- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Interest Rates and Monetary Policy презентация

Содержание

- 1. Interest Rates and Monetary Policy

- 2. Interest Rates The price paid for the

- 3. Demand for Money Why hold money? Transactions

- 4. Demand for Money Rate of interest, i

- 5. Assets Securities Loans to commercial banks Liabilities

- 6. Tools of Monetary Policy Open market operations

- 7. Tools of Monetary Policy Fed buys bonds

- 8. Tools of Monetary Policy Fed sells bonds

- 9. Tools of Monetary Policy The reserve ratio

- 10. Tools of Monetary Policy Open market operations

- 11. The Federal Funds Rate Rate charged by

- 12. Monetary Policy Expansionary monetary policy Economy faces

- 13. Monetary Policy Restrictive monetary policy Periods of

- 14. Taylor Rule Rule of thumb for tracking

- 15. Expansionary Monetary Policy Problem: Unemployment and Recession

- 16. Restrictive Monetary Policy Problem: Inflation Fed sells

- 17. Evaluation and Issues Advantages over fiscal policy

- 18. Problems and Complications Lags Recognition and operational Cyclical asymmetry Liquidity trap

Слайд 2Interest Rates

The price paid for the use of money

Many different interest

Speak as if only one interest rate

Determined by the money supply and money demand

Слайд 3Demand for Money

Why hold money?

Transactions demand, Dt

Determined by nominal GDP

Independent of

Asset demand, Da

Money as a store of value

Varies inversely with the interest rate

Total money demand, Dm

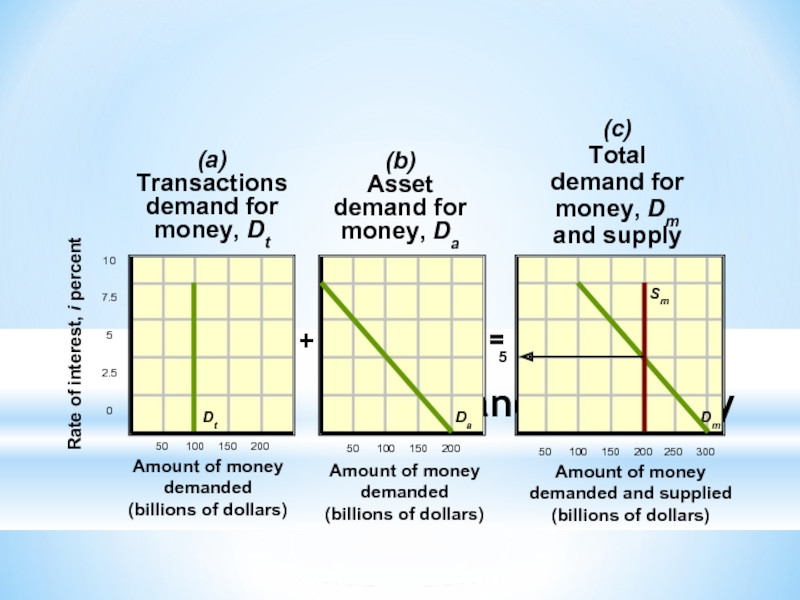

Слайд 4Demand for Money

Rate of interest, i percent

10

7.5

5

2.5

0

Amount of money

demanded

(billions of dollars)

Amount

demanded

(billions of dollars)

Amount of money

demanded and supplied

(billions of dollars)

=

+

(a)

Transactions

demand for

money, Dt

(b)

Asset

demand for

money, Da

(c)

Total

demand for

money, Dm

and supply

Dt

Da

Dm

Sm

5

Слайд 5Assets

Securities

Loans to commercial banks

Liabilities

Reserves of commercial banks

Treasury deposits

Federal Reserve Notes outstanding

Federal

Слайд 6Tools of Monetary Policy

Open market operations

Buying and selling of government securities

Commercial banks and the general public

Used to influence the money supply

When the Fed sells securities, commercial bank reserves are reduced

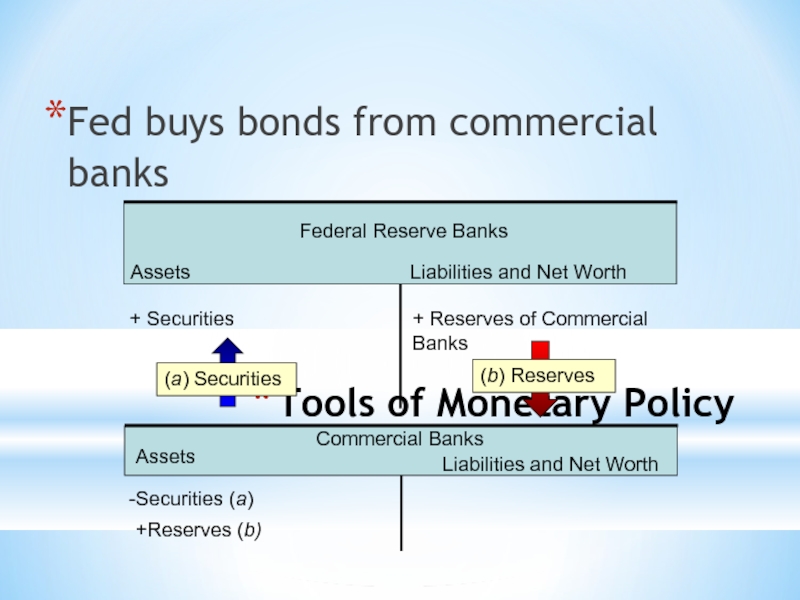

Слайд 7Tools of Monetary Policy

Fed buys bonds from commercial banks

Federal Reserve Banks

+

+ Reserves of Commercial Banks

(b) Reserves

Commercial Banks

Securities (a)

+Reserves (b)

Assets

Liabilities and Net Worth

(a) Securities

Слайд 8Tools of Monetary Policy

Fed sells bonds to commercial banks

Federal Reserve Banks

-

- Reserves of Commercial Banks

Commercial Banks

+ Securities (a)

- Reserves (b)

Assets

Liabilities and Net Worth

(a) Securities

(b) Reserves

Слайд 9Tools of Monetary Policy

The reserve ratio

Changes the money multiplier

The discount rate

The

Short term loans

Term auction facility

Introduced December 2007

Banks bid for the right to borrow reserves

Слайд 10Tools of Monetary Policy

Open market operations are the most important

Reserve ratio

Discount rate was a passive tool

Term auction facility is new

Guaranteed amount lent by the Fed

Anonymous

Слайд 11The Federal Funds Rate

Rate charged by banks on overnight loans

Targeted by

FOMC conducts open market operations to achieve the target

Demand curve for Federal funds

Supply curve for Federal funds

Слайд 12Monetary Policy

Expansionary monetary policy

Economy faces a recession

Lower target for Federal funds

Fed buys securities

Expanded money supply

Downward pressure on other interest rates

Слайд 13Monetary Policy

Restrictive monetary policy

Periods of rising inflation

Increases Federal funds rate

Increases money

Increases other interest rates

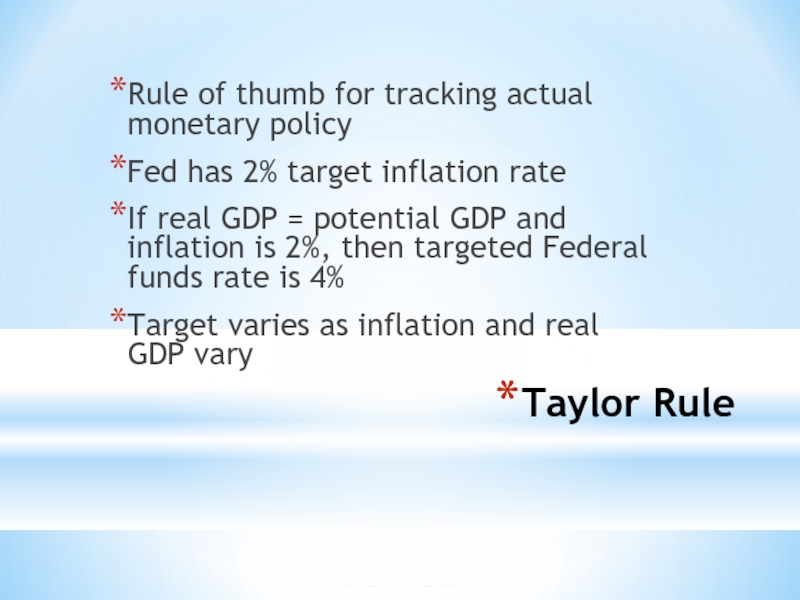

Слайд 14Taylor Rule

Rule of thumb for tracking actual monetary policy

Fed has 2%

If real GDP = potential GDP and inflation is 2%, then targeted Federal funds rate is 4%

Target varies as inflation and real GDP vary

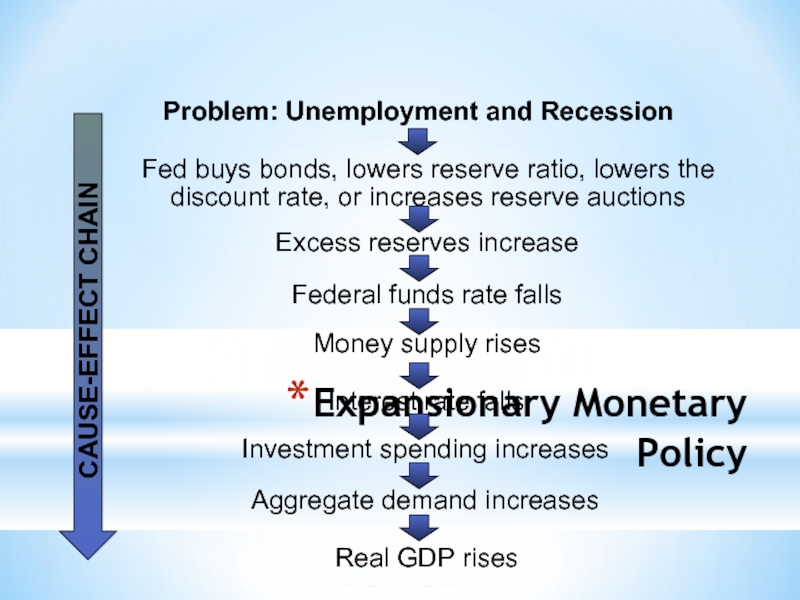

Слайд 15Expansionary Monetary Policy

Problem: Unemployment and Recession

Fed buys bonds, lowers reserve ratio,

Excess reserves increase

Federal funds rate falls

Money supply rises

Interest rate falls

Investment spending increases

Aggregate demand increases

Real GDP rises

CAUSE-EFFECT CHAIN

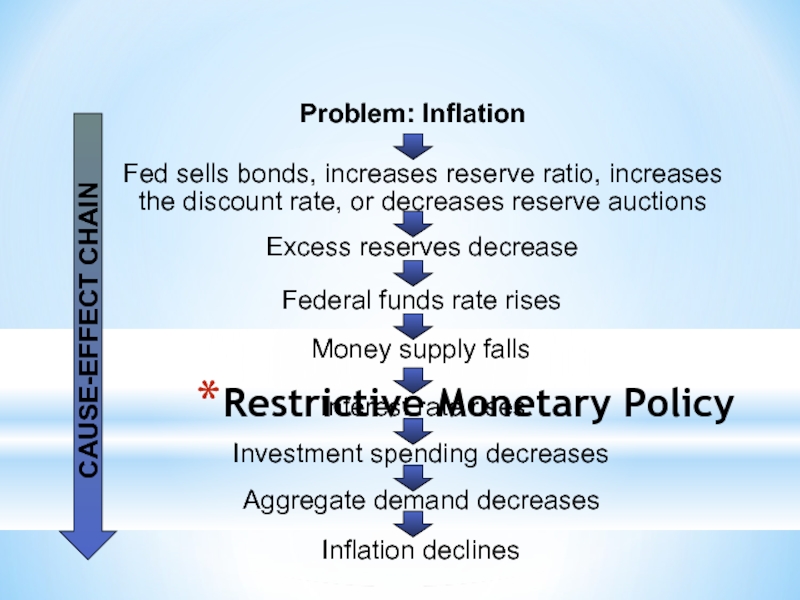

Слайд 16Restrictive Monetary Policy

Problem: Inflation

Fed sells bonds, increases reserve ratio, increases the

Excess reserves decrease

Federal funds rate rises

Money supply falls

Interest rate rises

Investment spending decreases

Aggregate demand decreases

Inflation declines

CAUSE-EFFECT CHAIN