties with Inelastic Demand Bear Taxes Perfectly

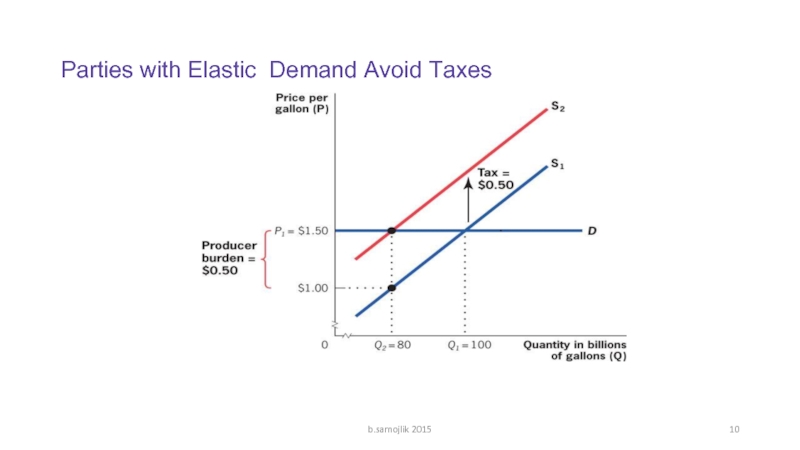

- 10. Parties with Elastic Demand Avoid Taxes b.samojlik 2015

- 11. Parties with Perfectly Elastic Demand Avoid Taxes

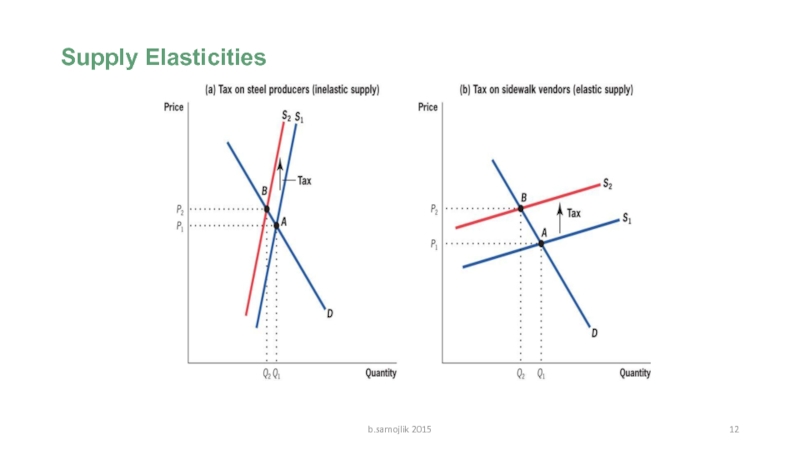

- 12. Supply Elasticities b.samojlik 2015

- 13. Supply Elasticity There is two supply cases.

- 14. Parties with Inelastic Supply Bear Taxes;

- 15. Recap: The statutory burden of a tax

- 16. Tax Inefficiencies and Optimal Taxation b.samojlik 2015

- 17. Optimal income and commodity taxation 1 Optimal

- 18. Max-min rule as a standard of rational

- 19. Economic function of taxes Which factor

- 20. Type of taxes Direct taxes / on

- 21. Optimal taxation of income b.samojlik 2015

- 22. The importance of the PIT revenues in the EU/% of total tax revenues/ b.samojlik 2015

- 23. Taxation of income in the UE There

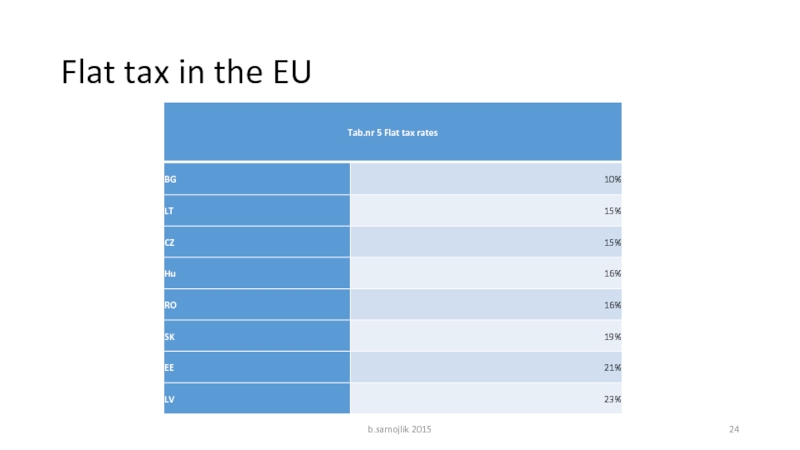

- 24. Flat tax in the EU b.samojlik 2015

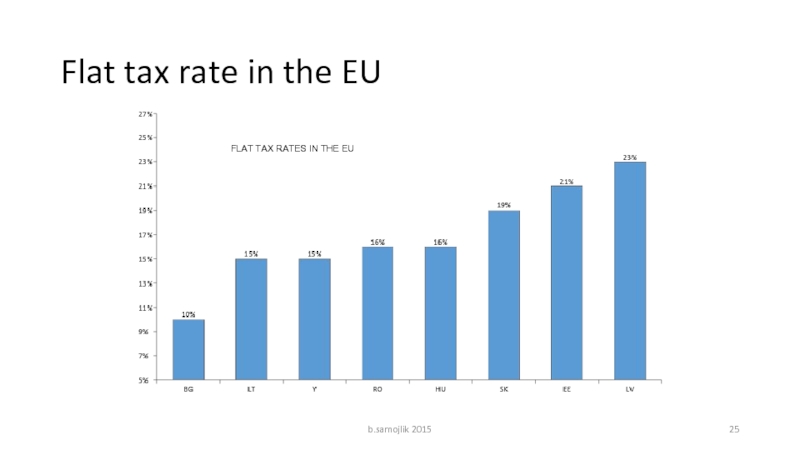

- 25. Flat tax rate in the EU b.samojlik 2015 FLAT TAX RATES IN THE EU

- 26. Other countries with a flat tax

- 27. Laffer curve b.samojlik 2015

- 28. The interpretation of Laffer curve If the

- 29. "there is no sign of Laffer-type behavioral

- 30. Flat tax rate Flat tax rates on

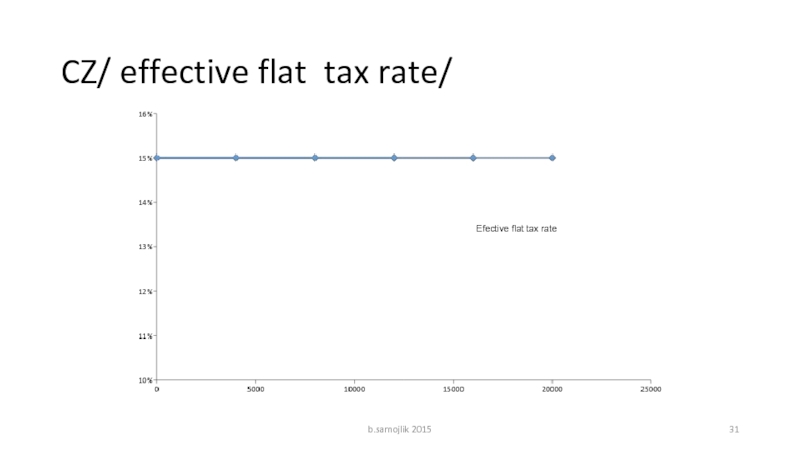

- 31. CZ/ effective flat tax rate/ Efective flat tax rate b.samojlik 2015

- 32. effective flat tax rate effective flat tax

- 33. Flat income tax Low income Average

- 34. Flat income tax At the flat tax

- 35. Effective tax rate/ETR/ taxes paid/income F.e.: income=

- 36. Progressive income tax Low income

- 37. Progressive income tax In the case of

- 38. Efficiency of public sector b.samojlik 2015

- 39. Efficiency of public sector use of tax

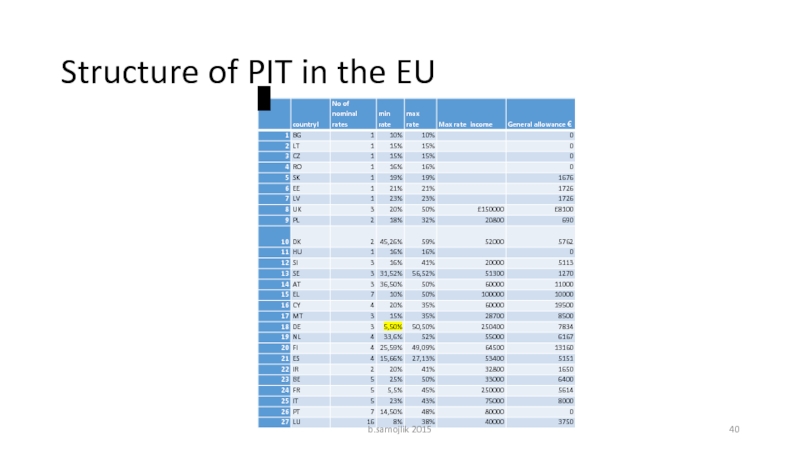

- 40. Structure of PIT in the EU . b.samojlik 2015

- 41. PIT in the EU countries PIT in

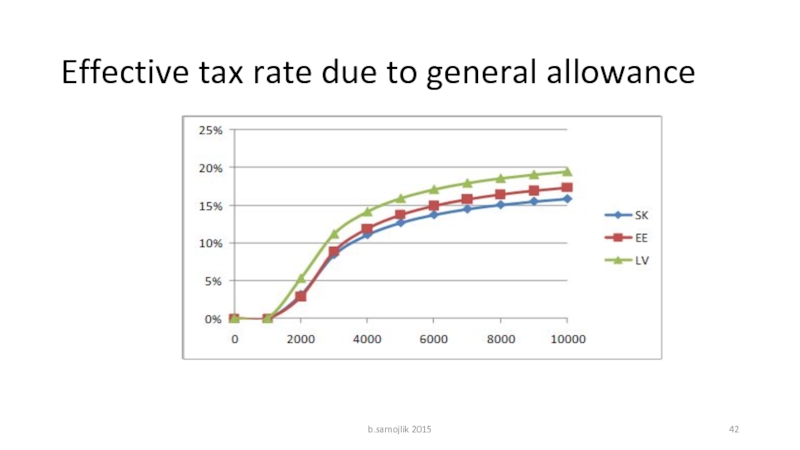

- 42. Effective tax rate due to general allowance b.samojlik 2015

- 43. The importance od sizable general allowance

- 44. LU income tax structure b.samojlik 2015

- 45. Taxation of income in increasing brackets/1908€/ in LU b.samojlik 2015

- 46. LU taxation of income LU taxation of

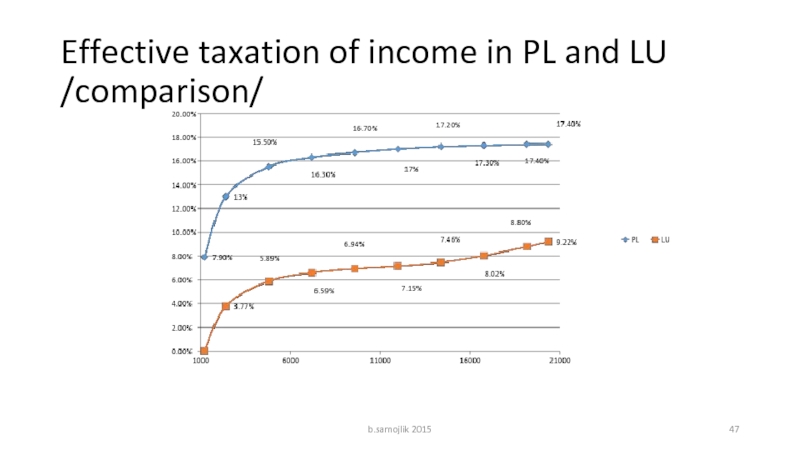

- 47. Effective taxation of income in PL and LU /comparison/ b.samojlik 2015

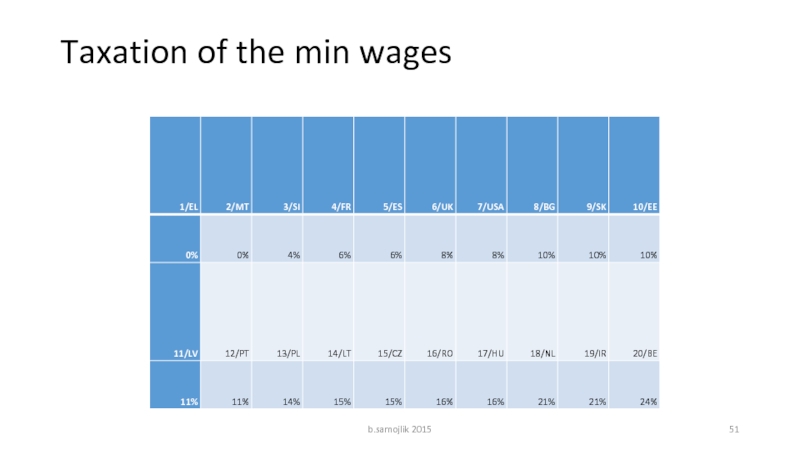

- 48. Effective taxation of income in PL and

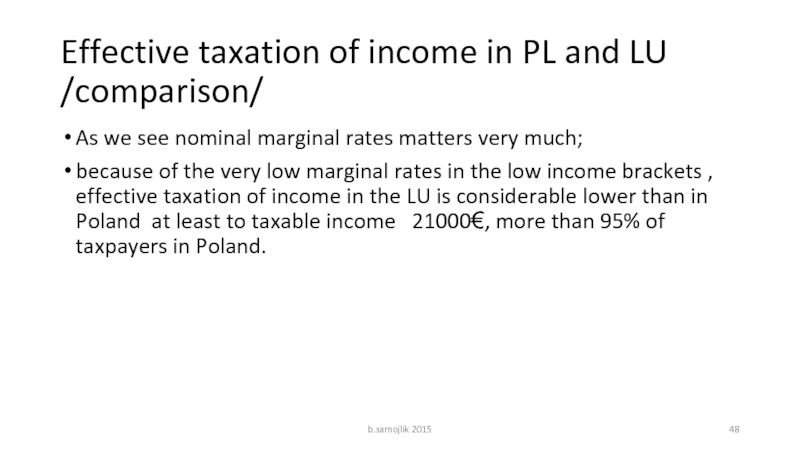

- 49. Effective taxation of income on the level of PPS per capita b.samojlik 2015

- 50. Taxation of the PPS per capita income

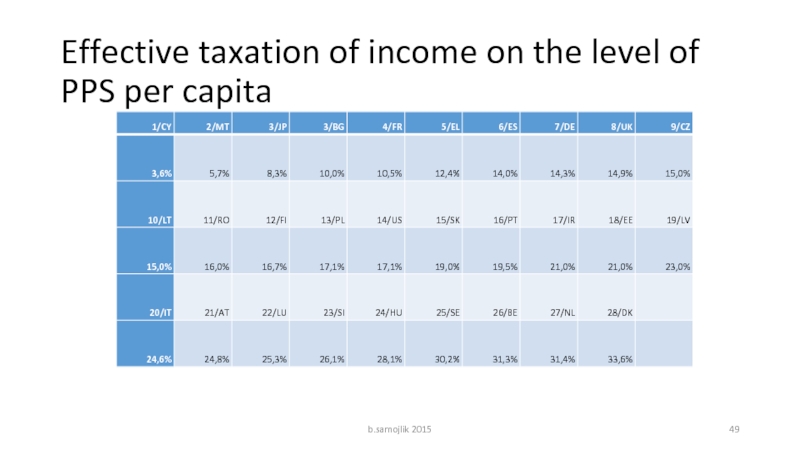

- 51. Taxation of the min wages b.samojlik 2015

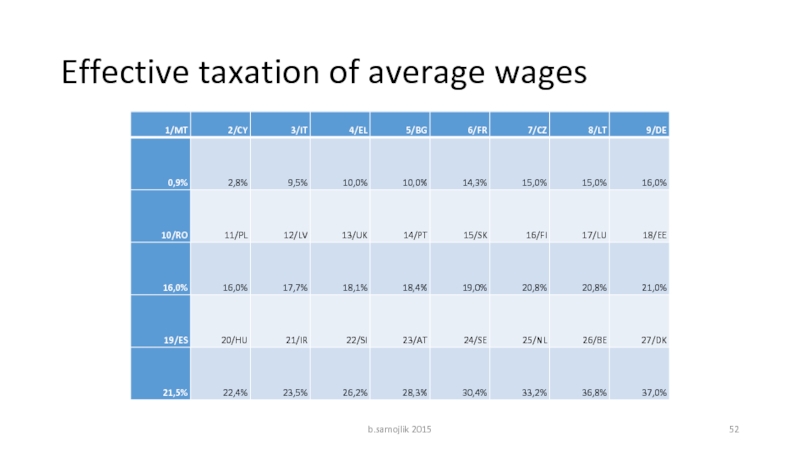

- 52. Effective taxation of average wages b.samojlik 2015

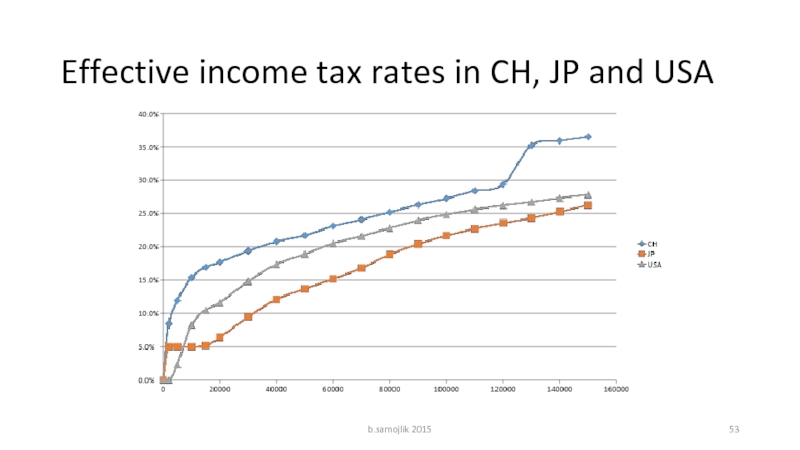

- 53. Effective income tax rates in CH, JP and USA b.samojlik 2015

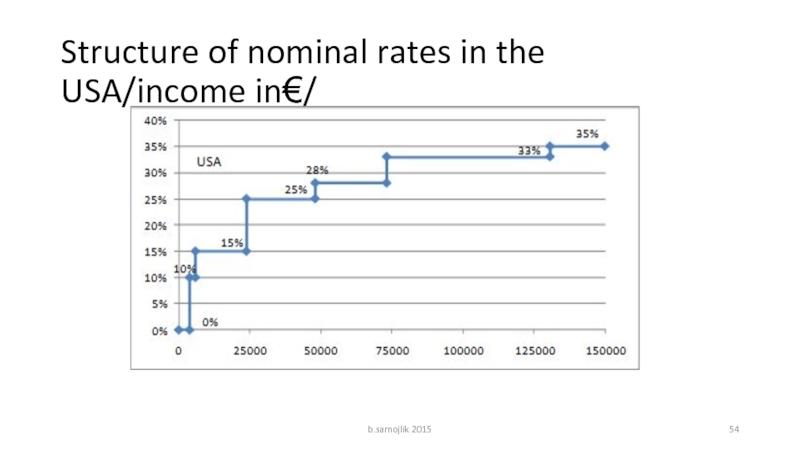

- 54. Structure of nominal rates in the USA/income in€/ b.samojlik 2015

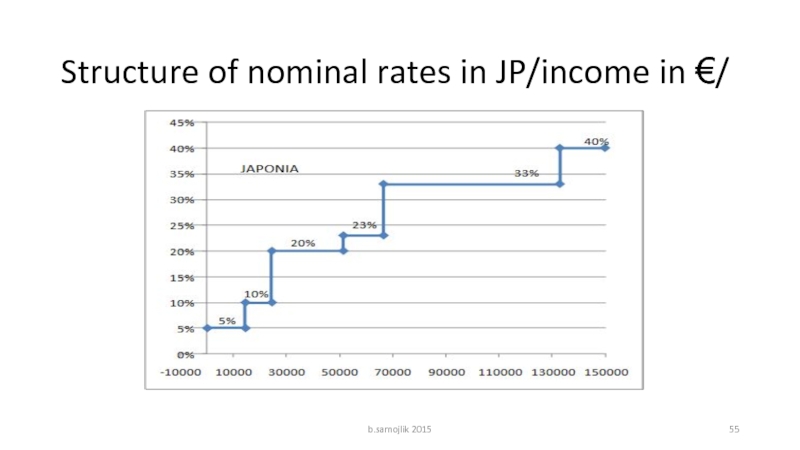

- 55. Structure of nominal rates in JP/income in €/ b.samojlik 2015

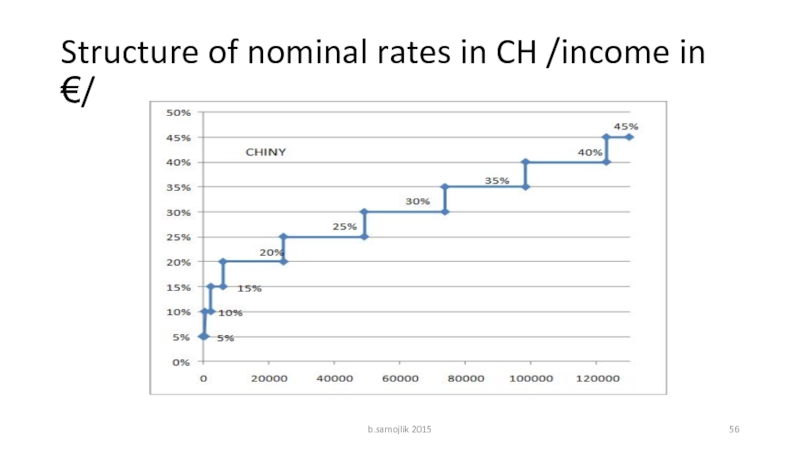

- 56. Structure of nominal rates in CH /income in€/ b.samojlik 2015

- 57. Optimal taxation of goods and services b.samojlik 2015

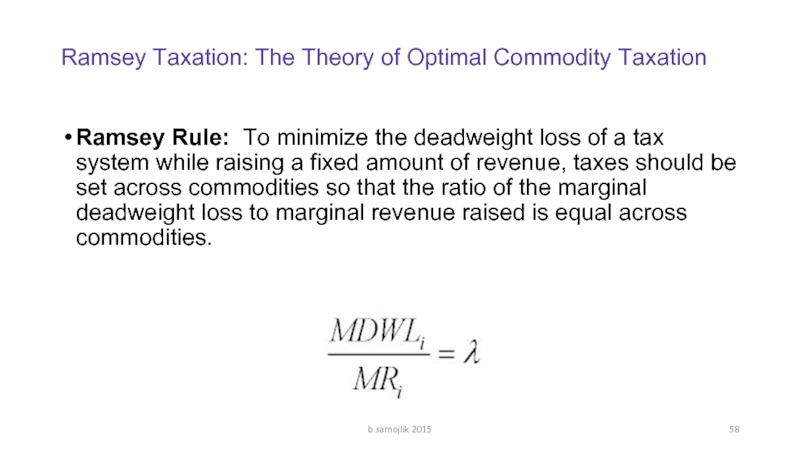

- 58. Ramsey Taxation: The Theory of Optimal Commodity

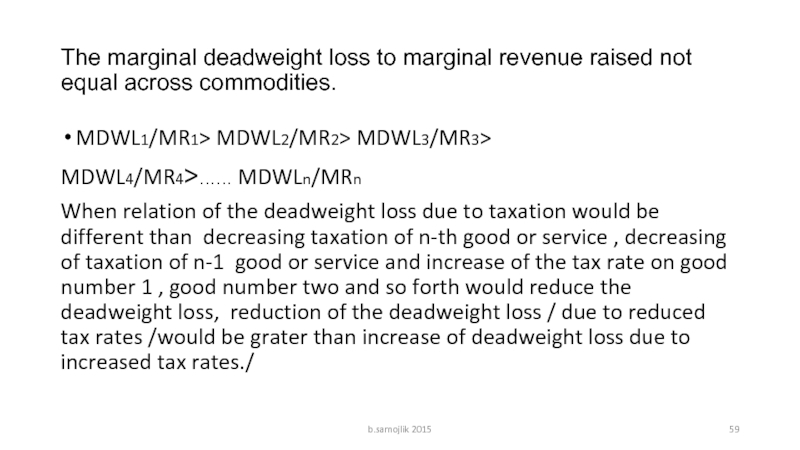

- 59. The marginal deadweight loss to marginal revenue

- 60. Inverse Elasticity Rule If we assume

- 61. Optimal commodity taxes The elasticity rule: When

- 62. Equity Implications of the Ramsey Rule

- 63. The loss of utility due to taxation of commodity b.samojlik 2015

- 64. The loss of utility due to taxation

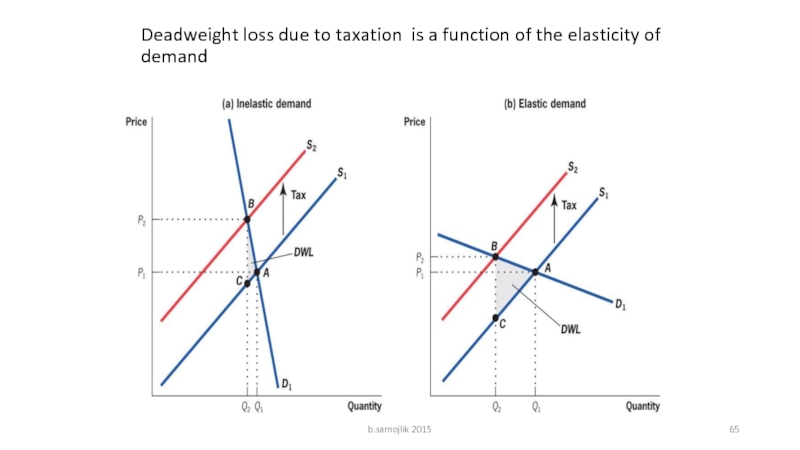

- 65. Deadweight loss due to taxation is a

- 66. Deadweight loss due to taxation is a

- 67. The nature of the deadweight loss The

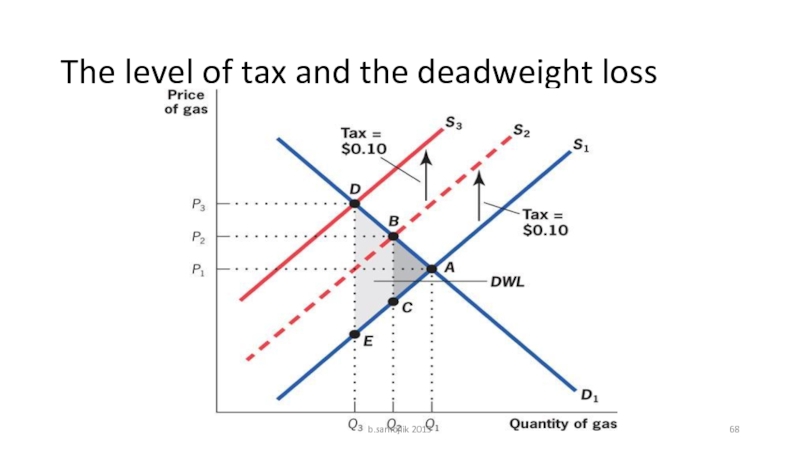

- 68. The level of tax and the deadweight loss b.samojlik 2015

- 69. The level of tax and the deadweight

- 70. Conclusion The fundamental issue in designing

- 71. The EU VAT concept and the Ramsey

- 72. Quality of taxation Taxation structure from growth

Слайд 2The Three Rules of Tax Incidence

The Statutory Burden of a Tax

The Side of the Market on Which the Tax Is Imposed Is Irrelevant to the Distribution of the Tax Burdens

Parties with Inelastic Supply or Demand Bear Taxes; Parties with Elastic Supply or Demand Avoid Them

b.samojlik 2015

Слайд 3The Statutory Burden of a Tax Does Not Describe Who Really

statutory incidence: The burden of a tax borne by the party that sends tax payment to the tax office.

economic incidence: The burden of taxation measured by the change in the resources available to any economic agent as a result of taxation.

b.samojlik 2015

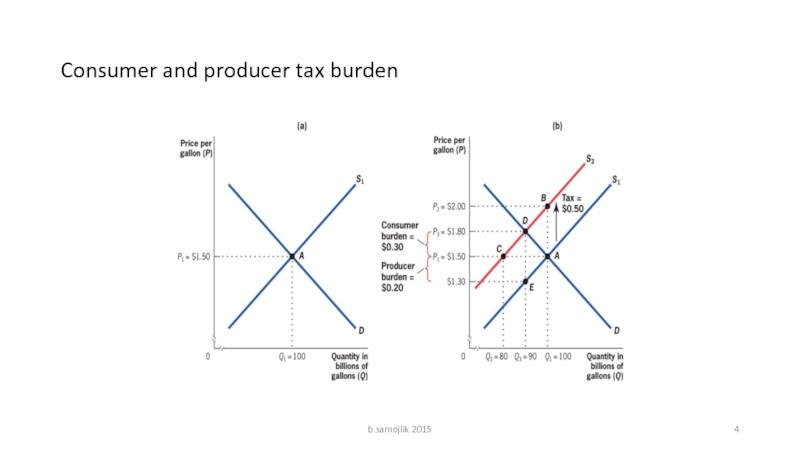

Слайд 5Discription of panels (a) &(b)

On the left side (a) there is

On the right side (b) there is tax imposed $0.5per unit (the statutory burden); supply curve shifts to the left from S1 to S2 and equilibrium point, intersection of demand curve D and a new supply curve S2 , shifts from A to D; the coordinates of the point A changes to ($1.8;90) at the point D.

The economic tax burden: $0.2 is borne by producers and $0.3 is borne by consumers.

b.samojlik 2015

Слайд 6Burden of the Tax on Consumers and Producers

tax wedge: The difference

The difference between what employers are charged and employees receive (net of tax) from a transaction;

E.g.: price of gas for producer and consumer due to excise tax, production tax and VAT ; cost of wages for employers and employees wage due to social security charges and PIT

b.samojlik 2015

Слайд 7II.The Side of the Market on Which the Tax Is Imposed

Tax insidence is identical whether the tax is levied on producers or consumers.

b.samojlik 2015

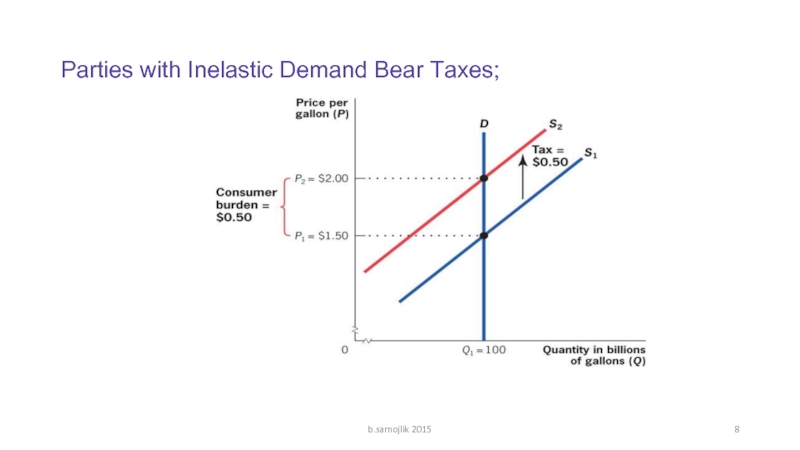

Слайд 9Parties with Inelastic Demand Bear Taxes

Perfectly inelastic demand /demand curve D

Price increases from $1.5 to $2.0;

Perfectly inelastic demand means that consumers bear the full tax.

When demand is perfectly inelastic producers bear none of the tax and consumers bear all of the tax: the full shifting of the tax.

b.samojlik 2015

Слайд 11Parties with Perfectly Elastic Demand Avoid Taxes

The full burden of tax

Consumers avoid tax because of elastic demand.

b.samojlik 2015

Слайд 13Supply Elasticity

There is two supply cases. On the left side (a)

On the right side (b) elastic supply, curve S almost horizontal.

On both services(commodities) the same tax is levied;

Shift of the supply curve is the greater the higher is elasticity of supply.

Reaction of demand due to tax increase /=increase of price/ on panel (a) is minor on panel (b) very strong.

b.samojlik 2015

Слайд 14Parties with Inelastic Supply Bear Taxes;

Inelastic supply/demand/ party of the

Absorption of the tax increase is inversely proportional to the elasticity of supply/demand/, the higher elasticity of supply/demand/ the lower absorption of tax increase, and reverse.

b.samojlik 2015

Слайд 15Recap:

The statutory burden of a tax does not describe who really

The side of the market on which the tax is imposed is irrelevant to the distribution of tax burdens.

Parties with inelastic supply or demand bear taxes; parties with elastic supply or demand avoid them.

b.samojlik 2015

Слайд 17Optimal income and commodity taxation

1 Optimal Income Taxes

2 Optimal Commodity Taxation

3

b.samojlik 2015

Слайд 18Max-min rule as a standard of rational behavior

Rationale behavior : max

A.Maximize results out of the given resources: max rule or

B.Minimize the costs of the predetermined goal:min rule

In the case of taxation we should apply „min”rule

We should know how much revenue to collect in order to finance projects/ bridges, roads, hospitals, schools etc. etc./

Taxation provides revenues for budget expenditure

At the same time we know that :every tax is inefficient: distorts the behavior of producers and consumers/ creates a deadweight loss/

So, taxation should minimize the loss of consumers and producers surplus achieving predetermined level of tax revenues

The levels of harmfulness of specific taxes are different; there is a room for optimization of tax structure

b.samojlik 2015

Слайд 19Economic function of taxes

Which factor of the GDP creation a given

labor /social security charges and personal income tax /PIT/

consumption/VAT, sales tax, production tax, exise taxes /

capital/dividend taxation, interest taxation ( no tax costs)/

green taxes /GDP demolition due to externalities/

b.samojlik 2015

Слайд 20Type of taxes

Direct taxes / on income; PIT, CIT/

Indirect taxes /

Social security charges /taxes on labor costs/

Green taxes/diminishing natural resources use/

Taxes on financial transactions/ The European Commission idea to have own resources of the EU budget / 3/4 to budget of the UE ¼ to national budget/

Tax shifting / forward and backward/ : who finally pay for it/charged as a result od green taxes and financial transaction taxes?

b.samojlik 2015

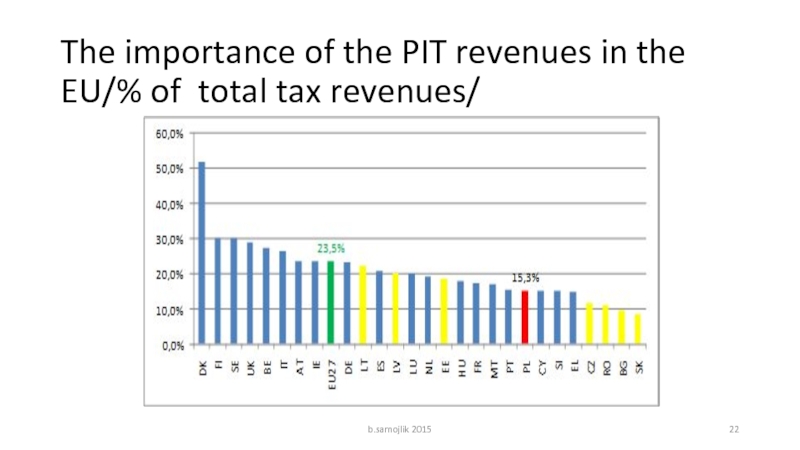

Слайд 23Taxation of income in the UE

There is no common acceptable rule

SK, BG, RO effective tax rate on income 10%; DK effective tax rate on income 50% /as a pp of the total taxation/

b.samojlik 2015

Слайд 26Other countries with a flat tax

Russia 13%; Serbia-14%; Kirgistan-10%; Georgia-12%;

according to the IMF:

“the empirical evidence on flat taxes effects is very limited" ;

"there is no sign of Laffer-type behavioral responses." / increase of tax revenues due to decrease of effective tax rate/

b.samojlik 2015

Слайд 28The interpretation of Laffer curve

If the effective tax rate on income

higher effective tax rates on the wrong side decrease the volume of tax revenues

Optimal level of the effective tax rate is unknown/ max of revenues is unknown/

b.samojlik 2015

Слайд 29"there is no sign of Laffer-type behavioral responses."

Interpretation:

If a flat

b.samojlik 2015

Слайд 30Flat tax rate

Flat tax rates on income are not in accordance

Flat tax rates of personal income are not in accordance with fairness of taxation

b.samojlik 2015

Слайд 32effective flat tax rate

effective flat tax rate with no general allowance

b.samojlik 2015

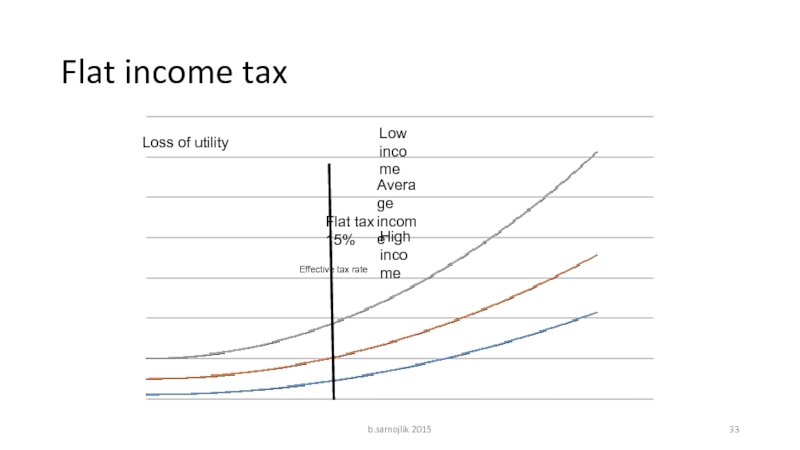

Слайд 33Flat income tax

Low income

Average income

High income

Effective tax rate

Loss of utility

Flat tax

b.samojlik 2015

Слайд 34Flat income tax

At the flat tax rate effective taxation rate is

Low income groups have a large loss of utility

High income groups have a smaller loss of utility

Flat tax system is unfair

b.samojlik 2015

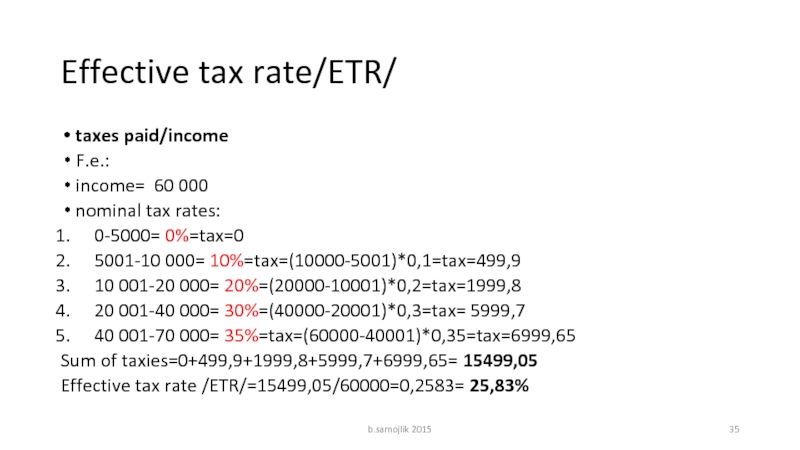

Слайд 35Effective tax rate/ETR/

taxes paid/income

F.e.:

income= 60 000

nominal tax rates:

0-5000= 0%=tax=0

5001-10 000= 10%=tax=(10000-5001)*0,1=tax=499,9

10

20 001-40 000= 30%=(40000-20001)*0,3=tax= 5999,7

40 001-70 000= 35%=tax=(60000-40001)*0,35=tax=6999,65

Sum of taxies=0+499,9+1999,8+5999,7+6999,65= 15499,05

Effective tax rate /ETR/=15499,05/60000=0,2583= 25,83%

b.samojlik 2015

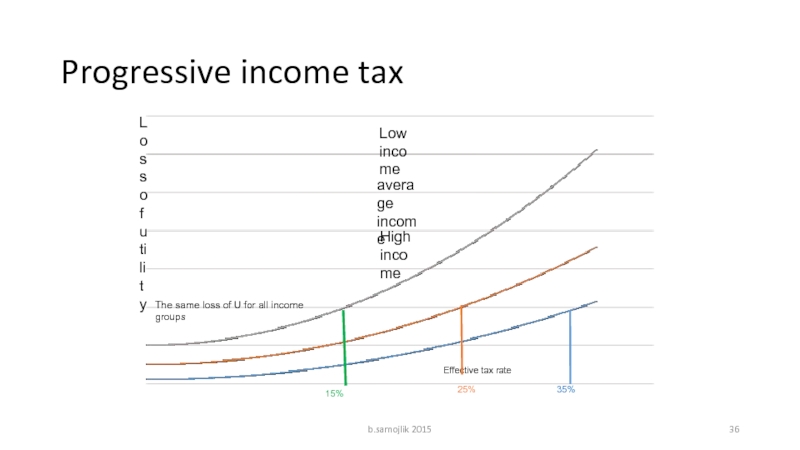

Слайд 36Progressive income tax

Low income

average income

High income

Effective tax rate

Loss of utility

15%

25%

35%

The

b.samojlik 2015

Слайд 37Progressive income tax

In the case of progressive income tax marginal tax

Effective increase of taxation depends on the value of the income brackets and the value of marginal rate

The more brackets the greater level of taxation fairness ; the loss of utility the same for all income brackets

b.samojlik 2015

Слайд 38Efficiency of public sector

b.samojlik 2015

Low income

average income

High income

Effective tax rate

Loss

15%

25%

35%

Слайд 39Efficiency of public sector use of tax revenues

What is an appropriate

The higher the efficiency of the use of tax revenues the higher acceptable effective taxation in every taxable income bracket /tax burden/.

b.samojlik 2015

Слайд 41PIT in the EU countries

PIT in the EU28 is extremely diversified:

Different

Different numbers of taxable income brackets

different marginal tax rates

Different effective taxation for a given total income

Different personal allowances/ because of age of the taxpayer , number of children in the family , disability etc. etc./

b.samojlik 2015

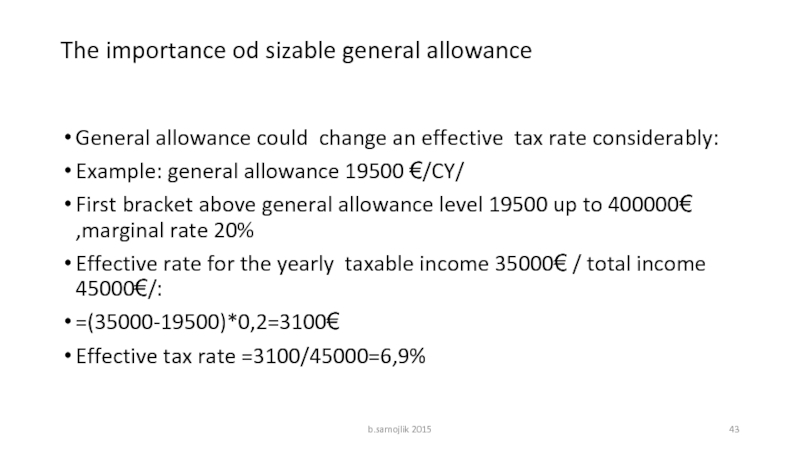

Слайд 43The importance od sizable general allowance

General allowance could change an

Example: general allowance 19500 €/CY/

First bracket above general allowance level 19500 up to 400000€ ,marginal rate 20%

Effective rate for the yearly taxable income 35000€ / total income 45000€/:

=(35000-19500)*0,2=3100€

Effective tax rate =3100/45000=6,9%

b.samojlik 2015

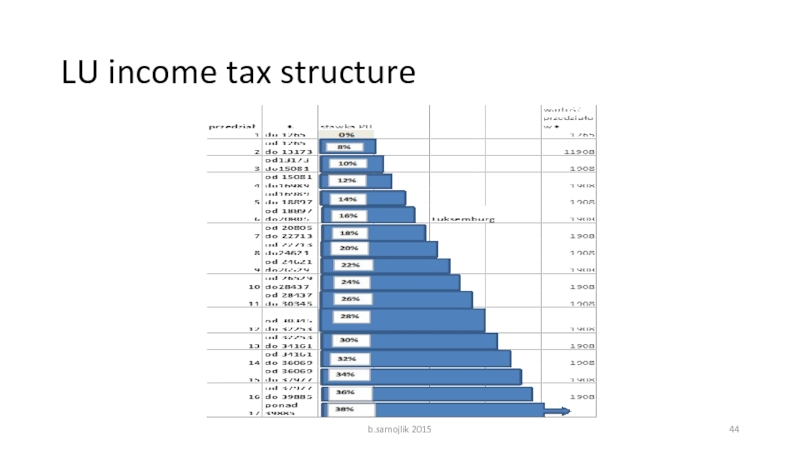

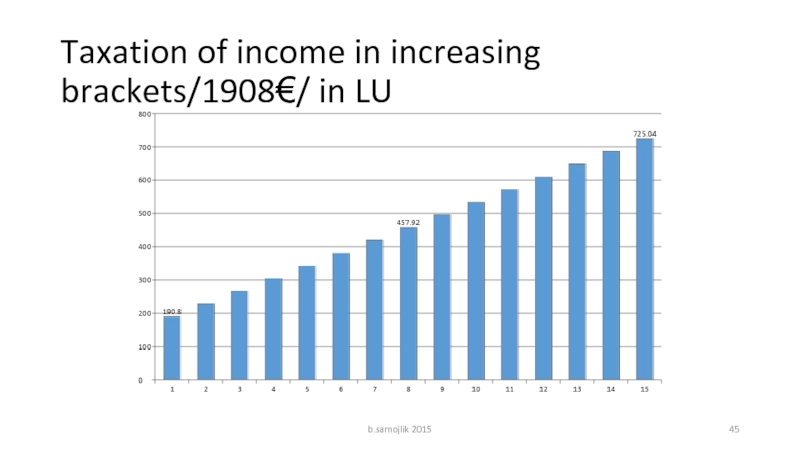

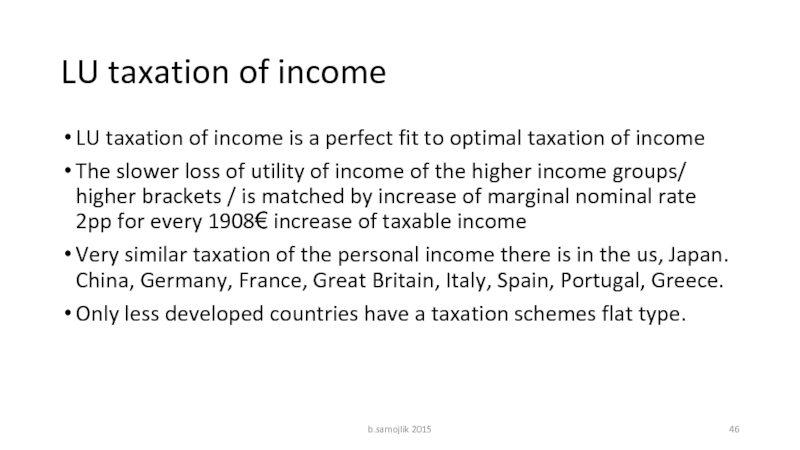

Слайд 46LU taxation of income

LU taxation of income is a perfect fit

The slower loss of utility of income of the higher income groups/ higher brackets / is matched by increase of marginal nominal rate 2pp for every 1908€ increase of taxable income

Very similar taxation of the personal income there is in the us, Japan. China, Germany, France, Great Britain, Italy, Spain, Portugal, Greece.

Only less developed countries have a taxation schemes flat type.

b.samojlik 2015

Слайд 48Effective taxation of income in PL and LU /comparison/

As we see

because of the very low marginal rates in the low income brackets , effective taxation of income in the LU is considerable lower than in Poland at least to taxable income 21000€, more than 95% of taxpayers in Poland.

b.samojlik 2015

Слайд 50Taxation of the PPS per capita income

There is a deep differentiation

Level of PPS per capita for 7 countries : AT, SE, DK, UK, DE, FI i BE is comparable: bracket 31000-29000 PPS per capita but taxation differs very much : from 14,5% in DE to 33,6% in DK.

PPS per capita in the USA =38700PPS in Poland= 14400PPS. Effective taxation in US and Poland is the same:17,1%.

In the US there is a strong tax preference for low income groups in Poland such a preference does not exists.

b.samojlik 2015

Слайд 58Ramsey Taxation: The Theory of Optimal Commodity Taxation

Ramsey Rule: To minimize

b.samojlik 2015

Слайд 59The marginal deadweight loss to marginal revenue raised not equal across

MDWL1/MR1> MDWL2/MR2> MDWL3/MR3>

MDWL4/MR4>…… MDWLn/MRn

When relation of the deadweight loss due to taxation would be different than decreasing taxation of n-th good or service , decreasing of taxation of n-1 good or service and increase of the tax rate on good number 1 , good number two and so forth would reduce the deadweight loss, reduction of the deadweight loss / due to reduced tax rates /would be grater than increase of deadweight loss due to increased tax rates./

b.samojlik 2015

Слайд 60Inverse Elasticity Rule

If we assume that the supply side of commodity

That means: tax rate on good or service should be set inversely to its elasticity of demand ηi;

The higher ηi the lower tax; the lower ηi the higher tax.

b.samojlik 2015

Слайд 61Optimal commodity taxes

The elasticity rule: When elasticity of demand for a

when elasticity is low, the tax rate should be high.

The broad base rule: It is better to tax a wide variety of goods at a moderate rate than to tax very few goods at a high rate.

Because the marginal deadweight loss from a tax rises with the tax rate, the government should spread taxes across a large number of commodities and not tax any one commodity at a very high rate.

b.samojlik 2015

Слайд 62Equity Implications of the Ramsey Rule

The elasticity of demand for luxury

This would mean imposing a tax on a good consumed exclusively by higher-income groups that was much lower than the tax imposed on a good consumed by all.

This outcome, while efficient, might violate a government’s sense of tax fairness across income groups (vertical equity) and requires a trade off beetwen fairness and efficiency of commodity and service taxation .

b.samojlik 2015

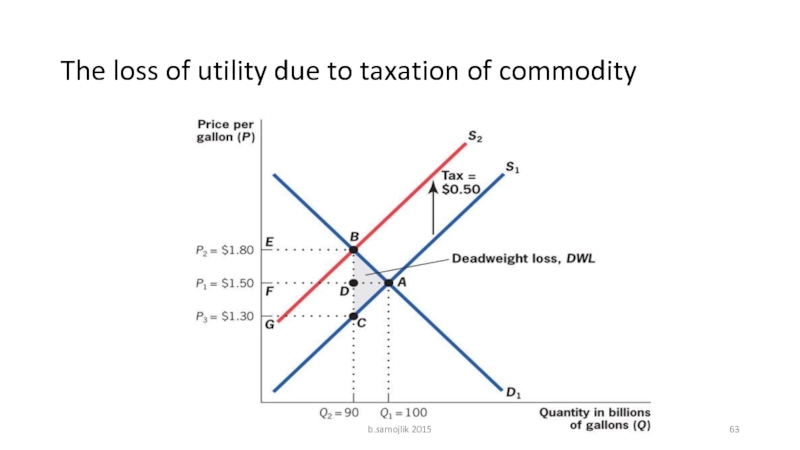

Слайд 64The loss of utility due to taxation

When a tax $0,5 is

b.samojlik 2015

Слайд 66Deadweight loss due to taxation is a function of the elasticity

The same tax is imposed on a commodity with elastic and inelastic demand; the shift od supply curve is the same ;

The deadweight loss increases with the increase of the elasticity of demand

b.samojlik 2015

Слайд 67The nature of the deadweight loss

The inefficiency of any tax is

b.samojlik 2015

Слайд 69The level of tax and the deadweight loss

The deadweight loss increases

b.samojlik 2015

Слайд 70Conclusion

The fundamental issue in designing tax policy is the equity-efficiency trade-off.

two

1.the more elastically supplied or demanded the good, the larger the deadweight loss from the tax.

2.the higher the tax rate, the larger the incremental deadweight loss of taxation.

b.samojlik 2015

Слайд 71The EU VAT concept and the Ramsey rule

The EU concept of

One standard rate /not lower than 15% for all goods and services/

Reduced or super reduced rate are only for a determined time, limited and conditional

Ramsey rule indicated that commodity and services taxation should be proportional/ inversely/ to price elasticity of demand.

So, The EU concept of VAT is wrong; it assumes that elasticity of demand for all good and services is the same and that is a wrong assumption; elasticity are different so VAT rates should be diversified to minimize loss of total surplus; standard rate for every good and service would no minimize deadweight loss.

b.samojlik 2015

Слайд 72Quality of taxation

Taxation structure from growth perspective

Decrease taxation of labor, increase

b.samojlik 2015