- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

The Capital Asset Pricing Model (CAPM). Corporate Finance презентация

Содержание

- 2. 10.1 Individual Securities 10.2 Expected Return, Variance,

- 3. 10.1 Individual Securities The characteristics of individual

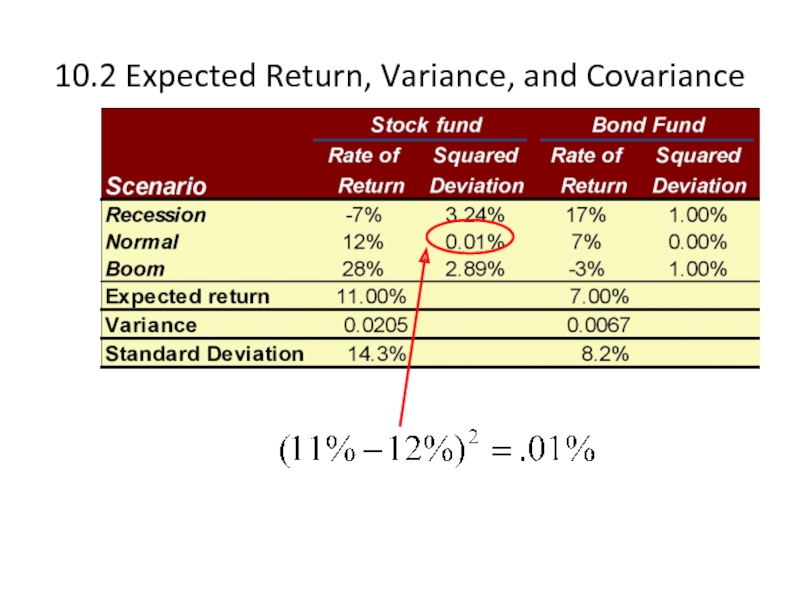

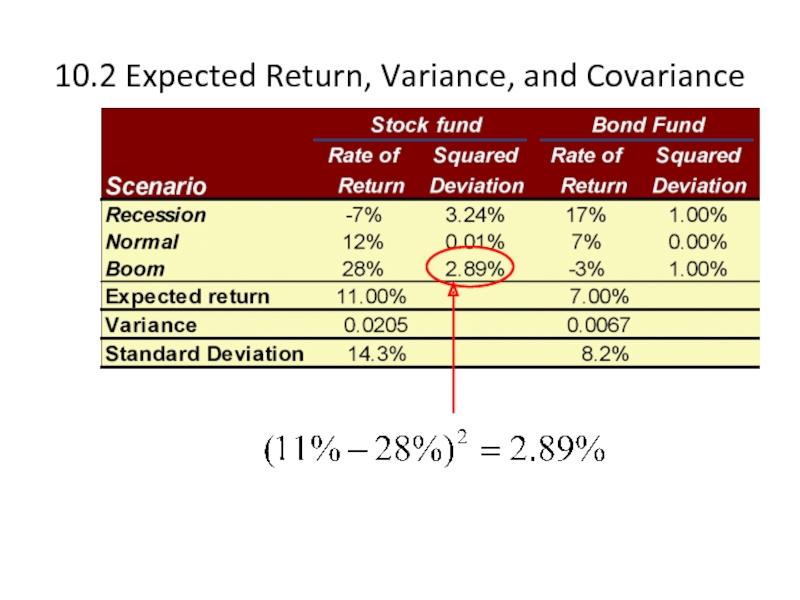

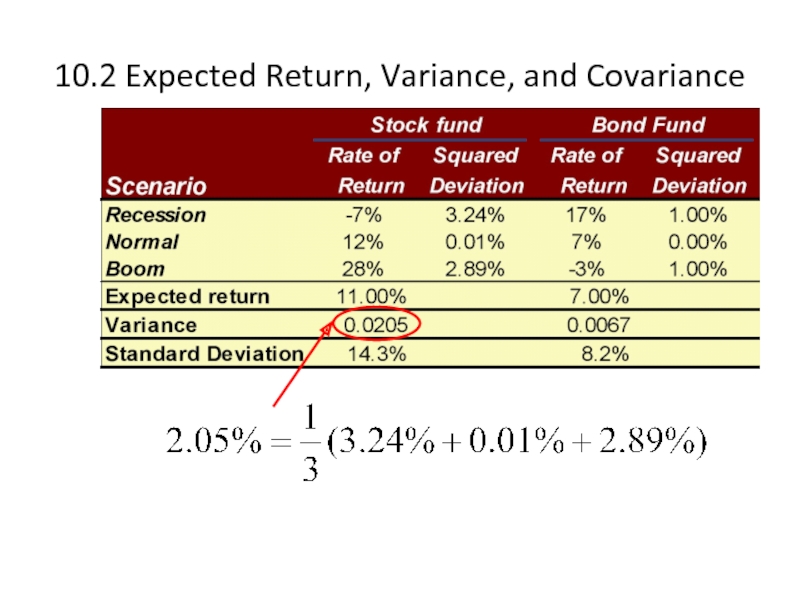

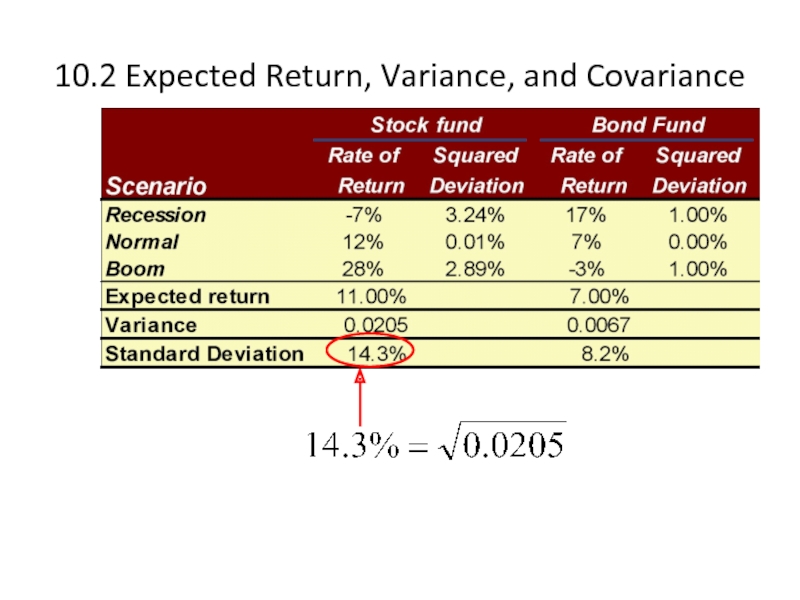

- 4. 10.2 Expected Return, Variance, and Covariance

- 5. 10.2 Expected Return, Variance, and Covariance

- 6. 10.2 Expected Return, Variance, and Covariance

- 7. 10.2 Expected Return, Variance, and Covariance

- 8. 10.2 Expected Return, Variance, and Covariance

- 9. 10.2 Expected Return, Variance, and Covariance

- 10. 10.2 Expected Return, Variance, and Covariance

- 11. 10.2 Expected Return, Variance, and Covariance

- 12. 10.2 Expected Return, Variance, and Covariance

- 13. 10.3 The Return and Risk for Portfolios

- 14. 10.3 The Return and Risk for Portfolios

- 15. 10.3 The Return and Risk for Portfolios

- 16. 10.3 The Return and Risk for Portfolios

- 17. 10.3 The Return and Risk for Portfolios

- 18. 10.3 The Return and Risk for Portfolios

- 19. 10.3 The Return and Risk for Portfolios

- 20. 10.4 The Efficient Set for Two

- 21. 10.4 The Efficient Set for Two

- 22. 10.4 The Efficient Set for Two

- 23. Two-Security Portfolios with Various Correlations

- 24. Portfolio Risk/Return Two Securities: Correlation Effects

- 25. Portfolio Risk as a Function

- 26. 10.5 The Efficient Set for Many Securities

- 27. 10.5 The Efficient Set for Many Securities

- 28. 10.5 The Efficient Set for Many

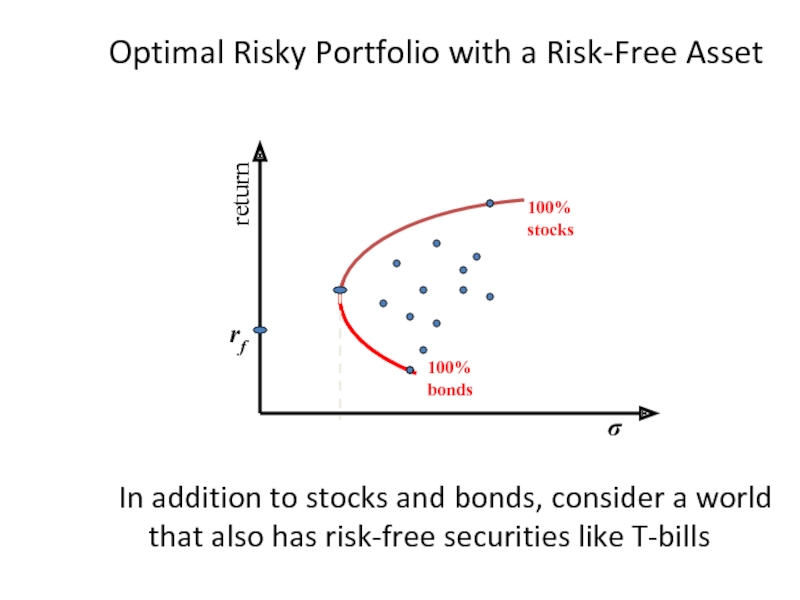

- 29. Optimal Risky Portfolio with a Risk-Free Asset

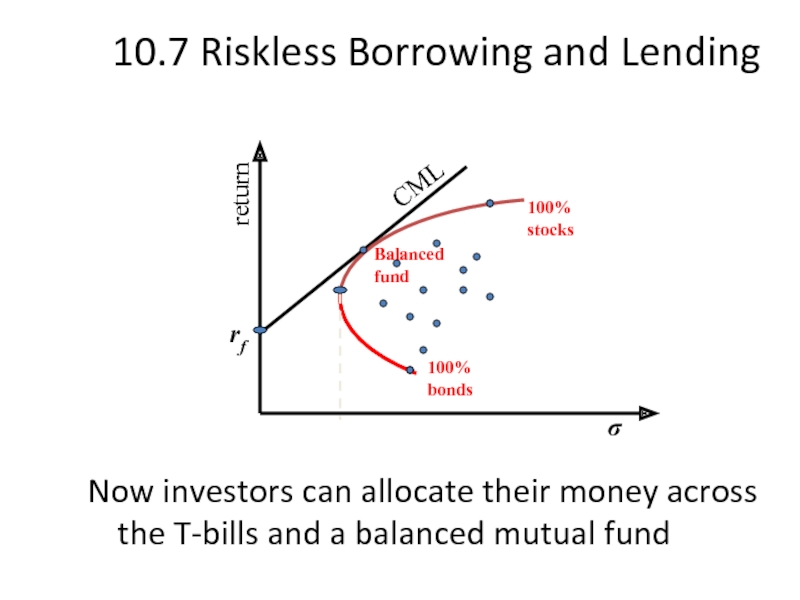

- 30. 10.7 Riskless Borrowing and Lending Now investors

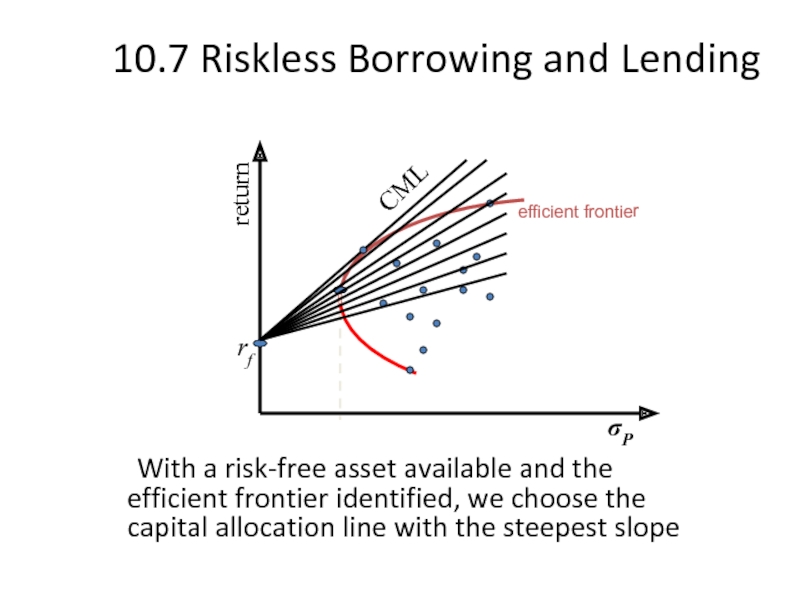

- 31. 10.7 Riskless Borrowing and Lending With

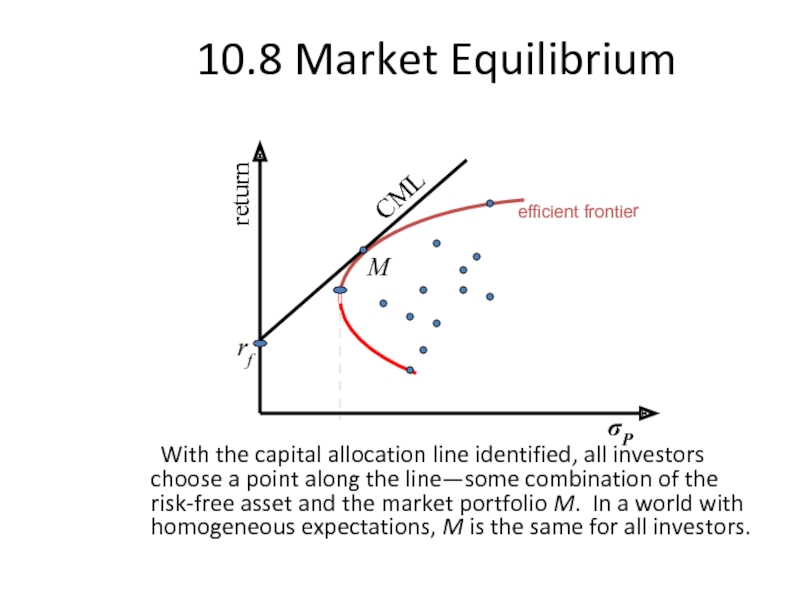

- 32. 10.8 Market Equilibrium With the capital

- 33. The Separation Property The Separation

- 34. The Separation Property Investor risk

- 35. Market Equilibrium Just where the investor chooses

- 36. Market Equilibrium All investors have the same

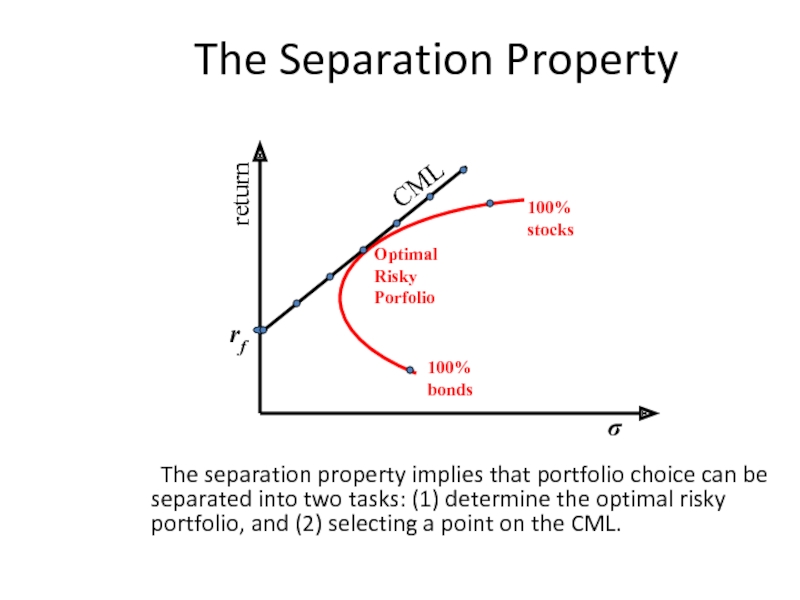

- 37. The Separation Property The separation property implies

- 38. Optimal Risky Portfolio with a Risk-Free Asset

- 39. Definition of Risk When Investors Hold

- 40. Estimating β with regression Security Returns

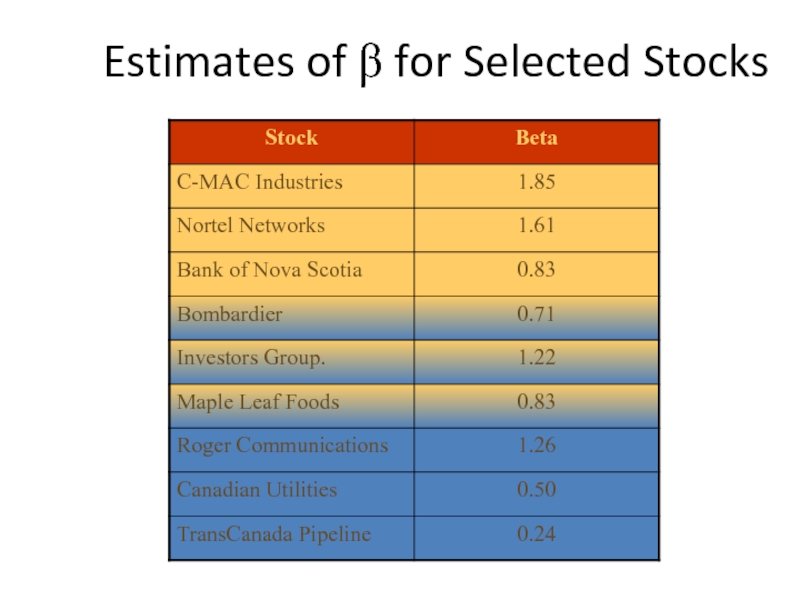

- 41. Estimates of β for Selected Stocks

- 42. The Formula for Beta Clearly, your estimate

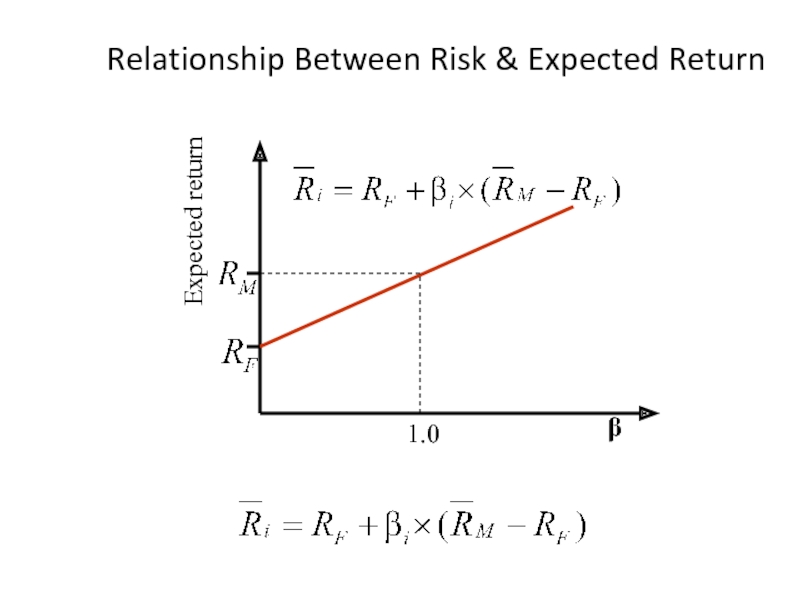

- 43. 10.9 Relationship between Risk and Expected

- 44. Expected Return on an Individual Security This

- 45. Relationship Between Risk & Expected Return Expected return β 1.0

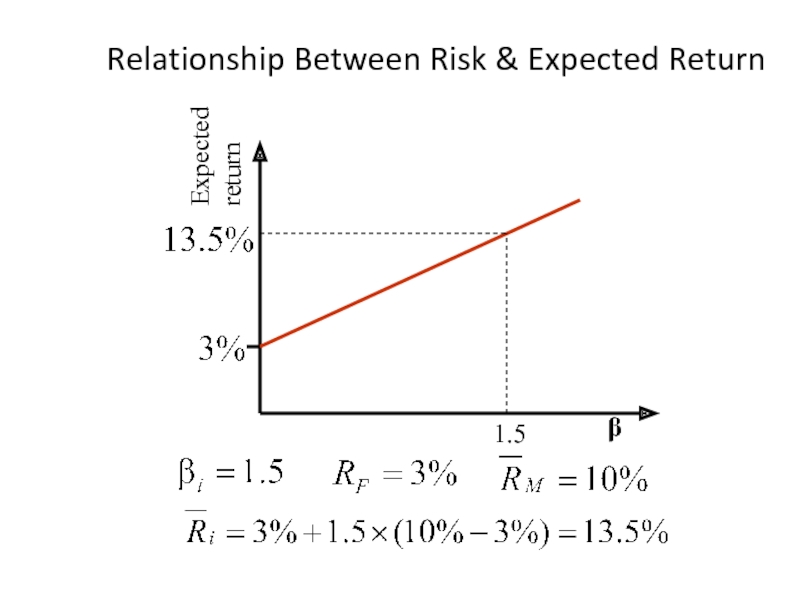

- 46. Relationship Between Risk & Expected Return Expected return β 1.5

- 47. 10.10 Summary and Conclusions This chapter sets

- 48. 10.10 Summary and Conclusions The efficient set

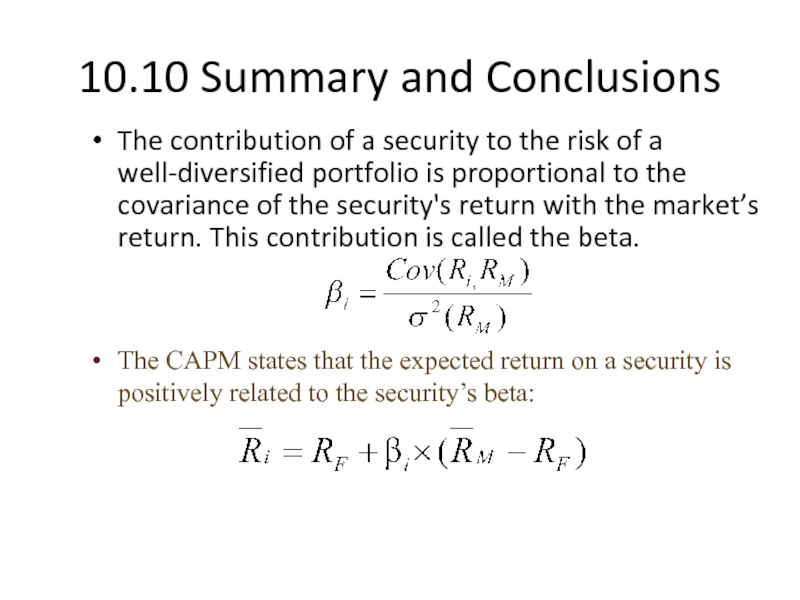

- 49. 10.10 Summary and Conclusions The contribution of

Слайд 210.1 Individual Securities

10.2 Expected Return, Variance, and Covariance

10.3 The Return and

10.4 The Efficient Set for Two Assets

10.5 The Efficient Set for Many Securities

10.6 Diversification: An Example

10.7 Riskless Borrowing and Lending

10.8 Market Equilibrium

10.9 Relationship between Risk and Expected Return (CAPM)

10.10 Summary and Conclusions

Слайд 310.1 Individual Securities

The characteristics of individual securities that are of interest

Expected Return

Variance and Standard Deviation

Covariance and Correlation

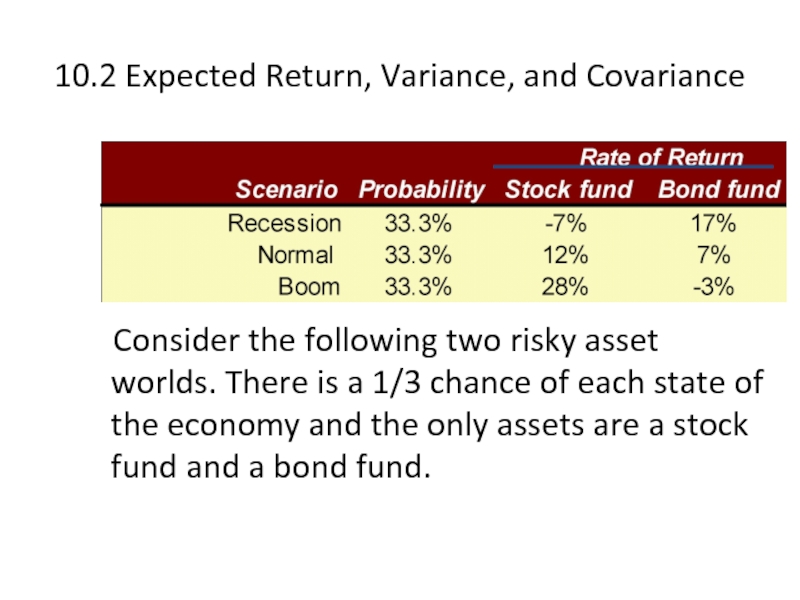

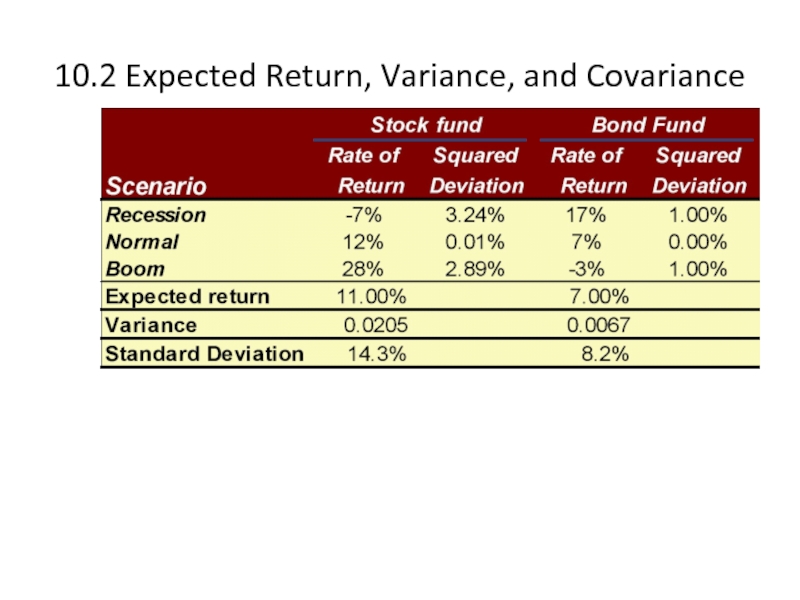

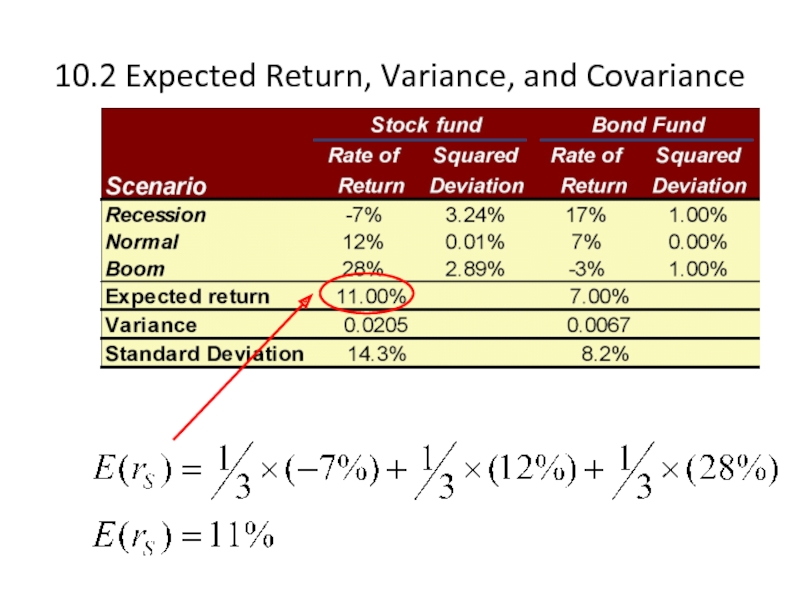

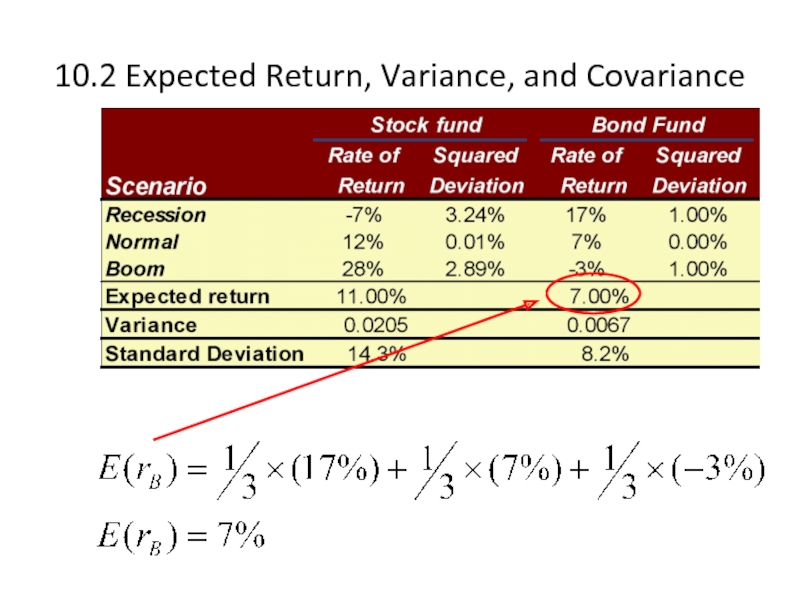

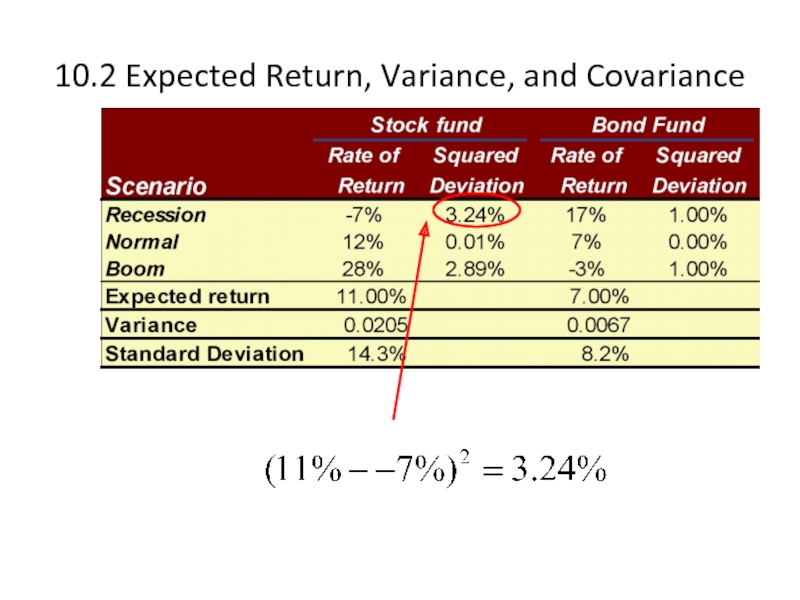

Слайд 410.2 Expected Return, Variance, and Covariance

Consider the following two

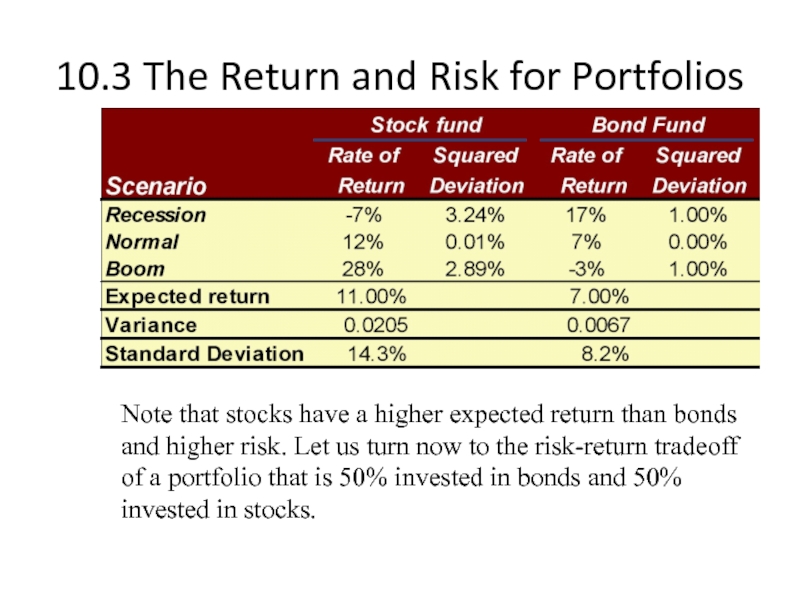

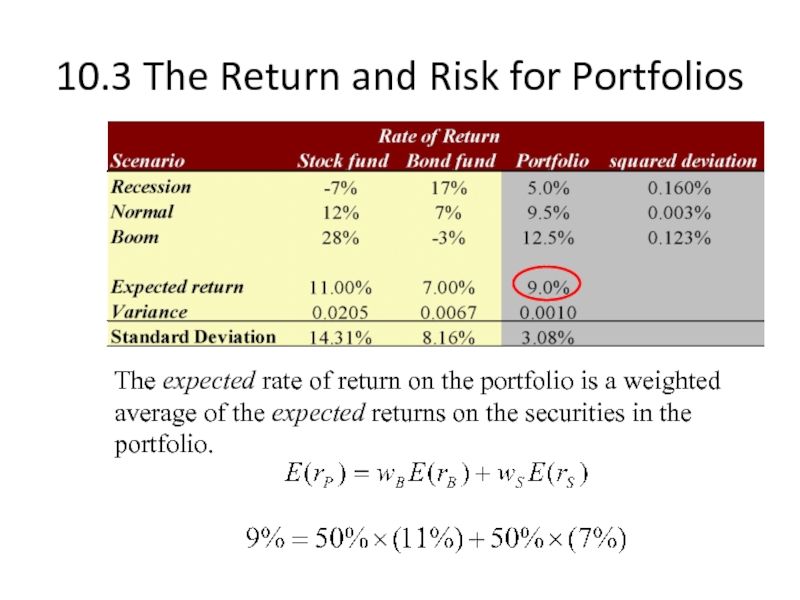

Слайд 1310.3 The Return and Risk for Portfolios

Note that stocks have a

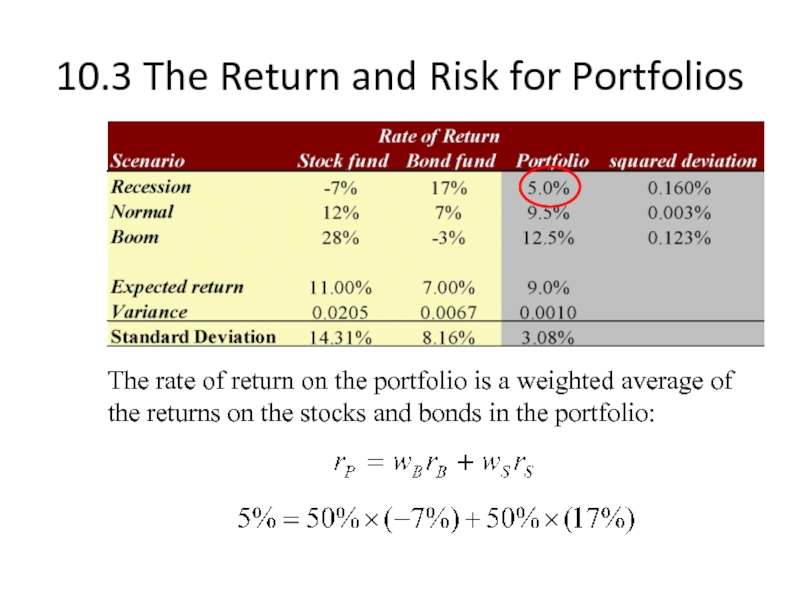

Слайд 1410.3 The Return and Risk for Portfolios

The rate of return on

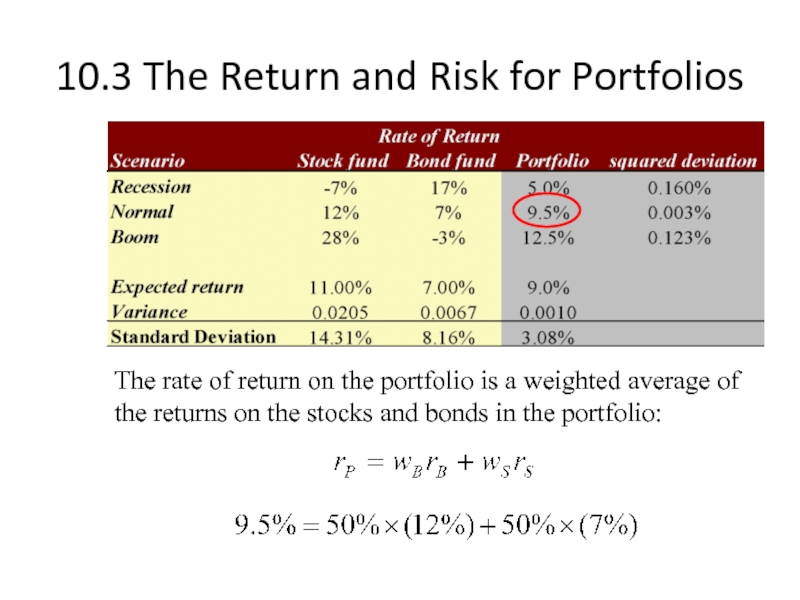

Слайд 1510.3 The Return and Risk for Portfolios

The rate of return on

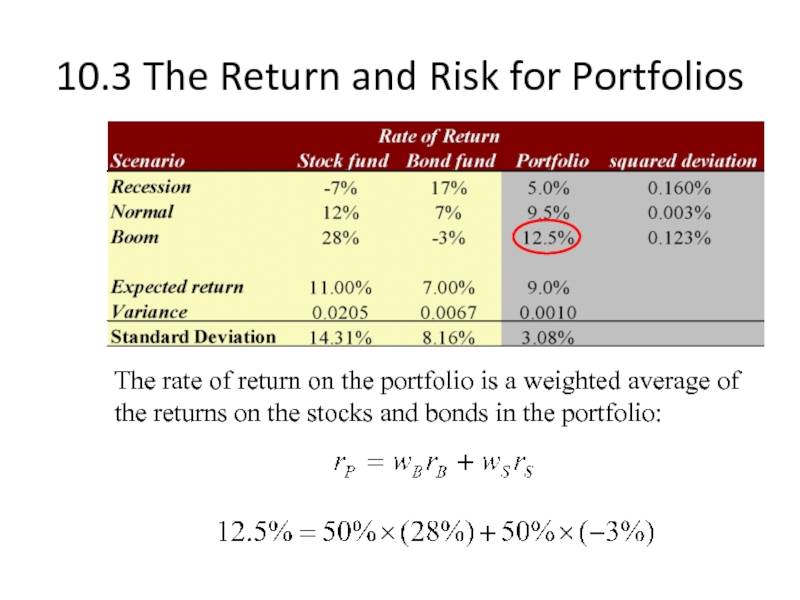

Слайд 1610.3 The Return and Risk for Portfolios

The rate of return on

Слайд 1710.3 The Return and Risk for Portfolios

The expected rate of return

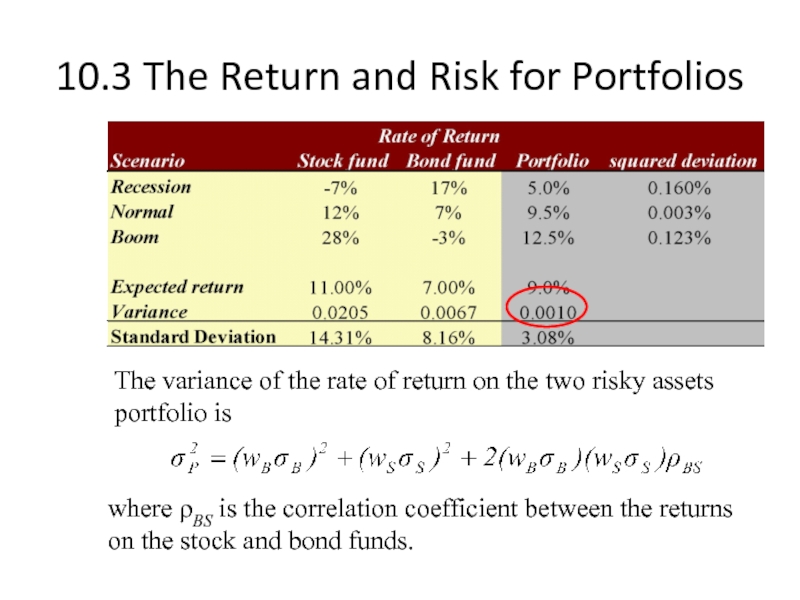

Слайд 1810.3 The Return and Risk for Portfolios

The variance of the rate

where ρBS is the correlation coefficient between the returns on the stock and bond funds.

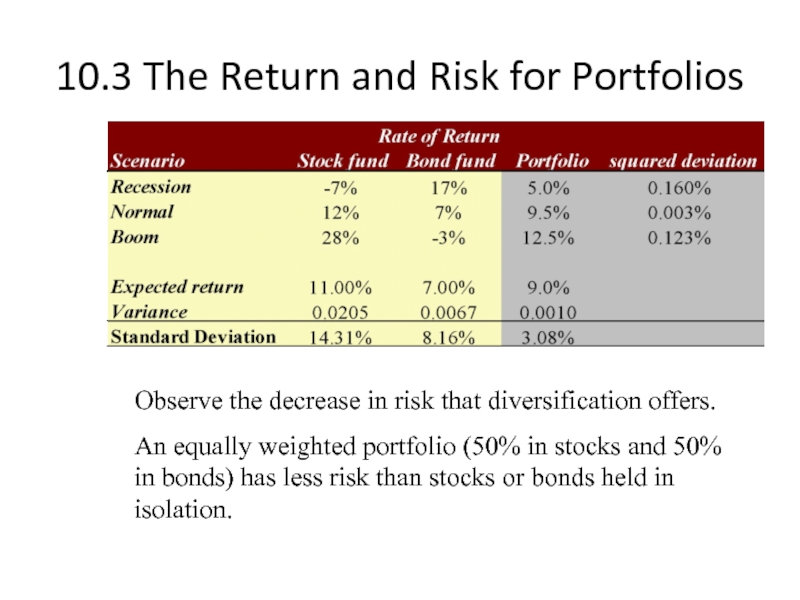

Слайд 1910.3 The Return and Risk for Portfolios

Observe the decrease in risk

An equally weighted portfolio (50% in stocks and 50% in bonds) has less risk than stocks or bonds held in isolation.

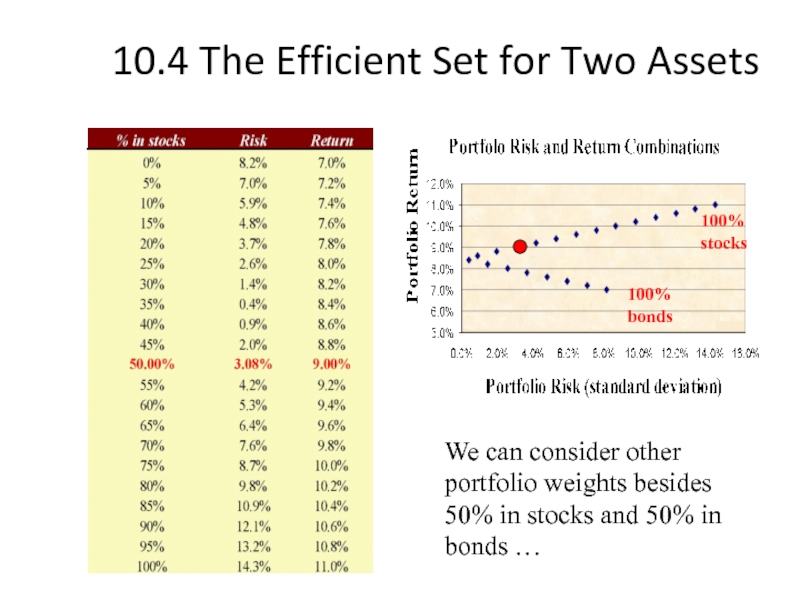

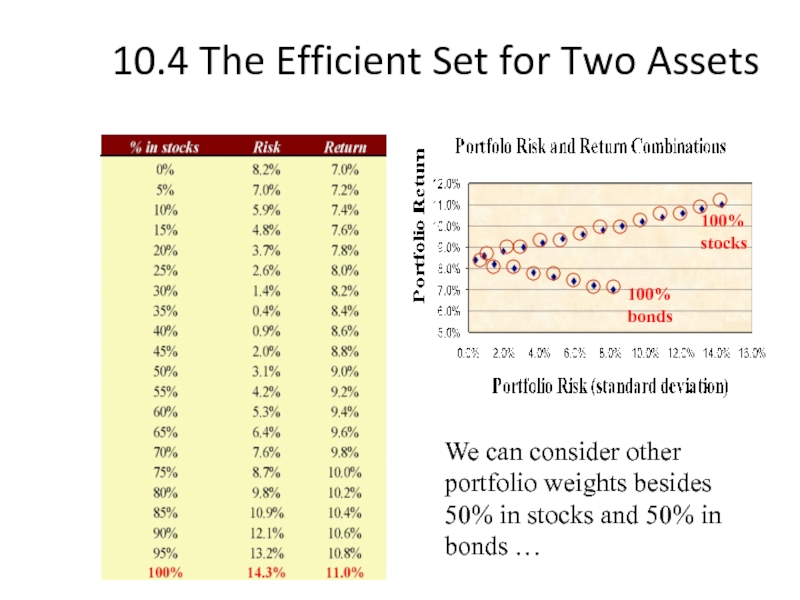

Слайд 20

10.4 The Efficient Set for Two Assets

We can consider other portfolio

100% bonds

100% stocks

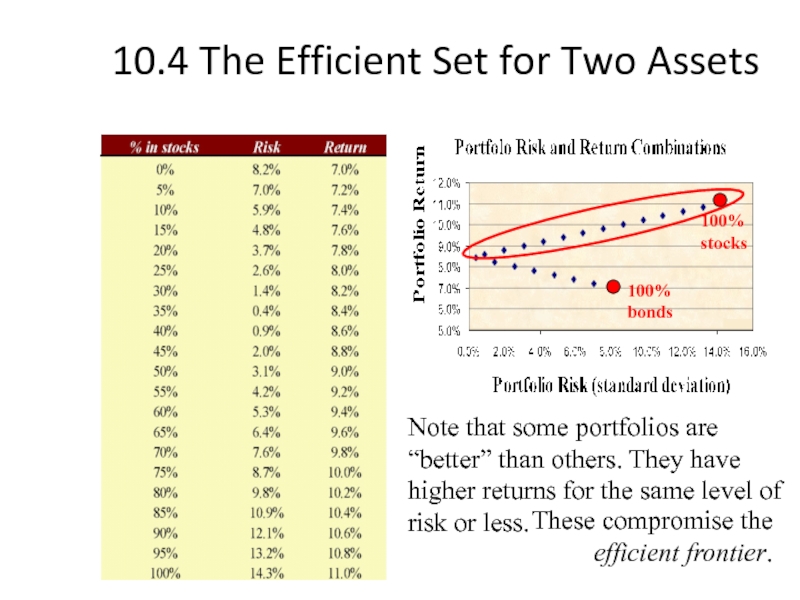

Слайд 21

10.4 The Efficient Set for Two Assets

We can consider other portfolio

100% bonds

100% stocks

Слайд 22

10.4 The Efficient Set for Two Assets

100% stocks

100% bonds

Note that some

These compromise the efficient frontier.

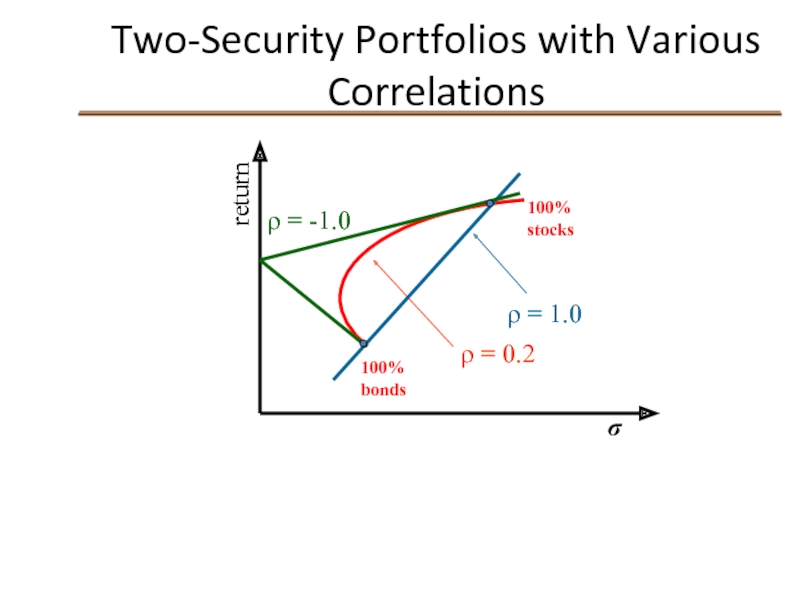

Слайд 23

Two-Security Portfolios with Various Correlations

100% bonds

return

σ

100% stocks

ρ = 0.2

ρ =

ρ = -1.0

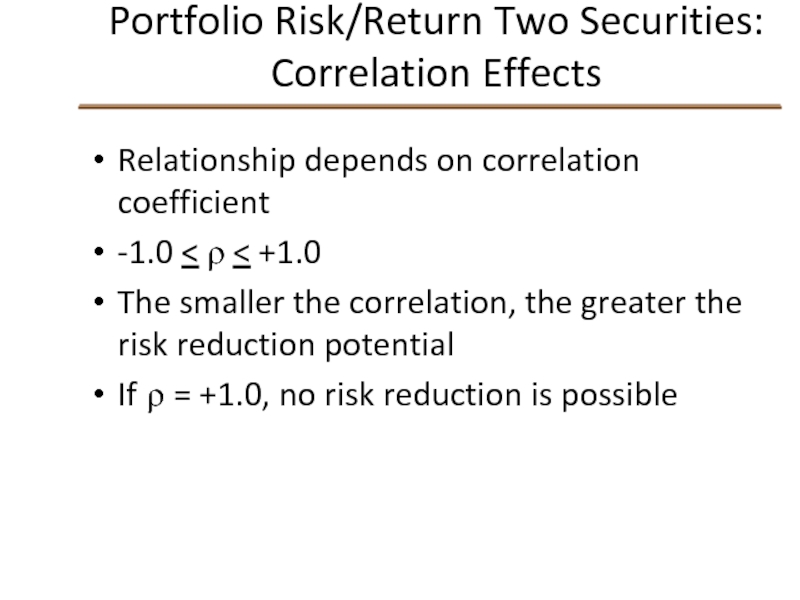

Слайд 24

Portfolio Risk/Return Two Securities: Correlation Effects

Relationship depends on correlation coefficient

-1.0

The smaller the correlation, the greater the risk reduction potential

If ρ = +1.0, no risk reduction is possible

Слайд 25

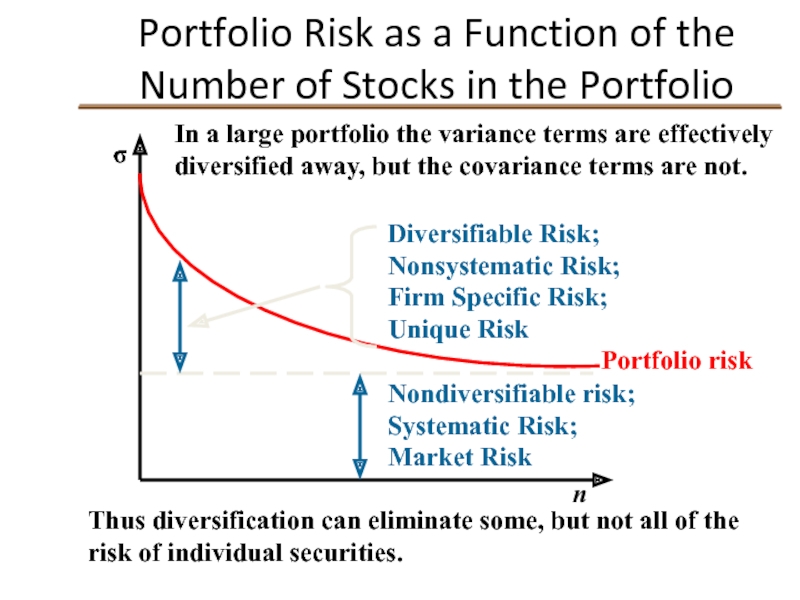

Portfolio Risk as a Function of the Number of Stocks in

Nondiversifiable risk; Systematic Risk; Market Risk

Diversifiable Risk; Nonsystematic Risk; Firm Specific Risk; Unique Risk

n

σ

In a large portfolio the variance terms are effectively diversified away, but the covariance terms are not.

Thus diversification can eliminate some, but not all of the risk of individual securities.

Portfolio risk

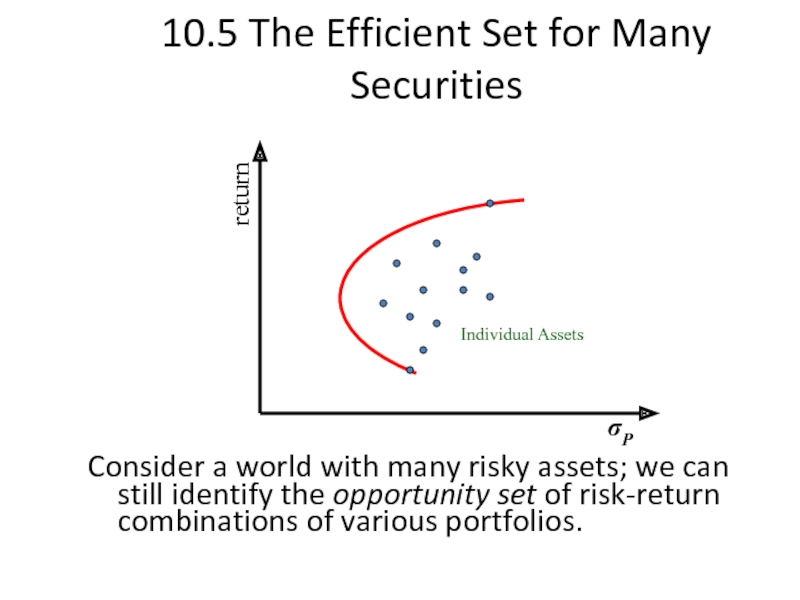

Слайд 2610.5 The Efficient Set for Many Securities

Consider a world with many

return

σP

Individual Assets

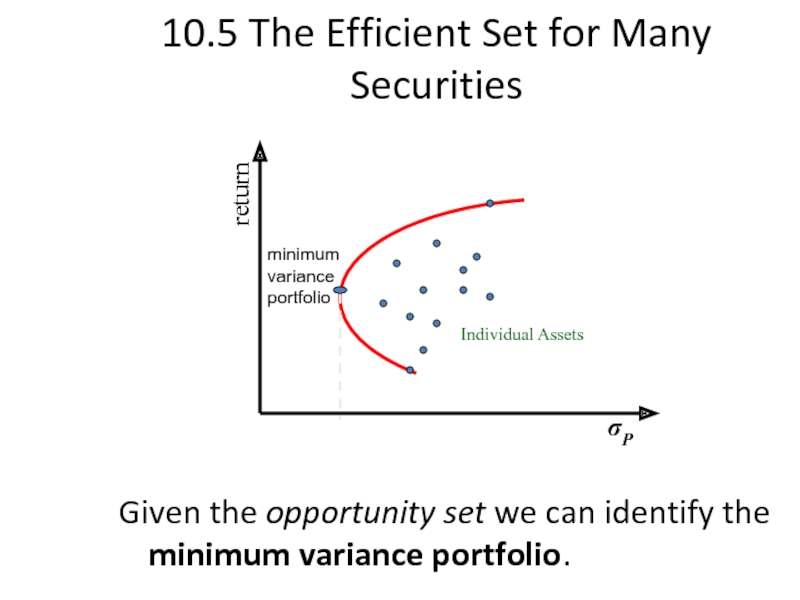

Слайд 2710.5 The Efficient Set for Many Securities

Given the opportunity set we

return

σP

minimum variance portfolio

Individual Assets

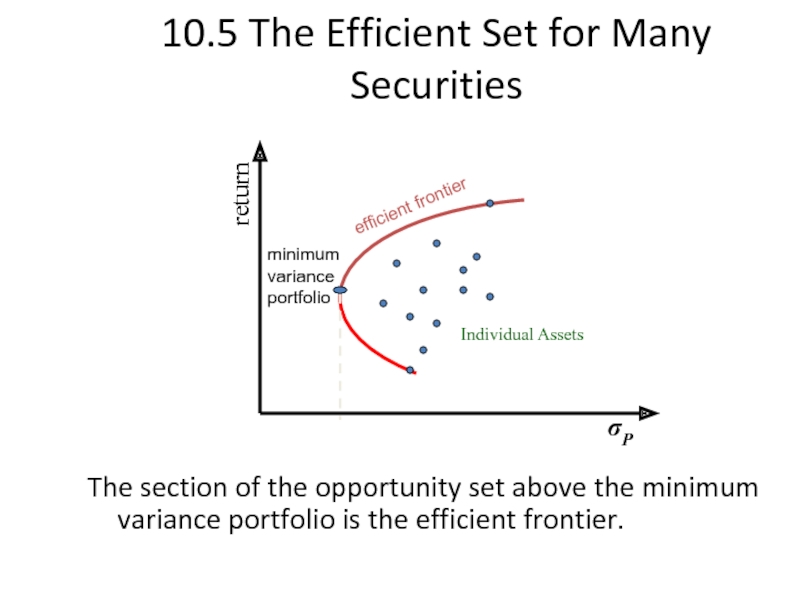

Слайд 28

10.5 The Efficient Set for Many Securities

The section of the opportunity

return

σP

minimum variance portfolio

efficient frontier

Individual Assets

Слайд 29Optimal Risky Portfolio with a Risk-Free Asset

In addition to stocks

100% bonds

100% stocks

rf

return

σ

Слайд 3010.7 Riskless Borrowing and Lending

Now investors can allocate their money across

100% bonds

100% stocks

rf

return

σ

Balanced fund

CML

Слайд 31

10.7 Riskless Borrowing and Lending

With a risk-free asset available and the

return

σP

efficient frontier

rf

CML

Слайд 32

10.8 Market Equilibrium

With the capital allocation line identified, all investors choose

return

σP

efficient frontier

rf

M

CML

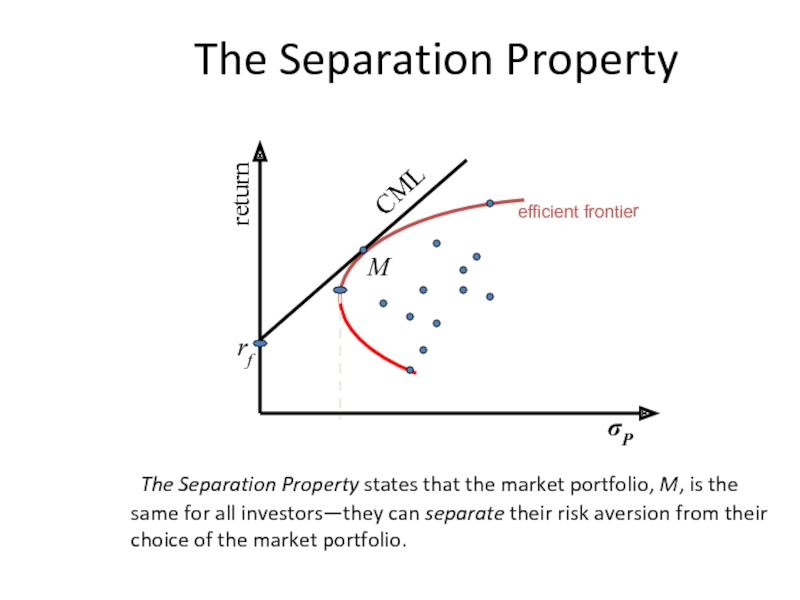

Слайд 33

The Separation Property

The Separation Property states that the market portfolio,

return

σP

efficient frontier

rf

M

CML

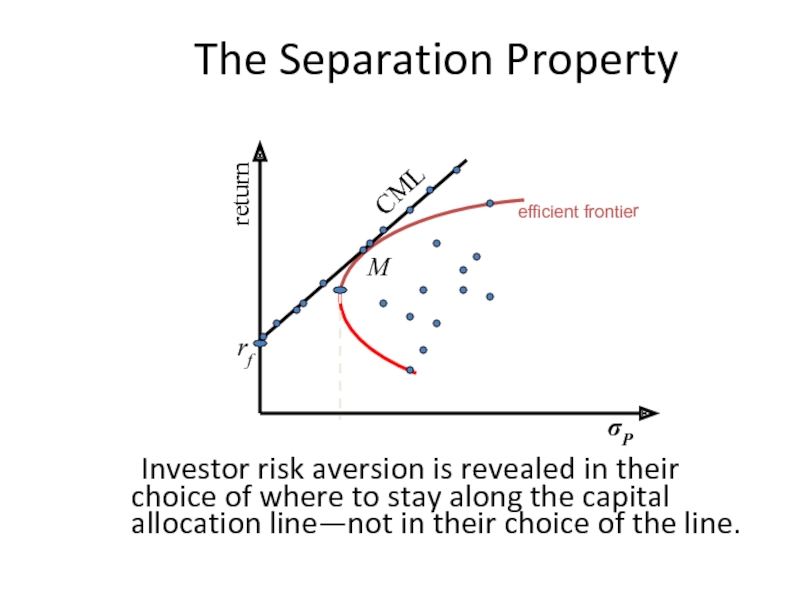

Слайд 34

The Separation Property

Investor risk aversion is revealed in their choice

return

σP

efficient frontier

rf

M

CML

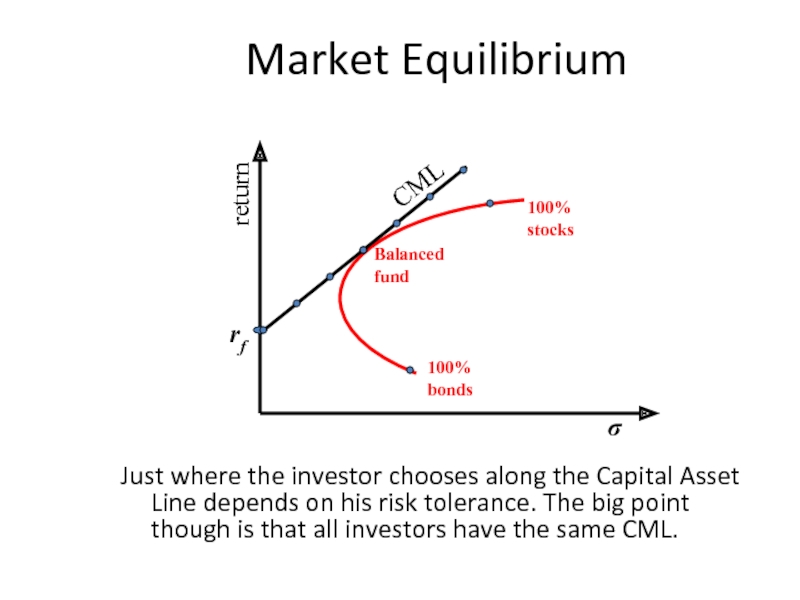

Слайд 35Market Equilibrium

Just where the investor chooses along the Capital Asset Line

100% bonds

100% stocks

rf

return

σ

Balanced fund

CML

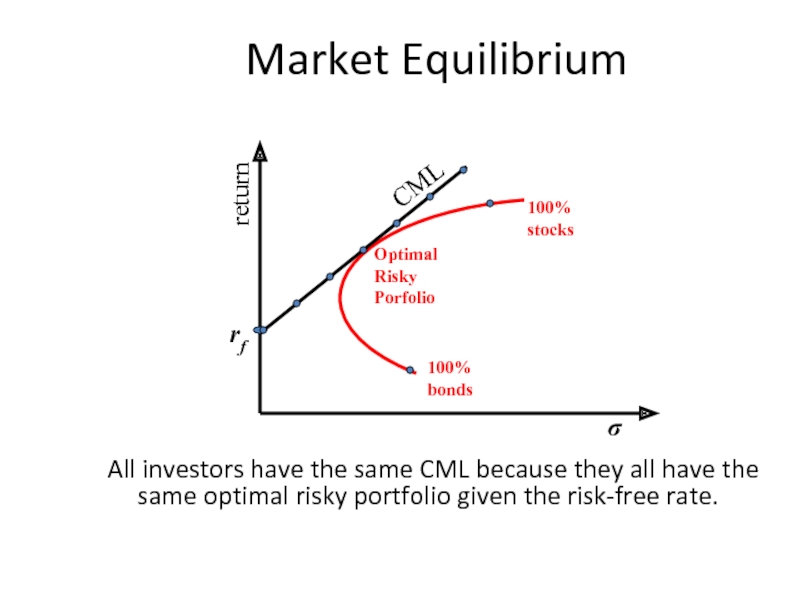

Слайд 36Market Equilibrium

All investors have the same CML because they all have

100% bonds

100% stocks

rf

return

σ

Optimal Risky Porfolio

CML

Слайд 37The Separation Property

The separation property implies that portfolio choice can be

100% bonds

100% stocks

rf

return

σ

Optimal Risky Porfolio

CML

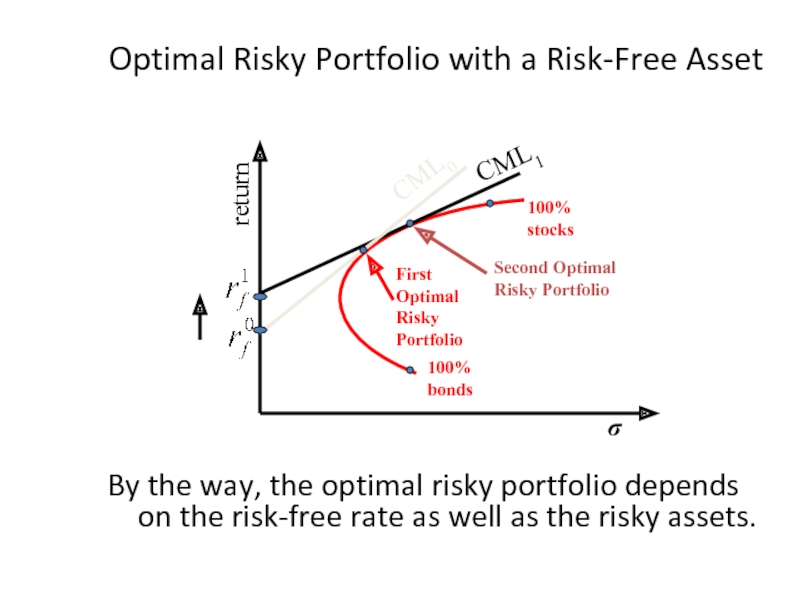

Слайд 38Optimal Risky Portfolio with a Risk-Free Asset

By the way, the

100% bonds

100% stocks

return

σ

First Optimal Risky Portfolio

Second Optimal Risky Portfolio

CML0

CML1

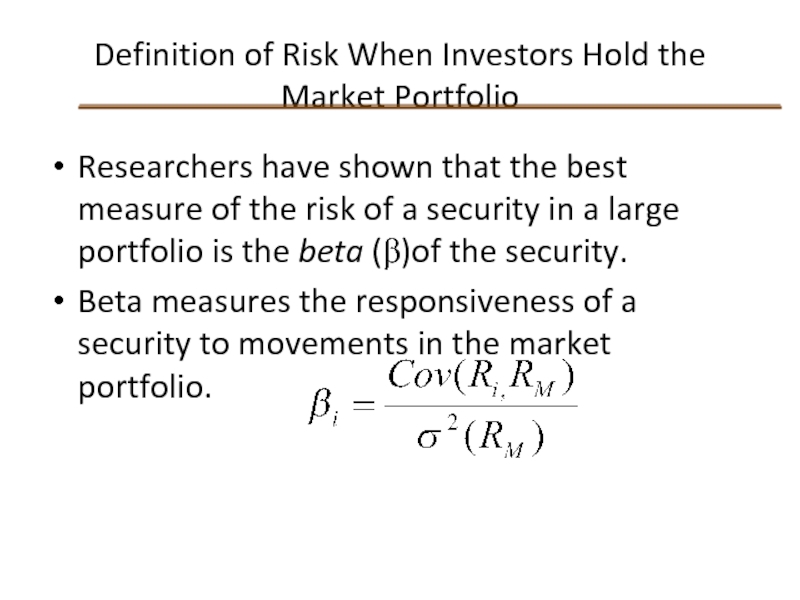

Слайд 39

Definition of Risk When Investors Hold the Market Portfolio

Researchers have shown

Beta measures the responsiveness of a security to movements in the market portfolio.

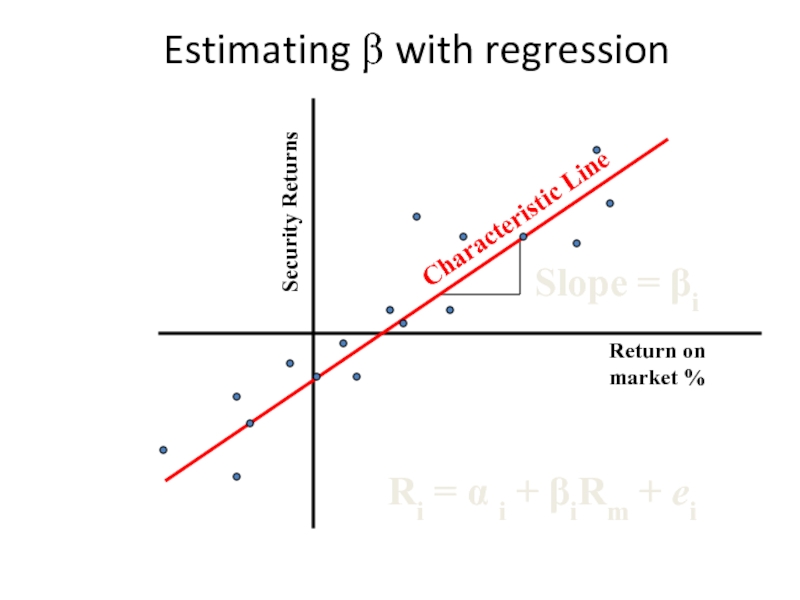

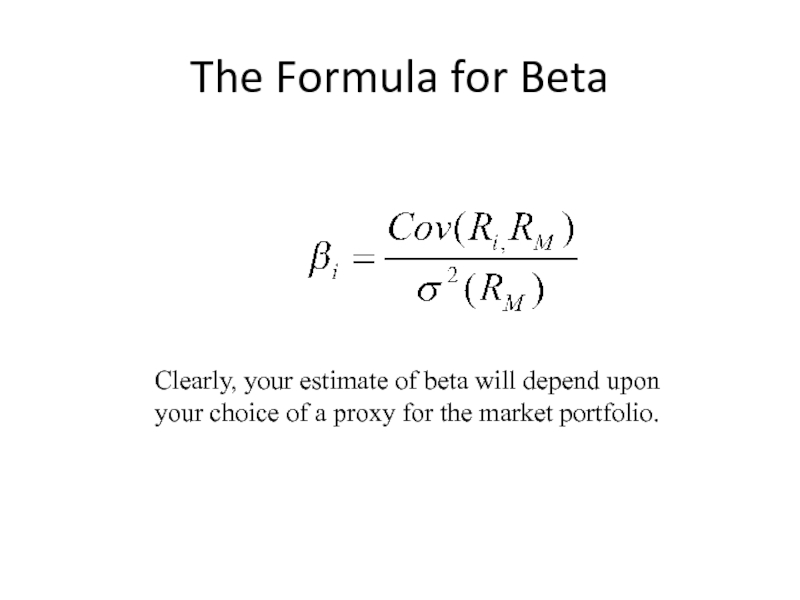

Слайд 42The Formula for Beta

Clearly, your estimate of beta will depend upon

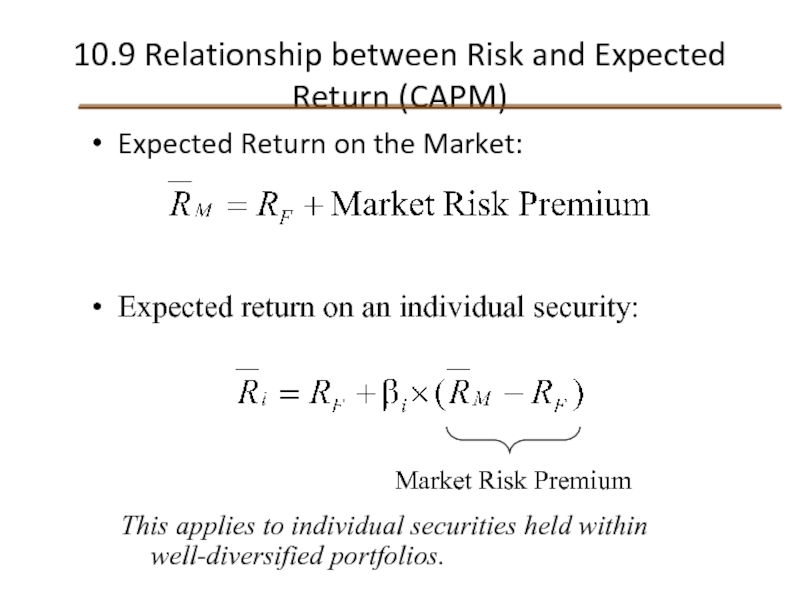

Слайд 43

10.9 Relationship between Risk and Expected Return (CAPM)

Expected Return on the

Expected return on an individual security:

Market Risk Premium

This applies to individual securities held within well-diversified portfolios.

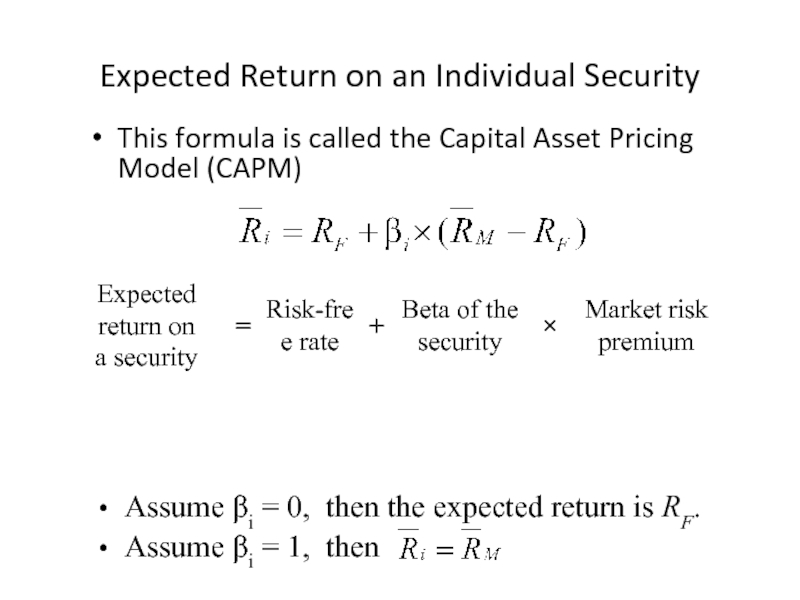

Слайд 44Expected Return on an Individual Security

This formula is called the Capital

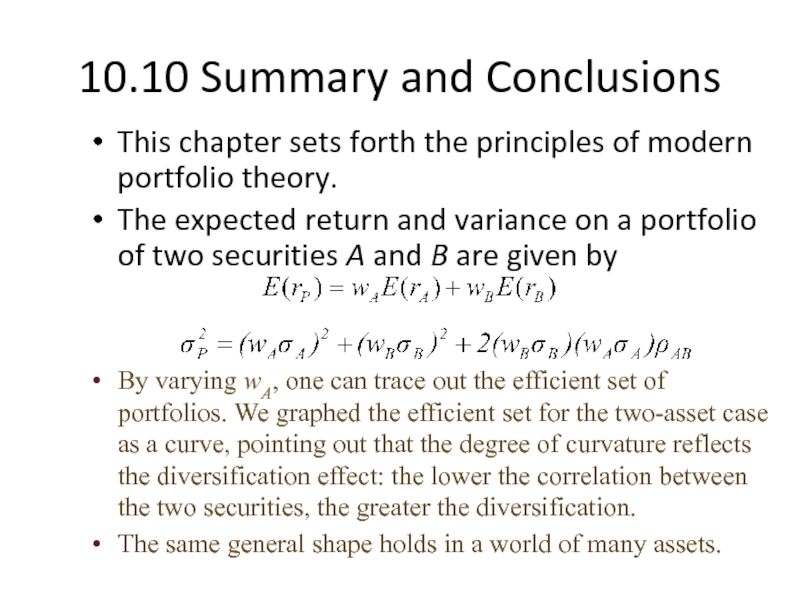

Слайд 4710.10 Summary and Conclusions

This chapter sets forth the principles of modern

The expected return and variance on a portfolio of two securities A and B are given by

By varying wA, one can trace out the efficient set of portfolios. We graphed the efficient set for the two-asset case as a curve, pointing out that the degree of curvature reflects the diversification effect: the lower the correlation between the two securities, the greater the diversification.

The same general shape holds in a world of many assets.

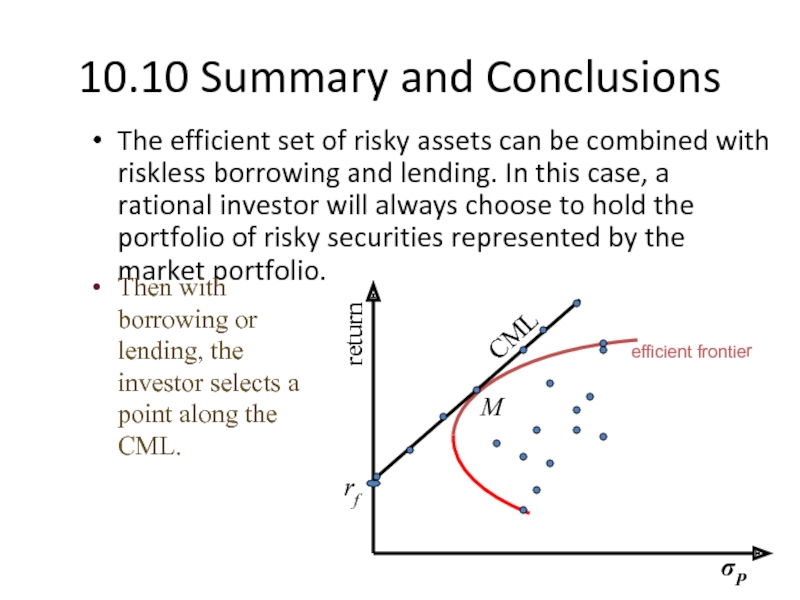

Слайд 4810.10 Summary and Conclusions

The efficient set of risky assets can be

return

σP

efficient frontier

rf

M

CML

Then with borrowing or lending, the investor selects a point along the CML.

Слайд 4910.10 Summary and Conclusions

The contribution of a security to the risk

The CAPM states that the expected return on a security is positively related to the security’s beta: