- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

The New Era of Investor Relations #JOBSAct презентация

Содержание

- 1. The New Era of Investor Relations #JOBSAct

- 2. Doug Ellenoff is a partner at

- 3. Joy Schoffler is the founder and

- 4. Judd Hollas is a pioneer in

- 5. Judy Robinett served as the CEO

- 6. Disclaimer of Liability

- 7. What is Crowdfunding?

- 8. Donation or rewards-based crowdfunding is where contributions

- 9. Equity crowdfunding is where the exchange

- 10. When a crowd lends money to

- 11. Hedges risk Can be used

- 12. JOBS Act Overview

- 13. An issuer may still choose to conduct

- 14. Conceptual Framework of Novel

- 15. Title III (NOT YET

- 16. On September 23, 2013, the SEC voted

- 17. U.S. Equity Crowdfunding Activity

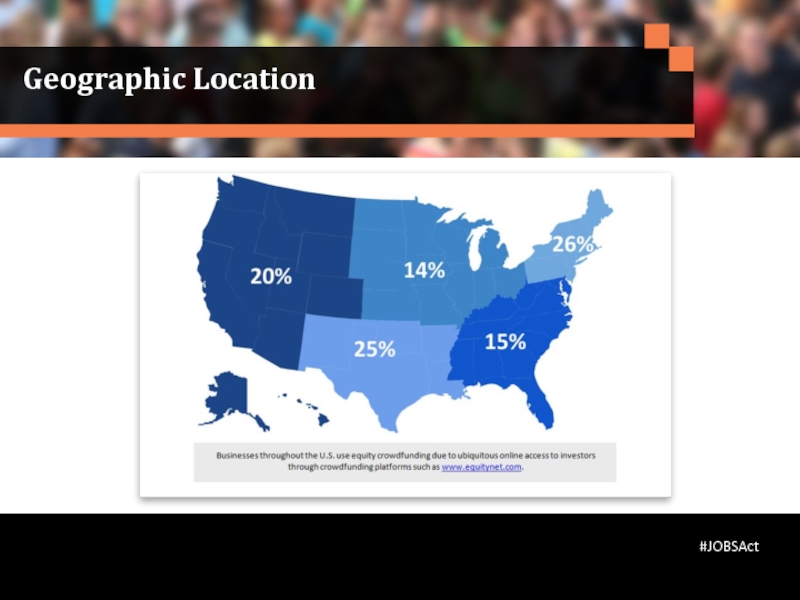

- 18. Geographic Location #JOBSAct

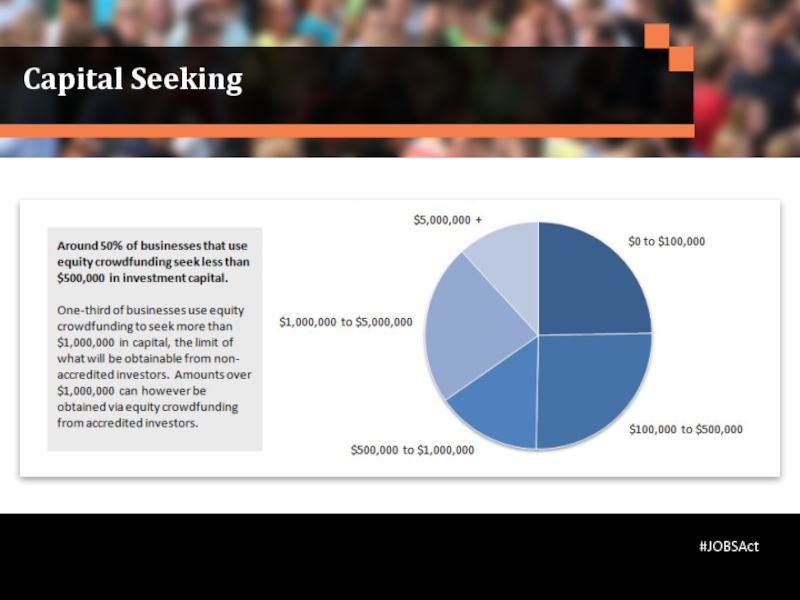

- 19. Capital Seeking #JOBSAct

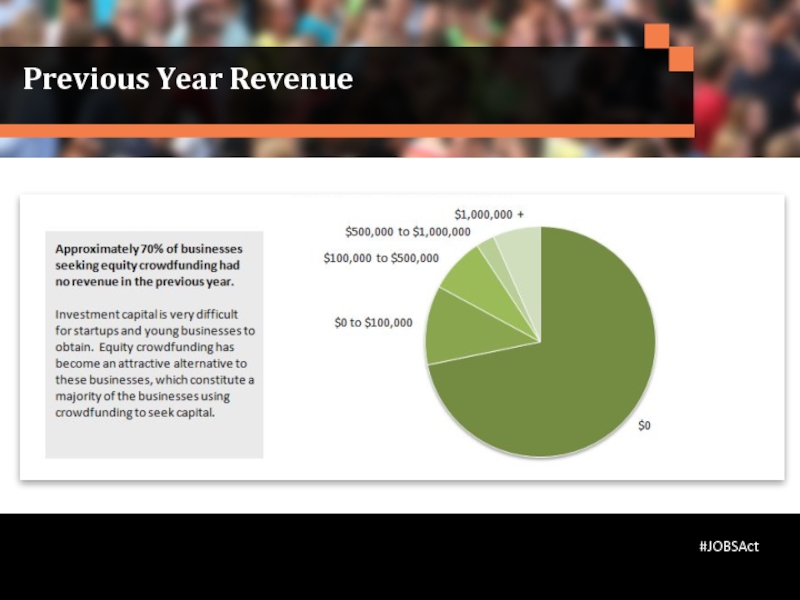

- 20. Previous Year Revenue #JOBSAct

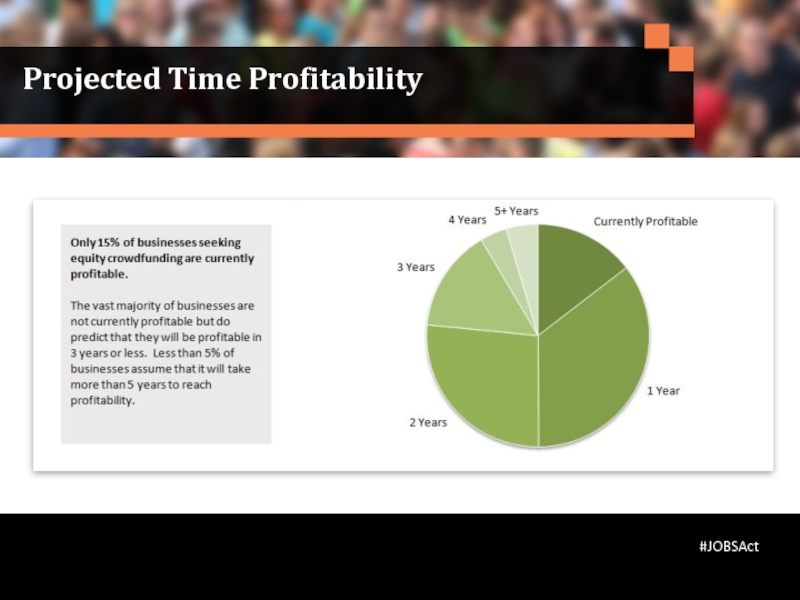

- 21. Projected Time Profitability #JOBSAct

- 22. Industry Sectors #JOBSAct

- 23. Navigating The Changing Landscape

- 24. General Solicitation

- 25. Title II – Accredited

- 26. No Bad Actors

- 27. Reasonable Steps

- 28. Misrepresentations—Antifraud Rules Still Apply!

- 29. Marketing Your Offering –New

- 30. Be Careful with Social

- 31. The Funding Ecosystem #JOBSAct Finding and Securing Investment

- 32. The Funding Ecosystem

- 33. Who Gives?

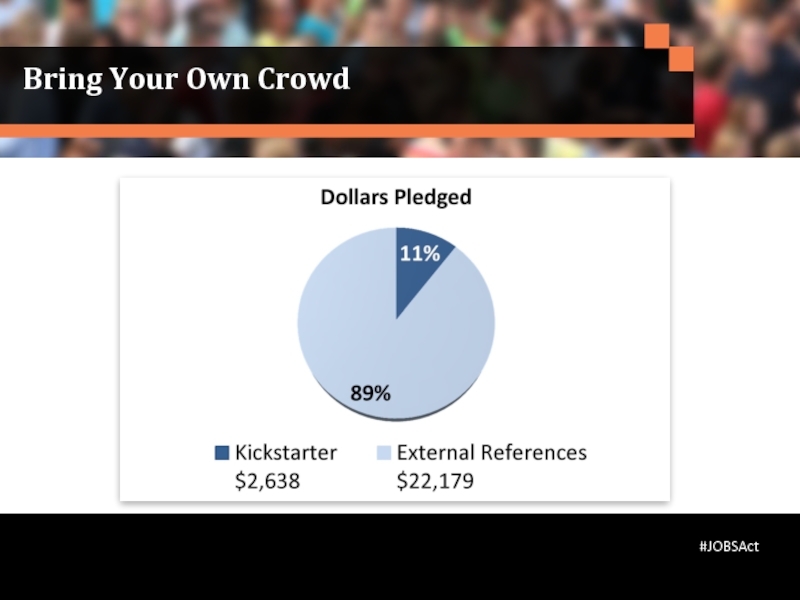

- 34. Bring Your Own Crowd #JOBSAct

- 35. Building Your Crowd

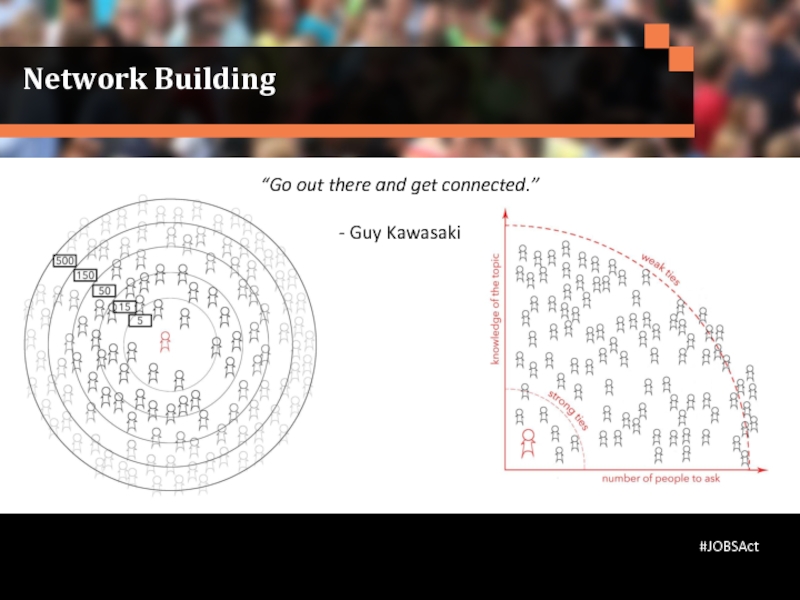

- 36. Network Building

- 37. Keys to Success

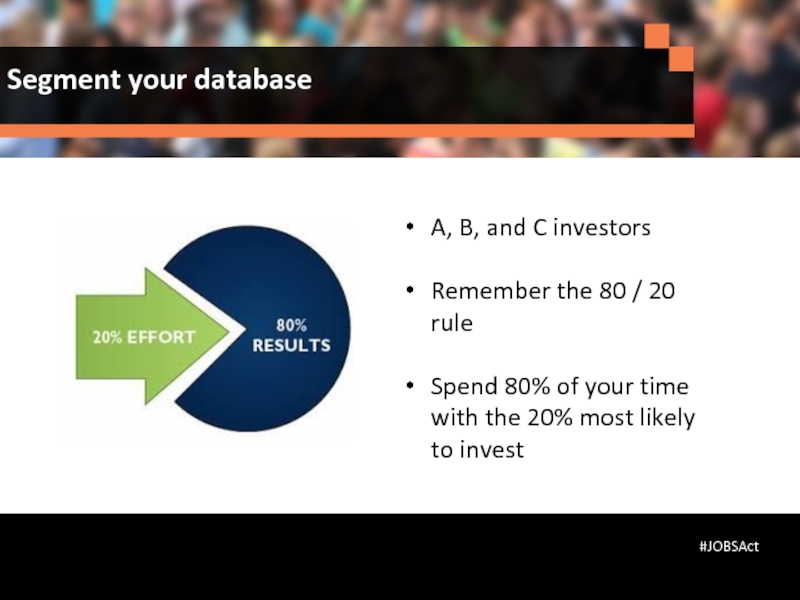

- 38. A, B, and C investors

- 39. Accomplishments Client list Associations Media coverage

- 40. Have a good idea Have reputable

- 41. @douglasellenoff @equitynet @judyrobinett @joyschoffler Questions? #JOBSAct

- 42. A Copy of the slides

Слайд 2

Doug Ellenoff is a partner at Ellenoff Grossman & Schole LLP.

With respect to crowdfunding, he is actively engaged with clients (funding portals, broker-dealers, technology solution providers, software developers, investors and entrepreneurs), and has visited both the SEC and FINRA numerous times to discuss the proposed rules, and presented at a National Press Club event in 2013.

@douglasellenoff

www.egsllp.com

Douglas Ellenoff | Ellenoff, Grossman & Schole

#JOBSAct

Слайд 3

Joy Schoffler is the founder and principal of financial technology services

As principal of Leverage PR, Joy and her team regularly work with leaders within the crowdfunding, investment and fintech sectors.

Having a passion for startups, she recently launched CrowdBuilder.co, a PR and influencer engagement platform that helps crowdfunders and startups connect with media and influencers.

@joyschoffler

@leverage_pr

www.leverage-pr.com

Joy Schoffler | Leverage PR

#JOBSAct

Слайд 4

Judd Hollas is a pioneer in the field of crowdfunding with

@equitynet

www.equitynet.com

Judd Hollas | EquityNet

#JOBSAct

Слайд 5

Judy Robinett served as the CEO and president of a publicly-traded

With her powerful network of senior executives, funding sources, and content experts, she helps companies identify the things that are often causing them to stall and brings together the various resources needed to put them on the right track for success. Whether their needs are a workable funding strategy, a focused company strategy, or technology resources, Ms. Robinett either fills the needs herself or calls on her team of internationally renowned experts to get the job done.

@judyrobinett

www.judyrobinett.com

Judy Robinett | Power Connecting and Startup Funding Expert

#JOBSAct

Слайд 6

Disclaimer of Liability

The information which is being shared with you

Visit SEC.gov for more information

#JOBSAct

Слайд 8

Donation or rewards-based crowdfunding is where contributions are exchanged for current or

Kickstarter and Indiegogo are the most popular donations-based crowdfunding platforms.

Source: Crowdfund Insider

The Ultimate Crowdfunding Guide

Donation/Reward Based Crowdfunding

#JOBSAct

Слайд 9

Equity crowdfunding is where the exchange is company equity, or ownership,

Equity crowdfunding cannot take place in the U.S. at scale right now. That isn’t to say it can’t take place at all. It can and does in the form of “Title II” crowdfunding. There are complex rules in current law that allow a company to sell stock to accredited investors under “Regulation D.”

Source: Crowdfund Insider

The Ultimate Crowdfunding Guide

Equity Crowdfunding

#JOBSAct

Слайд 10

When a crowd lends money to an individual or company with

Companies also use debt crowdfunding to acquire capital from the crowd. As the individual or company pays back the debt accrued, subsequent rounds generally come at lower interest rates. Over time those seeking funding can acquire capital at rates much lower than traditional credit cards or other types of high-interest debt.

Source: Crowdfund Insider

The Ultimate Crowdfunding Guide

Debt Crowdfunding

#JOBSAct

Слайд 11

Hedges risk

Can be used as a great marketing tool

Provides market validation

Showcase

Non-Monetary Benefits of Crowdfunding

#JOBSAct

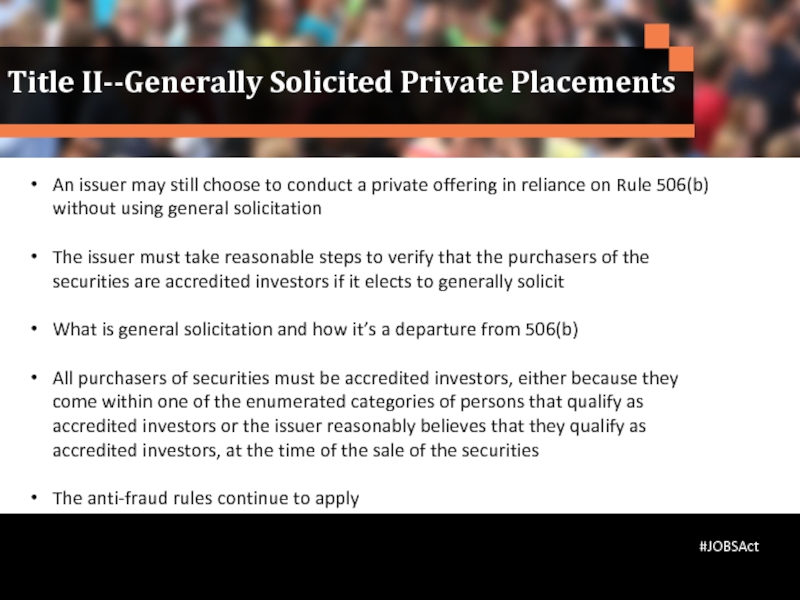

Слайд 13An issuer may still choose to conduct a private offering in

The issuer must take reasonable steps to verify that the purchasers of the securities are accredited investors if it elects to generally solicit

What is general solicitation and how it’s a departure from 506(b)

All purchasers of securities must be accredited investors, either because they come within one of the enumerated categories of persons that qualify as accredited investors or the issuer reasonably believes that they qualify as accredited investors, at the time of the sale of the securities

The anti-fraud rules continue to apply

Title II--Generally Solicited Private Placements

#JOBSAct

Слайд 14

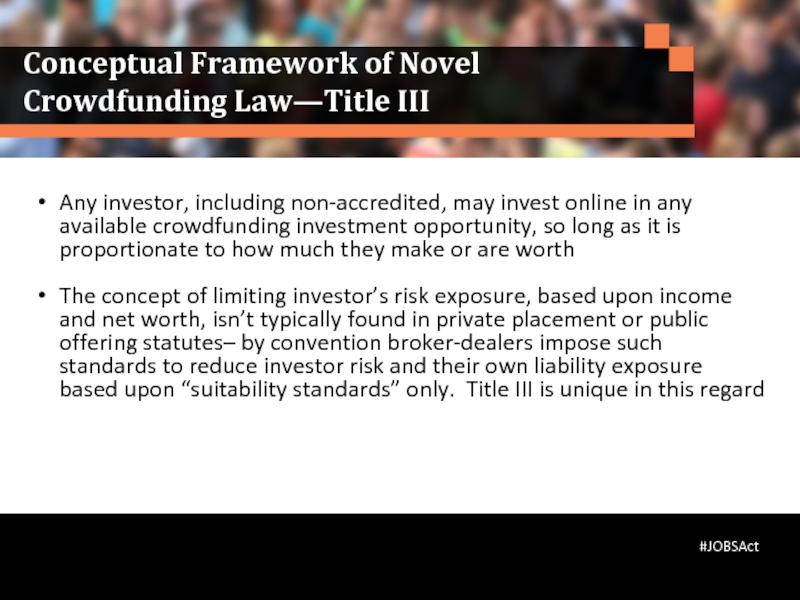

Conceptual Framework of Novel Crowdfunding Law—Title III

Any investor, including non-accredited,

The concept of limiting investor’s risk exposure, based upon income and net worth, isn’t typically found in private placement or public offering statutes– by convention broker-dealers impose such standards to reduce investor risk and their own liability exposure based upon “suitability standards” only. Title III is unique in this regard

#JOBSAct

Слайд 15

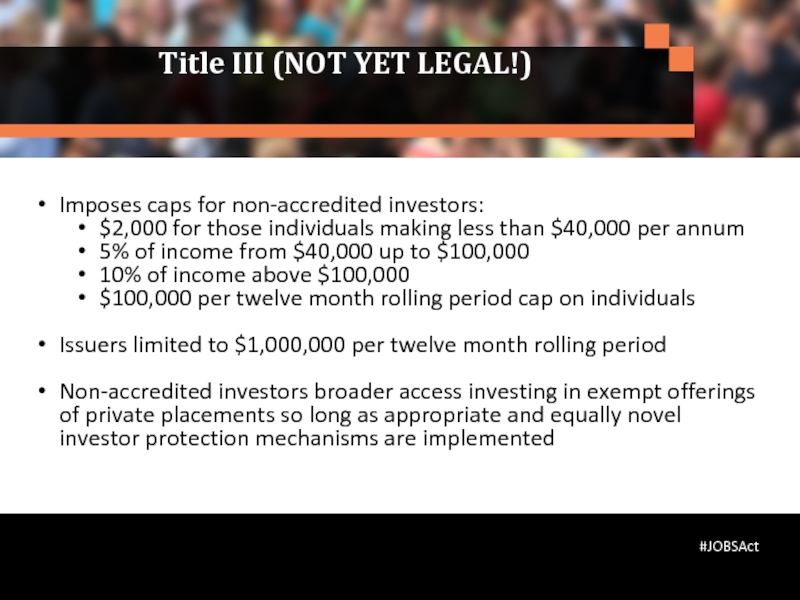

Title III (NOT YET LEGAL!)

Imposes caps for non-accredited investors:

$2,000 for those

5% of income from $40,000 up to $100,000

10% of income above $100,000

$100,000 per twelve month rolling period cap on individuals

Issuers limited to $1,000,000 per twelve month rolling period

Non-accredited investors broader access investing in exempt offerings of private placements so long as appropriate and equally novel investor protection mechanisms are implemented

#JOBSAct

Слайд 16

On September 23, 2013, the SEC voted unanimously to pass proposed rules

October 23rd, 2013 the SEC released proposed rules for Title III crowdfunding—aka unaccredited investor crowdfunding

Comment period for Title III proposed rules ended February 3rd

Regulatory Update

#JOBSAct

Слайд 17

U.S. Equity Crowdfunding Activity

Characteristics of Businesses Using Equity Crowdfunding

#JOBSAct

Слайд 24

General Solicitation

“General solicitation” is the act of publicly advertising or making

Examples include but are not limited to:

Advertisements published in newspapers, magazines, TV, and other public websites

Communications during seminars or other events

The use of an unrestricted, and therefore publicly available, website

Social media posts and email blasts

#JOBSAct

Source: SEC.gov

Слайд 25

Title II – Accredited crowdfunding

Has no restrictions on the type of

However, there are certain considerations that an issuer must be aware of and precautions that it must take.

#JOBSAct

Source: SEC.gov

Слайд 26

No Bad Actors

“Bad actor” disqualification requirements prohibit issuers and others, such

The rule includes the following categories of disqualifying events

Criminal convictions; Court injunctions and restraining orders

Final orders of certain state regulators (such as securities, banking, and insurance) and federal regulators

Commission disciplinary orders relating to brokers, dealers, municipal securities dealers, investment advisers, and investment companies and their associated persons

Certain Commission cease-and-desist orders

Suspension or expulsion from membership in, or suspension or barring from association with a member of, a securities self-regulatory organization (“SRO”)

Commission stop orders and orders suspending a Regulation A exemption

U.S. Postal Service false representation orders

#JOBSAct

Слайд 27

Reasonable Steps

Underpinning the verification process, the SEC will take a principles-based

The SEC has indicated that reasonable efforts to verify investor status may differ depending on the facts and circumstances

The nature of the purchaser

The nature and amount of information about the purchaser

The nature of the offering

#JOBSAct

Слайд 28

Misrepresentations—Antifraud Rules Still Apply!

A through review of all information regarding the

Be extra careful with sales and marketing efforts before and during a raise!

#JOBSAct

The issuer will be liable for any material misstatements it makes in connection with the offering!

Слайд 29

Marketing Your Offering –New Rules Apply!

All advertisements or promotional statements

This includes social media likes, retweets, etc. –major implications for 3rd party marketers

Compensation could take the form of cash, debt or equity interests (including options) in the issuer and other non-cash compensation

#JOBSAct

Source: SEC.gov

Слайд 30

Be Careful with Social Media

Maintain a clear communication policy regarding

Actively manage social media campaigns

Have legal review all social media posts and strategies before campaign

Monitor social media daily

Be careful of misstatements and omissions on social

Report compensation of promoters in advertising/ marketing

#JOBSAct

Source: SEC.gov

Слайд 32

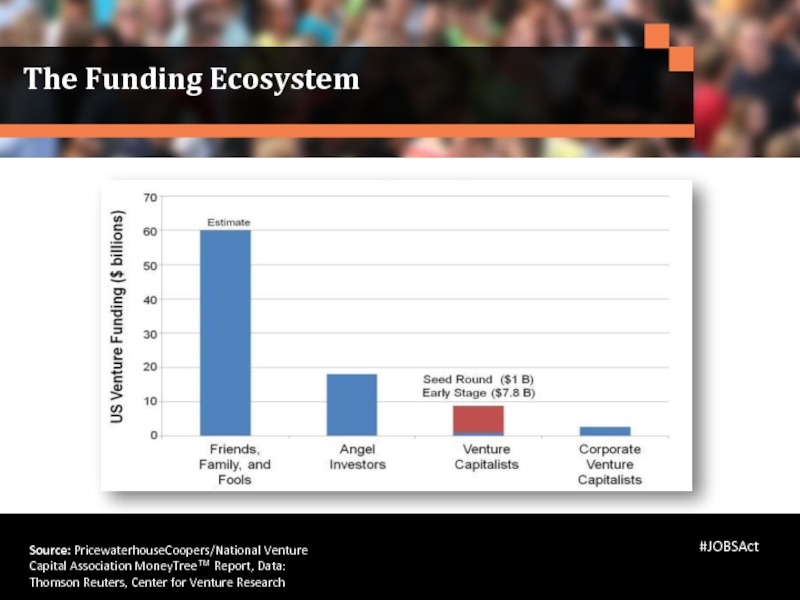

The Funding Ecosystem

Source: PricewaterhouseCoopers/National Venture Capital Association MoneyTree™ Report, Data: Thomson

#JOBSAct

Слайд 33

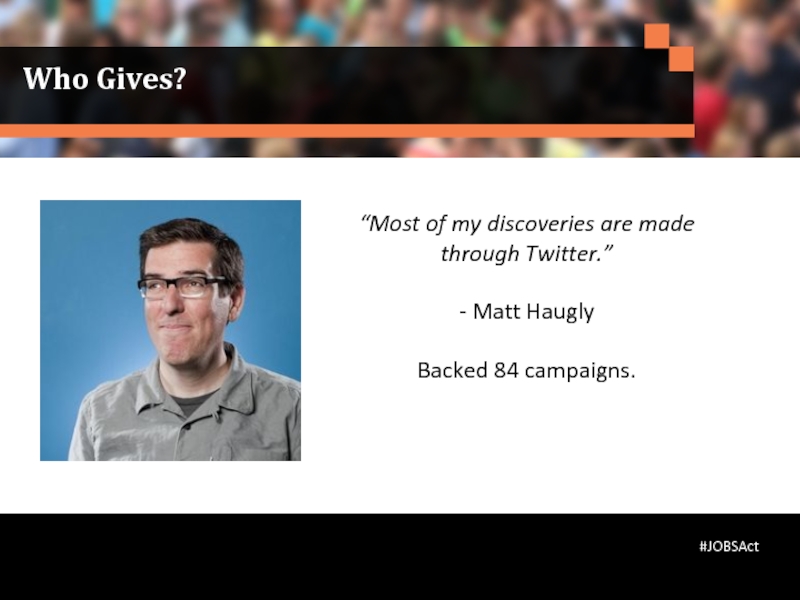

Who Gives?

“Most of my discoveries are made through Twitter.”

- Matt Haugly

Backed

#JOBSAct

Слайд 37

Keys to Success

#JOBSAct

Build your crowd

Segment your database

Prepare your

Build your digital profile

Make sure your team is ready

Слайд 38

A, B, and C investors

Remember the 80 / 20 rule

Spend 80% of your time with the 20% most likely to invest

Segment your database

#JOBSAct

Слайд 39

Accomplishments

Client list

Associations

Media coverage

Following

Speaking engagements

Online profile

Website or blog

Social media profiles

Quality of

Own Your Industry—Build Thought Leadership

#JOBSAct

Слайд 40

Have a good idea

Have reputable co-founders

Be legally licensed

Create an executive summary

Have

Have realistic financial projections

Create an offering document

Have a reasonable valuation

Crowdfunding is Pitching Investors

#JOBSAct