- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Plant and intangible assets. (Chapter 9) презентация

Содержание

- 1. Plant and intangible assets. (Chapter 9)

- 2. Plant assets represent a bundle of future

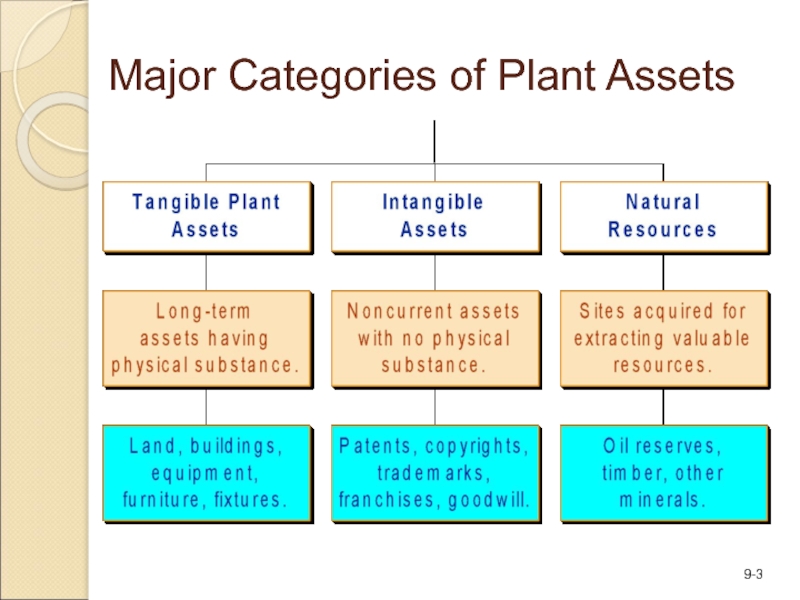

- 3. Major Categories of Plant Assets

- 4. Accountable Events in the Lives of Plant

- 5. Asset price . . . for

- 6. Improvements to land such as driveways, fences,

- 7. Repairs made prior to the building being

- 8. Special Considerations The allocation is based on

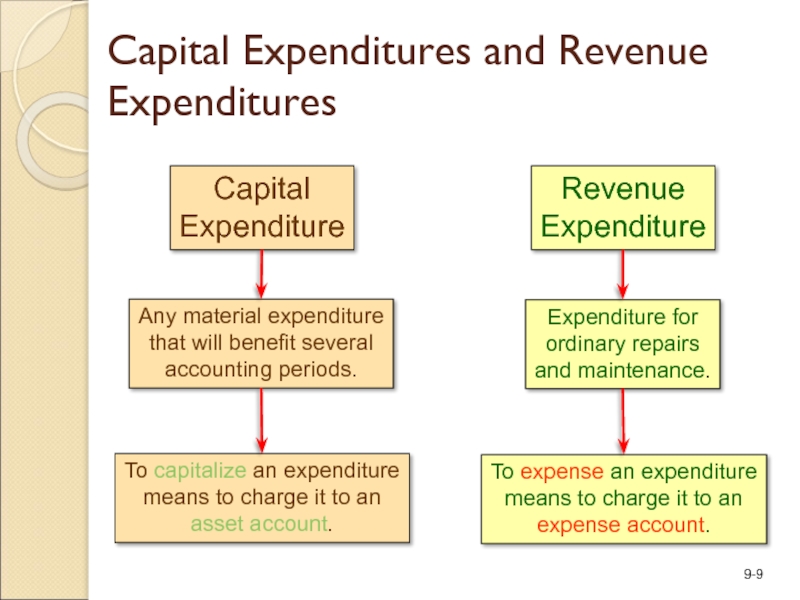

- 9. Capital Expenditure Revenue Expenditure Any material expenditure

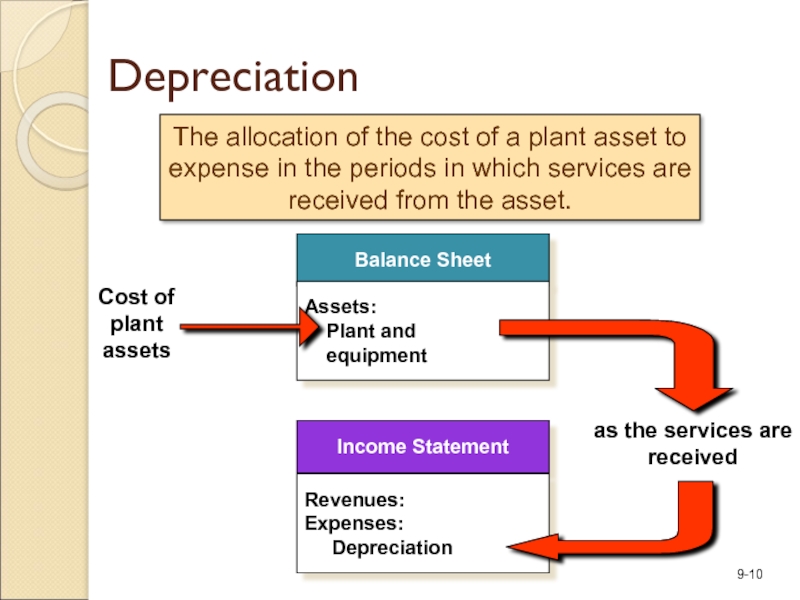

- 10. The allocation of the cost of a

- 11. Depreciation Book Value Cost – Accumulated Depreciation

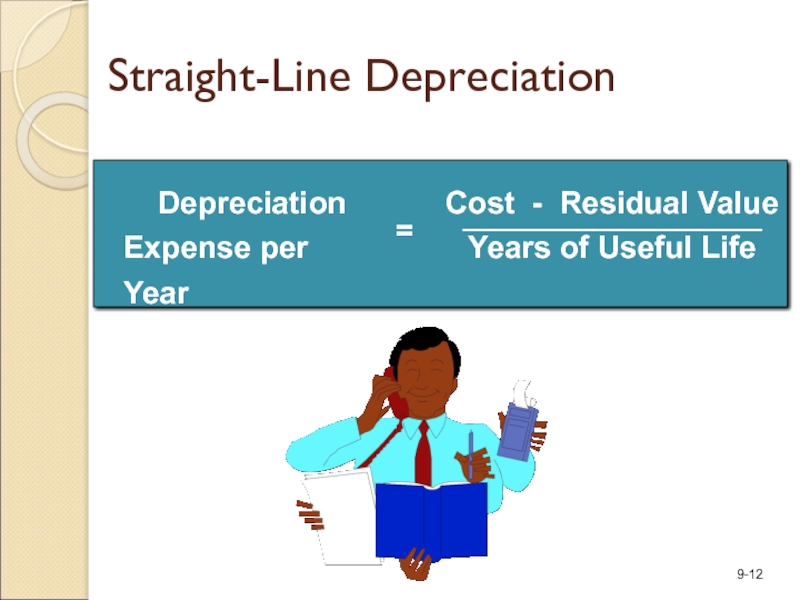

- 12. Straight-Line Depreciation

- 13. On January 2, S&G Wholesale Grocery buys

- 14. S&G will record $4,200 depreciation each year

- 15. When an asset is acquired during the

- 16. Half-Year Convention Using the half-year convention, calculate

- 17. Depreciation in the early years of an

- 18. On January 2, S&G buys a new

- 19. Compute depreciation for the rest of the

- 20. Financial Statement Disclosures Estimates of Useful Life

- 21. So depreciation is an estimate. Predicted

- 22. Revising Depreciation Rates On January 1, 2006,

- 23. When our estimates change, depreciation is: Revising Depreciation Rates

- 24. If the cost of an asset cannot

- 25. Update depreciation to the date of

- 26. If Cash > BV, record a

- 27. Assume that a machine costing $10,000,

- 28. Disposal of Plant and Equipment Assume

- 29. Assume that Essex Company exchanges a

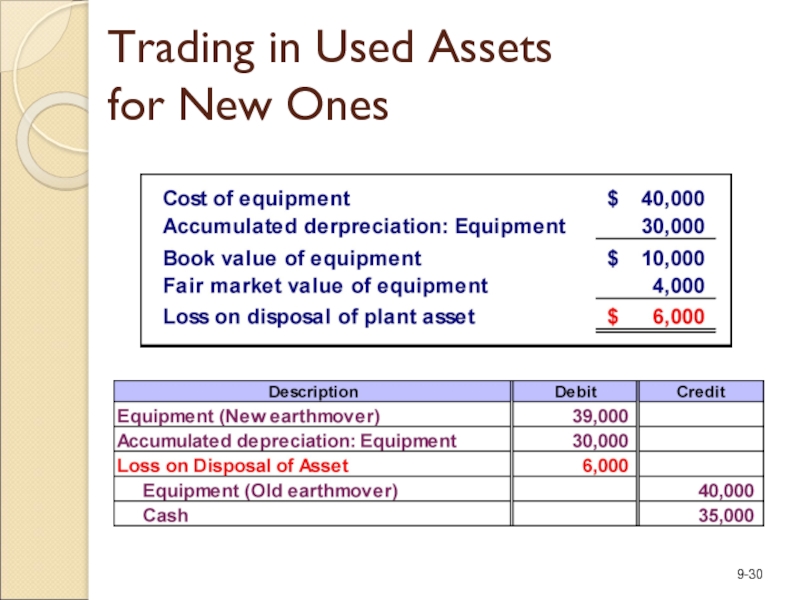

- 30. Trading in Used Assets for New Ones

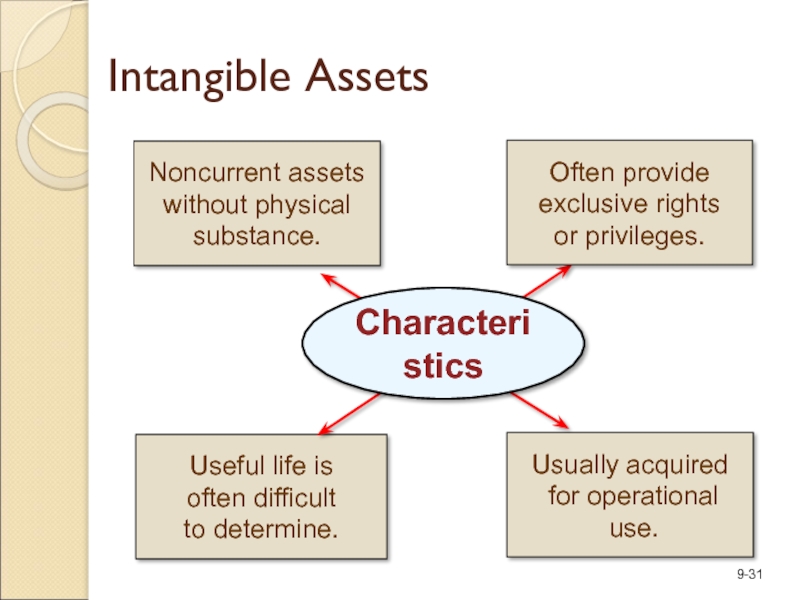

- 31. Noncurrent assets without physical substance. Useful life

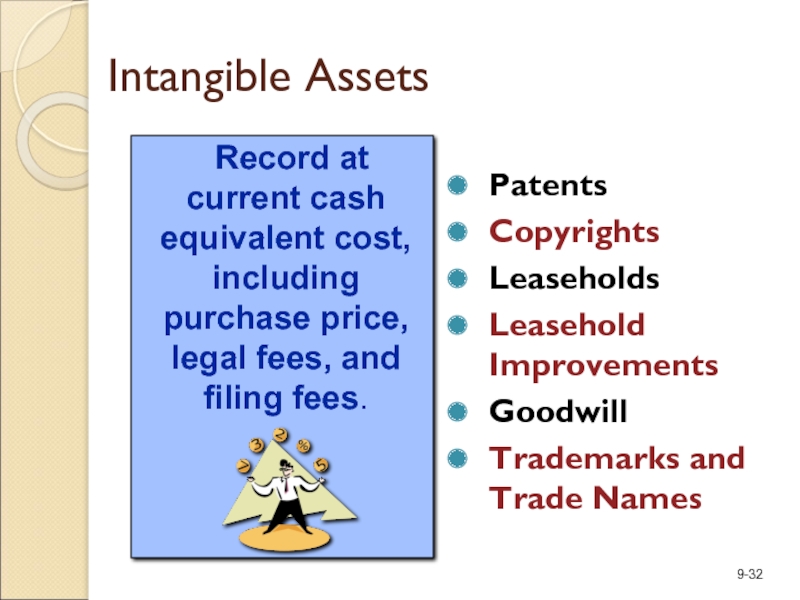

- 32. Intangible Assets Patents Copyrights

- 33. Amortization Amortization is the systematic write-off to

- 34. The amount by which the purchase price

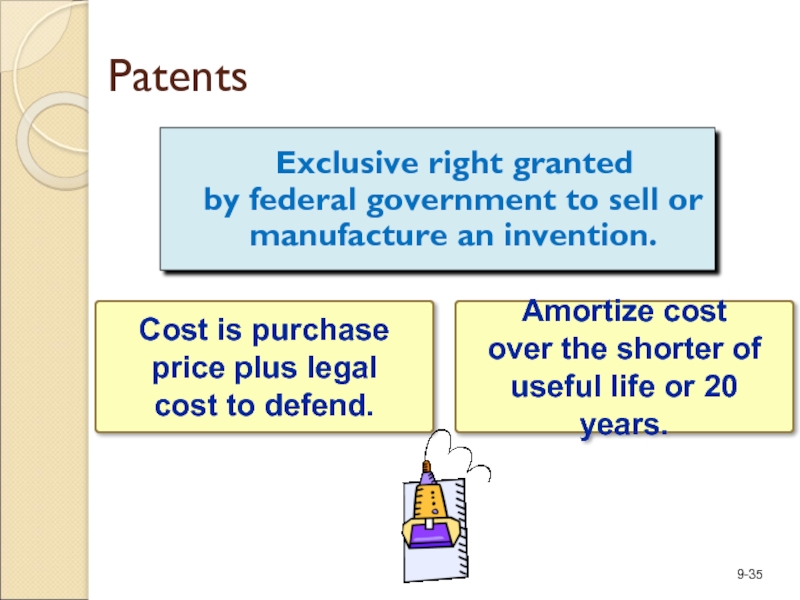

- 35. Patents Exclusive right granted by

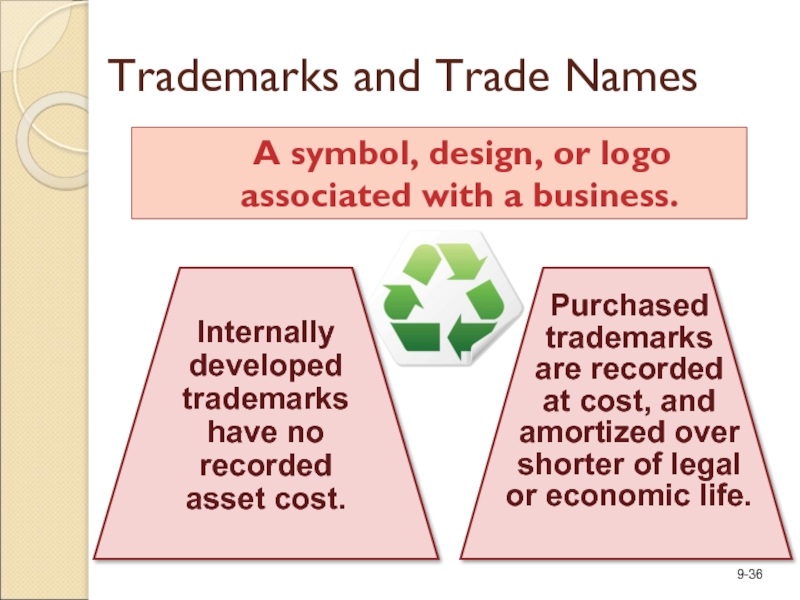

- 36. Trademarks and Trade Names A

- 37. Franchises Legally protected right to

- 38. Copyrights Exclusive right granted by

- 39. Research and Development Costs All expenditures classified

- 40. Total cost, including exploration and development,

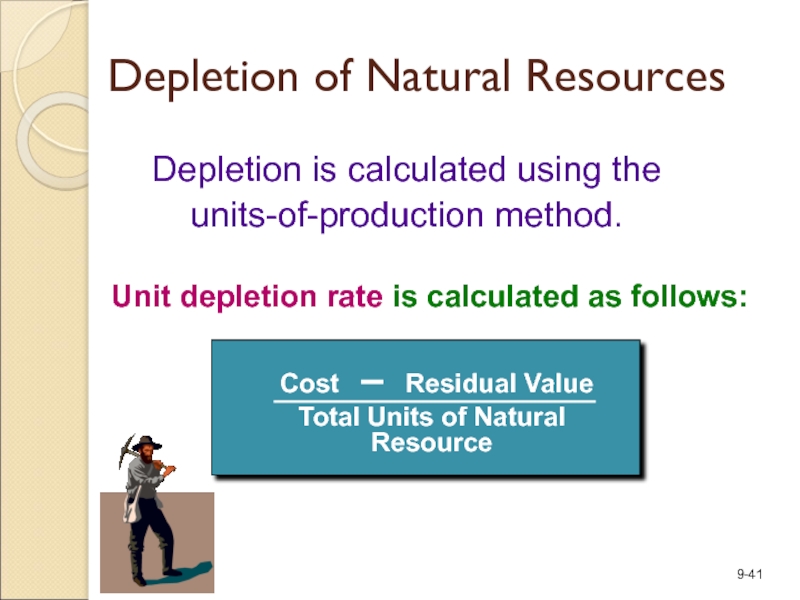

- 41. Depletion is calculated using the units-of-production method.

- 42. Plant Transactions and the Statement of Cash

- 43. End of Chapter 9

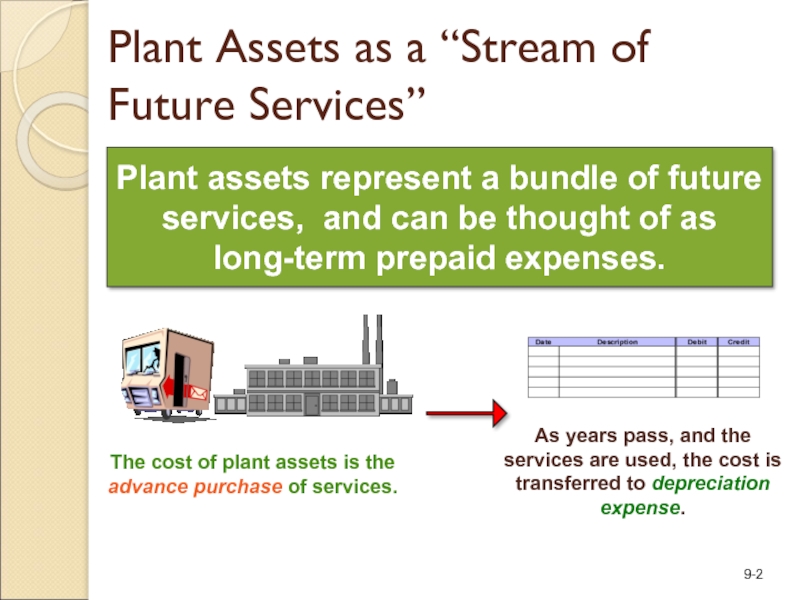

Слайд 2Plant assets represent a bundle of future services, and can be

The cost of plant assets is the advance purchase of services.

As years pass, and the services are used, the cost is transferred to depreciation expense.

Plant Assets as a “Stream of Future Services”

Слайд 4Accountable Events in the

Lives of Plant Assets

Acquisition.

Allocation of the acquisition cost

Sale or disposal.

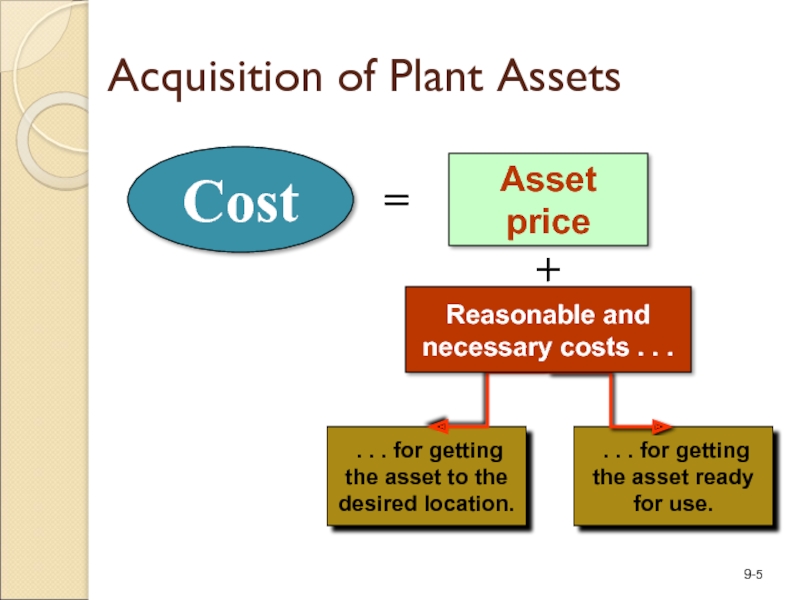

Слайд 5Asset price

. . . for getting the asset to the

. . . for getting the asset ready for use.

Cost

Acquisition of Plant Assets

=

Reasonable and necessary costs . . .

+

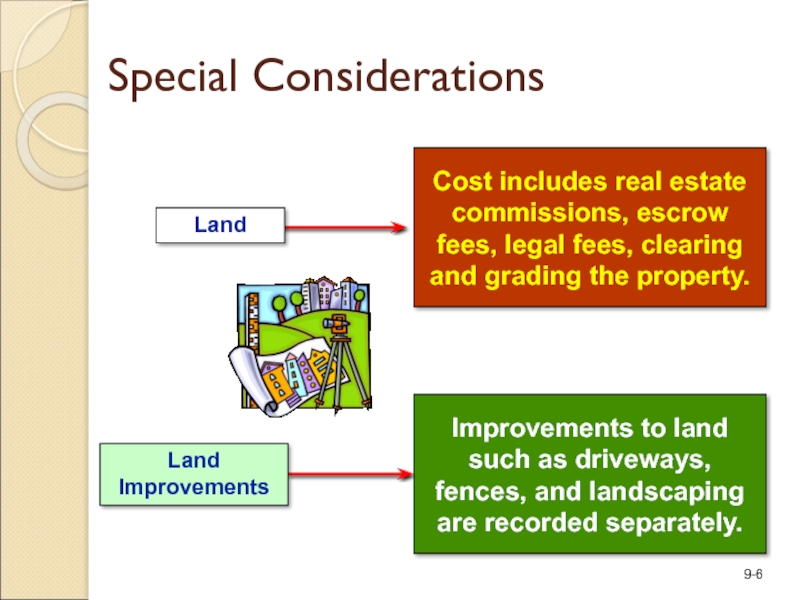

Слайд 6Improvements to land such as driveways, fences, and landscaping are recorded

Cost includes real estate commissions, escrow fees, legal fees, clearing and grading the property.

Land Improvements

Land

Special Considerations

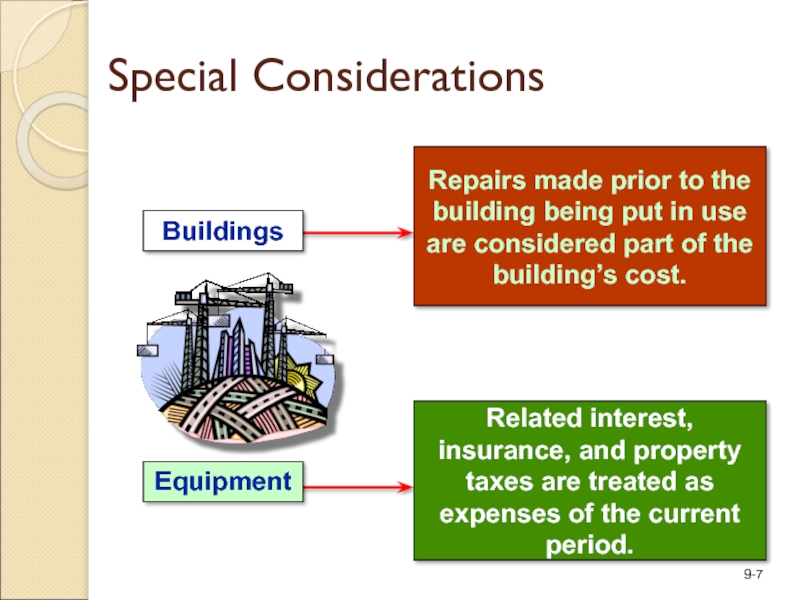

Слайд 7Repairs made prior to the building being put in use are

Buildings

Special Considerations

Equipment

Related interest, insurance, and property taxes are treated as expenses of the current period.

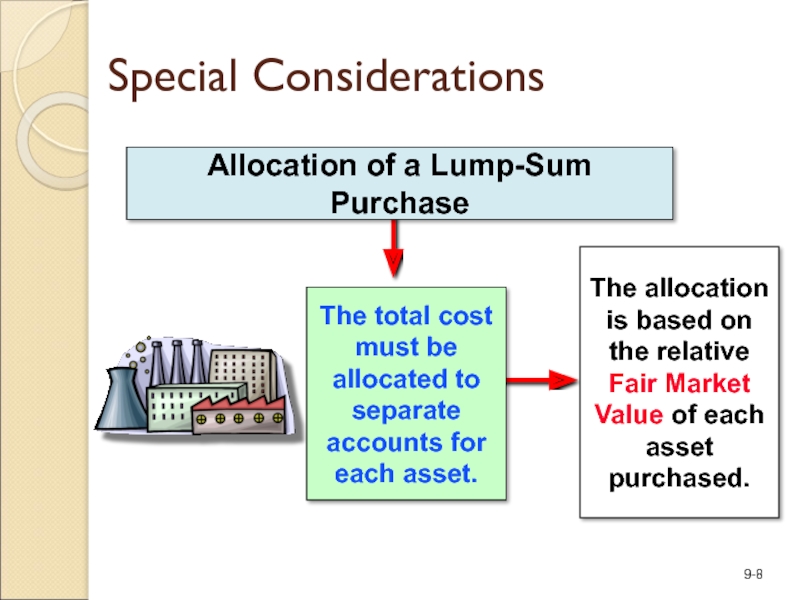

Слайд 8Special Considerations

The allocation is based on the relative Fair Market Value

The total cost must be allocated to separate accounts for each asset.

Allocation of a Lump-Sum Purchase

Слайд 9Capital

Expenditure

Revenue

Expenditure

Any material expenditure

that will benefit several

accounting periods.

To capitalize an expenditure

means to

Expenditure for

ordinary repairs

and maintenance.

To expense an expenditure

means to charge it to an

expense account.

Capital Expenditures and Revenue Expenditures

Слайд 10The allocation of the cost of a plant asset to expense

Cost of plant assets

Balance Sheet

Assets:

Plant and

equipment

as the services are received

Depreciation

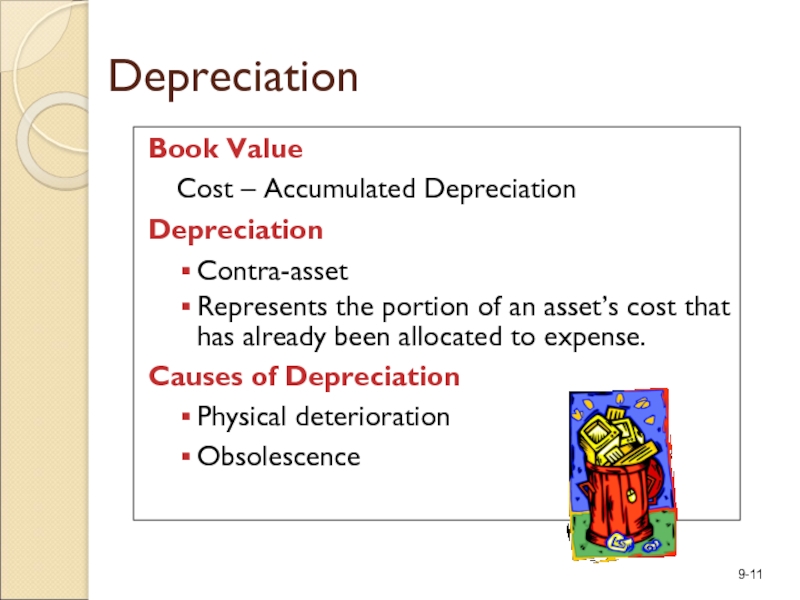

Слайд 11Depreciation

Book Value

Cost – Accumulated Depreciation

Depreciation

Contra-asset

Represents the portion of an asset’s cost

Causes of Depreciation

Physical deterioration

Obsolescence

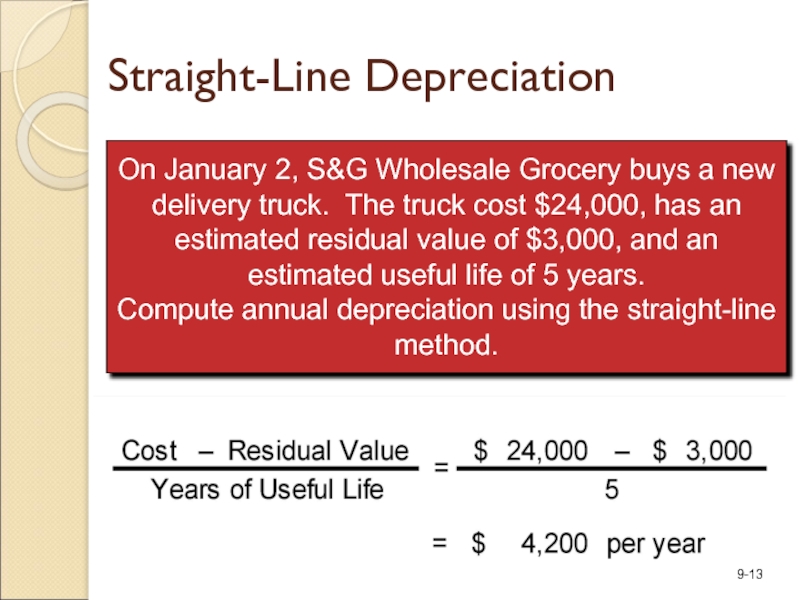

Слайд 13On January 2, S&G Wholesale Grocery buys a new delivery truck.

Compute annual depreciation using the straight-line method.

Straight-Line Depreciation

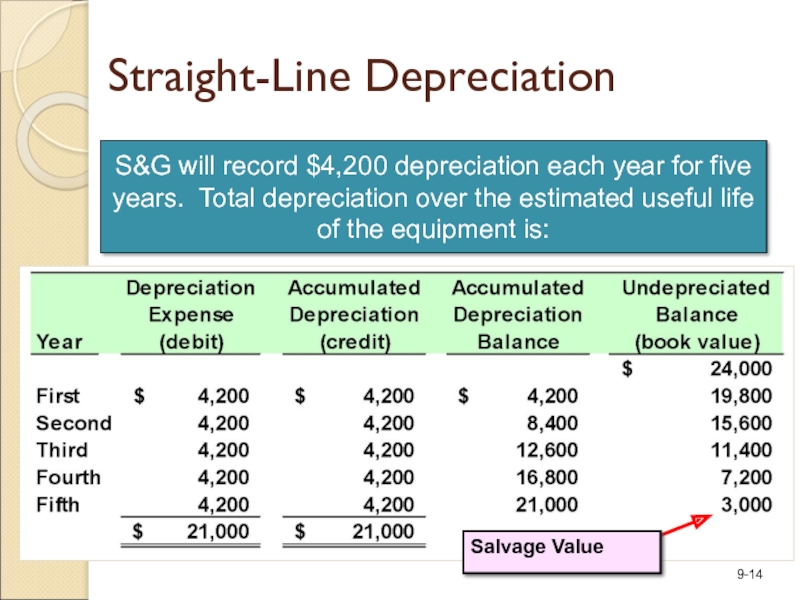

Слайд 14S&G will record $4,200 depreciation each year for five years. Total

Salvage Value

Straight-Line Depreciation

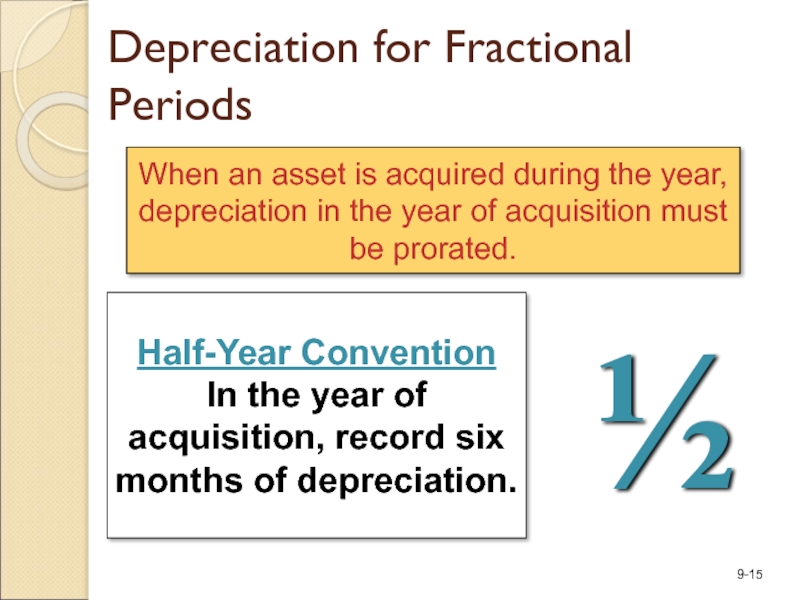

Слайд 15When an asset is acquired during the year, depreciation in the

Half-Year Convention

In the year of acquisition, record six months of depreciation.

½

Depreciation for Fractional Periods

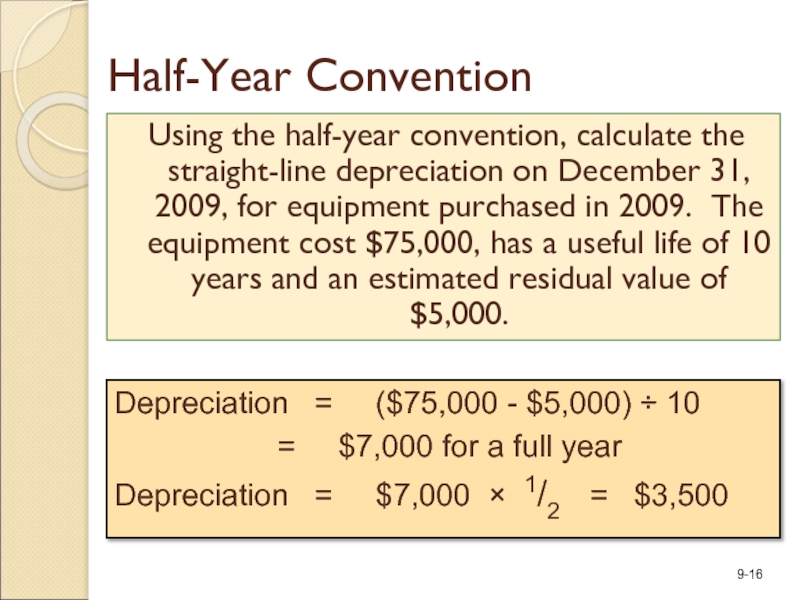

Слайд 16Half-Year Convention

Using the half-year convention, calculate the straight-line depreciation on December

Depreciation = ($75,000 - $5,000) ÷ 10

= $7,000 for a full year

Depreciation = $7,000 × 1/2 = $3,500

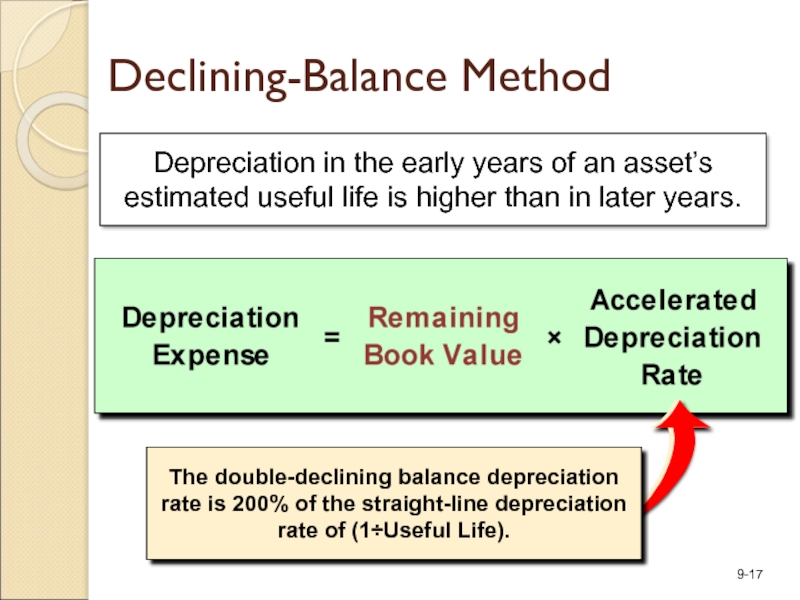

Слайд 17Depreciation in the early years of an asset’s estimated useful life

The double-declining balance depreciation rate is 200% of the straight-line depreciation rate of (1÷Useful Life).

Declining-Balance Method

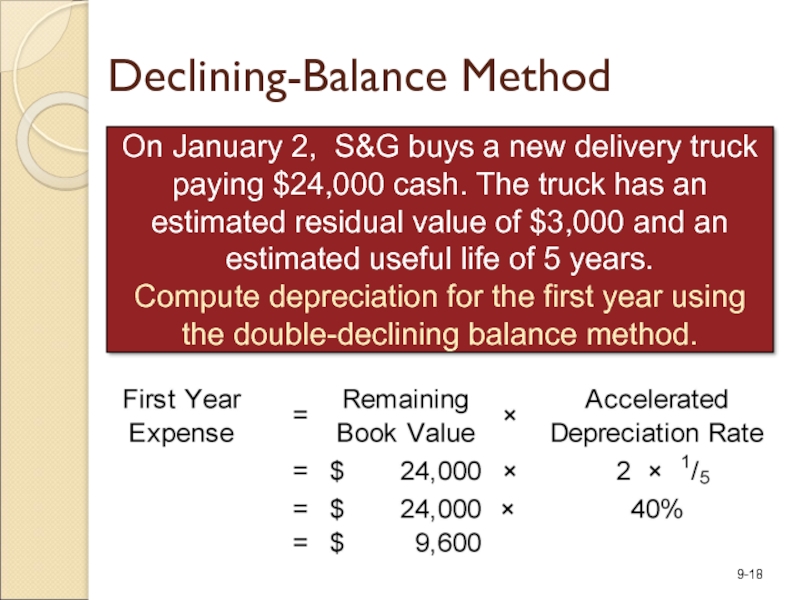

Слайд 18On January 2, S&G buys a new delivery truck paying $24,000

Compute depreciation for the first year using the double-declining balance method.

Declining-Balance Method

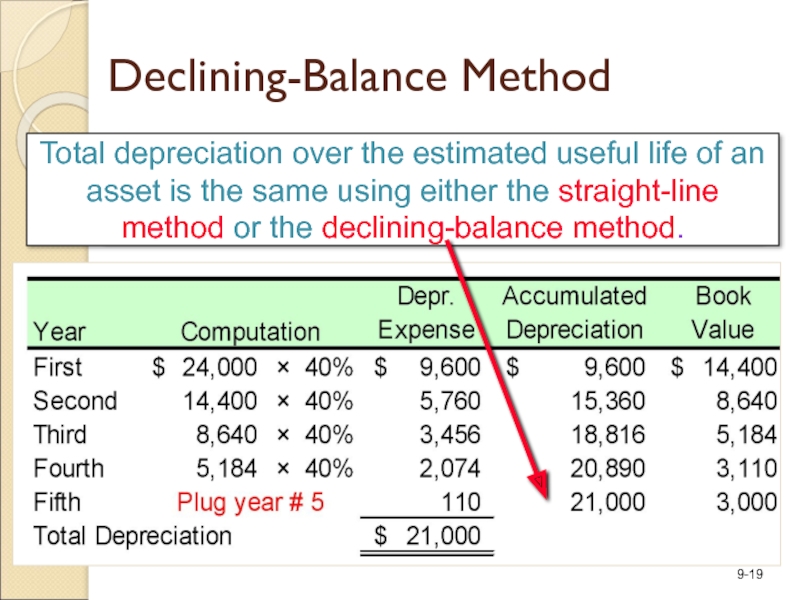

Слайд 19Compute depreciation for the rest of the truck’s estimated useful life.

Declining-Balance Method

Total depreciation over the estimated useful life of an asset is the same using either the straight-line method or the declining-balance method.

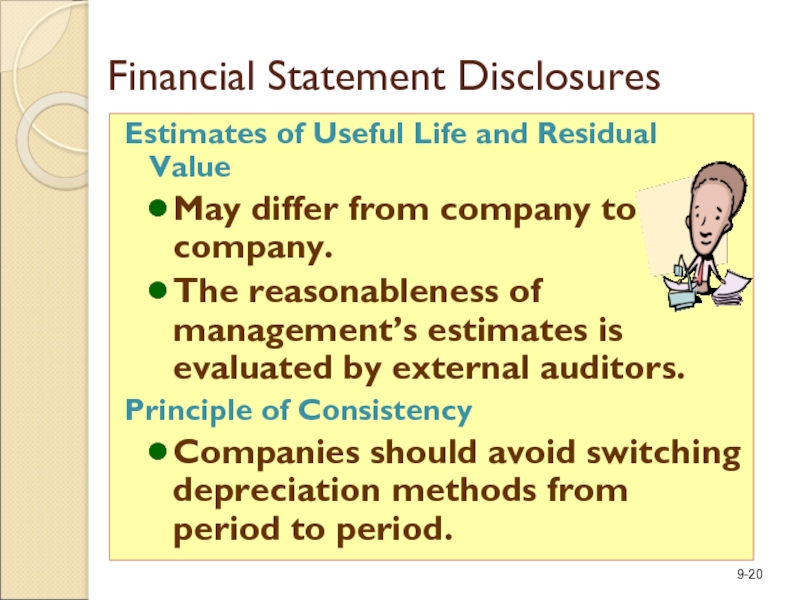

Слайд 20Financial Statement Disclosures

Estimates of Useful Life and Residual Value

May differ from

The reasonableness of management’s estimates is evaluated by external auditors.

Principle of Consistency

Companies should avoid switching depreciation methods from period to period.

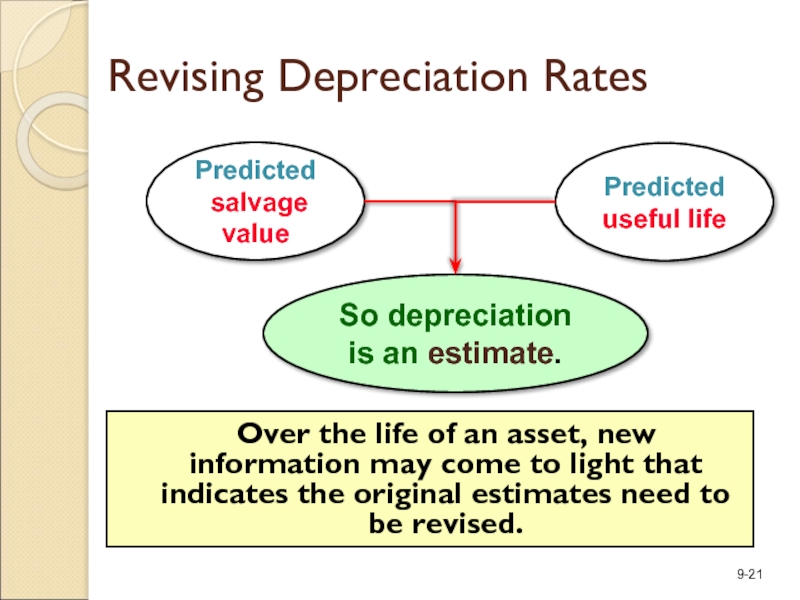

Слайд 21So depreciation

is an estimate.

Predicted

salvage value

Revising Depreciation Rates

Over the

Predicted

useful life

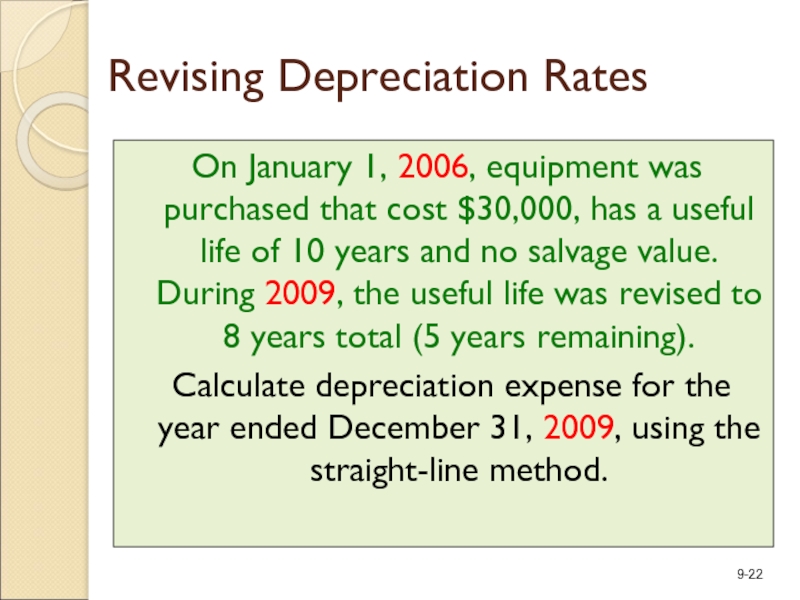

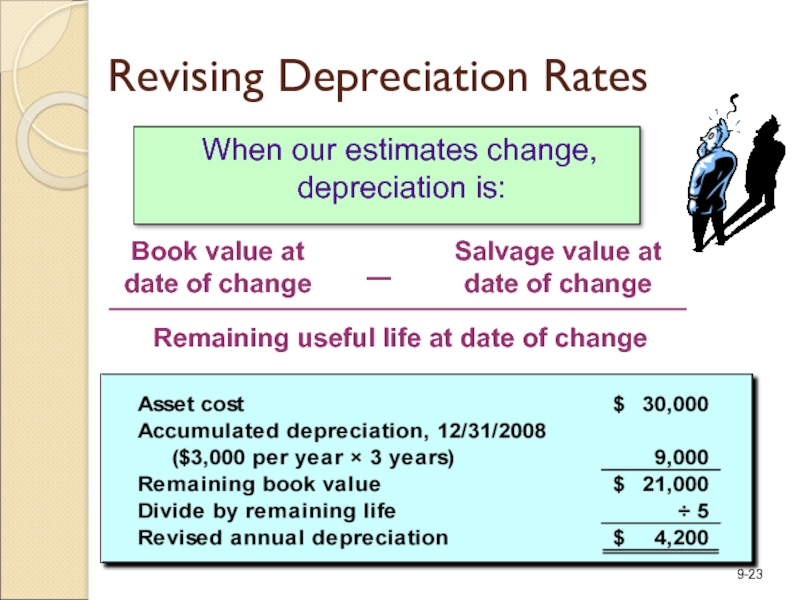

Слайд 22Revising Depreciation Rates

On January 1, 2006, equipment was purchased that cost

Calculate depreciation expense for the year ended December 31, 2009, using the straight-line method.

Слайд 24If the cost of an asset cannot be recovered through future

Impairment of Plant Assets

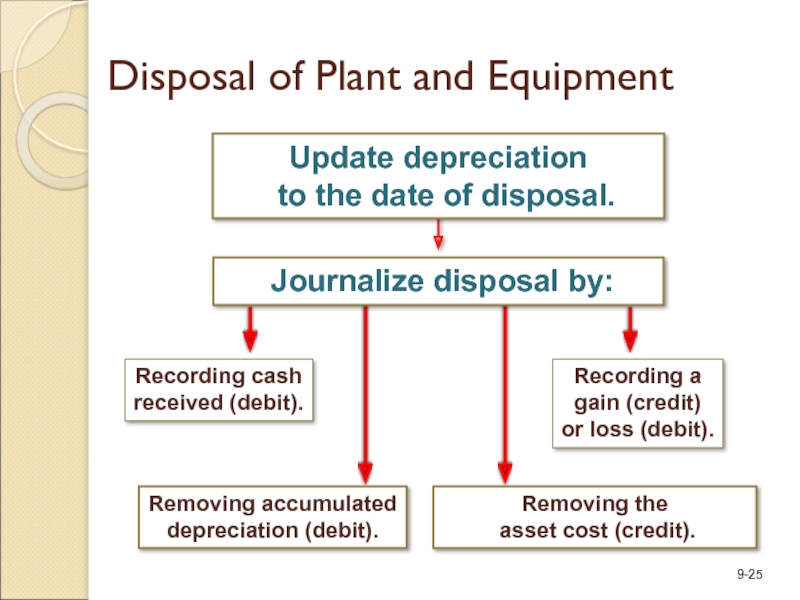

Слайд 25Update depreciation

to the date of disposal.

Recording cash

received (debit).

Removing accumulated

depreciation (debit).

Removing

Recording a

gain (credit)

or loss (debit).

Disposal of Plant and Equipment

Journalize disposal by:

Слайд 26

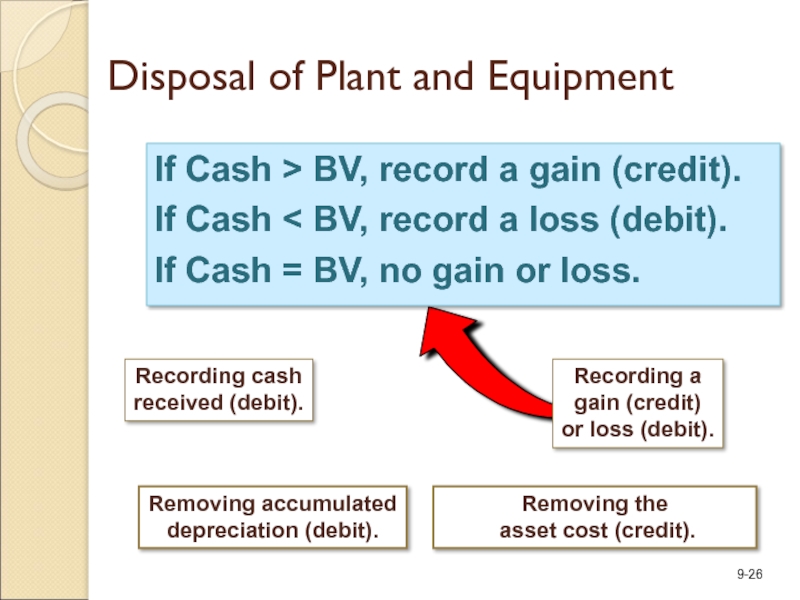

If Cash > BV, record a gain (credit).

If Cash < BV,

If Cash = BV, no gain or loss.

Disposal of Plant and Equipment

Recording cash

received (debit).

Removing accumulated

depreciation (debit).

Removing the

asset cost (credit).

Recording a

gain (credit)

or loss (debit).

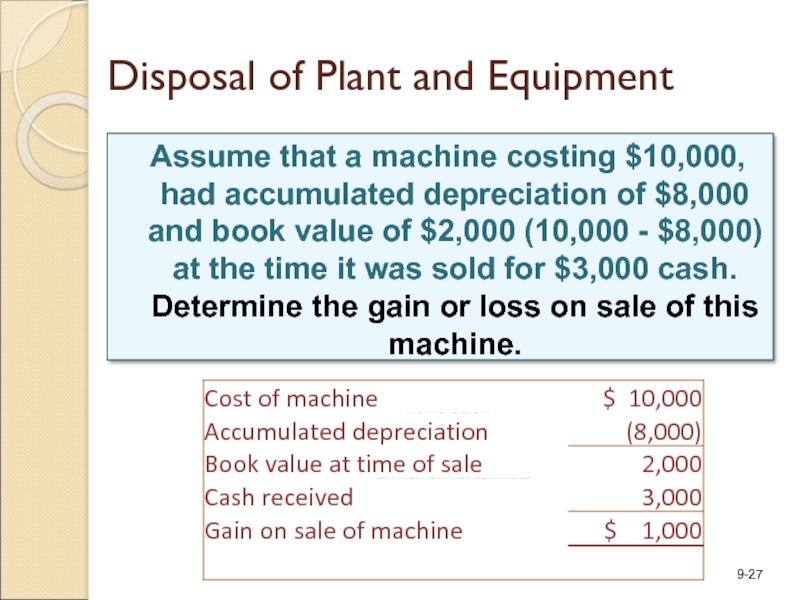

Слайд 27 Assume that a machine costing $10,000, had accumulated depreciation of

Disposal of Plant and Equipment

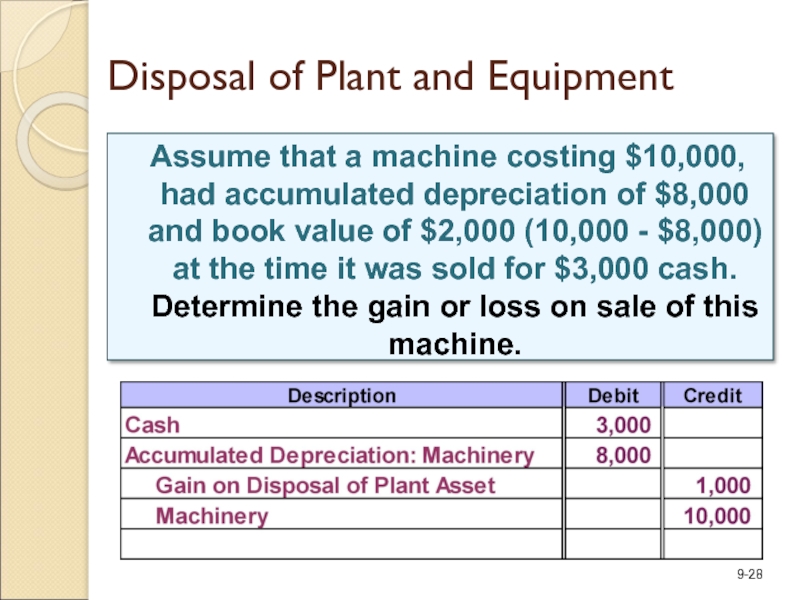

Слайд 28Disposal of Plant and Equipment

Assume that a machine costing $10,000,

Слайд 29 Assume that Essex Company exchanges a used earthmover and $35,000

Trading in Used Assets

for New Ones

+ $35,000

Слайд 31Noncurrent assets

without physical

substance.

Useful life is

often difficult

to determine.

Usually acquired

for operational

use.

Often provide

exclusive rights

or privileges.

Intangible Assets

Characteristics

Слайд 32Intangible Assets

Patents

Copyrights

Leaseholds

Leasehold

Improvements

Goodwill

Trademarks and

Trade

Record at current cash equivalent cost, including purchase price, legal fees, and filing fees.

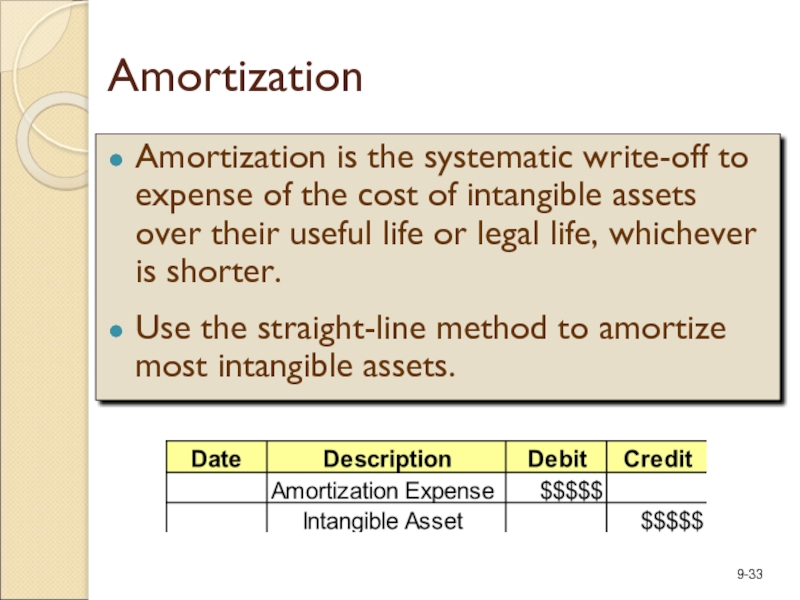

Слайд 33Amortization

Amortization is the systematic write-off to expense of the cost of

Use the straight-line method to amortize most intangible assets.

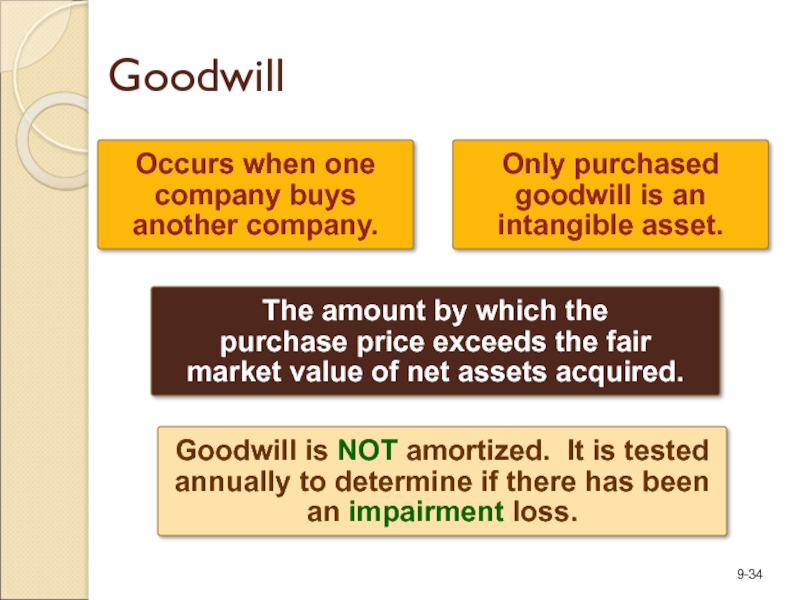

Слайд 34The amount by which the purchase price exceeds the fair market value of

Occurs when one

company buys

another company.

Only purchased

goodwill is an

intangible asset.

Goodwill

Goodwill is NOT amortized. It is tested annually to determine if there has been an impairment loss.

Слайд 37Franchises

Legally protected right to sell products or provide services

Purchase price is intangible asset which is amortized over the shorter of the protected right or useful life.

Слайд 38Copyrights

Exclusive right granted by the federal government to protect

Amortize cost

over period benefited.

Legal life is

life of creator

plus 70 years.

Слайд 39Research and Development Costs

All expenditures classified as research and development should

All of these R&D costs will really reduce our net income this year!

Слайд 40Total cost,

including

exploration and

development,

is charged to

depletion expense

over periods

benefited.

Examples: oil, coal, gold

Extracted

Natural Resources

Слайд 41Depletion is calculated using the

units-of-production method.

Unit depletion rate is calculated as

Depletion of Natural Resources

Слайд 42Plant Transactions and the

Statement of Cash Flows

Cash payments for plant assets

Depreciation is a non-cash charge to income and has no effect on cash flows.