The views expressed in this presentation are those of the author and do not necessarily reflect the official views of the Deutsche Bundesbank

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Macro-prudential policy and its instruments презентация

Содержание

- 1. Macro-prudential policy and its instruments

- 2. Macro-prudential policy and its instruments Overview

- 3. Macro-prudential policy and its instruments Introduction – Evolution of systemic risk 27/04/2016 Slide

- 4. Macro-prudential policy and its instruments Introduction – Evolution of systemic risk 27/04/2016 Slide

- 5. Macro-prudential policy and its instruments Introduction –

- 6. Macro-prudential policy and its instruments Overview

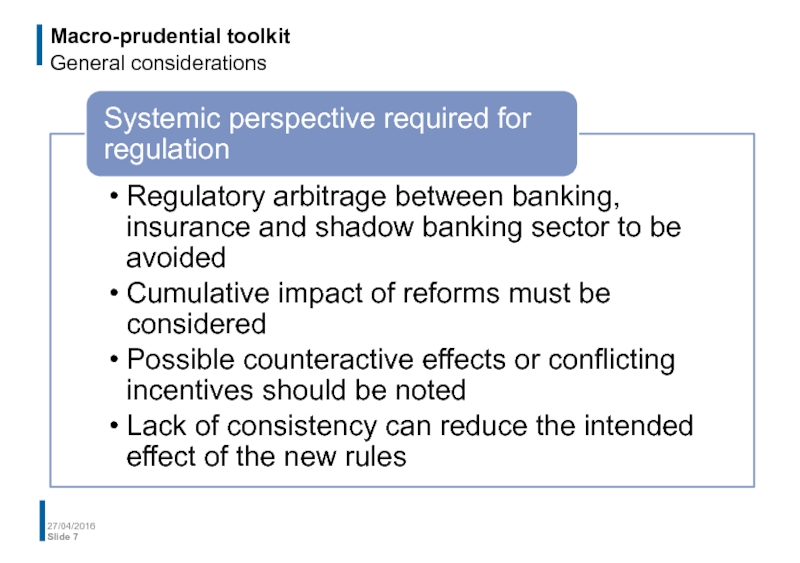

- 7. Macro-prudential toolkit General considerations 27/04/2016 Slide

- 8. Macro-prudential toolkit Types of instruments 27/04/2016 Slide

- 9. Macro-prudential toolkit ”Soft” instruments 27/04/2016 Slide

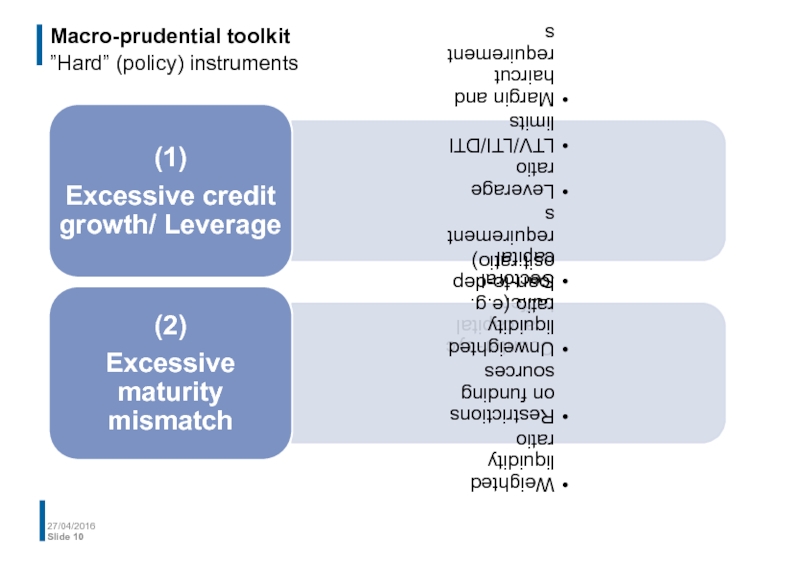

- 10. Macro-prudential toolkit ”Hard” (policy) instruments 27/04/2016 Slide

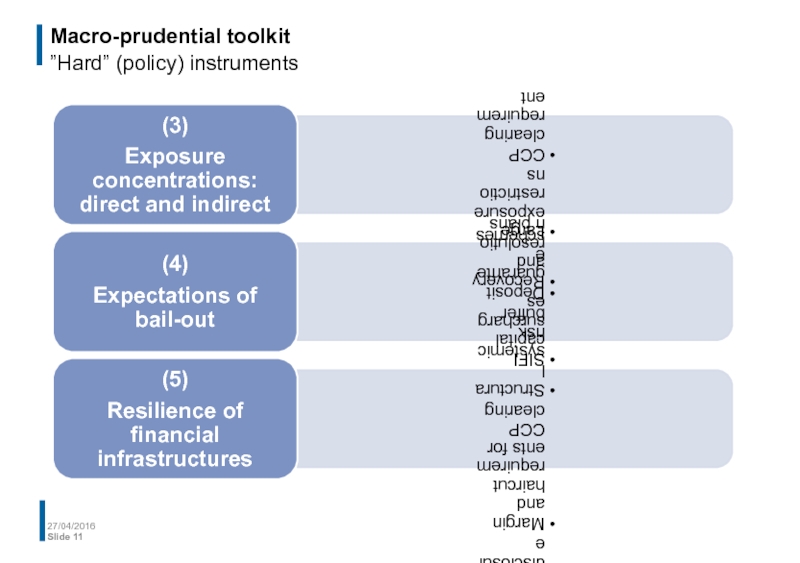

- 11. Macro-prudential toolkit ”Hard” (policy) instruments 27/04/2016 Slide

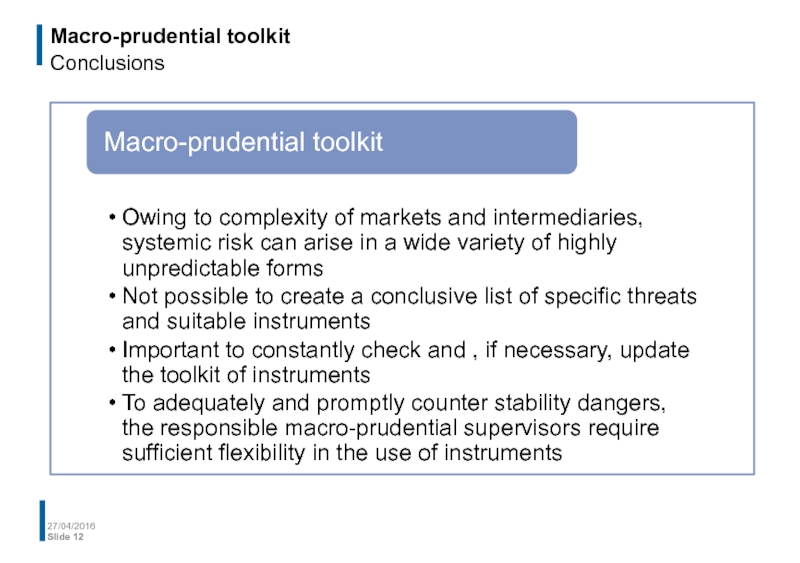

- 12. Macro-prudential toolkit Conclusions 27/04/2016 Slide

- 13. Macro-prudential policy and its instruments Overview

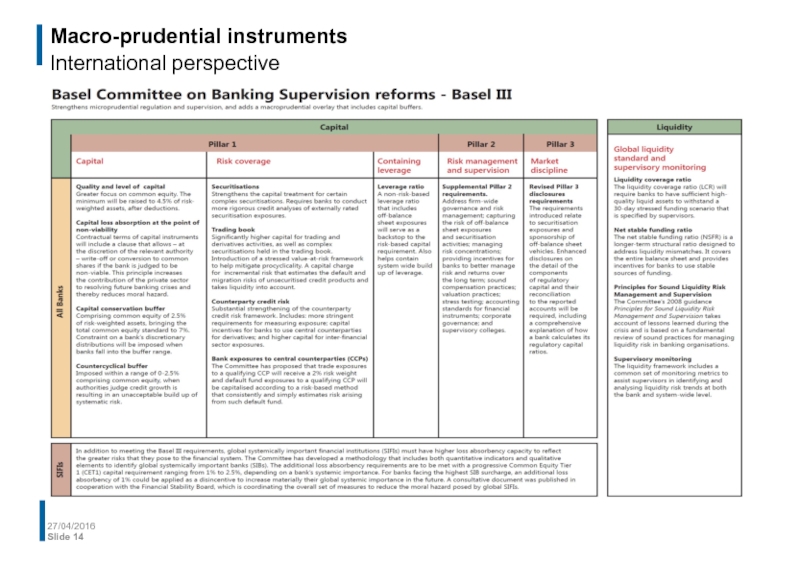

- 14. Macro-prudential instruments International perspective 27/04/2016 Slide

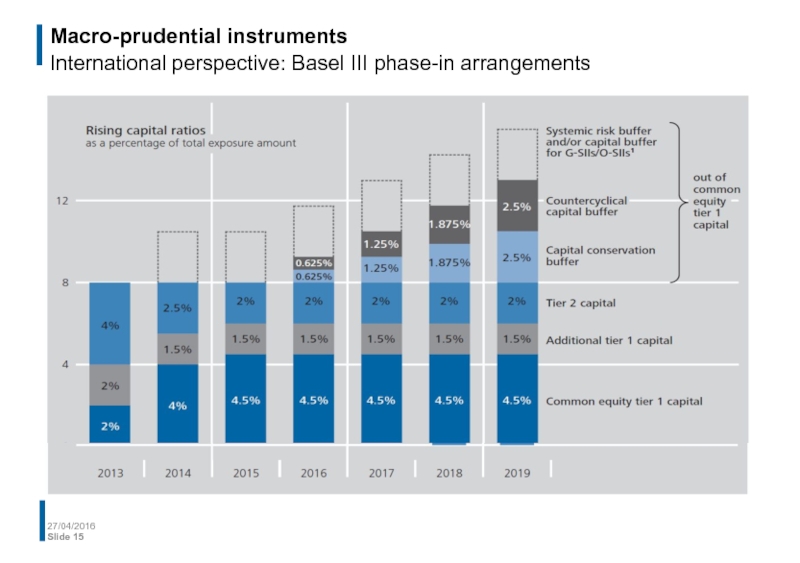

- 15. Macro-prudential instruments International perspective: Basel III phase-in arrangements 27/04/2016 Slide

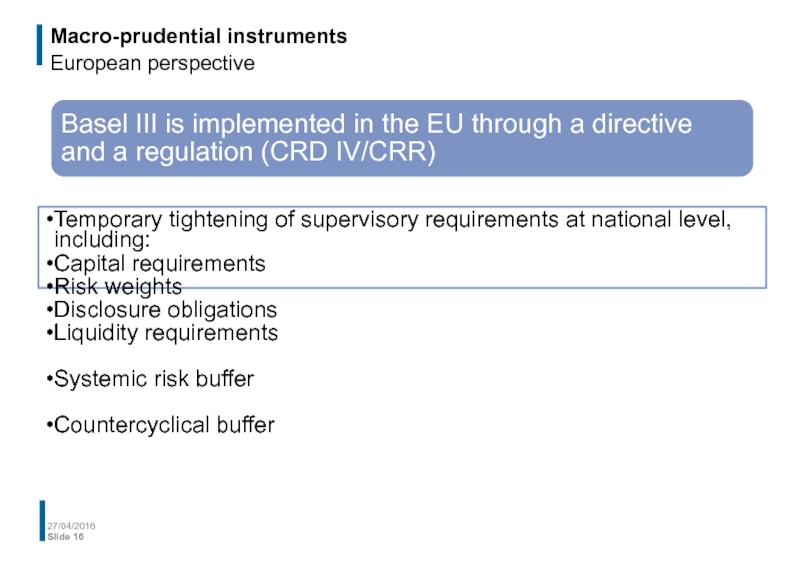

- 16. Macro-prudential instruments European perspective 27/04/2016 Slide

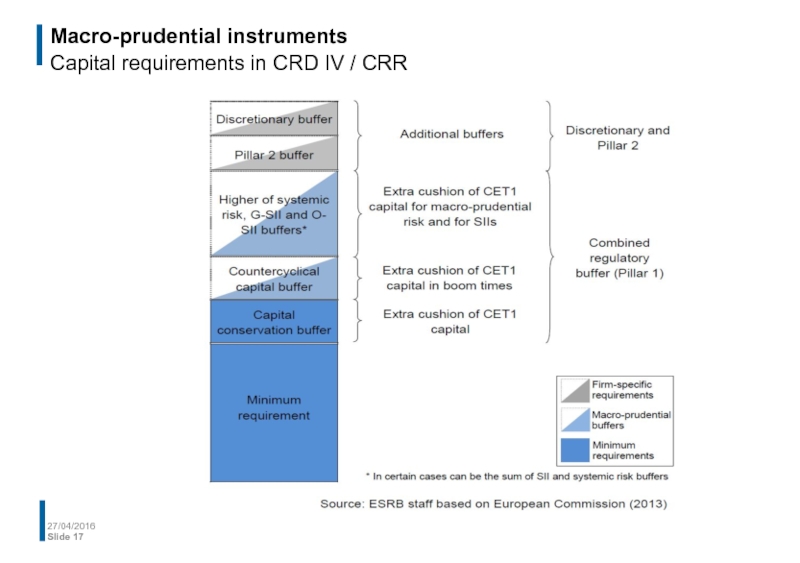

- 17. Macro-prudential instruments Capital requirements in CRD IV / CRR 27/04/2016 Slide

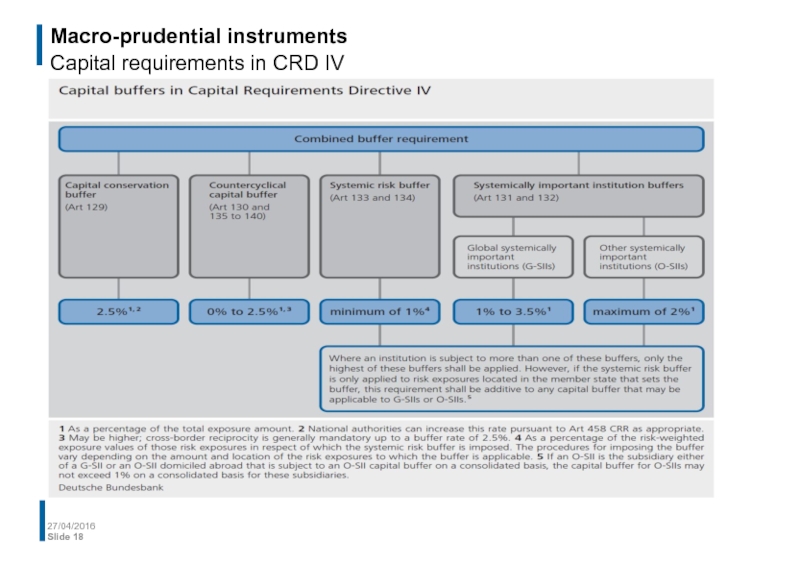

- 18. Macro-prudential instruments Capital requirements in CRD IV 27/04/2016 Slide

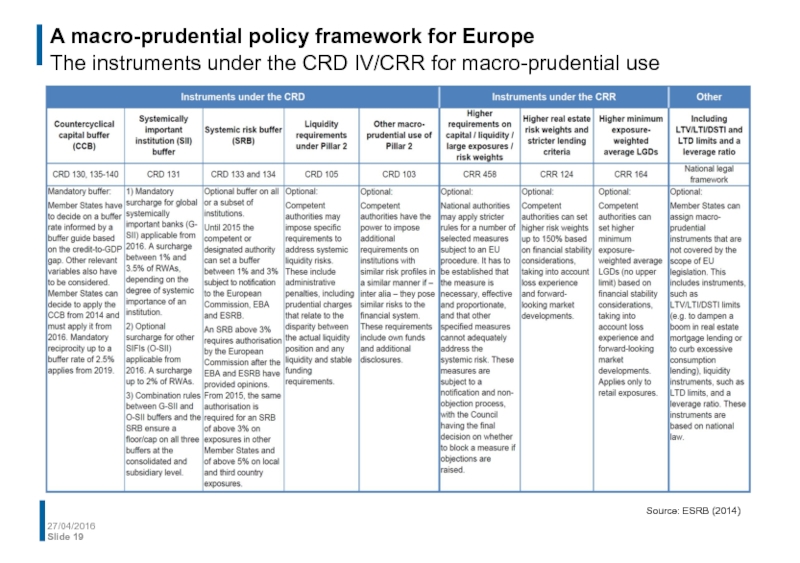

- 19. A macro-prudential policy framework for Europe The

- 20. Macro-prudential policy and its instruments Overview

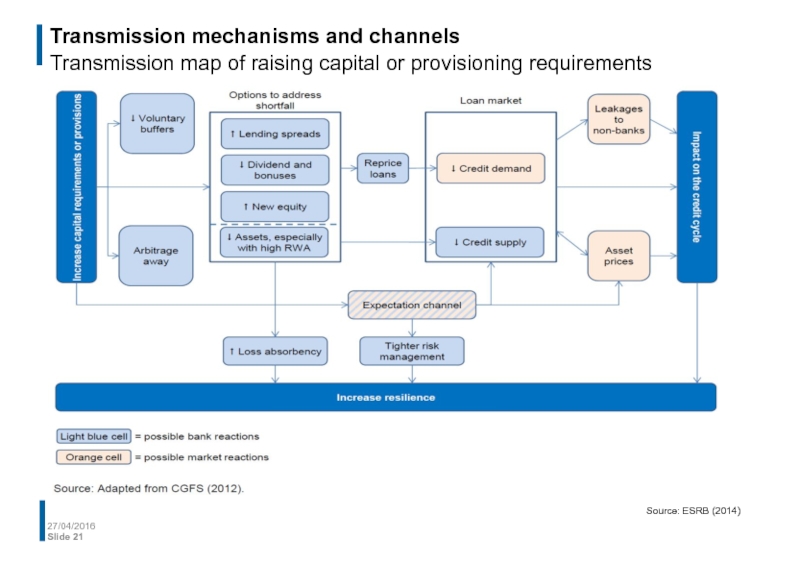

- 21. Transmission mechanisms and channels Transmission map of

- 22. Transmission mechanisms and channels Transmission map of

- 23. Transmission mechanisms and channels Transmission map of

- 24. Transmission mechanisms and channels Transmission map for

- 25. Macro-prudential policy and its instruments Overview

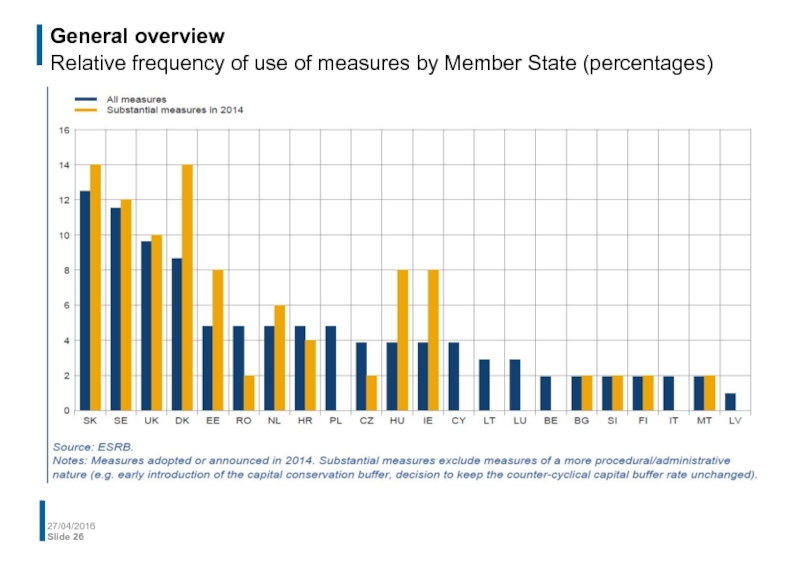

- 26. General overview Relative frequency of use of measures by Member State (percentages) 27/04/2016 Slide

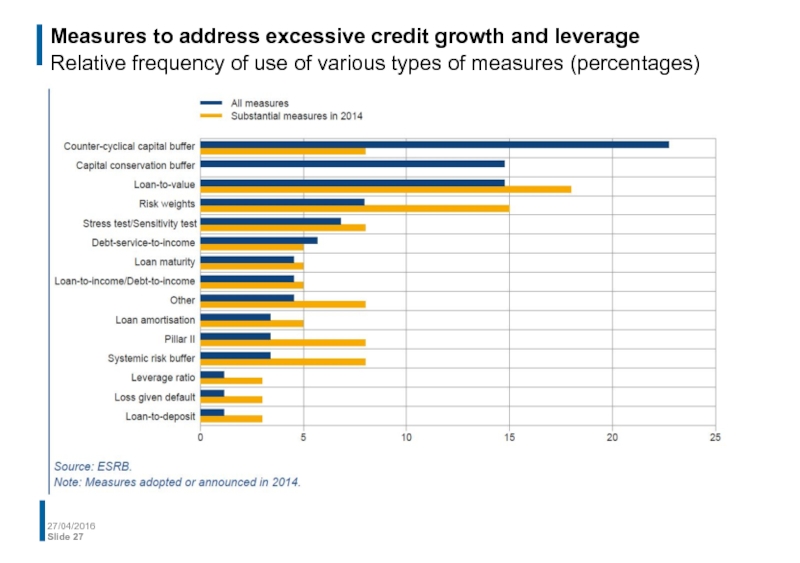

- 27. Measures to address excessive credit growth and

- 28. Thank you very much for your attention! Contact: Peter.Spicka@bundesbank.de

Слайд 1Macro-prudential policy and its instruments

Peter Spicka, Senior Adviser for Banking Supervision

Слайд 2Macro-prudential policy and its instruments

Overview

Introduction

Macro-prudential toolkit

Macro-prudential instruments in

Transmission mechanisms and channels

Review of initial experiences

27/04/2016

Slide

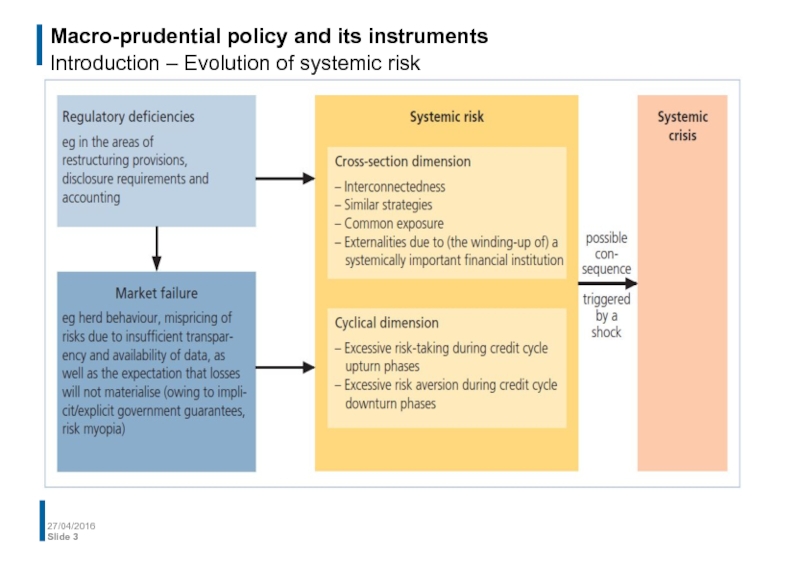

Слайд 3Macro-prudential policy and its instruments

Introduction – Evolution of systemic risk

27/04/2016

Slide

Слайд 4Macro-prudential policy and its instruments

Introduction – Evolution of systemic risk

27/04/2016

Slide

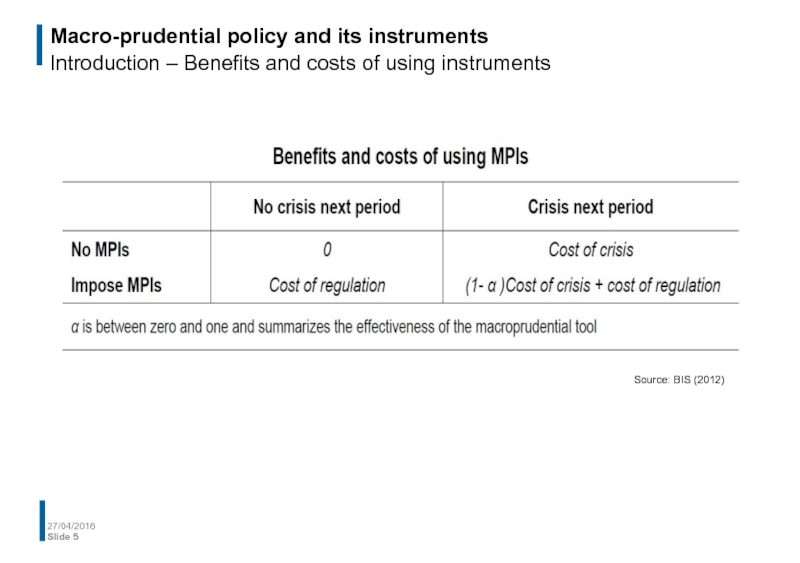

Слайд 5Macro-prudential policy and its instruments Introduction – Benefits and costs of using

27/04/2016

Slide

Source: BIS (2012)

Слайд 6Macro-prudential policy and its instruments

Overview

Introduction

Macro-prudential toolkit

Macro-prudential instruments in

Transmission mechanisms and channels

Review of initial experiences

27/04/2016

Slide

Слайд 13Macro-prudential policy and its instruments

Overview

Introduction

Macro-prudential toolkit

Macro-prudential instruments in

Transmission mechanisms and channels

Review of initial experiences

27/04/2016

Slide

Слайд 15Macro-prudential instruments

International perspective: Basel III phase-in arrangements

27/04/2016

Slide

Слайд 16Macro-prudential instruments

European perspective

27/04/2016

Slide

Basel III is implemented in the EU through

Temporary tightening of supervisory requirements at national level, including:

Capital requirements

Risk weights

Disclosure obligations

Liquidity requirements

Systemic risk buffer

Countercyclical buffer

Слайд 19A macro-prudential policy framework for Europe The instruments under the CRD IV/CRR

27/04/2016

Slide

Source: ESRB (2014)

Слайд 20Macro-prudential policy and its instruments

Overview

Introduction

Macro-prudential toolkit

Macro-prudential instruments in

Transmission mechanisms and channels

Review of initial experiences

27/04/2016

Slide

Слайд 21Transmission mechanisms and channels

Transmission map of raising capital or provisioning requirements

27/04/2016

Slide

Source: ESRB (2014)

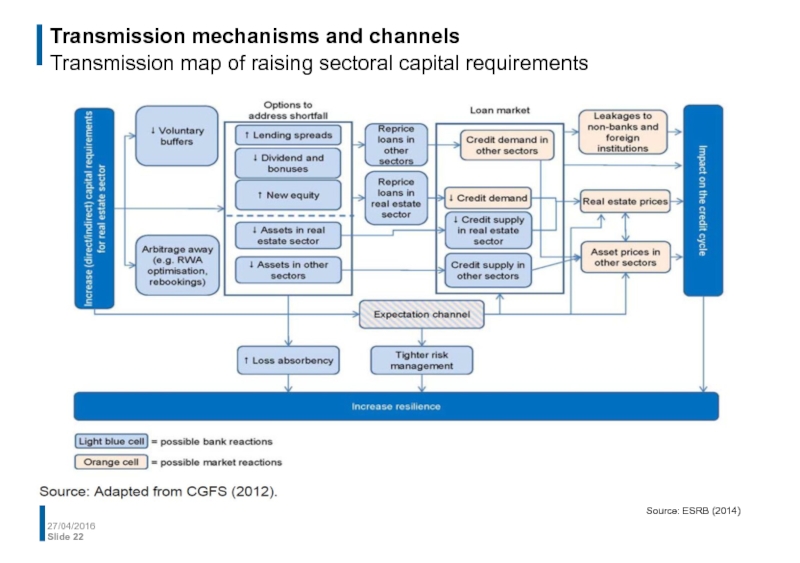

Слайд 22Transmission mechanisms and channels

Transmission map of raising sectoral capital requirements

27/04/2016

Slide

Source:

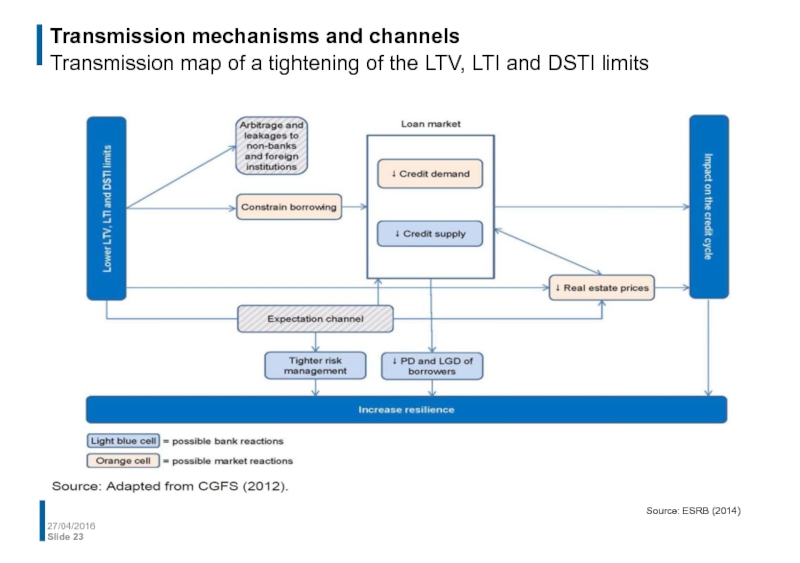

Слайд 23Transmission mechanisms and channels Transmission map of a tightening of the LTV,

27/04/2016

Slide

Source: ESRB (2014)

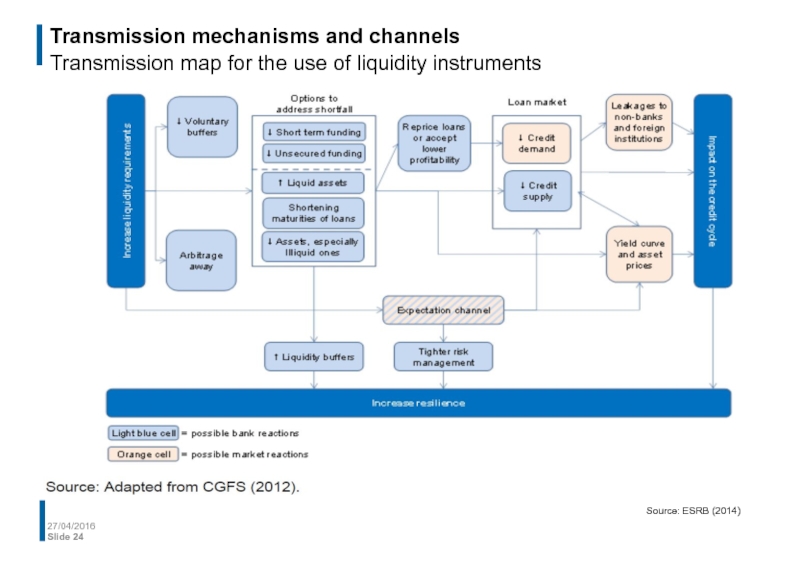

Слайд 24Transmission mechanisms and channels

Transmission map for the use of liquidity instruments

27/04/2016

Slide

Source: ESRB (2014)

Слайд 25Macro-prudential policy and its instruments

Overview

Introduction

Macro-prudential toolkit

Macro-prudential instruments in

Transmission mechanisms and channels

Review of initial experiences

27/04/2016

Slide

Слайд 26General overview

Relative frequency of use of measures by Member State (percentages)

27/04/2016

Slide

Слайд 27Measures to address excessive credit growth and leverage Relative frequency of use

27/04/2016

Slide