- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Municipal investment plan презентация

Содержание

- 1. Municipal investment plan

- 2. Agenda What Me Save? Guide Saving for

- 3. Saving For Retirement

- 4. Where Retirees Get Their Income Retirement income

- 5. How much do you need for retirement?

- 6. What? Me Save?

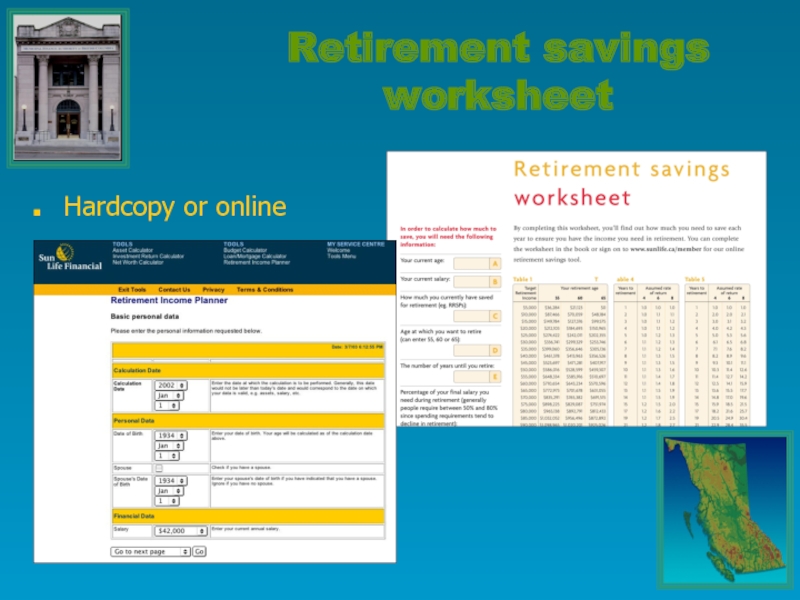

- 7. Retirement savings worksheet Hardcopy or online

- 8. Making the most of your plan

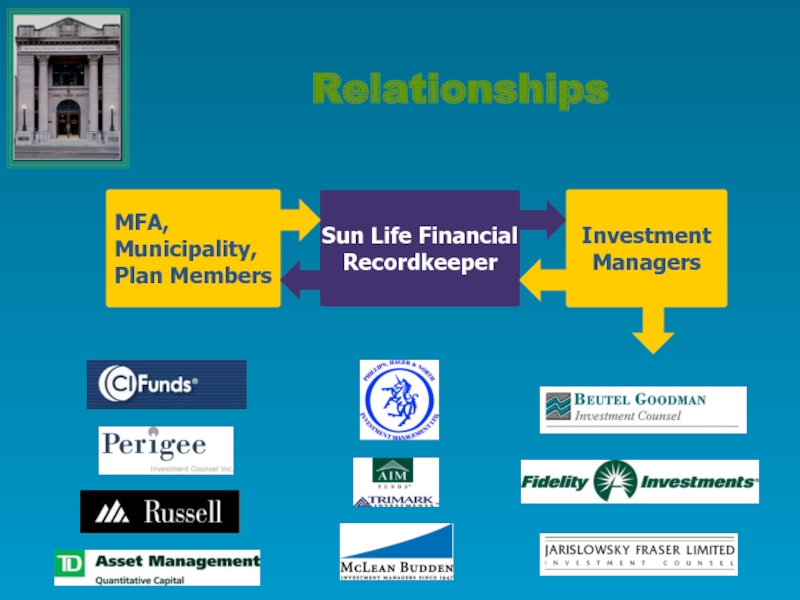

- 9. Relationships MFA, Municipality, Plan Members Sun

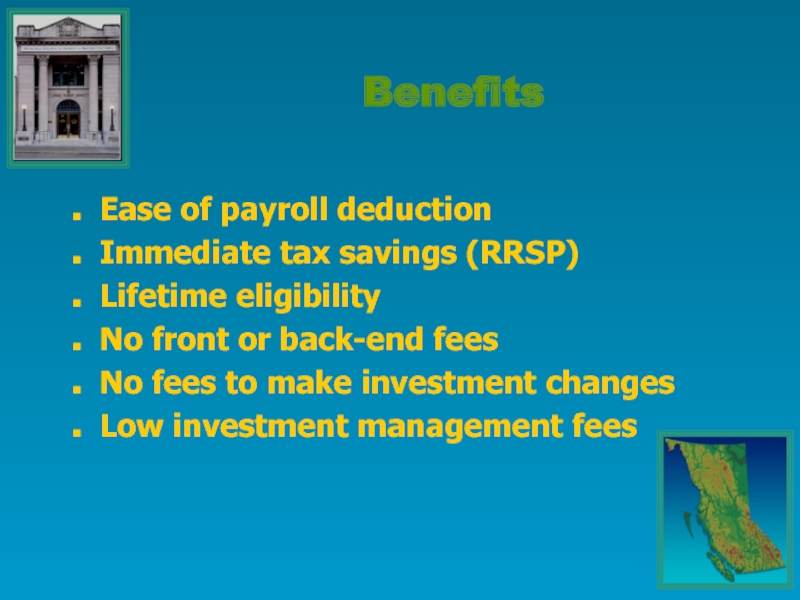

- 10. Ease of payroll deduction Immediate tax

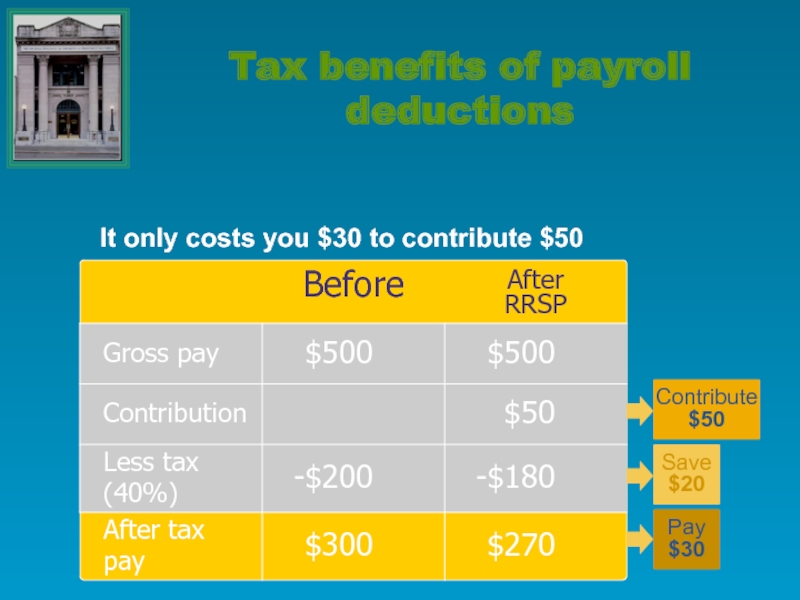

- 11. Tax benefits of payroll deductions It only

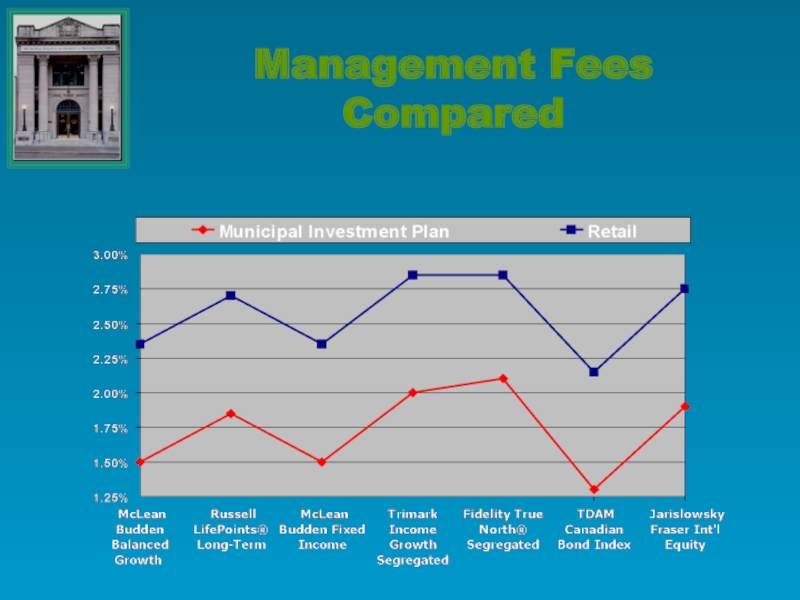

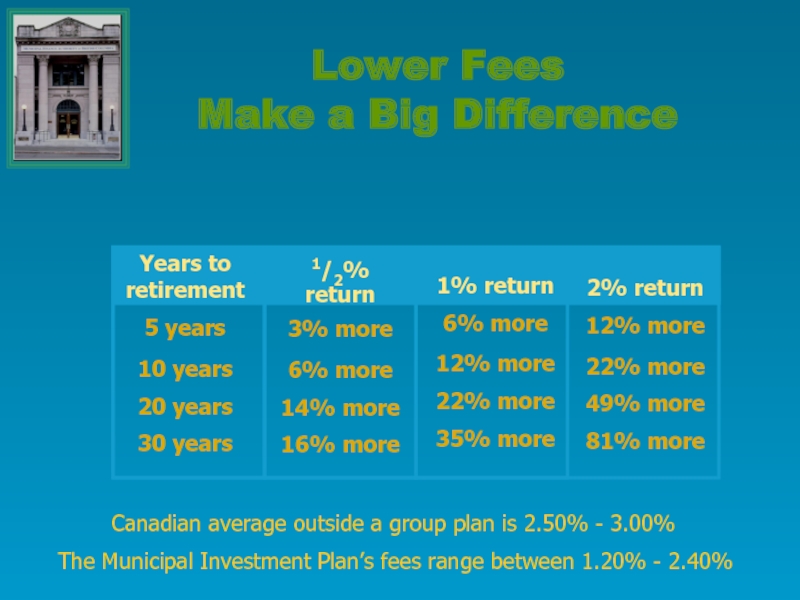

- 12. Management Fees Compared

- 13. The Municipal Investment Plan’s fees range

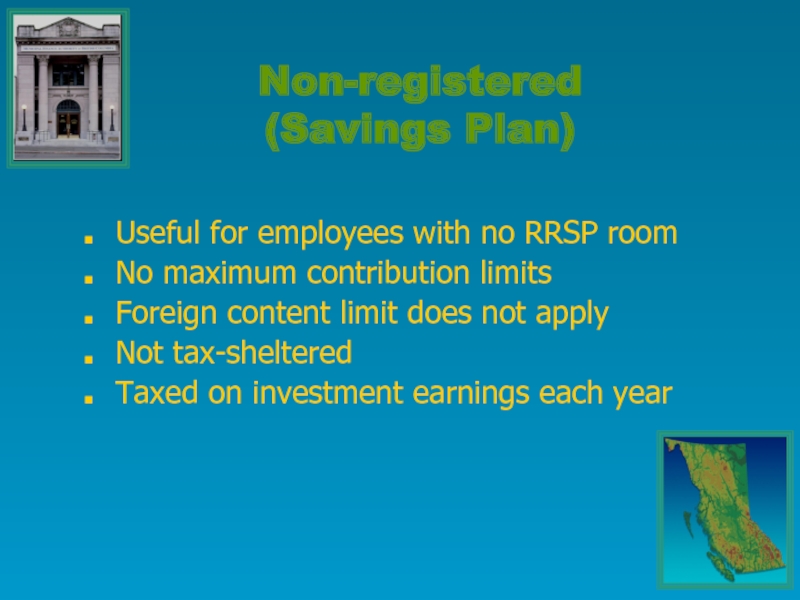

- 14. Useful for employees with no RRSP room

- 15. You make the contributions

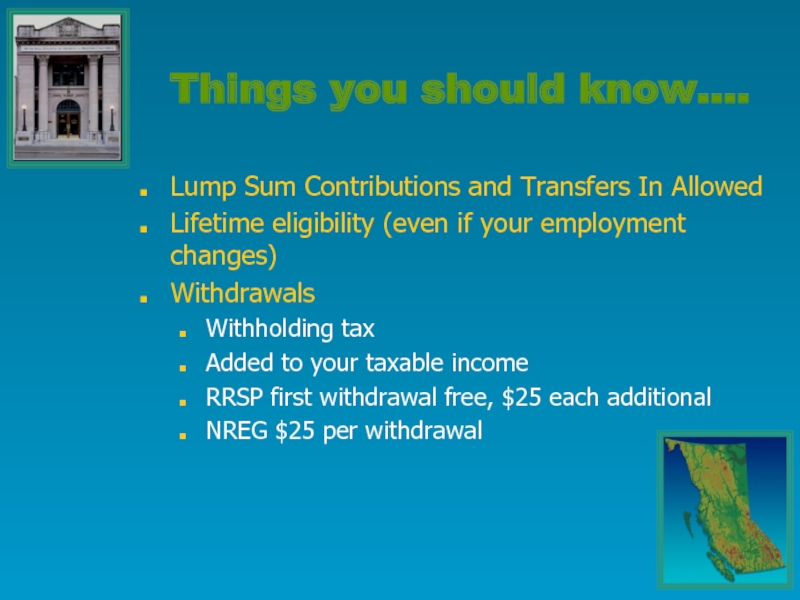

- 17. Things you should know…. Lump Sum Contributions

- 18. Payroll deduction (if municipality opts in)

- 19. Developing Your Investment Strategy

- 20. Investment Types (Asset Classes) Equities (Stocks)

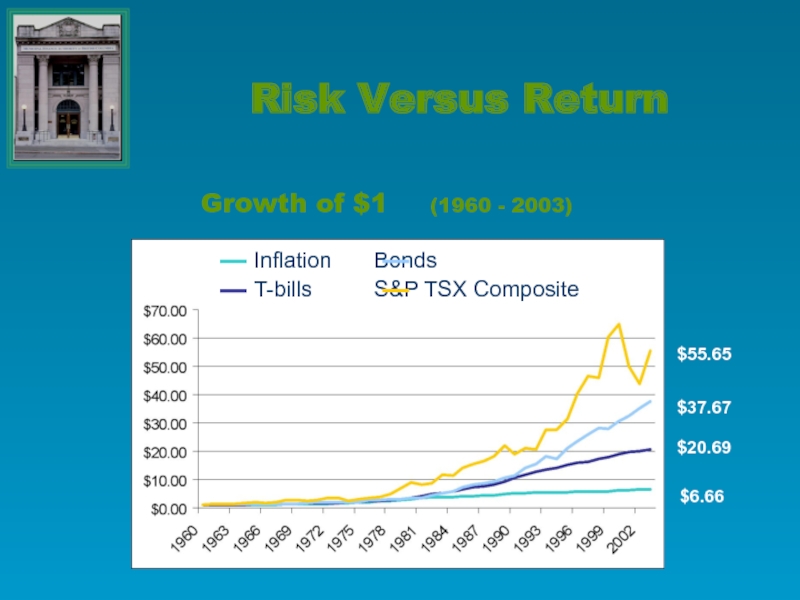

- 21. Growth of $1 (1960 - 2003) Risk Versus Return

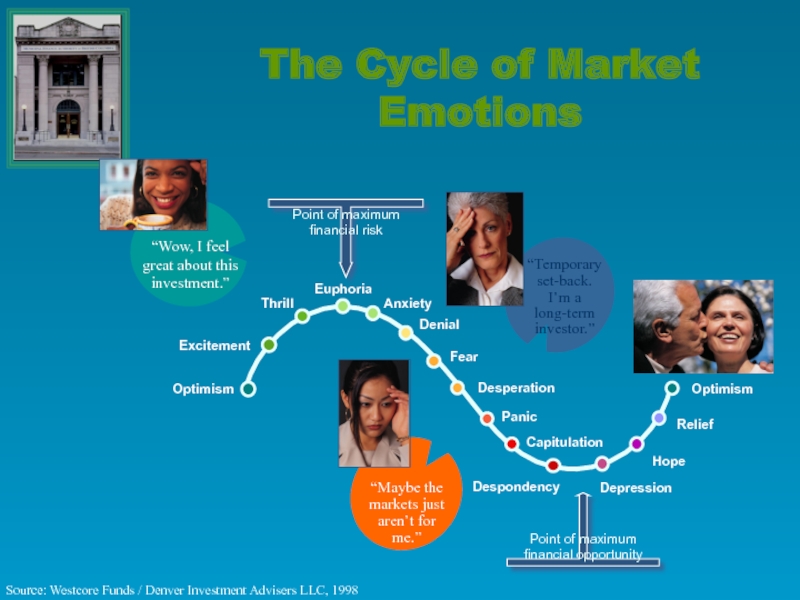

- 22. Source: Westcore Funds / Denver Investment

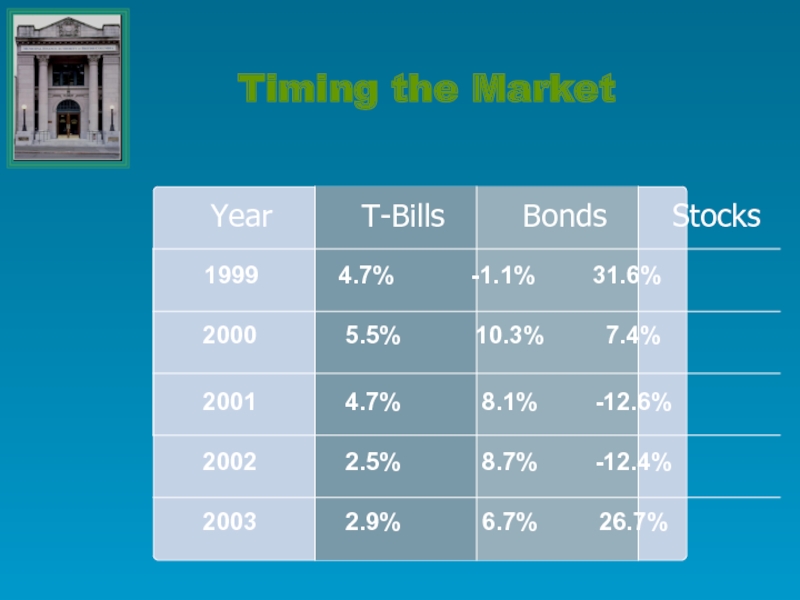

- 23. Timing the Market

- 24. Objective to produce returns that

- 25. Value Manager looking for a bargain

- 26. Buys stock in companies that tend

- 27. Specialty Funds Beutel Goodman Small Cap

- 28. Select ONE balanced fund best suited

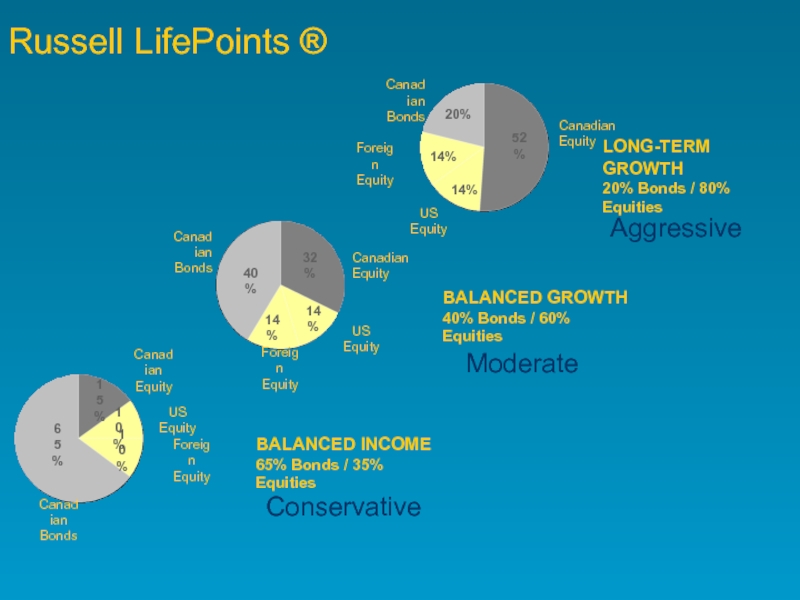

- 29. Russell LifePoints ® Conservative Moderate Aggressive

- 30. Investment Risk Questionnaire Hardcopy or online

- 31. Choosing and Monitoring your investments

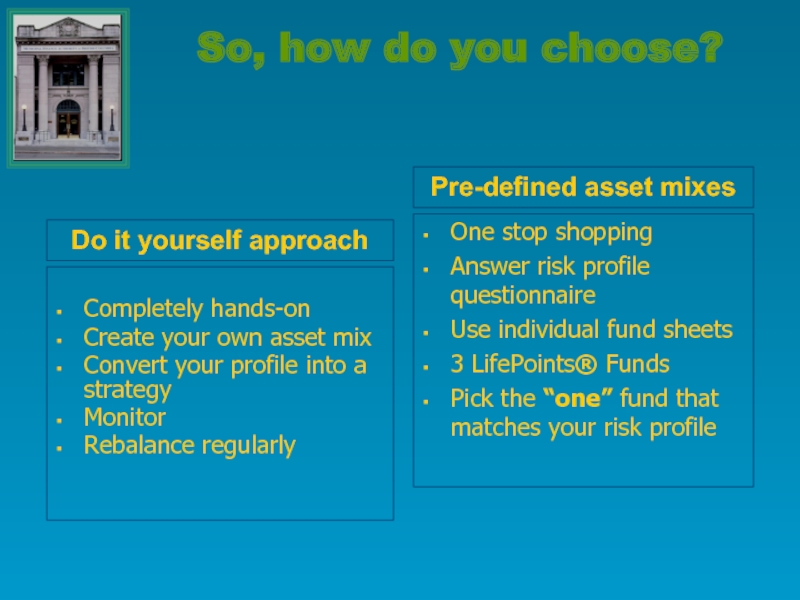

- 32. So, how do you choose? Completely

- 33. Monitor Your Investments Revisit your strategy

- 34. Stay Informed – Personal Statements Semi-Annual Easy

- 35. Customer Care Centre 1-866-733-8613 Account balances

- 36. Your Next Steps Complete the Investor Risk

- 37. Questions?

Слайд 2Agenda

What Me Save? Guide

Saving for Retirement

Understanding Your Group Plan

Developing Your

Monitoring Your Investments

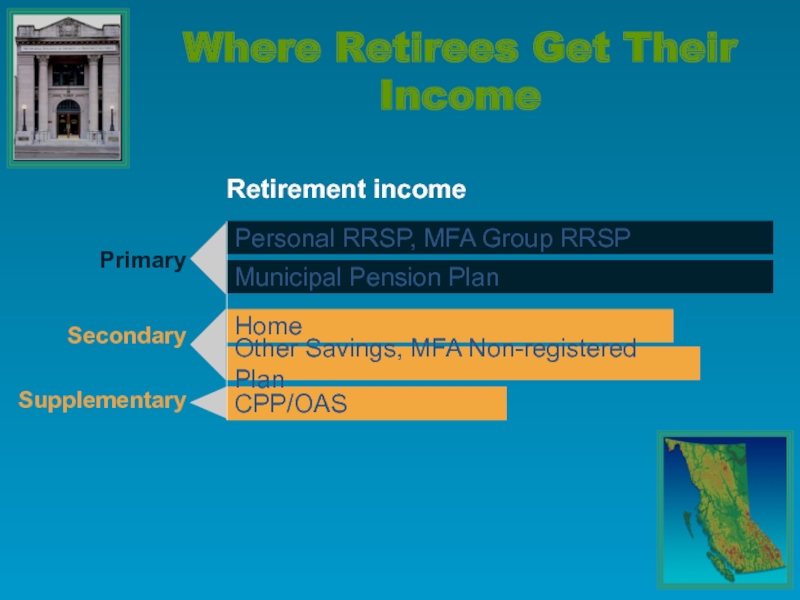

Слайд 4Where Retirees Get Their Income

Retirement income

Primary

Secondary

Supplementary

CPP/OAS

Home

Other Savings, MFA Non-registered Plan

Municipal Pension

Personal RRSP, MFA Group RRSP

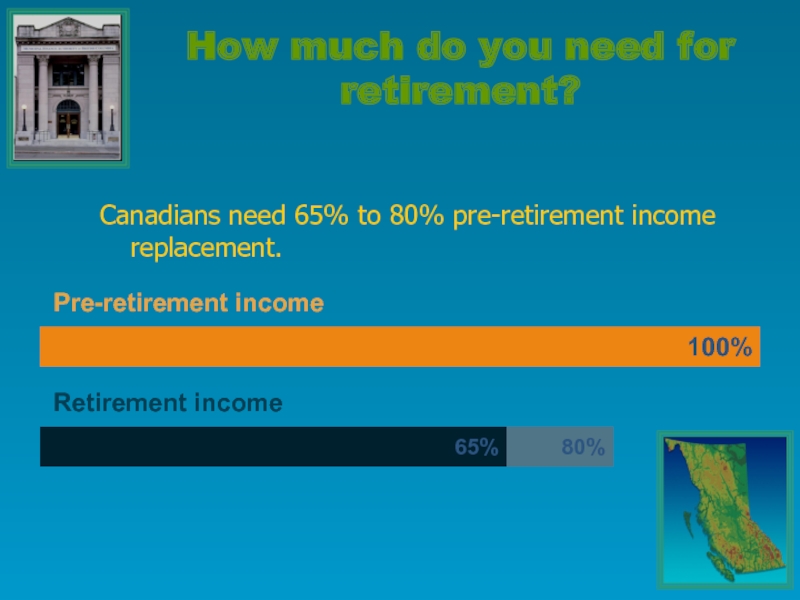

Слайд 5How much do you need for retirement?

Canadians need 65% to 80%

Pre-retirement income

100%

Retirement income

80%

65%

Слайд 10Ease of payroll deduction

Immediate tax savings (RRSP)

Lifetime eligibility

No front or

No fees to make investment changes

Low investment management fees

Benefits

Слайд 11Tax benefits of payroll deductions

It only costs you $30 to contribute

Save

$20

Contribute

$50

Pay

$30

Слайд 13

The Municipal Investment Plan’s fees range between 1.20% - 2.40%

Lower Fees

Canadian average outside a group plan is 2.50% - 3.00%

Слайд 14Useful for employees with no RRSP room

No maximum contribution limits

Foreign

Not tax-sheltered

Taxed on investment earnings each year

Non-registered

(Savings Plan)

Слайд 15

You make the contributions

You receive the tax deduction

Your spouse owns the

Money accumulates in your spouse's name

Spousal RRSP

Слайд 16

RRSP Spousal Account = Income Splitting

Reasons for spousal account

Your spouse is

Your spouse has no retirement savings

You will pay less tax if you have two smaller incomes instead of one large income

Слайд 17Things you should know….

Lump Sum Contributions and Transfers In Allowed

Lifetime eligibility

Withdrawals

Withholding tax

Added to your taxable income

RRSP first withdrawal free, $25 each additional

NREG $25 per withdrawal

Слайд 18Payroll deduction (if municipality opts in)

Lump sum payments

Monthly contributions through the

Transfer in from other institutions

Ways to Contribute

Слайд 20Investment Types

(Asset Classes)

Equities (Stocks)

Ownership in company

Share in company profits

Canadian or

Bonds (Fixed Income)

Promise to repay debt

Receives interest

Government and corporate

Money Market/Guaranteed

Federal government debt

Short term, less than 1 year

Слайд 24

Objective to produce returns that replicate a particular index (e.g.

No surprises, consistent with market returns

Passive / Market Oriented

Слайд 25 Value Manager looking for a bargain when buying stocks

Tend to outperform during bear markets

Reasonably priced without sacrificing quality

Considered a defensive investment

Value / Long Term Oriented

Слайд 26 Buys stock in companies that tend to grow faster than

Technology companies were “growth” stocks over past 5-10 years

Sometimes young companies with high potential

Future growth in earnings is expected

Growth Oriented

Слайд 28 Select ONE balanced fund best suited to your objectives

Rebalancing

Takes the guess-work out of picking funds

Russell Lifepoints® Funds

Слайд 32So, how do you choose?

Completely hands-on

Create your own asset mix

Convert your

Monitor

Rebalance regularly

One stop shopping

Answer risk profile questionnaire

Use individual fund sheets

3 LifePoints® Funds

Pick the “one” fund that matches your risk profile

Do it yourself approach

Pre-defined asset mixes

Слайд 33Monitor Your Investments

Revisit your strategy periodically

Will change over time

Rebalance your portfolio

Keeps your asset mix on track

Sell high, buy low principle

Слайд 34Stay Informed – Personal Statements

Semi-Annual

Easy to read

Personal rates of return

Transaction history

Plan

Bulletin board

Слайд 35Customer Care Centre

1-866-733-8613

Account balances

Rates of return

Transfer between funds

Market information

Enrolment assistance

Over 150

Account Access Tools

Internet Access

www.sunlife.ca

Account balances

Lump sum deposits

Transfer between funds

what? me save? guide

Asset allocation

Secure e-mail

Webcast

RRSP receipts

Morningstar

Слайд 36Your Next Steps

Complete the Investor Risk Profile - What? Me Save?

Review the Investment Fund Pages in your package

Complete the enclosed application form and forward to the MFA

For further assistance contact Meagan at the

MFA at (250) 380-0432 ext 225, or an

investment specialist at the Customer

Care Centre at 1-866-733-8613