- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Financial Methods in Business Valuation презентация

Содержание

- 1. Financial Methods in Business Valuation

- 2. Outline Business Valuation Introduction Reasons for

- 3. Business Valuations “The act

- 4. What are “Business Valuations?”

- 5. Reasons for Business Valuations Sale

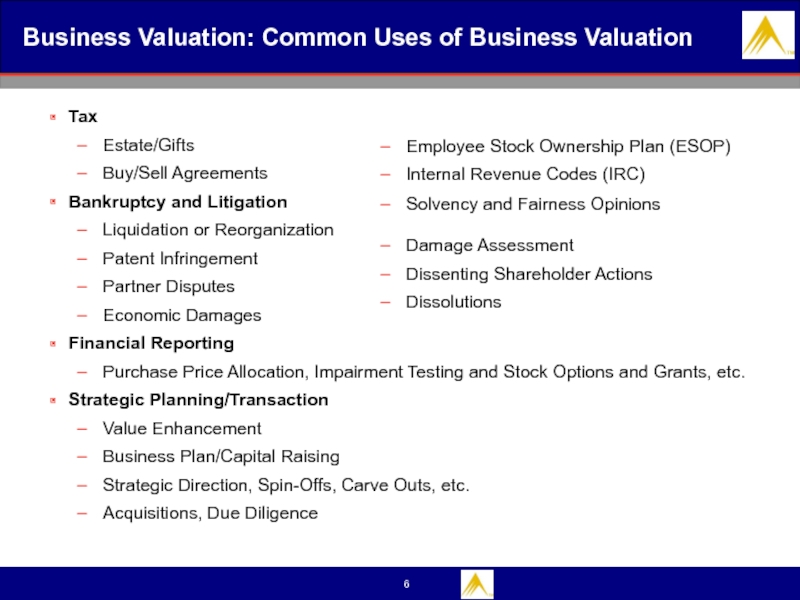

- 6. Business Valuation: Common Uses of Business Valuation

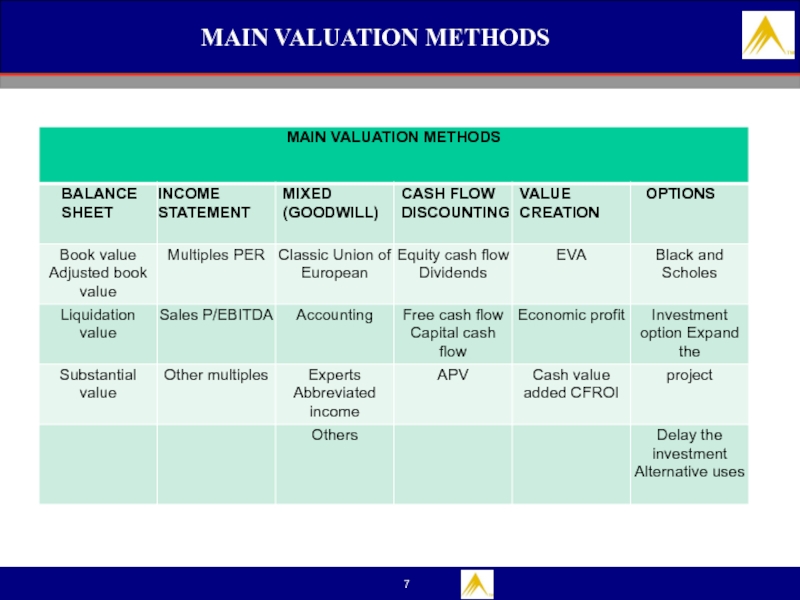

- 7. MAIN VALUATION METHODS

- 8. Standards of Value and Valuation Process

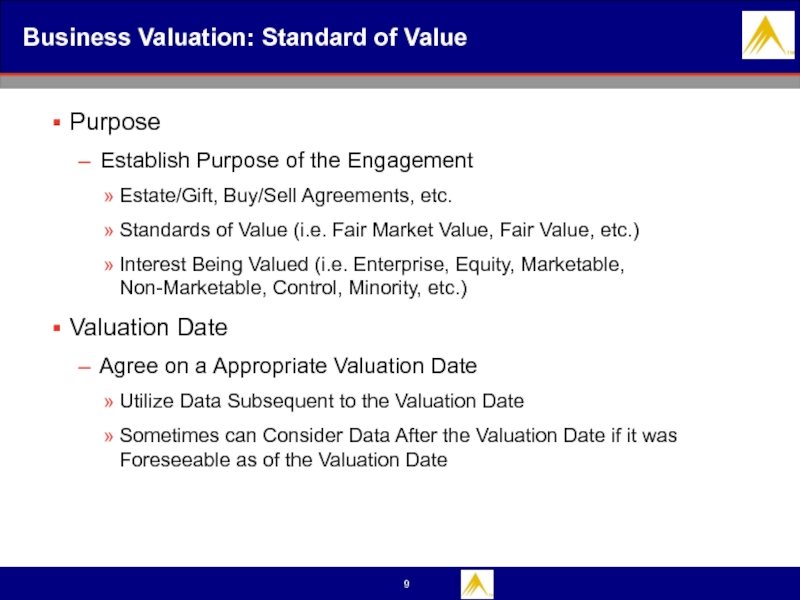

- 9. Business Valuation: Standard of Value Purpose

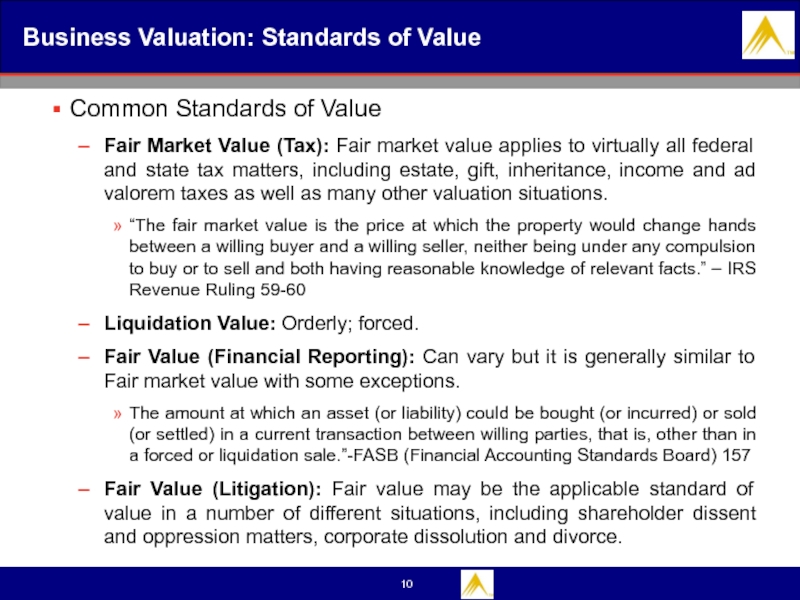

- 10. Business Valuation: Standards of Value Common Standards

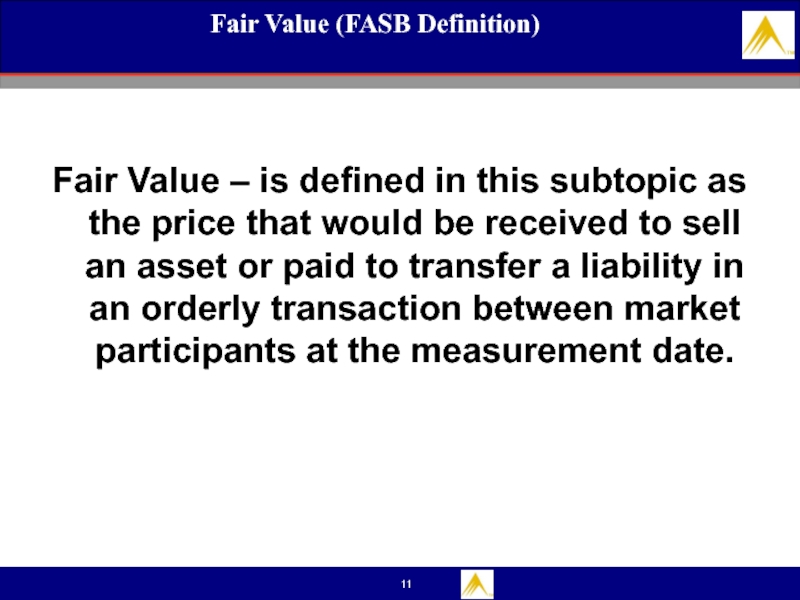

- 11. Fair Value (FASB Definition) Fair

- 12. Fair Value (Legal Definition) Fair

- 13. General Valuation Objectives There is no

- 14. Misconceptions about Valuation Myth 1: A valuation

- 15. Professional Organizations: The Appraisal Foundation The Appraisal

- 16. Standards Business valuation appraisers follow the

- 17. Revenue Rulings Revenue Ruling 59-60 Outlines

- 18. RR 59-60 Factors The nature of the

- 19. National valuation standards of RK 1.

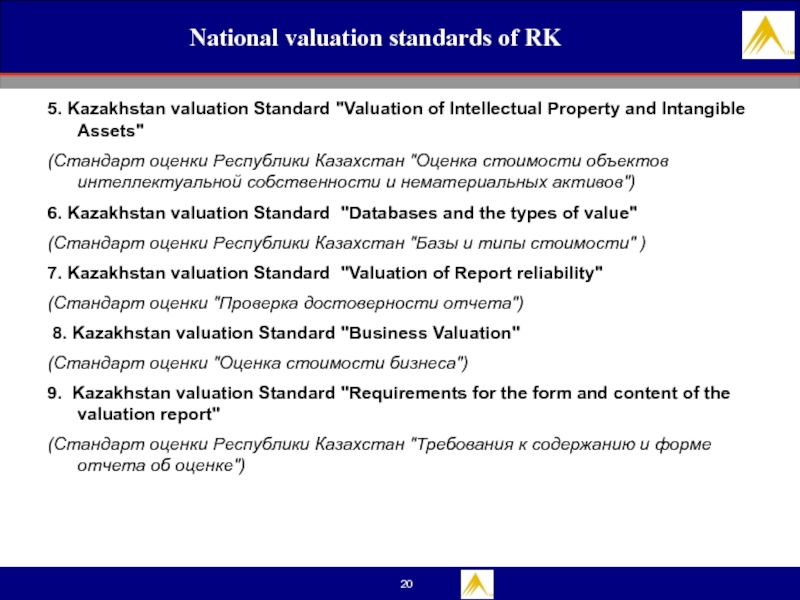

- 20. National valuation standards of RK 5. Kazakhstan

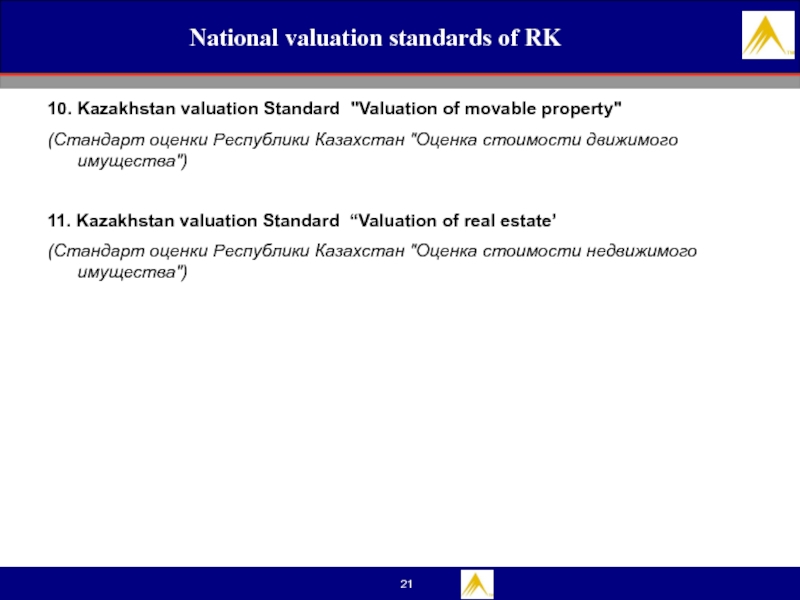

- 21. National valuation standards of RK 10. Kazakhstan

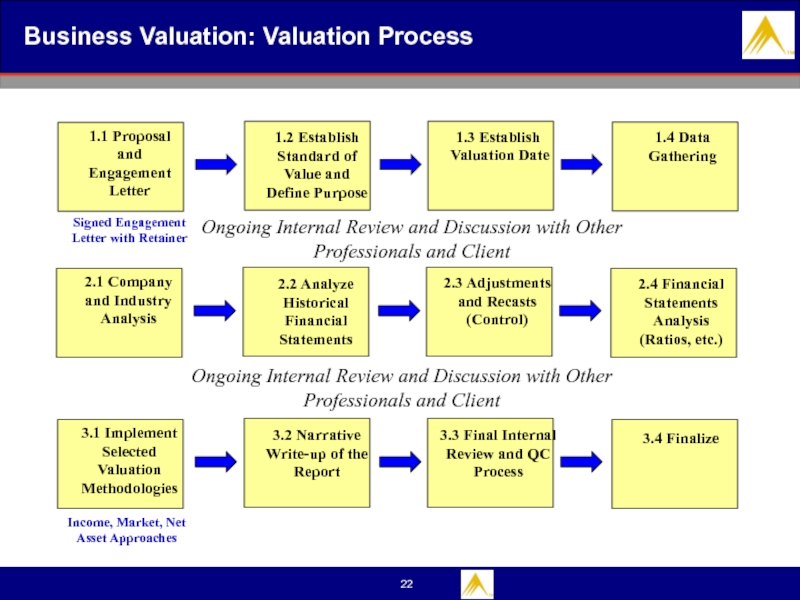

- 22. Business Valuation: Valuation Process 1.1 Proposal

- 23. Elements of a Business Valuation Packet Engagement Agreement Checklist Site Visit

- 24. Engagement Agreement Rule 201A, Professional

- 25. Engagement Agreement In determining to accept an

- 26. Engagement Agreement Other factors to be considered

- 27. Business Valuation: Analyzing Data Researching Economic and

- 28. Business Valuation: Gathering Data Gathering Company Data

- 29. Checklist A basic information checklist includes the

- 30. Checklist Appraiser should try to derive an

- 31. Valuation Methodologies

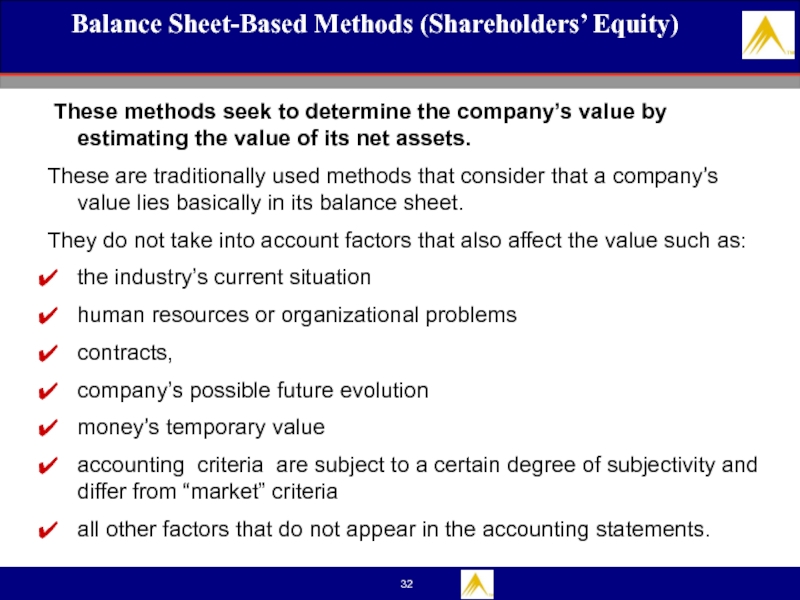

- 32. Balance Sheet-Based Methods (Shareholders’ Equity)

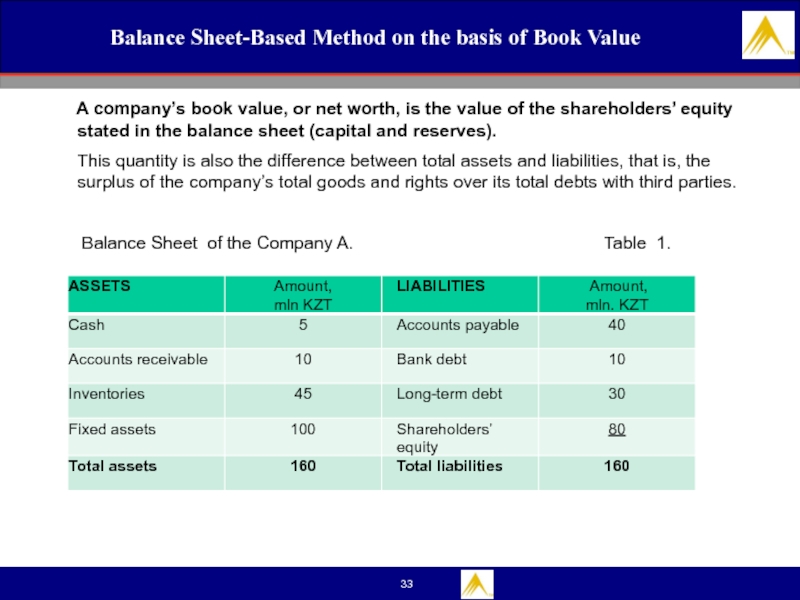

- 33. Balance Sheet-Based Method on the basis of

- 34. Balance Sheet-Based Method on the basis

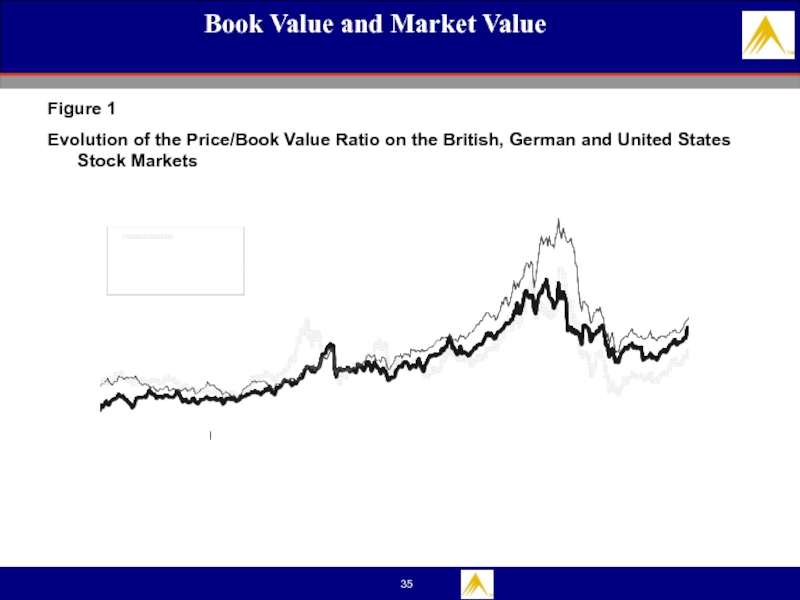

- 35. Book Value and Market Value Figure

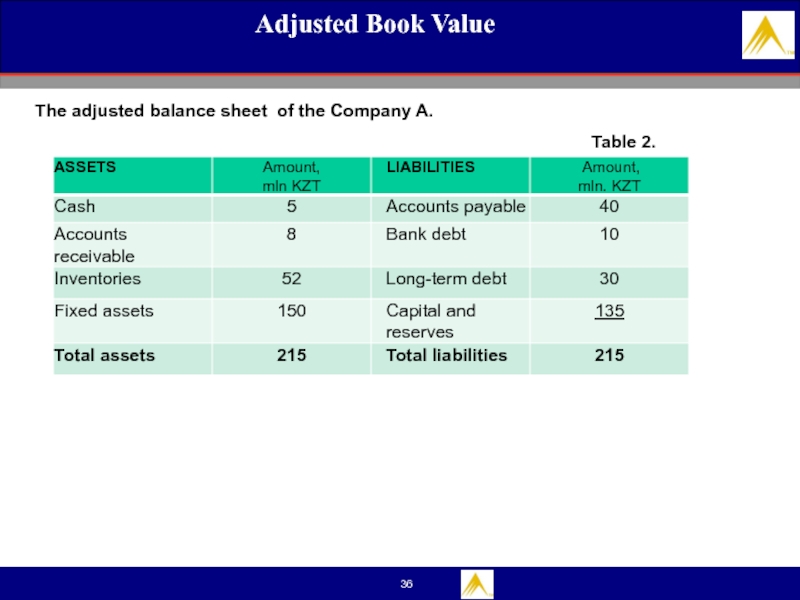

- 36. Adjusted Book Value The adjusted balance

- 37. Liquidation Value This is the company’s

- 38. Substantial Value The substantial value represents

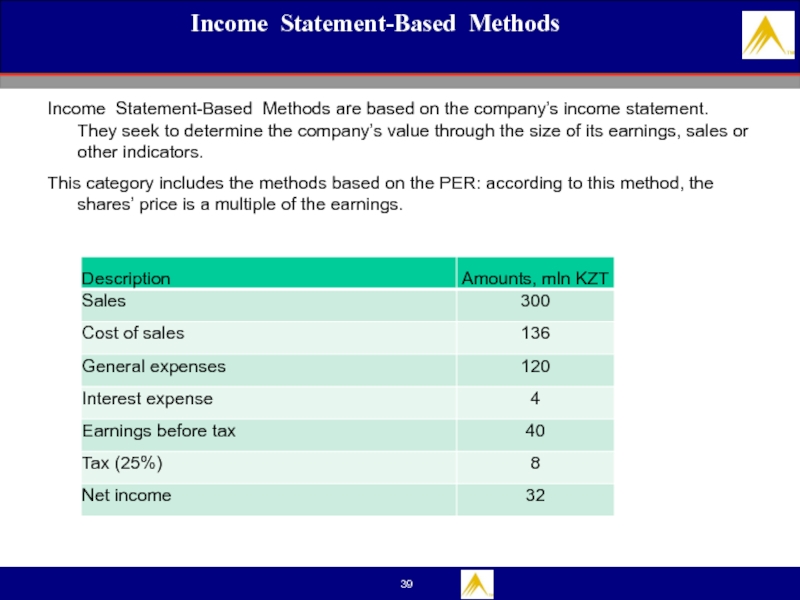

- 39. Income Statement-Based Methods Income Statement-Based Methods

- 40. Value of Earnings According to this

- 41. Sometimes, the relative PER is also

- 42. Value of the Dividends Dividends are

- 43. Business Valuation: Weighted Average Cost of Capital

- 44. Sales Multiples This valuation method, which

- 45. Other Multiples In addition to the

- 47. Business Valuation: Cash Flow Discounting Approaches

- 48. Business Valuation: Cash Flow Discounting Approaches

- 49. Business Valuation: Cash Flow Discounting Approaches

- 50. Business Valuation: Cash Flow Discounting Approaches

- 51. Business Valuation: Cash Flow Discounting Approaches Although

- 52. Business Valuation: Cash Flow Discounting Approaches The

- 53. Business Valuation: Cash Flow Discounting Approaches For

- 54. Business Valuation: Cash Flow Discounting Approaches Main

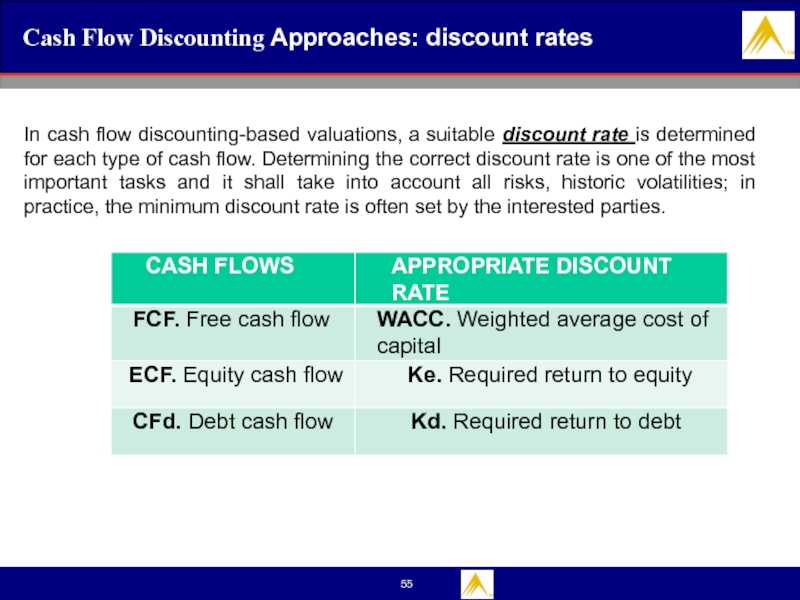

- 55. Cash Flow Discounting Approaches: discount rates

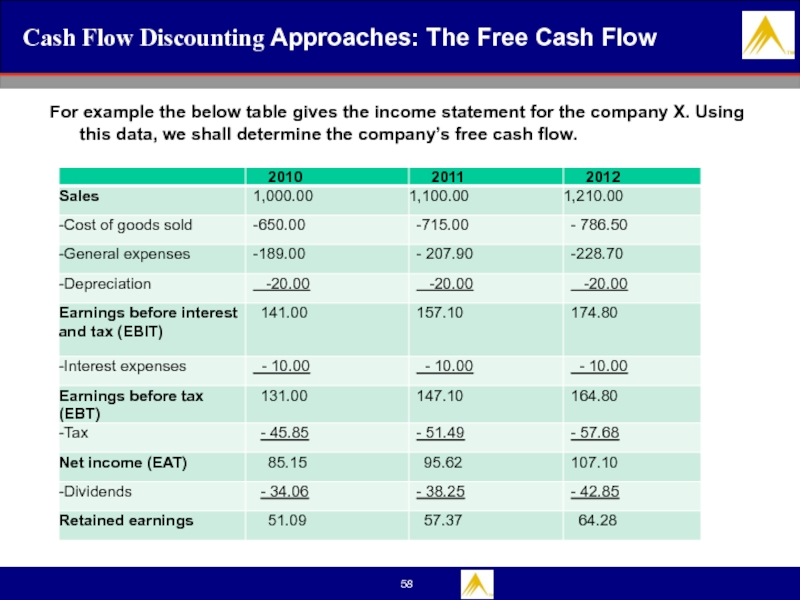

- 56. Cash Flow Discounting Approaches: The Free Cash

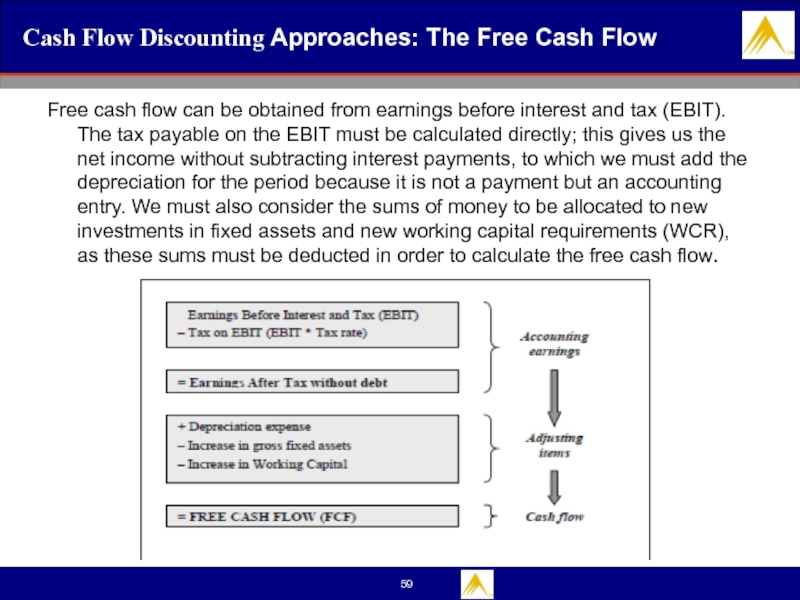

- 57. Cash Flow Discounting Approaches: The Free Cash

- 58. Cash Flow Discounting Approaches: The Free Cash

- 59. Cash Flow Discounting Approaches: The Free Cash

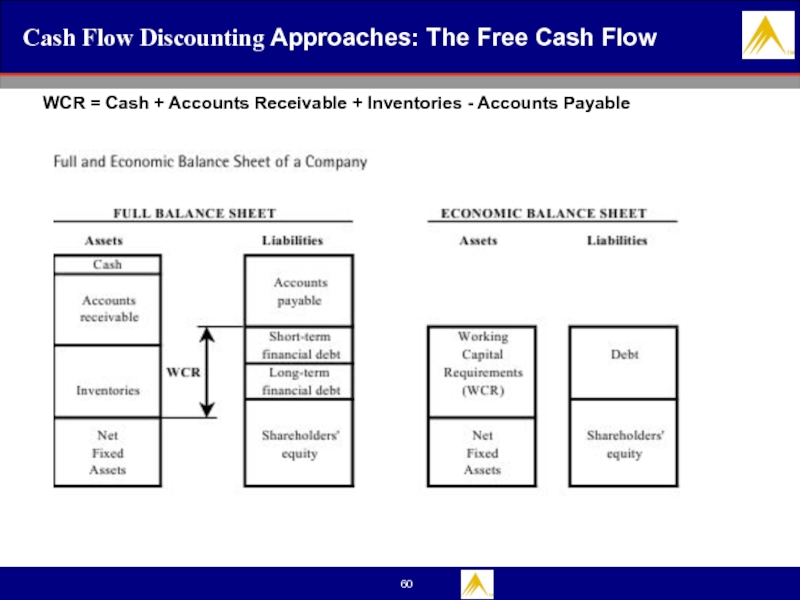

- 60. Cash Flow Discounting Approaches: The Free Cash

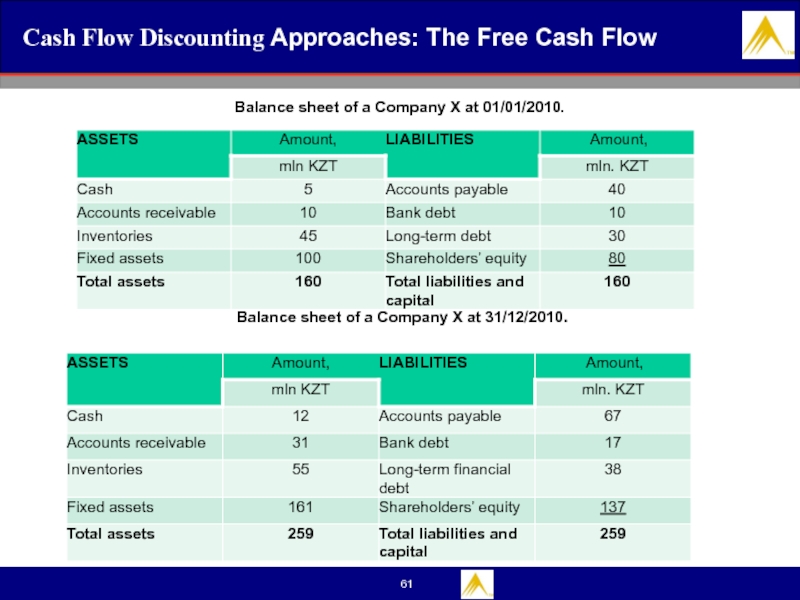

- 61. Cash Flow Discounting Approaches: The Free Cash

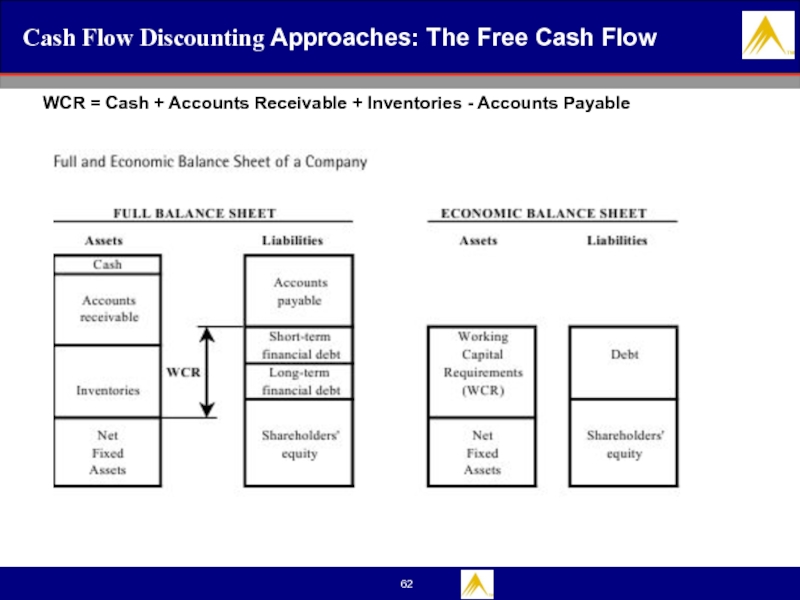

- 62. Cash Flow Discounting Approaches: The Free Cash

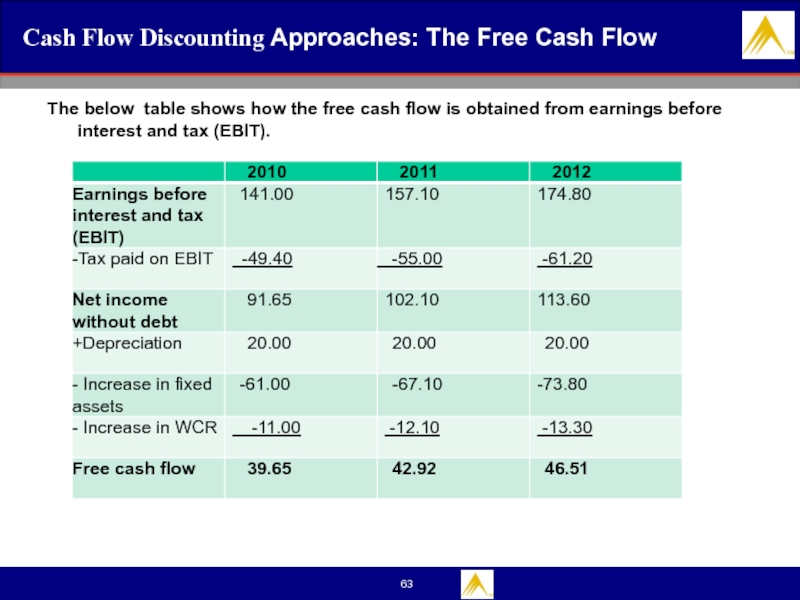

- 63. Cash Flow Discounting Approaches: The Free Cash

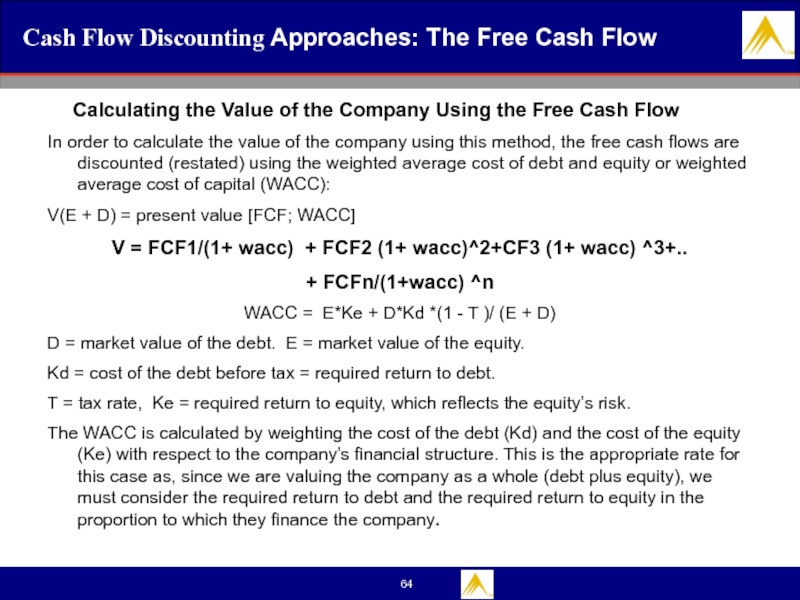

- 64. Cash Flow Discounting Approaches: The Free Cash

- 65. Cash Flow Discounting Approaches The Free Cash Flow

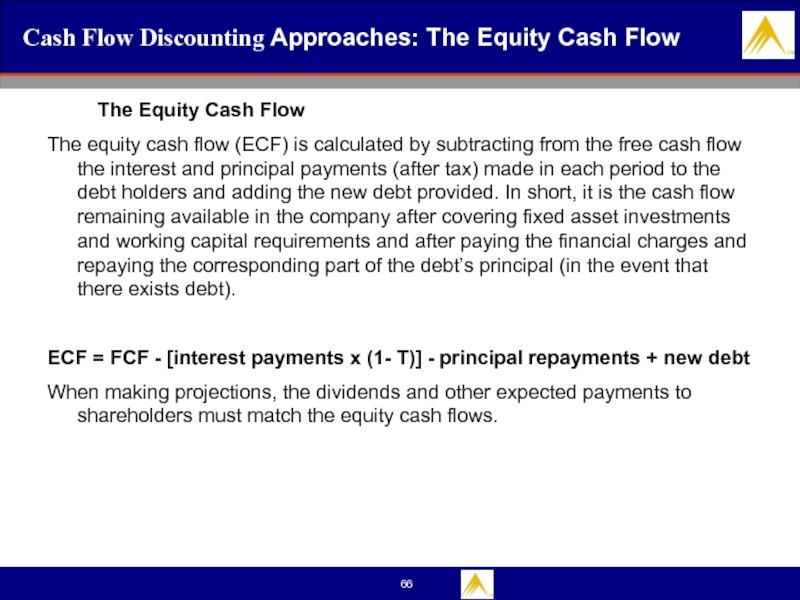

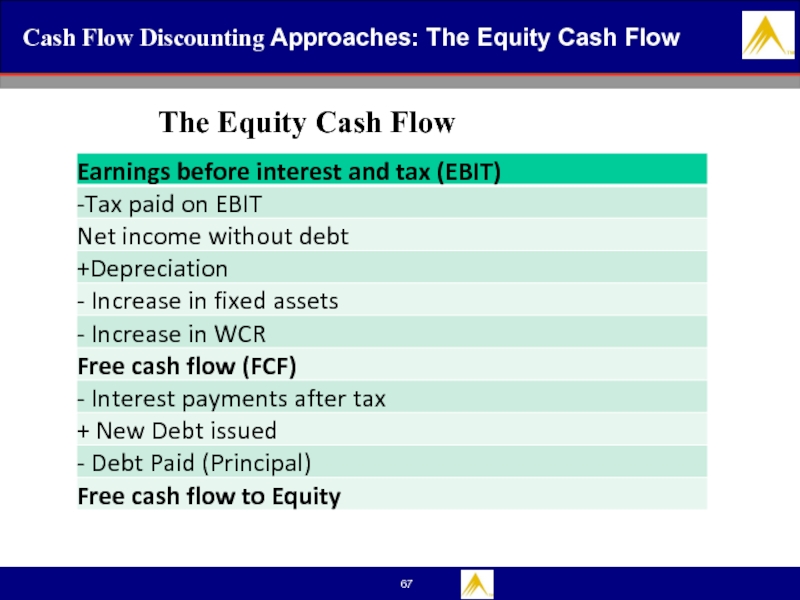

- 66. Cash Flow Discounting Approaches: The Equity Cash

- 67. Cash Flow Discounting Approaches: The Equity Cash Flow The Equity Cash Flow

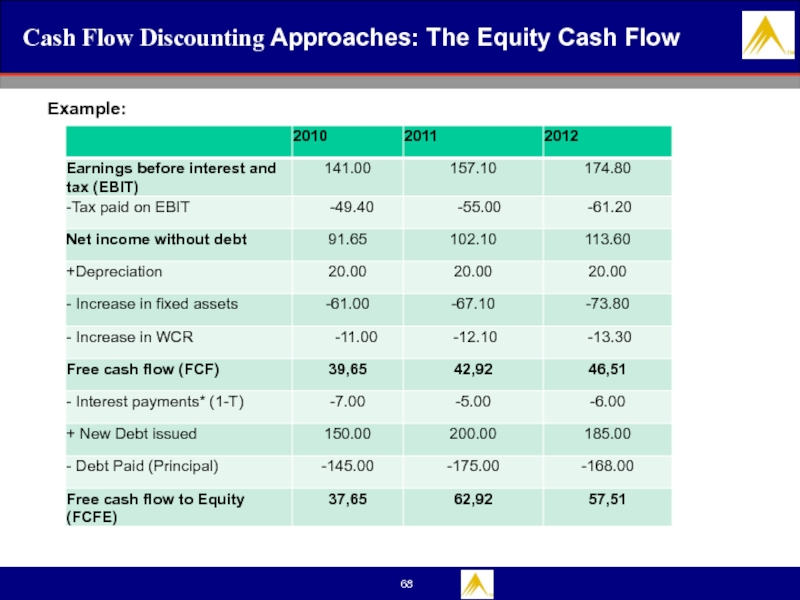

- 68. Cash Flow Discounting Approaches: The Equity Cash Flow Example:

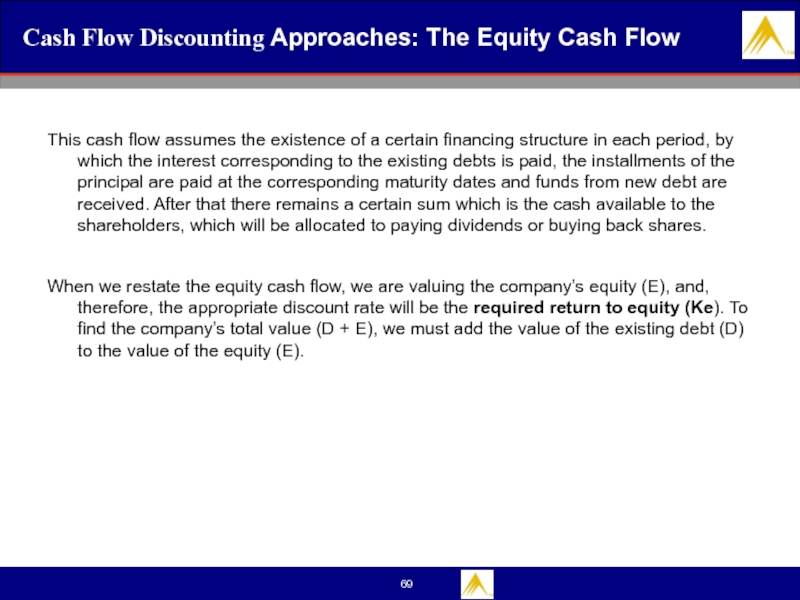

- 69. Cash Flow Discounting Approaches: The Equity Cash

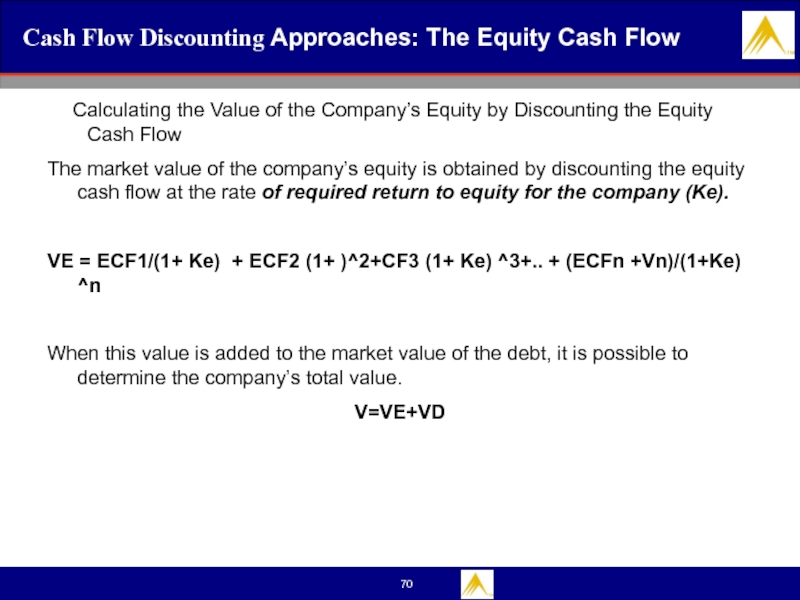

- 70. Cash Flow Discounting Approaches: The Equity Cash

- 71. Cash Flow Discounting Approaches: The Equity Cash

- 72. Cash Flow Discounting Approaches: The Equity Cash

- 73. Cash Flow Discounting Approaches: The Equity Cash

- 74. Cash Flow Discounting Approaches: The Equity Cash

- 75. Cash Flow Discounting Approaches: The Equity Cash

- 76. Cash Flow Discounting Approaches: The Equity Cash

- 77. Cash Flow Discounting Approaches: The Equity Cash

- 78. Cash Flow Discounting Approaches The Capital Cash Flow

- 79. Cash Flow Discounting Approaches: The Capital Cash

- 80. Cash Flow Discounting Approaches: The Capital Cash

- 81. Cash Flow Discounting Approaches: The Capital Cash

- 82. Cash Flow Discounting Approaches: The Free Cash

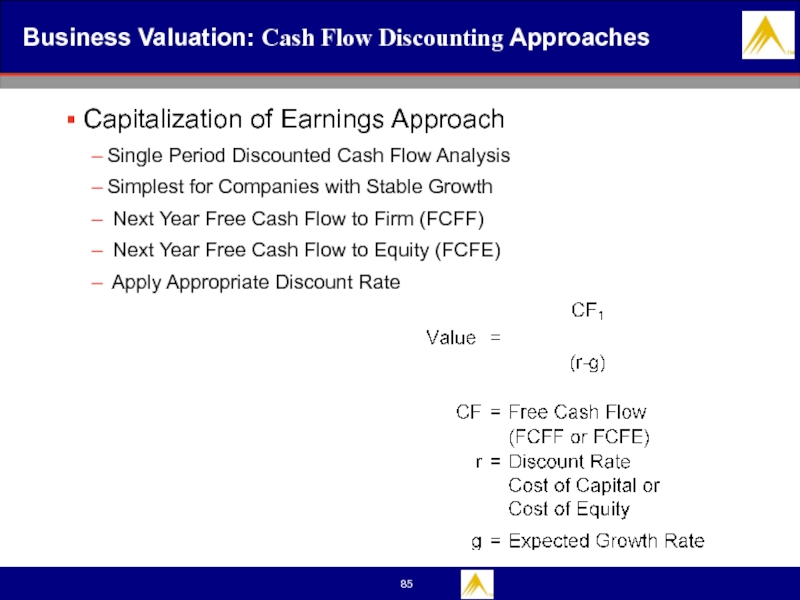

- 84. Business Valuation: Cash Flow Discounting Approaches

- 85. Business Valuation: Cash Flow Discounting Approaches

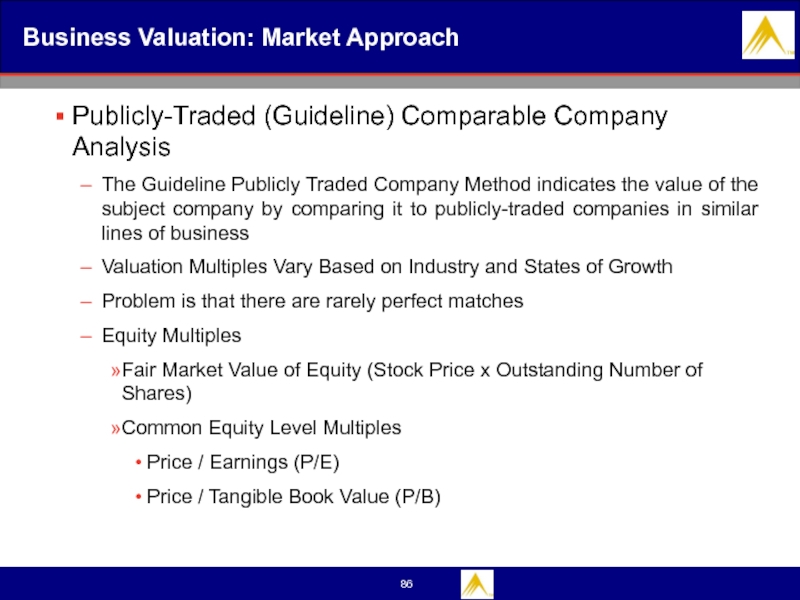

- 86. Business Valuation: Market Approach Publicly-Traded

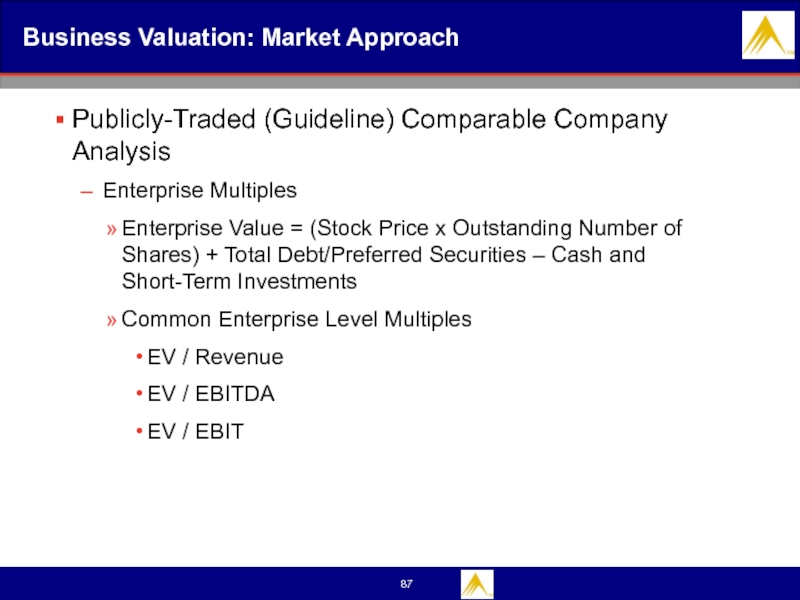

- 87. Business Valuation: Market Approach Publicly-Traded

- 88. Business Valuation: Market Approach Publicly-Traded

- 89. Business Valuation: Market Approach Market

- 90. Business Valuation: Market Approach Market

- 91. Business Valuation: Reconciling Items Reconciling Items and

- 92. Discounts and Premiums Control

- 93. Business Valuation: Lack of Marketability Discounts Let

- 94. Business Valuation: Lack of Marketability Discounts Lack

- 95. Business Valuation: Lack of Marketability Discounts Lack

- 96. Business Valuation: Lack of Marketability Discounts Lack

- 97. Business Valuation: Lack of Marketability Discounts Restricted

- 98. Business Valuation: Lack of Marketability Discounts Pre-IPO

- 99. Business Valuation: Lack of Marketability Discounts Other

- 100. Business Valuation: Lack of Marketability Discounts Factors

- 101. Business Valuation: Lack of Marketability Discounts Lack

- 102. Business Valuation: Control Premium and Minority Discount

- 103. Business Valuation: Control Premium and Minority Discount

- 104. Business Valuation: Control Premium and Minority Discount

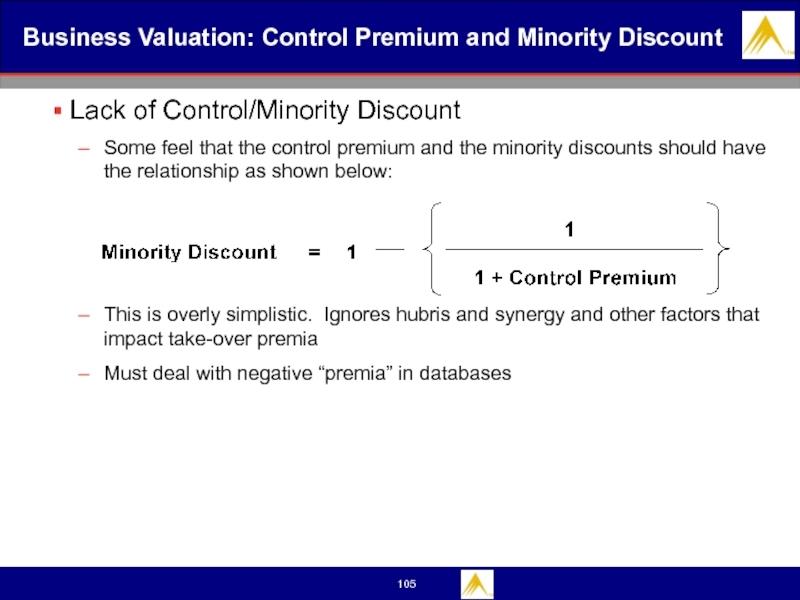

- 105. Business Valuation: Control Premium and Minority Discount

- 106. Business Valuation: Control Premium and Minority Discount

- 107. Business Valuation: Other Discounts Other Discounts

- 108. Business Valuation: Other Discounts Other Discounts Voting

- 109. Business Valuation: Discounts and Premiums Common Errors

- 110. Business Valuation: Discounts and Premiums Common Errors

- 111. References Brealey, R.A. and S.C. Myers (2000),

- 112. References Fernández, Pablo (2001c), “Valuing real options:

- 113. termins Patent infringement is the

- 114. An engagement letter defines the legal

- 115. Corporate spin-off, a type of corporate transaction forming a new company or entity

- 116. Everything You Should Know Understand the

- 117. СРСП Define the Company for your

Слайд 2Outline

Business Valuation Introduction

Reasons for a Business Valuation

Valuation Process and Standards of

Valuation Methodology

Methods of Corporate Valuation

Private Company Valuation

Discounts and Premiums

Слайд 3Business Valuations

“The act or process of determining the value of a

*International Glossary of Business Valuation.

*IRS Business Valuation Guideline 2006

Слайд 4

What are “Business Valuations?”

ASSET APPRAISAL

Real Estate

Machinery & Equipment

Intangible Assets

BUSINESS VALUATION

Complete Business

Слайд 5Reasons for Business Valuations

Sale of business or part interest

Ownership Disputes

Financing

Buy-Sell Agreements

Employee

Condemnation

Divorce

Estate Planning

Change of Business Structure

Recapitalization

Life Insurance

Слайд 6Business Valuation: Common Uses of Business Valuation

Tax

Estate/Gifts

Buy/Sell Agreements

Bankruptcy and Litigation

Liquidation or Reorganization

Patent Infringement

Partner Disputes

Economic Damages

Financial Reporting

Purchase Price Allocation, Impairment Testing and Stock Options and Grants, etc.

Strategic Planning/Transaction

Value Enhancement

Business Plan/Capital Raising

Strategic Direction, Spin-Offs, Carve Outs, etc.

Acquisitions, Due Diligence

Employee Stock Ownership Plan (ESOP)

Internal Revenue Codes (IRC)

Solvency and Fairness Opinions

Damage Assessment

Dissenting Shareholder Actions

Dissolutions

Слайд 9Business Valuation: Standard of Value

Purpose

Establish Purpose of the Engagement

Estate/Gift,

Standards of Value (i.e. Fair Market Value, Fair Value, etc.)

Interest Being Valued (i.e. Enterprise, Equity, Marketable, Non-Marketable, Control, Minority, etc.)

Valuation Date

Agree on a Appropriate Valuation Date

Utilize Data Subsequent to the Valuation Date

Sometimes can Consider Data After the Valuation Date if it was Foreseeable as of the Valuation Date

Слайд 10Business Valuation: Standards of Value

Common Standards of Value

Fair Market Value (Tax):

“The fair market value is the price at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts.” – IRS Revenue Ruling 59-60

Liquidation Value: Orderly; forced.

Fair Value (Financial Reporting): Can vary but it is generally similar to Fair market value with some exceptions.

The amount at which an asset (or liability) could be bought (or incurred) or sold (or settled) in a current transaction between willing parties, that is, other than in a forced or liquidation sale.”-FASB (Financial Accounting Standards Board) 157

Fair Value (Litigation): Fair value may be the applicable standard of value in a number of different situations, including shareholder dissent and oppression matters, corporate dissolution and divorce.

Слайд 11Fair Value (FASB Definition)

Fair Value – is defined in this subtopic

Слайд 12Fair Value (Legal Definition)

Fair Value- is often used in court cases

Слайд 13General Valuation Objectives

There is no one right way to value an

Business appraisers strive to achieve results that meet certain general requirements.

Consistency Ideally, different skilled appraisers should produce a similar valuation for a given asset.

Defensibility There is always the general possibility that any valuation could be subjected to legal challenges.

Suitability for purpose Valuations must be suitable to the purposes and circumstances of the individuals needing the information.

Слайд 14Misconceptions about Valuation

Myth 1: A valuation is an objective search for

Truth 1.1: All valuations are biased. The only questions are how much and in which direction.

Truth 1.2: The direction and magnitude of the bias in your valuation is directly proportional to who pays you.

Myth 2.: A good valuation provides a precise estimate of value

Truth 2.1: There are no precise valuations

Truth 2.2: The payoff to valuation is greatest when valuation is least precise.

Myth 3: . The more quantitative a model, the better the valuation

Truth 3.1: One’s understanding of a valuation model is inversely proportional to the number of inputs required for the model.

Truth 3.2: Simpler valuation models do much better than complex ones.

Слайд 15Professional Organizations: The Appraisal Foundation

The Appraisal Foundation comprises two independent boards.

Standards and standards rules For example, Standard 10 deals with business appraisal reporting.

Statements on appraisal standards For example, Statement on Appraisal Standard 2 deals with discounted cash flow analysis.

Advisory opinions These opinions relate to specific subjects. For example, Advisory Opinion 10 deals with the appraiser-client relationship.

Слайд 16Standards

Business valuation appraisers follow the following standards and guidelines:

American Institute of

The Appraisal Foundation’s Uniform Standards of Professional Appraisal Practice (“USPAP”);

The ethics and standards of the American Society of Appraisers; and

The Internal Revenue Service’s business valuation development and reporting guidelines.

Слайд 17Revenue Rulings

Revenue Ruling 59-60

Outlines the approaches, methods, and factors to be

Revenue Ruling 65-192

Extended the concepts in Revenue Ruling 59-60 to income and other tax purposes as well as to business interests of any type.

Слайд 18RR 59-60 Factors

The nature of the business and its history since

The economic outlook in general and the condition and outlook of the specific industry in particular

The book value of the stock and the financial condition of the business

The earning capacity of the company

The dividend paying capacity

Whether or not the enterprise has goodwill or other intangible value

Sales of stock and the size of the block of stock to be valued

The market price of stocks of corporations engaged in the same or in a similar line of business having their stocks actively traded in a free and open market, either on an exchange or over- the-counter

Слайд 19National valuation standards of RK

1. Kazakhstan valuation Standard "Valuation of assets

(Стандарт оценки "Оценка имущества, приобретаемого и отчуждаемого государством по отдельным основаниям")

2. Kazakhstan valuation Standard "Defining the cadastral value of real estate"

(Стандарт оценки Республики Казахстан "Определение кадастровой стоимости объектов недвижимости")

3. Kazakhstan valuation Standard of "Determination of fair value in accordance with IFRS"

(Стандарт оценки Республики Казахстан "Определение справедливой стоимости в соответствии с МСФО")

4. Kazakhstan valuation Standard "Valuation for lending purpose"

(Стандарт оценки Республики Казахстан "Оценка для целей кредитования" )

Слайд 20National valuation standards of RK

5. Kazakhstan valuation Standard "Valuation of Intellectual

(Стандарт оценки Республики Казахстан "Оценка стоимости объектов интеллектуальной собственности и нематериальных активов")

6. Kazakhstan valuation Standard "Databases and the types of value"

(Стандарт оценки Республики Казахстан "Базы и типы стоимости" )

7. Kazakhstan valuation Standard "Valuation of Report reliability"

(Стандарт оценки "Проверка достоверности отчета")

8. Kazakhstan valuation Standard "Business Valuation"

(Стандарт оценки "Оценка стоимости бизнеса")

9. Kazakhstan valuation Standard "Requirements for the form and content of the valuation report"

(Стандарт оценки Республики Казахстан "Требования к содержанию и форме отчета об оценке")

Слайд 21National valuation standards of RK

10. Kazakhstan valuation Standard "Valuation of movable

(Стандарт оценки Республики Казахстан "Оценка стоимости движимого имущества")

11. Kazakhstan valuation Standard “Valuation of real estate’

(Стандарт оценки Республики Казахстан "Оценка стоимости недвижимого имущества")

Слайд 22Business Valuation: Valuation Process

1.1 Proposal and Engagement Letter

1.3 Establish Valuation Date

1.2

Ongoing Internal Review and Discussion with Other Professionals and Client

Ongoing Internal Review and Discussion with Other Professionals and Client

Income, Market, Net Asset Approaches

Signed Engagement Letter with Retainer

1.4 Data Gathering

2.1 Company and Industry Analysis

2.3 Adjustments and Recasts (Control)

2.2 Analyze Historical Financial Statements

2.4 Financial Statements Analysis (Ratios, etc.)

3.1 Implement Selected Valuation Methodologies

3.3 Final Internal Review and QC Process

3.2 Narrative Write-up of the Report

3.4 Finalize

Слайд 24Engagement Agreement

Rule 201A, Professional Competence, of the AICPA Code of Professional

Слайд 25Engagement Agreement

In determining to accept an assignment, an evaluator considers, at

Subject entity and its industry

Subject interest

Valuation date

Scope of the valuation engagement

Purpose of the valuation

Assumptions and limiting conditions

Applicable standard of value

Type of valuation report

Government regulations

Слайд 26Engagement Agreement

Other factors to be considered

Objectivity and Conflict of Interest

Independence and

Establishing an Understanding with the Client

Assumptions and Limiting Conditions

Scope Restrictions and Limitations

Слайд 27Business Valuation: Analyzing Data

Researching Economic and Industry Information

Economy of Country

Target Industry

Financial Statements Analysis

Adjustments and Recasts (Control Value)

Extraordinary Items, Shareholders’ Perquisites (Personal Expenses), Fair Market Value Compensation and Rent, etc.

Ratio and Trend Analysis

Growth Rates, Liquidity, Leverage, Profitability, Efficiency, etc.

Слайд 28Business Valuation: Gathering Data

Gathering Company Data

Articles of Incorporation; Operating Agreement

History and

Products and Services

Shareholders and Key Personnel Compensations and Responsibilities

Organization/Corporate Structure

Operations

Customers/Clients, Target Markets and Suppliers

Legal, Tax and Other Considerations

Five Year Historical and Latest Interim Financial Statements

Other Financial Information (A/R, A/P, Fixed Asset Ledger, etc. - if needed)

Adjustments

Projections (If applicable)

Слайд 29Checklist

A basic information checklist includes the following:

Historical financials of the company

Debt

Schedule of fixed assets

Lease agreements for facilities or equipment

Any existing contracts

List of shareholders with shares outstanding

Budgets or projections

Details on any transactions with a related party

Company documents

Other information including list of locations, customers, competitors, suppliers, contingent liabilities, and regulations

Слайд 30Checklist

Appraiser should try to derive an answer to the following:

How does

Strengths, weaknesses, prospects, market, etc.

How does the company see the industry?

Influential factors, trends, growth, competition, etc.

Management and management compensation

Personal expenses, market rate compensation, etc.

Слайд 32Balance Sheet-Based Methods (Shareholders’ Equity)

These methods seek to determine the

These are traditionally used methods that consider that a company’s value lies basically in its balance sheet.

They do not take into account factors that also affect the value such as:

the industry’s current situation

human resources or organizational problems

contracts,

company’s possible future evolution

money’s temporary value

accounting criteria are subject to a certain degree of subjectivity and differ from “market” criteria

all other factors that do not appear in the accounting statements.

Слайд 33Balance Sheet-Based Method on the basis of Book Value

This quantity is also the difference between total assets and liabilities, that is, the surplus of the company’s total goods and rights over its total debts with third parties.

Balance Sheet of the Company A. Table 1.

Слайд 34Balance Sheet-Based Method

on the basis of adjusted Book Value

This method

When the values of assets and liabilities match their market value, the adjusted net worth is obtained.

Example:

Accounts receivable includes 2 million thousands of bad debt, this item should have a value of 8 million dollars.

Stock, after discounting obsolete, worthless items and revaluing the remaining items at their market value, has a value of 52 million dollars.

Fixed assets (land, buildings, and machinery) have a value of 150 million dollars, according to an expert.

The book value of accounts payable, bank debt and long-term debt is equal to their market value.

Слайд 35Book Value and Market Value

Figure 1

Evolution of the Price/Book Value Ratio

Слайд 37Liquidation Value

This is the company’s value if it is liquidated, that

Taking the example given in Table 2, if the redundancy payments and other expenses associated with the liquidation of the company A. were to amount to 60 million dollars, the shares’ liquidation value would be 75 million dollars (135-60).

Obviously, this method’s usefulness is limited to a highly specific situation, namely, when the company is bought with the purpose of liquidating it at a later date. However, Liquidation Value always represents the company’s minimum value as a company’s value.

Слайд 38Substantial Value

The substantial value represents the investment that must be made

It can also be defined as the assets’ replacement value, assuming the company continues to operate, as opposed to their liquidation value. Normally, the substantial value does not include those assets that are not used for the company’s operations (unused land, holdings in other companies, etc.).

Three types of substantial value are usually defined:

Gross substantial value: this is the assets’ value at market price (in the example of Table 2: 215).

Net substantial value or corrected net assets: this is the gross substantial value less liabilities.

It is also known as adjusted net worth, which we have already seen in the previous section (in the example of Table 2: 135).

Reduced gross substantial value: this is the gross substantial value reduced only by the value of the cost-free debt (in the example of Table 2: 175 = 215 - 40). The remaining 40 mln KZTs correspond to accounts payable.

Слайд 39Income Statement-Based Methods

Income Statement-Based Methods are based on the company’s income

This category includes the methods based on the PER: according to this method, the shares’ price is a multiple of the earnings.

Слайд 40Value of Earnings

According to this method, the equity’s value is obtained

Equity value = PER x earnings

The PER (price earnings ratio) of a share indicates the multiple of the earnings per share that is paid on the stock market.

Thus, if the earnings per share in the last year has been $3 and the share’s price is $26, its PER will be 8.66 (26/3).

So Equity value = PER x earnings=8.66*32 mln KZT=277.12 mln KZT

The PER is the benchmark used predominantly by the stock markets. Note that the PER is a parameter that relates a market item (share price) with a purely accounting item (earnings).

Слайд 41

Sometimes, the relative PER is also used, which is simply the

Evolution of the PER of the German, English and United States Stock Markets markets in 1992 and 2002.

Слайд 42Value of the Dividends

Dividends are the part of the earnings effectively

According to this method, a share’s value is the net present value of the dividends that we expect to obtain from it. In the perpetuity case, that is, a company from which we expect constant dividends every year, this value can be expressed as follows:

Equity value = DPS / Ke

Where: DPS = dividend per share distributed by the company in the last year; Ke = required return to equity.

If, on the other hand, the dividend is expected to grow indefinitely at a constant annual rate g, the above formula becomes the following:

Equity value = DPS1 / (Ke - g)

Where DPS1 is the dividends per share for the next year.

Слайд 43Business Valuation: Weighted Average Cost of Capital

Weighted Average Cost of Capital

WACC = Weight of Equity (Cost of Equity) + Weight of Debt (Cost of Debt * (1-Tax)) + Weight of Preferred Security (Cost of Preferred Security)

Provides Overall Cost of Capital to Whole Company

Assumes Constant Debt to Capital Over Time

Слайд 44Sales Multiples

This valuation method, which is used in some industries with

For example, a pharmacy is often valued by multiplying its annual sales (in dollars) by 2 or another number, depending on the market situation. It is also a common practice to value a soft drink bottling plant by multiplying its annual sales in liters by 500 or another number, depending on the market situation.

The price/sales ratio can be broken down into a further two ratios:

Price/sales = (price/earnings) x (earnings/sales)

The first ratio (price/earnings) is the PER and the second (earnings/sales) is normally known as return on sales.

Слайд 45Other Multiples

In addition to the PER and the price/sales ratio, some

Value of the company / earnings before interest and taxes (EBIT).

Value of the company / earnings before interest, taxes, depreciation and amortization (EBITDA).

Value of the company / operating cash flow.

Value of the equity / book value.

Obviously, in order to value a company using multiples, multiples of comparable companies must be used.

Слайд 48Business Valuation: Cash Flow Discounting Approaches

Cash Flow Discounting-based methods seek to

In these methods, the company is viewed as a cash flow generator and the company’s value is obtained by calculating these flows’ present value using a suitable discount rate.

Cash flow discounting methods are based on the detailed, careful forecasts, for each period, of each of the financial items related with the generation of the cash flows corresponding to the company’s operations.

Слайд 49Business Valuation: Cash Flow Discounting Approaches

Cash flow discounting-based valuation methods are

The various forms:

Discounted Cash Flow Analysis (DCF)

Capitalization of Earnings

Dividend Discount Model (DDM)

Слайд 50Business Valuation: Cash Flow Discounting Approaches

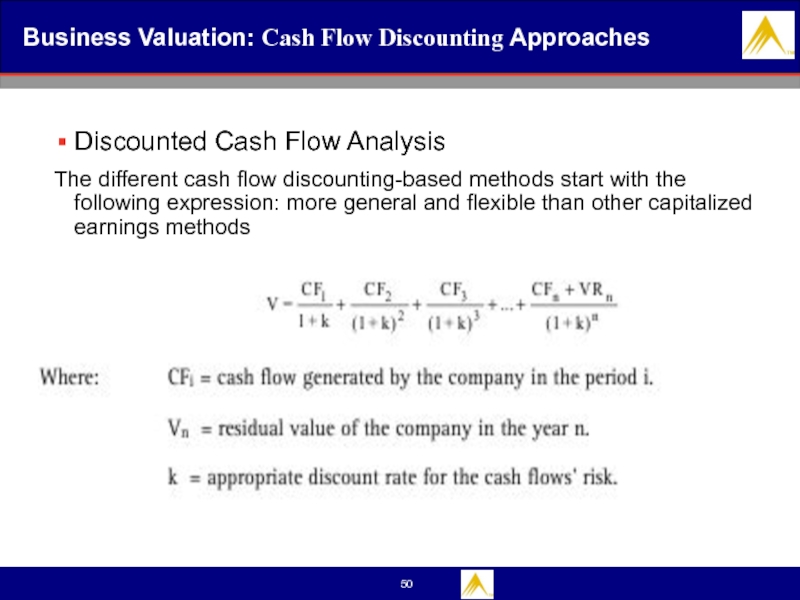

Discounted Cash Flow Analysis

The different cash

Слайд 51Business Valuation: Cash Flow Discounting Approaches

Although at first sight it may

A simplified procedure for considering an indefinite duration of future flows after the year n is to assume a constant growth rate (g) of flows after that period. Then the residual value in year n is:

VRn = CFn (1 + g) / (k - g).

Although the flows may have an indefinite duration, it may be acceptable to ignore their value after a certain period, as their present value decreases progressively with longer time horizons. Furthermore, the competitive advantage of many businesses tends to disappear after a few years.

Слайд 52Business Valuation: Cash Flow Discounting Approaches

The main idea behind a DCF

Many variables go into estimating cash flows, but among the most important are the company's future sales growth and profit margins. Projecting such variables doesn't involve simply extrapolating present trends into the future. It's important to consider a variety of factors, including:

the industry’s evolution and trends

economic data

market share of a company

a company's competitive advantages and future position

competitive position of the main competitors

identification of the value drivers

a company’s suppliers and customers

internal and external risks and etc

Слайд 53Business Valuation: Cash Flow Discounting Approaches

For example:

A company with strong competitive

Chemical companies that are heavily reliant on oil and natural gas, for example, could see profit margins contract if these materials go up in price and they cannot pass these cost increases on to customer.

Some companies benefit from operating leverage. Operating leverage means that as a company grows larger, it is able to spread its fixed costs across a broader base of production. As a result, the company's operating profits should grow at a faster rate than revenue. It can add thousands of customers with only very modest investments to its existing computer systems.

Likewise, a software company sees most of its costs in development. Adding an additional customer doesn't change this key cost.

Слайд 54Business Valuation: Cash Flow Discounting Approaches

Main questions that must be asked

There are three basic cash flows: the free cash flow, the equity cash flow, and the debt cash flow.

The free cash flow (FCF) enables the company’s total value (debt and equity: D + E) to be obtained.

The debt cash flow (DCF), which is the sum of the interest to be paid on the debt plus principal repayments. In order to determine the present market value of the existing debt, this flow must be discounted at the required rate of return to debt. In many cases, the debt’s market value shall be equivalent to its book value, which is why its book value is often taken as a sufficient approximation to the market value. (This is only valid if the required return to debt is equal to the debt’s cost)

The equity cash flow (ECF) enables the value of the equity to be obtained, which, combined with the value of the debt, will also enable the company’s total value to be determined.

Слайд 55Cash Flow Discounting Approaches: discount rates

In cash flow discounting-based valuations, a

Слайд 56Cash Flow Discounting Approaches: The Free Cash Flow

The Free Cash Flow

The

In order to calculate future free cash flows, we must forecast the cash we will receive and must pay in each period. This is basically the approach used to draw up a cash budget.

Слайд 57Cash Flow Discounting Approaches: The Free Cash Flow

Company’s free cash flow

In order to calculate the free cash flow, we must ignore financing for the company’s operations and concentrate on the financial return on the company’s assets after tax, viewed from the perspective of a going concern, taking into account in each period the investments required for the business’s continued existence.

Finally, if the company had no debt, the free cash flow would be identical to the equity cash flow.

Слайд 58Cash Flow Discounting Approaches: The Free Cash Flow

For example the below

Слайд 59Cash Flow Discounting Approaches: The Free Cash Flow

Free cash flow can

Слайд 60Cash Flow Discounting Approaches: The Free Cash Flow

WCR = Cash +

Слайд 61Cash Flow Discounting Approaches: The Free Cash Flow

Balance sheet of a

Balance sheet of a Company X at 31/12/2010.

Слайд 62Cash Flow Discounting Approaches: The Free Cash Flow

WCR = Cash +

Слайд 63Cash Flow Discounting Approaches: The Free Cash Flow

The below table shows

Слайд 64Cash Flow Discounting Approaches: The Free Cash Flow

Calculating the Value of

In order to calculate the value of the company using this method, the free cash flows are discounted (restated) using the weighted average cost of debt and equity or weighted average cost of capital (WACC):

V(E + D) = present value [FCF; WACC]

V = FCF1/(1+ wacc) + FCF2 (1+ wacc)^2+CF3 (1+ wacc) ^3+..

+ FCFn/(1+wacc) ^n

WACC = E*Ke + D*Kd *(1 - T )/ (E + D)

D = market value of the debt. E = market value of the equity.

Kd = cost of the debt before tax = required return to debt.

T = tax rate, Ke = required return to equity, which reflects the equity’s risk.

The WACC is calculated by weighting the cost of the debt (Kd) and the cost of the equity (Ke) with respect to the company’s financial structure. This is the appropriate rate for this case as, since we are valuing the company as a whole (debt plus equity), we must consider the required return to debt and the required return to equity in the proportion to which they finance the company.

Слайд 66Cash Flow Discounting Approaches: The Equity Cash Flow

The Equity Cash Flow

The

ECF = FCF - [interest payments x (1- T)] - principal repayments + new debt

When making projections, the dividends and other expected payments to shareholders must match the equity cash flows.

Слайд 69Cash Flow Discounting Approaches: The Equity Cash Flow

This cash flow assumes

When we restate the equity cash flow, we are valuing the company’s equity (E), and, therefore, the appropriate discount rate will be the required return to equity (Ke). To find the company’s total value (D + E), we must add the value of the existing debt (D) to the value of the equity (E).

Слайд 70Cash Flow Discounting Approaches: The Equity Cash Flow

Calculating the Value of

The market value of the company’s equity is obtained by discounting the equity cash flow at the rate of required return to equity for the company (Ke).

VE = ECF1/(1+ Ke) + ECF2 (1+ )^2+CF3 (1+ Ke) ^3+.. + (ECFn +Vn)/(1+Ke) ^n

When this value is added to the market value of the debt, it is possible to determine the company’s total value.

V=VE+VD

Слайд 71Cash Flow Discounting Approaches: The Equity Cash Flow

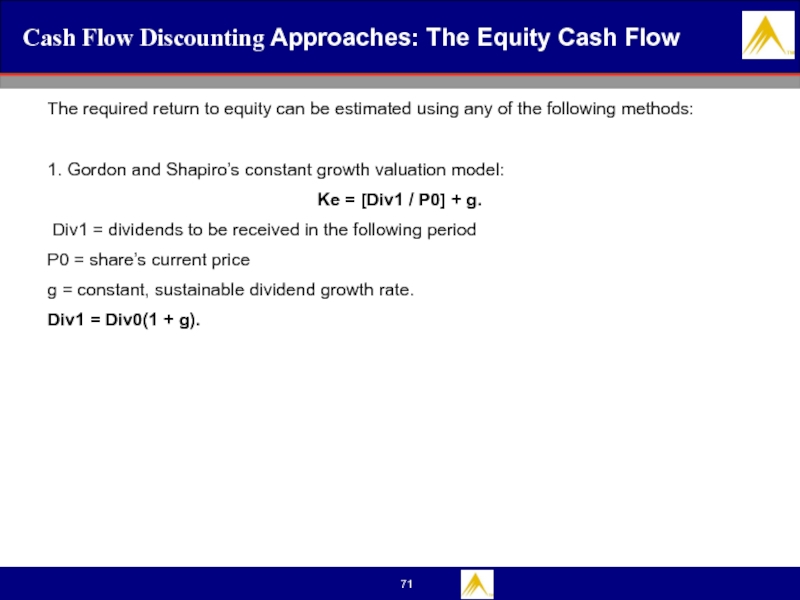

The required return to

1. Gordon and Shapiro’s constant growth valuation model:

Ke = [Div1 / P0] + g.

Div1 = dividends to be received in the following period

P0 = share’s current price

g = constant, sustainable dividend growth rate.

Div1 = Div0(1 + g).

Слайд 72Cash Flow Discounting Approaches: The Equity Cash Flow

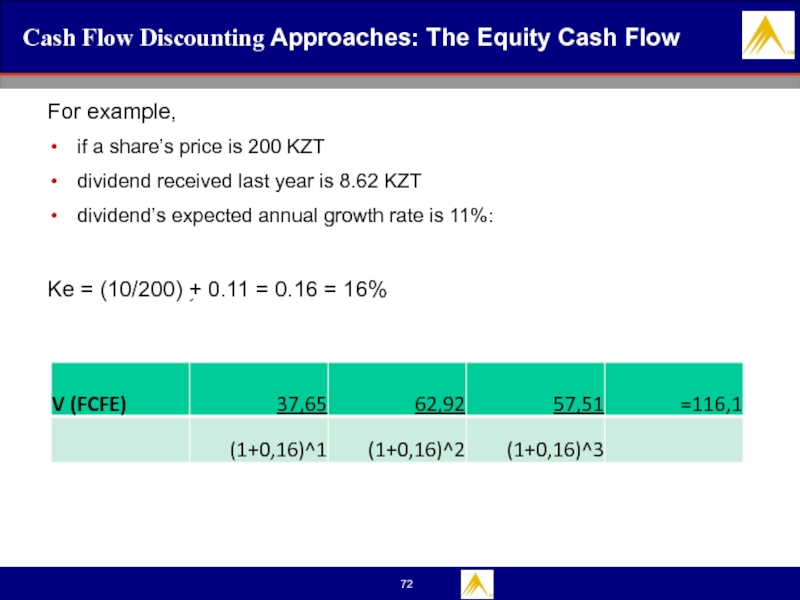

For example,

if a

dividend received last year is 8.62 KZT

dividend’s expected annual growth rate is 11%:

Ke = (10/200) + 0.11 = 0.16 = 16%

Слайд 73Cash Flow Discounting Approaches: The Equity Cash Flow

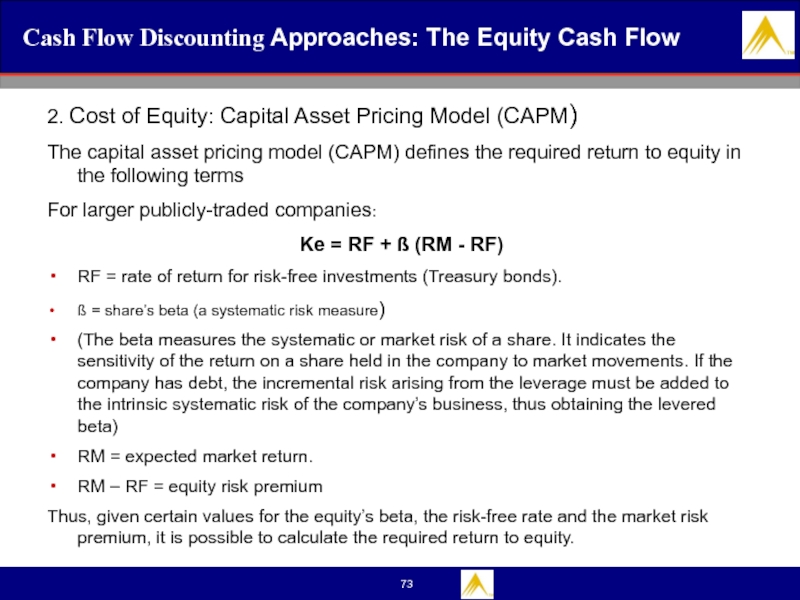

2. Cost of Equity:

The capital asset pricing model (CAPM) defines the required return to equity in the following terms

For larger publicly-traded companies:

Ke = RF + ß (RM - RF)

RF = rate of return for risk-free investments (Treasury bonds).

ß = share’s beta (a systematic risk measure)

(The beta measures the systematic or market risk of a share. It indicates the sensitivity of the return on a share held in the company to market movements. If the company has debt, the incremental risk arising from the leverage must be added to the intrinsic systematic risk of the company’s business, thus obtaining the levered beta)

RM = expected market return.

RM – RF = equity risk premium

Thus, given certain values for the equity’s beta, the risk-free rate and the market risk premium, it is possible to calculate the required return to equity.

Слайд 74Cash Flow Discounting Approaches: The Equity Cash Flow

Cost of Equity: Capital

For example, if

RF =4%

ß =1.3

RM=10%

Growth rate =5%

Слайд 75Cash Flow Discounting Approaches: The Equity Cash Flow

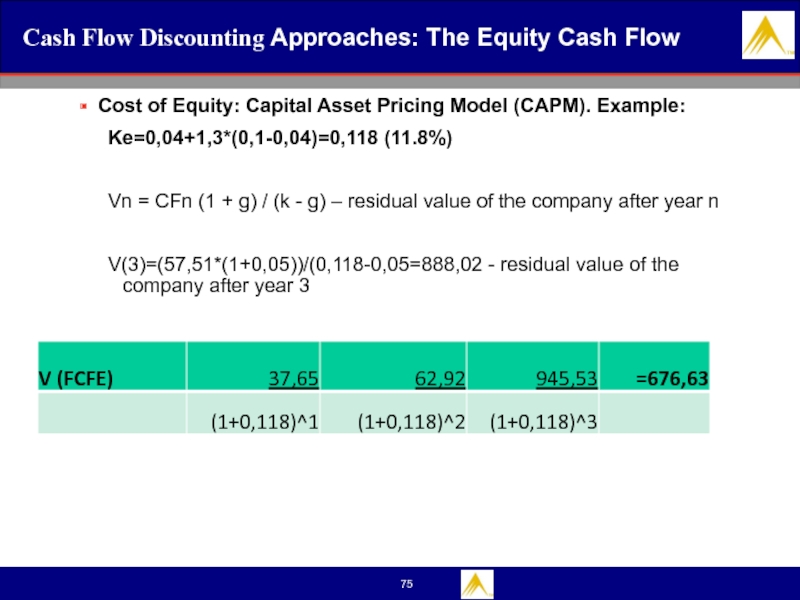

Cost of Equity: Capital

Ke=0,04+1,3*(0,1-0,04)=0,118 (11.8%)

Vn = CFn (1 + g) / (k - g) – residual value of the company after year n

V(3)=(57,51*(1+0,05))/(0,118-0,05=888,02 - residual value of the company after year 3

Слайд 76Cash Flow Discounting Approaches: The Equity Cash Flow

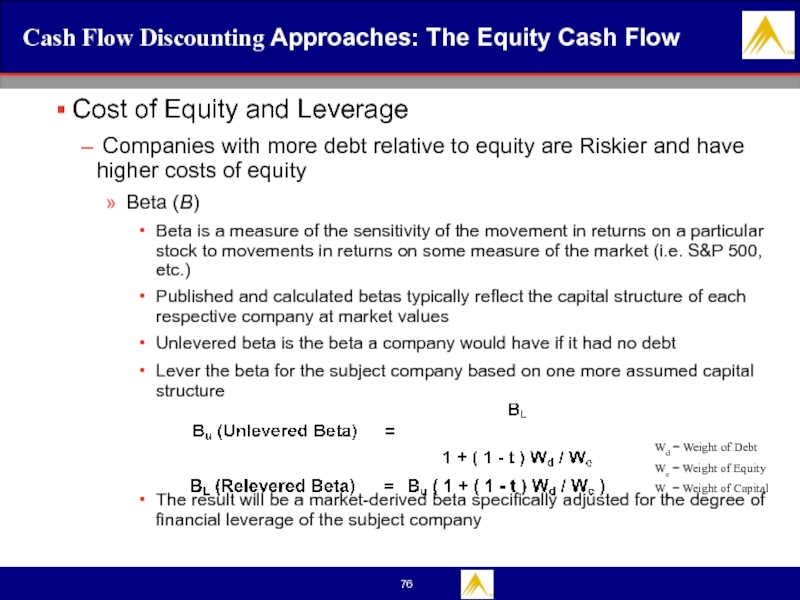

Cost of Equity and

Companies with more debt relative to equity are Riskier and have higher costs of equity

Beta (B)

Beta is a measure of the sensitivity of the movement in returns on a particular stock to movements in returns on some measure of the market (i.e. S&P 500, etc.)

Published and calculated betas typically reflect the capital structure of each respective company at market values

Unlevered beta is the beta a company would have if it had no debt

Lever the beta for the subject company based on one more assumed capital structure

The result will be a market-derived beta specifically adjusted for the degree of financial leverage of the subject company

Wd = Weight of Debt

We = Weight of Equity

Wc = Weight of Capital

Слайд 77Cash Flow Discounting Approaches: The Equity Cash Flow

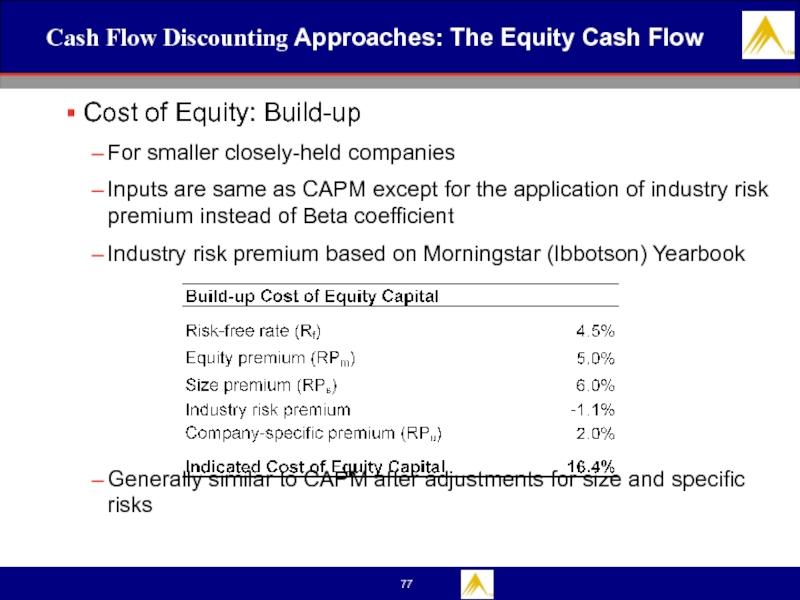

Cost of Equity: Build-up

For smaller closely-held companies

Inputs are same as CAPM except for the application of industry risk premium instead of Beta coefficient

Industry risk premium based on Morningstar (Ibbotson) Yearbook

Generally similar to CAPM after adjustments for size and specific risks

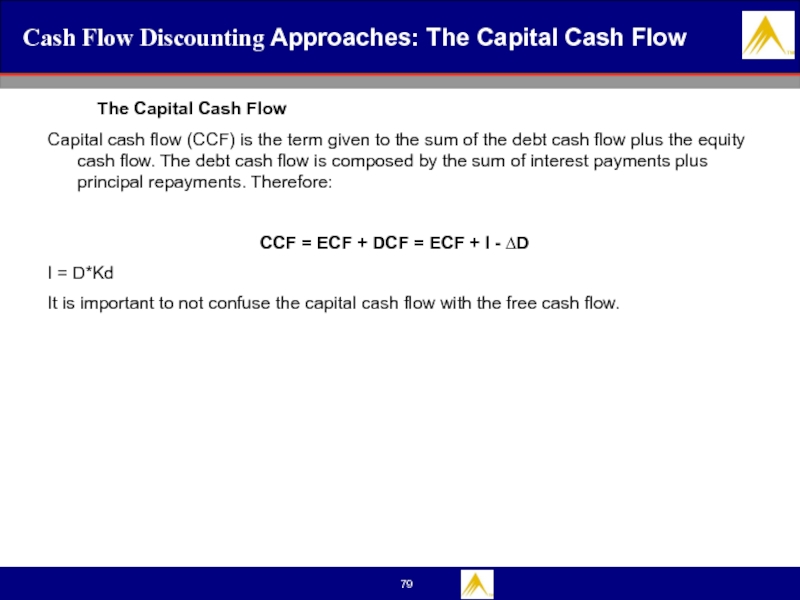

Слайд 79Cash Flow Discounting Approaches: The Capital Cash Flow

The Capital Cash Flow

Capital

CCF = ECF + DCF = ECF + I - ∆D

I = D*Kd

It is important to not confuse the capital cash flow with the free cash flow.

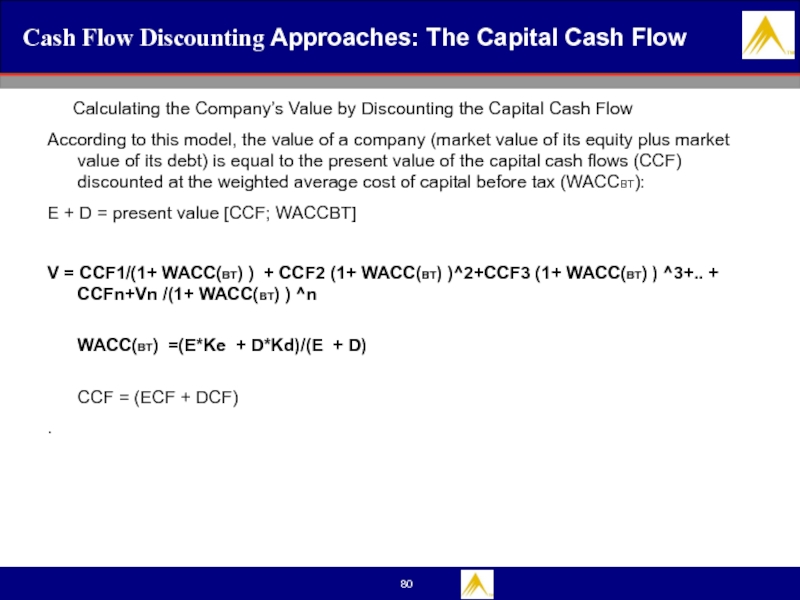

Слайд 80Cash Flow Discounting Approaches: The Capital Cash Flow

Calculating the Company’s Value

According to this model, the value of a company (market value of its equity plus market value of its debt) is equal to the present value of the capital cash flows (CCF) discounted at the weighted average cost of capital before tax (WACCBT):

E + D = present value [CCF; WACCBT]

V = CCF1/(1+ WACC(BT) ) + CCF2 (1+ WACC(BT) )^2+CCF3 (1+ WACC(BT) ) ^3+.. + CCFn+Vn /(1+ WACC(BT) ) ^n

WACC(BT) =(E*Ke + D*Kd)/(E + D)

CCF = (ECF + DCF)

.

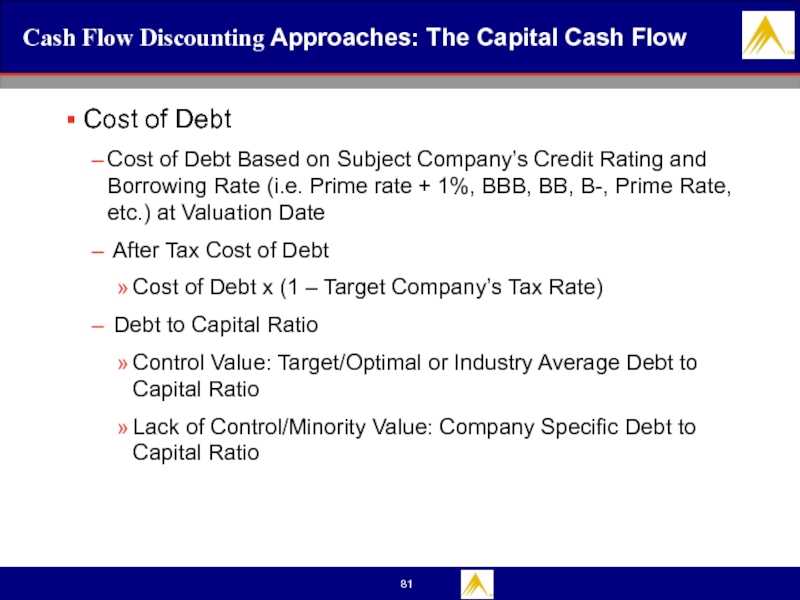

Слайд 81Cash Flow Discounting Approaches: The Capital Cash Flow

Cost of Debt

Cost

After Tax Cost of Debt

Cost of Debt x (1 – Target Company’s Tax Rate)

Debt to Capital Ratio

Control Value: Target/Optimal or Industry Average Debt to Capital Ratio

Lack of Control/Minority Value: Company Specific Debt to Capital Ratio

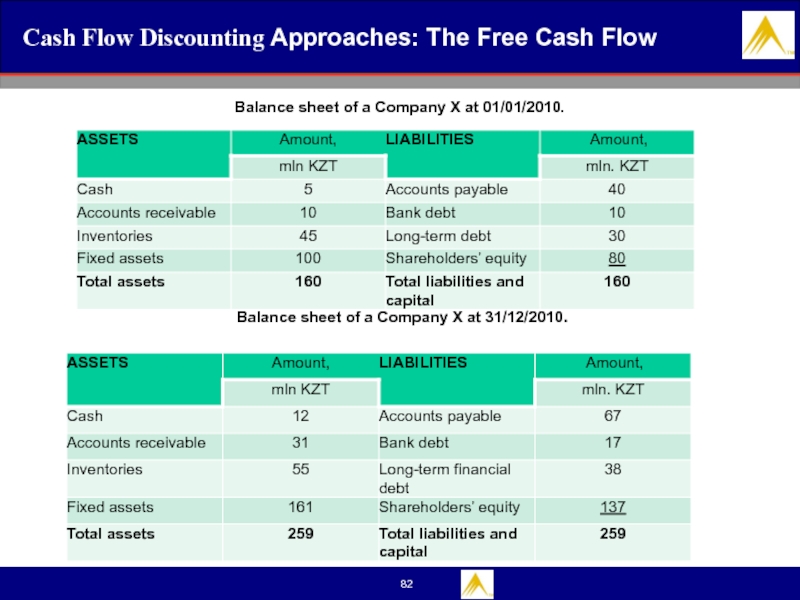

Слайд 82Cash Flow Discounting Approaches: The Free Cash Flow

Balance sheet of a

Balance sheet of a Company X at 31/12/2010.

Слайд 84Business Valuation: Cash Flow Discounting Approaches

The DCF model that we will

Note: There are actually two types of DCF models: "free cash flow to equity" and "cash flow to the firm." The first involves counting just the cash flow available to shareholders and is a bit easier to understand.

The second involves counting the cash flow available to both debt and equity holders and has several additional steps. We will talk about just the first method here, though both methods should give you roughly the same result for any given company. -

Слайд 85Business Valuation: Cash Flow Discounting Approaches

Capitalization of Earnings Approach

Single Period Discounted

Simplest for Companies with Stable Growth

Next Year Free Cash Flow to Firm (FCFF)

Next Year Free Cash Flow to Equity (FCFE)

Apply Appropriate Discount Rate

Слайд 86Business Valuation: Market Approach

Publicly-Traded (Guideline) Comparable Company Analysis

The Guideline Publicly Traded

Valuation Multiples Vary Based on Industry and States of Growth

Problem is that there are rarely perfect matches

Equity Multiples

Fair Market Value of Equity (Stock Price x Outstanding Number of Shares)

Common Equity Level Multiples

Price / Earnings (P/E)

Price / Tangible Book Value (P/B)

Слайд 87Business Valuation: Market Approach

Publicly-Traded (Guideline) Comparable Company Analysis

Enterprise Multiples

Enterprise

Common Enterprise Level Multiples

EV / Revenue

EV / EBITDA

EV / EBIT

Слайд 88Business Valuation: Market Approach

Publicly-Traded (Guideline) Comparable Company Analysis

Other Multiples

EV / R&D

EV / # of Licenses and Rights – Shell Company, etc

Appropriate Multiple Depends on Company Characteristics

Слайд 89Business Valuation: Market Approach

Market Transaction (M&A) Approach

In the Guideline Merged and

Public Market Transaction Approach

Public Buyer or Seller Transactions

Control Value

Private Market Transaction Approach

Private to Private Transactions

Control Value

Common Transaction Database

MergerStat, Pratts’ Stat, Biz Comps, Capital IQ

Слайд 90Business Valuation: Market Approach

Market Approach Adjustments

Most Companies Differ from the

Need to Adjust for Differences between Market Comparables and Subject Company

Common Adjustments are Based on:

Size

Growth Rate

Profitability

Leverage

Other Company Specific Factors

Discounts and Premiums

Слайд 91Business Valuation: Reconciling Items

Reconciling Items and Adjustments

Appropriate Weighting Value Conclusions

Non-Operating Assets/Liabilities and Excess Working Capital/Cash

Pass-Through Entity Tax Adjustments

Adjustment for Discounted Cash Flow Analysis and Publicly-Traded Guideline Comparable Company Analysis

Depends on Hypothetical Buyer (C-Corp.? S-Corp.?, etc.)

Interest-Bearing Debt and Contingent Liabilities

Discounts and Premiums

Apply to Equity Level

Lack of Marketability and Minority Discounts, Key Person Discount and Control Premium, etc.

Слайд 92Discounts and Premiums

Control Premium

Lack of Control/Minority Discounts

Lack of Marketability/Illiquidity Discounts

Others Discounts

Слайд 93Business Valuation: Lack of Marketability Discounts

Let the Fireworks Begin!!

Often subject to

Determination based on analogy

Data sources problematic

Reasonable range

Слайд 94Business Valuation: Lack of Marketability Discounts

Lack of Marketability Discounts (LOM)

Marketability (liquidity)

The discount for lack of marketability is the largest money issue in many, if not most, disputed valuations of minority interests in closely-held, private companies

The U.S. Tax Court normally allows discounts for lack of marketability for non-controlling interests in closely held companies, but the size of the discounts varies greatly from one case to another

Need to carefully study the recent case law in the relevant jurisdiction

The quality of the expert evidence and testimony presented in the Tax Court makes a big difference in the outcome

The Tax Court expects good empirical evidence, relevant to the subject at hand; simple averages are insufficient

Слайд 95Business Valuation: Lack of Marketability Discounts

Lack of Marketability Discounts

The highest discount

The ESOP discounts for lack of marketability are generally low because most ESOP stock has a “put” right to sell the stock back to the sponsoring company, thus enhancing its liquidity and value.

Dissenting shareholder and shareholder oppression cases are quite mixed on the matter of discount for lack of marketability

There is little case law on discount for lack of marketability in divorce cases, and what exists is also quite mixed

If the standard of value is clearly stated as fair market value, then a discount for lack of marketability is appropriate

Слайд 96Business Valuation: Lack of Marketability Discounts

Lack of Marketability/Illiquidity Discount for Minority

Restricted Stock Studies

Restricted stocks are, by definition, stocks of public companies that are restricted from public trading under SEC Rule 144

Although they cannot be sold on the open market, they can be bought by qualified institutional investors. Thus, the “restricted stock studies” compare the price of restricted shares of a public company with the freely-traded public market price on the same date

Price differences are attributed to liquidity

Many feel the discounts are a reliable guide to discounts for LOM

Empirical Studies: McConaughy, SEC Institutional Investor, Gelman, Trout, Moroney, Maher, Standard Research Consultants, Siber, FMV Opinion, Management Planning, Johnson, Columbia Financial Advisors Studies

Слайд 97Business Valuation: Lack of Marketability Discounts

Restricted Stock Studies

General Findings

Show

Discounts are larger for smaller companies and companies with more volatile stocks and more debt

These data are most appropriate for valuing restricted stocks and are difficult to apply to private companies

The value of the studies is that the comparisons are apples to apples (i.e. liquid stock value vs. illiquid stock value of the same company at the same time).

Restrictions have been relaxed and discounts have dropped

Statistical studies can explain at best 1/3 of the discount

Слайд 98Business Valuation: Lack of Marketability Discounts

Pre-IPO Stock Studies

A pre-IPO transaction is

The pre-IPO studies compare the price of the private stock transaction with the public offering price. The percentage below the public offering price at which the private transaction occurred is a proxy for the discount for lack of marketability

The application of pre-IPO studies heavily debated and criticized because comparisons are apples to oranges

The dates of the transaction differ at a time when the company is changing rapidly (in the year before the IPO)

Discounts are very large

Discounts/premium should be based on specific to the subject case and not past court cases

Слайд 99Business Valuation: Lack of Marketability Discounts

Other Studies

Modified put option model (i.e.

Modified cost of capital – total beta (McConaughy and Covrig)

“Private Company Discount” by Koeplin, Sarin & Shapiro, Journal of Applied Corporate Finance Winter 2000.

Find approximately a 30% discount. Perhaps the best study, but limited sample size makes it difficult to apply to a specific case.

Слайд 100Business Valuation: Lack of Marketability Discounts

Factors Affecting Discounts for Lack of

Company’s Financial Performance and Growth

Size of Distributions

Prospects for Liquidity (Expected Liquidity Event)

Restrictions on Transferability

Company’s Redemption Policy

Costs Associated with a Public Offering

Pool of Potential Buyers

Nature of the Company, Its History, Other Risk Factors

Amount of Control in Transferred Shares

Company’s Management

Слайд 101Business Valuation: Lack of Marketability Discounts

Lack of Marketability/Illiquidity Discounts for Controlling

Still a controversial concept

A company with control can be marketable, but illiquid

More marketable and liquid than the minority interest; Higher lack of marketability discount for smaller blocks (for closely held companies)

Super majority requirement for certain States

Typically, private companies sell in 6 months which is shorter than the restriction period of restricted stocks

Слайд 102Business Valuation: Control Premium and Minority Discount

Control Premium

Other things equal, an

An amount by which the pro rata value of a controlling interest exceeds the pro rata value of a noncontrolling interest in a business enterprise that reflects the power of control often associated with takeovers of public companies

Some suggest that valuations of controlling interests be adjusted upward if they are based on publicly-traded stock prices which are minority interests

Hubris and synergy may explain premia

Not needed if cash flows are estimated at the control level

Слайд 103Business Valuation: Control Premium and Minority Discount

Control Premium

Common Prerogatives of Control

Elect

Determine management compensation and perquisites

Set policy and change the course of business

Acquire or liquidate assets

Select people with whom to do business and award contracts

Make acquisitions

Liquidate, dissolve, sell, leverage or recapitalize the company

Sell or acquire treasury shares

Register the company’s stock for a public offering

Declare and pay dividends

Change the articles of incorporation or bylaws or operating agreement

Слайд 104Business Valuation: Control Premium and Minority Discount

Control Premium Database

Control Premia Based

Identify one month to six months control premium prior to announcement date for public and private transactions from Mergerstat, Capital IQ, etc.

Control premia should exclude potential synergies associated with selected transactions, but this is extremely difficult

Appropriately adjust for other qualitative factors based on control prerogatives

Слайд 105Business Valuation: Control Premium and Minority Discount

Lack of Control/Minority Discount

Some feel

This is overly simplistic. Ignores hubris and synergy and other factors that impact take-over premia

Must deal with negative “premia” in databases

Слайд 106Business Valuation: Control Premium and Minority Discount

Lack of Control/Minority Discount

Supermajority Requirement

Swing Vote Potential – Depending on distribution of the stock, a minority, swing block could have the potential to gain a premium price over a pure minority value

Interest of 50% - Discount from lack of control value should be less for the interest with some control prerogatives and a little greater for the interest without the control prerogatives

Many experts feel that publicly-traded stocks generally sell at a control value

Слайд 107Business Valuation: Other Discounts

Other Discounts

Key Person Discount

Measure potential negative impact

Trapped-in Capital Gains

A company holding an appreciated asset would have to pay a capital gains tax on the sale of the asset. If ownership of the company were to change, the liability for the tax on the sale of the appreciated asset would not disappear

Use with Caution, it depends on expected time of liquidity event (usually applied when liquidity event is imminent

Consult a tax expert to analyze the situations

Block Discount

A large interest may be less liquid than a smaller one

Слайд 108Business Valuation: Other Discounts

Other Discounts

Voting vs. Non-Voting

If a company has both

Based on level of influence by the voting shareholders, restrictive agreements, state laws and policies and the total number of block of shares between voting and non-voting

Empirical studies indicates premium for voting shares

Lease, McConnell and Mikkelson Study – 5.4%

Robinson, Rumsey and White Study – 3.5% ~ 4.5%

O’Shea and Siwicki Study – 3.5%

Houlihan Lokey Howard & Zukin Study – 3.2% (average), 2.7% (median)

Слайд 109Business Valuation: Discounts and Premiums

Common Errors in Applying Discounts and Premiums

Greed

Low value desired

Conservative projections

High discount rate

Large DLOM, etc.

Higher value desired

Aggressive projections

Low discount rate

Small DLOM, etc.

Conservative projections should be accompanied by a lower discount rate

Aggressive projections should be accompanied by a higher discount rate

Слайд 110Business Valuation: Discounts and Premiums

Common Errors in Applying Discounts and Premiums

Using

Assuming that the discounted cash flow valuation method always produces a minority value

Assuming that the guideline public company method always produces a minority value

Valuing underlying assets instead of the stock or partnership interests

Using minority interest marketability discount data to quantify marketability discounts for controlling interests

Using only pre-initial public offering studies and not restricted stock studies as benchmark for discounts for lack of marketability

Indiscriminate use of average discounts or premiums applying (or omitting) a premium or discount inappropriately for the legal context

Applying discounts or premiums to the entire capital structure

Quantifying discounts or premiums based on past court cases

Using a tangible (real property, fixed assets, etc.) appraiser to quantity discounts and premiums

Слайд 111References

Brealey, R.A. and S.C. Myers (2000), “Principles of Corporate Finance,” 6th

Copeland, T. E., T. Koller and J. Murrin (2000), “Valuation: Measuring and Managing the Value of Companies”, 3rd edition, Wiley, New York.

Copeland and Weston (1988), “Financial Theory and Corporate Policy,” 3rd edition, Addison- Wesley, Reading, Massachusetts.

Faus, Josep (1996), “Finanzas operativas,” Biblioteca IESE de Gestión de Empresas, Ediciones Folio.

Fernández, Pablo (2001a), “Internet Valuations: The Case of Terra-Lycos”, SSRN Working Paper n. 265608.

Fernandez, Pablo (2001b), “Valuation using multiples. How do analysts reach their conclusions?,” SSRN Working Paper n. 274972.

Слайд 112References

Fernández, Pablo (2001c), “Valuing real options: frequently made errors,” SSRN Working

Fernández, Pablo (2002), “Valuation Methods and Shareholder Value Creation,” Academic Press, San Diego, CA.

Miller, M.H. (1986), “Behavioral Rationality in Finance: The Case of Dividends,” Journal of Business, No. 59, october, pp. 451-468.

Sorensen, E. H. and D.A. Williamson (1985), “Some evidence on the value of the dividend discount model,” Financial Analysts Journal, 41, pp. 60-69.

Слайд 113termins

Patent infringement is the commission of a prohibited act with respect

A buy–sell agreement, also known as a buyout agreement, is a legally binding agreement between co-owners of a business that governs the situation if a co-owner dies or is otherwise forced to leave the business, or chooses to leave the business.

An employee stock ownership plan (ESOP) is an employee-owner scheme that provides a company's workforce with an ownership interest in the company. In an ESOP, companies provide their employees with stock ownership, often at no up-front cost to the employees. ESOP shares, however, are part of employees' compensation for work performed. Shares are allocated to employees and may be held in an ESOP trust until the employee retires or leaves the company. The shares are then sold.

Слайд 114

An engagement letter defines the legal relationship (or engagement) between a

Equity carve-out (ECO), also known as a split-off IPO or a partial spin-off, is a type of corporate reorganization, in which a company creates a new subsidiary and subsequently IPOs it, while retaining management control. Only part of the shares are offered to the public, so the parent company retains an equity stake in the subsidiary. Typically, up to 20% of subsidiary shares is offered to the public.

Corporate spin-off, a type of corporate transaction forming a new company or entity

Слайд 116Everything You Should Know

Understand the Standard of Value

Involve the Appraiser Early

Distinguish Between a Business Appraisal and a Real Estate Appraisal

Establish a Reasonable Time Frame

Insist on an Appraisal Firm with Experience and Credentials

Know the Primary Business Valuation Methods

Consider the Appraisal as a First Line of Defense

Litigation Support Issues

Слайд 117СРСП

Define the Company for your Project , give the below

Articles of Incorporation; Operating Agreement

History and Background

Products and Services

Shareholders

Organization/Corporate Structure

Operations

Customers/Clients, Target Markets and Suppliers

Legal, Tax and Other Considerations

Five Year Historical and Latest Interim Financial Statements

Other Financial Information (A/R, A/P, Fixed Asset Ledger, etc. - if needed)