- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Supply, Demand and Government Policies презентация

Содержание

- 1. Supply, Demand and Government Policies

- 2. Supply, Demand, and

- 3. Price Controls... Are usually enacted when policymakers

- 4. Price Ceilings & Price Floors Price Ceiling

- 5. Price Ceilings Two outcomes are possible when

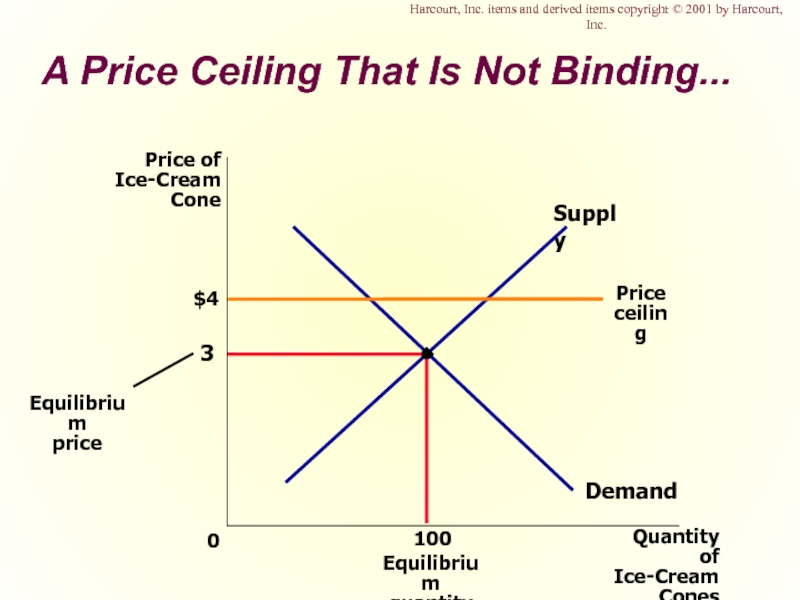

- 6. A Price Ceiling That Is Not Binding...

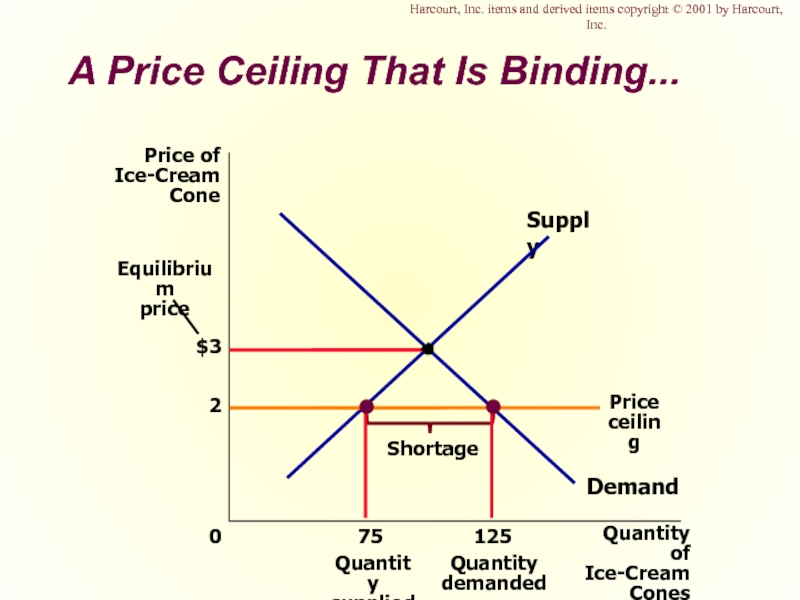

- 7. A Price Ceiling That Is

- 8. Effects of Price Ceilings A

- 9. Lines at the Gas Pump In 1973

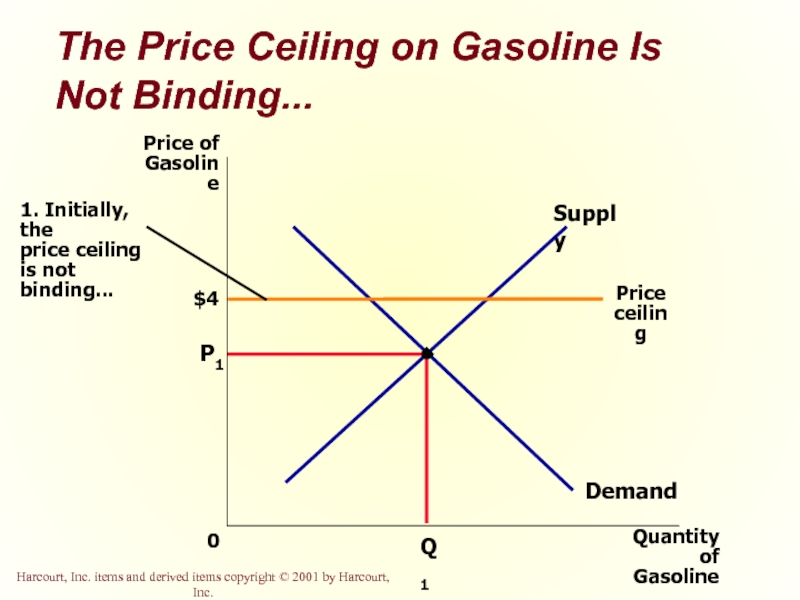

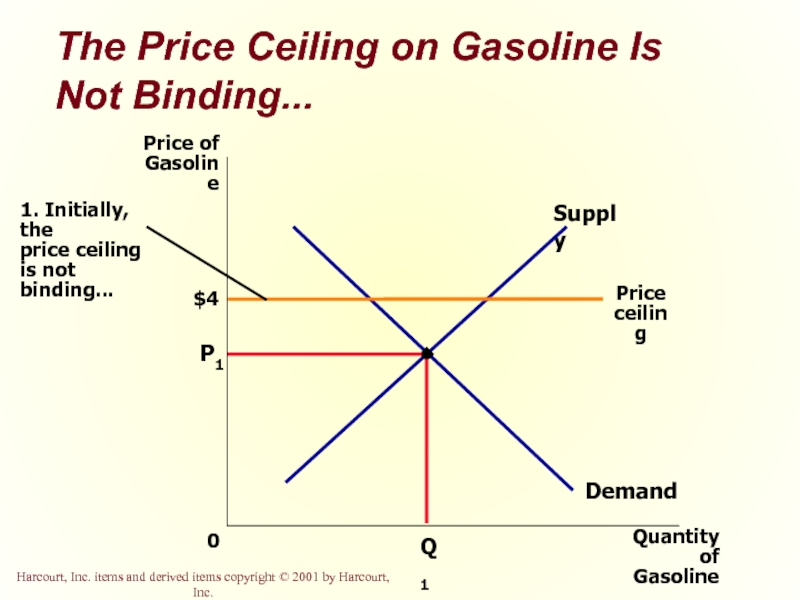

- 10. The Price Ceiling on Gasoline Is Not

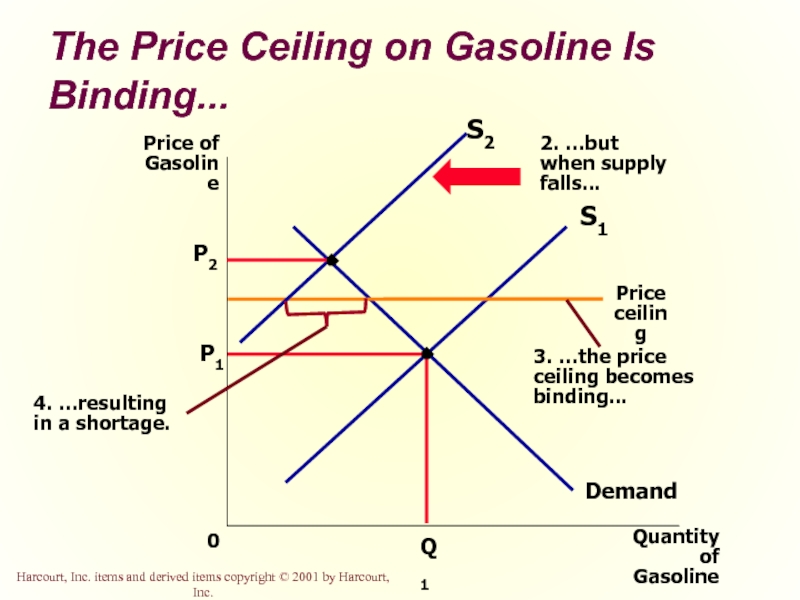

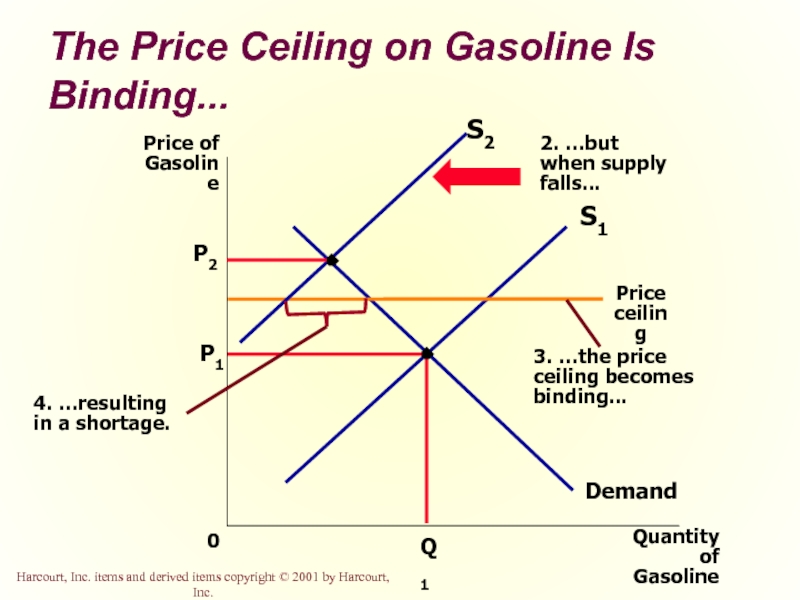

- 11. The Price Ceiling on Gasoline Is Binding...

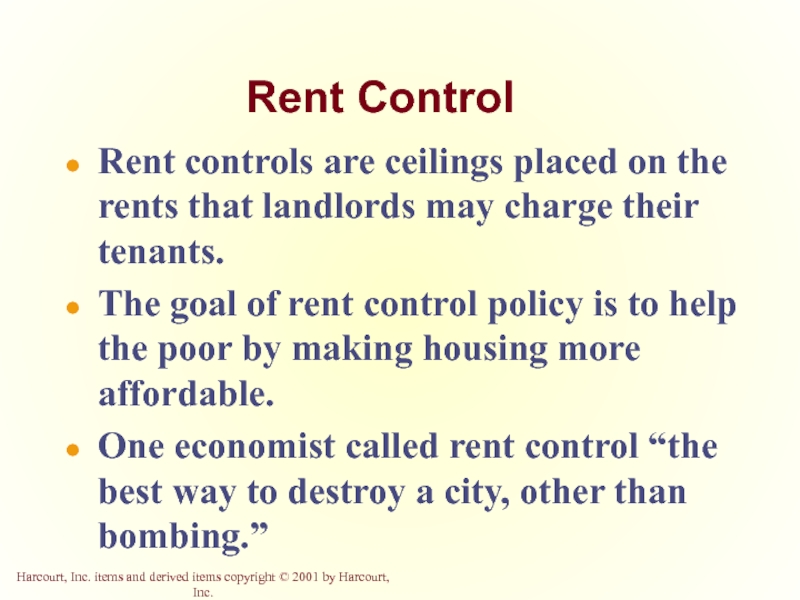

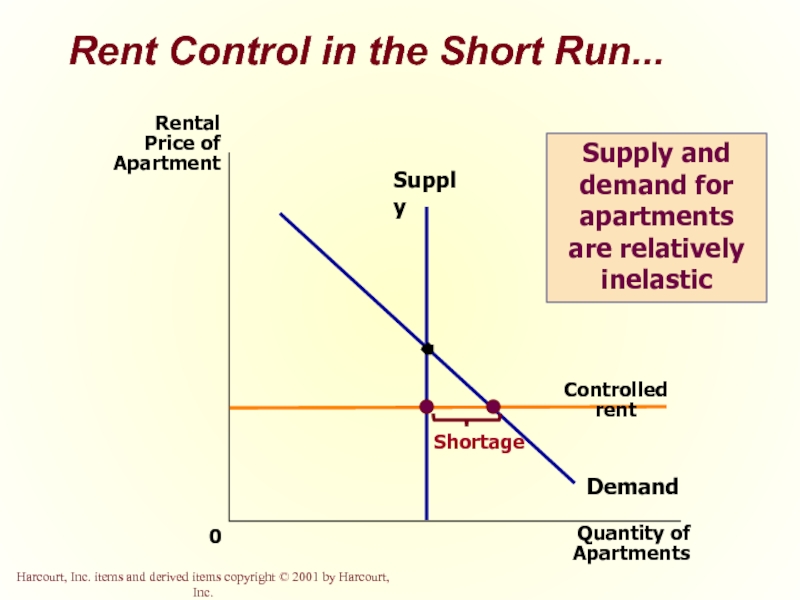

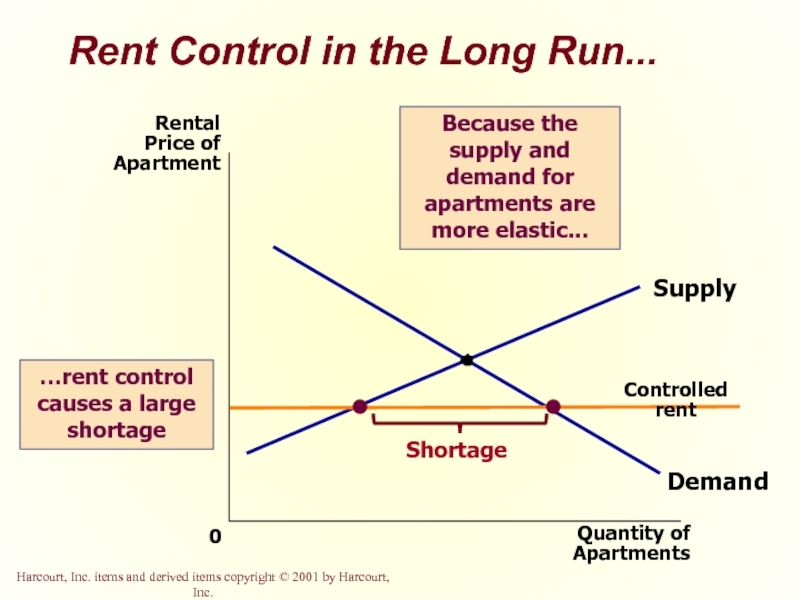

- 12. Rent Control Rent controls are ceilings placed

- 13. Rent Control in the Short

- 14. Rent Control in the Long

- 15. Price Floors When

- 16. A Price Floor That Is

- 17. A Price Floor That Is

- 18. Effects of a Price Floor

- 19. Effects of a Price Floor

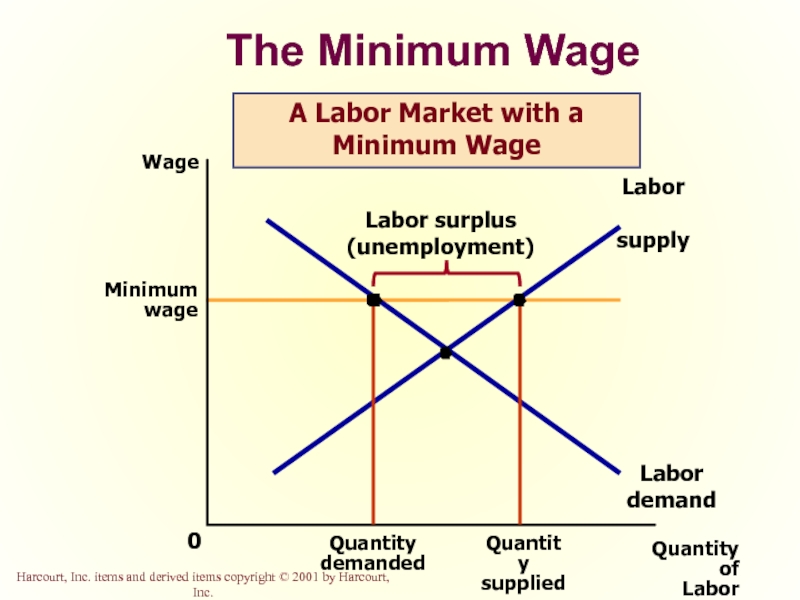

- 20. The Minimum Wage An important example of

- 21. The Minimum Wage Quantity of

- 22. The Minimum Wage Quantity of

- 23. Taxes Governments levy taxes to raise revenue for public projects.

- 24. What are some potential impacts

- 25. Taxes Tax incidence is the

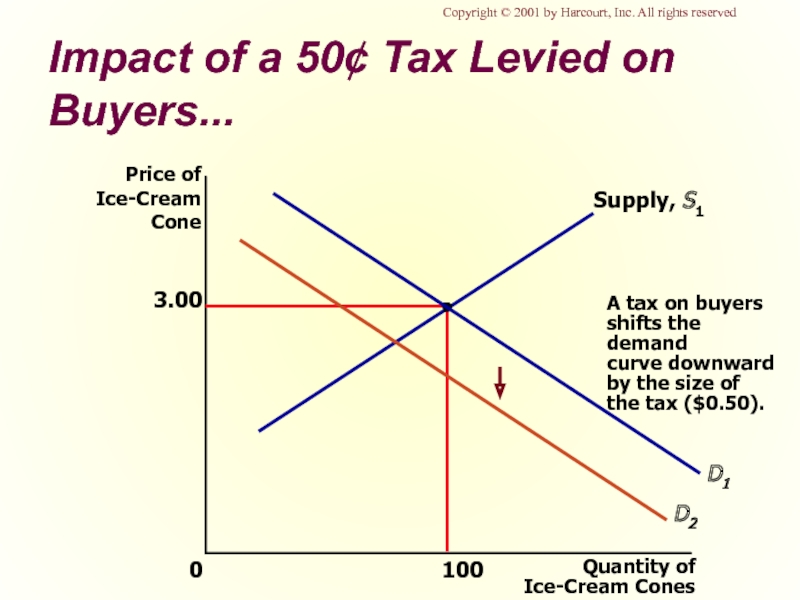

- 26. Impact of a 50¢ Tax Levied on

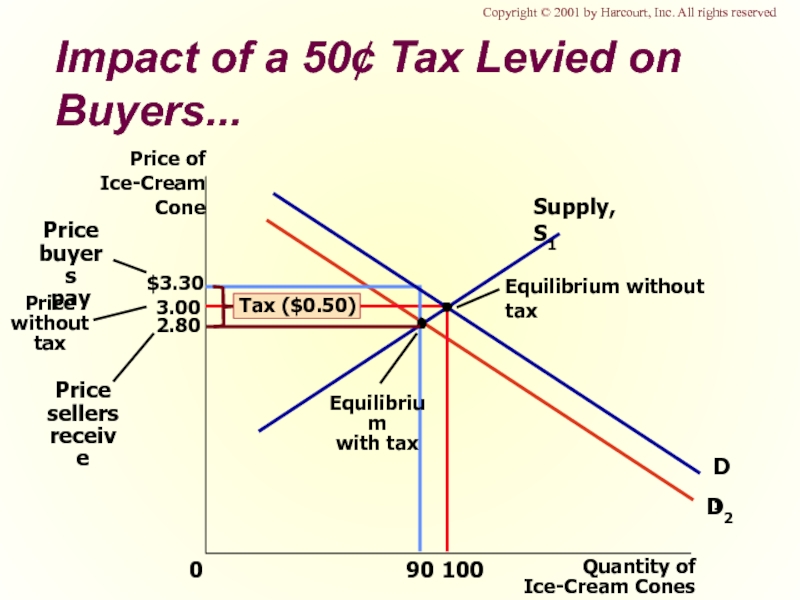

- 27. 3.00 Quantity of Ice-Cream Cones 0 Price

- 28. What was the impact of tax?

- 29. 3.00 0 100 S1

- 30. A Payroll Tax Quantity of Labor 0

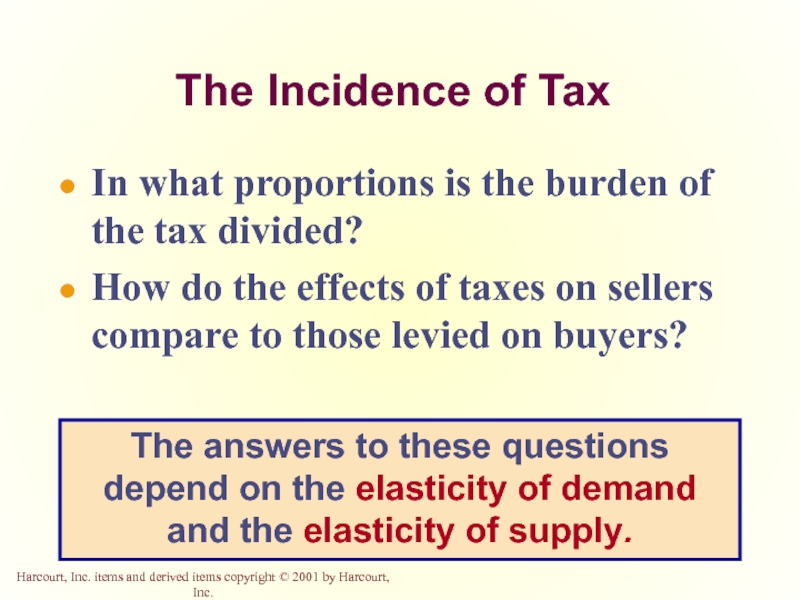

- 31. The Incidence of Tax In

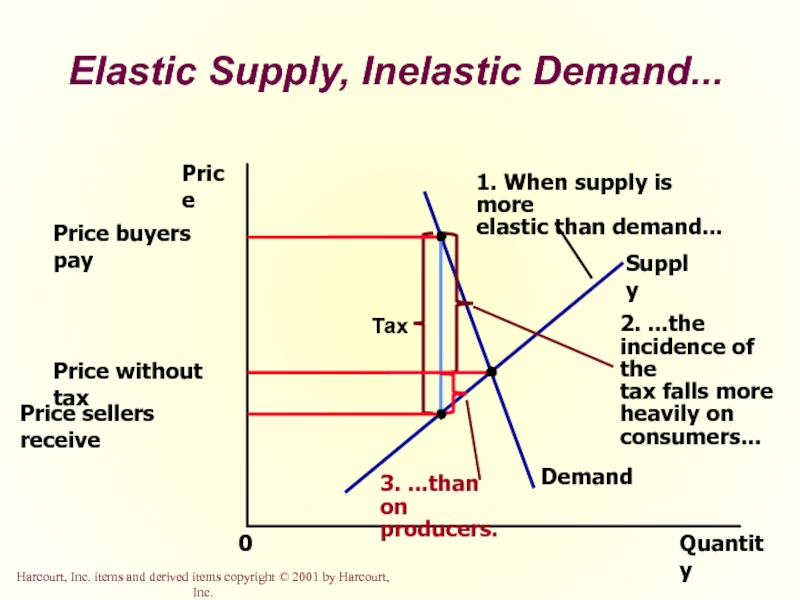

- 32. Elastic Supply, Inelastic Demand... Quantity 0 Price Demand Supply

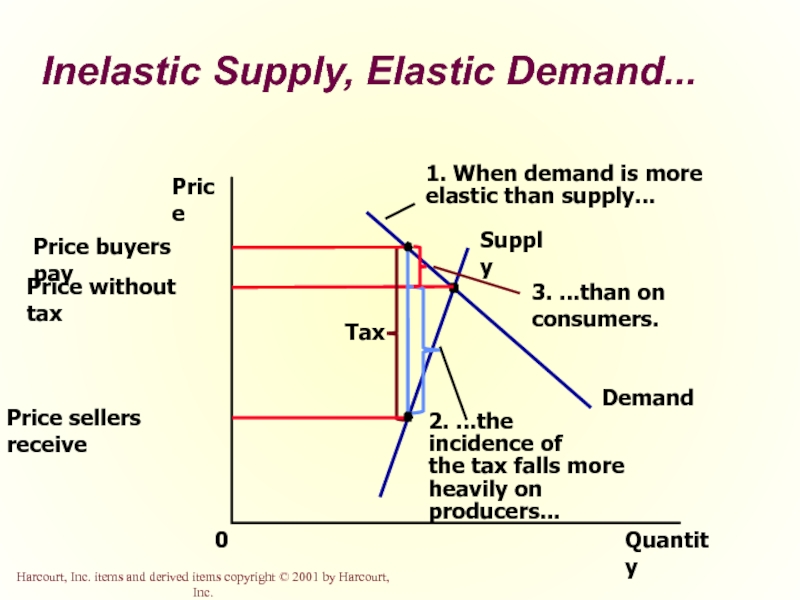

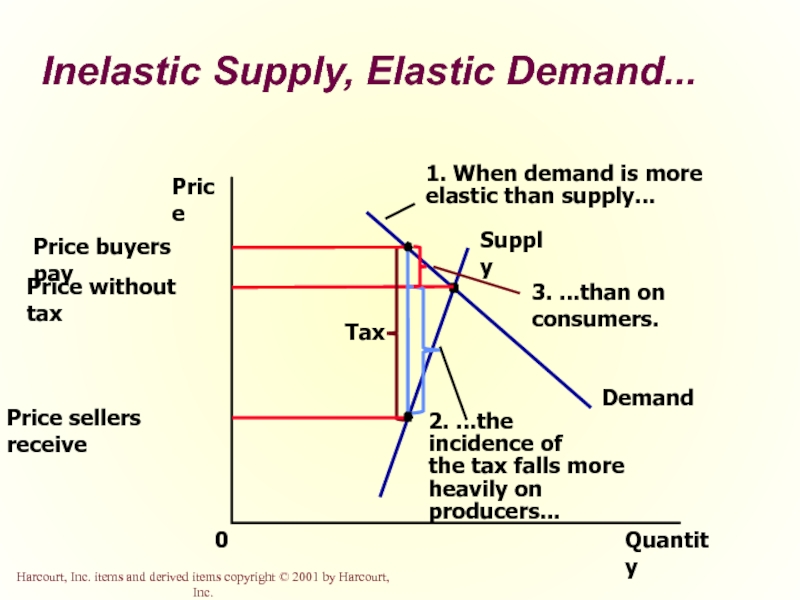

- 33. Inelastic Supply, Elastic Demand... Quantity 0 Price Demand Supply

- 34. So, how is

- 35. Summary Price controls include price ceilings and

- 36. Summary Taxes are used to raise revenue

- 37. Summary The incidence of a tax refers

- 39. A Price Ceiling That Is Not Binding...

- 40. A Price Ceiling That Is Binding... Harcourt,

- 41. The Price Ceiling on Gasoline Is Not Binding...

- 42. The Price Ceiling on Gasoline Is Binding...

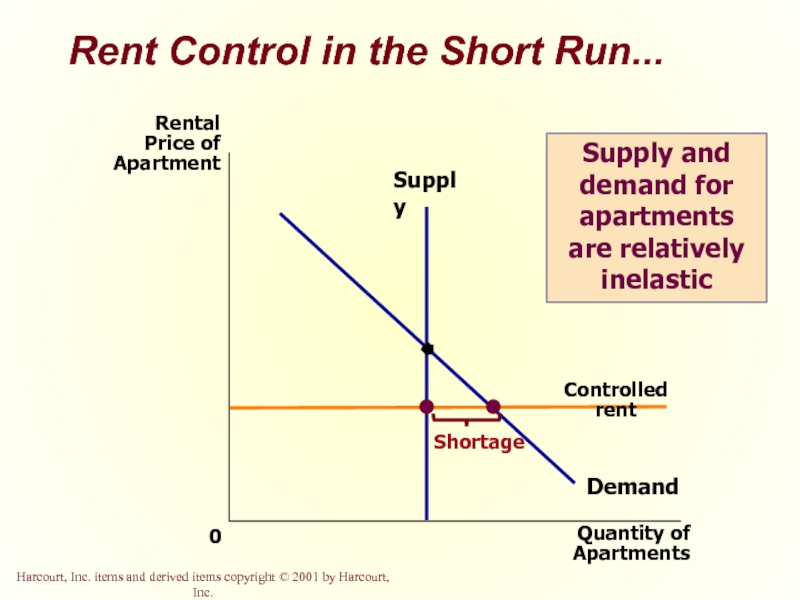

- 43. Rent Control in the Short Run... Supply and demand for apartments are relatively inelastic

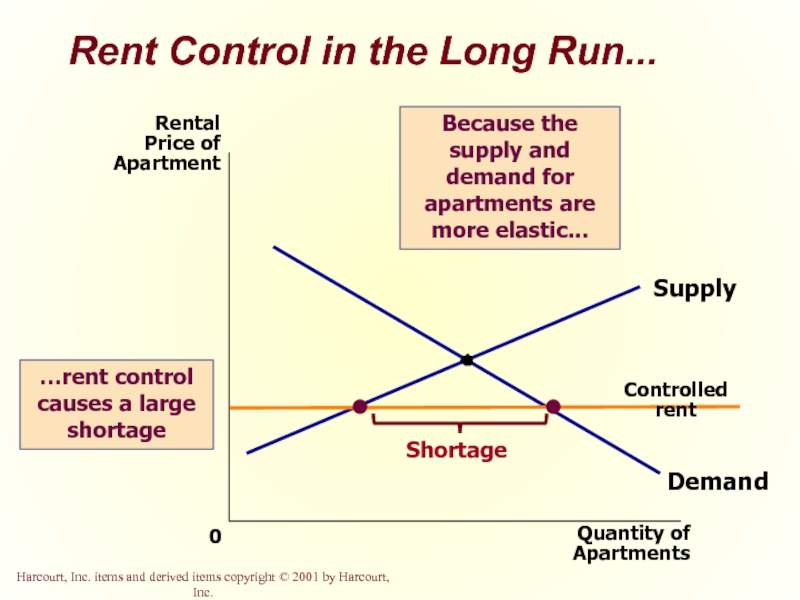

- 44. Rent Control in the Long Run...

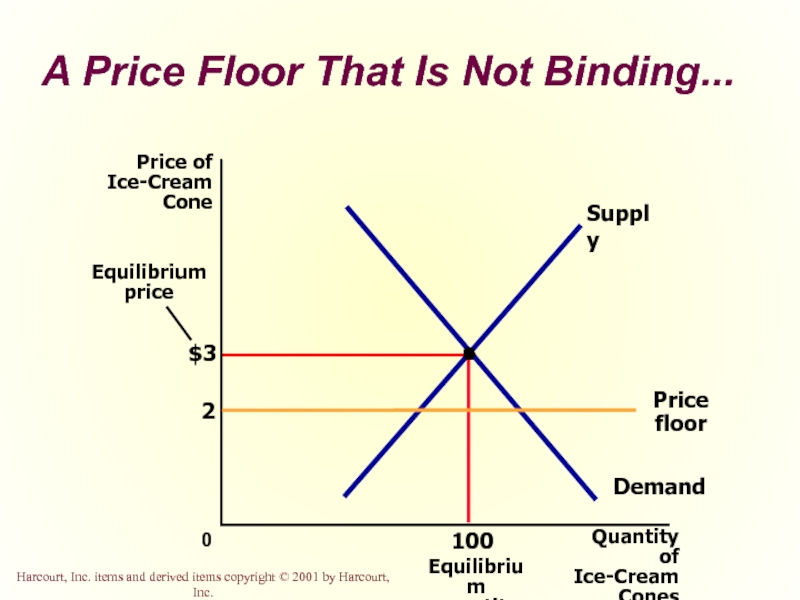

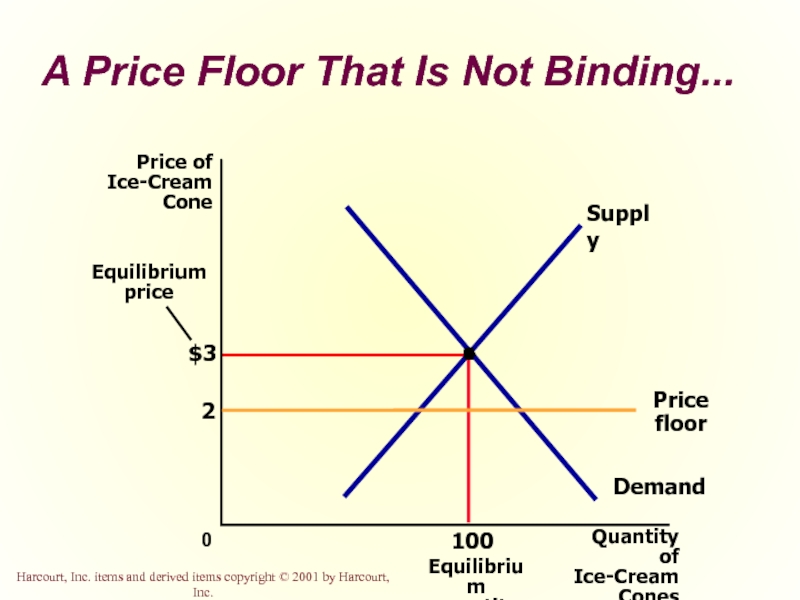

- 45. A Price Floor That Is Not Binding...

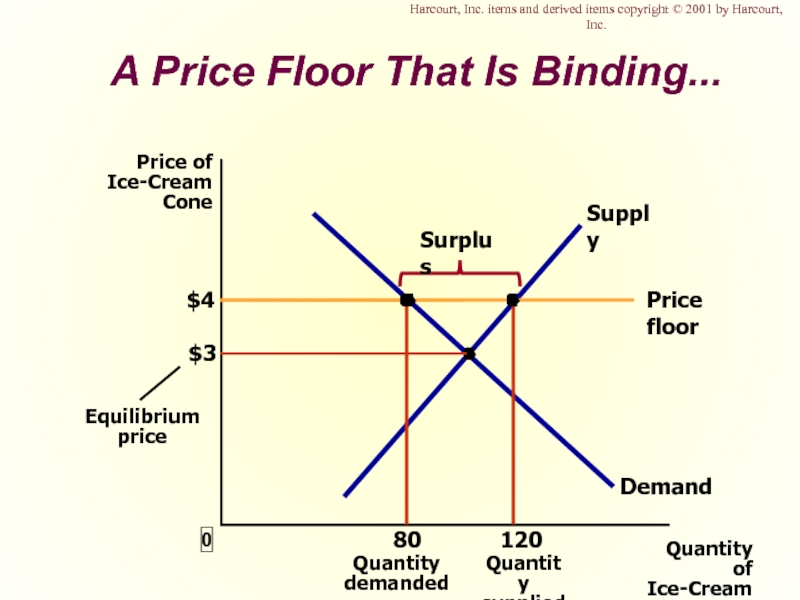

- 46. A Price Floor That Is Binding... Harcourt,

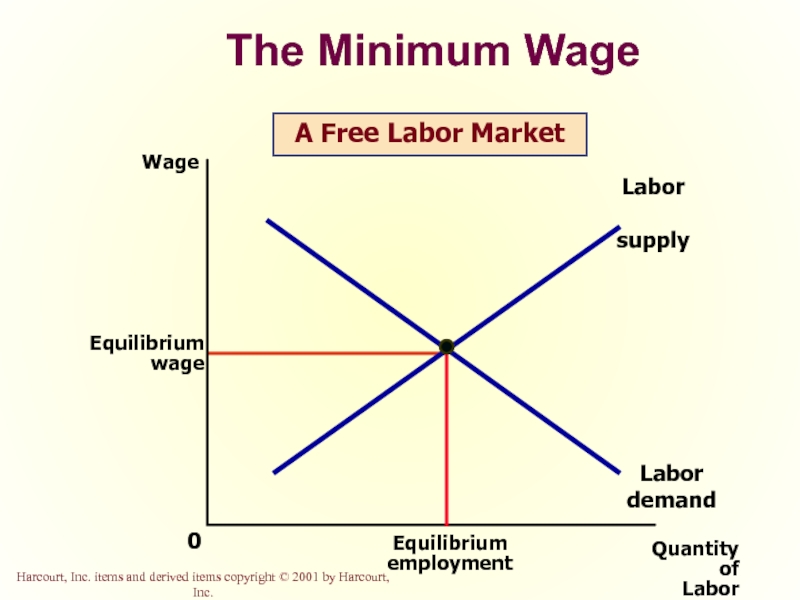

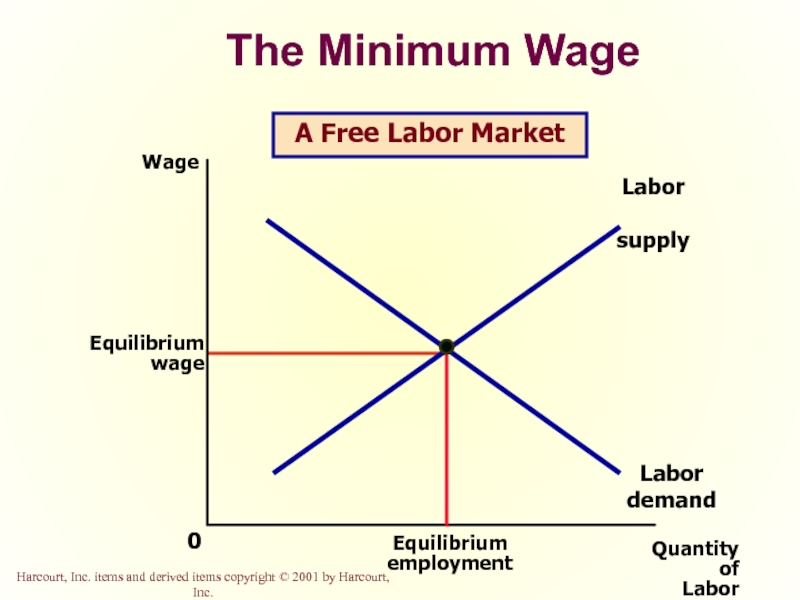

- 47. The Minimum Wage

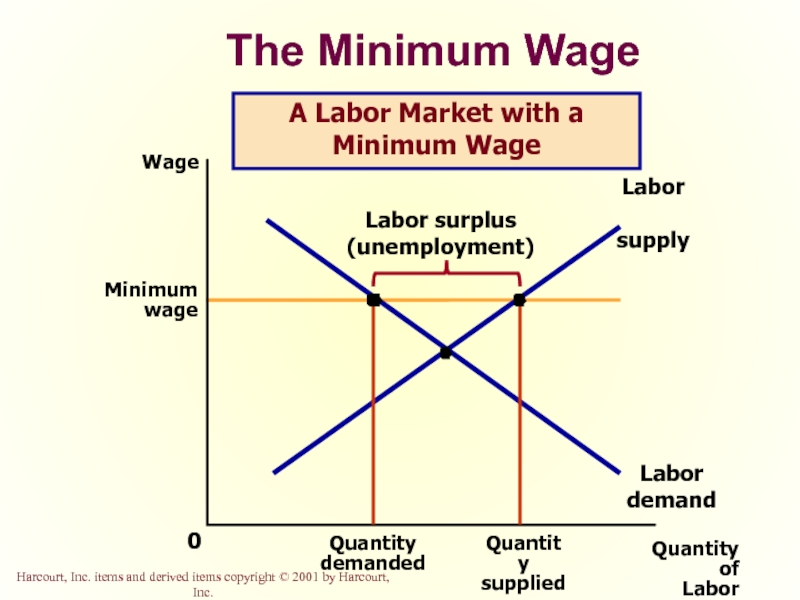

- 48. The Minimum Wage

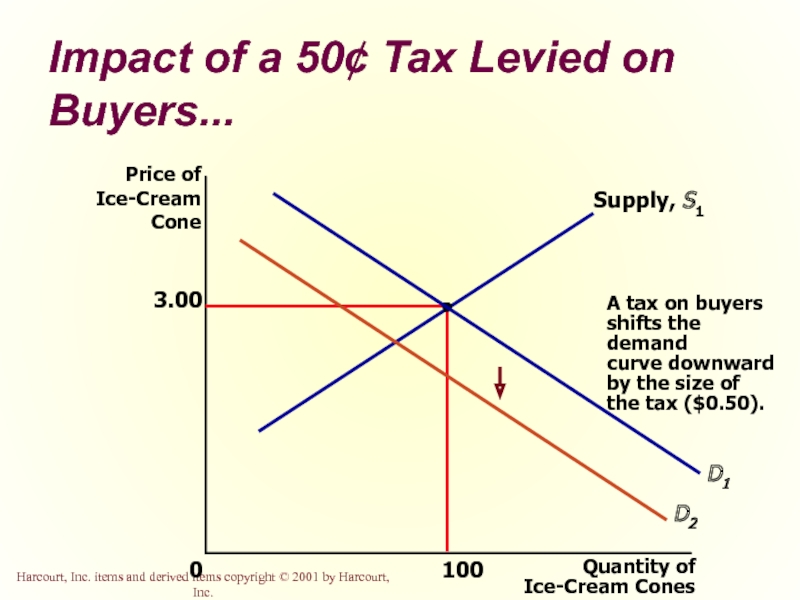

- 49. Impact of a 50¢ Tax Levied on Buyers...

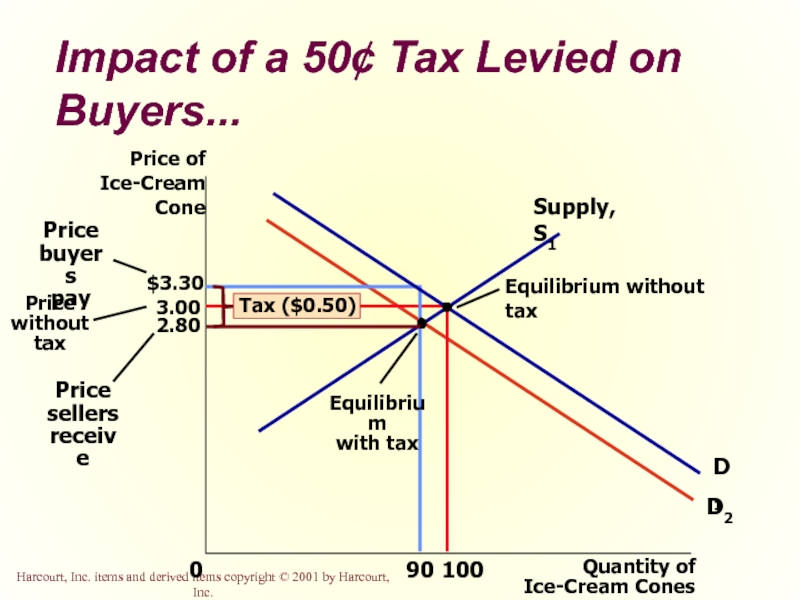

- 50. Impact of a 50¢ Tax Levied on Buyers...

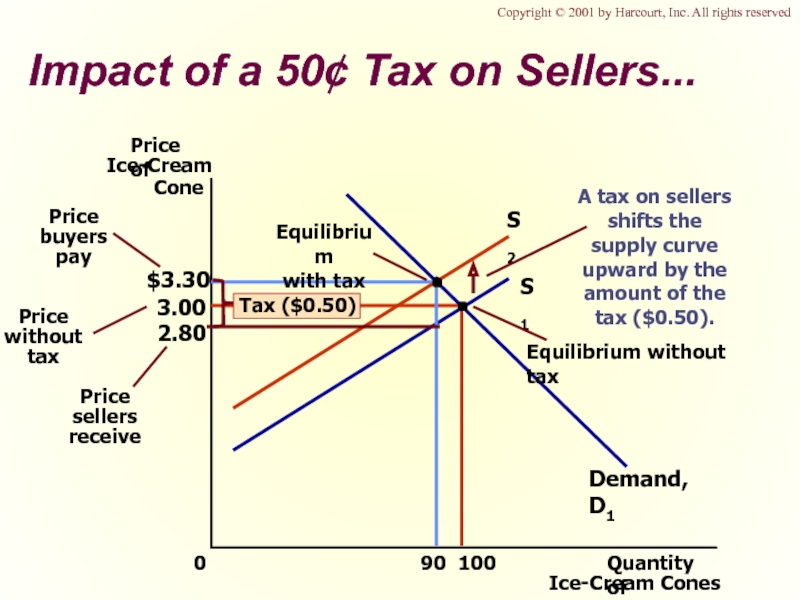

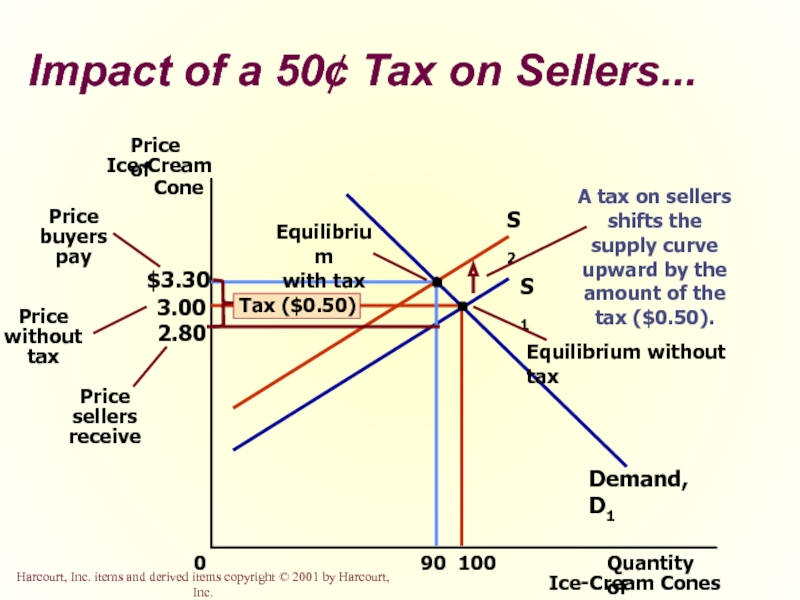

- 51. Impact of a 50¢ Tax on Sellers...

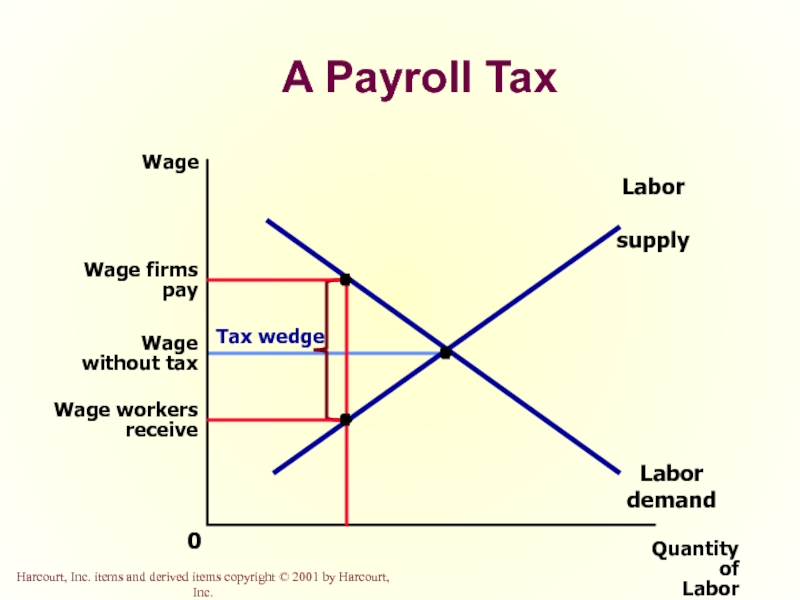

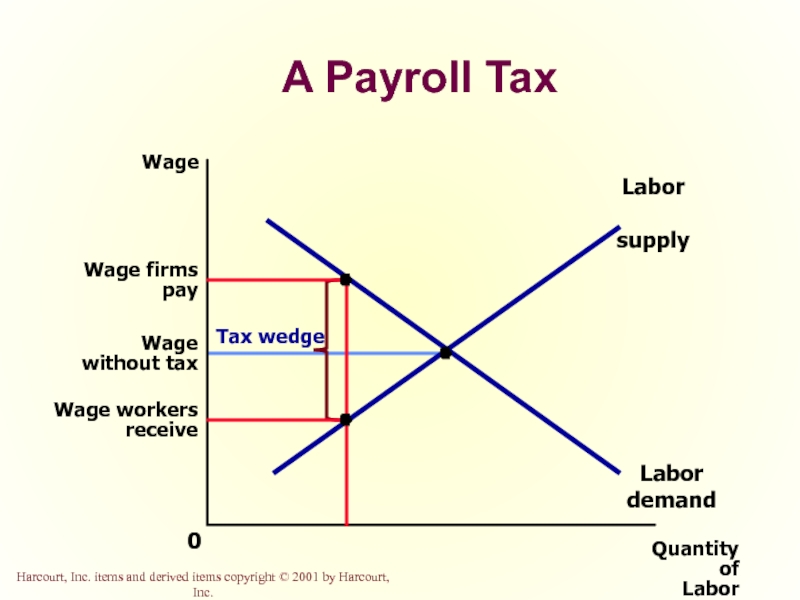

- 52. A Payroll Tax

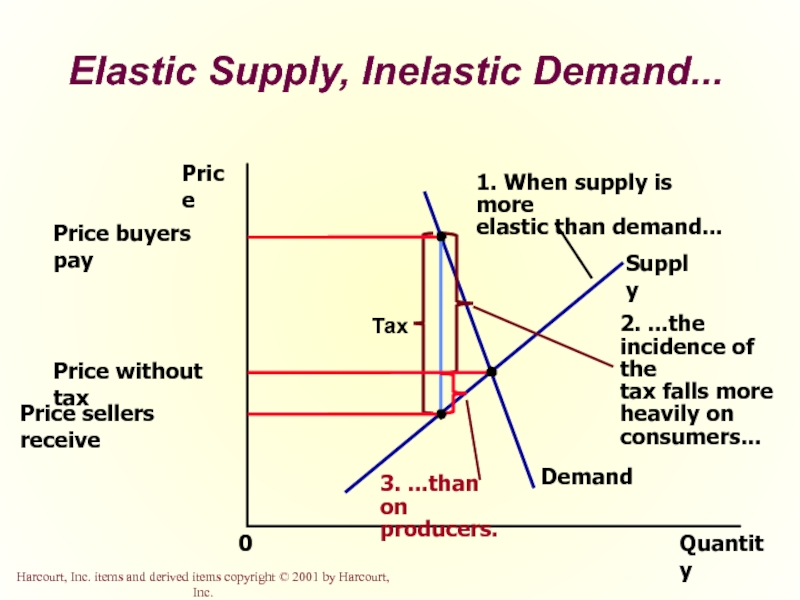

- 53. Elastic Supply, Inelastic Demand...

- 54. Inelastic Supply, Elastic Demand...

Слайд 1

Supply, Demand and Government Policies

Chapter 6

Copyright © 2001 by Harcourt, Inc.

All

Permissions Department, Harcourt College Publishers, 6277 Sea Harbor Drive, Orlando, Florida 32887-6777.

Слайд 2

Supply, Demand, and Government Policies

In a free, unregulated market system, market

While equilibrium conditions may be efficient, it may be true that not everyone is satisfied.

One of the roles of economists is to use their theories to assist in the development of policies.

Слайд 3Price Controls...

Are usually enacted when policymakers believe the market price is

Result in government-created price ceilings and floors.

Слайд 4Price Ceilings & Price Floors

Price Ceiling

A legally established maximum price

Price Floor

A legally established minimum price at which a good can be sold.

Слайд 5Price Ceilings

Two outcomes are possible when the government imposes a price

The price ceiling is not binding if set above the equilibrium price.

The price ceiling is binding if set below the equilibrium price, leading to a shortage.

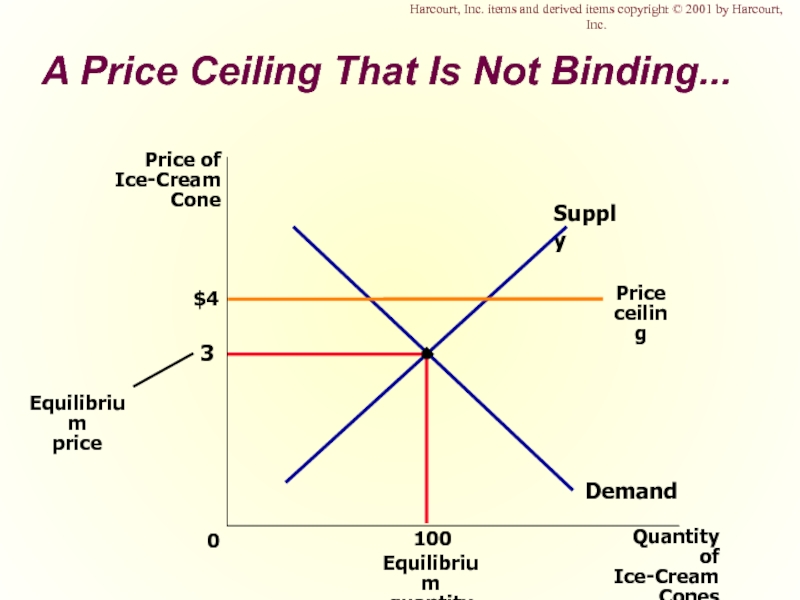

Слайд 6A Price Ceiling That Is Not Binding...

$4

3

Quantity of

Ice-Cream

Cones

0

Price of

Ice-Cream

Cone

Demand

Supply

100

Equilibrium

quantity

Harcourt, Inc. items

Слайд 7

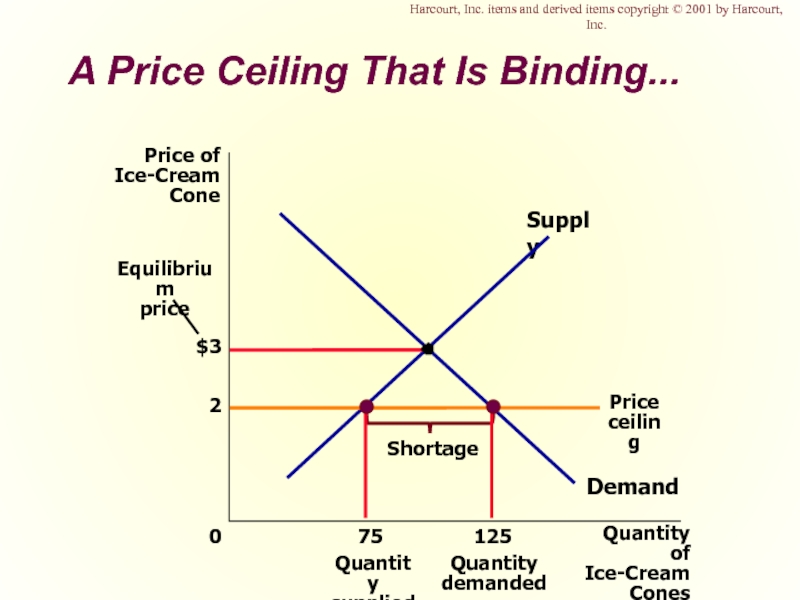

A Price Ceiling That Is Binding...

$3

Quantity of

Ice-Cream

Cones

0

Price of

Ice-Cream

Cone

2

Demand

Supply

Harcourt, Inc. items and

Слайд 8

Effects of Price Ceilings

A binding price ceiling creates ...

shortages

Example: Gasoline shortage of the 1970s

nonprice rationing

Examples: Long lines, Discrimination by sellers

Слайд 9Lines at the Gas Pump

In 1973 OPEC raised the price of

What was responsible for the long gas lines?

Economists blame government regulations that limited the price oil companies could charge for gasoline.

Слайд 10The Price Ceiling on Gasoline Is Not Binding...

$4

P1

Quantity of

Gasoline

0

Price of

Gasoline

Q1

Demand

Supply

Слайд 11The Price Ceiling on Gasoline Is Binding...

P1

Quantity of

Gasoline

0

Price of

Gasoline

Q1

Demand

S1

Price

ceiling

Слайд 12Rent Control

Rent controls are ceilings placed on the rents that landlords

The goal of rent control policy is to help the poor by making housing more affordable.

One economist called rent control “the best way to destroy a city, other than bombing.”

Слайд 13

Rent Control in the Short Run...

Quantity of

Apartments

0

Rental Price of

Apartment

Demand

Supply

Supply and demand

Слайд 14

Rent Control in the Long Run...

Quantity of

Apartments

0

Rental Price of

Apartment

Demand

Supply

Because the supply

…rent control causes a large shortage

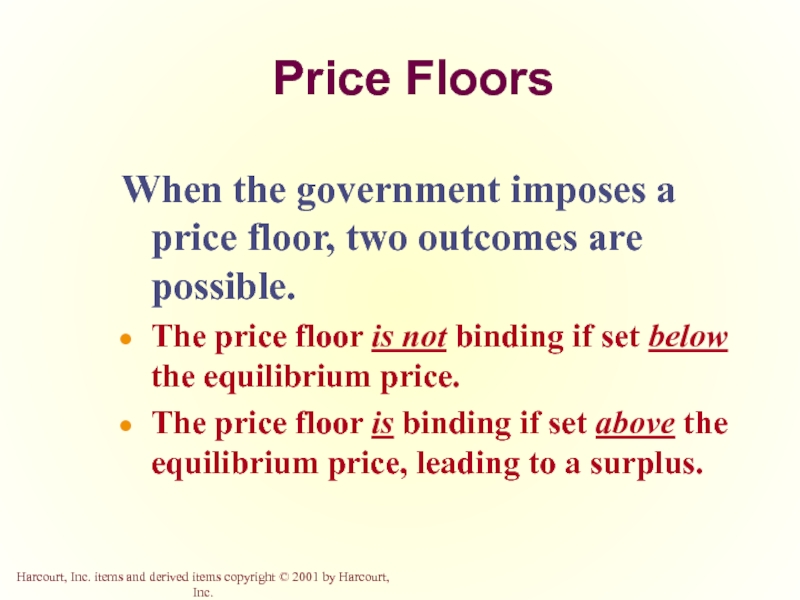

Слайд 15

Price Floors

When the government imposes a price floor, two outcomes are

The price floor is not binding if set below the equilibrium price.

The price floor is binding if set above the equilibrium price, leading to a surplus.

Слайд 16

A Price Floor That Is Not Binding...

$3

Quantity of

Ice-Cream

Cones

0

Price of

Ice-Cream

Cone

100

Equilibrium

quantity

Demand

Supply

2

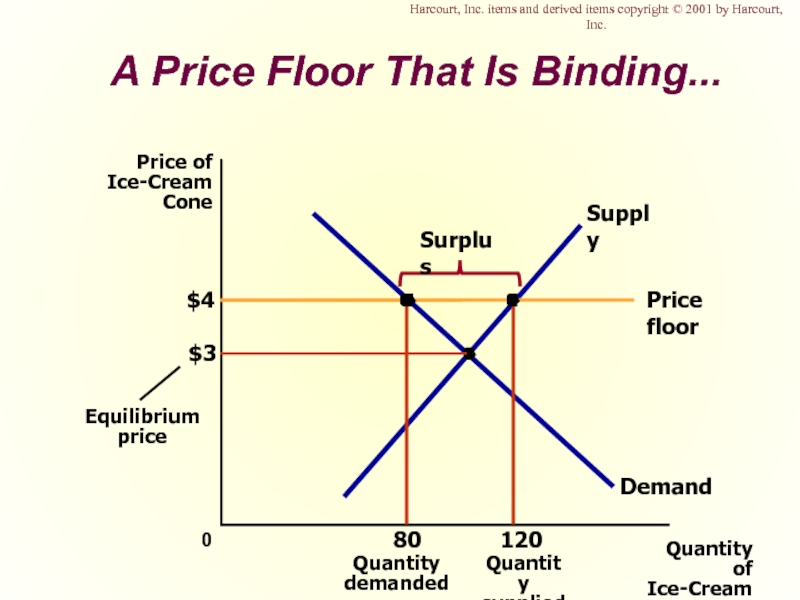

Слайд 17

A Price Floor That Is Binding...

$3

Quantity of

Ice-Cream

Cones

0

Price of

Ice-Cream

Cone

Demand

Supply

$4

Harcourt, Inc. items and

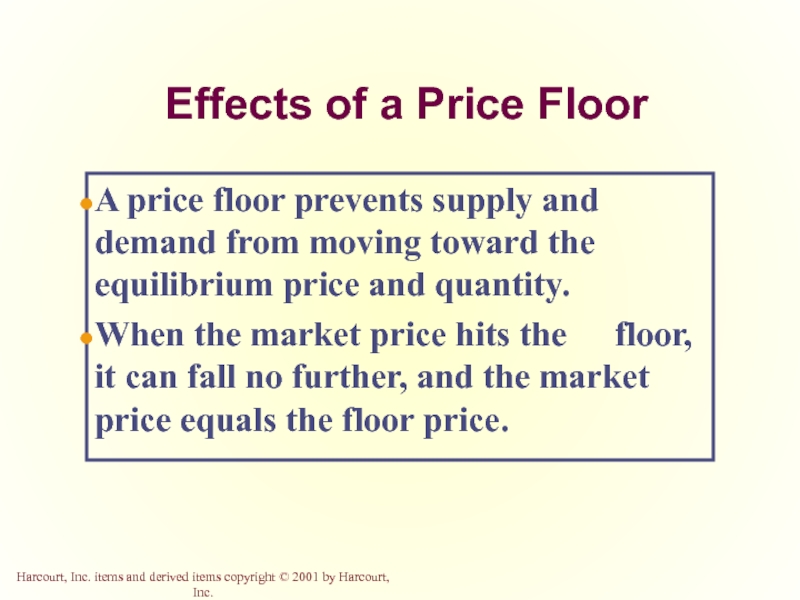

Слайд 18

Effects of a Price Floor

A price floor prevents supply and demand

When the market price hits the floor, it can fall no further, and the market price equals the floor price.

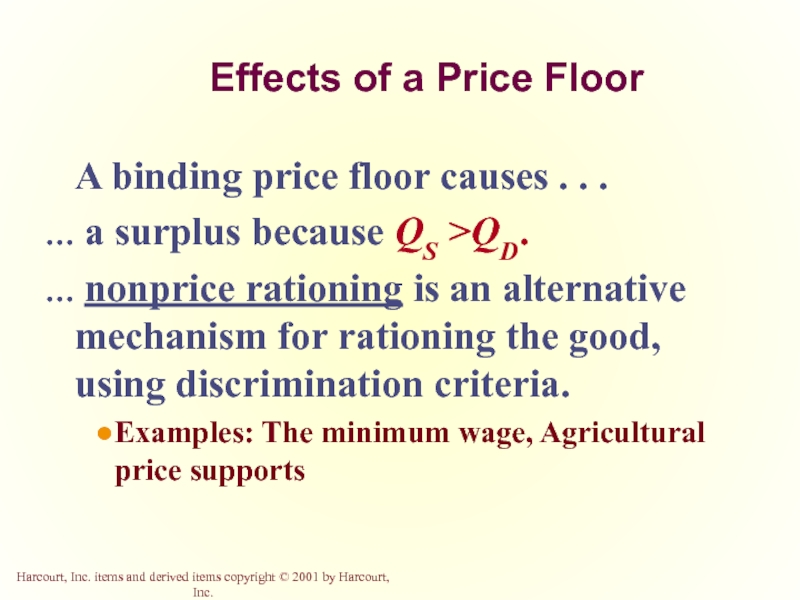

Слайд 19

Effects of a Price Floor

A binding price floor causes . .

a surplus because QS >QD.

nonprice rationing is an alternative mechanism for rationing the good, using discrimination criteria.

Examples: The minimum wage, Agricultural price supports

Слайд 20The Minimum Wage

An important example of a price floor is the

Слайд 22The Minimum Wage

Quantity of

Labor

0

Wage

Labor

demand

Labor

supply

A Labor Market with a Minimum

Слайд 24

What are some potential impacts of taxes?

Taxes discourage market activity.

When a

Buyers and sellers share the tax burden.

Слайд 25

Taxes

Tax incidence is the study of who bears the burden of

Taxes result in a change in market equilibrium.

Buyers pay more and sellers receive less, regardless of whom the tax is levied on.

Слайд 26Impact of a 50¢ Tax Levied on Buyers...

3.00

Quantity of

Ice-Cream Cones

0

Price of

Ice-Cream

Cone

100

D1

Supply,

Copyright © 2001 by Harcourt, Inc. All rights reserved

Слайд 273.00

Quantity of

Ice-Cream Cones

0

Price of

Ice-Cream

Cone

100

90

D1

D2

Supply, S1

Impact of a 50¢ Tax Levied on

Copyright © 2001 by Harcourt, Inc. All rights reserved

Слайд 28

What was the impact of tax?

Taxes discourage market activity.

When a good

Buyers and sellers share the tax burden.

Слайд 293.00

0

100

S1

Demand, D1

Impact of a 50¢ Tax on Sellers...

Copyright © 2001 by

Слайд 31

The Incidence of Tax

In what proportions is the burden of the

How do the effects of taxes on sellers compare to those levied on buyers?

The answers to these questions depend on the elasticity of demand and the elasticity of supply.

Слайд 34

So, how is the burden of the tax divided?

The burden of

Слайд 35Summary

Price controls include price ceilings and price floors.

A price ceiling

A price floor is a legal minimum on the price of a good or a service. An example is the minimum wage.

Слайд 36Summary

Taxes are used to raise revenue for public purposes.

When the government

A tax on a good places a wedge between the price paid by buyers and the price received by sellers.

Слайд 37Summary

The incidence of a tax refers to who bears the burden

The incidence of a tax does not depend on whether the tax is levied on buyers or sellers.

The incidence of the tax depends on the price elasticities of supply and demand.