- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

RAMEZ NAAM@ramez презентация

Содержание

- 1. RAMEZ NAAM@ramez

- 2. [TEXT HAS BEEN ADDED TO SLIDES TO

- 3. WHO AM I?

- 4. SCIENCE FICTION AUTHOR

- 5. 14 YEARS IN TECH

- 6. HELPED LEAD INTERNAL STARTUP DOING HIGH

- 8. LEARNING FROM A DISRUPTIVE ADVERSARY

- 10. NOW TEACHING IMPACTS OF EXPONENTIAL TECHNOLOGIES

- 12. SCIENCE FICTION IS HERE

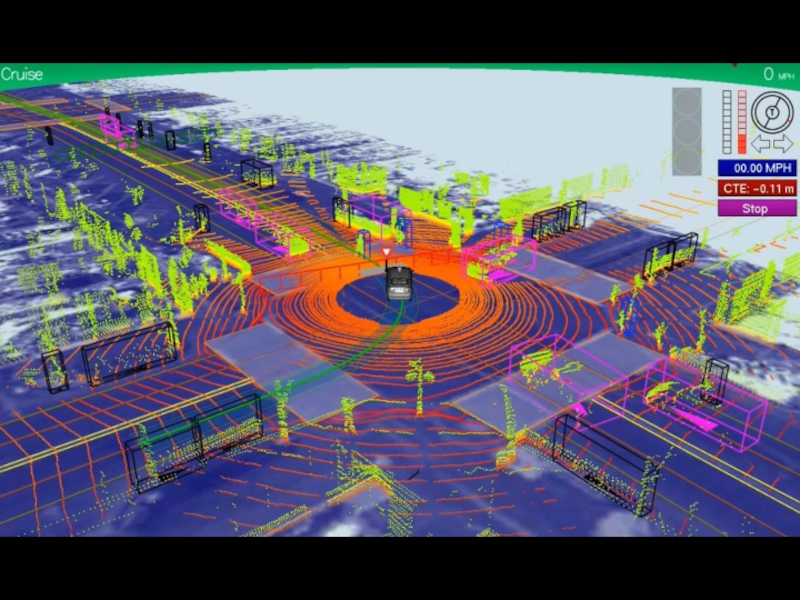

- 14. 1 MILLION MILES DRIVEN ZERO ACCIDENTS

- 15. SEES THINGS YOU CAN’T SEE REACTS

- 17. 30,000 US ROAD FATALITIES / YEAR 1

- 19. “DRIVING” WILL GO AWAY HUGE INDUSTRIES DISRUPTED YOUR LIFE CHANGED

- 21. IBM’S WATSON

- 22. TROUNCED TWO BEST HUMANS TASK RECENTLY CONSIDERED IMPOSSIBLE

- 24. IBM’S TARGET MARKET: MEDICINE 16% OF US GDP A BETTER DOCTOR, BETTER DIAGNOSIS

- 25. MEDICINE A LARGE TARGET X-PRIZE TRICORDER PRIZE MOBISANTE ULTRASOUND

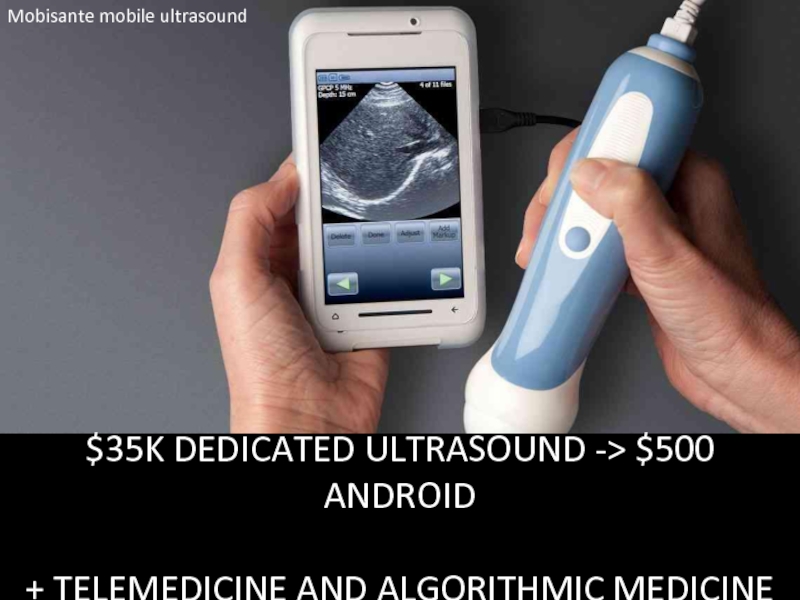

- 26. $35K DEDICATED ULTRASOUND -> $500 ANDROID

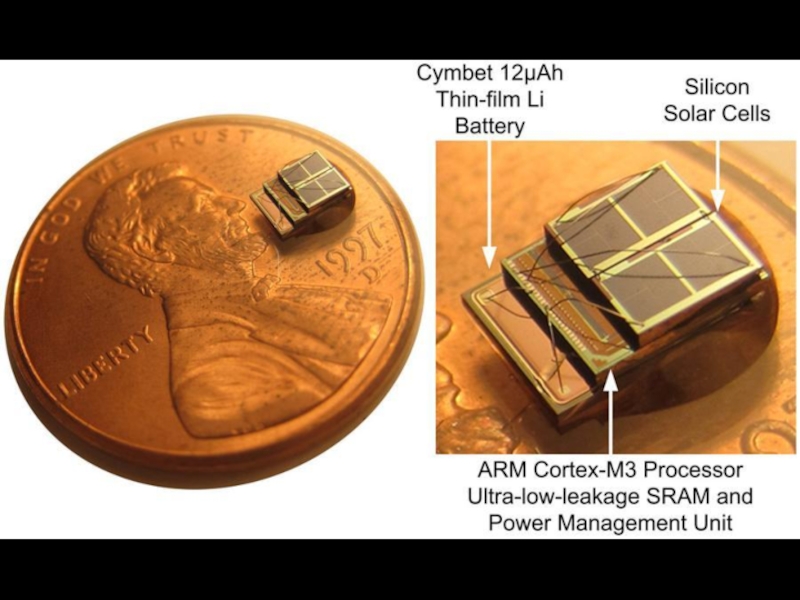

- 27. SENSORS EVERYWHERE EVERY APPLIANCE, VEHICLE, DEVICE, CONNECTED

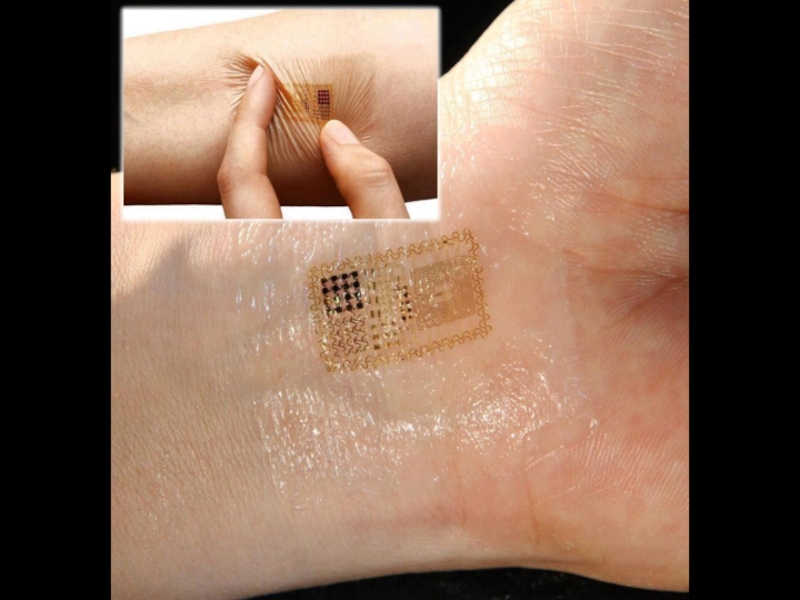

- 29. SENSORS FOR THE BODY THE INTERNET OF US

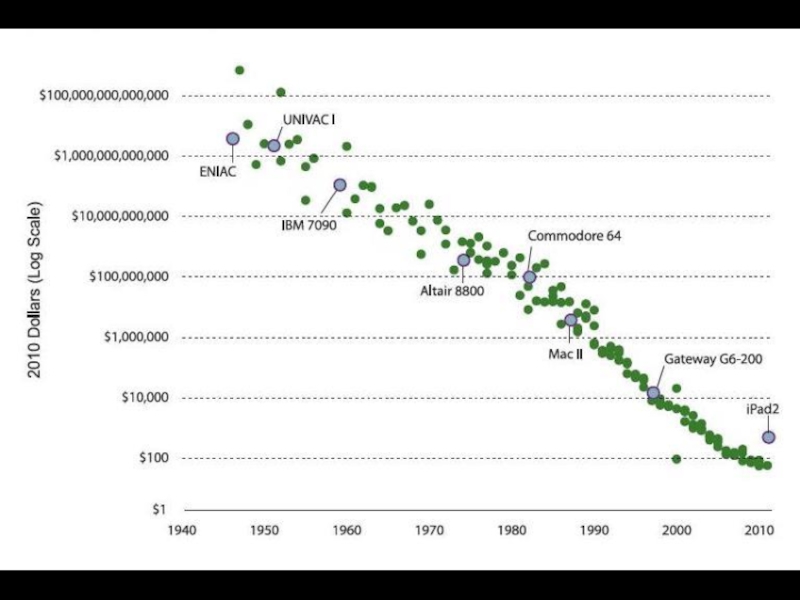

- 31. iPhone vs. ENIAC Michael O’Donnell $10 TRILLION TO BUILD IPHONE 5 WITH 1940s TECH

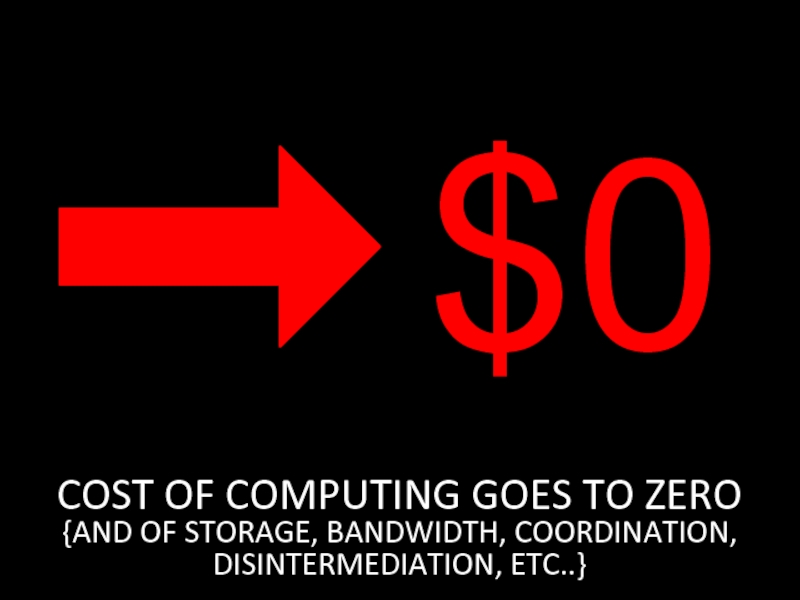

- 33. $0 COST OF

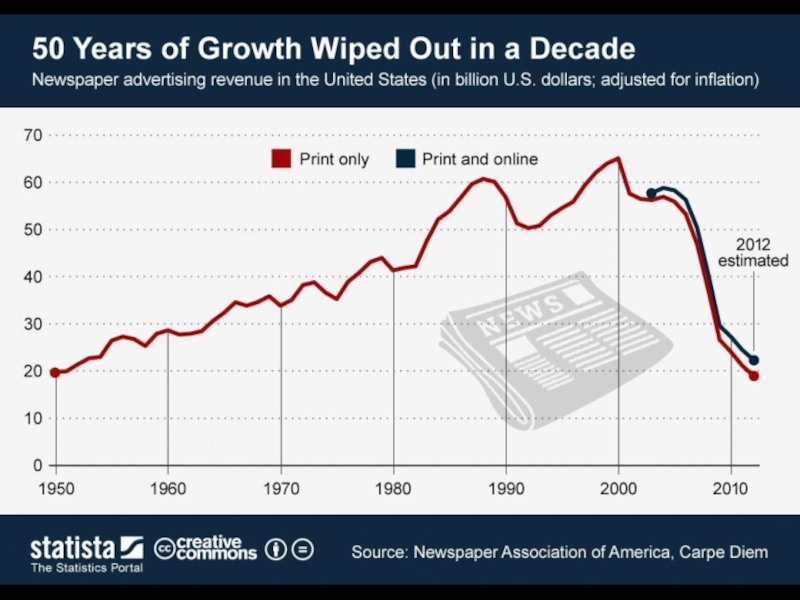

- 34. WINNERS AND LOSERS

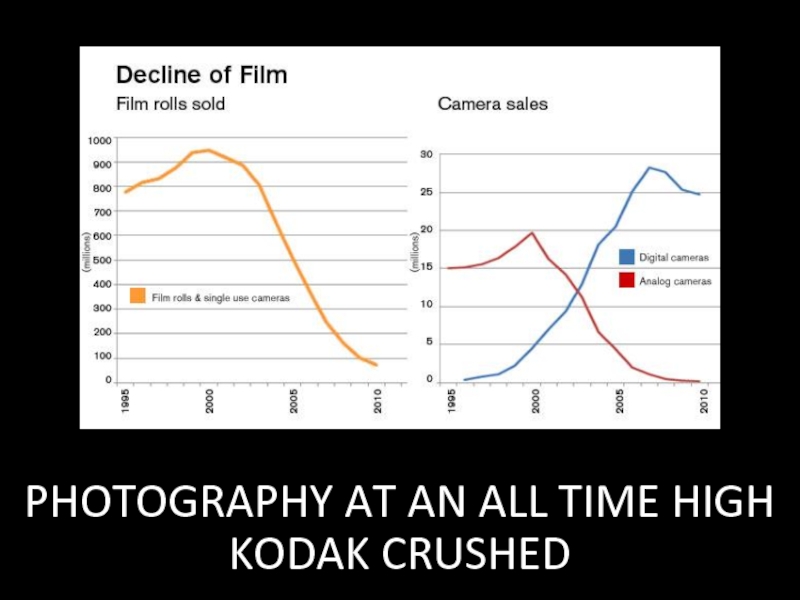

- 39. PHOTOGRAPHY AT AN ALL TIME HIGH KODAK CRUSHED

- 42. $18 Billion

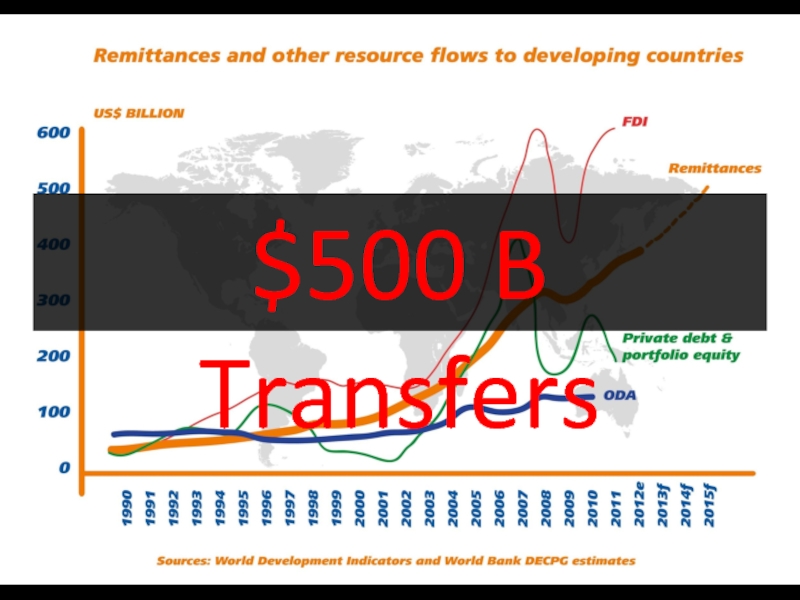

- 43. $10 Billion

- 44. $9.5 Billion

- 45. $18 Billion

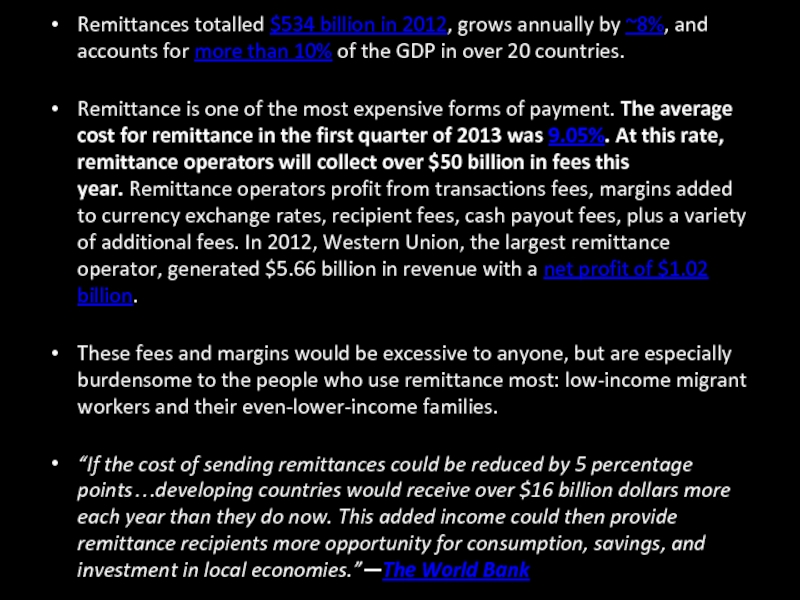

- 46. $23 Billion

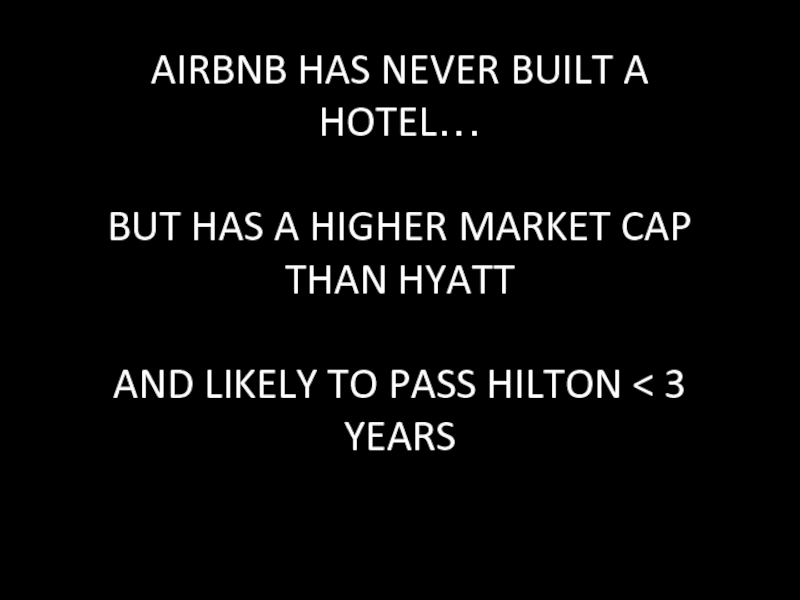

- 48. AIRBNB HAS NEVER BUILT A HOTEL…

- 49. AIRBNB vs. HOTEL CHAINS (MARKET CAPS)

- 50. WANT TO BE A WINNER? OR A LOSER?

- 51. DISRUPTED

- 52. DISRUPTION STARTS AT THE EDGES THEN HITS THE CORE PAYMENTS ARE THE EDGE

- 53. 20% BANKS EARN UP TO 20% OF

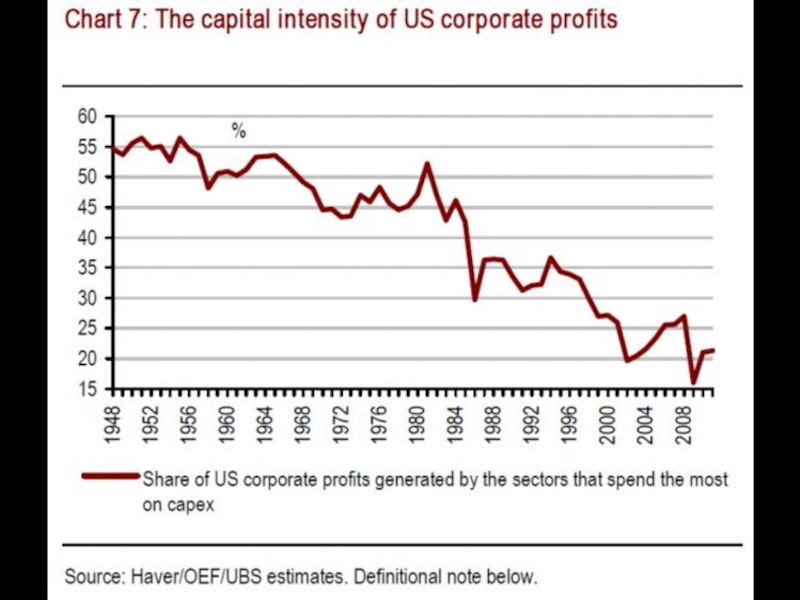

- 54. 3% CREDIT CARDS TAKE 2-3% OF EACH TRANSACTION

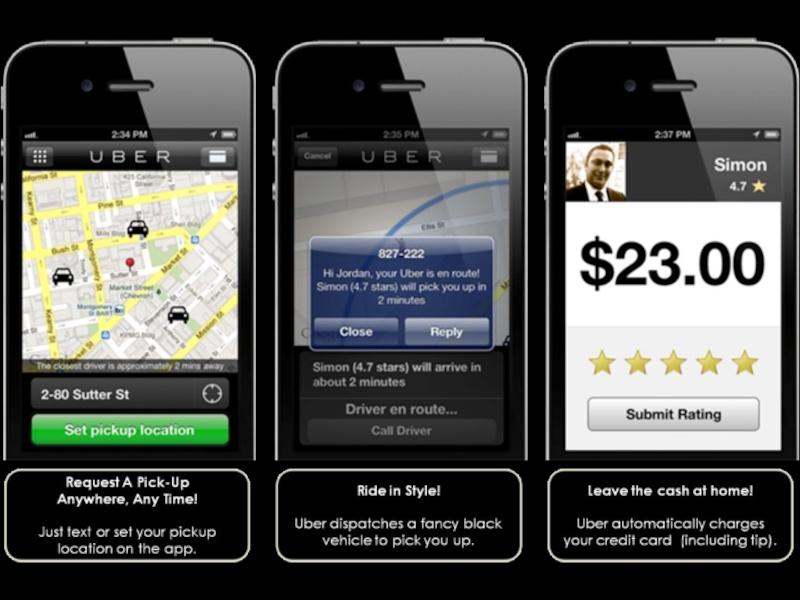

- 57. SQUARE WOULD LOVE TO REPLACE VISA AND MASTERCARD

- 59. BUT DOES THE WORLD EVEN NEED SQUARE?

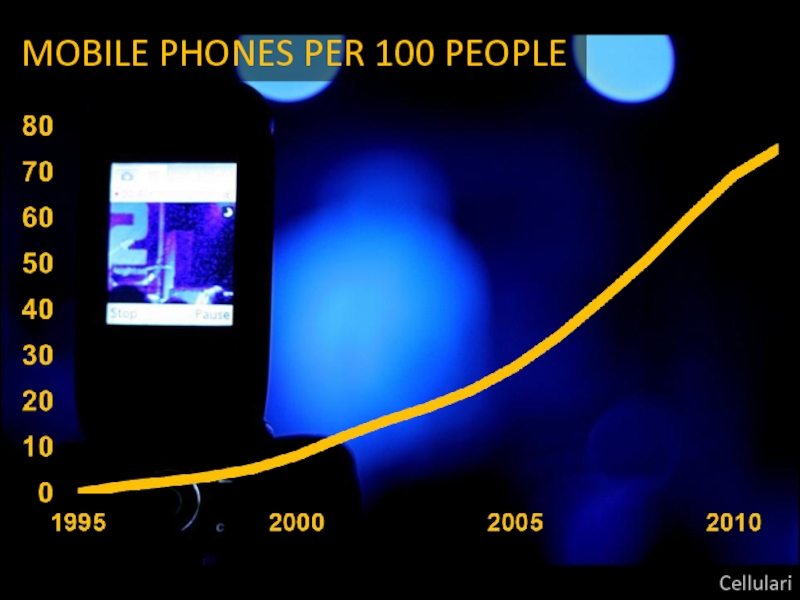

- 60. MOBILE PHONES PER 100 PEOPLE Cellulari

- 62. UBIQUITOUS SMART PHONES WILL ENABLE PAYMENTS WITHOUT ADDED HARDWARE

- 64. $1.6 TRILLION

- 65. CHINA $1.6 TRILLION IN MOBILE PAYMENTS IN 2013 317% GROWTH FROM 2012

- 66. VISA AND MASTERCARD WANT TO OWN THIS SPACE TOO

- 67. BUT 3% SKIM CREATES AMPLE INCENTIVES FOR MERCHANTS & RIVALS

- 69. ANALOGY: MOBILE SOCIAL & MOBILE MESSAGING

- 72. DISRUPTED MONEY WIRING ESPECIALLY VULNERABLE

- 73. DEVELOPING WORLD MAJOR GROWTH AREA DRIVEN BY ‘REMITTANCES’ FROM EMIGREES

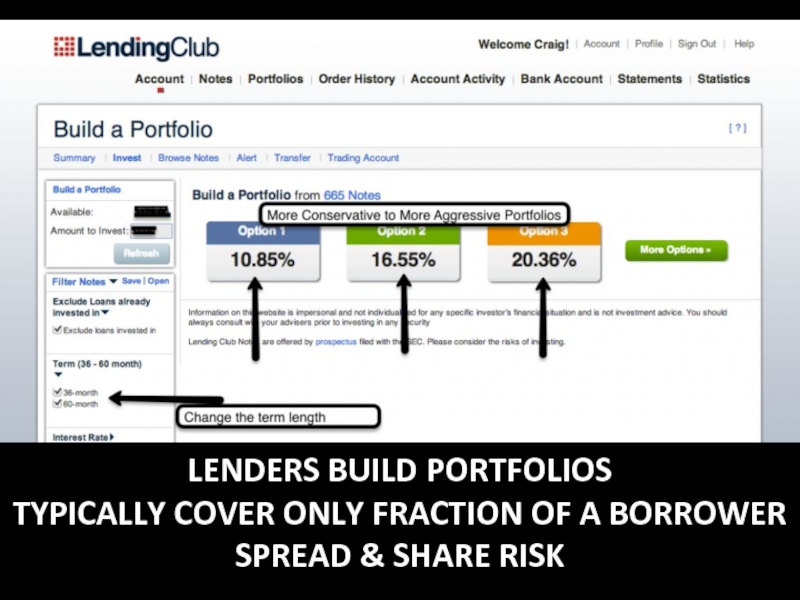

- 74. $500 B Transfers

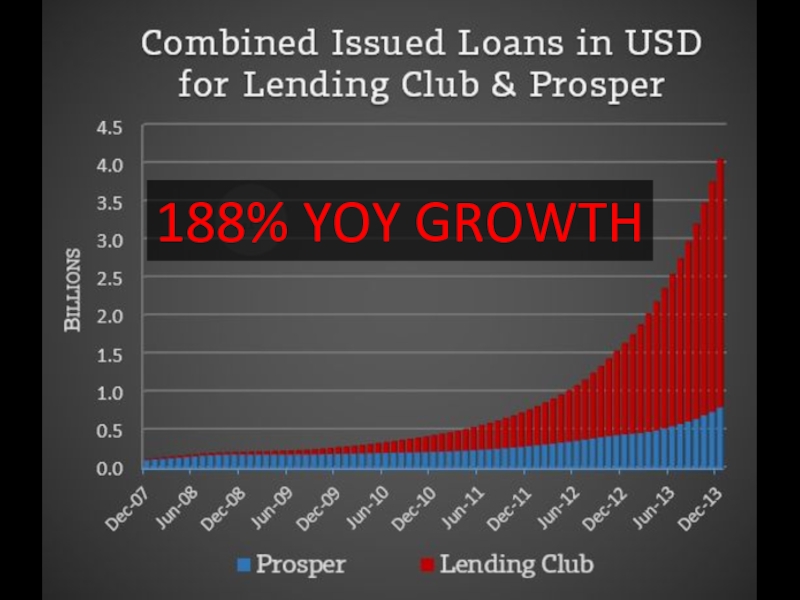

- 75. $528 BILLION IN REMITTANCES IN 2013

- 76. 10% FEES AVERAGE 10%. CAN BE 12%

- 77. Remittances totalled $534 billion in 2012, grows annually

- 79. 0%? BITCOIN AS A TRANSFER

- 80. DISRUPTED

- 81. 80% THE REAL MONEY FOR BANKS IS LOAN INTEREST 80% OF REVENUE: LOANS & SECURITIES

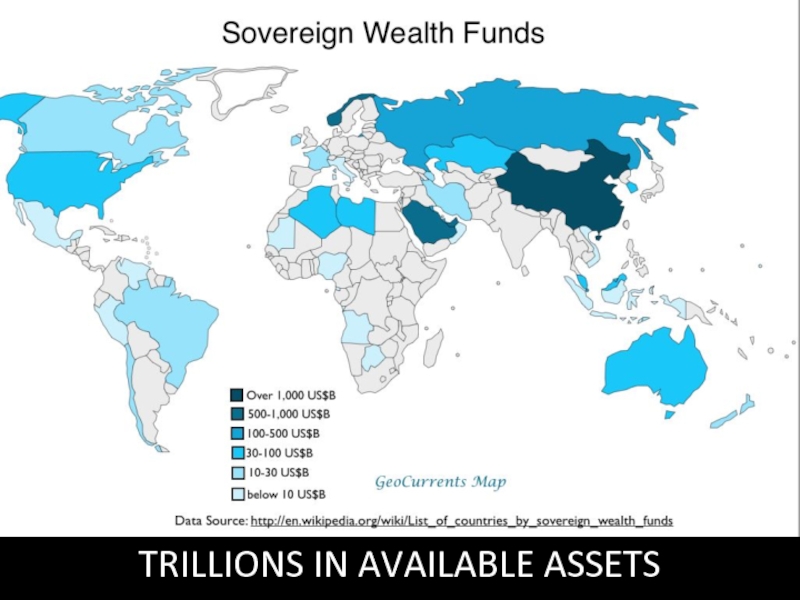

- 82. BANKS DEPEND UPON DEMAND FOR THEIR LOANS

- 84. US INDUSTRY IS LESS AND LESS CAPITAL

- 86. RECENT EXAMPLES

- 87. $280 million funding $22 BILLION exit

- 88. $800 million funding $10 BILLION value

- 89. AIRBNB NEVER BUILT ONE OF THESE

- 90. BUT AGAIN: NOT JUST RECENT.

- 92. PROBLEM 2: COMPETITION IN LENDING

- 93. PEER TO PEER LENDING

- 94. “AIRBNB FOR LOANS” CONNECTS BORROWERS TO LENDERS DISINTERMEDIATES BANKS

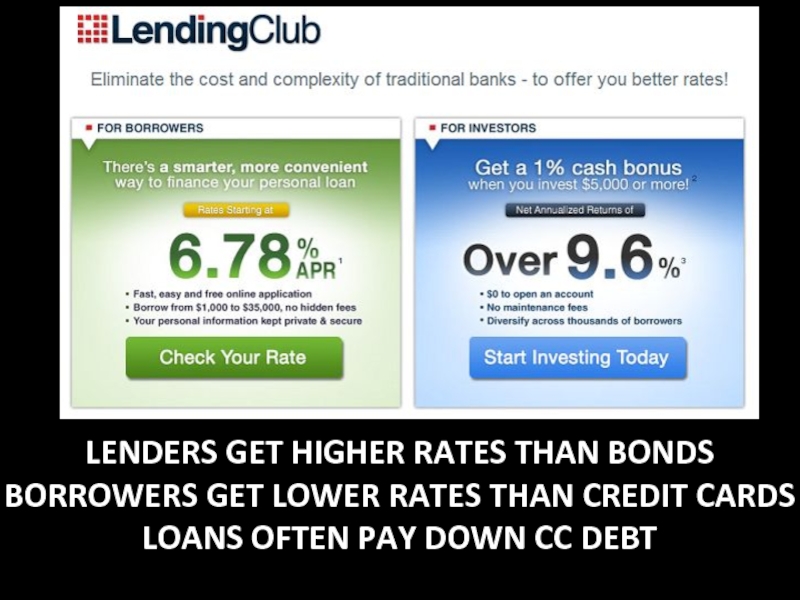

- 95. LENDERS GET HIGHER RATES THAN BONDS

- 96. LENDERS BUILD PORTFOLIOS TYPICALLY COVER ONLY FRACTION OF A BORROWER SPREAD & SHARE RISK

- 97. 188% YOY GROWTH

- 98. P2P LENDING STILL TINY VS $1.8T US

- 99. GOOGLE LEAD $125M LendingClub ROUND

- 100. OTHER COMPETITORS BEYOND P2P PRIVATE EQUITY FIRMS ?

- 101. $70+ BILLION IN LENDING IN 2013

- 102. NIGHTMARE SCENARIO: LARGE ASSET HOLDERS MOVE

- 103. TRILLIONS IN AVAILABLE ASSETS

- 104. ?

- 105. WHAT SHOULD BANKS DO? MOVE FAST IN

- 107. THE DISRUPTED FUTURE OF BANKING RAMEZ NAAM @ramez

Слайд 2[TEXT HAS BEEN ADDED TO SLIDES TO MAKE THEM USEFUL WITHOUT

A SPEAKER]

DON’T USE TEXT IN PRESENTATIONS

Слайд 6HELPED LEAD INTERNAL STARTUP

DOING HIGH SCALE,

DISTRIBUTED SYSTEMS,

MACHINE LEARNING,

INFORMATION RETRIEVAL

Слайд 1730,000 US ROAD FATALITIES / YEAR 1 MILLION /YEAR GLOBALLY 50 BILLION DRIVING

HOURS / YR IN US

~8% OF GDP LOST TO DRIVING TIME

Слайд 26

$35K DEDICATED ULTRASOUND -> $500 ANDROID

+ TELEMEDICINE AND ALGORITHMIC MEDICINE

Mobisante mobile

ultrasound

Слайд 33 $0

COST OF COMPUTING GOES TO ZERO

{AND OF STORAGE,

BANDWIDTH, COORDINATION, DISINTERMEDIATION, ETC..}

Слайд 48AIRBNB HAS NEVER BUILT A HOTEL… BUT HAS A HIGHER MARKET CAP

THAN HYATT

AND LIKELY TO PASS HILTON < 3 YEARS

Слайд 49AIRBNB vs. HOTEL CHAINS

(MARKET CAPS)

AIRBNB: $10b

HYATT: $9.5b

STARWOOD: $15B (LIKELY PASSED

IN 2015)

MARRIOTT: 18B (LIKELY PASSED BY 2016)

HILTON: $23b (LIKELY PASSED BY 2017)

MARRIOTT: 18B (LIKELY PASSED BY 2016)

HILTON: $23b (LIKELY PASSED BY 2017)

Слайд 5320%

BANKS EARN UP TO 20% OF REVENUE FROM NON-INTEREST SOURCES:

ATM

FEES, CREDIT CARD FEES, ACCOUNT FEES, ETC..

Слайд 69ANALOGY: MOBILE SOCIAL & MOBILE MESSAGING UBIQUITOUS HARDWARE LOWERED BARRIERS TO ENTRY

ALLOWED MULTIPLE NETWORKS TO SOAR RAPIDLY TO HIGH SCALE

Слайд 75$528 BILLION IN REMITTANCES IN 2013 8% YOY GROWTH >10% OF GDP IN

20 COUNTRIES

$50B IN MONEY TRANSFER FEES

Слайд 77Remittances totalled $534 billion in 2012, grows annually by ~8%, and accounts for more

than 10% of the GDP in over 20 countries.

Remittance is one of the most expensive forms of payment. The average cost for remittance in the first quarter of 2013 was 9.05%. At this rate, remittance operators will collect over $50 billion in fees this year. Remittance operators profit from transactions fees, margins added to currency exchange rates, recipient fees, cash payout fees, plus a variety of additional fees. In 2012, Western Union, the largest remittance operator, generated $5.66 billion in revenue with a net profit of $1.02 billion.

These fees and margins would be excessive to anyone, but are especially burdensome to the people who use remittance most: low-income migrant workers and their even-lower-income families.

“If the cost of sending remittances could be reduced by 5 percentage points…developing countries would receive over $16 billion dollars more each year than they do now. This added income could then provide remittance recipients more opportunity for consumption, savings, and investment in local economies.”—The World Bank

Remittance is one of the most expensive forms of payment. The average cost for remittance in the first quarter of 2013 was 9.05%. At this rate, remittance operators will collect over $50 billion in fees this year. Remittance operators profit from transactions fees, margins added to currency exchange rates, recipient fees, cash payout fees, plus a variety of additional fees. In 2012, Western Union, the largest remittance operator, generated $5.66 billion in revenue with a net profit of $1.02 billion.

These fees and margins would be excessive to anyone, but are especially burdensome to the people who use remittance most: low-income migrant workers and their even-lower-income families.

“If the cost of sending remittances could be reduced by 5 percentage points…developing countries would receive over $16 billion dollars more each year than they do now. This added income could then provide remittance recipients more opportunity for consumption, savings, and investment in local economies.”—The World Bank

Слайд 79

0%?

BITCOIN AS A TRANSFER PROTCOL

INHERENTLY GLOBAL AND INSTANT

PROCESSORS BIDDING AT

1% CHARGES

Слайд 90BUT AGAIN: NOT JUST RECENT. A LONG TERM TREND TOWARDS INCREASED CAPITAL EFFICIENCY

OF PROFITS

Слайд 95

LENDERS GET HIGHER RATES THAN BONDS

BORROWERS GET LOWER RATES THAN CREDIT

CARDS

LOANS OFTEN PAY DOWN CC DEBT

LOANS OFTEN PAY DOWN CC DEBT

Слайд 98P2P LENDING STILL TINY VS $1.8T US LOAN MKT BUT DOUBLING EVERY

9 MONTHS

2/3 NEW LOANS FROM INST. INVESTORS

DEFAULT INSURANCE NOW AN OPTION

Слайд 102NIGHTMARE SCENARIO: LARGE ASSET HOLDERS MOVE INTO LENDING ASSISTED BY ALGORITHMS THAT VET

LENDERS

& NETWORKS THAT DISINTERMEDIATE BANKS

Слайд 105WHAT SHOULD BANKS DO?

MOVE FAST IN A FAST CHANGING WORLD

KEEP YOUR

CUSTOMERS HAPPY!

UNDERSTAND YOU’RE NOT THE ONLY GAME IN TOWN

KNOW YOUR ADVANTAGES:

FDIC, PERCEIVED STABILITY, CONVENIENCE, RELATIONSHIPS

DISRUPT YOURSELF BEFORE SOMEONE ELSE DOES

UNDERSTAND YOU’RE NOT THE ONLY GAME IN TOWN

KNOW YOUR ADVANTAGES:

FDIC, PERCEIVED STABILITY, CONVENIENCE, RELATIONSHIPS

DISRUPT YOURSELF BEFORE SOMEONE ELSE DOES

![[TEXT HAS BEEN ADDED TO SLIDES TO MAKE THEM USEFUL WITHOUT A SPEAKER] DON’T USE](/img/tmb/4/315575/2d010b05a09b87d342f9b94701ebf889-800x.jpg)