- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

7 Reasons is a Buy презентация

Содержание

- 1. 7 Reasons is a Buy

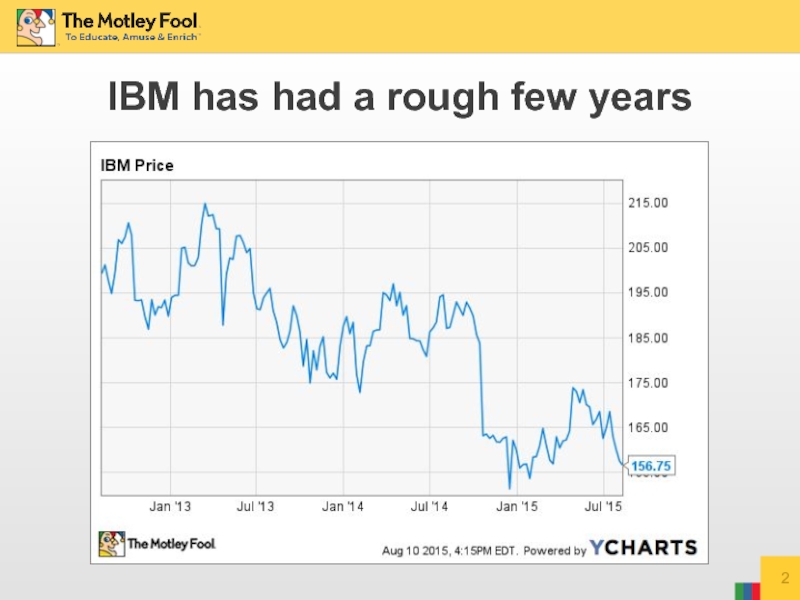

- 2. IBM has had a rough few years

- 3. But for long-term

- 4. 1) IBM’s competitive advantage Roughly 80%

- 5. IBM clients include More than 90% of

- 6. 2) An attractive valuation With 2015 operating

- 7. 3) A fast growing cloud IBM is

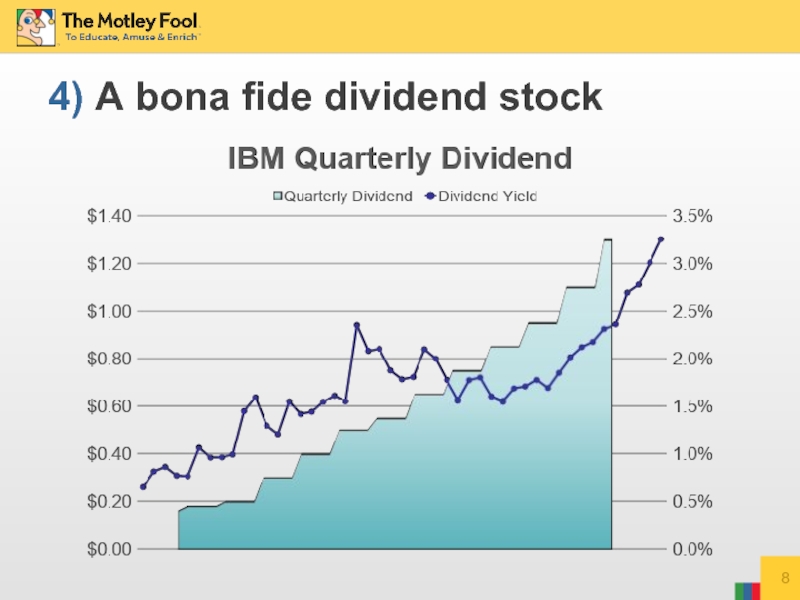

- 8. 4) A bona fide dividend stock

- 9. One of the best big tech dividends

- 10. 5) A big push into healthcare One

- 11. 6) Software could raise margins Over the

- 12. 7) The potential of OpenPOWER IBM’s

- 13. You may also enjoy… This

Слайд 3 But for long-term investors, there are plenty of reasons to take

advantage of IBM’s stock slump

Слайд 41) IBM’s competitive advantage

Roughly 80% of IBM’s revenue comes from

clients deploying hardware, software, and services

IBM’s ability to deliver integrated solutions is the key to its economic moat

Industries like banking and retail depend on IBM’s mainframe systems, and switching to a competing solution would be infeasible in most cases

IBM’s ability to deliver integrated solutions is the key to its economic moat

Industries like banking and retail depend on IBM’s mainframe systems, and switching to a competing solution would be infeasible in most cases

Слайд 5IBM clients include

More than 90% of the top 100 banks

9 of

the top 10 oil and gas companies

80% of the global top 50 retailers

92 of the top 100 healthcare organizations

9 of the top 10 telecom companies

Hundreds of state and local governments

80% of the global top 50 retailers

92 of the top 100 healthcare organizations

9 of the top 10 telecom companies

Hundreds of state and local governments

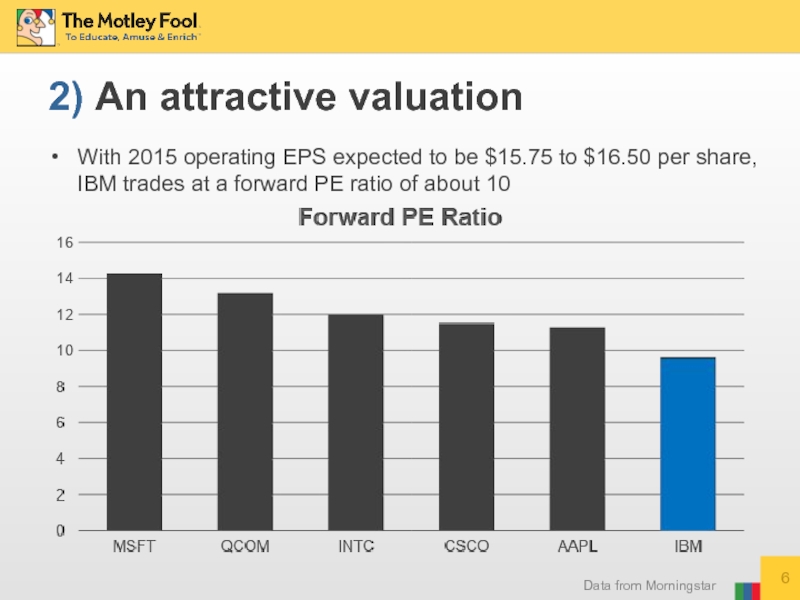

Слайд 62) An attractive valuation

With 2015 operating EPS expected to be $15.75

to $16.50 per share, IBM trades at a forward PE ratio of about 10

Data from Morningstar

Слайд 73) A fast growing cloud

IBM is investing in strategic imperatives, areas

that will drive most of its growth going forward

IBM generated $8.7 billion from its cloud business over the past twelve months, including hardware, software, and services

This number grew by 50% year-over-year during IBM’s latest quarter, and IBM is actively making strategic acquisitions

IBM’s cloud revenue delivered as service has reached an annual run rate of $4.5 billion

IBM generated $8.7 billion from its cloud business over the past twelve months, including hardware, software, and services

This number grew by 50% year-over-year during IBM’s latest quarter, and IBM is actively making strategic acquisitions

IBM’s cloud revenue delivered as service has reached an annual run rate of $4.5 billion

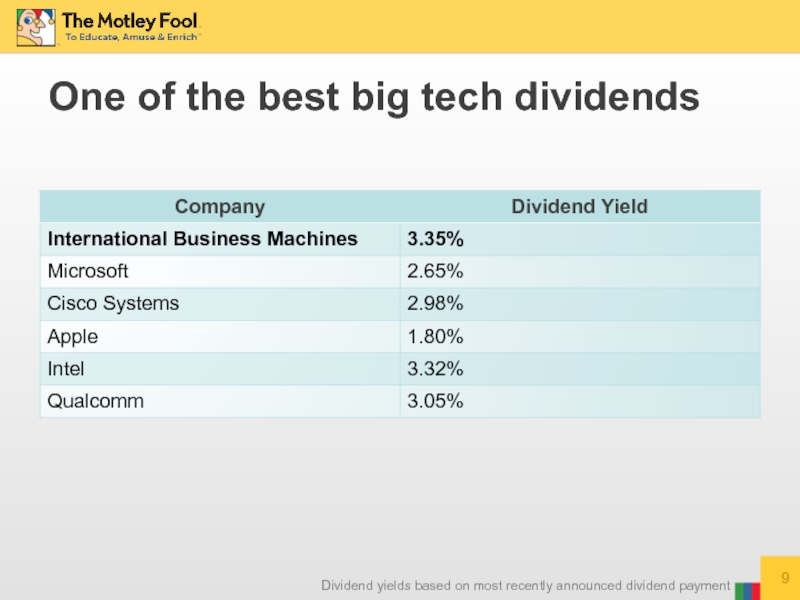

Слайд 9One of the best big tech dividends

Dividend yields based on most

recently announced dividend payment

Слайд 105) A big push into healthcare

One of IBM’s largest opportunities is

the healthcare industry

Watson, IBM’s machine learning system, is being used by cancer institutes to analyze vast troves of data and provide personalized treatment options

IBM’s Watson Health unit has entered partnerships with Apple, Medtronic, Johnson & Johnson, and CVS Health

The $700 million acquisition of Merge Healthcare combines Watson with Merge’s medical imaging management platform

IBM’s goal is for Watson to become a critical tool for the multi-trillion dollar healthcare industry

Watson, IBM’s machine learning system, is being used by cancer institutes to analyze vast troves of data and provide personalized treatment options

IBM’s Watson Health unit has entered partnerships with Apple, Medtronic, Johnson & Johnson, and CVS Health

The $700 million acquisition of Merge Healthcare combines Watson with Merge’s medical imaging management platform

IBM’s goal is for Watson to become a critical tool for the multi-trillion dollar healthcare industry

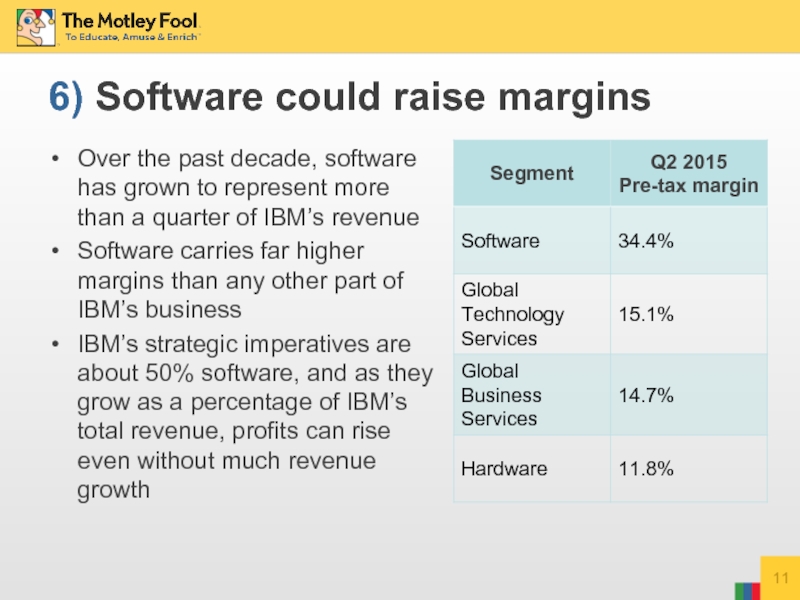

Слайд 116) Software could raise margins

Over the past decade, software has grown

to represent more than a quarter of IBM’s revenue

Software carries far higher margins than any other part of IBM’s business

IBM’s strategic imperatives are about 50% software, and as they grow as a percentage of IBM’s total revenue, profits can rise even without much revenue growth

Software carries far higher margins than any other part of IBM’s business

IBM’s strategic imperatives are about 50% software, and as they grow as a percentage of IBM’s total revenue, profits can rise even without much revenue growth

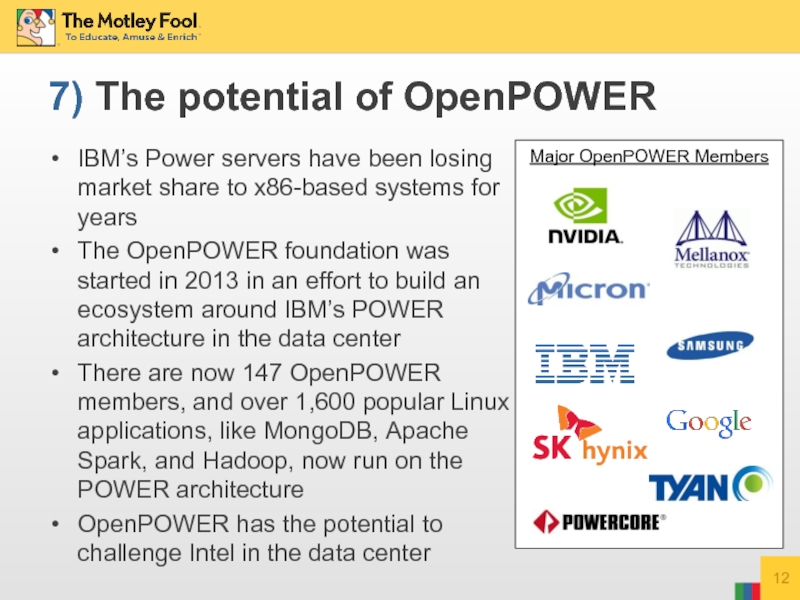

Слайд 12

7) The potential of OpenPOWER

IBM’s Power servers have been losing market

share to x86-based systems for years

The OpenPOWER foundation was started in 2013 in an effort to build an ecosystem around IBM’s POWER architecture in the data center

There are now 147 OpenPOWER members, and over 1,600 popular Linux applications, like MongoDB, Apache Spark, and Hadoop, now run on the POWER architecture

OpenPOWER has the potential to challenge Intel in the data center

The OpenPOWER foundation was started in 2013 in an effort to build an ecosystem around IBM’s POWER architecture in the data center

There are now 147 OpenPOWER members, and over 1,600 popular Linux applications, like MongoDB, Apache Spark, and Hadoop, now run on the POWER architecture

OpenPOWER has the potential to challenge Intel in the data center

Major OpenPOWER Members

Слайд 13You may also enjoy… This $19 trillion industry could destroy the Internet CLICK

HERE TO READ NOW