- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

3 Stocks That Could Make Huge Moves презентация

Содержание

- 1. 3 Stocks That Could Make Huge Moves

- 2. Fuel Cell (Nasdaq: FCEL)

- 3. Why Are Investors So Negative? Fuel Cell

- 4. Here’s What to Really Watch Wall Street

- 5. Amabarella (Nasdaq: AMBA)

- 6. Why Are Investors So Negative? The popularity

- 7. Here’s What to Really Watch Wall Street

- 8. Vera Bradley (Nasdaq: VRA)

- 9. Why Are Investors So Negative? Comparable store

- 10. Here’s What to Really Watch Wall Street

- 11. The technology of the future: Wearable Computing

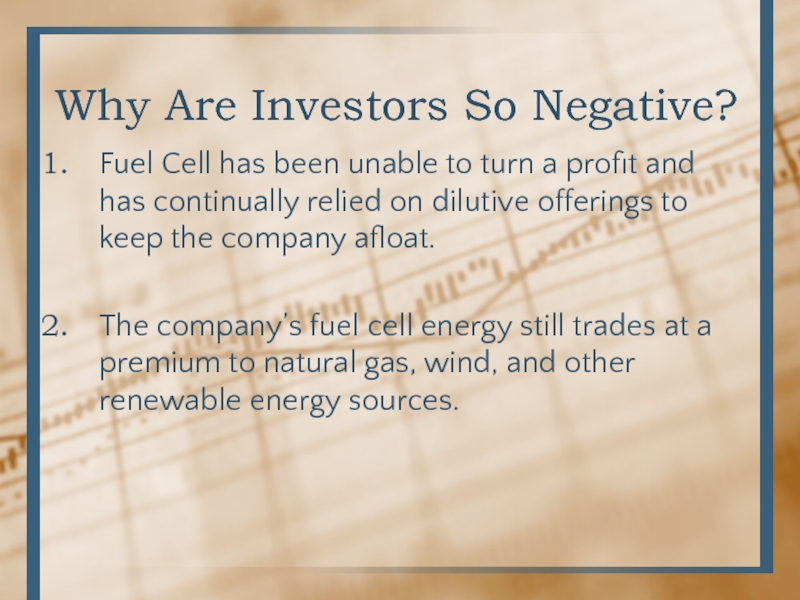

Слайд 3Why Are Investors So Negative?

Fuel Cell has been unable to turn

The company’s fuel cell energy still trades at a premium to natural gas, wind, and other renewable energy sources.

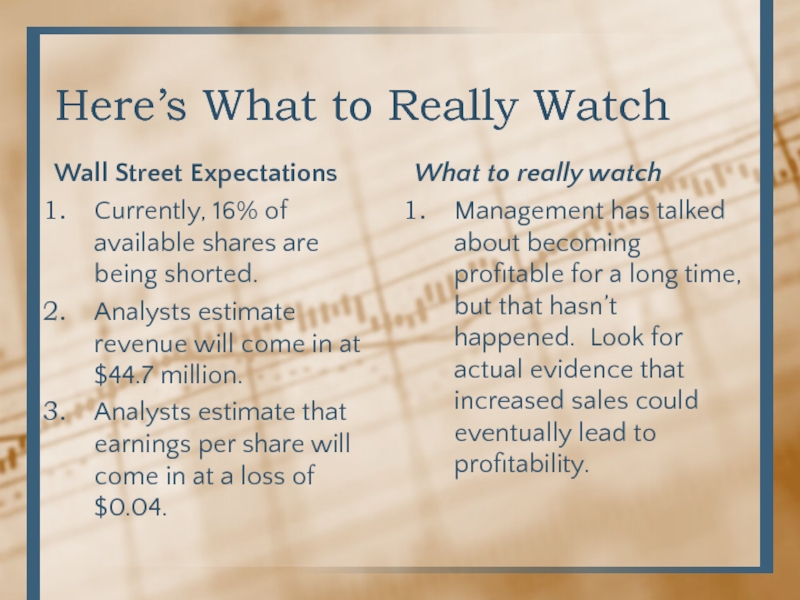

Слайд 4Here’s What to Really Watch

Wall Street Expectations

Currently, 16% of available shares

Analysts estimate revenue will come in at $44.7 million.

Analysts estimate that earnings per share will come in at a loss of $0.04.

What to really watch

Management has talked about becoming profitable for a long time, but that hasn’t happened. Look for actual evidence that increased sales could eventually lead to profitability.

Слайд 6Why Are Investors So Negative?

The popularity of wearable cameras for adventure

The stock was up 200% in 2013.

Shares trade for 24 times earnings, which isn’t bad, but earnings are only expected to increase by 3% in the coming year.

Слайд 7Here’s What to Really Watch

Wall Street Expectations

Currently, 16% of available shares

Analysts estimate the company will report revenue of $40 million.

Analysts estimate earnings per share will come in at $0.21 per share.

What to Really Watch

These possible applications of AMBA’s technology stretch far and wide. Keep an eye on the long-term trends here.

Listen in for progress on Google’s Helpouts deal.

Pay attention to the strength of the automotive and security segments

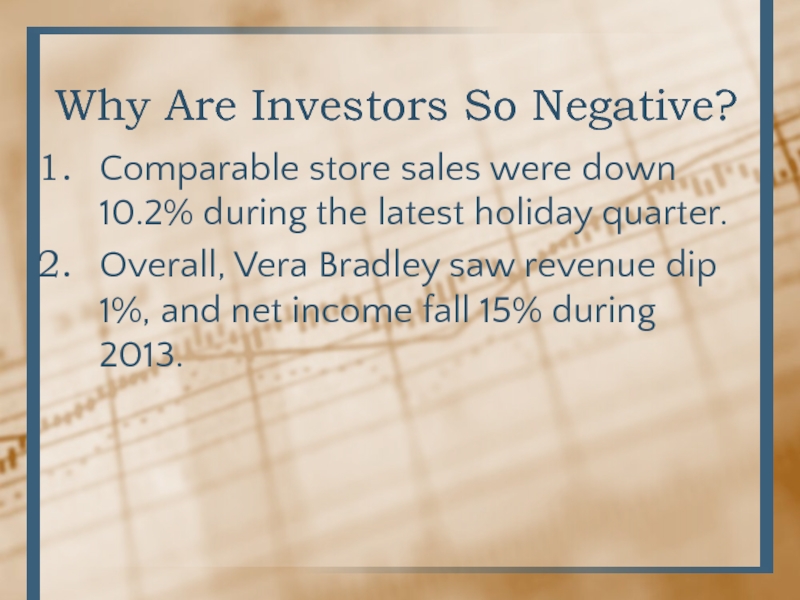

Слайд 9Why Are Investors So Negative?

Comparable store sales were down 10.2% during

Overall, Vera Bradley saw revenue dip 1%, and net income fall 15% during 2013.

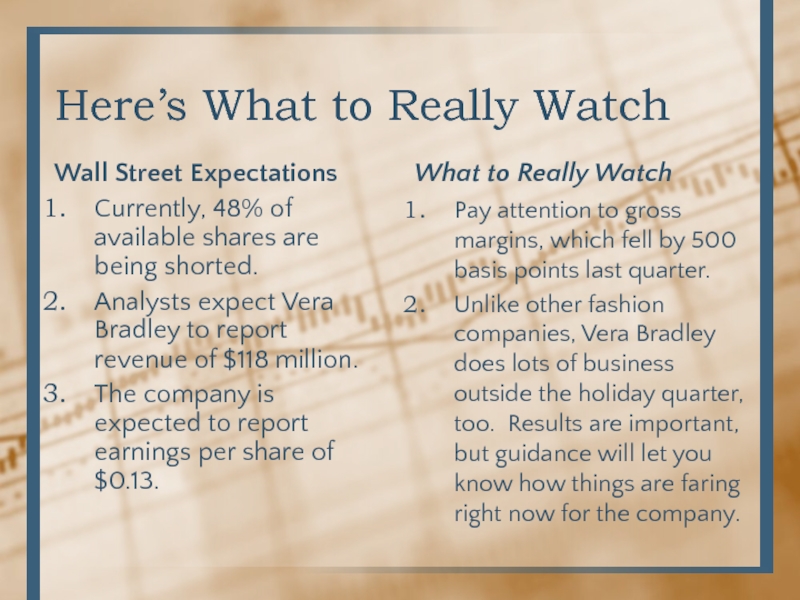

Слайд 10Here’s What to Really Watch

Wall Street Expectations

Currently, 48% of available shares

Analysts expect Vera Bradley to report revenue of $118 million.

The company is expected to report earnings per share of $0.13.

What to Really Watch

Pay attention to gross margins, which fell by 500 basis points last quarter.

Unlike other fashion companies, Vera Bradley does lots of business outside the holiday quarter, too. Results are important, but guidance will let you know how things are faring right now for the company.

Слайд 11The technology of the future: Wearable Computing

We highlight one company benefitting

The Company Behind Apple’s Newest Product