Brooks, Raymond. 2010. Financial management : core concepts. 1st ed, The Prentice Hall series in finance. Boston: Prentice Hall. (Chapters 2, 14)

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Fundamentals of financial statement analysis. (Lecture 1) презентация

Содержание

- 1. Fundamentals of financial statement analysis. (Lecture 1)

- 2. LEARNING OBJECTIVES Understand and conduct horizontal analysis

- 3. I. Overview of Financial Statements

- 4. TYPES OF FINANCIAL STATEMENTS Balance Sheet Income

- 5. BALANCE SHEET Assets Liabilities Equity = +

- 6. INCOME STATEMENT (P/L STATEMENT) It is also

- 7. INCOME STATEMENT (P/L STATEMENT) Total Sales

- 8. CASH FLOWS STATEMENT Cash flows from Operations

- 9. STATEMENT OF OWNER’S EQUITY Statement

- 10. Stockholders’ (Owners’) Equity accounts Owners’ investment

- 11. Stockholders’ (Owners’) Equity accounts Increase in

- 12. (1) Increases in stockholders’ equity:

- 13. II. ANALYSIS OF FINANCIAL STATEMENTS

- 14. APPROACHES TOWARDS FINANCIAL ANALYSIS To conduct

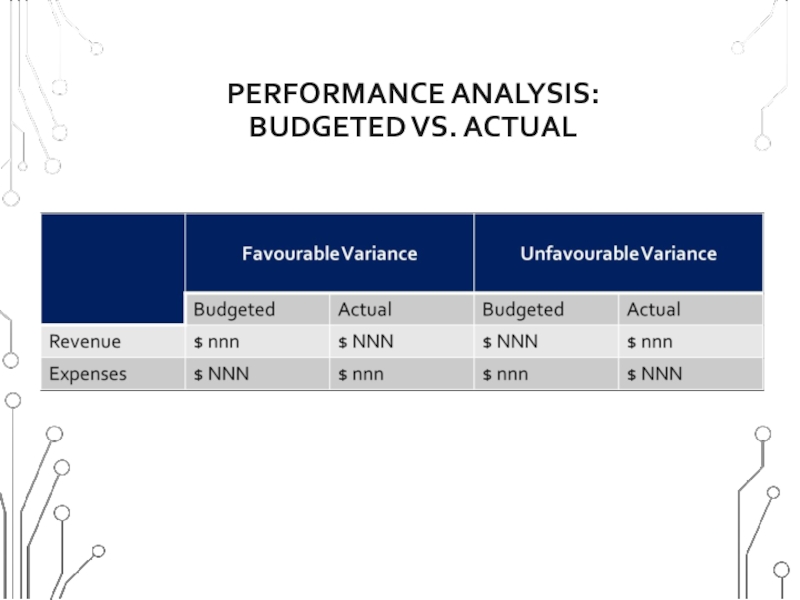

- 15. PERFORMANCE ANALYSIS: BUDGETED VS. ACTUAL

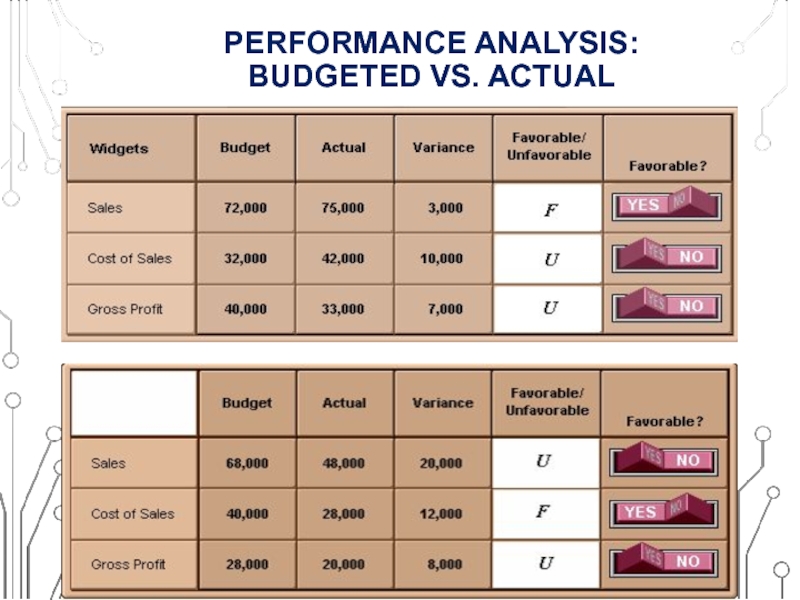

- 16. PERFORMANCE ANALYSIS: BUDGETED VS. ACTUAL

- 17. HORIZONTAL (TREND) ANALYSIS Type 1: Percentage changes

- 18. Illustration: Amazon.com, Inc. Step 1 Compute the

- 19. Illustration: Amazon.com, Inc. Comparative Consolidated Statements of Operations—Horizontal Analysis (partial exhibit)

- 20. Illustration: Amazon.com, Inc. Consolidated Balance Sheets—Horizontal Analysis (partial exhibit)

- 21. Illustration Prepare a horizontal analysis of

- 22. HORIZONTAL (TREND) ANALYSIS Type 2: Trend

- 23. HORIZONTAL (TREND) ANALYSIS Type2: Trend Percentages Amazon.com,

- 24. HORIZONTAL (TREND) ANALYSIS Type 3: Used to

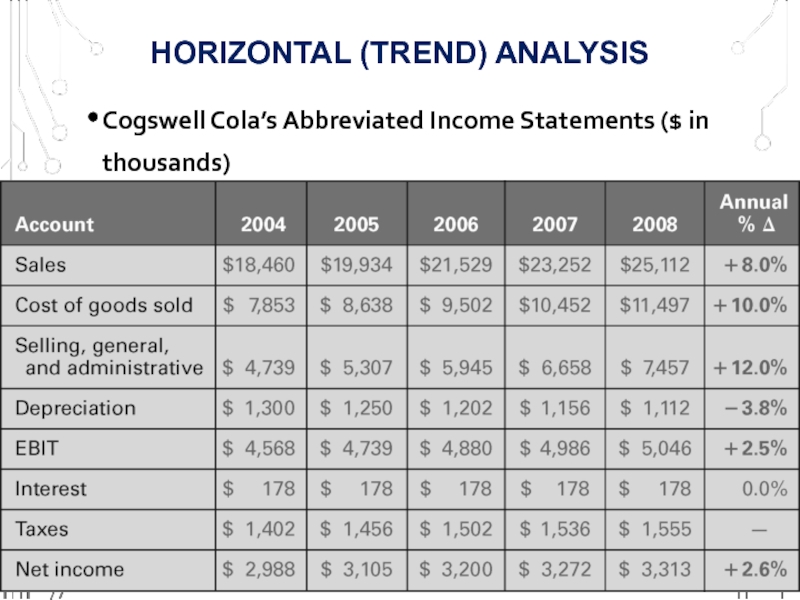

- 25. HORIZONTAL (TREND) ANALYSIS Cogswell Cola’s Abbreviated Income Statements ($ in thousands)

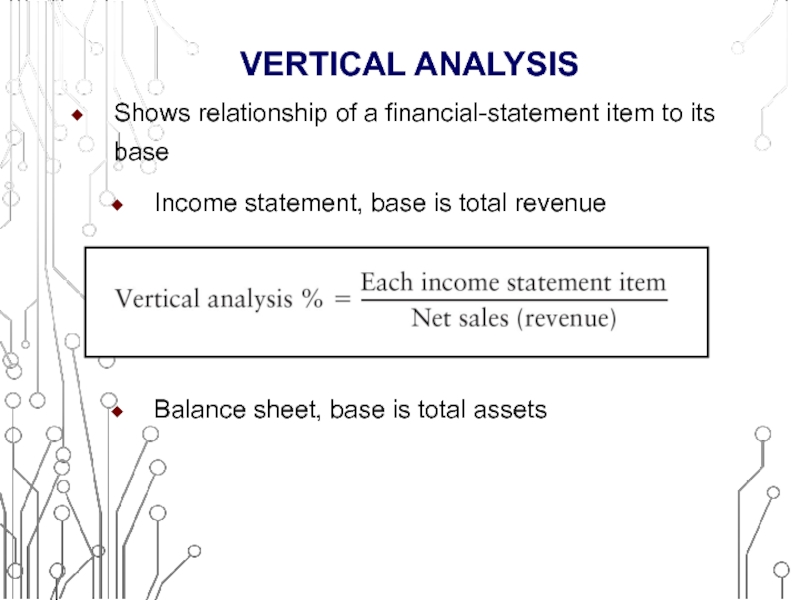

- 26. VERTICAL ANALYSIS Shows relationship of a financial-statement

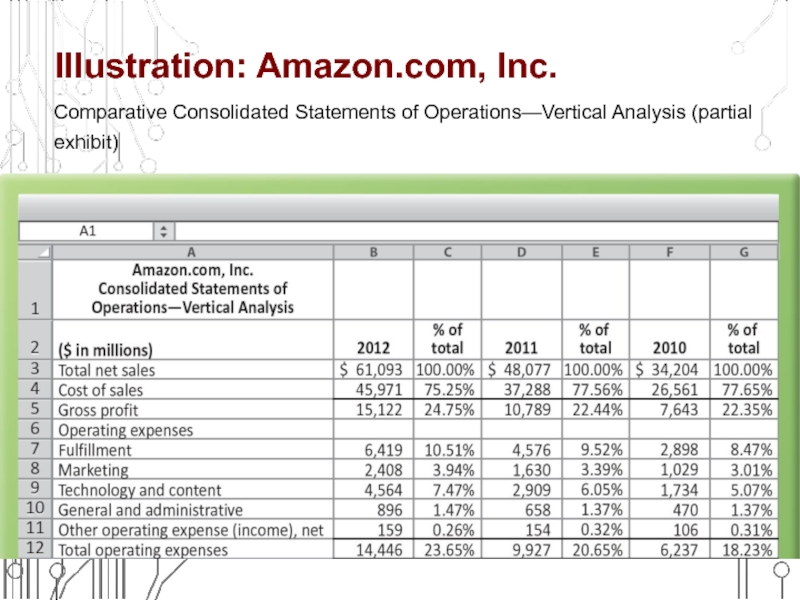

- 27. Illustration: Amazon.com, Inc. Comparative Consolidated Statements of Operations—Vertical Analysis (partial exhibit)

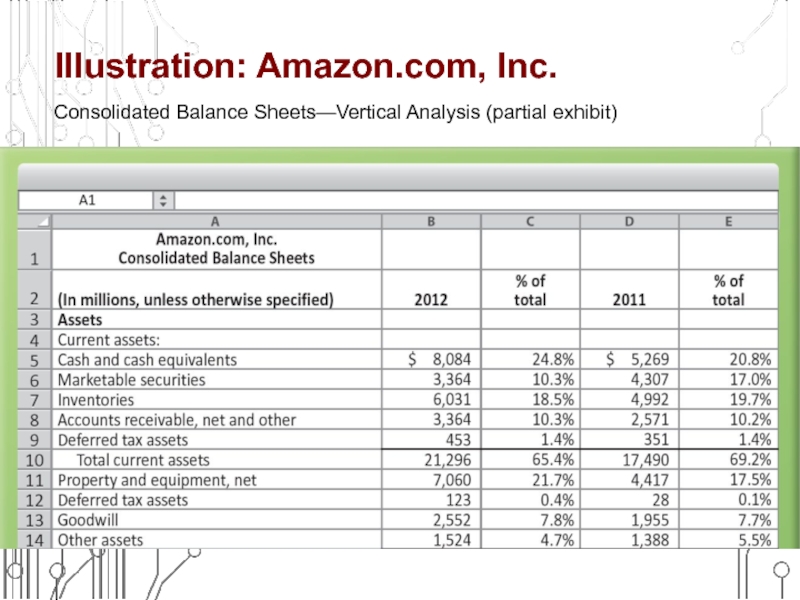

- 28. Illustration: Amazon.com, Inc. Consolidated Balance Sheets—Vertical Analysis (partial exhibit)

- 29. COMMON-SIZE FINANCIAL STATEMENTS Type of vertical analysis

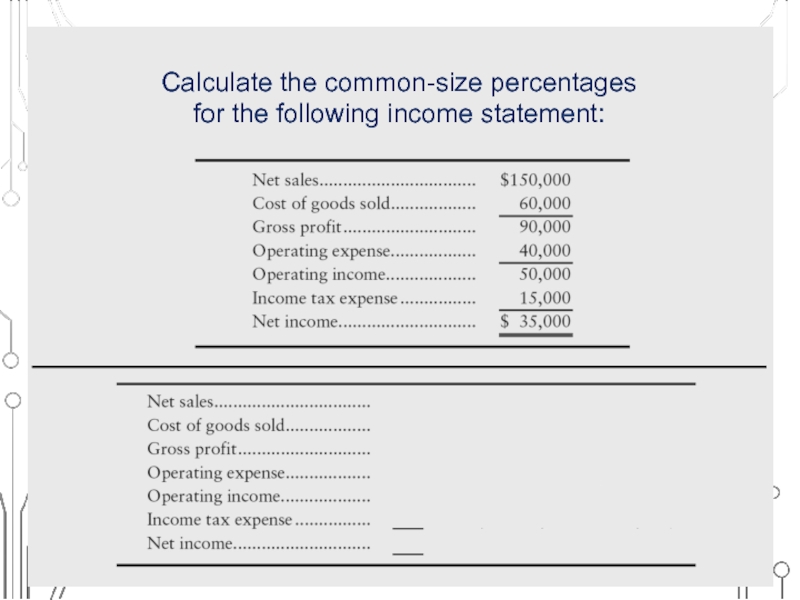

- 30. Calculate the common-size percentages for the following income statement:

- 31. FINANCIAL RATIO ANALYSIS Financial ratios are

- 32. FINANCIAL RATIO ANALYSIS Firm’s performance can be

- 33. PROFITABILITY RATIOS

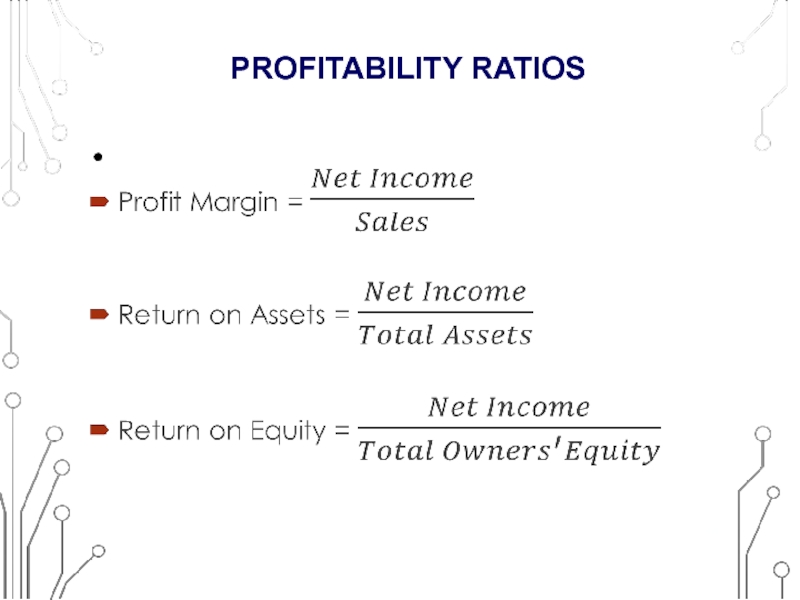

- 34. NET INCOME AS A % OF SALES (NET PROFIT MARGIN)

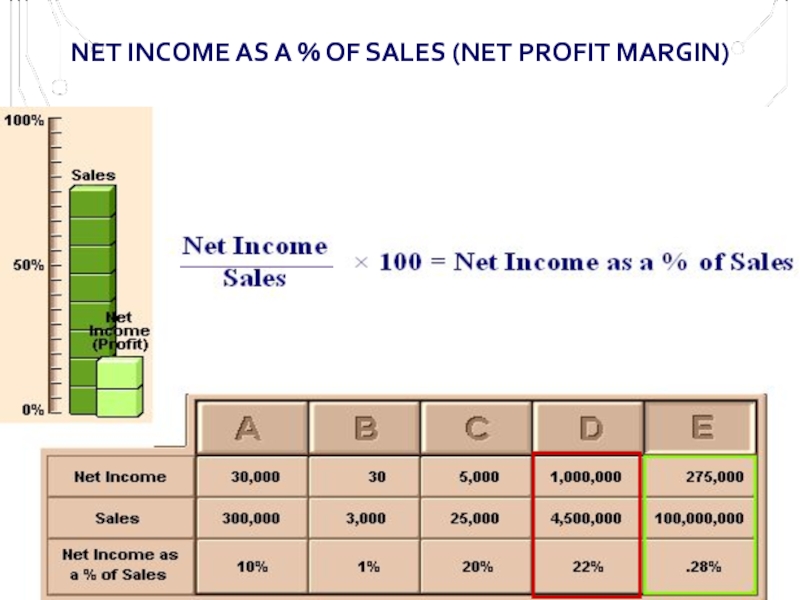

- 35. RETURN ON ASSETS (ROA)

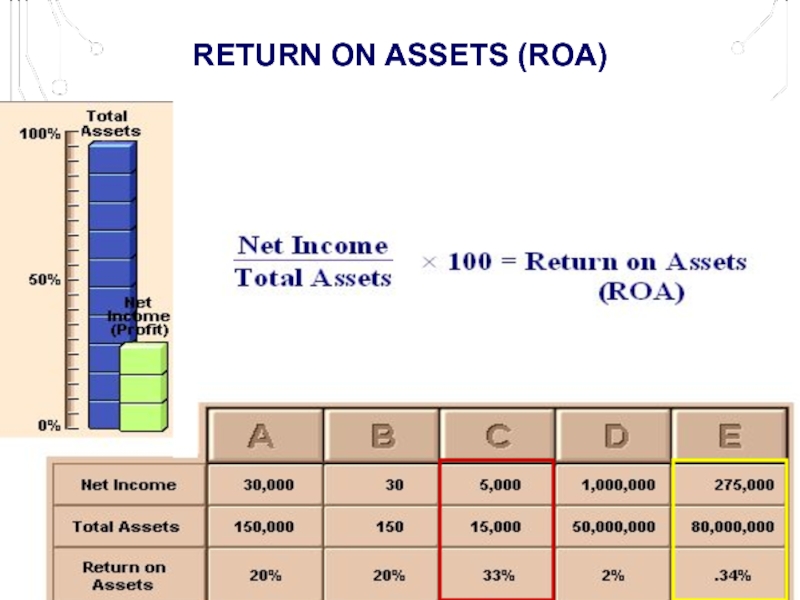

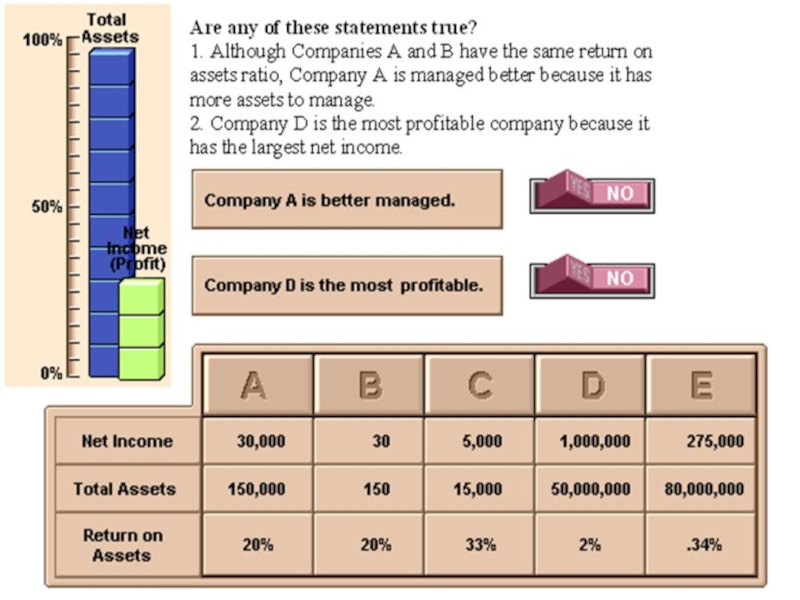

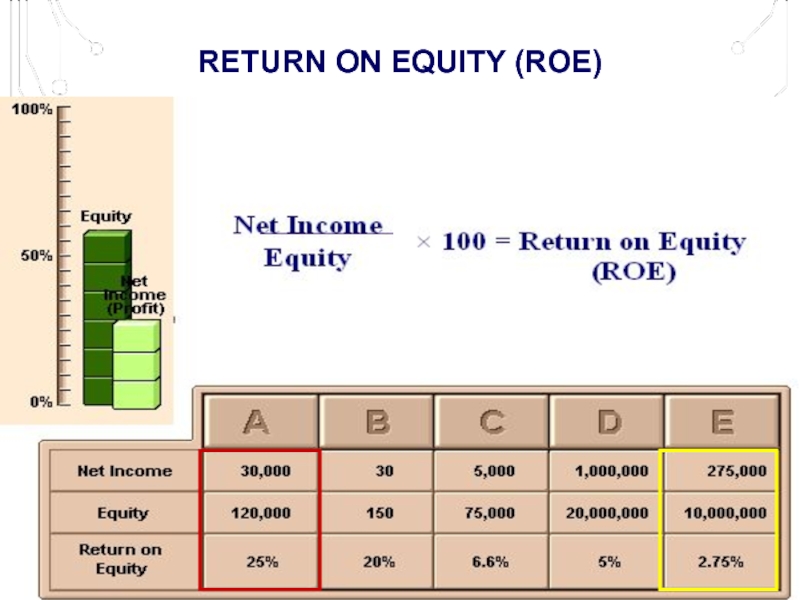

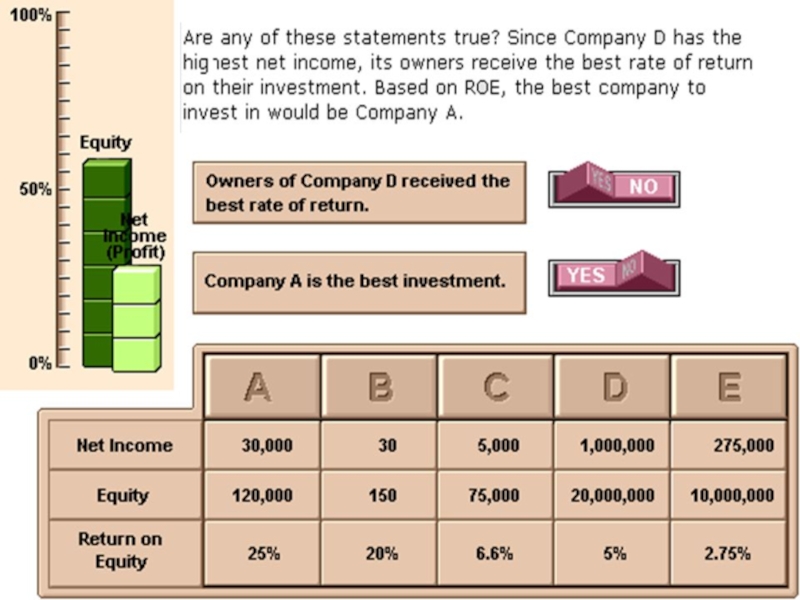

- 37. RETURN ON EQUITY (ROE)

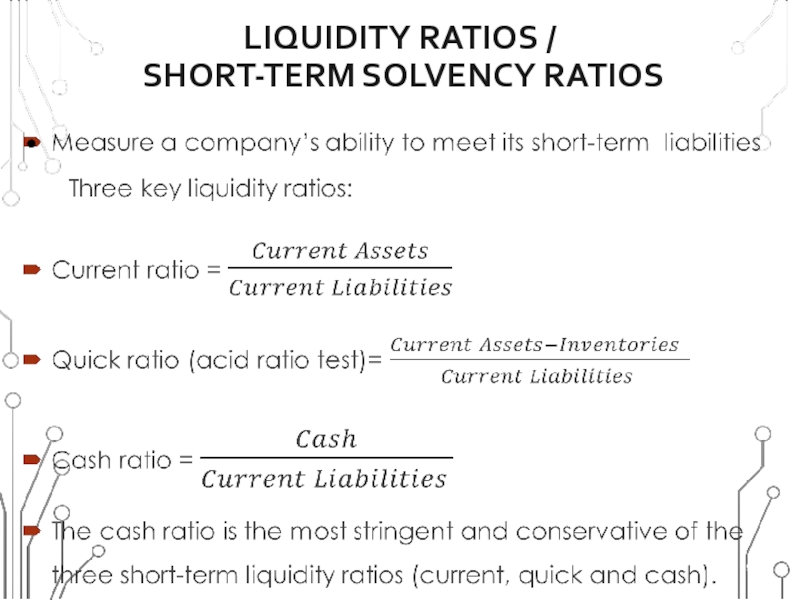

- 39. LIQUIDITY RATIOS / SHORT-TERM SOLVENCY RATIOS

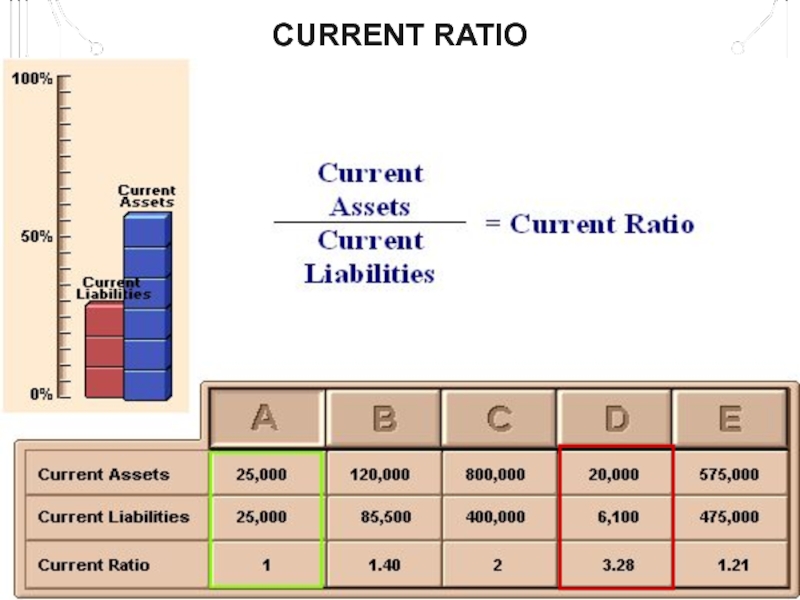

- 40. CURRENT RATIO

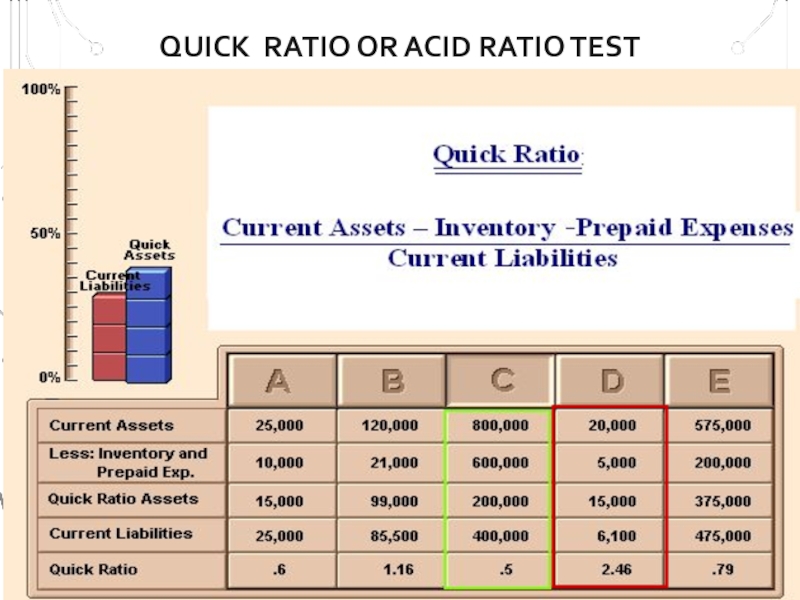

- 41. QUICK RATIO OR ACID RATIO TEST

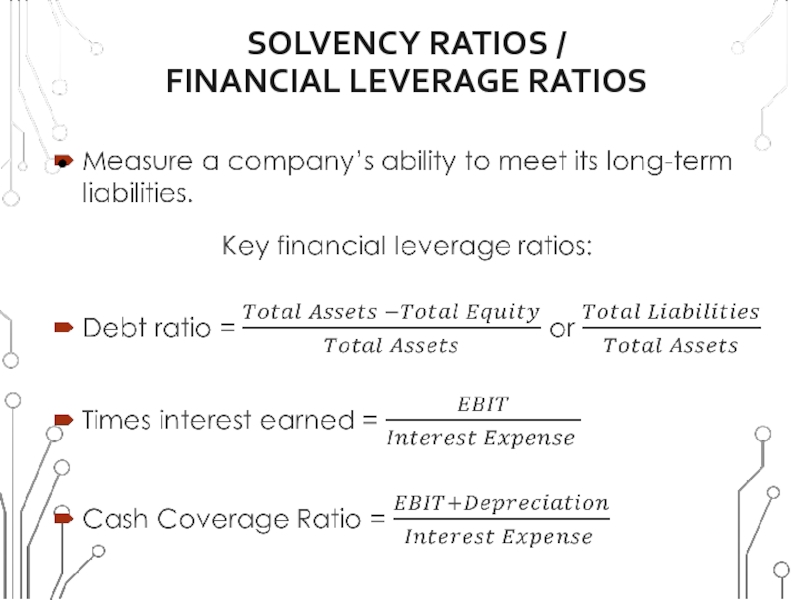

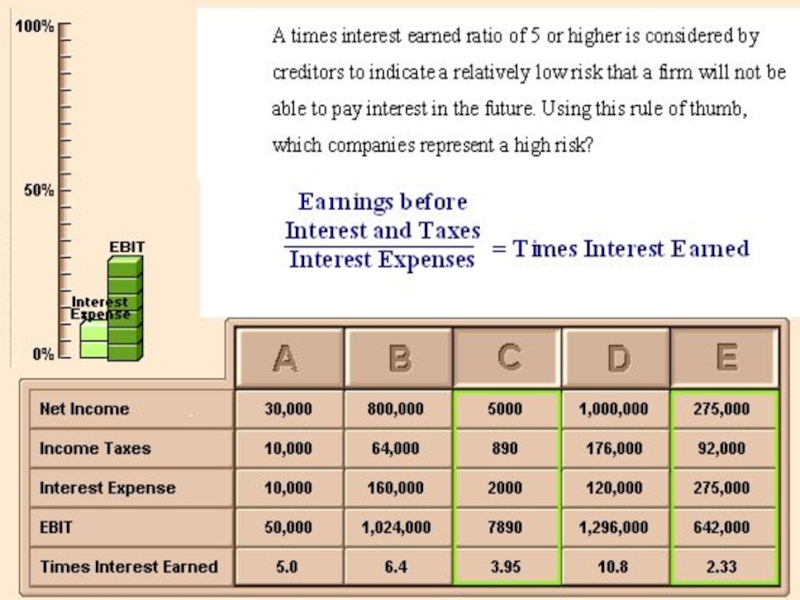

- 42. SOLVENCY RATIOS / FINANCIAL LEVERAGE RATIOS

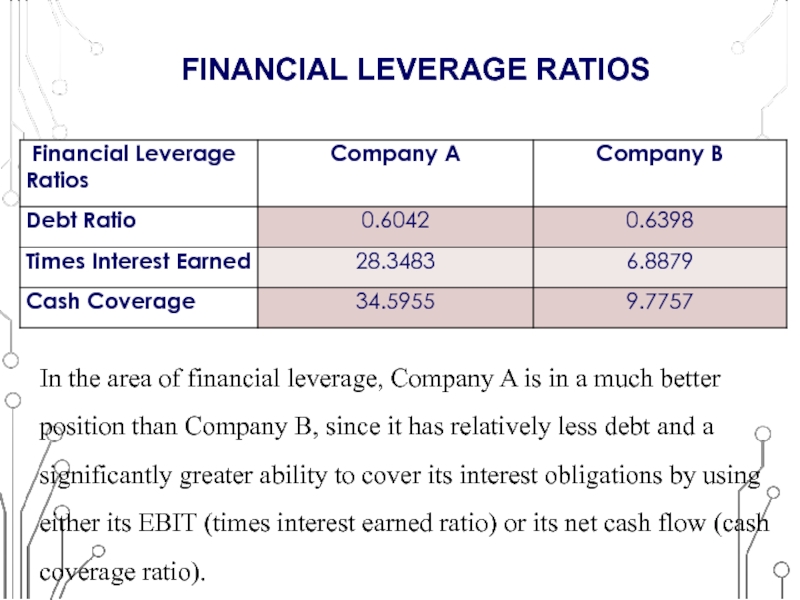

- 43. FINANCIAL LEVERAGE RATIOS In the area of

- 45. ACTIVITY / ASSET MANAGEMENT RATIOS These ratios

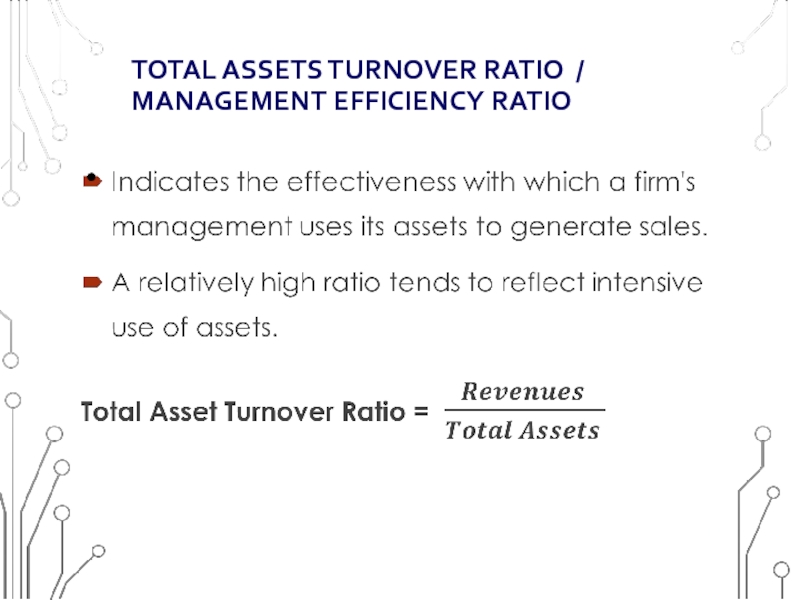

- 46. TOTAL ASSETS TURNOVER RATIO / MANAGEMENT EFFICIENCY RATIO

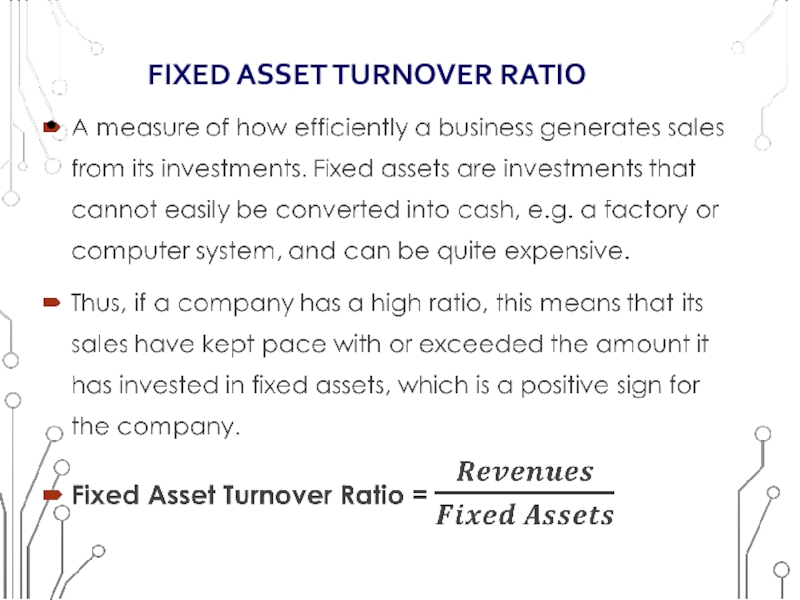

- 47. FIXED ASSET TURNOVER RATIO

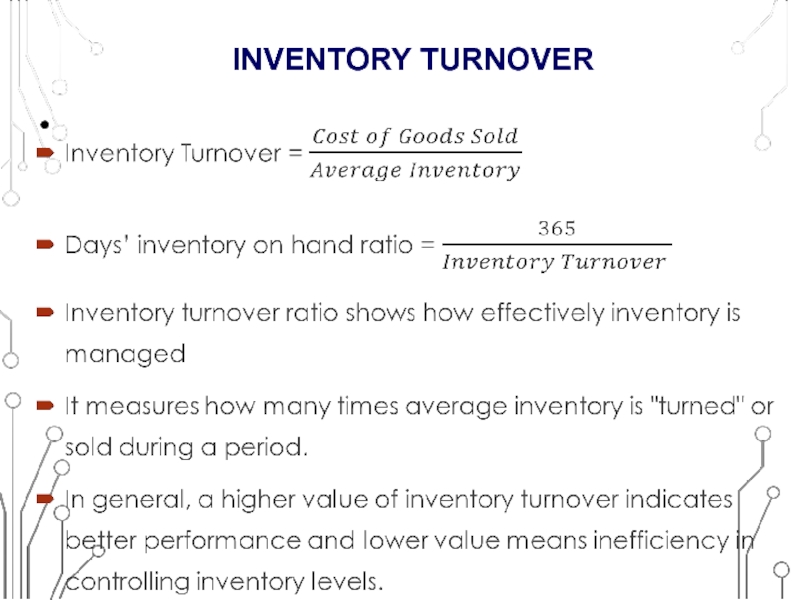

- 48. INVENTORY TURNOVER

- 49. INVENTORY TURNOVER A lower inventory turnover

- 50. INVENTORY TURNOVER

- 51. INVENTORY TURNOVER A low turnover is

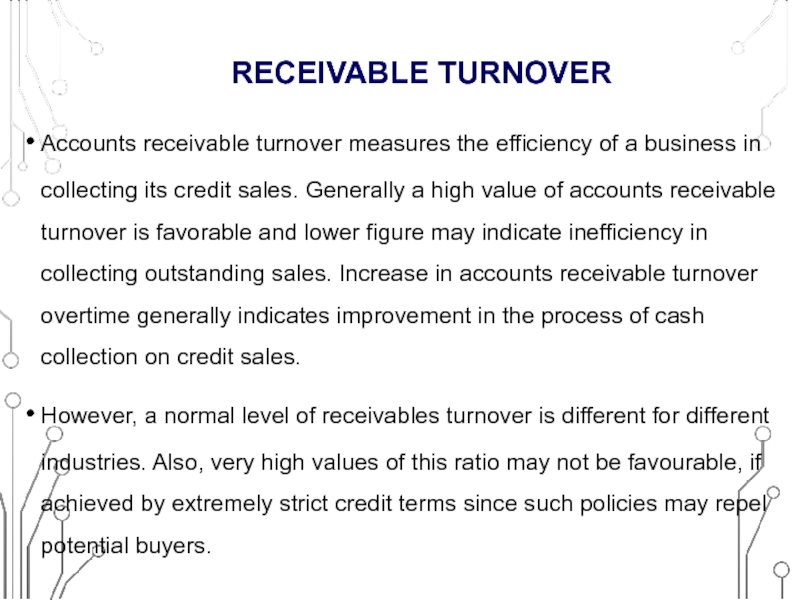

- 52. RECEIVABLE TURNOVER

- 53. RECEIVABLE TURNOVER Accounts receivable turnover measures the

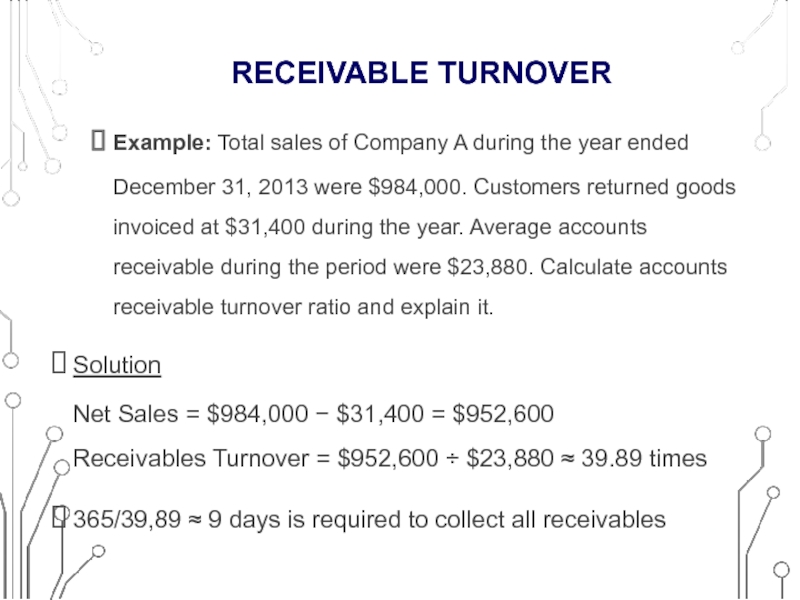

- 54. Example: Total sales of Company A during

- 55. INVESTMENT VALUATION RATIOS / MARKET VALUE

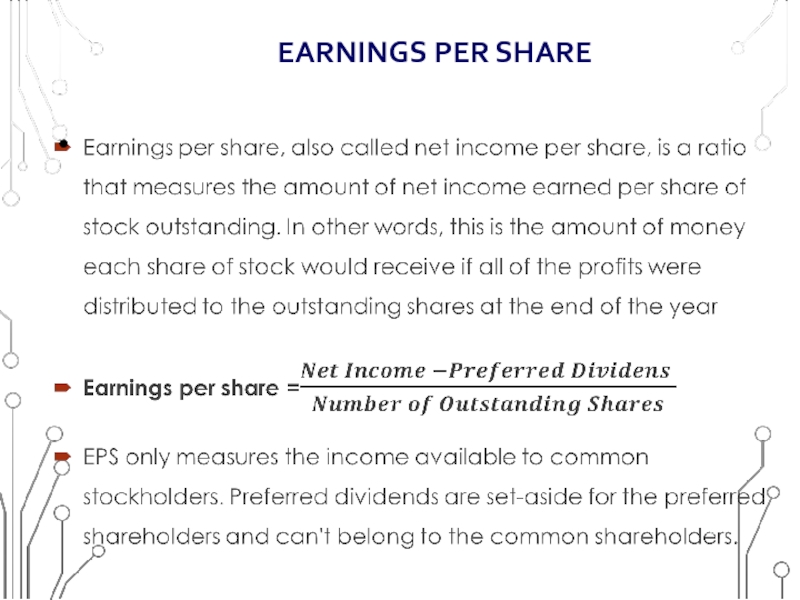

- 56. EARNINGS PER SHARE

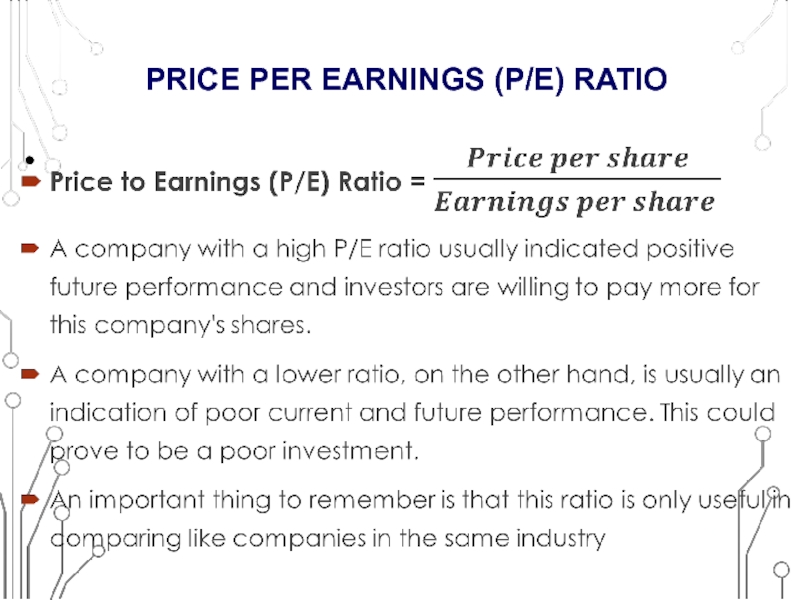

- 57. PRICE PER EARNINGS (P/E) RATIO

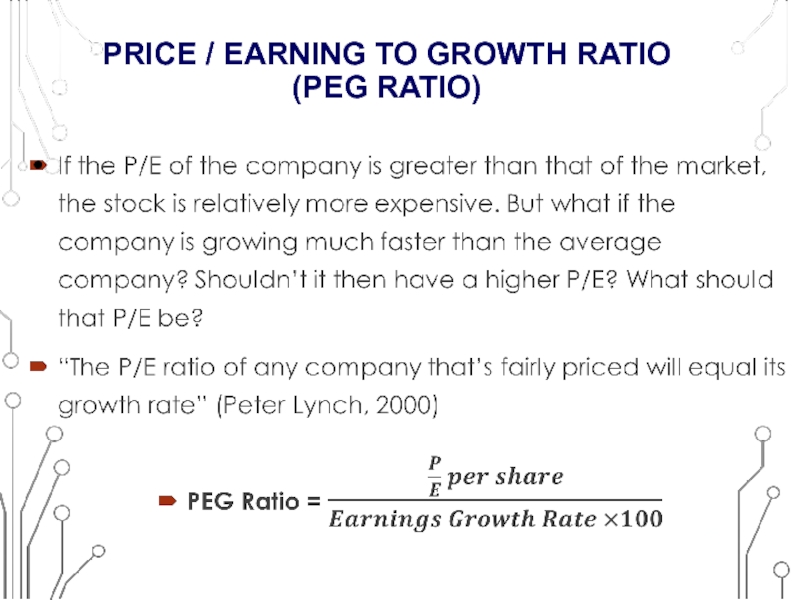

- 58. PRICE / EARNING TO GROWTH RATIO (PEG RATIO)

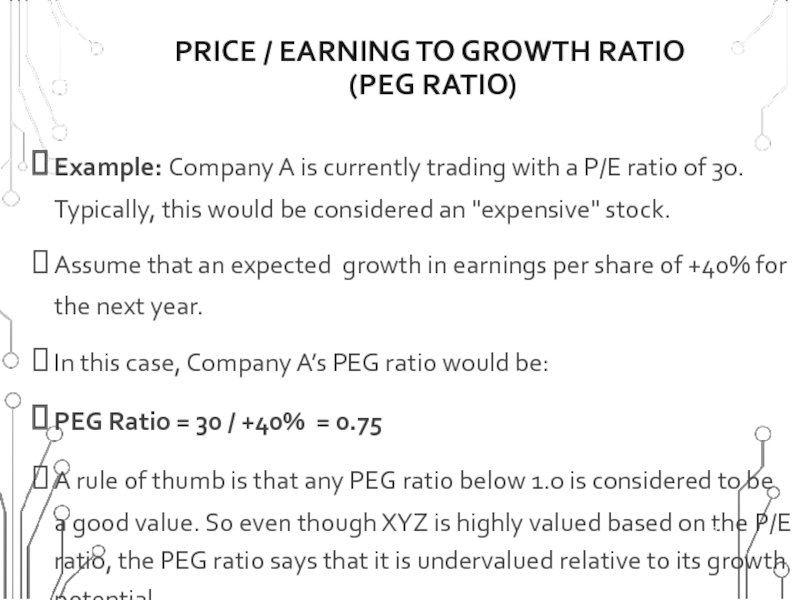

- 59. PRICE / EARNING TO GROWTH RATIO

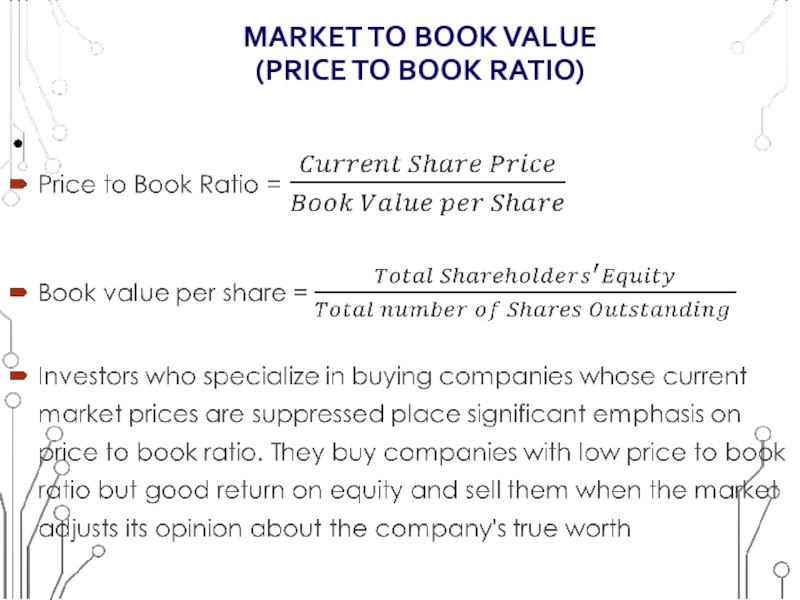

- 60. MARKET TO BOOK VALUE (PRICE TO BOOK RATIO)

- 61. To be useful, ratios should be analyzed

- 62. THE END

Слайд 1LECTURE 1. FUNDAMENTALS OF FINANCIAL STATEMENT ANALYSIS

Olga Uzhegova, DBA

2015

FIN 3121

Слайд 2LEARNING OBJECTIVES

Understand and conduct horizontal analysis

Create, understand, and interpret common-size financial

Calculate and interpret financial ratios.

Compare different company performances, using financial ratios, historical financial ratio trends, and industry ratios.

Слайд 4TYPES OF FINANCIAL STATEMENTS

Balance Sheet

Income Statement

Statement of Cash Flows

Statement of Changes

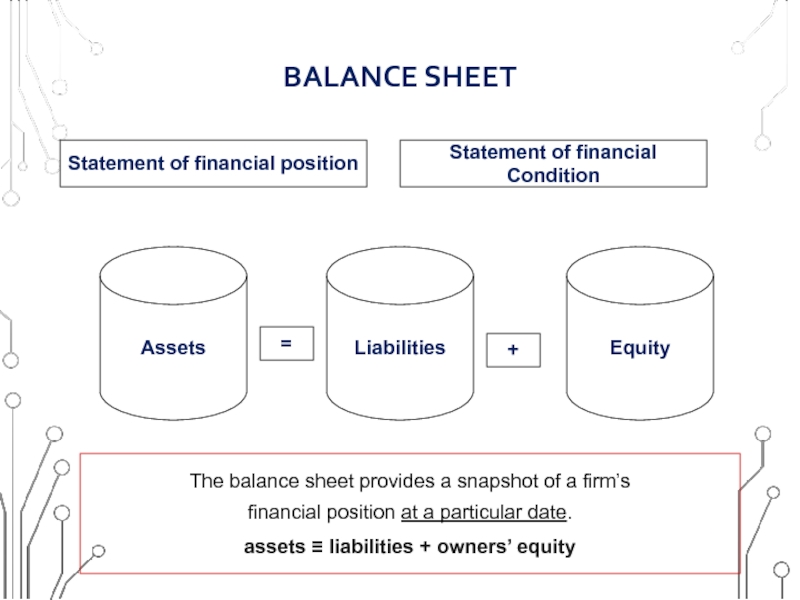

Слайд 5BALANCE SHEET

Assets

Liabilities

Equity

=

+

Statement of financial position

Statement of financial Condition

The balance sheet provides

financial position at a particular date.

assets ≡ liabilities + owners’ equity

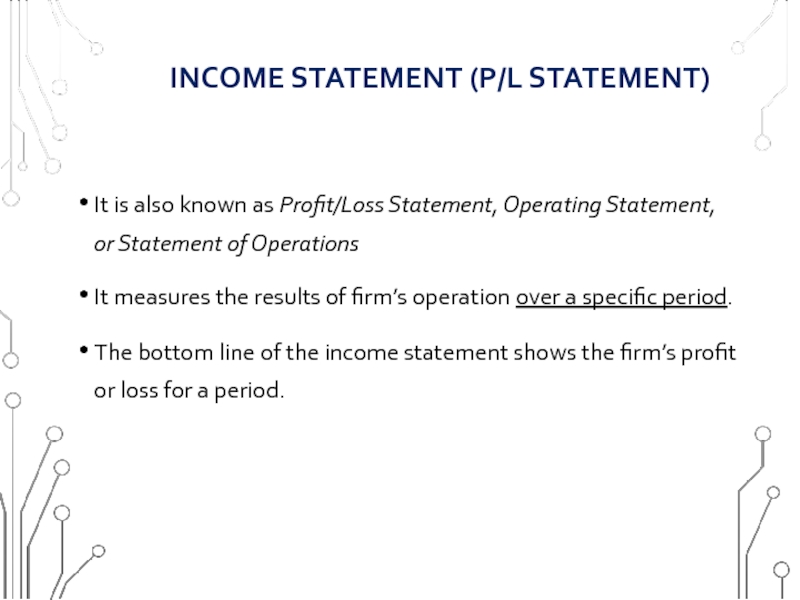

Слайд 6INCOME STATEMENT (P/L STATEMENT)

It is also known as Profit/Loss Statement, Operating

It measures the results of firm’s operation over a specific period.

The bottom line of the income statement shows the firm’s profit or loss for a period.

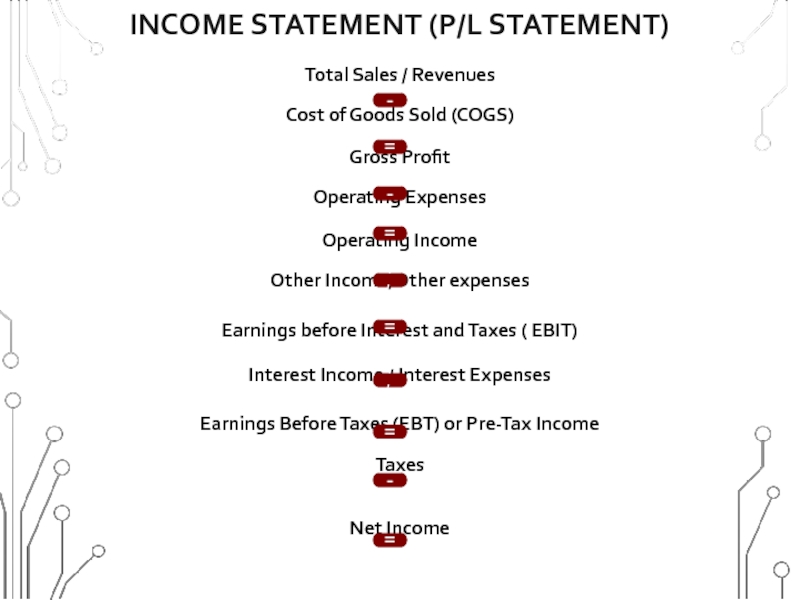

Слайд 7INCOME STATEMENT (P/L STATEMENT)

Total Sales / Revenues

Cost of Goods Sold (COGS)

Gross

Operating Expenses

Operating Income

Other Income/Other expenses

Earnings before Interest and Taxes ( EBIT)

Interest Income / Interest Expenses

Earnings Before Taxes (EBT) or Pre-Tax Income

Taxes

Net Income

-

=

-

=

+/-

=

-

=

+/-

=

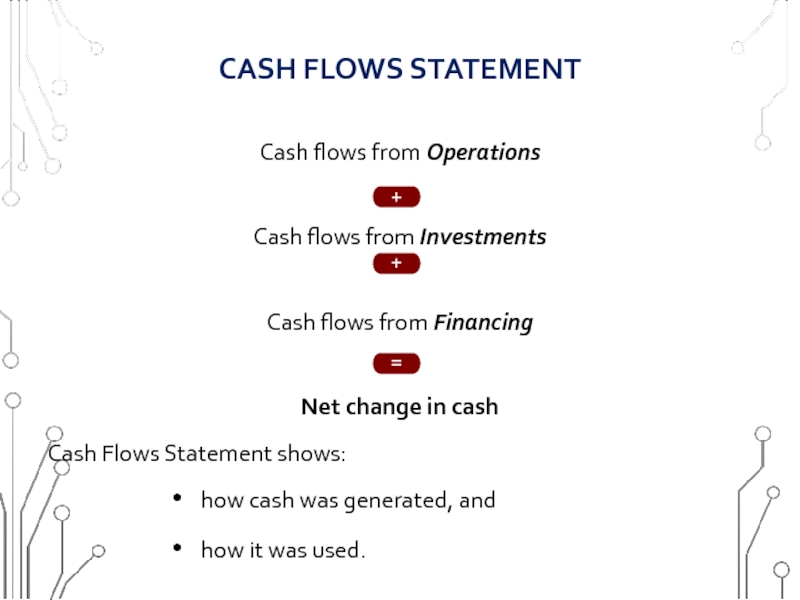

Слайд 8CASH FLOWS STATEMENT

Cash flows from Operations

Cash flows from Investments

Cash

Net change in cash

Cash Flows Statement shows:

how cash was generated, and

how it was used.

+

+

=

Слайд 9STATEMENT OF OWNER’S EQUITY

Statement of Changes in the Owner’s Equity

Figures used to compile this statement are derived from previous and current Balance Sheets and from the current Income Statement.

Слайд 10

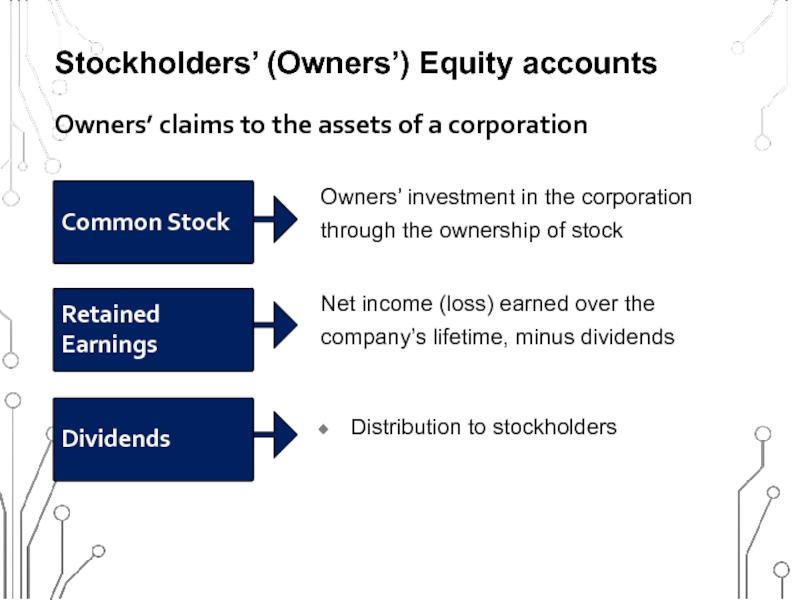

Stockholders’ (Owners’) Equity accounts

Owners’ investment in the corporation through the ownership

Owners’ claims to the assets of a corporation

Common Stock

Net income (loss) earned over the company’s lifetime, minus dividends

Retained Earnings

Dividends

Distribution to stockholders

Слайд 11

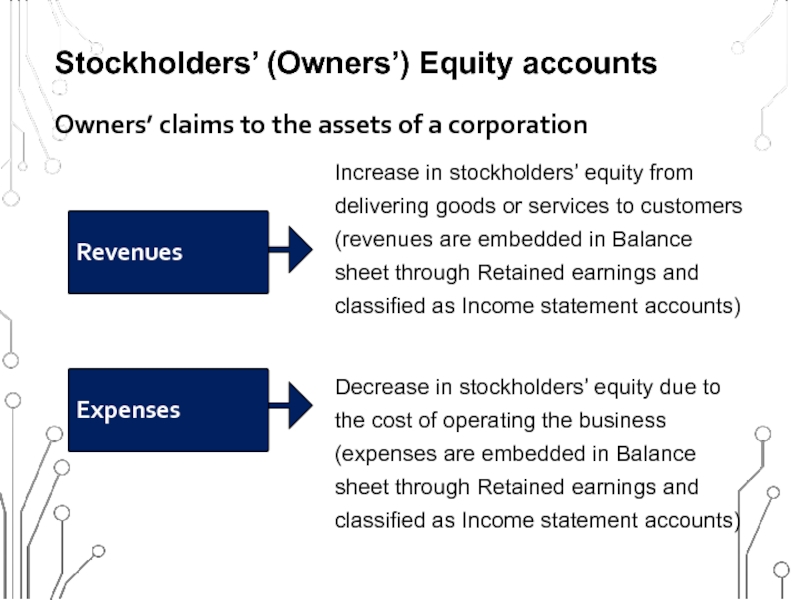

Stockholders’ (Owners’) Equity accounts

Increase in stockholders’ equity from delivering goods or

Owners’ claims to the assets of a corporation

Revenues

Expenses

Decrease in stockholders’ equity due to the cost of operating the business (expenses are embedded in Balance sheet through Retained earnings and classified as Income statement accounts)

Слайд 12

(1) Increases in stockholders’ equity: Sale of stock and net

(2) Decreases in stockholders’ equity: Dividends and net loss (expenses greater than revenue).

Слайд 14APPROACHES TOWARDS FINANCIAL ANALYSIS

To conduct financial analysis it is possible

Compare actual with budgeted values

Compare a firm’s current performance against that of its own performance (and/or of the performance of other companies in the industry) over a certain time period by looking at the growth (decline) rate in various key items such as sales, costs, and profits (trend analysis). Once trends are established, future performance could be predicted.

Recast the income statement and the balance sheet into common-size statements by expressing each income statement item as a percent of sales and each balance sheet item as a percent of total assets.

Conduct ratio analysis. This allows for more in-depth diagnosis through individual item analyses and comparisons

Setting up a standard of comparison is a benchmarking.

Слайд 17HORIZONTAL (TREND) ANALYSIS

Type 1: Percentage changes from year-to-year

Two steps:

Compute dollar (or

Divide dollar (or any currency) amount of change by base-period amount

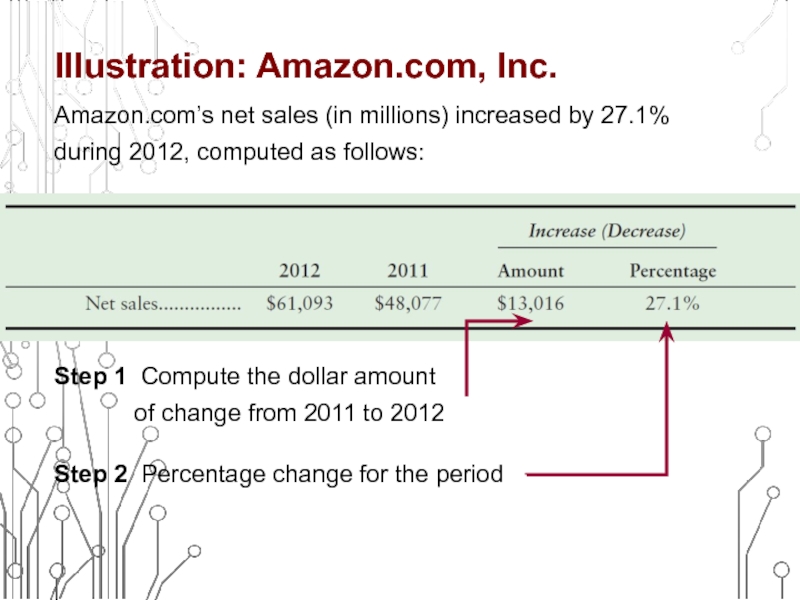

Слайд 18Illustration: Amazon.com, Inc.

Step 1 Compute the dollar amount of change from

Step 2 Percentage change for the period

Amazon.com’s net sales (in millions) increased by 27.1% during 2012, computed as follows:

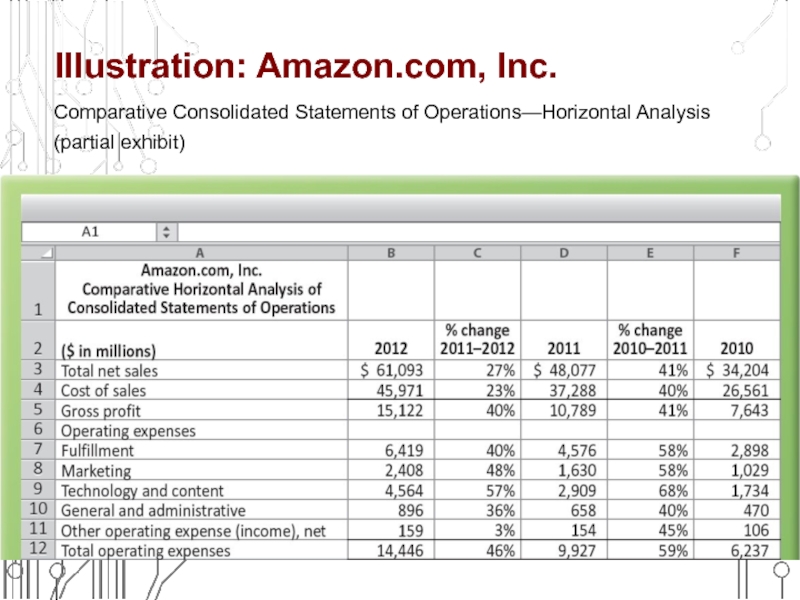

Слайд 19Illustration: Amazon.com, Inc.

Comparative Consolidated Statements of Operations—Horizontal Analysis (partial exhibit)

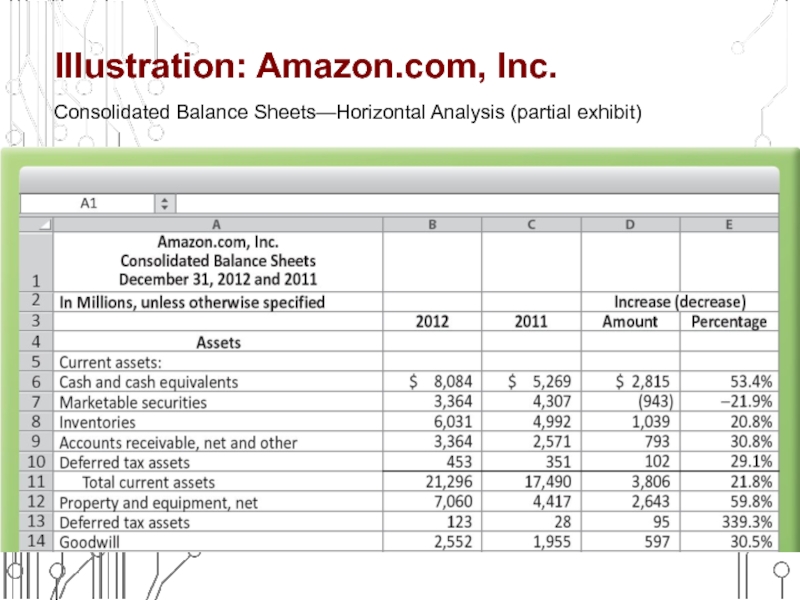

Слайд 20Illustration: Amazon.com, Inc.

Consolidated Balance Sheets—Horizontal Analysis (partial exhibit)

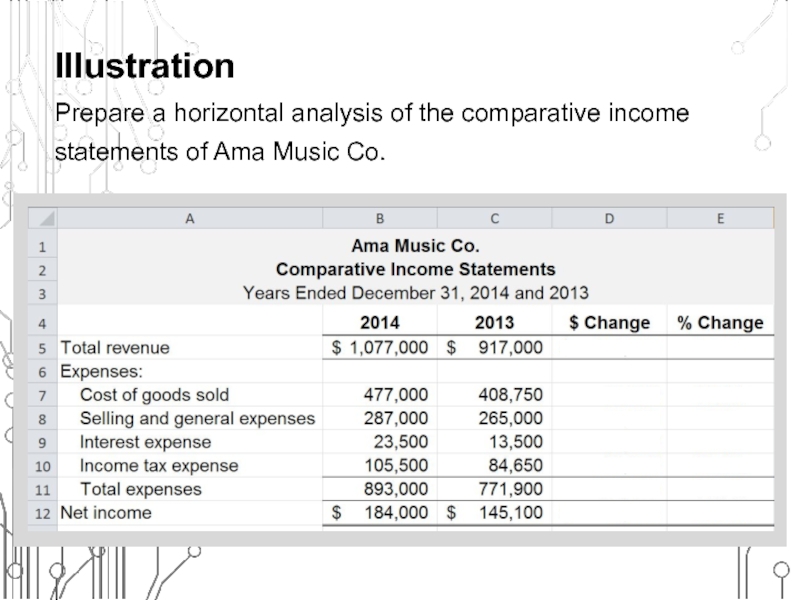

Слайд 21

Illustration

Prepare a horizontal analysis of the comparative income statements of Ama

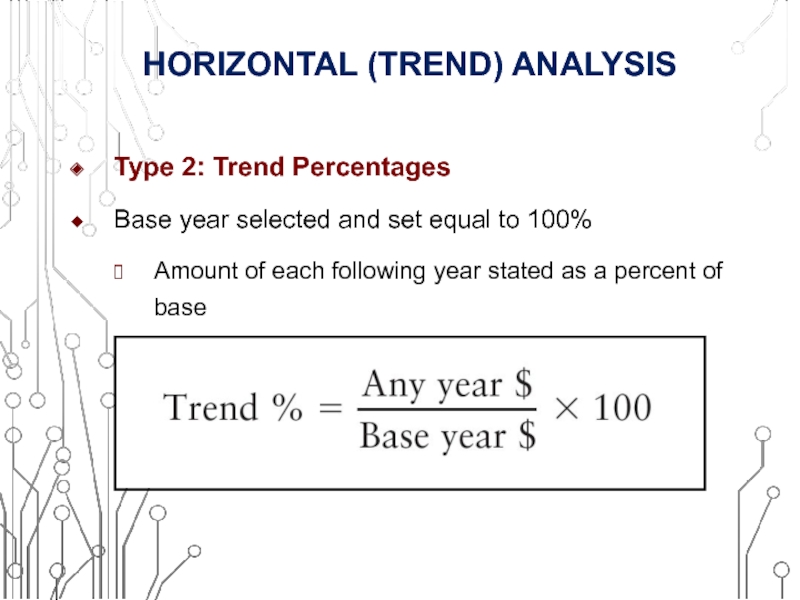

Слайд 22HORIZONTAL (TREND) ANALYSIS

Type 2: Trend Percentages

Base year selected and set equal

Amount of each following year stated as a percent of base

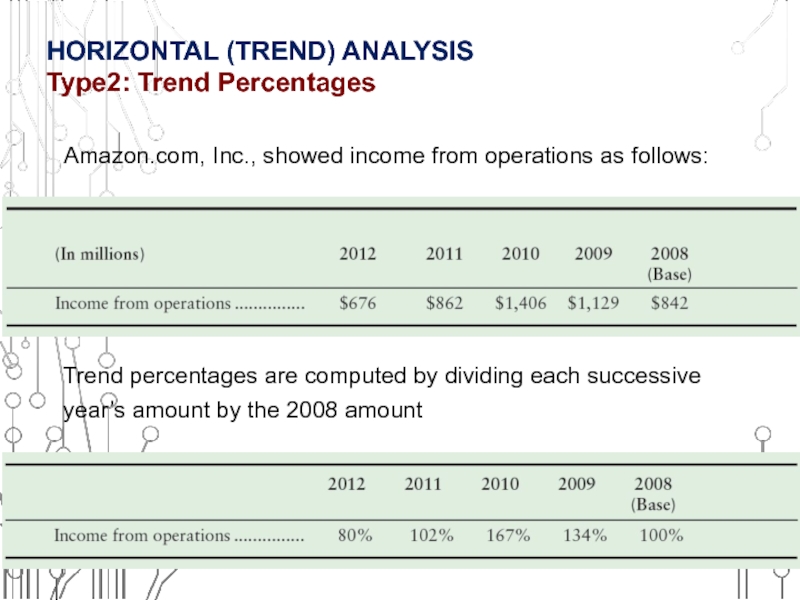

Слайд 23HORIZONTAL (TREND) ANALYSIS

Type2: Trend Percentages

Amazon.com, Inc., showed income from operations as

Trend percentages are computed by dividing each successive year’s amount by the 2008 amount

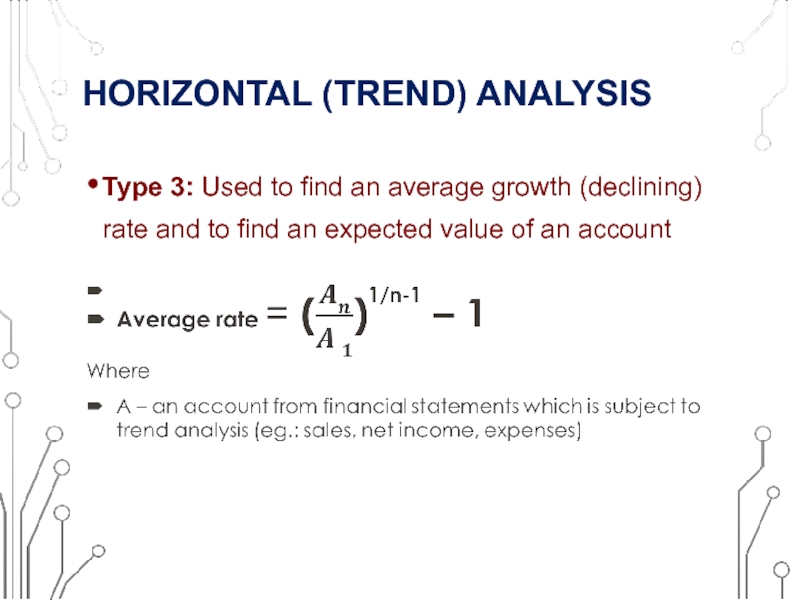

Слайд 24HORIZONTAL (TREND) ANALYSIS

Type 3: Used to find an average growth (declining)

Слайд 26VERTICAL ANALYSIS

Shows relationship of a financial-statement item to its base

Income statement,

Balance sheet, base is total assets

Слайд 27Illustration: Amazon.com, Inc.

Comparative Consolidated Statements of Operations—Vertical Analysis (partial exhibit)

Слайд 28Illustration: Amazon.com, Inc.

Consolidated Balance Sheets—Vertical Analysis (partial exhibit)

Слайд 29COMMON-SIZE FINANCIAL STATEMENTS

Type of vertical analysis

Report only percentages (no dollar

Assists in the comparison of different companies

Expresses financial results in terms of a common denominator

Слайд 31FINANCIAL RATIO ANALYSIS

Financial ratios are relationships between different accounts from

Financial ratios allow for meaningful comparisons across time, between competitors, and with industry averages.

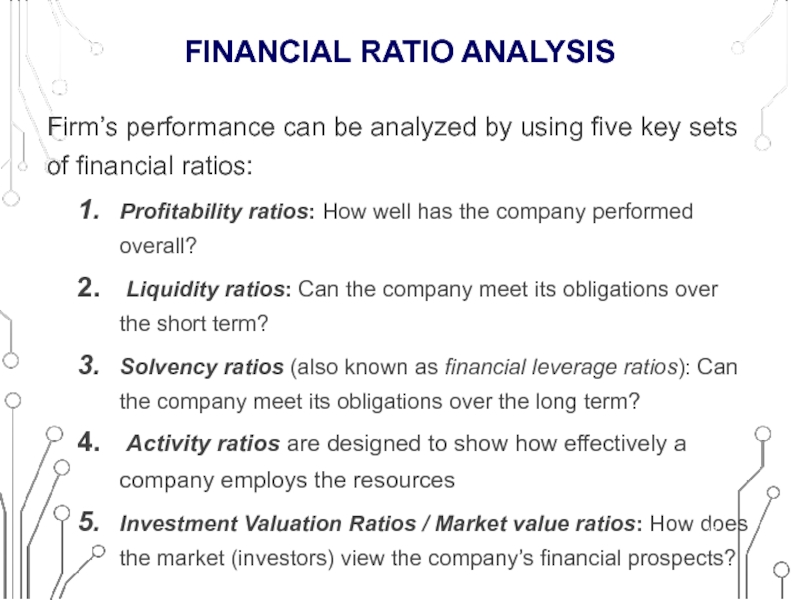

Слайд 32FINANCIAL RATIO ANALYSIS

Firm’s performance can be analyzed by using five key

Profitability ratios: How well has the company performed overall?

Liquidity ratios: Can the company meet its obligations over the short term?

Solvency ratios (also known as financial leverage ratios): Can the company meet its obligations over the long term?

Activity ratios are designed to show how effectively a company employs the resources

Investment Valuation Ratios / Market value ratios: How does the market (investors) view the company’s financial prospects?

Слайд 43FINANCIAL LEVERAGE RATIOS

In the area of financial leverage, Company A is

Слайд 45ACTIVITY / ASSET MANAGEMENT RATIOS

These ratios measure how efficiently a firm

Total Assets Turnover Ratio

Fixed Asset Turnover Ratio

Inventory Turnover

Account Receivable Turnover

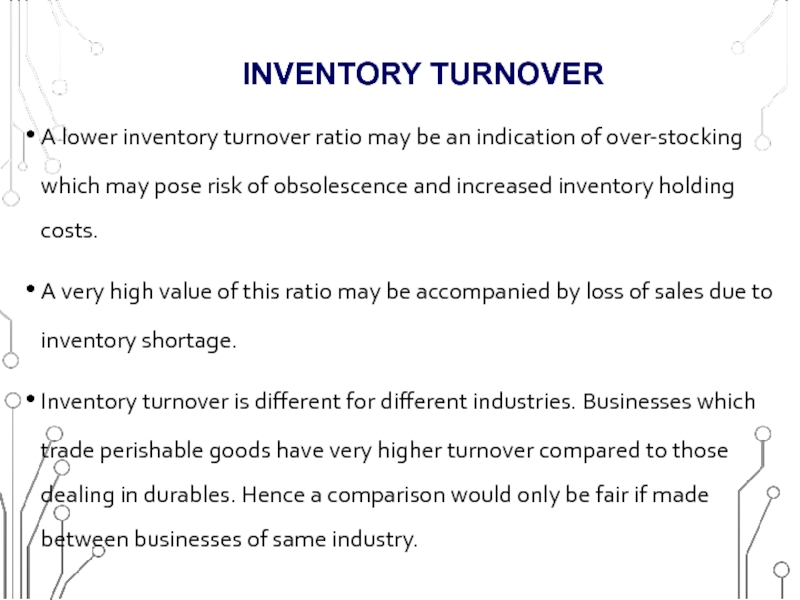

Слайд 49INVENTORY TURNOVER

A lower inventory turnover ratio may be an indication

A very high value of this ratio may be accompanied by loss of sales due to inventory shortage.

Inventory turnover is different for different industries. Businesses which trade perishable goods have very higher turnover compared to those dealing in durables. Hence a comparison would only be fair if made between businesses of same industry.

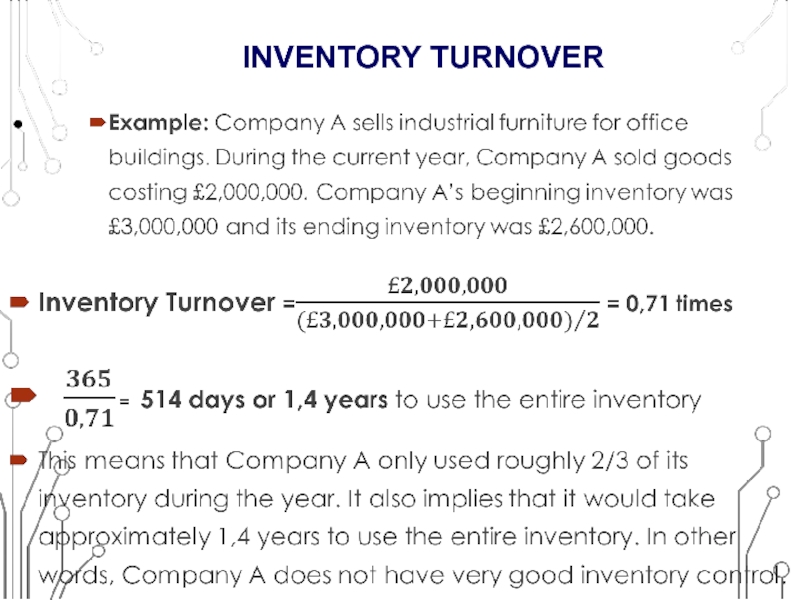

Слайд 51INVENTORY TURNOVER

A low turnover is usually a bad sign because

Companies selling perishable items have very high turnover.

For more accurate inventory turnover figures due to fluctuation in the level of inventory throughout the year, the average inventory figure [(beginning inventory + ending inventory)/2] is used when computing inventory turnover. Average inventory accounts for any seasonality effects on the ratio.

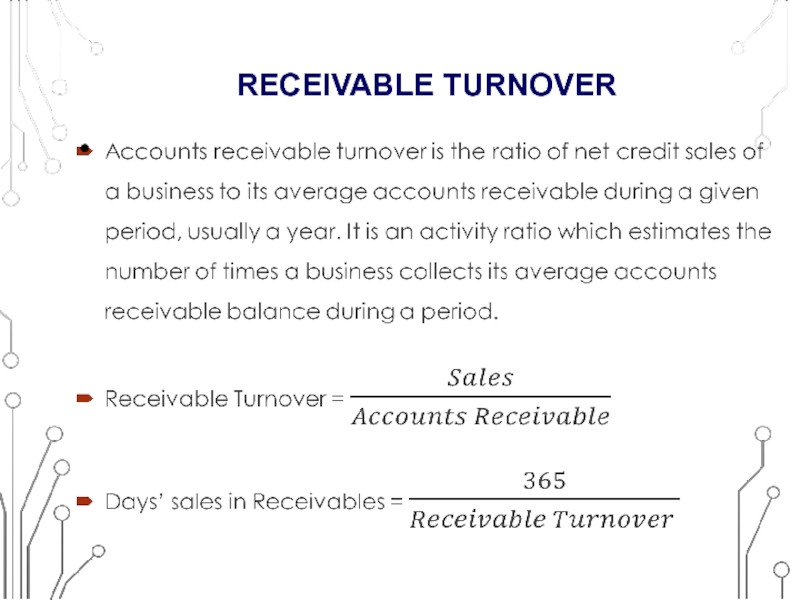

Слайд 53RECEIVABLE TURNOVER

Accounts receivable turnover measures the efficiency of a business in

However, a normal level of receivables turnover is different for different industries. Also, very high values of this ratio may not be favourable, if achieved by extremely strict credit terms since such policies may repel potential buyers.

Слайд 54Example: Total sales of Company A during the year ended December

Solution Net Sales = $984,000 − $31,400 = $952,600 Receivables Turnover = $952,600 ÷ $23,880 ≈ 39.89 times

365/39,89 ≈ 9 days is required to collect all receivables

RECEIVABLE TURNOVER

Слайд 55INVESTMENT VALUATION RATIOS /

MARKET VALUE RATIOS

Investment valuation ratios are

Key ratios are:

Earning per Share

Price to Earnings Ratio (P/E Ratio)

Price / Earning to Growth Ratio (PEG Ratio)

Market to Book value (Price to Book Ratio)

Typically, if a firm has a high price-to-earnings and a high market-to-book value ratio, it is an indication that investors have a good perception about the firm’s performance.

However, if these ratios are very high, it could also mean that a firm is overvalued.

Слайд 59PRICE / EARNING TO GROWTH RATIO

(PEG RATIO)

Example: Company A is

Assume that an expected growth in earnings per share of +40% for the next year.

In this case, Company A’s PEG ratio would be:

PEG Ratio = 30 / +40% = 0.75

A rule of thumb is that any PEG ratio below 1.0 is considered to be a good value. So even though XYZ is highly valued based on the P/E ratio, the PEG ratio says that it is undervalued relative to its growth potential.

Слайд 61To be useful, ratios should be analyzed over a period of

Any one year, or even any two years, may not represent the company’s performance over the long term

Limitations of Ratio Analysis