- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

10 Easy Ways to Save More for Retirement презентация

Содержание

- 1. 10 Easy Ways to Save More for Retirement

- 2. A Quick Note Before Starting The most

- 3. 1) Get the Maximum Match Many employers

- 4. 2) Open and Max Out a Roth

- 5. 3) Open a Health Savings Account (HSA)

- 6. 4) Wait to Claim Social Security Currently,

- 7. 5) Invest with Low Fees ETFs or

- 8. By now, you might be thinking… “You’re

- 9. That’s fair! So these next five tips

- 10. 6) Save That Raise We have an

- 11. 7) Learn How to Cook Last year,

- 12. 8) Switch to Republic Wireless In late

- 13. 9) Cut the Cable The average monthly

- 14. 10) Get those Credit Cards Working for

- 15. One more thing… …there’s a Social Security

- 16. To learn more, check out: THE $60,000 SOCIAL SECURITY BONUS MOST RETIREES COMPLETELY OVERLOOK

Слайд 2A Quick Note Before Starting

The most effective ways for saving more

But these are not “easy” actions to take, so they aren’t included here.

On some pages, I’ll give an idea for how much extra retirement money you could save.

This will assume that money saved will be invested for 25 years and return 6% after inflation—to keep these numbers in today’s dollars.

Слайд 31) Get the Maximum Match

Many employers offer a “match” for participating

The most common form is when an employer donates $0.50 for every dollar an employee does, up to 6%.

This is the closest thing to “free retirement money” you’ll ever see!

If you earn $75,000 per year...

The “free money” you get just this year will be worth $9,650 in 25 years.

If you do this every year for 25 years, this “free money” will total over $130,850.

Remember, this is just the match—you didn’t have to do anything but contribute to get it!

Слайд 42) Open and Max Out a Roth IRA

The money you contribute

A Roth is the exact opposite: you pay taxes now, but all growth and withdrawals in retirement are tax-free

Under age 50, the maximum contribution is $5,500. Older workers can contribute up to $6,500

The money that you put away this year will be worth $23,600 in 25 years.

If we assume that you contribute the maximum and retire at age 67 (and contribute the elevated level for 17 years), your Roth IRA would be worth $350,000 when you retire.

Слайд 53) Open a Health Savings Account (HSA)

You must have a qualified

Contribution limits:

$3,350 for individuals

$6,650 for families

Add $1,000 if over 50

The money never disappears

HSA money is tax-deductible, can be invested and grow tax-free, and is dispersed tax-free for qualified medical expenses.

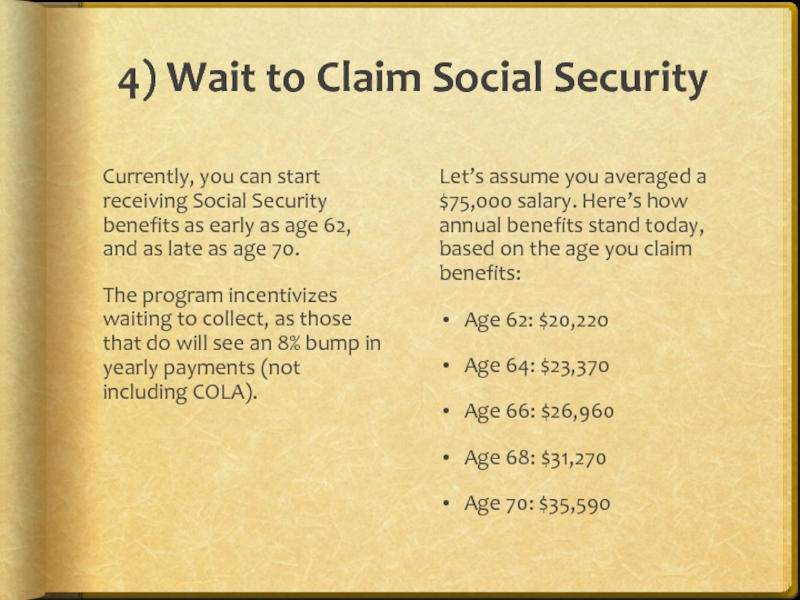

Слайд 64) Wait to Claim Social Security

Currently, you can start receiving Social

The program incentivizes waiting to collect, as those that do will see an 8% bump in yearly payments (not including COLA).

Let’s assume you averaged a $75,000 salary. Here’s how annual benefits stand today, based on the age you claim benefits:

Age 62: $20,220

Age 64: $23,370

Age 66: $26,960

Age 68: $31,270

Age 70: $35,590

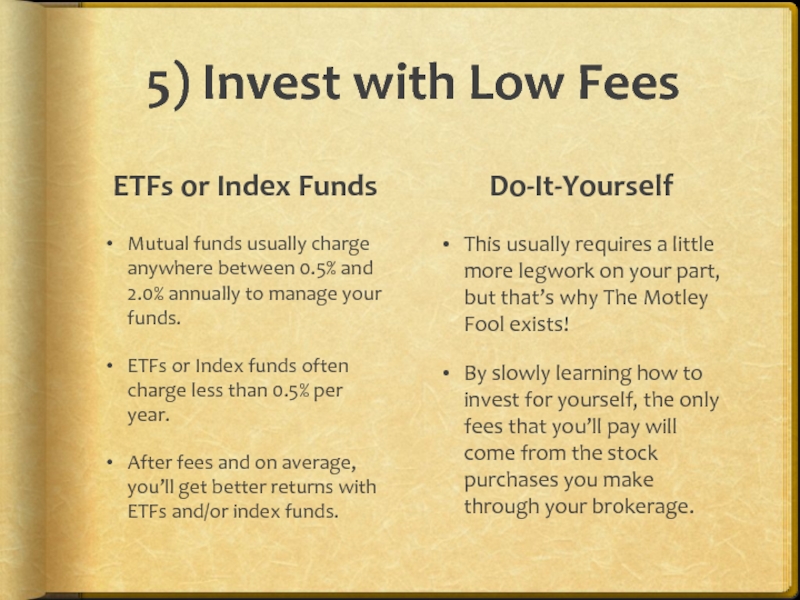

Слайд 75) Invest with Low Fees

ETFs or Index Funds

Mutual funds usually charge

ETFs or Index funds often charge less than 0.5% per year.

After fees and on average, you’ll get better returns with ETFs and/or index funds.

Do-It-Yourself

This usually requires a little more legwork on your part, but that’s why The Motley Fool exists!

By slowly learning how to invest for yourself, the only fees that you’ll pay will come from the stock purchases you make through your brokerage.

Слайд 8By now, you might be thinking…

“You’re telling me where to save

Слайд 9That’s fair!

So these next five tips will focus on easy ways

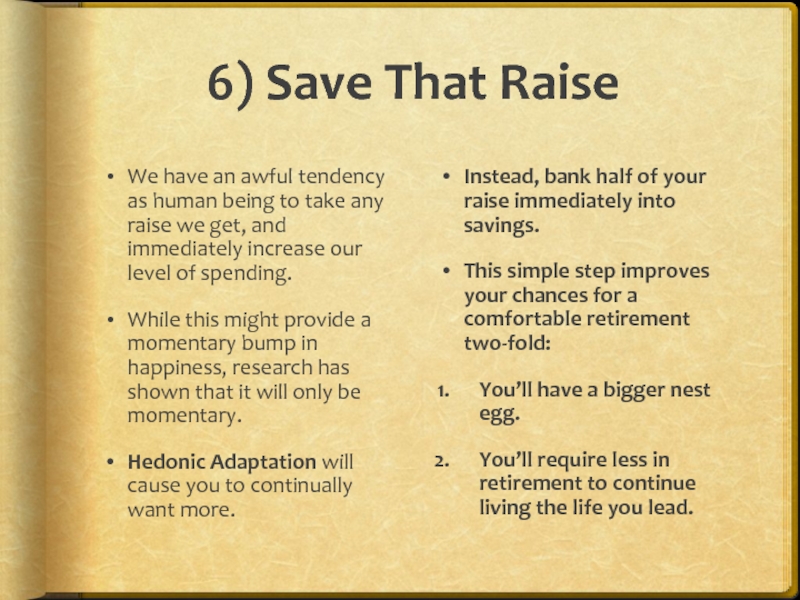

Слайд 106) Save That Raise

We have an awful tendency as human being

While this might provide a momentary bump in happiness, research has shown that it will only be momentary.

Hedonic Adaptation will cause you to continually want more.

Instead, bank half of your raise immediately into savings.

This simple step improves your chances for a comfortable retirement two-fold:

You’ll have a bigger nest egg.

You’ll require less in retirement to continue living the life you lead.

Слайд 117) Learn How to Cook

Last year, for the first time, Americans

The average American family with a household income of $75,000 spends $3,200 eating out

If we assume that eating at home is only have as expensive as eating out, that’s $1,600 in savings.

If you do this, and invest the difference, over 25 years, you’re adding $93,000 to your nest egg.

Слайд 128) Switch to Republic Wireless

In late 2013, the average household smartphone

Republic offers unlimited talk, text, and data on a 3G network for $25 per month.

Assuming 2 smartphone users in a family, using Republic represents savings of almost $1,200 per year.

If this difference is saved and invested over 25 years, you’ll add $70,000 to your nest egg.

Слайд 139) Cut the Cable

The average monthly cable bill is $64; DirectTV

A subscription to Netflix costs $8 per month

Broadcast TV is free and can meet most of your news/weather/sports needs.

Average yearly savings from Netflix over cable or DirectTV are $670 and $1,190, respectively.

Investing the difference over 25 years will increase your nest egg by $39,000 and $69,000, respectively.

Слайд 1410) Get those Credit Cards Working for You

Some expenses are unavoidable.

If you’re willing to put a little legwork in, you can use the rewards programs on these cards to your advantage.

Here’s a link to a great place to get started investigating these benefits.