- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Preparing Financial Statements презентация

Содержание

- 1. Preparing Financial Statements

- 2. Preparing Financial Statements Publicly owned companies –

- 3. Now, let’s prepare the financial statements for JJ’s Lawn Care Service for May.

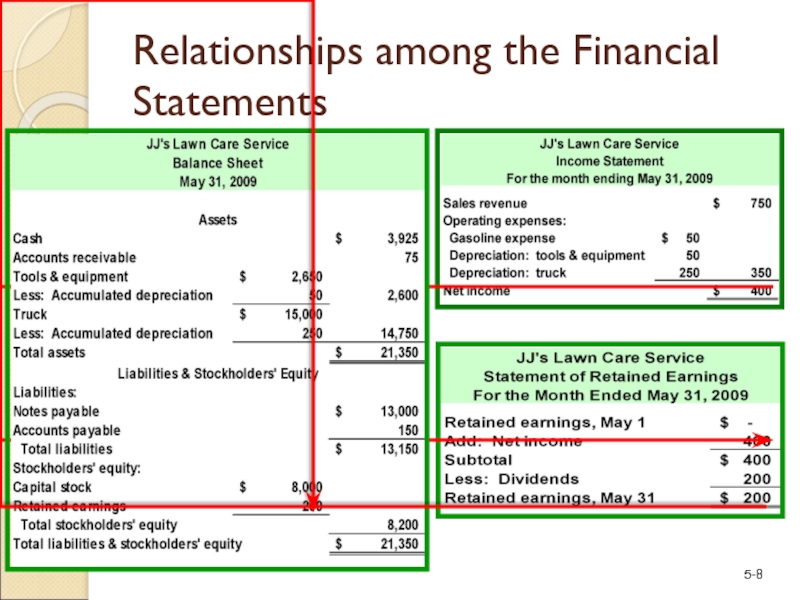

- 4. Net income also appears on the Statement of Retained Earnings. The Income Statement

- 5. Summarizes the increases and decreases in Retained

- 6. Now, let’s prepare the Balance Sheet. The Statement of Retained Earnings

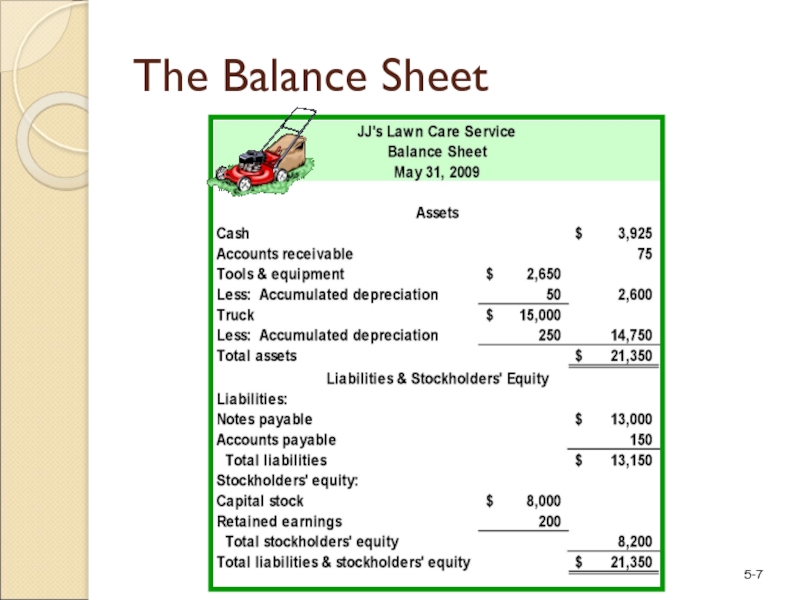

- 7. The Balance Sheet

- 8. Relationships among the Financial Statements

- 9. Notes to the Financial Statements Examples

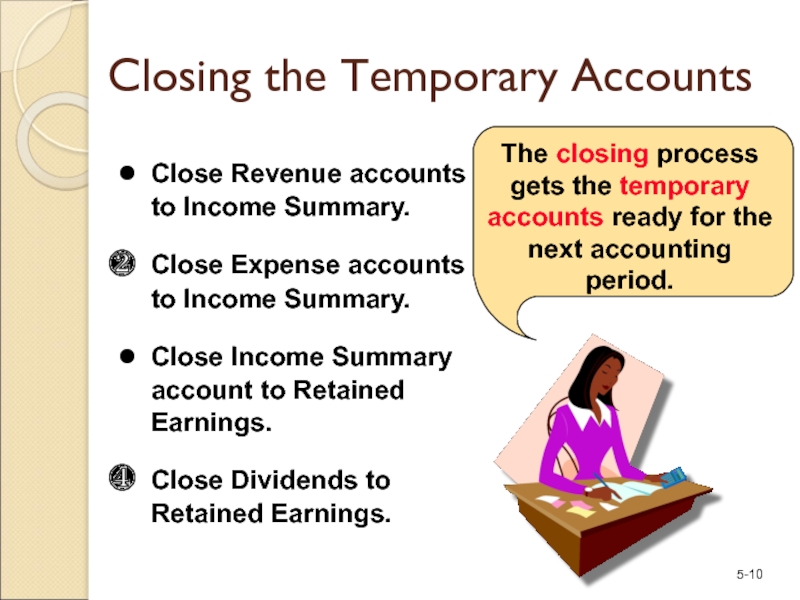

- 10. Closing the Temporary Accounts Close Revenue accounts

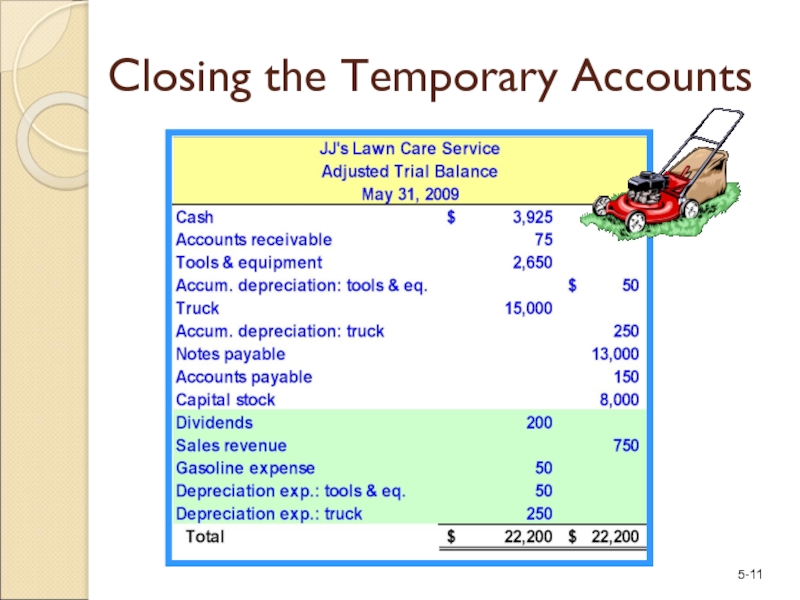

- 11. Closing the Temporary Accounts

- 12. Since Sales Revenue has a credit balance,

- 13. Closing Entries for Revenue Accounts

- 14. Since expense accounts have a debit balance,

- 15. Closing Entries for Expense Accounts

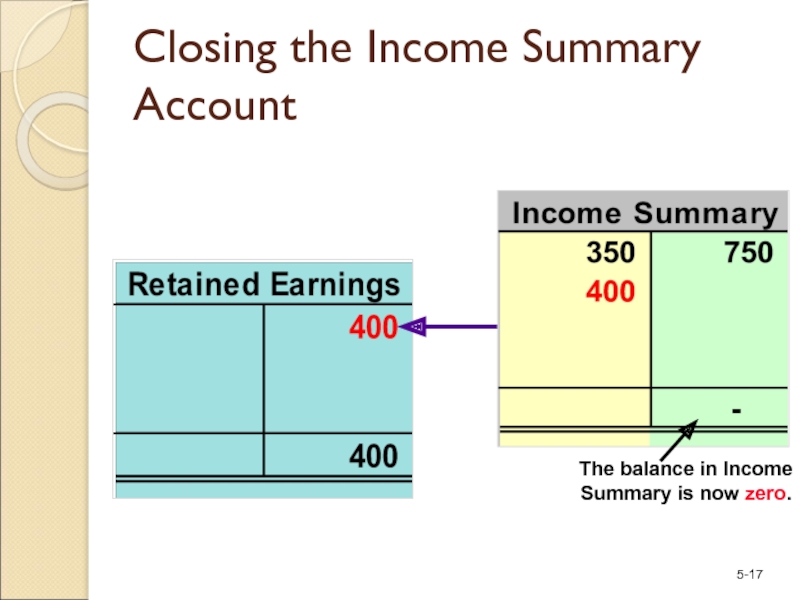

- 16. Since Income Summary has a $400 credit

- 17. Closing the Income Summary Account

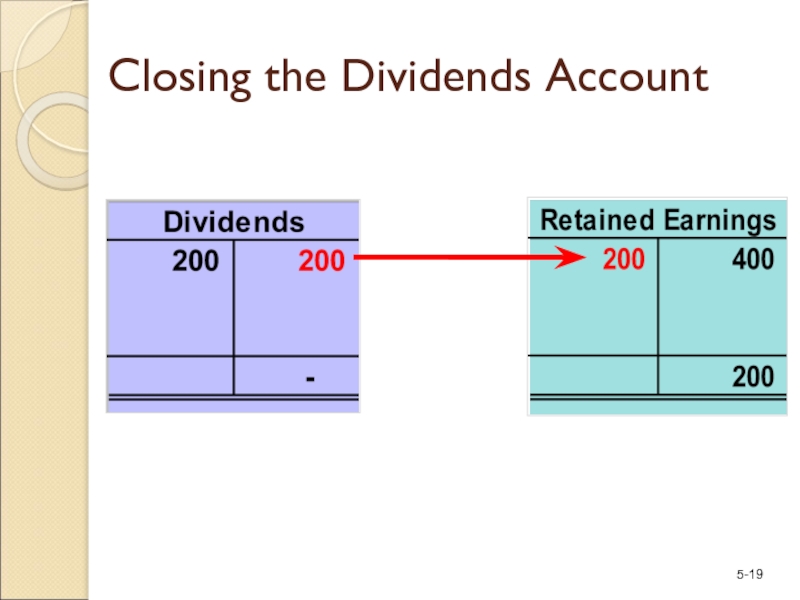

- 18. Since the Dividends account has a debit

- 19. Closing the Dividends Account

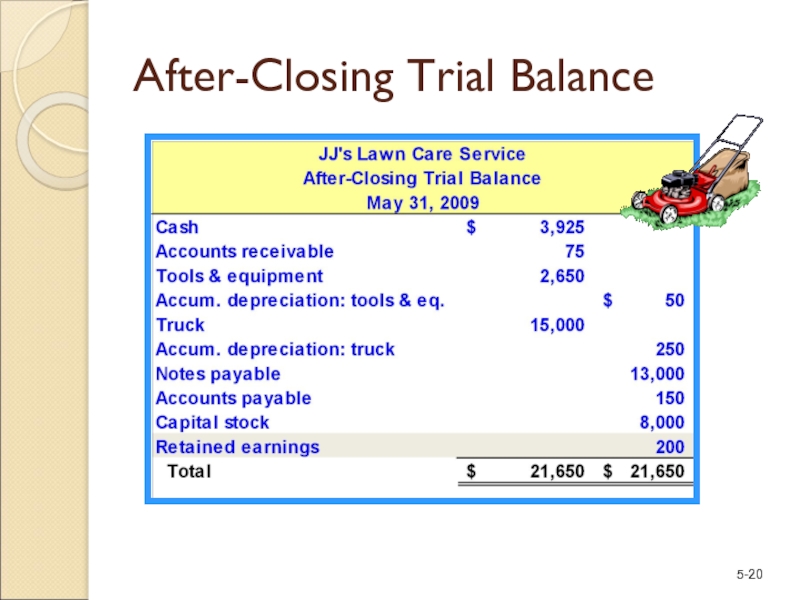

- 20. After-Closing Trial Balance

- 21. Evaluating the Business

- 22. Monthly Quarterly Jan. 1 Dec. 31 Annually

- 23. Ethics, Fraud, and Corporate Governance A company

- 24. Supplemental Topic: The Worksheet

- 25. End of Chapter 5

Слайд 2Preparing Financial Statements

Publicly owned companies – those with shares listed on

The annual report includes comparative financial statements and other information relating to the company’s financial position, business operations, and future prospects.

The financial statements contained in the annual report must be audited by a firm of certified public accountants (CPAs).

Слайд 5Summarizes the increases and decreases in Retained Earnings during the period.

The

Слайд 9Notes to the

Financial Statements

Examples of Items Disclosed

Lawsuits pending

Scheduled plant closings

Governmental

Significant events occurring

after the balance sheet date

Specific customers that

account for a large portion of

revenue

Unusual transactions and

related party transactions

Drafting the Notes that Accompany Financial Statements

Слайд 10Closing the Temporary Accounts

Close Revenue accounts to Income Summary.

Close Expense accounts

Close Income Summary account to Retained Earnings.

Close Dividends to Retained Earnings.

The closing process gets the temporary accounts ready for the next accounting period.

Слайд 12Since Sales Revenue has a credit balance, the closing entry requires

Closing Entries for Revenue Accounts

Слайд 14Since expense accounts have a debit balance, the closing entry requires

Closing Entries for Expense Accounts

Слайд 16Since Income Summary has a $400 credit balance, the closing entry

Closing the Income Summary Account

Слайд 18Since the Dividends account has a debit balance, the closing entry

Closing the Dividends Account

Слайд 22Monthly

Quarterly

Jan. 1

Dec. 31

Annually

Many companies prepare financial statements at various points throughout

Interim Financial Statements

Preparing Financial Statements Covering Different Periods of Time

Слайд 23Ethics, Fraud, and

Corporate Governance

A company should disclose any facts that an

Public companies are required to file annual reports with the Securities and Exchange Commission (SEC). The SEC requires that companies include a section labeled “Management Discussion and Analysis” (MD&A) because the financial statements and related notes may be inadequate for assessing the quantity and sustainability of a company’s earnings.