- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Behavioral finance презентация

Содержание

- 1. Behavioral finance

- 2. PART III

- 3. Role of Investor Behavior Bounded Rationality: “satisficing”

- 4. “Irrational” Behavior of Professional Money Managers May

- 5. An Example Initial endowment: $300. Consider a

- 6. Reversal in Choice Case 1: 72% chose

- 7. Allais Paradox The Allais paradox is a choice problem

- 8. Kahneman Framework of “two minds”

- 9. Kahneman Framework of “two minds” Behavioral Finance, St. Petersburg, 2014

- 10. Kahneman Framework of “two minds”

- 11. Kahneman Framework of “two minds”

- 12. Kahneman Framework of “two minds”

- 13. Kahneman Framework of “two minds”

- 14. Kahneman Framework of “two minds”

- 15. Kahneman Framework of “two minds”

- 16. Kahneman Framework of “two minds”

- 17. SMarT Richard Thaler Save More TomorrowTM

- 18. SMarT There are four ingredients to the

- 19. SMarT 3. The contribution rate continues to

- 20. SMarT In the first case study of

- 21. SMarT “The lesson of the experience with

Слайд 1Behavioral Finance

Utevskaya Marina Valerievna

PhD

Saint-Petersburg State University of Economics

Associate Professor, Corporate Finance

Director of International Master Program “Corporate Finance, Control and Risks”

Слайд 3Role of Investor Behavior

Bounded Rationality: “satisficing” behavior. Information processing limitations. Example:

Investor Sentiment: beliefs based on heuristics rather than Bayesian rationality.

Investors may react to “irrelevant information” and hence may trade on “noise” rather than information.

Слайд 4“Irrational” Behavior of Professional Money Managers

May choose a portfolio very close

Herding: may select stocks that other managers select to avoid “falling behind” and “looking bad”.

Window-dressing: add to the portfolio stocks that have done well in the recent past and sell stocks that have recently done poorly.

Слайд 5An Example

Initial endowment: $300. Consider a choice between:

a sure gain of

a 50% chance to gain $200, a 50% chance to gain $0.

Initial endowment: $500. Consider a choice between:

a sure loss of $100

a 50% chance to lose $200, a 50% chance to lose $0.

Слайд 6Reversal in Choice

Case 1: 72% chose option 1, 28% chose option

Case 2: 36% chose option 1, 64% chose option 2.

=> A reversal in Choice

Problem framed as a gain: decision maker is risk averse.

Problem framed as a loss: decision maker is risk seeking.

Слайд 7Allais Paradox

The Allais paradox is a choice problem designed by Maurice Allais (1953) to show

The Allais paradox arises when comparing participants' choices in two different experiments, each of which consists of a choice between two gambles, A and B.

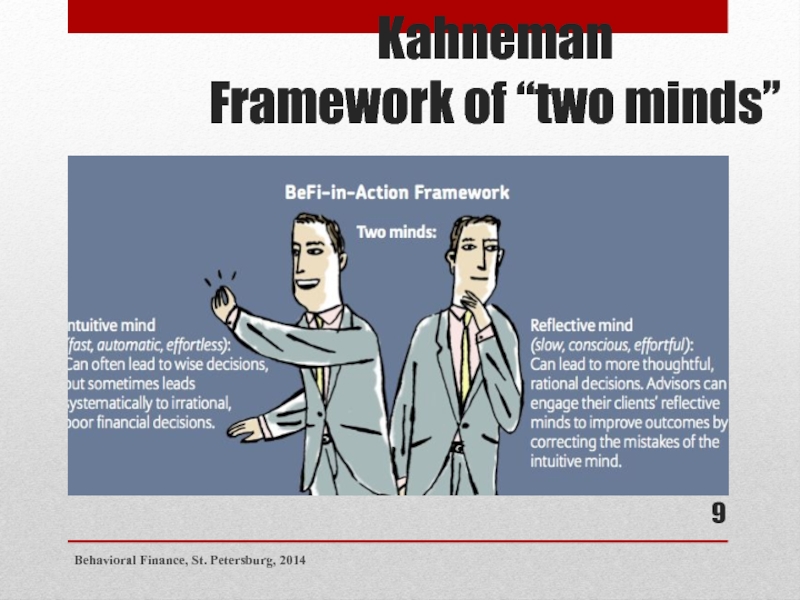

Слайд 8Kahneman

Framework of “two minds”

to describe the way people make

an “intuitive” mind: rapid judgments with great ease and with no conscious input

“reflective” mind: slow, analytical and requires conscious effort

Behavioral Finance, St. Petersburg, 2014

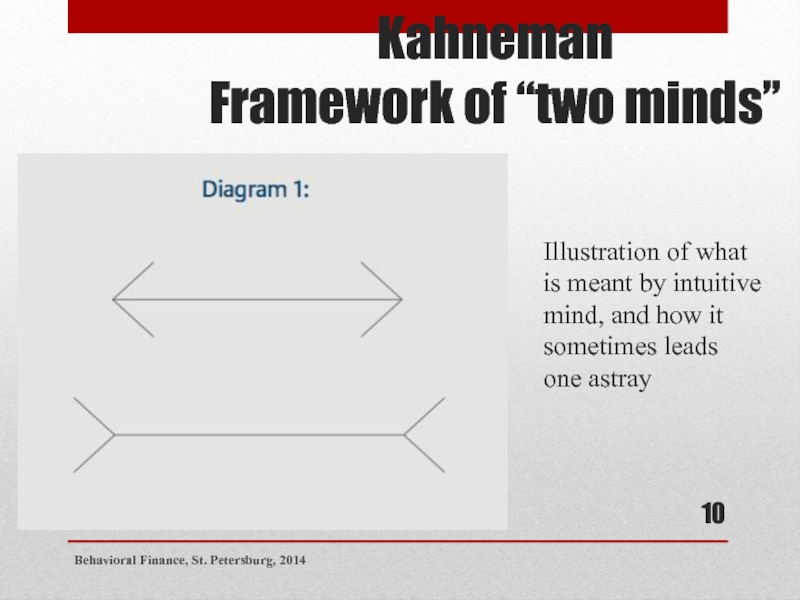

Слайд 10Kahneman

Framework of “two minds”

Illustration of what is meant by

Behavioral Finance, St. Petersburg, 2014

Слайд 11Kahneman

Framework of “two minds”

One of the insights that earned

These illusions, also known as biases, result from the use of heuristics, or, more simply, mental shortcuts.

Kahneman’s discovery that under certain circumstances intuition can systematically lead to incorrect decisions and judgments changed psychologists’ understanding of decision making, and, ultimately, economists’, too.

Behavioral Finance, St. Petersburg, 2014

Слайд 12Kahneman

Framework of “two minds”

Behavioral economics showed instead that we

It is not that people are irrational in the colloquial sense, but that by the nature of how our intuitive mind works we are susceptible to mental shortcuts that lead to erroneous decisions.

Our intuitive mind delivers the products of these mental shortcuts to us, and we accept them. It’s hard to help ourselves.

Behavioral Finance, St. Petersburg, 2014

Слайд 13Kahneman

Framework of “two minds”

Loss aversion:

described by Prospect Theory

losses loom larger than equal-sized gains

loss aversion affects many of our decisions, including financial ones

Behavioral Finance, St. Petersburg, 2014

Слайд 14Kahneman

Framework of “two minds”

EXAMPLE

Selling a losing stock is extremely

People often sell winning stocks too soon because the act of selling a winning stock realizes a gain, and that gives us pleasure.

The mistake people are making here is one of mental accounting: instead of looking at their portfolio “as a whole” they look at each stock separately, and make decisions based on these separately perceived realities.

Behavioral Finance, St. Petersburg, 2014

Слайд 15Kahneman

Framework of “two minds”

Loss aversion also makes people reluctant

Inertia is at play when people know they should be doing certain things that are in their best interests (saving for retirement, dieting to lose weight, or exercising), but find it hard to do today.

Behavioral Finance, St. Petersburg, 2014

Слайд 16Kahneman

Framework of “two minds”

“We make intuitive judgments all the

Behavioral Finance, St. Petersburg, 2014

Слайд 17SMarT

Richard Thaler

Save More TomorrowTM program (SMarT)

An alarmingly large proportion of

SMarT effectively removes psychological obstacles to saving in the short and longer term, and helps people overcome them with very little effort on their part

Behavioral Finance, St. Petersburg, 2014

Слайд 18SMarT

There are four ingredients to the program:

Employees are invited to pre-commit

For those employees who do enroll, their first increase in savings coincides with a pay raise so that their take- home pay does not go down. This avoids triggering the mind’s hypersensitivity to loss, or loss aversion.

Behavioral Finance, St. Petersburg, 2014

Слайд 19SMarT

3. The contribution rate continues to increase automati- cally with each

4. Employees may opt out of the plan at any time they choose, though experience shows that people rarely do. This provision makes them more comfortable about joining in the first place.

Behavioral Finance, St. Petersburg, 2014

Слайд 20SMarT

In the first case study of SMarT, employees at a midsize

Behavioral Finance, St. Petersburg, 2014

Слайд 21SMarT

“The lesson of the experience with the SMarT program, therefore, is

Financial advisors can take advantage of such insights in their own practices to help their clients make better decisions which, ultimately, should lead to better financial outcomes.

Behavioral Finance, St. Petersburg, 2014