- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

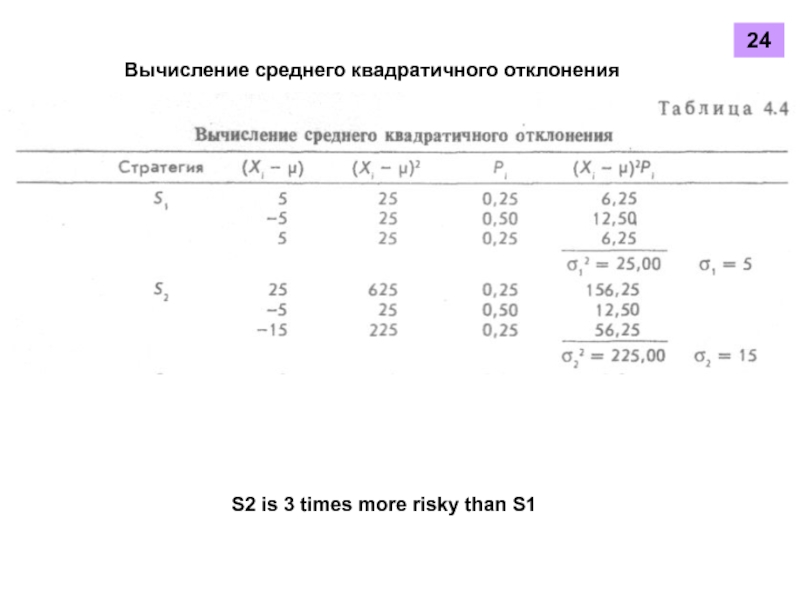

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Decision environment презентация

Содержание

- 1. Decision environment

- 2. 3 How managers can make a decision

- 3. 4 How managers can make a decision in risk – and uncertainty environment?

- 4. Unlike short-term decisions, long-term decisions are made

- 5. Solutions matrix I wonder, what

- 6. This tool: Formalizes the process of decision-making

- 7. Decision-making in terms of risk

- 8. Methods of risk evaluation: (Risk – probability of undesired occurense) 9

- 9. 2 approach to objective measurement of probability

- 10. A priori (deductive method) No

- 11. Aposteriori (statistical analysis of empirical data) past

- 12. Frequency distribution can be converted into a

- 13. Determine and minimize the risks inherent to

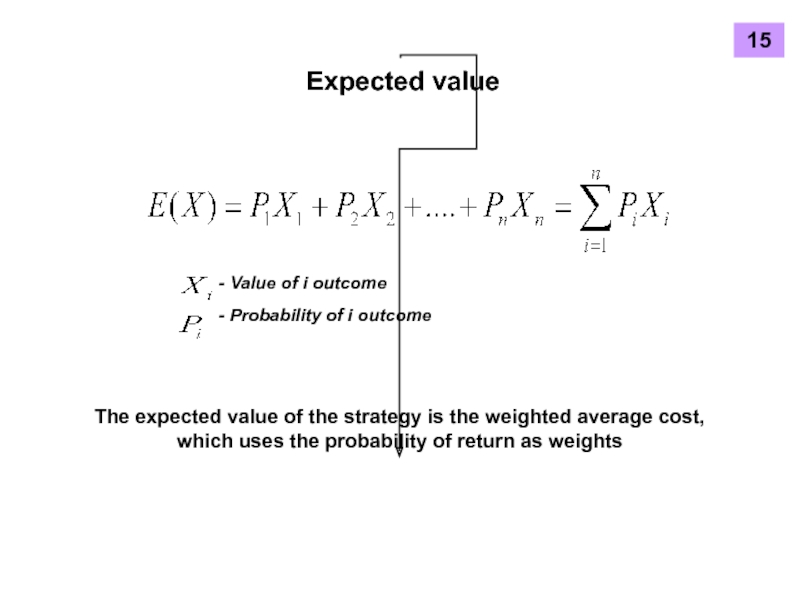

- 14. Expected value - Value of i outcome

- 15. Manager choose strategy with the highest expected value 16

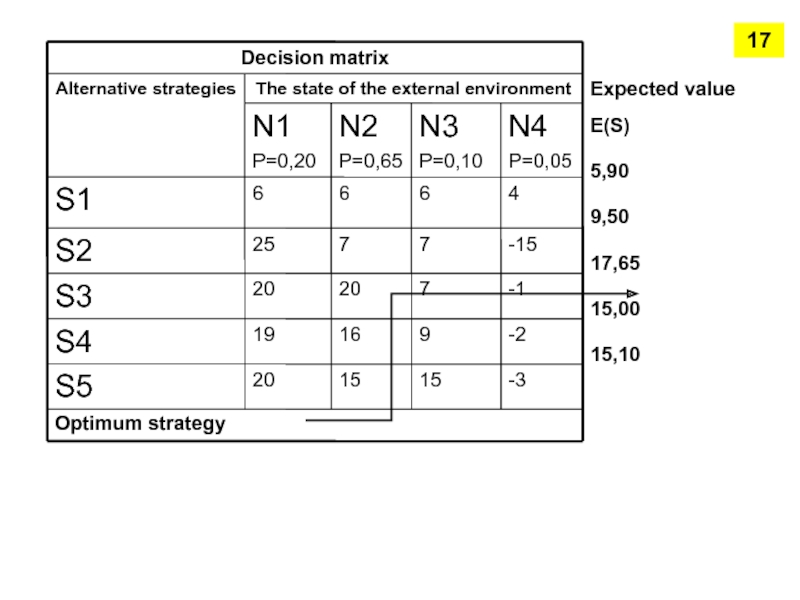

- 16. Expected value E(S) 5,90 9,50 17,65 15,00 15,10 Optimum strategy 17

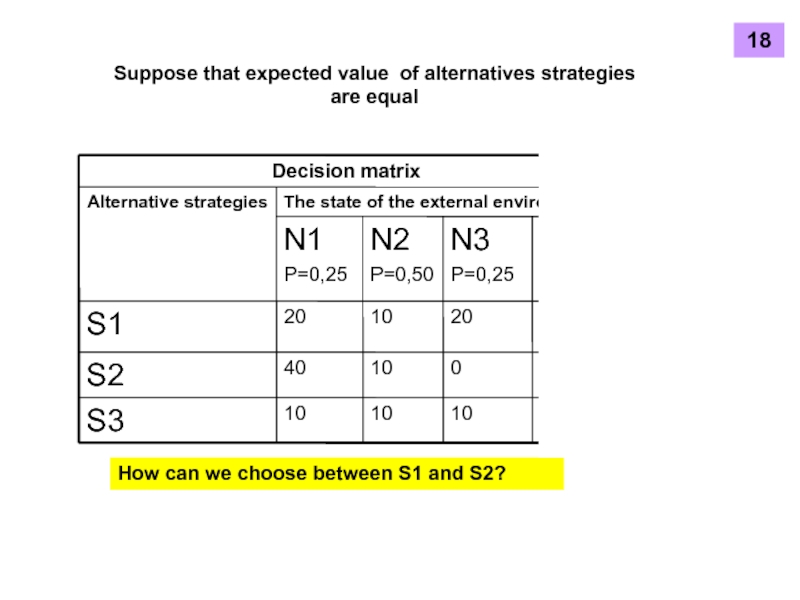

- 17. Suppose that expected value of alternatives strategies

- 18. New criteria – degree of risk May

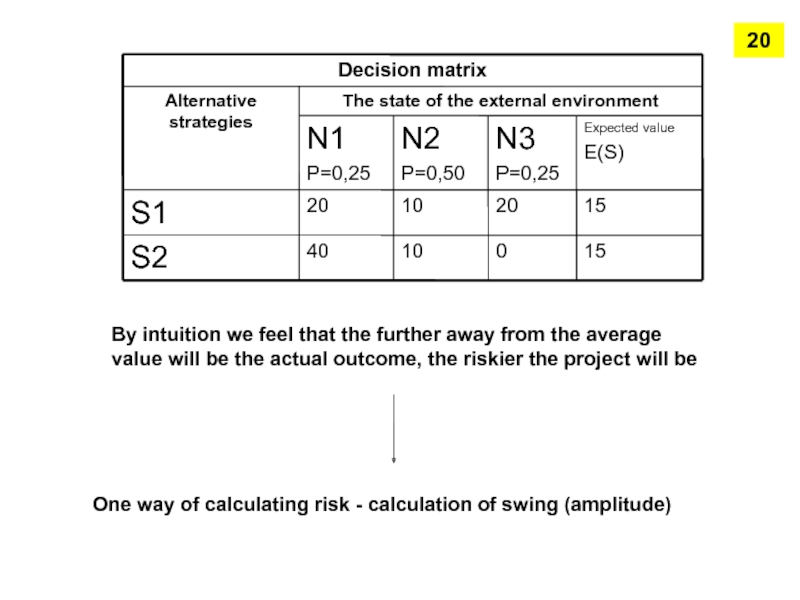

- 19. By intuition we feel that the further

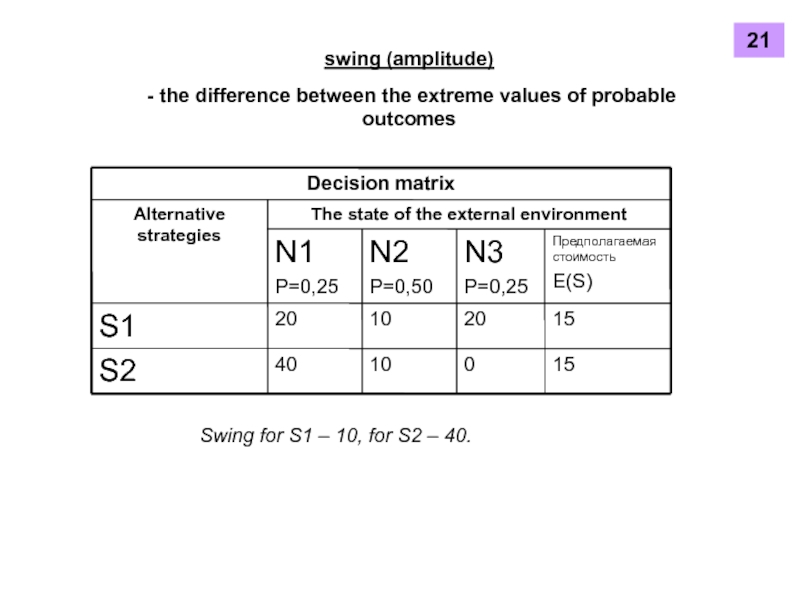

- 20. swing (amplitude) - the difference between

- 21. root-mean-square deviation The higher root-mean-square deviation - the higher risk 22

- 22. Calculation of the root-mean-square deviation: 23

- 23. Вычисление среднего квадратичного отклонения S2 is 3 times more risky than S1 24

Слайд 23

How managers can make a decision in certainty environment?

Search for options

3 optimization methods:

marginal analysis

linear programming

Incremental profit analysis

Слайд 4Unlike short-term decisions, long-term decisions are made under risk and uncertainty

I

5

Слайд 5

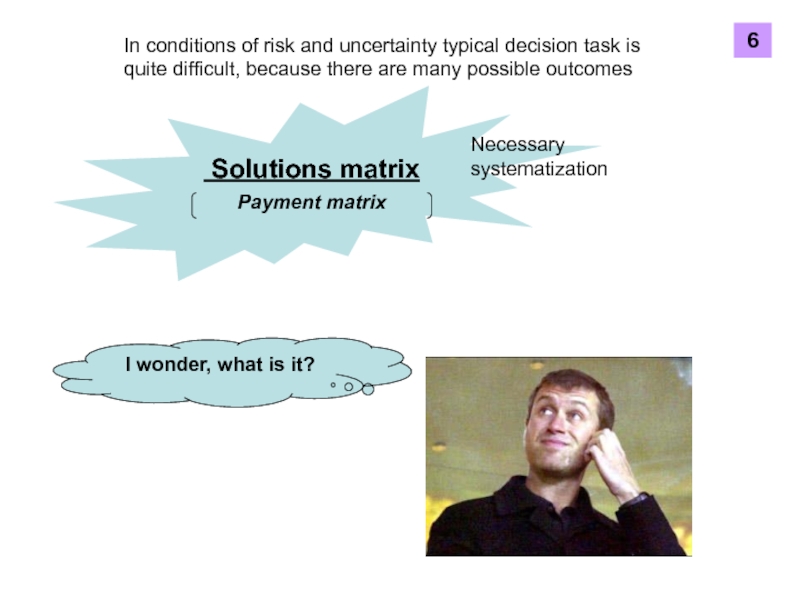

Solutions matrix

I wonder, what is it?

Payment matrix

In conditions of risk

Necessary systematization

6

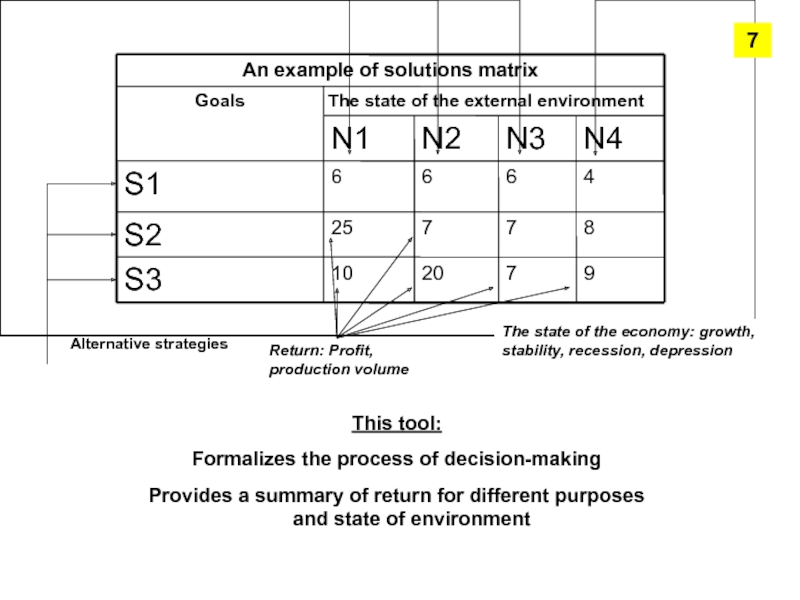

Слайд 6This tool:

Formalizes the process of decision-making

Provides a summary of return for

Alternative strategies

Return: Profit, production volume

The state of the economy: growth, stability, recession, depression

7

Слайд 92 approach to objective measurement of probability (degree of risk)

A priori

(deductive method)

Aposteriori (statistical analysis of empirical data)

10

Слайд 10 A priori

(deductive method)

No experiment and analysis of past experience

characteristics

Ex:

11

Слайд 11Aposteriori (statistical analysis of empirical data)

past experience will continue in the

Watch the frequency of occurrence of the event

Understand the frequency distribution for the total number of observations

Predict the probability distribution

12

Слайд 12Frequency distribution can be converted into a probability distribution

13

If a certain

Слайд 13Determine and minimize the risks inherent to a particular project

One of

14

Слайд 14Expected value

- Value of i outcome

- Probability of i outcome

The expected

15

Слайд 17Suppose that expected value of alternatives strategies are equal

How can we

18

Слайд 18New criteria – degree of risk

May be determined as deviation scope

19

Слайд 19By intuition we feel that the further away from the average

One way of calculating risk - calculation of swing (amplitude)

20

Слайд 20swing (amplitude)

- the difference between the extreme values of probable

Swing for S1 – 10, for S2 – 40.

21