- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Q2 Fiscal Year 2015Conference Call презентация

Содержание

- 1. Q2 Fiscal Year 2015Conference Call

- 2. FORWARD-LOOKING STATEMENTS This presentation contains projections and

- 3. Business Momentum & Key Trends Financial Overview Guidance Summary and Q&A

- 4. We are executing well and growing at

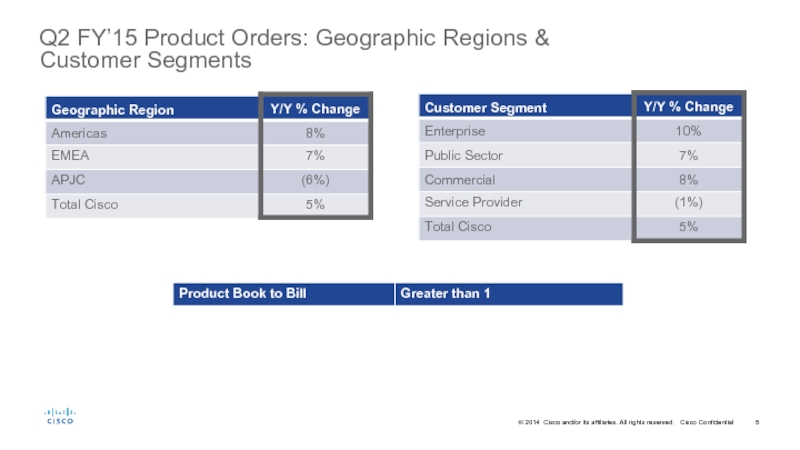

- 5. Q2 FY’15 Product Orders: Geographic Regions & Customer Segments

- 6. Geographies (in terms of product orders) Americas

- 7. Q2 FY’15 – Revenue Highlights Certain reclassifications

- 8. Products (in terms of revenue) Switching up

- 9. Business Momentum & Key Trends Financial Overview Guidance Summary and Q&A

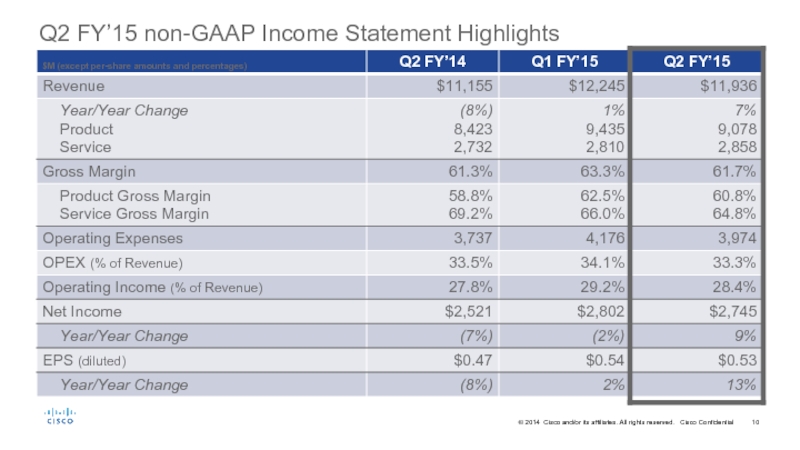

- 10. Q2 FY’15 non-GAAP Income Statement Highlights

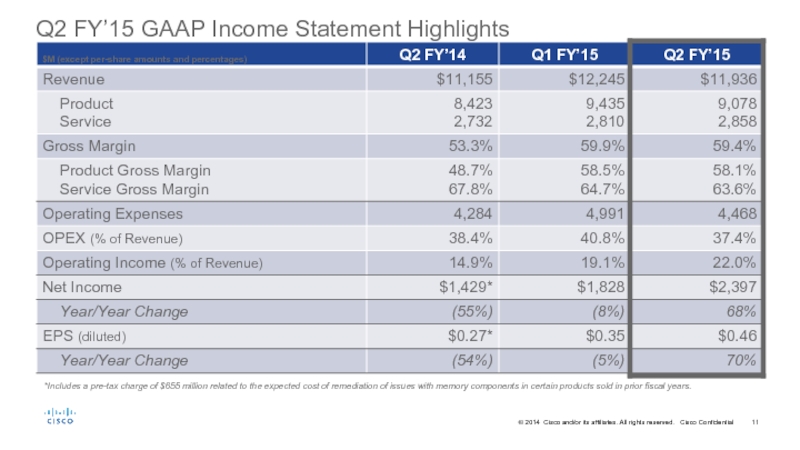

- 11. Q2 FY’15 GAAP Income Statement Highlights *Includes

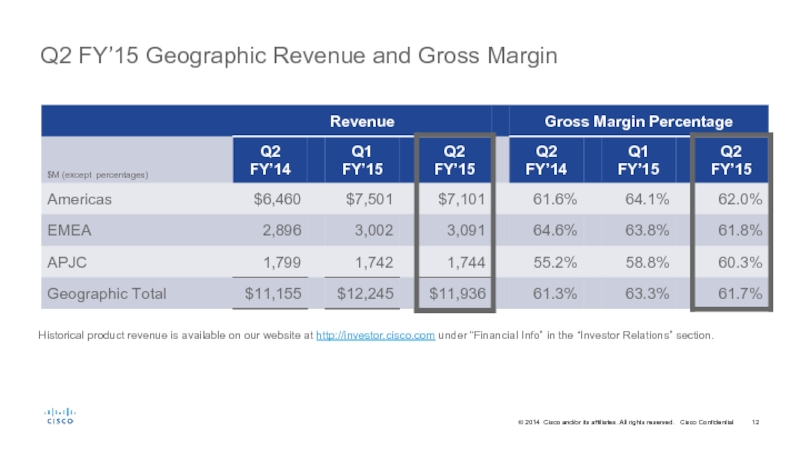

- 12. Q2 FY’15 Geographic Revenue and Gross Margin

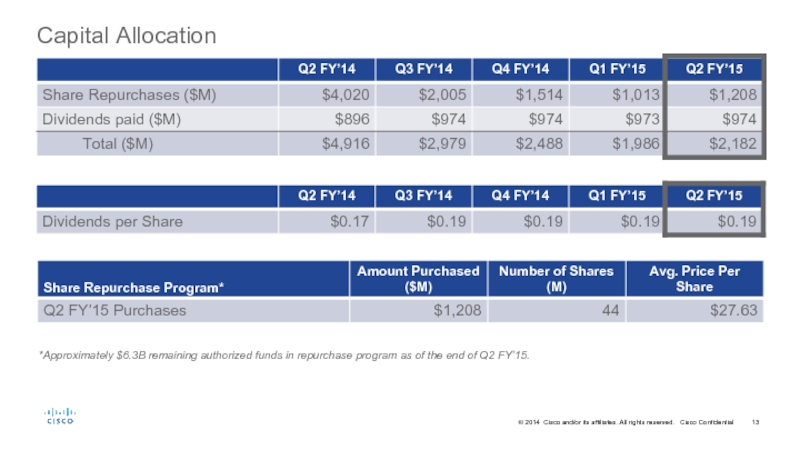

- 13. Capital Allocation *Approximately $6.3B remaining authorized funds

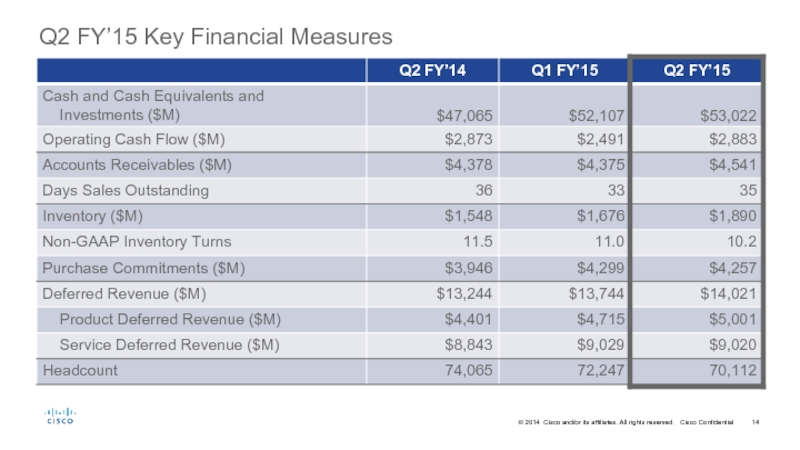

- 14. Q2 FY’15 Key Financial Measures

- 15. Business Momentum & Key Trends Financial Overview Guidance Summary and Q&A

- 16. Q&A

- 17. FORWARD-LOOKING STATEMENTS These presentation slides and

- 18. Supplemental Materials

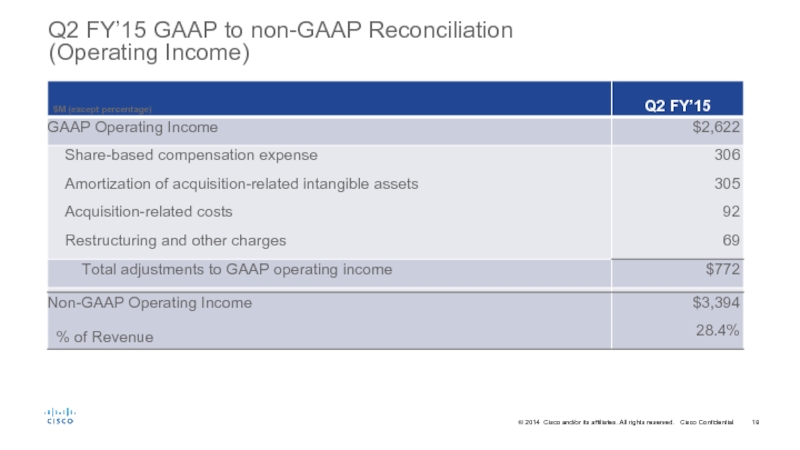

- 19. Q2 FY’15 GAAP to non-GAAP Reconciliation (Operating Income)

Слайд 2FORWARD-LOOKING STATEMENTS This presentation contains projections and other forward-looking statements regarding future

Слайд 4We are executing well and growing at a healthy pace in

Grew revenues this quarter to $11.9B, up 7% y/y

Generated $2.9B in operating cash flow

Returned close to $2.2B to shareholders through share repurchases and dividends

Delivered non-GAAP earnings per share of $0.53, up 13% y/y

Strong total non-GAAP gross margin of 61.7%

Changes enabled us to drive…with innovation, speed, agility and efficiencies

Best balanced growth in 12 quarters…across geographies, products and customer segments

Continue to deliver value for our shareholders…including another $.02 dividend increase to $0.21 per share

Q2 FY’15 Highlights

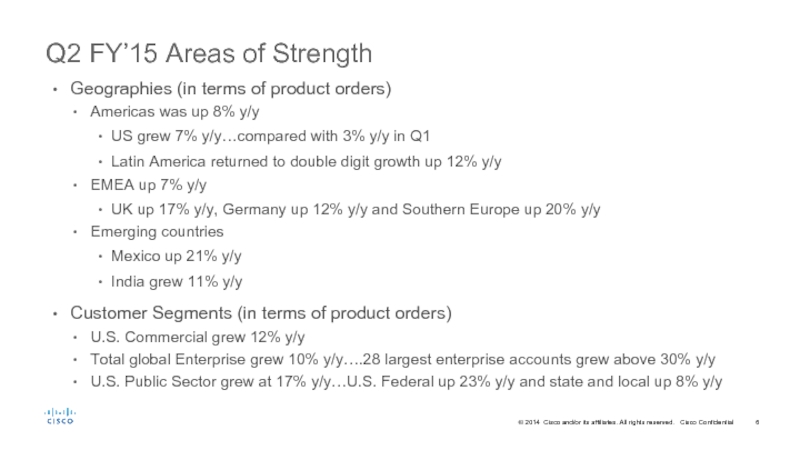

Слайд 6Geographies (in terms of product orders)

Americas was up 8% y/y

US grew

Latin America returned to double digit growth up 12% y/y

EMEA up 7% y/y

UK up 17% y/y, Germany up 12% y/y and Southern Europe up 20% y/y

Emerging countries

Mexico up 21% y/y

India grew 11% y/y

Customer Segments (in terms of product orders)

U.S. Commercial grew 12% y/y

Total global Enterprise grew 10% y/y….28 largest enterprise accounts grew above 30% y/y

U.S. Public Sector grew at 17% y/y…U.S. Federal up 23% y/y and state and local up 8% y/y

Q2 FY’15 Areas of Strength

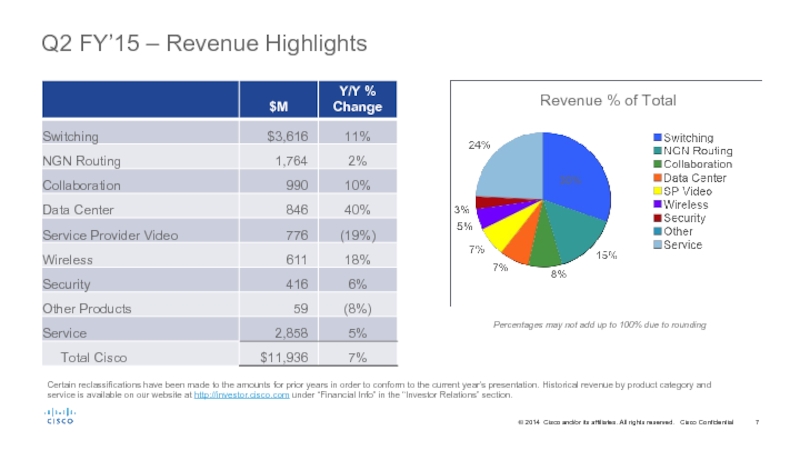

Слайд 7Q2 FY’15 – Revenue Highlights

Certain reclassifications have been made to the

Revenue % of Total

Percentages may not add up to 100% due to rounding

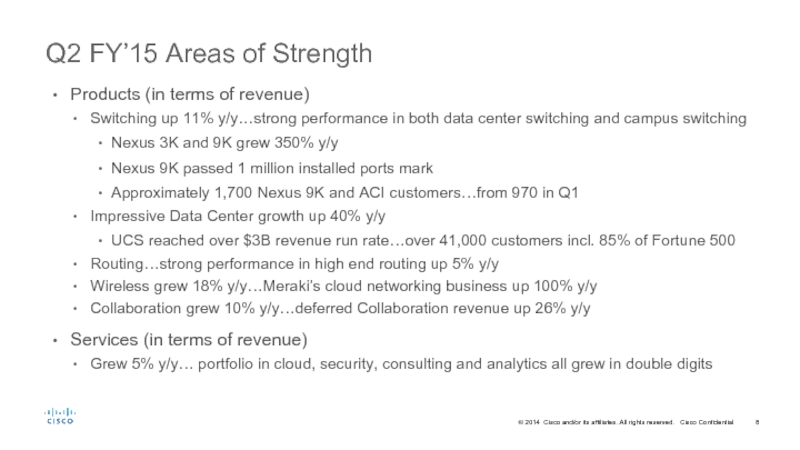

Слайд 8Products (in terms of revenue)

Switching up 11% y/y…strong performance in both

Nexus 3K and 9K grew 350% y/y

Nexus 9K passed 1 million installed ports mark

Approximately 1,700 Nexus 9K and ACI customers…from 970 in Q1

Impressive Data Center growth up 40% y/y

UCS reached over $3B revenue run rate…over 41,000 customers incl. 85% of Fortune 500

Routing…strong performance in high end routing up 5% y/y

Wireless grew 18% y/y…Meraki’s cloud networking business up 100% y/y

Collaboration grew 10% y/y…deferred Collaboration revenue up 26% y/y

Services (in terms of revenue)

Grew 5% y/y… portfolio in cloud, security, consulting and analytics all grew in double digits

Q2 FY’15 Areas of Strength