- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Emerging Markets: Gimme Shelter презентация

Содержание

- 1. Emerging Markets: Gimme Shelter

- 2. What’s this about? Growth in emerging

- 3. Emerging markets matter more than ever

- 4. Pass the credit parcel While credit

- 5. Quelle surprise – China is the main

- 6. A reckoning awaits China’s banking sector

- 7. That debt is becoming more of a

- 8. A big score…off-shore Offshore bond issuance

- 9. The problems are more than debt alone

- 10. Here comes the deflationary wind Emerging

- 11. Falling productivity, but room for reform

- 12. Less favourable demographics have arrived China’s

- 13. Consequences… The issues facing emerging markets,

- 14. …and yet more consequences All the

- 15. Follow us on Twitter @RBS_Economics https://twitter.com/rbs_economics

- 16. Disclaimer This material is published by

Слайд 2What’s this about?

Growth in emerging markets is slowing. This is

1. What are the problems in emerging market economies?

2. Why does that matter to us?

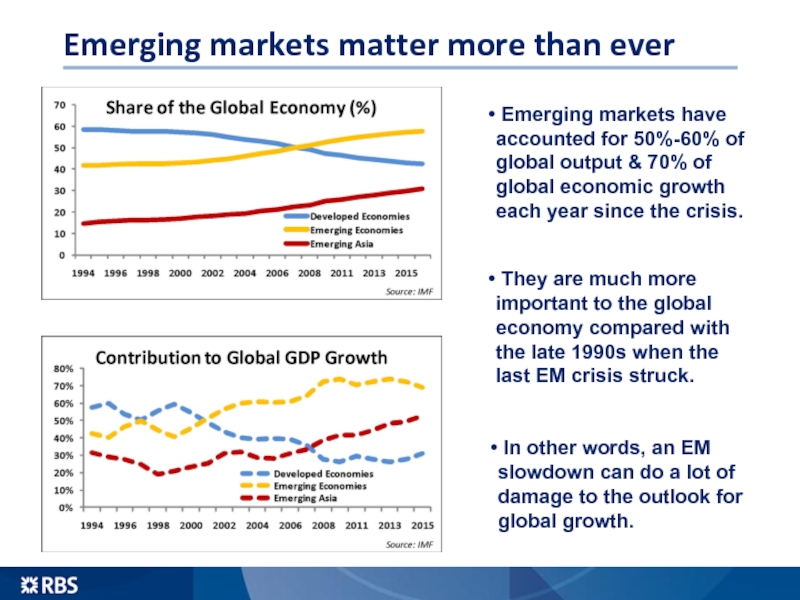

Слайд 3Emerging markets matter more than ever

Emerging markets have accounted for

They are much more important to the global economy compared with the late 1990s when the last EM crisis struck.

In other words, an EM slowdown can do a lot of damage to the outlook for global growth.

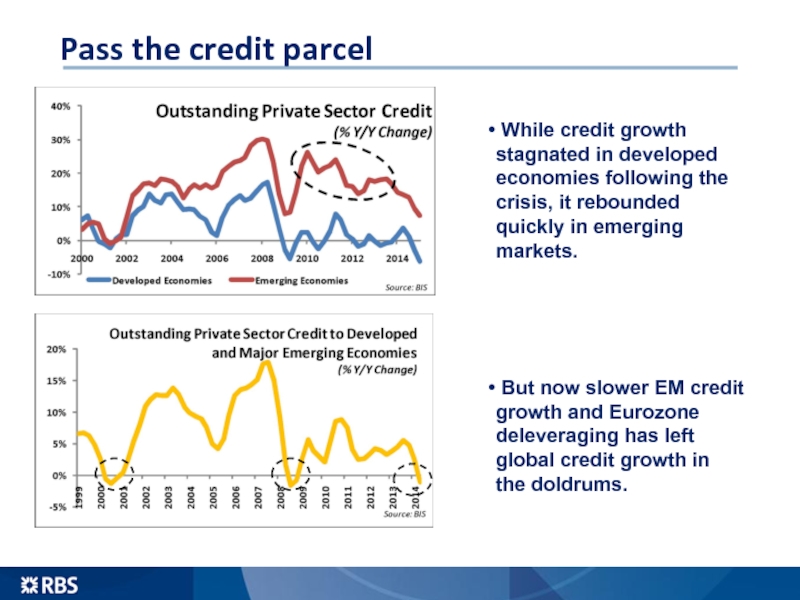

Слайд 4Pass the credit parcel

While credit growth stagnated in developed economies

But now slower EM credit growth and Eurozone deleveraging has left global credit growth in the doldrums.

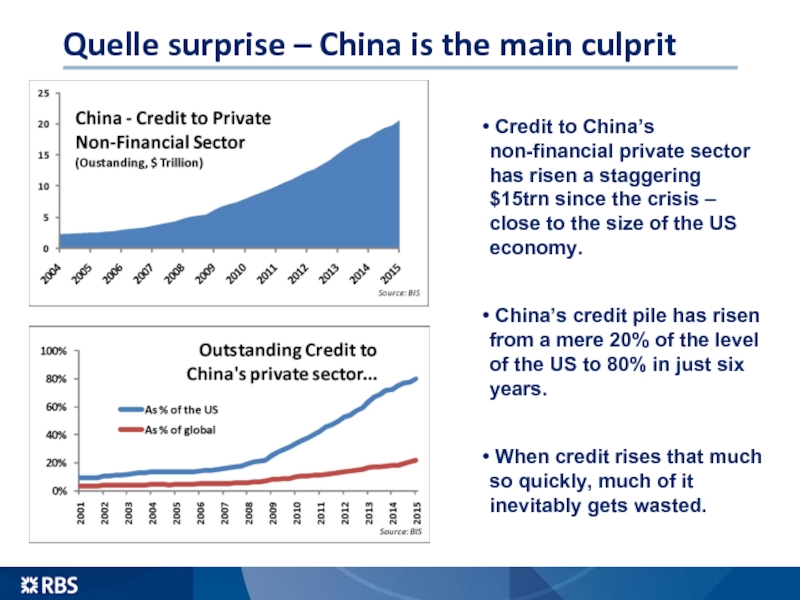

Слайд 5Quelle surprise – China is the main culprit

Credit to China’s

China’s credit pile has risen from a mere 20% of the level of the US to 80% in just six years.

When credit rises that much so quickly, much of it inevitably gets wasted.

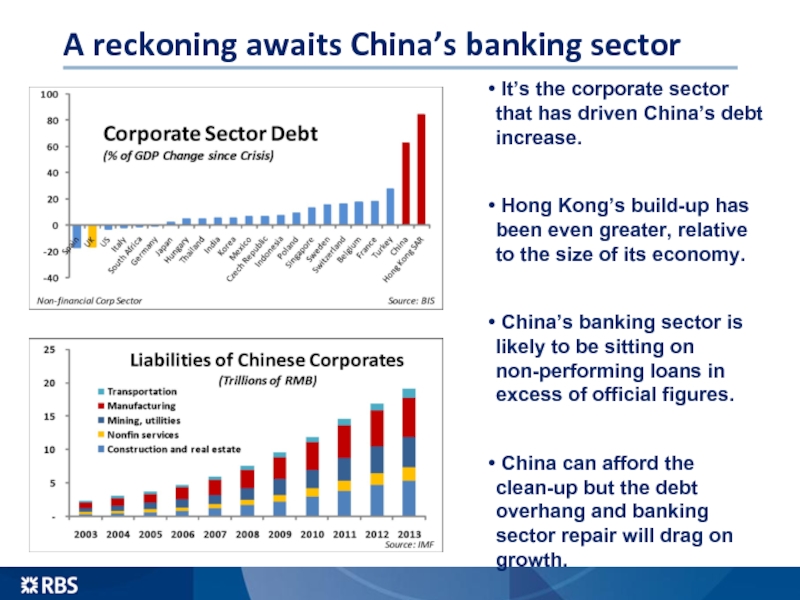

Слайд 6A reckoning awaits China’s banking sector

It’s the corporate sector that

Hong Kong’s build-up has been even greater, relative to the size of its economy.

China’s banking sector is likely to be sitting on non-performing loans in excess of official figures.

China can afford the clean-up but the debt overhang and banking sector repair will drag on growth.

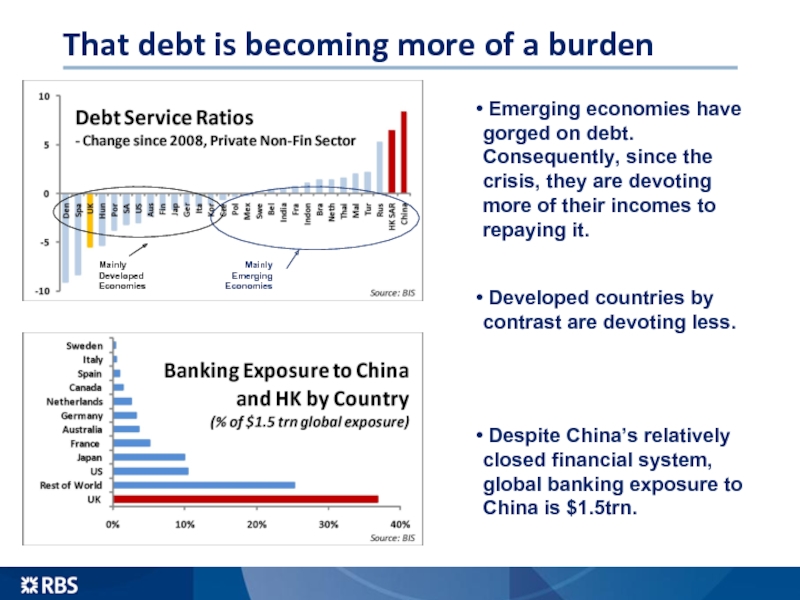

Слайд 7That debt is becoming more of a burden

Emerging economies have

Developed countries by contrast are devoting less.

Despite China’s relatively closed financial system, global banking exposure to China is $1.5trn.

Слайд 8A big score…off-shore

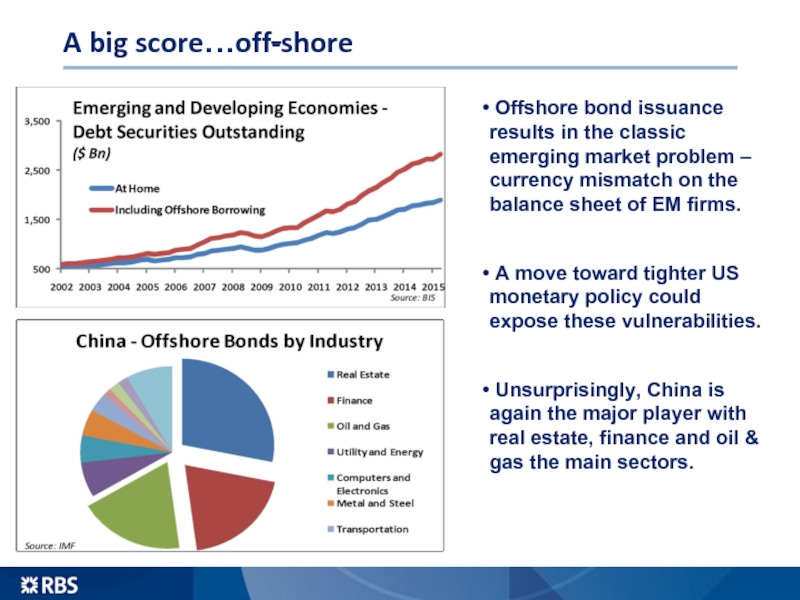

Offshore bond issuance results in the classic emerging

A move toward tighter US monetary policy could expose these vulnerabilities.

Unsurprisingly, China is again the major player with real estate, finance and oil & gas the main sectors.

Слайд 9The problems are more than debt alone

Having previously grown much

Emerging markets hoped for a strong rebound in export growth following the crisis but it never materialised. It’s not just due to the Eurozone.

China’s slowdown is transmitting across other emerging markets as reduced demand for their exports.

Слайд 10Here comes the deflationary wind

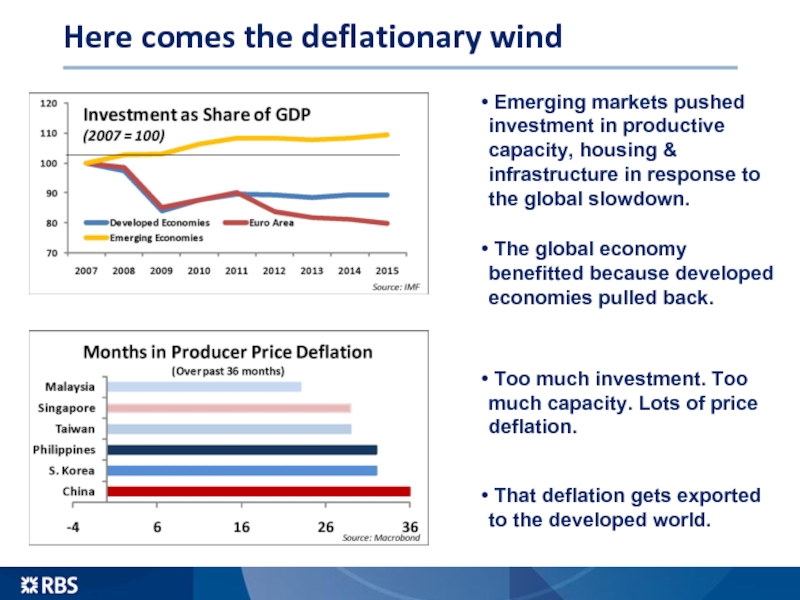

Emerging markets pushed investment in productive

The global economy benefitted because developed economies pulled back.

Too much investment. Too much capacity. Lots of price deflation.

That deflation gets exported to the developed world.

Слайд 11Falling productivity, but room for reform

Emerging market productivity growth has

It’s another sign that investment in many emerging markets, particularly China, has been targeted at the wrong areas. Capital has been misallocated.

And emerging markets, generally speaking, are relatively difficult places to do business.

They remain a long way behind the great emerging market success story – S.Korea.

Слайд 12Less favourable demographics have arrived

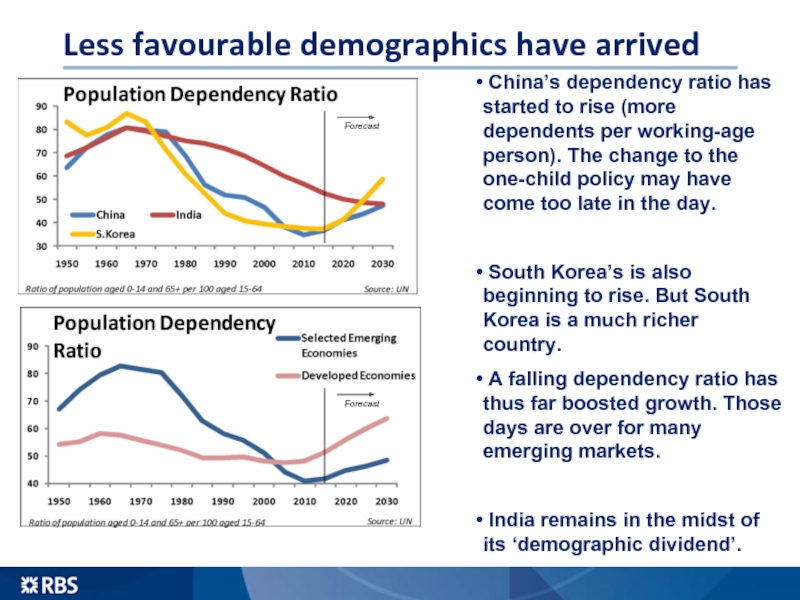

China’s dependency ratio has started to

South Korea’s is also beginning to rise. But South Korea is a much richer country.

A falling dependency ratio has thus far boosted growth. Those days are over for many emerging markets.

India remains in the midst of its ‘demographic dividend’.

Слайд 13Consequences…

The issues facing emerging markets, are deep-rooted & unlikely to disappear

In response, the US Fed & the Bank of England may have to keep interest rates lower for longer. The ECB and the Bank of Japan will likely expand their Quantitative Easing (Buying for longer).

Слайд 14…and yet more consequences

All the while emerging markets will likely remain

China’s policy response to its debt problems will be a crucial influence on the fortunes of the global economy in the coming years. Either it cleans up its banks and rebalances growth toward services and consumption (of which there is so far little or no evidence) or it doesn’t & risks heading into financial stress.