- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Market Gravity презентация

Содержание

- 1. Market Gravity

- 2. Market Gravity is a specialist growth and

- 3. Some of our recent clients:

- 4. Neo Banks 53% of millennials don’t think

- 5. Banking for Canada’s Gen Y Koho focus

- 6. Digital Investment Platforms Digital Investment Platforms have

- 7. Dip your toe into investments Loyal3 allows

- 8. Enhanced Customer Experiences Customer experiences associated with

- 9. Consolidate Customer Loyalty Loyalty programme aggregator to

- 10. Security & Authentication Alternatives Security has become

- 11. Secure Password Consolidator Anchor ID is a

- 12. Youthful Banking Banks are looking to the

- 13. Youth Current Account FlexOne is a checking

- 14. Alternative Scoring Mechanisms Traditional credit scoring mechanisms

- 15. More Than a Credit Score Consumer analytics

- 16. Improving the Back End Most enterprise level

- 17. Connecting the World via API Standard Treasury

- 18. Banking with Wearables No trends briefing would

- 19. Tap & Pay at Southampton FC bPay

Слайд 1Finspiration

Our Favorite Financial Services Precedents for 2015

15th December 2014

Market Gravity

Слайд 2Market Gravity is a specialist growth and innovation consultancy.

We help

We work with some of the world’s leading Financial Services firms and over the past few weeks have picked out some of our favorite market trends and precedents for 2015.

Слайд 4Neo Banks

53% of millennials don’t think their bank is any different

There has been initial enthusiasm for such propositions as 88.5 million Americans have attempted to open an account online or with a mobile device in the past 12 months.

Слайд 5Banking for Canada’s Gen Y

Koho focus on 18 to 34 year

Koho provide a mobile app and what they call a ‘pre-paid credit card’ for making transactions

Like Moven Bank, Koho plan to use data to improve the insights made available to customers

Britain’s 1st Pure Digital Player

Atom Bank, due to launch in 2015, will be the UK’s first digital only bank

Founded by Anthony Thomson, co-founder of Metro Bank, Atom will look to take advantage of the current churn in UK current accounts

Atom will sit on top of Fiserv’s Agiliti cloud based banking platform

Walmart and GreenDot Team Up

GoBank is a Simple-esque digital bank formed by GreenDot Corporation, a pre-paid debit card provider

Access to a GoBank account is made available through the purchase of a $2.95 starter kit at any Walmart store in the US enabling distribution to middle America

Слайд 6Digital Investment Platforms

Digital Investment Platforms have emerged due to changing customer

Most people struggle to understand or meet their investment goals, particularly for retirement.

Many new offerings focus on removing the confusion of traditional advisor based models.

Слайд 7Dip your toe into investments

Loyal3 allows customers to buy shares in

Customers are able to invest small amounts to test their investment strategies and have no transactions charges which can act as a barrier to smaller investments

Get the UK Ready for Retirement

Retiready is a simple, direct to consumer investment platform by Aegon

The majority of people in the UK are not saving enough to meet their retirement expectations

With Retiready, customers get a score out of 100 and guidance on how to meet their goal through 5 easy to understand funds

Follow the Expert Investors

iBillionnaire taps into the investment strategies of Wall Street billionaires, providing key insights into the financial data and investment decisions of leading U.S investors

Customers are able to follow the trades made by the world’s highest profile investors to give them confidence in their trading strategy through the iBillionnaire ETF

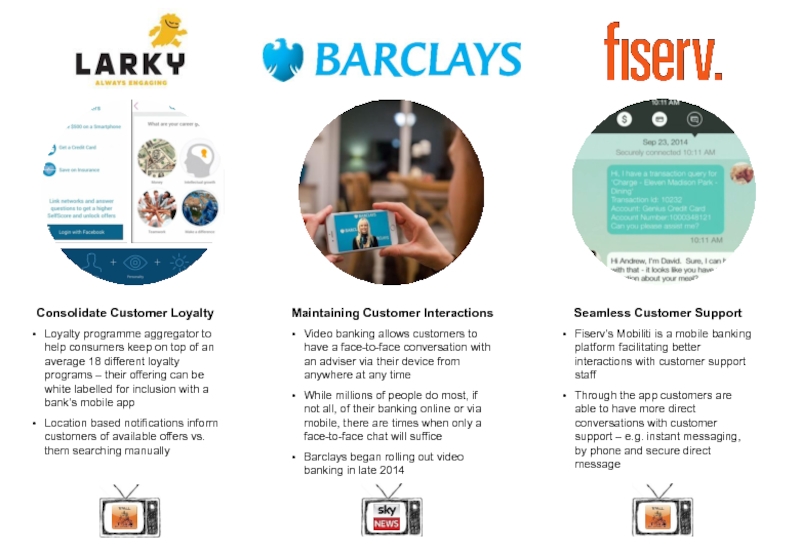

Слайд 8Enhanced Customer Experiences

Customer experiences associated with Financial Services have ranked poorly

Many financial technology firms are offering solutions to improve particular customer pain points, e.g. loyalty, digital interactions, customer support and pre-paid cards.

Слайд 9Consolidate Customer Loyalty

Loyalty programme aggregator to help consumers keep on top

Location based notifications inform customers of available offers vs. them searching manually

Maintaining Customer Interactions

Video banking allows customers to have a face-to-face conversation with an adviser via their device from anywhere at any time

While millions of people do most, if not all, of their banking online or via mobile, there are times when only a face-to-face chat will suffice

Barclays began rolling out video banking in late 2014

Seamless Customer Support

Fiserv’s Mobiliti is a mobile banking platform facilitating better interactions with customer support staff

Through the app customers are able to have more direct conversations with customer support – e.g. instant messaging, by phone and secure direct message

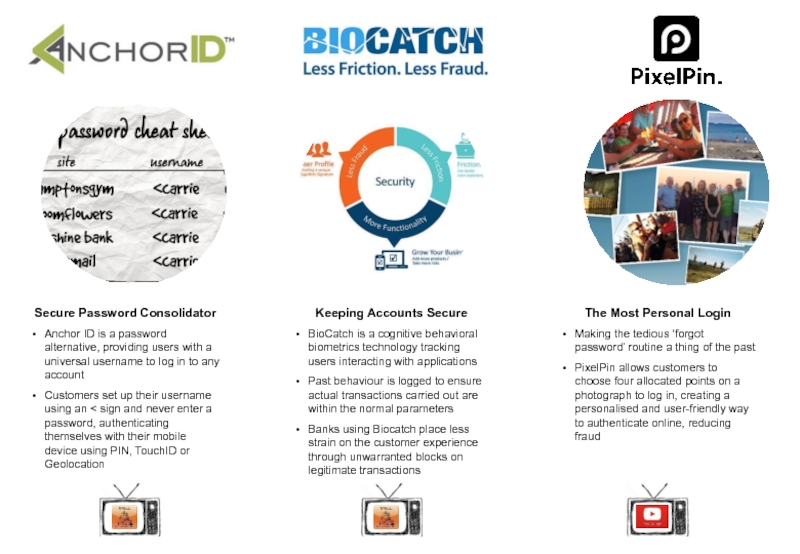

Слайд 10Security & Authentication Alternatives

Security has become a key issue for digital

Entering complex security credentials however is often detrimental to the user experience.

A number of alternatives have been demonstrated this year, offering both high levels of security and a better user experience.

Слайд 11Secure Password Consolidator

Anchor ID is a password alternative, providing users with

Customers set up their username using an < sign and never enter a password, authenticating themselves with their mobile device using PIN, TouchID or Geolocation

Keeping Accounts Secure

BioCatch is a cognitive behavioral biometrics technology tracking users interacting with applications

Past behaviour is logged to ensure actual transactions carried out are within the normal parameters

Banks using Biocatch place less strain on the customer experience through unwarranted blocks on legitimate transactions

The Most Personal Login

Making the tedious ‘forgot password’ routine a thing of the past

PixelPin allows customers to choose four allocated points on a photograph to log in, creating a personalised and user-friendly way to authenticate online, reducing fraud

Слайд 12Youthful Banking

Banks are looking to the next generation of customers to

Generation Z expect financial services to be digital, helping them build their financial awareness and access money from their family. Parents also benefit from such services as they can monitor and motivate their children’s financial behavior.

Слайд 13Youth Current Account

FlexOne is a checking account aimed at customers aged

The account comes with a contactless Visa debit card, mobile banking, pays 1% credit interest on balances up to £1,000 and provides discounted cinemas tickets

It even has its own dedicated Twitter feed

Pre-Paid Card for Kids & Families

Osper is a UK based payment service that aims to teach and empower young people to manage their money responsibly

Osper provides young people with a mobile app and pre-paid debit card that can be credited and monitored by their parents

Kids are able to get track their spending and get help to meet their goals

Digital Allowances for Children

Famdoo is a point based rewards tool for families. Parents reward their children for tasks they carry out – e.g. chores, learning or good behaviour using native iOS or Android apps

Customers and their families can spend loyalty points through FamDoo with companies like Amazon, BestBuy, Target or put their points into a savings program

Слайд 14Alternative Scoring Mechanisms

Traditional credit scoring mechanisms such as FICO have remained

Some companies are recognizing there is more to customers than just their financial records, especially as more personal information – e.g. promotions, having children and day to day activity – is shared on social media.

Слайд 15More Than a Credit Score

Consumer analytics supplement for FICO scores using

Financial institutions can use online profile, phone and psychometric data to improve accuracy

By more accurately assessing risk, the business can offer more competitive pricing

Social Media Credit Score

Traditional credit scoring does not accurately portray the financial risk of people under the age of 30 due to their lifestyle (moving frequently, limited credit history etc.)

Friendly Score analyzes social media profiles to access more personal data and provide a more accurate credit worthiness score

Transparent Credit Score

Discover provide customers with a free FICO credit score as part of their monthly statement

Although a traditional credit scoring system, by highlighting a customer’s credit score, Discover are making the process transparent to them

Otherwise, customers would need to pay to access their rating

Слайд 16Improving the Back End

Most enterprise level financial institutions are reliant on

Many FinTech startups are developing new products to help the financial institutions make back end improvements, at low cost with minimal risk. The knock on impact being huge leaps in the end customer experience.

Слайд 17Connecting the World via API

Standard Treasury is building middleware that allows

Their first product is a RESTful API processing checks, book transfers, account opening/closing and foreign currency quoting/execution

Powering International Payments

Currency Cloud’s vision is for a transparent, fast, easy-to-use and secure payments engine to transform the way businesses move money around the world

Customers can automate end-to-end international payment processes and deliver sophisticated solutions

One Platform, Multiple Solutions

Yodlee offers a single API and customized developer portal, built for each customer and exposable to developers

With the data, the API, and the tools to build and create, financial institutions are free to innovate with speed and agility. For example, enabling consumers to “invest their change” in stocks

Слайд 18Banking with Wearables

No trends briefing would be complete at the moment

Large financial services firms are considering applications for wearables to build new interactions with customers, primarily starting in the payments space.

Слайд 19Tap & Pay at Southampton FC

bPay by Barclaycard is a new

Customers add money from a debit or credit card and use the band to make contactless payments, up to £20

Southampton FC fans can get a club themed bank for making payments at their St Mary’s stadium

Balance on Your Wrist

Customers of Canada's Scotiabank can now check their account balances with a quick glance at their wrists with a new app for the Samsung Gear range of smartwatches

Customers swipe the screen to see the balance of their preferred account

Banking with Google Glass

Ukrainian Bank PrivatBank has provided a glimpse of what banking with Google Glass could look like for customers

Examples include using voice commands to authorise payments, using the camera to pay bills or a QR code reader to redeem offers

PrivatBank say this could be achieved by re-using existing architecture