- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

5 Signs Your Dividend Stocks Might Be In Trouble презентация

Содержание

- 1. 5 Signs Your Dividend Stocks Might Be In Trouble

- 2. Many investors look at dividend stocks as

- 3. 1. High payout ratio For example,

- 4. The lower the payout ratio, the easier

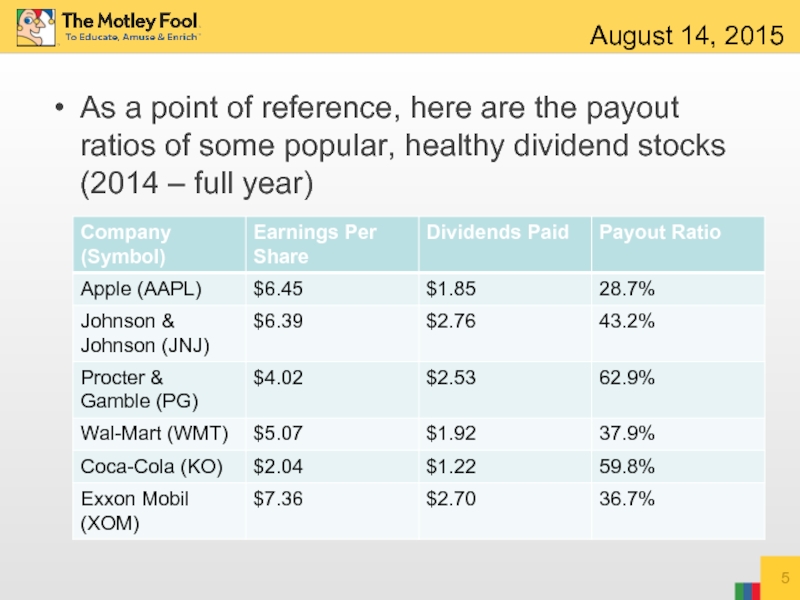

- 5. As a point of reference, here are

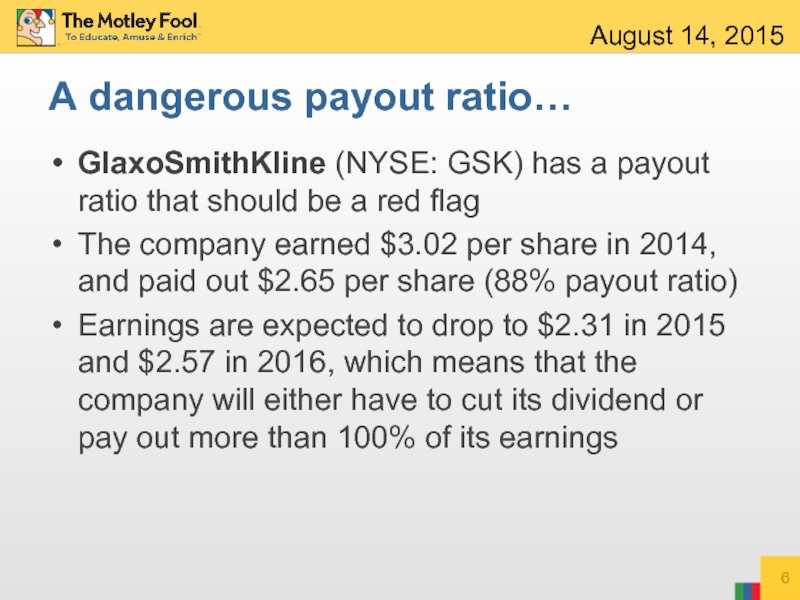

- 6. GlaxoSmithKline (NYSE: GSK) has a payout ratio

- 7. 2. Increasing debt / High leverage If

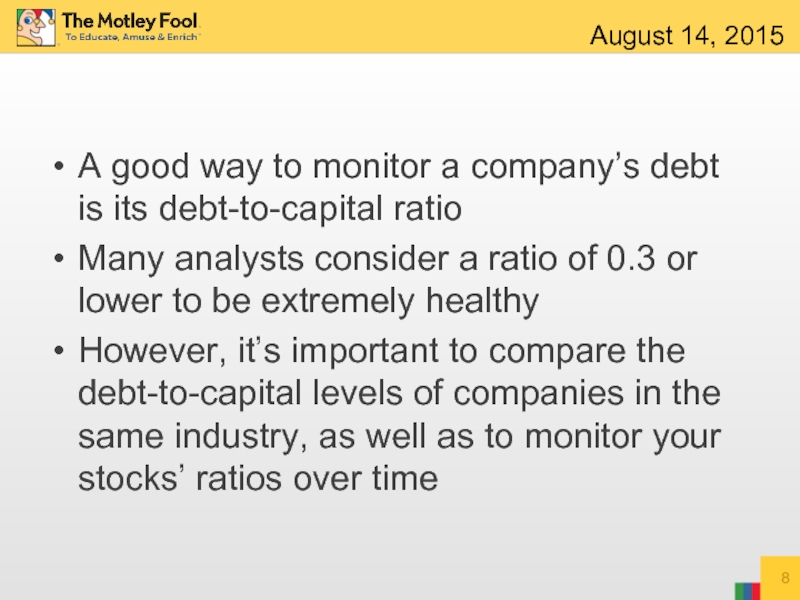

- 8. A good way to monitor a company’s

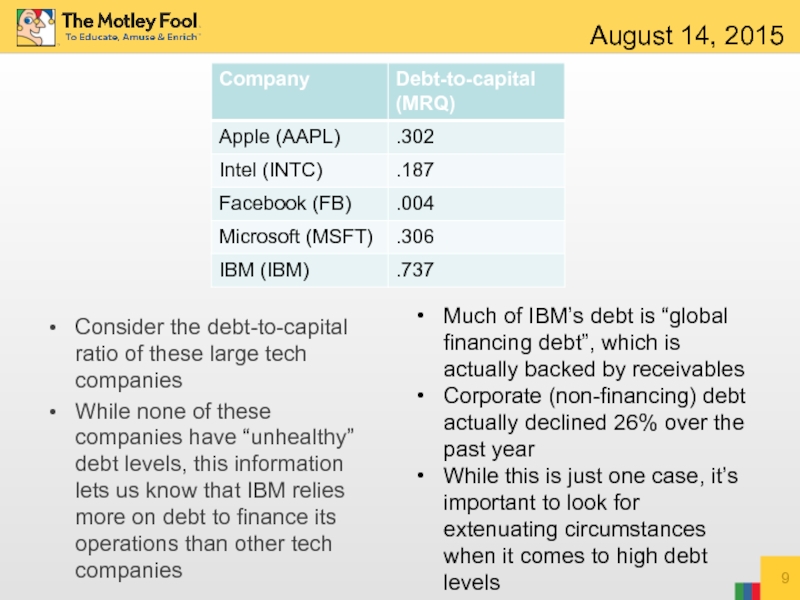

- 9. Consider the debt-to-capital ratio of these

- 10. On the other hand,

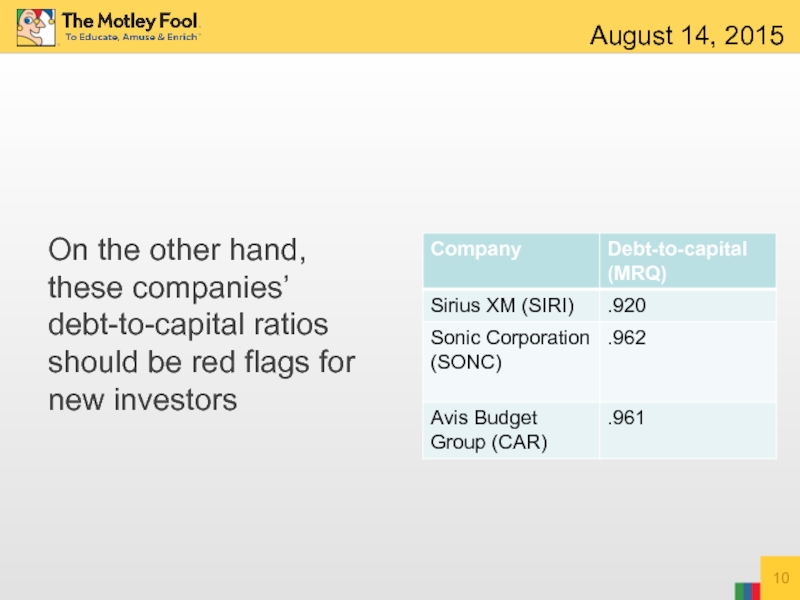

- 11. 3. An “unhealthy” industry Trouble within an

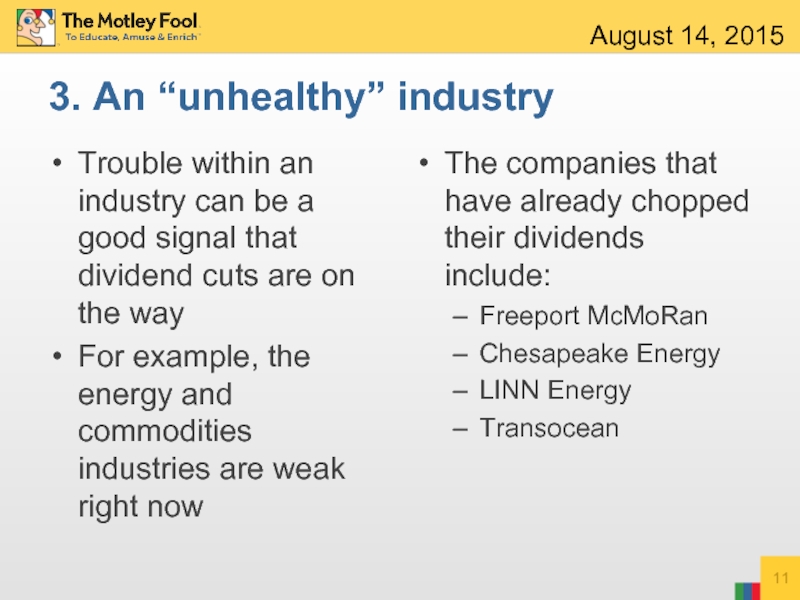

- 12. 4. Recent dividend cuts If a company

- 13. While a dividend cut isn’t necessarily the

- 14. On the other hand, some companies experience

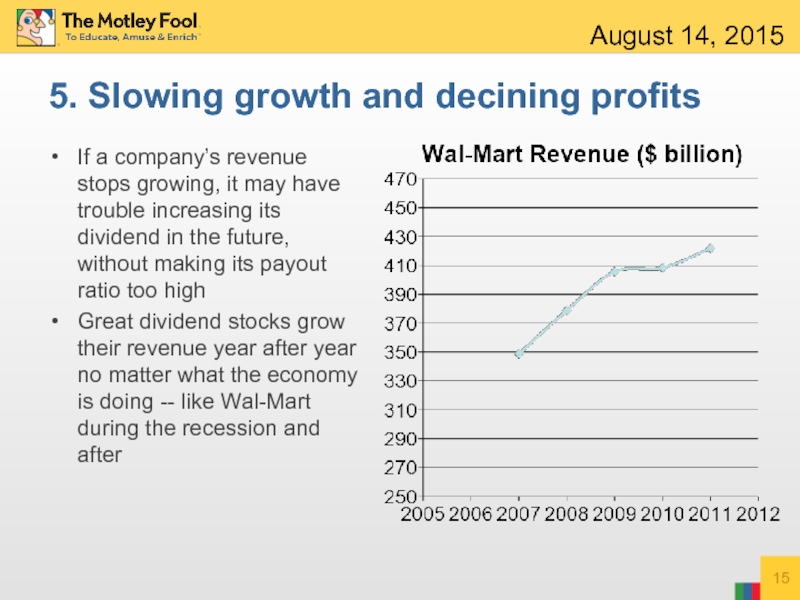

- 15. 5. Slowing growth and decining profits If

- 16. Declining profitability Declining profits (earnings per

- 17. You may also like… The $60,000

Слайд 2Many investors look at dividend stocks as a safe way to

While this may be true for many stocks, there are many red flags to be aware of

Слайд 31. High payout ratio

For example, if a certain company earns $1.00

August 14, 2015

Слайд 4The lower the payout ratio, the easier it is for a

In general, I like to invest in companies with payout ratios below 50%

Be particularly wary of companies whose payout ratios are close to or more than 100%

(Note: certain stocks, like REITs, are required to pay out the majority of their earnings, so a high payout ratio isn’t necessarily bad for these companies.)

August 14, 2015

Слайд 5As a point of reference, here are the payout ratios of

August 14, 2015

Слайд 6GlaxoSmithKline (NYSE: GSK) has a payout ratio that should be a

The company earned $3.02 per share in 2014, and paid out $2.65 per share (88% payout ratio)

Earnings are expected to drop to $2.31 in 2015 and $2.57 in 2016, which means that the company will either have to cut its dividend or pay out more than 100% of its earnings

August 14, 2015

A dangerous payout ratio…

Слайд 72. Increasing debt / High leverage

If a company’s debt starts to

High debt payments can eat into a company’s ability to pay dividends and force cuts

Also, companies whose business models involve high uses of debt (leverage) to achieve profitability tend to be volatile dividend stocks

Mortgage REITs are a good example

August 14, 2015

Слайд 8A good way to monitor a company’s debt is its debt-to-capital

Many analysts consider a ratio of 0.3 or lower to be extremely healthy

However, it’s important to compare the debt-to-capital levels of companies in the same industry, as well as to monitor your stocks’ ratios over time

August 14, 2015

Слайд 9

Consider the debt-to-capital ratio of these large tech companies

While none of

August 14, 2015

Much of IBM’s debt is “global financing debt”, which is actually backed by receivables

Corporate (non-financing) debt actually declined 26% over the past year

While this is just one case, it’s important to look for extenuating circumstances when it comes to high debt levels

Слайд 10

On the other hand, these companies’ debt-to-capital ratios should be red

August 14, 2015

Слайд 113. An “unhealthy” industry

Trouble within an industry can be a good

For example, the energy and commodities industries are weak right now

The companies that have already chopped their dividends include:

Freeport McMoRan

Chesapeake Energy

LINN Energy

Transocean

August 14, 2015

Слайд 124. Recent dividend cuts

If a company is forced to make a

Or, if the company has historically increased its payout every year, not doing so all of a sudden can be a sign of trouble

Companies cut dividends for a variety of reasons including

Falling revenue

Increasing expenses

Decision to reinvest more capital in the business

August 14, 2015

Слайд 13While a dividend cut isn’t necessarily the wrong move in 100%

For example, many energy companies have slashed dividends in the wake of plunging oil prices (bad news)

August 14, 2015

Слайд 14On the other hand, some companies experience temporary cash flow issues

Wynn Resorts (WYNN) is a good example of this, in my opinion

In April, Wynn cut its quarterly dividend from $1.50 to $0.50 per share, on the heels of declining revenue in Macau and slow growth in Las Vegas.

The company is investing $5 billion in new resorts over the next few years, and Steve Wynn refuses to use debt financing to pay a dividend.

Instead, the company will focus its cash on creating long-term value for its shareholders.

August 14, 2015

Слайд 155. Slowing growth and decining profits

If a company’s revenue stops growing,

Great dividend stocks grow their revenue year after year no matter what the economy is doing -- like Wal-Mart during the recession and after

August 14, 2015

Слайд 16 Declining profitability

Declining profits (earnings per share) can be a red

Profits can fall, even if revenue continues to rise

Potential reasons for lower profitability include

Litigation expenses (like most of the banking industry over the past several years)

Increased regulatory costs

Poor management of operating expenses

August 14, 2015