- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

BITCOIN – 2015 & BEYOND презентация

Содержание

- 1. BITCOIN – 2015 & BEYOND

- 2. Money Transmission on the Federal Level FinCEN

- 3. Money Transmission on the Federal Level According

- 4. Money Transmission on the Federal Level Still,

- 5. Money Transmission on the State Level The

- 6. Money Transmission on the State Level First

- 7. Money Transmission on the State Level Second

- 8. Money Transmission on the State Level Recent

- 9. Money Transmission on the State Level Recent

- 10. Global Outlook Bolivia: All digital currency transactions

Слайд 1BITCOIN – 2015 & BEYOND

Deborah Thoren-Peden

Pillsbury Winthrop Shaw Pittman LLC

thoren@pillsburylaw.com |

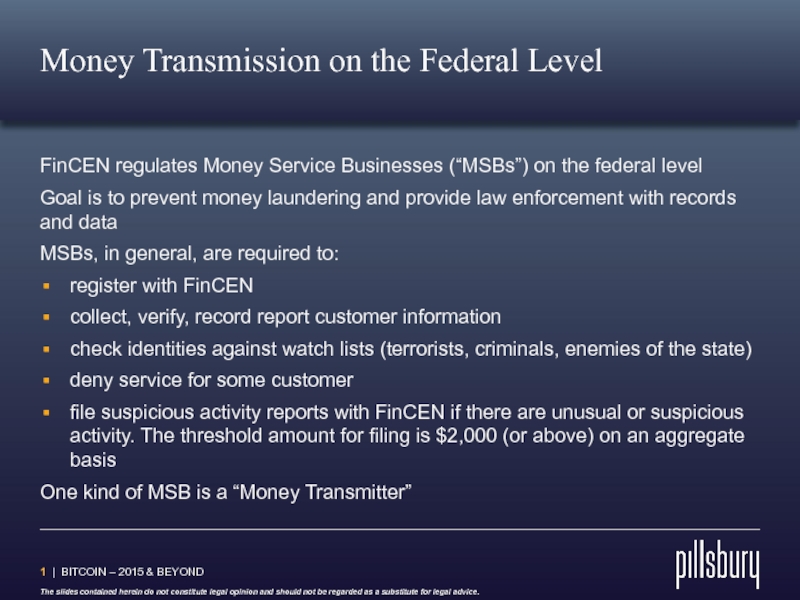

Слайд 2Money Transmission on the Federal Level

FinCEN regulates Money Service Businesses (“MSBs”)

Goal is to prevent money laundering and provide law enforcement with records and data

MSBs, in general, are required to:

register with FinCEN

collect, verify, record report customer information

check identities against watch lists (terrorists, criminals, enemies of the state)

deny service for some customer

file suspicious activity reports with FinCEN if there are unusual or suspicious activity. The threshold amount for filing is $2,000 (or above) on an aggregate basis

One kind of MSB is a “Money Transmitter”

| BITCOIN – 2015 & BEYOND

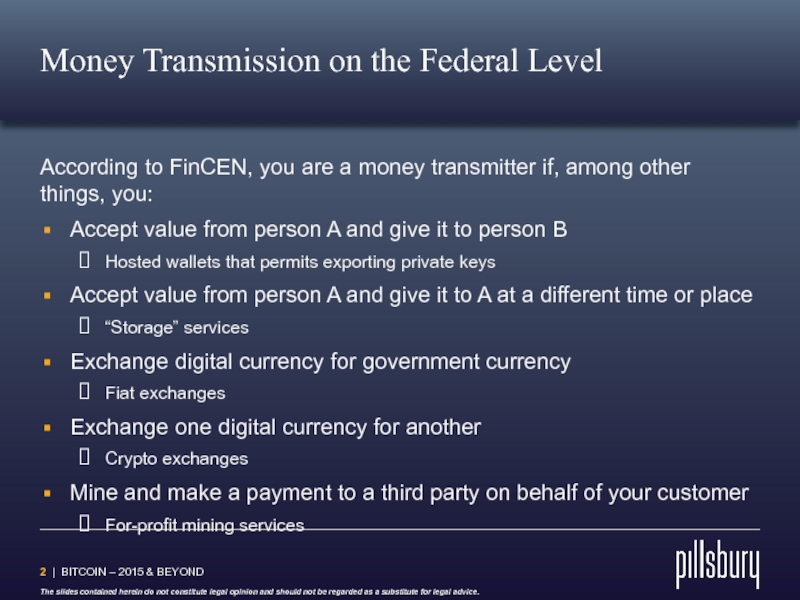

Слайд 3Money Transmission on the Federal Level

According to FinCEN, you are a

Accept value from person A and give it to person B

Hosted wallets that permits exporting private keys

Accept value from person A and give it to A at a different time or place

“Storage” services

Exchange digital currency for government currency

Fiat exchanges

Exchange one digital currency for another

Crypto exchanges

Mine and make a payment to a third party on behalf of your customer

For-profit mining services

| BITCOIN – 2015 & BEYOND

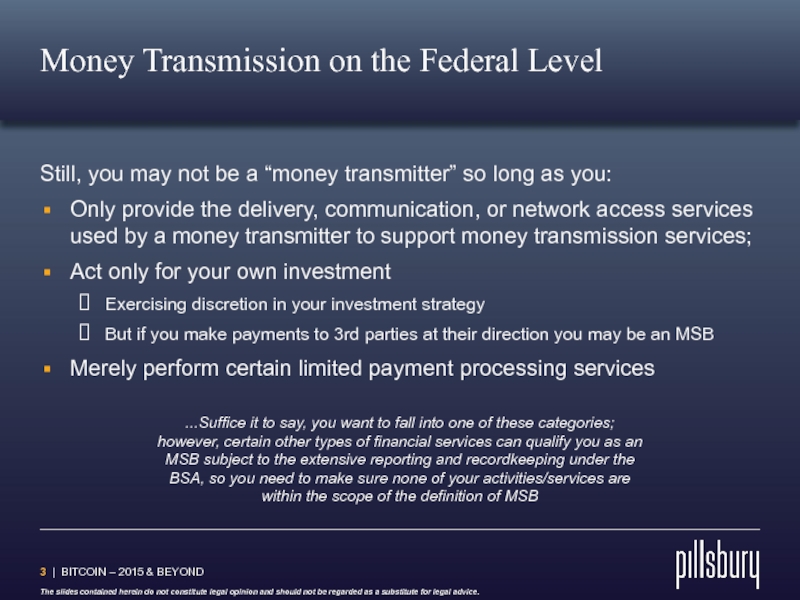

Слайд 4Money Transmission on the Federal Level

Still, you may not be a

Only provide the delivery, communication, or network access services used by a money transmitter to support money transmission services;

Act only for your own investment

Exercising discretion in your investment strategy

But if you make payments to 3rd parties at their direction you may be an MSB

Merely perform certain limited payment processing services

| BITCOIN – 2015 & BEYOND

...Suffice it to say, you want to fall into one of these categories; however, certain other types of financial services can qualify you as an MSB subject to the extensive reporting and recordkeeping under the BSA, so you need to make sure none of your activities/services are within the scope of the definition of MSB

Слайд 5Money Transmission on the State Level

The states regulate money transmitters separately

The states require not mere registration, but full blown licensure

That your business must be licensed in one state does not mean it must be licensed in any other

Not guaranteed to be awarded a license; money transmission is a privilege, not a right

| BITCOIN – 2015 & BEYOND

Слайд 6Money Transmission on the State Level

First Question: Must my business be

So long as you service or solicit that state's citizens or businesses, no matter where in the world you are, a license may be required.

Each state has its own laws on what constitutes:

“money”

“transmission”

| BITCOIN – 2015 & BEYOND

Слайд 7Money Transmission on the State Level

Second Question: Will my business be

Licensing requirements are onerous; they often include, but are not limited to:

Minimum capitalization

Six-figure bonding

Audited financial statements

Personal financial and other records of certain individual owners and executes and directions

Appropriate policies and procedures for compliance with applicable laws and regulations

| BITCOIN – 2015 & BEYOND

Слайд 8Money Transmission on the State Level

Recent Developments

Texas & Kansas recently published

Only dealings in money and monetary value are regulated.

Pure decentralized digital currency transactions are unregulated.

Exchange of Bitcoin for Litecoin? Unregulated.

Direct exchange of bitcoins for dollars between two parties? Unregulated.

Exchanges that hold dollars until customer orders are matched? Regulated.

New York recently proposed a digital currency-specific “BitLicense”

First comprehensive state-level AML program

Still only a proposal, expected effective in Q1 2015

Poorly-received criticized by the industry as overbroad and unduly restrictive

| BITCOIN – 2015 & BEYOND

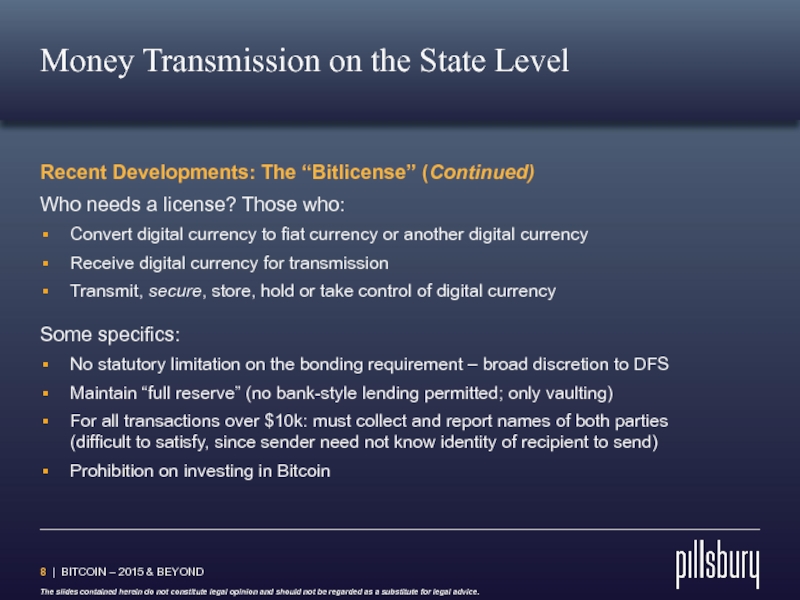

Слайд 9Money Transmission on the State Level

Recent Developments: The “Bitlicense” (Continued)

Who needs

Convert digital currency to fiat currency or another digital currency

Receive digital currency for transmission

Transmit, secure, store, hold or take control of digital currency

Some specifics:

No statutory limitation on the bonding requirement – broad discretion to DFS

Maintain “full reserve” (no bank-style lending permitted; only vaulting)

For all transactions over $10k: must collect and report names of both parties (difficult to satisfy, since sender need not know identity of recipient to send)

Prohibition on investing in Bitcoin

| BITCOIN – 2015 & BEYOND

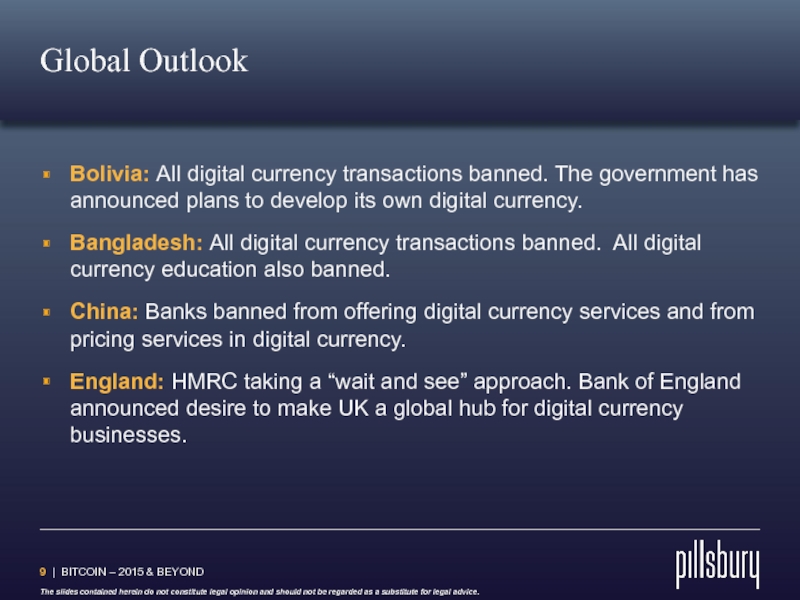

Слайд 10Global Outlook

Bolivia: All digital currency transactions banned. The government has announced

Bangladesh: All digital currency transactions banned. All digital currency education also banned.

China: Banks banned from offering digital currency services and from pricing services in digital currency.

England: HMRC taking a “wait and see” approach. Bank of England announced desire to make UK a global hub for digital currency businesses.

| BITCOIN – 2015 & BEYOND