III

Dr. A. B. Rastogi

NMIMS

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Introduction to Project Finance. Project Appraisal, Financing and Management презентация

Содержание

- 1. Introduction to Project Finance. Project Appraisal, Financing and Management

- 2. What is a Project? High operating margins.

- 3. What is a Project? (cont.) Projects have

- 4. What Does a Project Need? Customized capital

- 5. “Project finance” is not the same thing as “financing projects”.

- 6. What is Project Finance? Project Finance involves

- 7. Project Structure Structure highlights Disadvantages Motivations

- 8. Structure Highlights SPV - Independent, single purpose

- 9. Structure Highlights (cont.) Highly concentrated equity and

- 10. Disadvantages of Project Financing Often takes longer

- 11. Type of Projects BOT - Build Operate

- 12. Means of Finance Equity Capital Mezzanine Finance

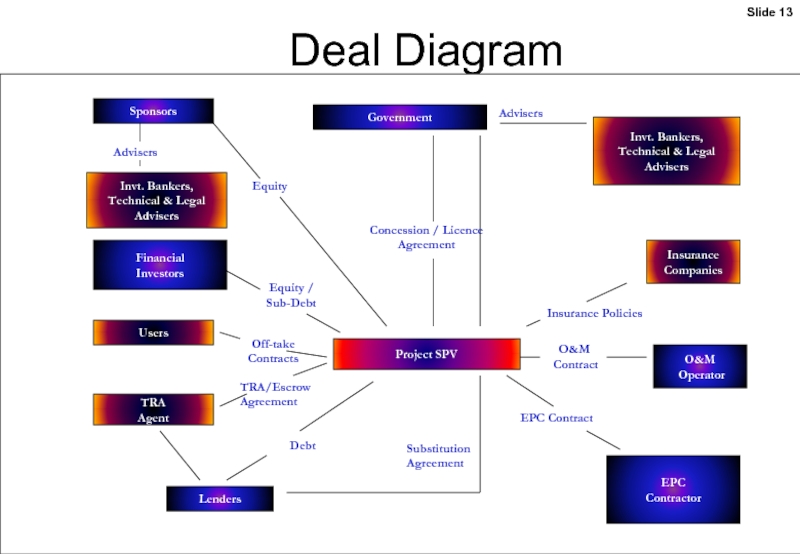

- 13. Financing Infrastructure Projects Deal Diagram Government Project SPV

- 14. Key Components Cash flow projections based on

- 15. Base case analysis shows adequate debt servicing

- 16. Why Investors Use Project Finance High leverage

- 17. Benefits of Project Finance to Third Parties

- 18. Case Study - 1 Project : 4-laning

- 19. Case Study - 2 Project SPV

- 20. INFRASTRUCTURE Transport – road including toll road,

- 21. Thank you

Слайд 1

Introduction to Project Finance

Project Appraisal, Financing and Management

CRISIL CERTIFIED ANALYST PROGRAMME

SEMESTER

Слайд 2What is a Project?

High operating margins.

Low to medium return on capital.

Limited

Life.

Significant free cash flows.

Few diversification opportunities.

Asset specificity.

Significant free cash flows.

Few diversification opportunities.

Asset specificity.

Слайд 3What is a Project? (cont.)

Projects have unique risks:

Symmetric risks:

Demand, price.

Input/supply.

Currency,

interest rate, inflation.

Reserve (stock) or throughput (flow).

Asymmetric downside risks:

Environmental.

Creeping expropriation.

Binary risks

Technology failure.

Direct expropriation.

Counterparty failure

Force majeure

Regulatory risk

Reserve (stock) or throughput (flow).

Asymmetric downside risks:

Environmental.

Creeping expropriation.

Binary risks

Technology failure.

Direct expropriation.

Counterparty failure

Force majeure

Regulatory risk

Слайд 4What Does a Project Need?

Customized capital structure

Asset specific governance systems

to minimize

cash flow volatility and

to maximize firm value.

to maximize firm value.

Слайд 6What is Project Finance?

Project Finance involves a corporate sponsor investing in

and owning a single purpose, industrial asset through a legally independent entity financed with non-recourse debt.

Cash flow is security to lenders.

Cash flow is security to lenders.

Слайд 8Structure Highlights

SPV - Independent, single purpose company formed to build and

operate the project.

Extensive contracting

As many as 15 parties in up to 1000 contracts.

Contracts govern inputs, off take, construction and operation.

Government contracts/concessions: one off or operate-transfer.

Ancillary contracts include financial hedges, insurance for Force Majeure, etc.

Extensive contracting

As many as 15 parties in up to 1000 contracts.

Contracts govern inputs, off take, construction and operation.

Government contracts/concessions: one off or operate-transfer.

Ancillary contracts include financial hedges, insurance for Force Majeure, etc.

Слайд 9Structure Highlights (cont.)

Highly concentrated equity and debt ownership

One to three equity

sponsors.

Syndicate of banks and/or financial institutions provide credit.

Governing Board comprised of mainly affiliated directors from sponsoring firms/ independent directors

Extremely high debt levels

Mean debt of 70% and as high as nearly 95%.

Balance of capital provided by sponsors in the form of equity or quasi equity (subordinated debt).

Debt is non-recourse to the sponsors.

Debt service depends exclusively on project revenues.

Has higher spreads than corporate debt.

Syndicate of banks and/or financial institutions provide credit.

Governing Board comprised of mainly affiliated directors from sponsoring firms/ independent directors

Extremely high debt levels

Mean debt of 70% and as high as nearly 95%.

Balance of capital provided by sponsors in the form of equity or quasi equity (subordinated debt).

Debt is non-recourse to the sponsors.

Debt service depends exclusively on project revenues.

Has higher spreads than corporate debt.

Слайд 10Disadvantages of Project Financing

Often takes longer to structure than equivalent size

corporate finance.

Higher transaction costs (~60bp) due to creation of an independent entity.

Project debt is substantially more expensive (50-400 bp) due to its non-recourse nature.

Extensive contracting restricts managerial decision making.

Project finance requires greater disclosure of proprietary information and strategic deals.

Higher transaction costs (~60bp) due to creation of an independent entity.

Project debt is substantially more expensive (50-400 bp) due to its non-recourse nature.

Extensive contracting restricts managerial decision making.

Project finance requires greater disclosure of proprietary information and strategic deals.

Слайд 11Type of Projects

BOT - Build Operate Transfer

BOOT - Build Own Operate

Transfer

BOO - Build Own Operate

BOOST - Build Own Operate Share Transfer

BOLT - Build Own Lease Transfer

DBFO - Design Build Finance Operate

OMT - Operate Maintain Transfer

BOO - Build Own Operate

BOOST - Build Own Operate Share Transfer

BOLT - Build Own Lease Transfer

DBFO - Design Build Finance Operate

OMT - Operate Maintain Transfer

Слайд 12Means of Finance

Equity Capital

Mezzanine Finance

Convertibles

Preference Capital

Sub-ordinated Debt

Senior Debt

Rupee Term Loan

Bonds

Foreign Currency

Loan

Export Credit

Supplier’s Credit

Export Credit

Supplier’s Credit

Слайд 14Key Components

Cash flow projections based on technical, market and financial analysis

Risk

allocation through project contracts and financing agreements

Structured financing

Security and documentation

Project monitoring and compliance

Structured financing

Security and documentation

Project monitoring and compliance

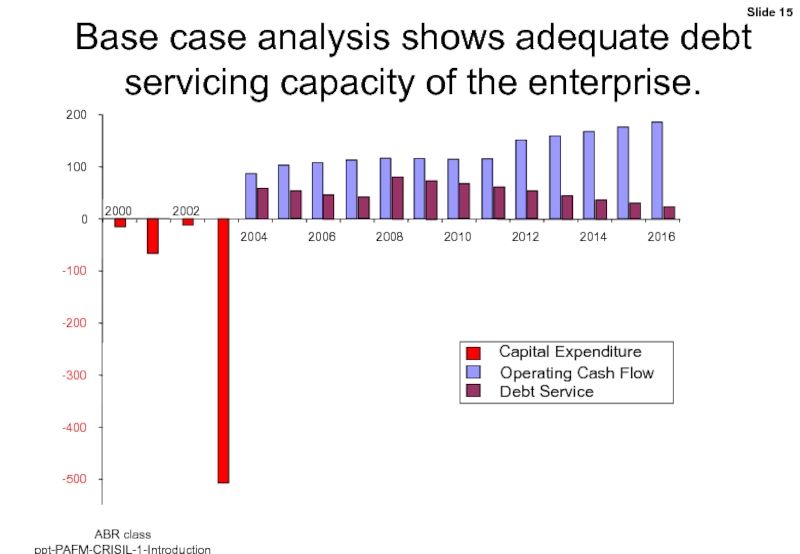

Слайд 15Base case analysis shows adequate debt servicing capacity of the enterprise.

-500

-400

-300

-200

-100

0

100

200

2000

2002

2004

2006

2008

2010

2012

2014

2016

Слайд 16Why Investors Use Project Finance

High leverage

Tax benefits

Off-balance sheet financing

Borrowing capacity

Risk limitation

Risk

spreading

Long-term finance

Enhanced credit

Unequal partnerships

Long-term finance

Enhanced credit

Unequal partnerships

Слайд 17Benefits of Project Finance to Third Parties

Lower product or service cost

Additional

investment in public infrastructure

Risk transfer

Lower project cost

Third-party due diligence

Transparency

Additional inward investment

Technology transfer

Risk transfer

Lower project cost

Third-party due diligence

Transparency

Additional inward investment

Technology transfer

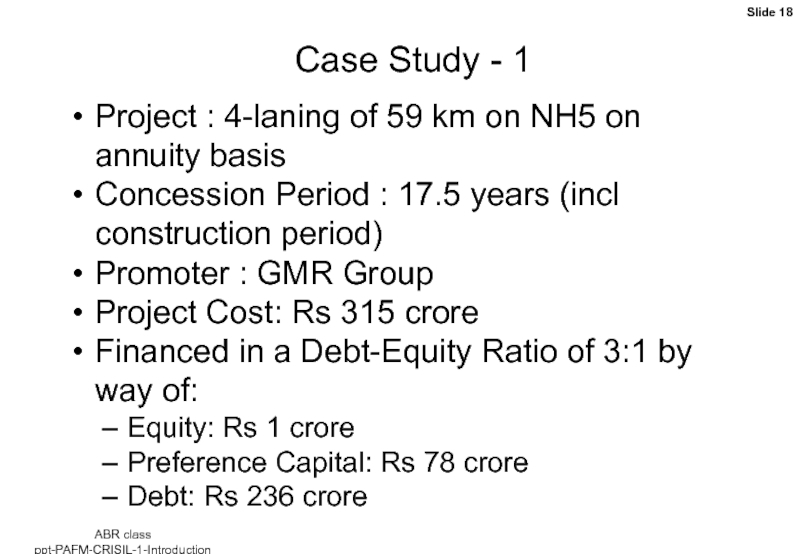

Слайд 18Case Study - 1

Project : 4-laning of 59 km on NH5

on annuity basis

Concession Period : 17.5 years (incl construction period)

Promoter : GMR Group

Project Cost: Rs 315 crore

Financed in a Debt-Equity Ratio of 3:1 by way of:

Equity: Rs 1 crore

Preference Capital: Rs 78 crore

Debt: Rs 236 crore

Concession Period : 17.5 years (incl construction period)

Promoter : GMR Group

Project Cost: Rs 315 crore

Financed in a Debt-Equity Ratio of 3:1 by way of:

Equity: Rs 1 crore

Preference Capital: Rs 78 crore

Debt: Rs 236 crore

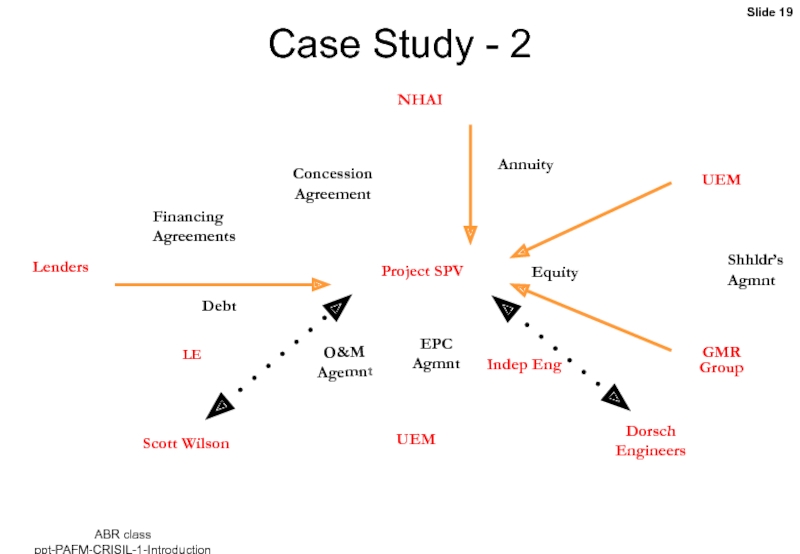

Слайд 19Case Study - 2

Project SPV

NHAI

Lenders

UEM

UEM

GMR Group

Dorsch Engineers

Scott Wilson

Debt

Financing Agreements

Equity

EPC

Agmnt

O&M Agemnt

Annuity

Shhldr’s Agmnt

Concession

Agreement

LE

Indep Eng

Слайд 20INFRASTRUCTURE

Transport – road including toll road, a bridge, rail system, a

highway project, a port, airport, inland port.

Telecommunication – basic or cellular, radio paging, domestic satellite services, broadband network, internet services.

Energy – generation, distribution, transmission, gas supply

C&I – a water project, irrigation project, water treatment system, industrial park, SEZ, education and hospitals.

Telecommunication – basic or cellular, radio paging, domestic satellite services, broadband network, internet services.

Energy – generation, distribution, transmission, gas supply

C&I – a water project, irrigation project, water treatment system, industrial park, SEZ, education and hospitals.