- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

3 Stocks That Could Make Huge Moves This Week презентация

Содержание

- 1. 3 Stocks That Could Make Huge Moves This Week

- 2. Lululemon Athletica Lulu got its start as

- 3. Here’s What You Should Watch Over the

- 4. Vera Bradley Vera Bradley is a

- 5. Here’s What You Should Watch Over the

- 6. Conn’s Conn’s is an electronics retailer. The

- 7. Here’s What You Should Watch Over the

- 8. The Next Billion-Dollar iSecret

Слайд 2Lululemon Athletica

Lulu got its start as a yoga clothing shop, and

Currently, 26% of Lulu’s shares are sold short.

The company has been plagued by inventory and quality issues, and recently got downgraded by analysts.

Слайд 3Here’s What You Should Watch

Over the Short Term

Lulu is expected to

Analysts expect the company to have collected $482 million in sales for the previous quarter.

For the holiday quarter, analysts expect the company to earn $0.86 per share on sales of $690 million.

Over the Long Term

Comparable-Store Sales are always important, and this quarter is no different. Management believes this metric will come in at the high single-digits.

There was talk last week of a possible buy-out at the hands of Under Armour. Listen to the conference call to see if management addresses this.

Слайд 4Vera Bradley

Vera Bradley is a retailer of high-end fashion accessories.

Currently, 26% of Vera’s shares are sold short.

Like many fashion retailers, business has been shrinking over the last few years. Bears believe this trend will continue and the stock will fall further.

Слайд 5Here’s What You Should Watch

Over the Short Term

Vera is expected to

The company is expected to have made $0.20 per share last quarter.

For the holiday quarter, expectations are set for $149 million in revenue and a profit of $0.39 per share.

Over the Long Term

Pay attention to gross margins, as they’ll tell you how much Vera had to discount goods to move them. Last year at the same time, they came in at 52.5%.

Look at comparable-store sales and e-commerce sales. Both shrunk last quarter, and investors should hope for this trend to at least stabilize.

Слайд 6Conn’s

Conn’s is an electronics retailer. The company will be releasing its

Currently, 69% of Conn’s float is sold short (much of the company is held by insiders).

Conn’s had a questionable program to help buyers finance purchases. Since putting quality controls in place, sales have slumped.

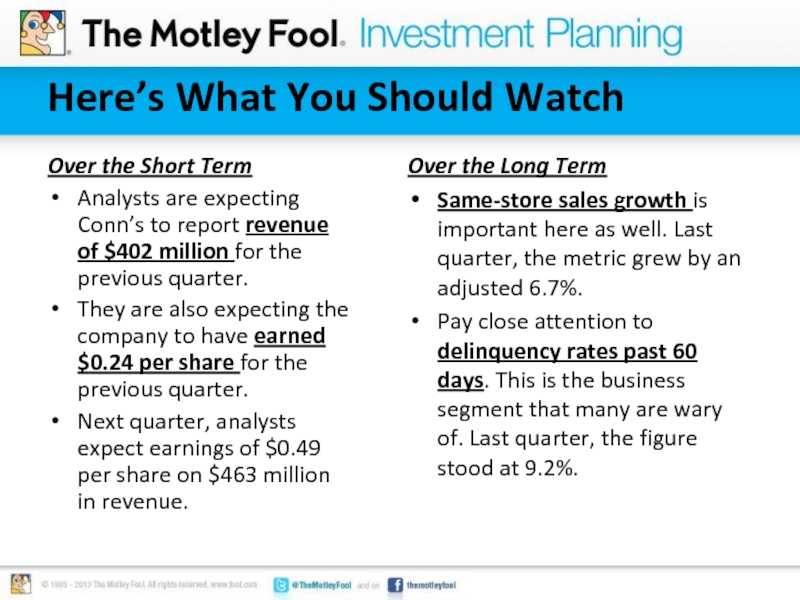

Слайд 7Here’s What You Should Watch

Over the Short Term

Analysts are expecting Conn’s

They are also expecting the company to have earned $0.24 per share for the previous quarter.

Next quarter, analysts expect earnings of $0.49 per share on $463 million in revenue.

Over the Long Term

Same-store sales growth is important here as well. Last quarter, the metric grew by an adjusted 6.7%.

Pay close attention to delinquency rates past 60 days. This is the business segment that many are wary of. Last quarter, the figure stood at 9.2%.