- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

4 Great Stocks For Beginners презентация

Содержание

- 1. 4 Great Stocks For Beginners

- 2. What makes a good “beginner” stock? July 17, 2015

- 3. The best stocks for beginners won’t make

- 4. Look for businesses will be around forever

- 5. Ideally, stocks for beginners will make their

- 6. Stocks with a history of dividend increases

- 7. 4 “Beginner” stocks to get you started… July 17, 2015

- 8. 1. Berkshire Hathaway (NYSE: BRK.B) Berkshire Hathaway

- 9. Berkshire Hathaway has more than 50 subsidiary

- 10. Just a few of Berkshire’s subsidiaries… GEICO

- 11. Some of Berkshire’s major stock holdings… American

- 12. 2. Colgate-Palmolive (NYSE: CL) Colgate-Palmolive produces many

- 13. Colgate Palmolive is a “dividend aristocrat”, which

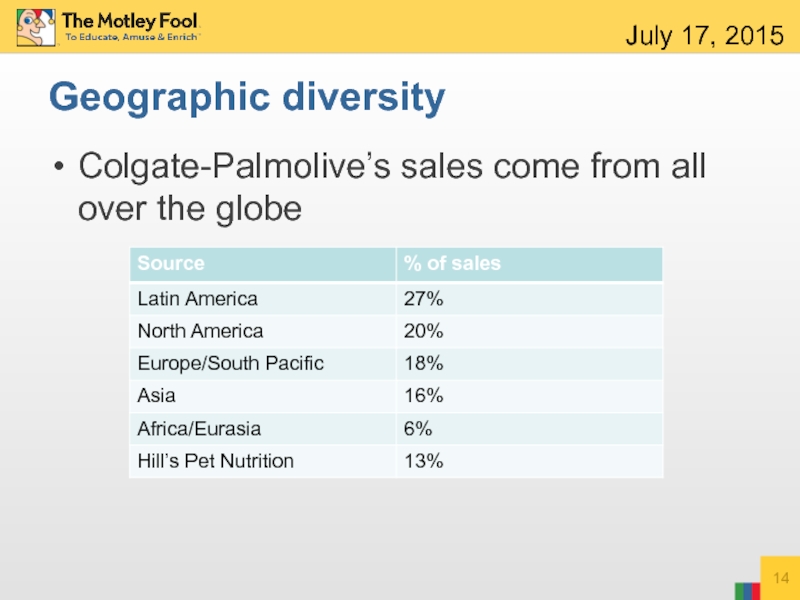

- 14. Colgate-Palmolive’s sales come from all over the globe July 17, 2015 Geographic diversity

- 15. Colgate has steadily grown its sales over

- 16. 3. ExxonMobil (NYSE: XOM) The largest publicly-traded

- 17. ExxonMobil has exposure to all aspects of

- 18. During tough times, ExxonMobil has the ability

- 19. In terms of valuation, not only has

- 20. 4. Johnson & Johnson (NYSE: JNJ) In

- 21. J&J’s size and brand power are tremendous

- 22. Johnson & Johnson has an outstanding 53-year

- 23. SFR CLICK HERE TO READ NOW

Слайд 3The best stocks for beginners won’t make you rich overnight, but

Look for companies with a steady track record of growing revenue and low debt levels

Low risk

Слайд 4Look for businesses will be around forever

For example, people will always

However, will people always buy a specific high-end brand of clothing? Or, will people always need to buy desktop computers? Maybe, but maybe not

July 17, 2015

“100-year” businesses

Слайд 5Ideally, stocks for beginners will make their money from a variety

Geographical diversity is important too

For example, companies that do a lot of business overseas are better-positioned to deal with a U.S. recession

July 17, 2015

A diverse revenue stream

Слайд 6Stocks with a history of dividend increases tend to make solid

And, only invest in businesses that are easily understood, at least while you’re just getting started

Basically, beginners should focus on building a good foundation. There may come a time when it’s okay to take some higher risks, but it isn’t a good idea while you’re new

July 17, 2015

Other things to look for…

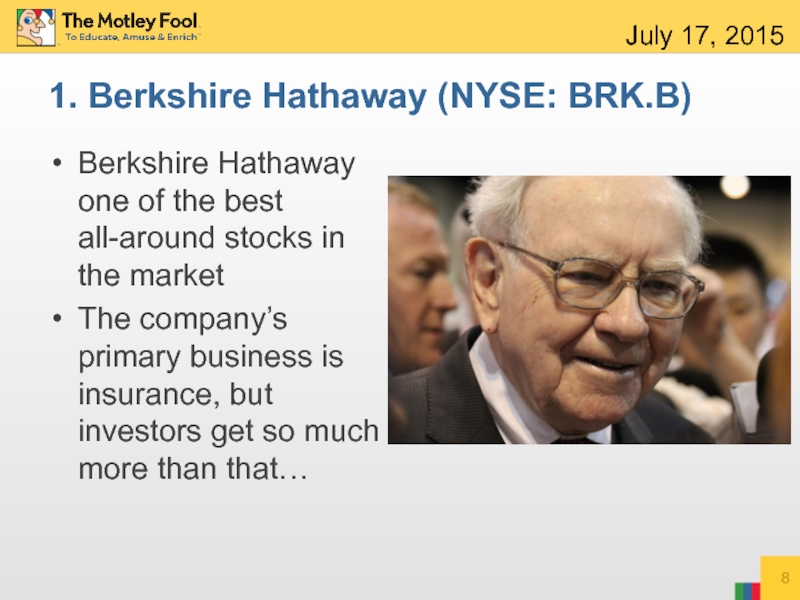

Слайд 81. Berkshire Hathaway (NYSE: BRK.B)

Berkshire Hathaway one of the best all-around

The company’s primary business is insurance, but investors get so much more than that…

July 17, 2015

Слайд 9Berkshire Hathaway has more than 50 subsidiary companies, as well as

Essentially, by investing in Berkshire Hathaway, you are buying an all-in-one diversified investment portfolio

July 17, 2015

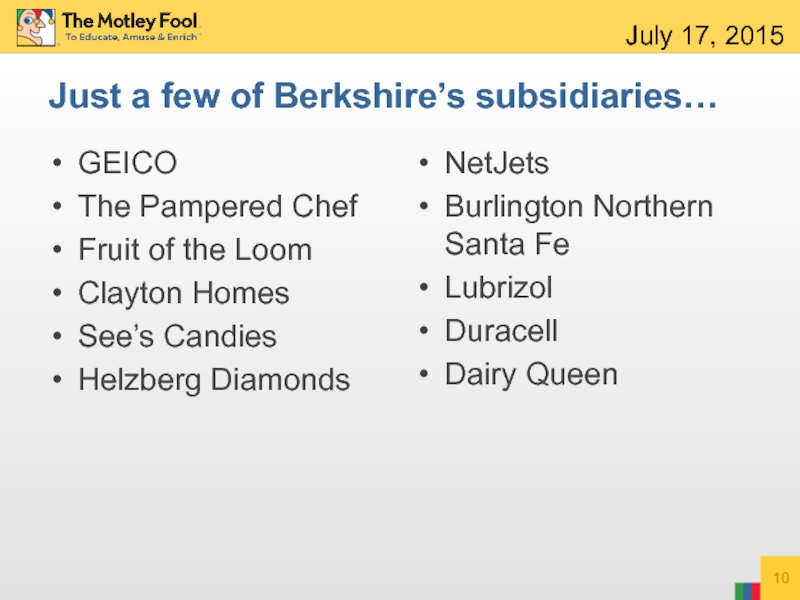

Слайд 10Just a few of Berkshire’s subsidiaries…

GEICO

The Pampered Chef

Fruit of the Loom

Clayton

See’s Candies

Helzberg Diamonds

NetJets

Burlington Northern Santa Fe

Lubrizol

Duracell

Dairy Queen

July 17, 2015

Слайд 11Some of Berkshire’s major stock holdings…

American Express

Deere & Company

General Motors

Goldman Sachs

International

Coca-Cola

Moody’s

Procter & Gamble

US Bancorp

Wells Fargo

Wal-Mart

Verizon

Phillips 66

Visa

MasterCard

Costco

July 17, 2015

Слайд 122. Colgate-Palmolive (NYSE: CL)

Colgate-Palmolive produces many name-brand products including

Ajax

Colgate toothpaste

Irish Spring

Murphy

Science Diet

Softsoap

Speed Stick

July 17, 2015

Слайд 13Colgate Palmolive is a “dividend aristocrat”, which means that it raises

In fact, Colgate-Palmolive has increased its dividend for 51 consecutive years, and has paid a dividend every year since 1895

July 17, 2015

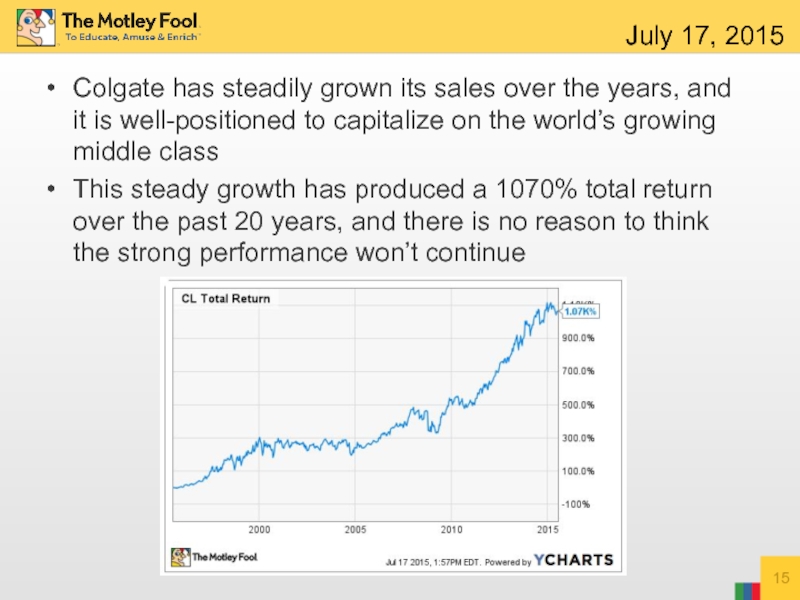

Слайд 15Colgate has steadily grown its sales over the years, and it

This steady growth has produced a 1070% total return over the past 20 years, and there is no reason to think the strong performance won’t continue

July 17, 2015

Слайд 163. ExxonMobil (NYSE: XOM)

The largest publicly-traded integrated oil company

ExxonMobil could be

July 17, 2015

Слайд 17ExxonMobil has exposure to all aspects of the oil business

So, even

Plus, its size gives it a competitive advantage, allowing the company to run more efficiently than rivals

July 17, 2015

Слайд 18During tough times, ExxonMobil has the ability to capitalize on smaller,

As one of only three U.S. companies with a AAA credit rating, ExxonMobil has access to virtually unlimited cheap capital for acquisitions or other opportunities

In fact, ExxonMobil has an even better credit rating than the U.S. government!

July 17, 2015

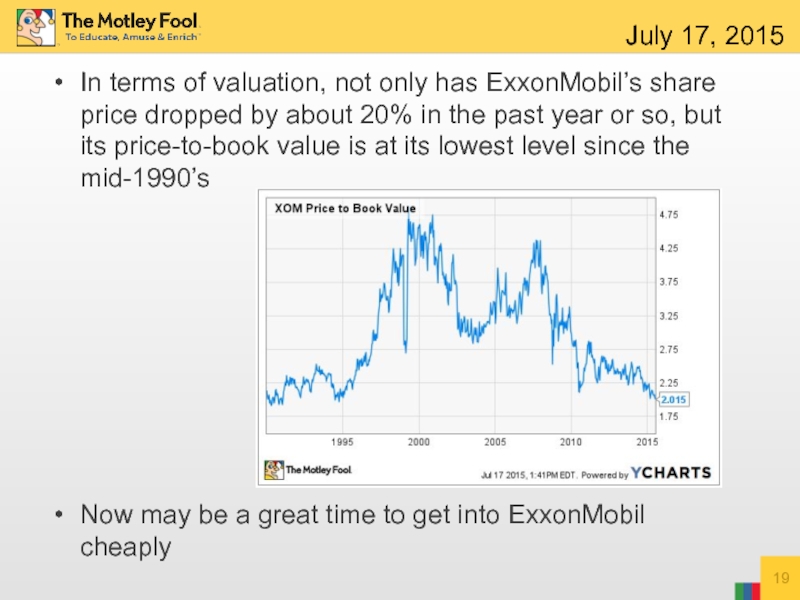

Слайд 19In terms of valuation, not only has ExxonMobil’s share price dropped

Now may be a great time to get into ExxonMobil cheaply

July 17, 2015

Слайд 204. Johnson & Johnson (NYSE: JNJ)

In addition to its portfolio of

Band-aid

Johnson’s baby products

Tylenol

Neutrogena

Johnson & Johnson’s largest business is pharmaceuticals

July 17, 2015

Слайд 21J&J’s size and brand power are tremendous competitive advantages

Its size allows

Its well-known brands give it more pricing power than lesser-known competitors

The massive pharmaceutical business is the real money maker, and the company invests aggressively in research and development, which has resulted in some innovative (read: profitable) drugs

July 17, 2015

Слайд 22Johnson & Johnson has an outstanding 53-year history of dividend increases

The

Even though many investors consider J&J to be a “boring” stock, it has handily beat the S&P 500’s returns over the past several decades

July 17, 2015