- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Experian Consumer Tax Survey Report презентация

Содержание

- 1. Experian Consumer Tax Survey Report

- 2. RESEARCH OBJECTIVE: To garner

- 3. Tax filing, document storage and refunds continue

- 4. Tax Filing & Refunds

- 5. Most prepare their own taxes on their

- 6. Tax filing has become increasingly electronic

- 7. Q9: What do you do with

- 8. Q21: How much of a tax refund,

- 9. Tax-Related Identity Theft

- 10. Consumers are increasingly aware of tax-related

- 11. Q19: To what extent do

- 12. There is limited awareness of new

- 13. Q20: What is the one

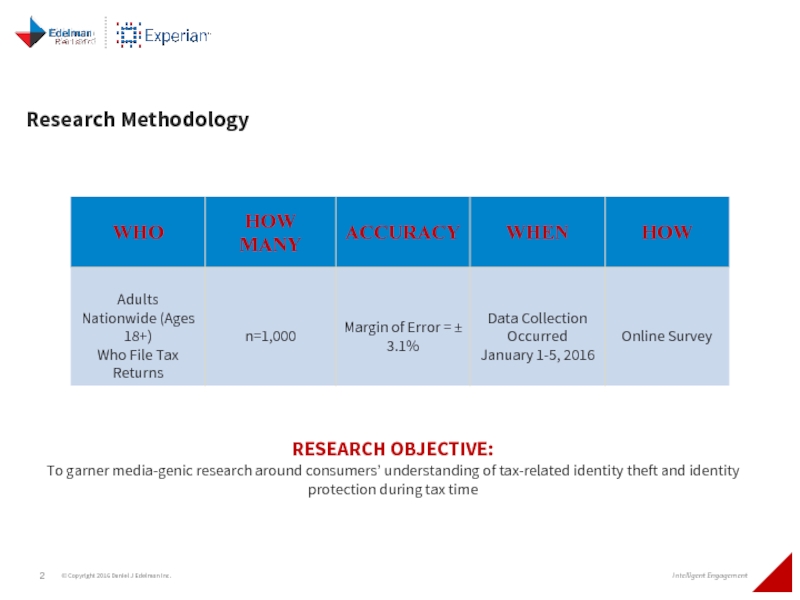

Слайд 2

RESEARCH OBJECTIVE:

To garner media-genic research around consumers’ understanding of tax-related

Research Methodology

Слайд 3Tax filing, document storage and refunds continue to be increasingly electronic.

79%

18% scan and save their tax documents electronically, up from 6% in 2011.

More than three quarters of respondents have used EFT for tax refunds.

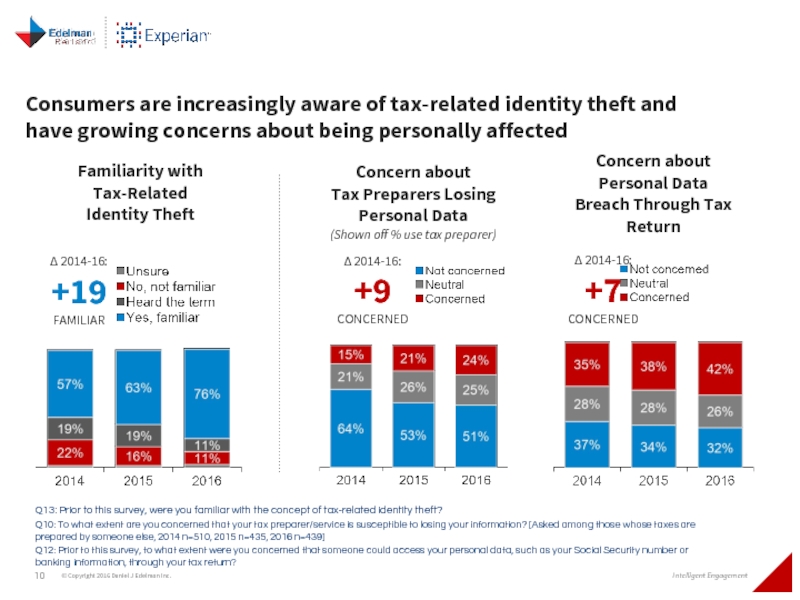

Consumer familiarity with tax-related identity theft has risen significantly in recent years and tax-filers are increasingly concerned about being affected.

76% are familiar with tax-related identity theft, up from 57% in 2014.

42% are concerned that someone could access their personal data through their tax return, up from 35% in 2014.

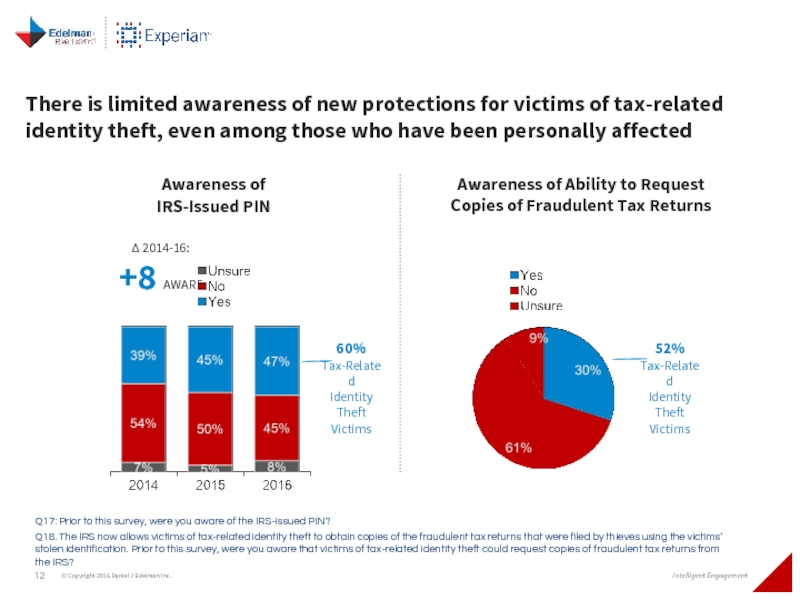

Awareness of the IRS-issued PIN continues to grow over time, but most are still unfamiliar with the newer protections available to victims of tax-related identity theft.

Less than half of tax-filers are aware of the IRS-issued PIN (47%) or victims’ ability to request copies of fraudulent tax returns (30%).

Still, there is consumer interest in using an IRS-issued PIN to protect their identity during tax season.

Key Findings

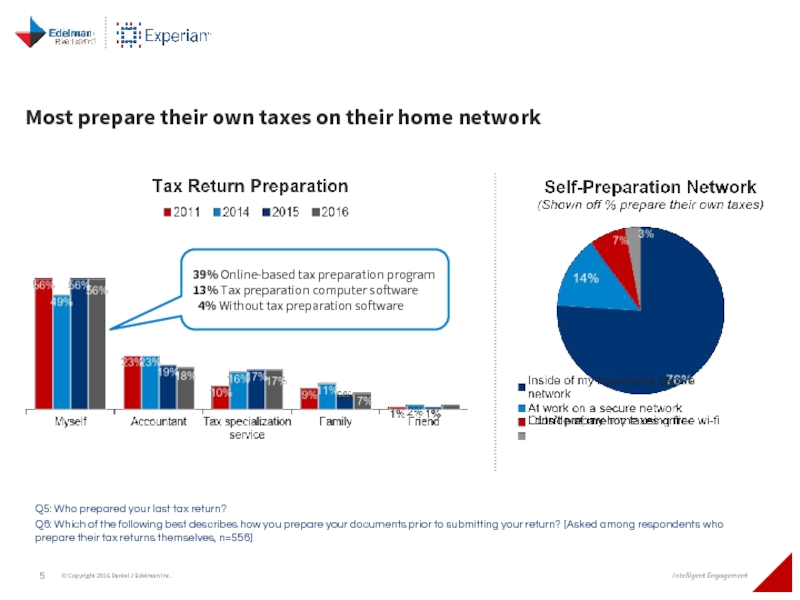

Слайд 5Most prepare their own taxes on their home network

39% Online-based tax

13% Tax preparation computer software

4% Without tax preparation software

Q5: Who prepared your last tax return?

Q6: Which of the following best describes how you prepare your documents prior to submitting your return? [Asked among respondents who prepare their tax returns themselves, n=556]

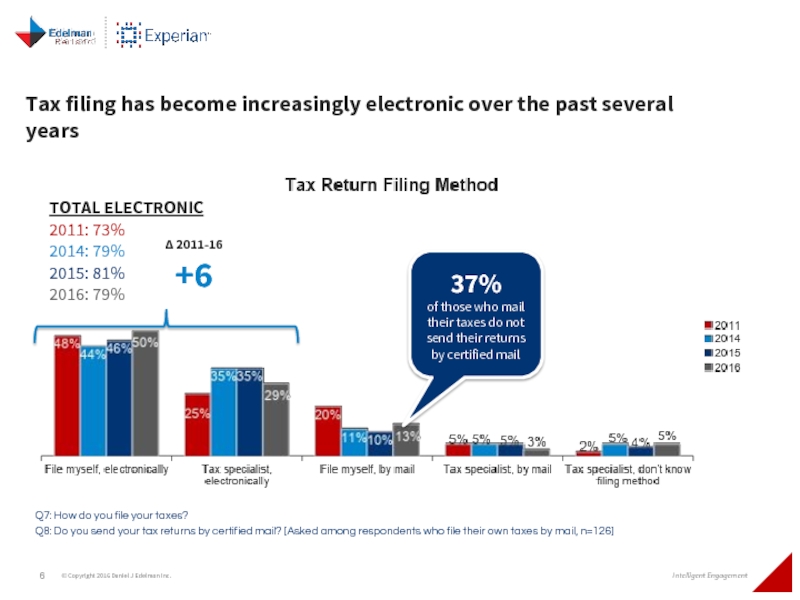

Слайд 6

Tax filing has become increasingly electronic over the past several years

37%

of those who mail their taxes do not send their returns by certified mail

Q7: How do you file your taxes?

Q8: Do you send your tax returns by certified mail? [Asked among respondents who file their own taxes by mail, n=126]

TOTAL ELECTRONIC

2011: 73%

2014: 79%

2015: 81%

2016: 79%

Δ 2011-16

+6

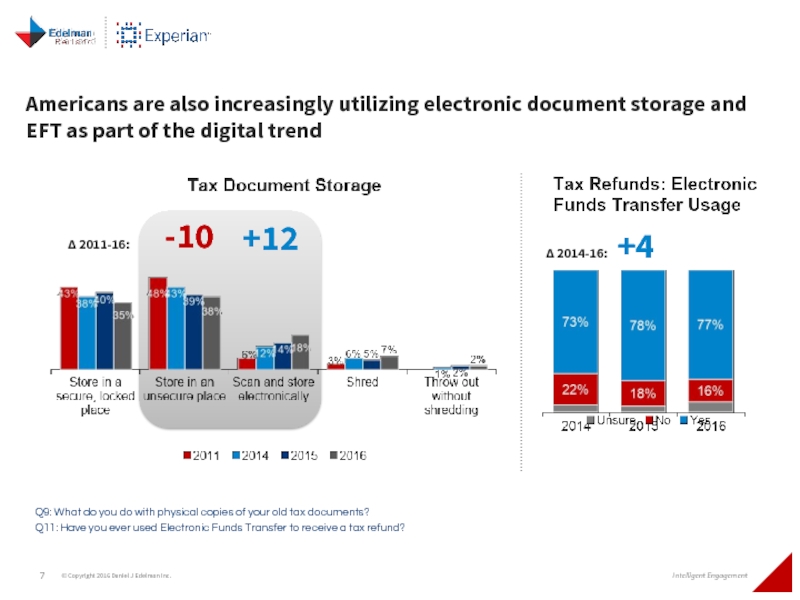

Слайд 7

Q9: What do you do with physical copies of your old

Q11: Have you ever used Electronic Funds Transfer to receive a tax refund?

Americans are also increasingly utilizing electronic document storage and EFT as part of the digital trend

-10

+12

Δ 2011-16:

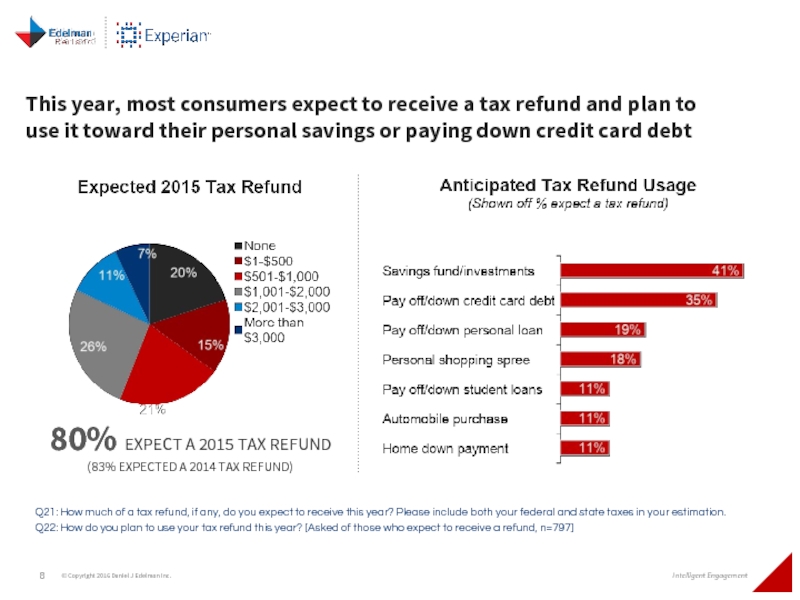

Слайд 8Q21: How much of a tax refund, if any, do you

Q22: How do you plan to use your tax refund this year? [Asked of those who expect to receive a refund, n=797]

This year, most consumers expect to receive a tax refund and plan to use it toward their personal savings or paying down credit card debt

80% EXPECT A 2015 TAX REFUND

(83% EXPECTED A 2014 TAX REFUND)

Слайд 10

Consumers are increasingly aware of tax-related identity theft and have growing

Q13: Prior to this survey, were you familiar with the concept of tax-related identity theft?

Q10: To what extent are you concerned that your tax preparer/service is susceptible to losing your information? [Asked among those whose taxes are prepared by someone else, 2014 n=510, 2015 n=435, 2016 n=439]

Q12: Prior to this survey, to what extent were you concerned that someone could access your personal data, such as your Social Security number or banking information, through your tax return?

Familiarity with Tax-Related Identity Theft

Δ 2014-16:

+19 FAMILIAR

Concern about

Tax Preparers Losing Personal Data

(Shown off % use tax preparer)

Concern about Personal Data Breach Through Tax Return

Δ 2014-16:

+7 CONCERNED

Δ 2014-16:

+9 CONCERNED

Слайд 11

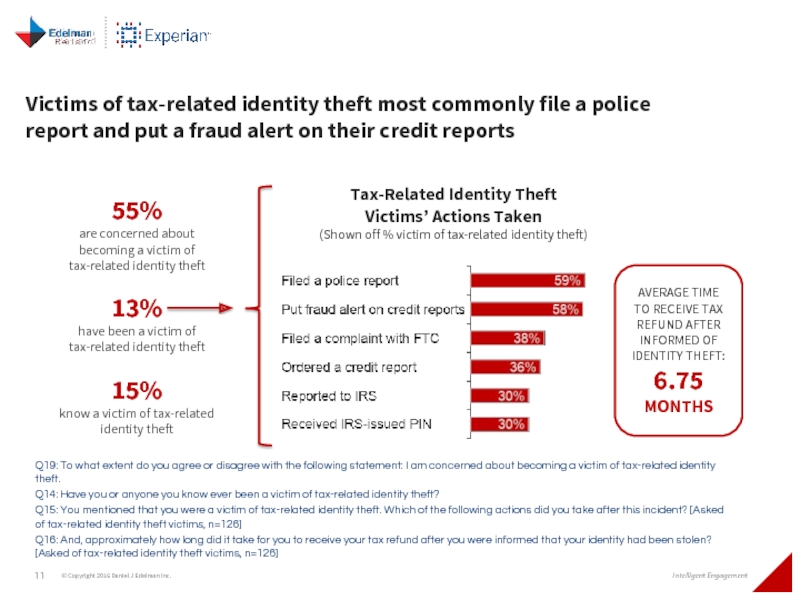

Q19: To what extent do you agree or disagree with the

Q14: Have you or anyone you know ever been a victim of tax-related identity theft?

Q15: You mentioned that you were a victim of tax-related identity theft. Which of the following actions did you take after this incident? [Asked of tax-related identity theft victims, n=126]

Q16: And, approximately how long did it take for you to receive your tax refund after you were informed that your identity had been stolen? [Asked of tax-related identity theft victims, n=126]

55%

are concerned about becoming a victim of tax-related identity theft

13%

have been a victim of tax-related identity theft

15%

know a victim of tax-related identity theft

Victims of tax-related identity theft most commonly file a police report and put a fraud alert on their credit reports

AVERAGE TIME TO RECEIVE TAX REFUND AFTER INFORMED OF IDENTITY THEFT:

6.75 MONTHS

Tax-Related Identity Theft

Victims’ Actions Taken

(Shown off % victim of tax-related identity theft)

Слайд 12

There is limited awareness of new protections for victims of tax-related

Awareness of

IRS-Issued PIN

Q17: Prior to this survey, were you aware of the IRS-issued PIN?

Q18. The IRS now allows victims of tax-related identity theft to obtain copies of the fraudulent tax returns that were filed by thieves using the victims’ stolen identification. Prior to this survey, were you aware that victims of tax-related identity theft could request copies of fraudulent tax returns from the IRS?

Δ 2014-16:

+8 AWARE

Awareness of Ability to Request Copies of Fraudulent Tax Returns

60%

Tax-Related

Identity Theft

Victims

52%

Tax-Related

Identity Theft

Victims

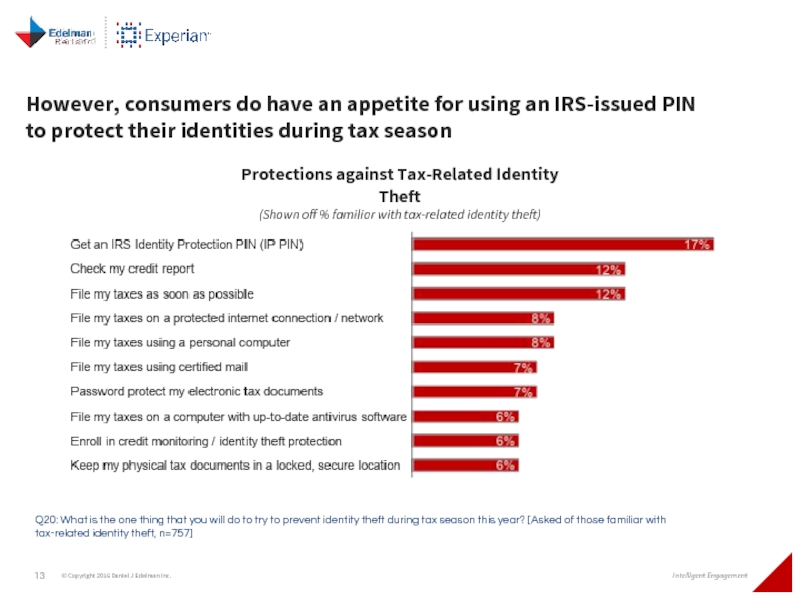

Слайд 13

Q20: What is the one thing that you will do to

Protections against Tax-Related Identity Theft

(Shown off % familiar with tax-related identity theft)

However, consumers do have an appetite for using an IRS-issued PIN to protect their identities during tax season