- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Rate Rise: The Fed Awakens презентация

Содержание

- 1. Rate Rise: The Fed Awakens

- 2. But will the economy strike back?

- 3. Inflation isn’t the phantom menace…it’s just a

- 4. The labour market is pointing in 2

- 5. Wage growth….very far from alarming Unit

- 6. And growth isn’t shooting the lights out

- 7. Investment is….meh! Fixed investment is a

- 8. The global backdrop is hardly great

- 9. China slowing and other EM concerns

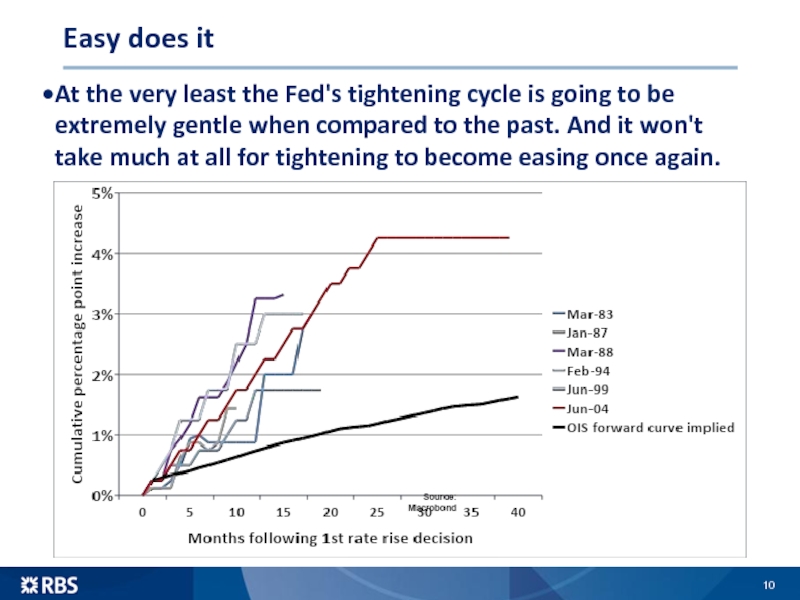

- 10. Easy does it At the very least

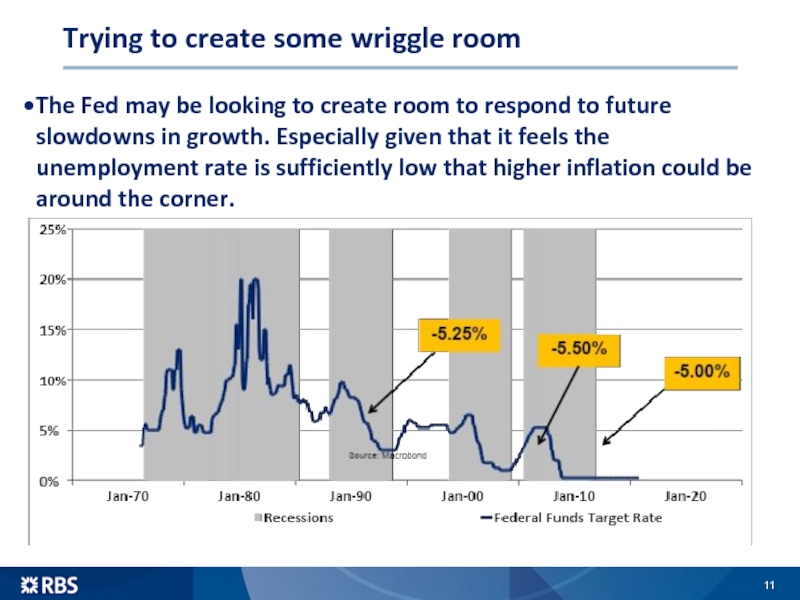

- 11. Trying to create some wriggle room The

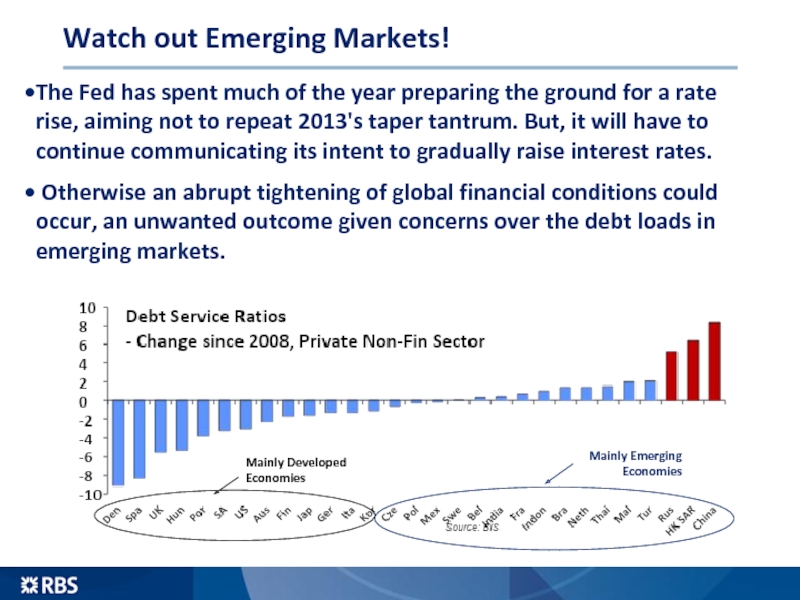

- 12. Watch out Emerging Markets! The Fed has

- 13. Final thoughts The US is better

- 14. Follow us on Twitter @RBS_Economics https://twitter.com/rbs_economics

- 15. Disclaimer This material is published by

Слайд 2But will the economy strike back?

The US has raised rates for

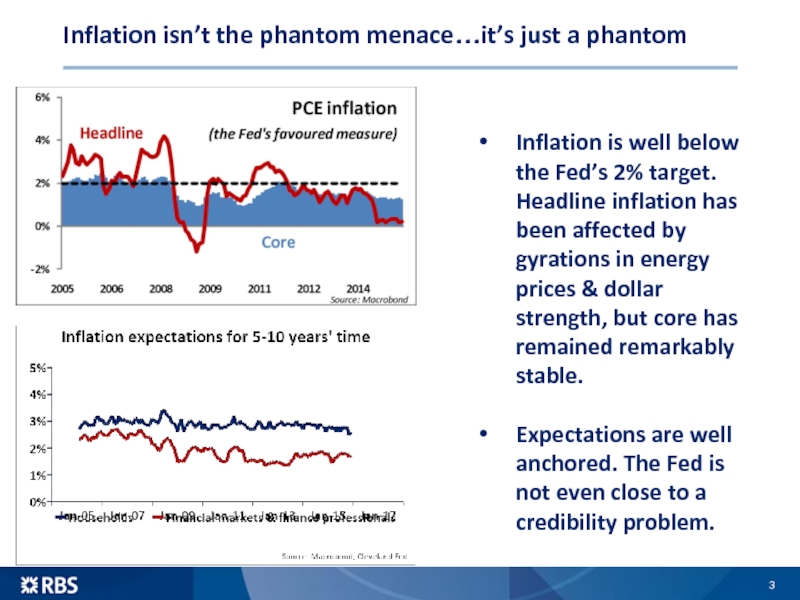

Слайд 3Inflation isn’t the phantom menace…it’s just a phantom

Inflation is well below

Expectations are well anchored. The Fed is not even close to a credibility problem.

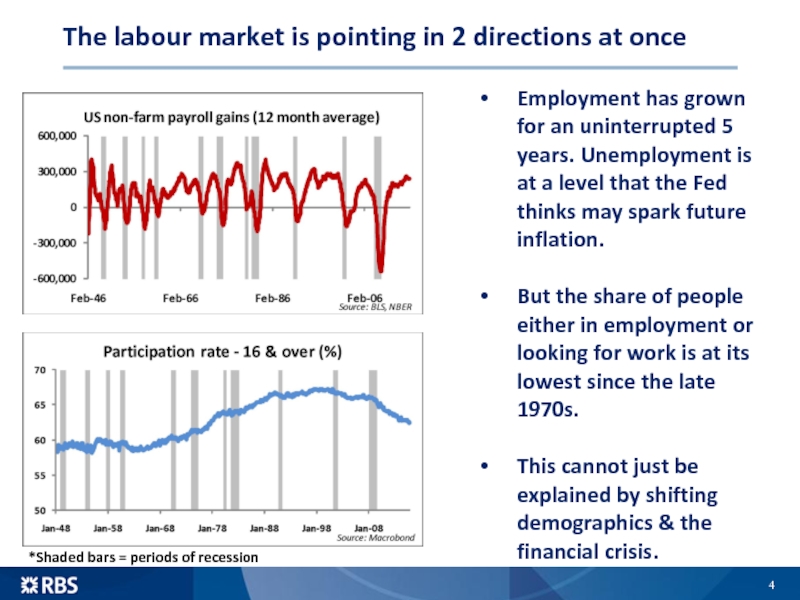

Слайд 4The labour market is pointing in 2 directions at once

Employment has

But the share of people either in employment or looking for work is at its lowest since the late 1970s.

This cannot just be explained by shifting demographics & the financial crisis.

*Shaded bars = periods of recession

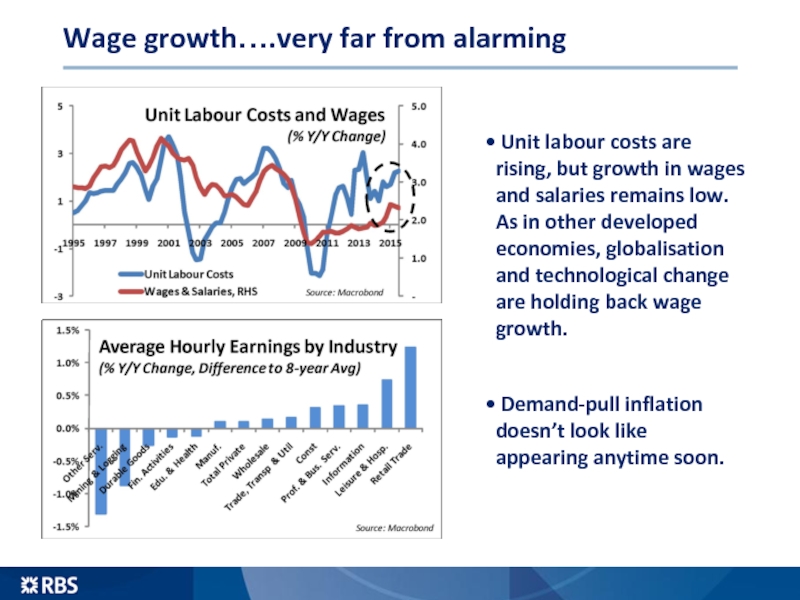

Слайд 5Wage growth….very far from alarming

Unit labour costs are rising, but

Demand-pull inflation doesn’t look like appearing anytime soon.

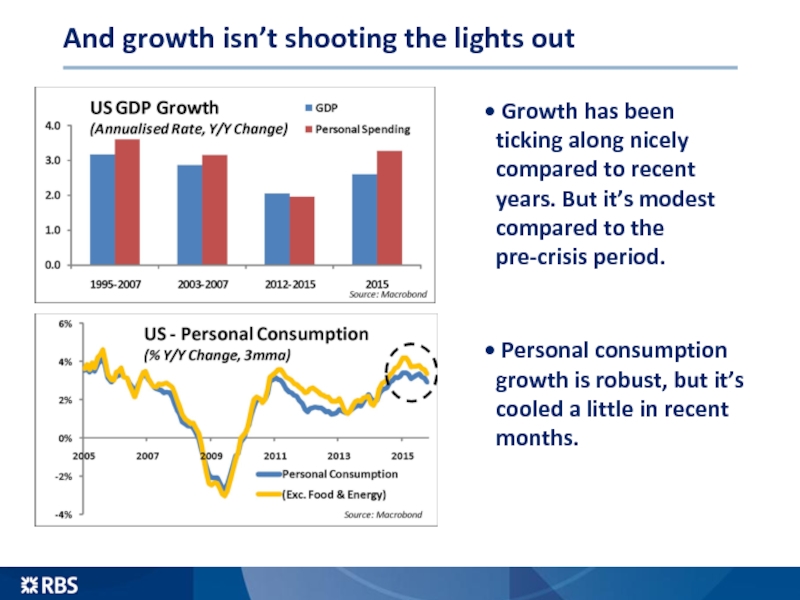

Слайд 6And growth isn’t shooting the lights out

Growth has been ticking

Personal consumption growth is robust, but it’s cooled a little in recent months.

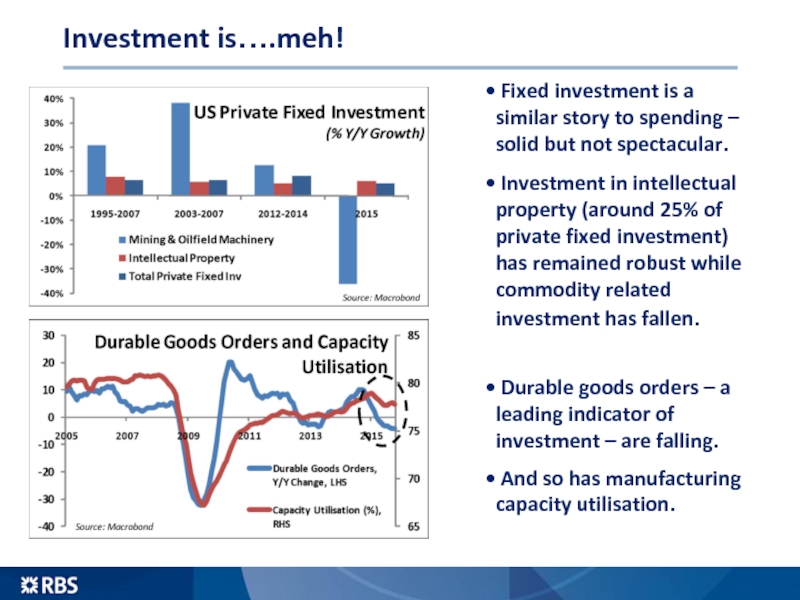

Слайд 7Investment is….meh!

Fixed investment is a similar story to spending –

Investment in intellectual property (around 25% of private fixed investment) has remained robust while commodity related investment has fallen.

Durable goods orders – a leading indicator of investment – are falling.

And so has manufacturing capacity utilisation.

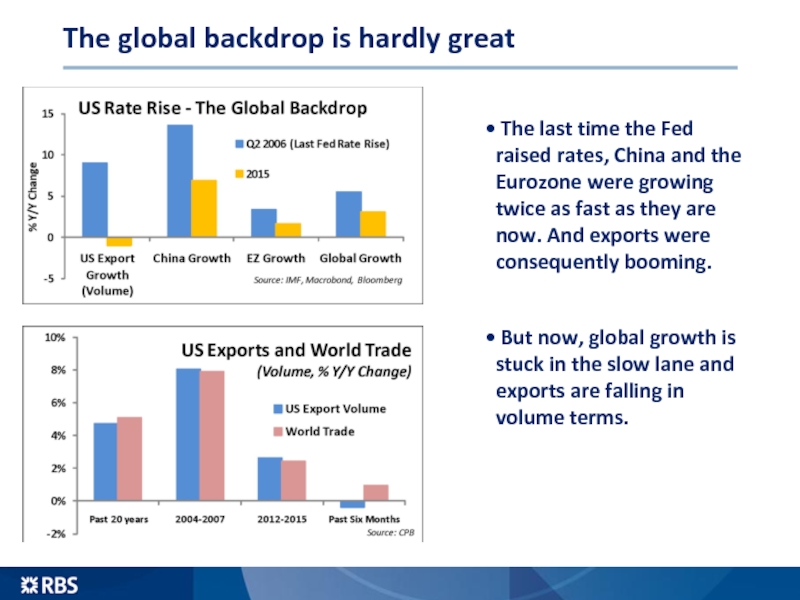

Слайд 8The global backdrop is hardly great

The last time the Fed

But now, global growth is stuck in the slow lane and exports are falling in volume terms.

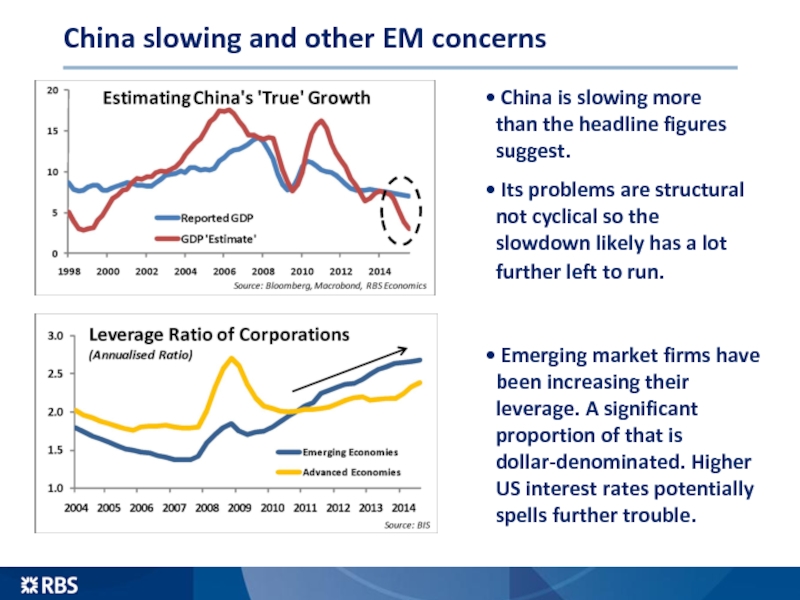

Слайд 9China slowing and other EM concerns

China is slowing more than

Its problems are structural not cyclical so the slowdown likely has a lot further left to run.

Emerging market firms have been increasing their leverage. A significant proportion of that is dollar-denominated. Higher US interest rates potentially spells further trouble.

Слайд 10Easy does it

At the very least the Fed's tightening cycle is

Слайд 11Trying to create some wriggle room

The Fed may be looking to

Слайд 12Watch out Emerging Markets!

The Fed has spent much of the year

Otherwise an abrupt tightening of global financial conditions could occur, an unwanted outcome given concerns over the debt loads in emerging markets.

Mainly Developed Economies

Mainly Emerging Economies

Слайд 13Final thoughts

The US is better placed than other major developed

The risk is that the Fed treads the well-worn path of other central banks in places such as the Euro Area, Sweden & Switzerland. Rates rise, disinflationary forces intensify and rates have to be brought down further than before.

There is an argument in favour of higher rates to cool asset price growth and risk-taking. But interest rates are a blunt tool for this purpose.