- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

The World Economy презентация

Содержание

- 1. The World Economy

- 2. Lecture 4 Overview of the World Economy

- 3. The World Economy “Globalization” Means different things

- 4. Lecture 1: Overview The World Economy “Globalization”

- 5. The World Economy International Economics Is NOT about countries It IS about interactions among countries

- 6. Lecture 4 Overview of the World Economy

- 7. The World Economy World Economy consists of

- 8. (Aside, on getting information) An excellent source

- 9. The World Economy World Economy consists of

- 10. The World Economy Implication US is very

- 11. Lecture 4 Overview of the World Economy

- 12. The World Economy Ways that countries interact

- 14. The World Economy See tables below

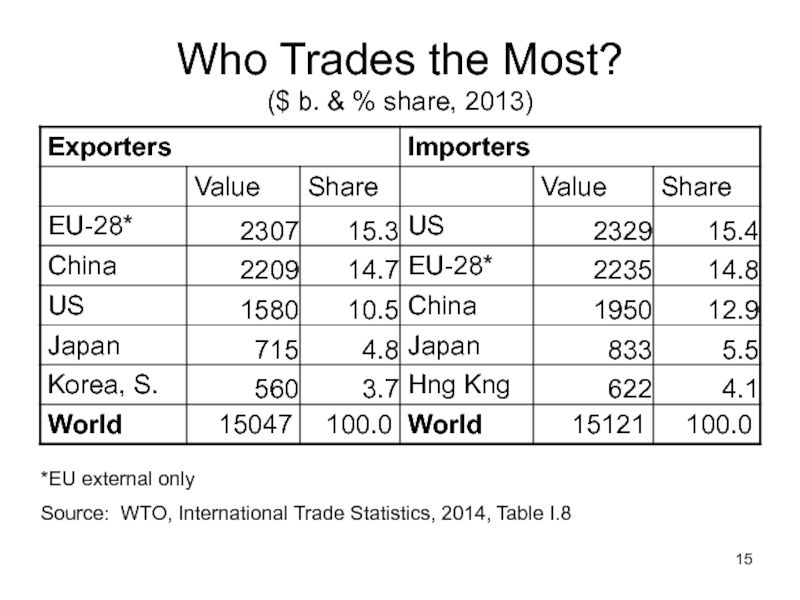

- 15. Who Trades the Most? ($ b. &

- 16. Who Trades the Most? Developed countries are

- 17. Who Trades the Most? See Economist from

- 18. Who Trades the Most? “Emerging Markets” in

- 19. Lecture 1: Overview

- 21. Who Trades with Whom? ($ b., 2013,

- 22. North America, Europe, and Asia trade mostly

- 23. What Does the World Trade? ($ b.

- 24. Lecture 1: Overview What Does the World

- 25. Lecture 1: Overview What Does the World

- 26. Lecture 1: Overview What Does the World

- 27. What Does the US Trade? ($ b.

- 28. Lecture 1: Overview What Does the US

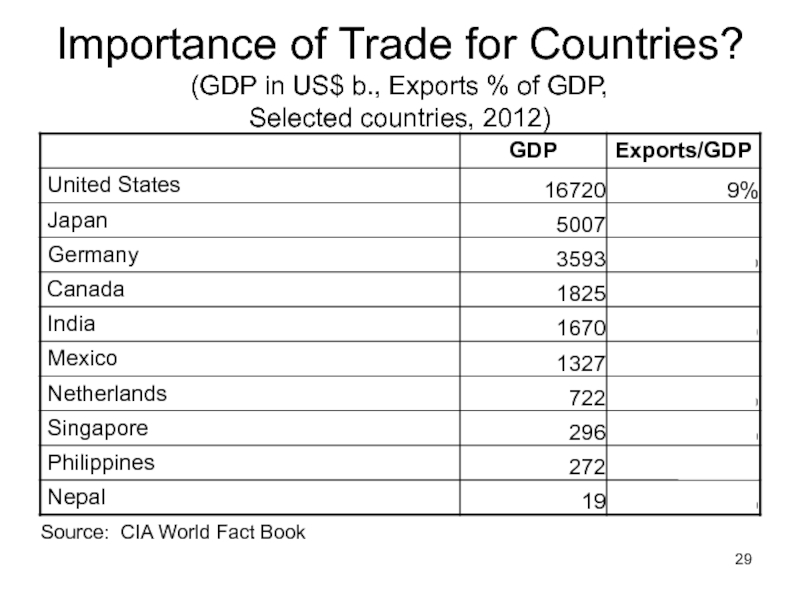

- 29. Importance of Trade for Countries? (GDP in

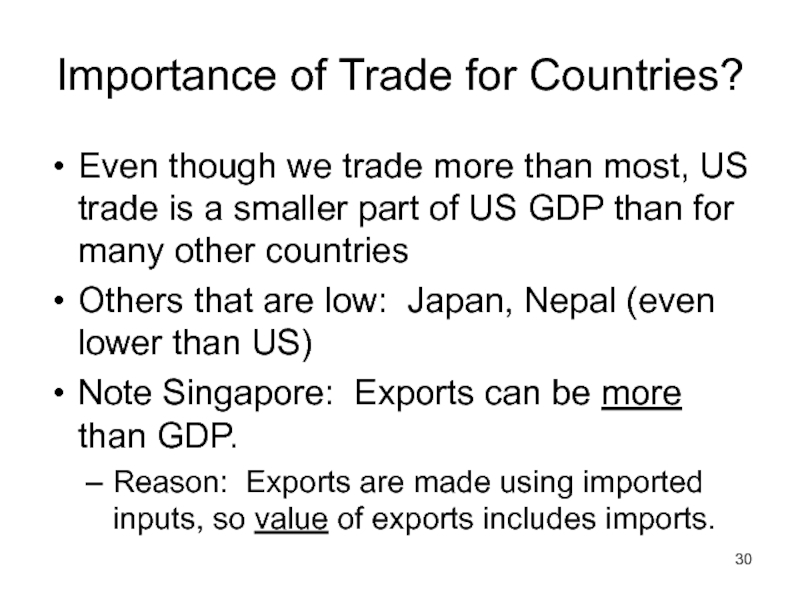

- 30. Importance of Trade for Countries? Even though

- 31. Importance of Trade for Countries? A Few

- 32. Lecture 4 Overview of the World Economy

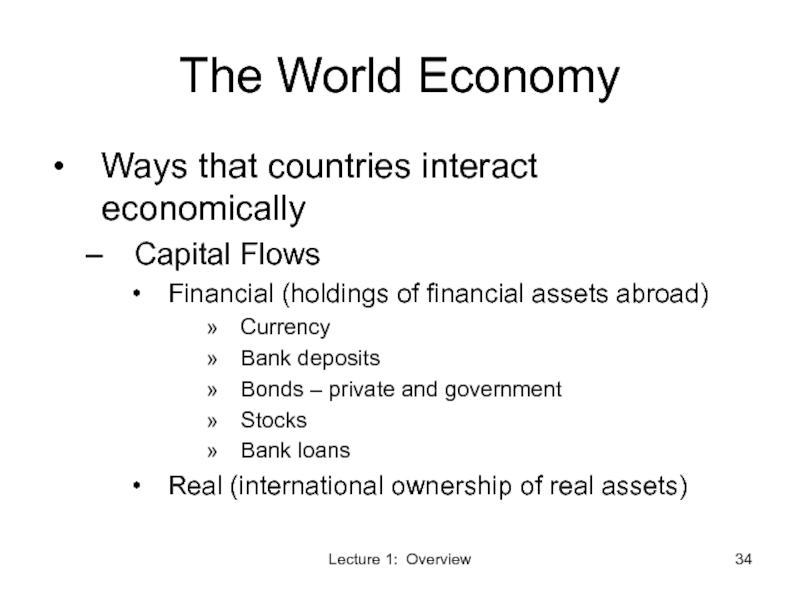

- 33. The World Economy Ways that countries interact

- 34. Lecture 1: Overview The World Economy Ways

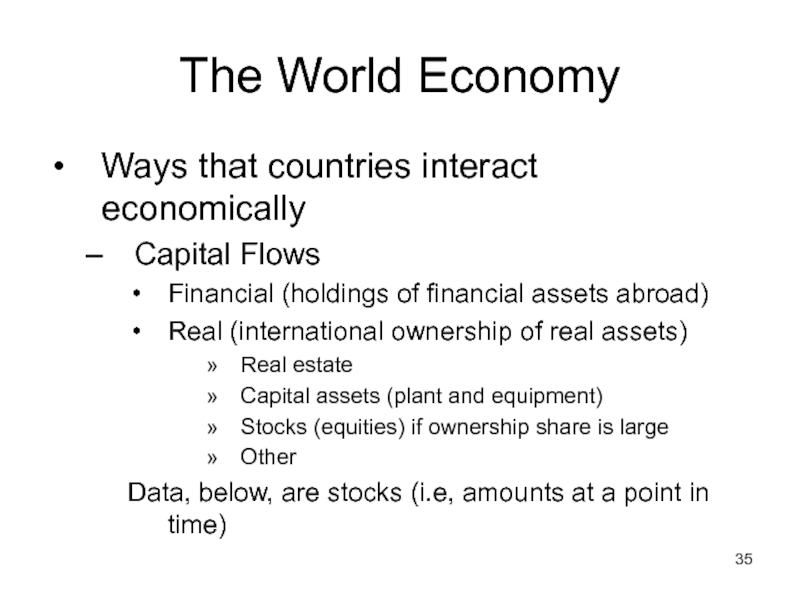

- 35. The World Economy Ways that countries interact

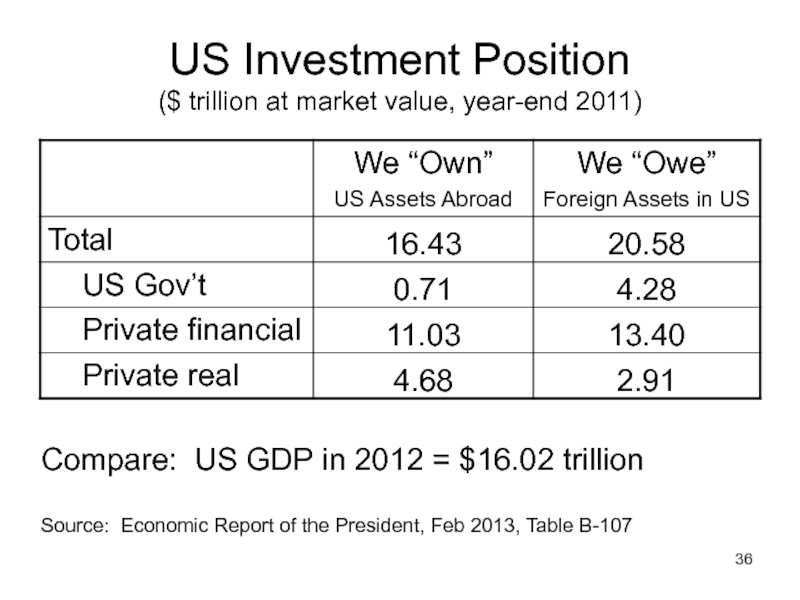

- 36. US Investment Position ($ trillion at market

- 37. US Investment Position (Qualification: “Owe” isn’t quite

- 38. Lecture 4 Overview of the World Economy

- 39. The World Economy Other ways that countries

- 40. Lecture 4 Overview of the World Economy

- 41. The World Economy Other ways that countries

- 42. The World Economy Other ways that countries

- 43. The World Economy Aside on Tariffs We

- 44. The World Economy Aside on Tariffs Tariffs

- 45. The World Economy Aside on Tariffs 45%

- 46. The World Economy Other ways that countries

- 47. Next Time Institutions of the International Economy

Слайд 2Lecture 4

Overview of the World Economy

“Globalization”

Elements of the World Economy

Ways that

Trade

Capital Flows

Migration

Policies that Affect Others

Слайд 3The World Economy

“Globalization”

Means different things to different people

My definitions (see my

1. The increasing world-wide integration of markets for goods, services and capital.

2. Also the role of MNCs, IMF, WTO, World Bank.

3. Elsewhere: domination by United States.

Some see good, others bad

Bad: reading by powell

Good: reading by Bhagwati

Both make valid points. Read to see what they are.

Слайд 4Lecture 1: Overview

The World Economy

“Globalization”

Some aspects of globalization declined with the

The Economist, on Nov 15, 2014, reported “Signs of Life”:

Globalization is back

Various measures of globalization (though not all) have risen past their previous peaks

The “depth” of trade (its volume) has increased

The “breadth” of trade (number of borders crossed) has not fully recovered

Слайд 5The World Economy

International Economics

Is NOT about countries

It IS about interactions among

Слайд 6Lecture 4

Overview of the World Economy

“Globalization”

Elements of the World Economy

Ways that

Trade

Capital Flows

Migration

Policies that Affect Others

Слайд 7The World Economy

World Economy consists of

Countries: a few hundred

(CIA lists about

(WTO has 160 members)

People: over 7 billion

(7.216 b. 1/5/15, compare 320 m. US)

Land: about 15 times the US

Слайд 8(Aside, on getting information)

An excellent source of information about countries is

(Just Google “fact book”)

Слайд 9The World Economy

World Economy consists of

GDP (2013 est., per CIA, in

World: Total = $87.25 trillion

per capita = $13,100

US: Total = $16.72 trillion

per capita = $52,800

Слайд 10The World Economy

Implication

US is very unusual

Very rich

US has less than

Слайд 11Lecture 4

Overview of the World Economy

“Globalization”

Elements of the World Economy

Ways that

Trade

Capital Flows

Migration

Policies that Affect Others

Слайд 12The World Economy

Ways that countries interact economically

Trade (per CIA, 2013 est.)

World

(compare world GDP of $87 trillion)

World trade has grown faster than world GDP most years

But not during 2008-9, due to world recession

Слайд 14The World Economy

See tables below for

Who trades most?

Who trades with whom?

Share

US:

What do we export/import?

To/from whom?

Слайд 15Who Trades the Most?

($ b. & % share, 2013)

*EU external only

Source:

Слайд 16Who Trades the Most?

Developed countries are the biggest traders

China is catching

It was the #3 exporter six years ago when I taught the course; now it’s #2 and closing in on EU.

Others are gaining as well: Four years ago Canada was #5 exporter. Three years ago that was S Korea

Слайд 17Who Trades the Most?

See Economist from about a year ago: “Trading

China claimed to have surpassed US. True only for goods, not goods + services

But with time China will pass US in both

China’s trade per GDP is much larger than the US, but below world average

Much of the value in China’s exports is imported inputs, thus low “value added.”

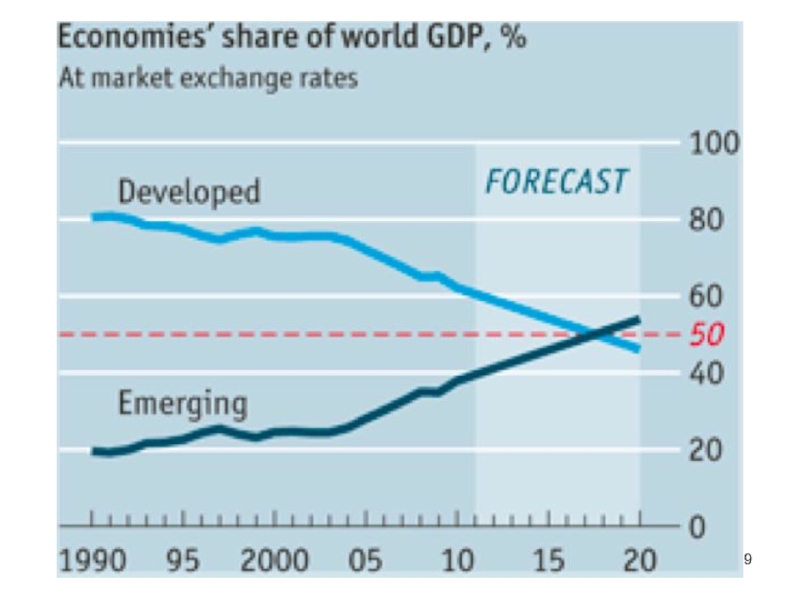

Слайд 18Who Trades the Most?

“Emerging Markets” in general are catching up to,

In GDP, trade, and more

See Economics Focus from The Economist, “Why the Tail Wags the Dog”

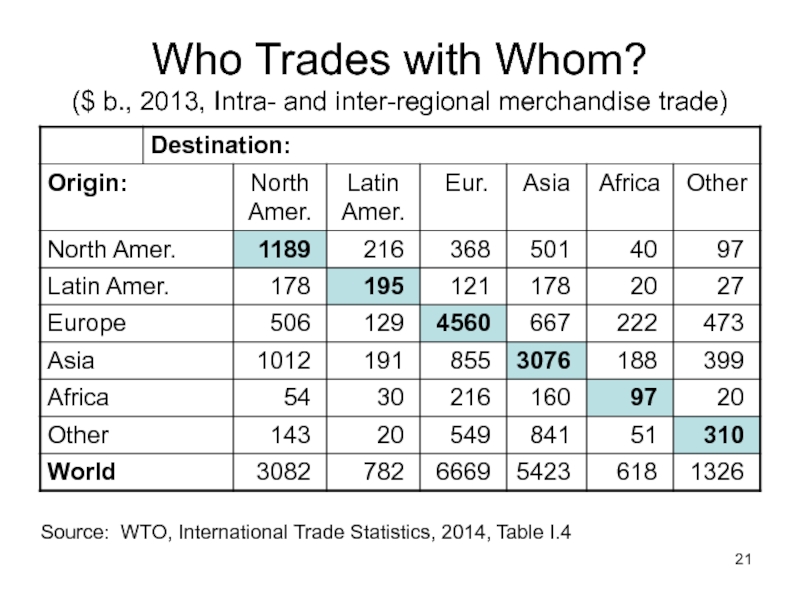

Слайд 21Who Trades with Whom?

($ b., 2013, Intra- and inter-regional merchandise trade)

Source:

Слайд 22North America, Europe, and Asia trade mostly within their group

Poorer regions

This reflects what is not so clear in the table:

Rich countries trade most with each other

Poor countries trade most with rich countries

But their trade with each other is growing

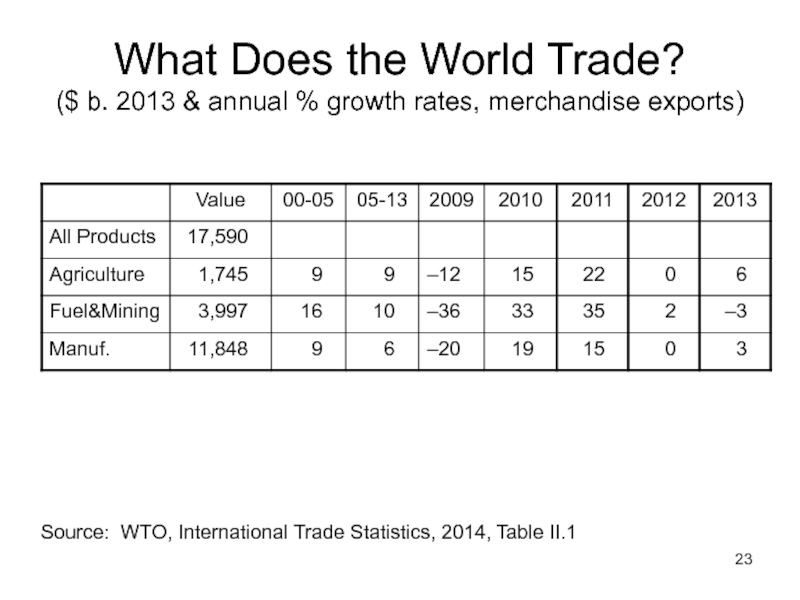

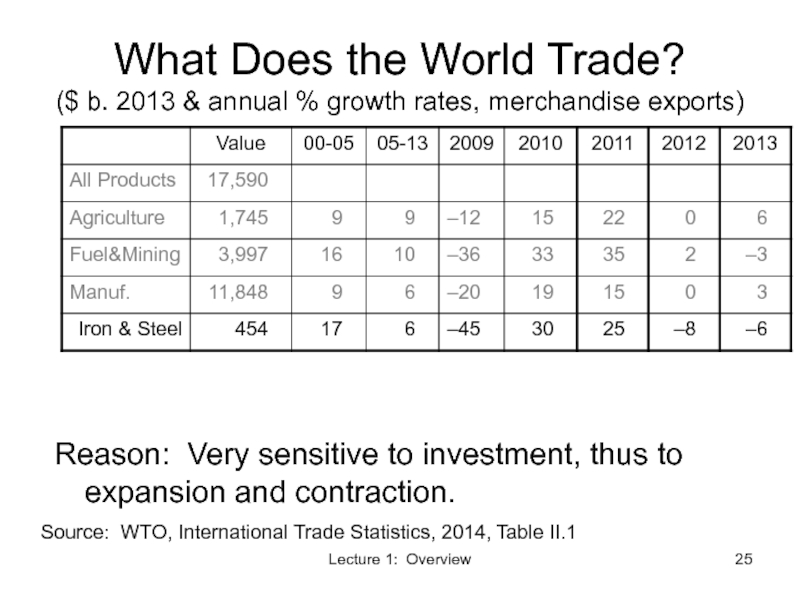

Слайд 23What Does the World Trade? ($ b. 2013 & annual % growth

Source: WTO, International Trade Statistics, 2014, Table II.1

Слайд 24Lecture 1: Overview

What Does the World Trade?

Biggest traded category: manufactures

Fastest growing,

Why?

Because this is the value of trade, and prices of oil and other raw materials were rising, and then falling.

But within Manufactures, Iron & Steel is even more volatile:

Слайд 25Lecture 1: Overview

What Does the World Trade?

($ b. 2013 & annual

Source: WTO, International Trade Statistics, 2014, Table II.1

Reason: Very sensitive to investment, thus to expansion and contraction.

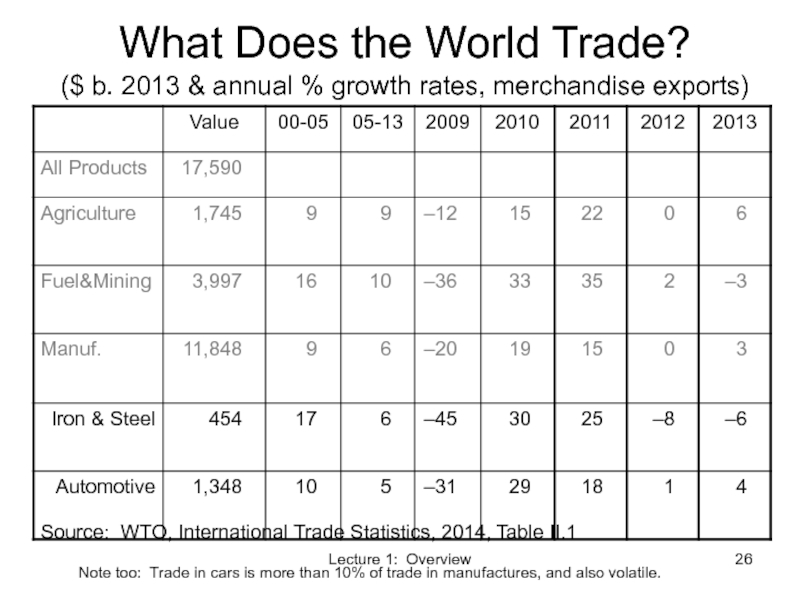

Слайд 26Lecture 1: Overview

What Does the World Trade?

($ b. 2013 & annual

Source: WTO, International Trade Statistics, 2014, Table II.1

Note too: Trade in cars is more than 10% of trade in manufactures, and also volatile.

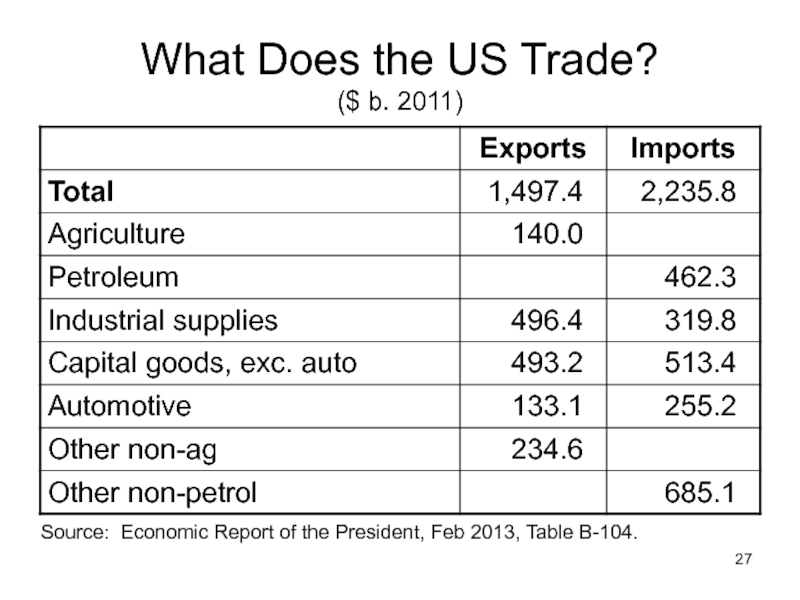

Слайд 27What Does the US Trade?

($ b. 2011)

Source: Economic Report of the

Слайд 28Lecture 1: Overview

What Does the US Trade?

US imports are much larger

(We’ll see what that means later in the course.)

US is a big…

Exporter of agricultural products

Importer of oil

Exporter and importer of capital goods (i.e., machines for making things)

Слайд 29Importance of Trade for Countries? (GDP in US$ b., Exports % of

Source: CIA World Fact Book

Слайд 30Importance of Trade for Countries?

Even though we trade more than most,

Others that are low: Japan, Nepal (even lower than US)

Note Singapore: Exports can be more than GDP.

Reason: Exports are made using imported inputs, so value of exports includes imports.

Слайд 32Lecture 4

Overview of the World Economy

“Globalization”

Elements of the World Economy

Ways that

Trade

Capital Flows

Migration

Policies that Affect Others

Слайд 33The World Economy

Ways that countries interact economically

Capital Flows

Financial (holdings of financial

Real (international ownership of real assets)

Слайд 34Lecture 1: Overview

The World Economy

Ways that countries interact economically

Capital Flows

Financial (holdings

Currency

Bank deposits

Bonds – private and government

Stocks

Bank loans

Real (international ownership of real assets)

Слайд 35The World Economy

Ways that countries interact economically

Capital Flows

Financial (holdings of financial

Real (international ownership of real assets)

Real estate

Capital assets (plant and equipment)

Stocks (equities) if ownership share is large

Other

Data, below, are stocks (i.e, amounts at a point in time)

Слайд 36US Investment Position

($ trillion at market value, year-end 2011)

Source: Economic Report

Compare: US GDP in 2012 = $16.02 trillion

Слайд 37US Investment Position

(Qualification: “Owe” isn’t quite right. This includes all assets

Lessons:

US is a large net “debtor” (result of our spending more than we earn)

Most of this today is government, but some is private

Слайд 38Lecture 4

Overview of the World Economy

“Globalization”

Elements of the World Economy

Ways that

Trade

Capital Flows

Migration

Policies that Affect Others

Слайд 39The World Economy

Other ways that countries interact economically

Migration

Temporary

Guest workers

Day workers

Permanent

In practice,

Слайд 40Lecture 4

Overview of the World Economy

“Globalization”

Elements of the World Economy

Ways that

Trade

Capital Flows

Migration

Policies that Affect Others

Слайд 41The World Economy

Other ways that countries interact economically

Policies that affect other

Direct

Indirect

Слайд 42The World Economy

Other ways that countries interact economically

Policies that affect other

Direct

Trade policies (tariffs, quotas)

Foreign aid

Capital controls

Exchange rate management

Immigration restrictions

Indirect

Слайд 43The World Economy

Aside on Tariffs

We will be dealing a lot with

See reading by Hufbauer and Grieco:

US tariffs are much lower than they used to be (average 4% now, vs. 40% in 1946)

US has gained a great deal from lowering tariffs

US still has much to gain from further lowering

But there are also severe costs for some people and firms who compete with imports

Слайд 44The World Economy

Aside on Tariffs

Tariffs could go up:

WTO enforces only upper

Actual tariffs in many countries are below these limits, and could legally rise

There was danger that the recent world recession would push countries to do that.

They didn’t – at least not much.

Слайд 45The World Economy

Aside on Tariffs

45% of US exports go to developing

US tariffs are much higher against developing countries than against developed countries

Слайд 46The World Economy

Other ways that countries interact economically

Policies that affect other

Indirect

Subsidies (esp. agriculture)

US farm subsidies > foreign aid (see CGD reading)

Macro policies (monetary, fiscal)

Exchange-rate policies

Environmental policies

Standards

Labor

Health & safety

Norms

Слайд 47Next Time

Institutions of the International Economy

What are they?

The WTO

The IMF

The World

The OECD

What’s happening (or not happening) now?