- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Firms in competitive markets. (Lecture 14) презентация

Содержание

- 1. Firms in competitive markets. (Lecture 14)

- 2. WHAT IS A COMPETITIVE MARKET? A perfectly

- 3. WHAT IS A COMPETITIVE MARKET? As a

- 4. WHAT IS A COMPETITIVE MARKET? A competitive

- 5. The Revenue of a Competitive Firm Total

- 6. The Revenue of a Competitive Firm Total revenue is proportional to the amount of output.

- 7. The Revenue of a Competitive Firm Average

- 8. The Revenue of a Competitive Firm In

- 9. The Revenue of a Competitive Firm Marginal

- 10. The Revenue of a Competitive Firm For

- 11. Table 1 Total, Average, and Marginal Revenue for a Competitive Firm Copyright©2004 South-Western

- 12. PROFIT MAXIMIZATION AND THE COMPETITIVE FIRM’S SUPPLY

- 13. Table 2 Profit Maximization: A Numerical Example Copyright©2004 South-Western

- 14. Figure 1 Profit Maximization for a Competitive

- 15. PROFIT MAXIMIZATION AND THE COMPETITIVE FIRM’S SUPPLY

- 16. PROFIT MAXIMIZATION AND THE COMPETITIVE FIRM’S SUPPLY

- 17. Figure 2 Marginal Cost as the Competitive

- 18. The Firm’s Short-Run Decision to Shut Down

- 19. The Firm’s Short-Run Decision to Shut Down

- 20. The Firm’s Short-Run Decision to Shut Down

- 21. Figure 3 The Competitive Firm’s Short Run

- 22. The Firm’s Short-Run Decision to Shut Down

- 23. The Firm’s Long-Run Decision to Exit or

- 24. The Firm’s Long-Run Decision to Exit or

- 25. Figure 4 The Competitive Firm’s Long-Run Supply

- 26. THE SUPPLY CURVE IN A COMPETITIVE MARKET

- 27. Figure 4 The Competitive Firm’s Long-Run Supply

- 28. THE SUPPLY CURVE IN A COMPETITIVE MARKET

- 29. Figure 5 Profit as the Area between

- 30. Figure 5 Profit as the Area between

- 31. THE SUPPLY CURVE IN A COMPETITIVE MARKET

- 32. The Short Run: Market Supply with a

- 33. Figure 6 Market Supply with a Fixed

- 34. The Long Run: Market Supply with Entry

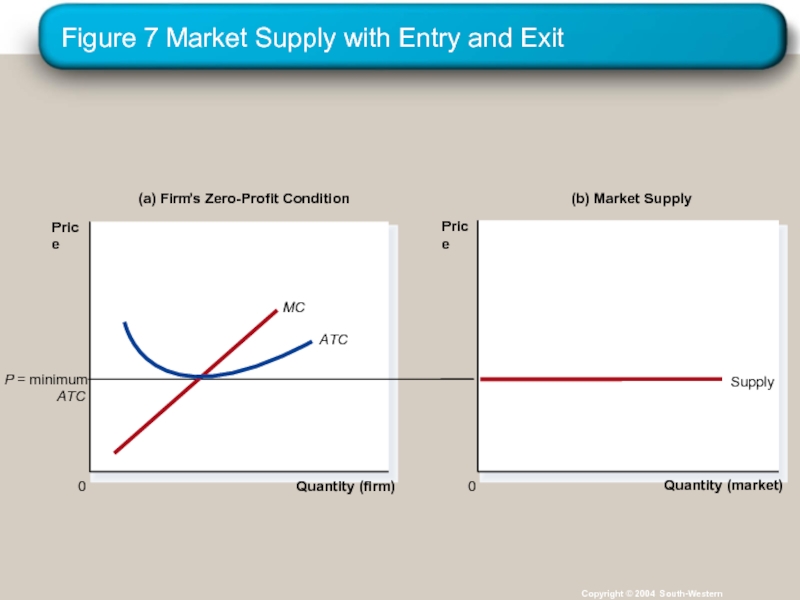

- 35. Figure 7 Market Supply with Entry and

- 36. The Long Run: Market Supply with Entry

- 37. Why Do Competitive Firms Stay in Business

- 38. A Shift in Demand in the Short

- 39. Figure 8 An Increase in Demand in

- 40. Figure 8 An Increase in Demand in

- 41. Figure 8 An Increase in Demand in

- 42. Why the Long-Run Supply Curve Might Slope

- 43. Why the Long-Run Supply Curve Might Slope

- 44. Summary Because a competitive firm is a

- 45. Summary To maximize profit, a firm chooses

- 46. Summary In the short run, when a

- 47. Summary In a market with free entry

Слайд 2WHAT IS A COMPETITIVE MARKET?

A perfectly competitive market has the following

There are many buyers and sellers in the market.

The goods offered by the various sellers are largely the same.

Firms can freely enter or exit the market.

Слайд 3WHAT IS A COMPETITIVE MARKET?

As a result of its characteristics, the

The actions of any single buyer or seller in the market have a negligible impact on the market price.

Each buyer and seller takes the market price as given.

Слайд 4WHAT IS A COMPETITIVE MARKET?

A competitive market has many buyers and

Buyers and sellers must accept the price determined by the market.

Слайд 5The Revenue of a Competitive Firm

Total revenue for a firm is

TR = (P × Q)

Слайд 7The Revenue of a Competitive Firm

Average revenue tells us how much

Average revenue is total revenue divided by the quantity sold.

Слайд 8The Revenue of a Competitive Firm

In perfect competition, average revenue equals

Слайд 9The Revenue of a Competitive Firm

Marginal revenue is the change in

MR =ΔTR/ ΔQ

Слайд 10The Revenue of a Competitive Firm

For competitive firms, marginal revenue equals

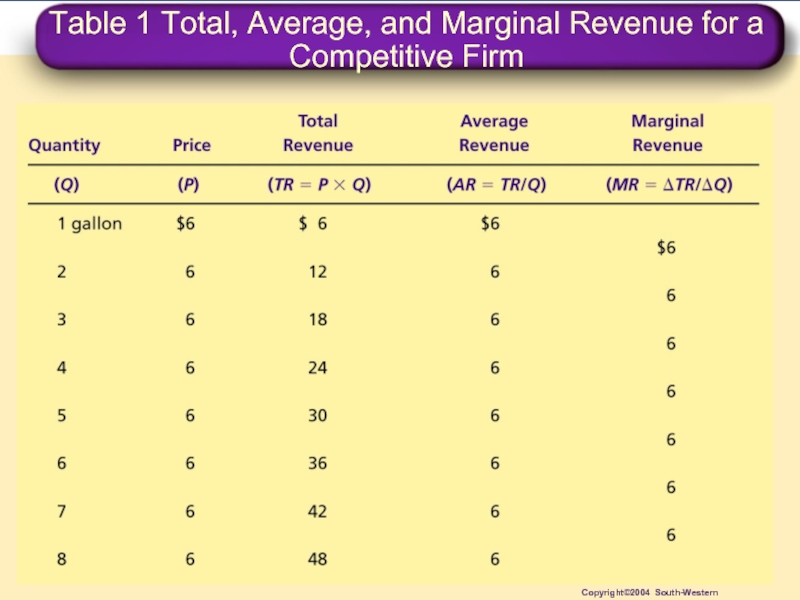

Слайд 11Table 1 Total, Average, and Marginal Revenue for a Competitive Firm

Copyright©2004

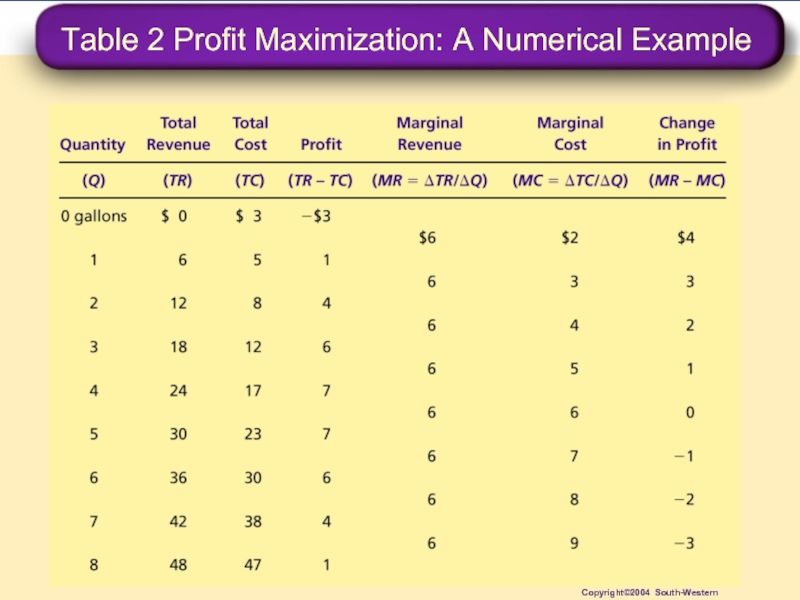

Слайд 12PROFIT MAXIMIZATION AND THE COMPETITIVE FIRM’S SUPPLY CURVE

The goal of a

This means that the firm will want to produce the quantity that maximizes the difference between total revenue and total cost.

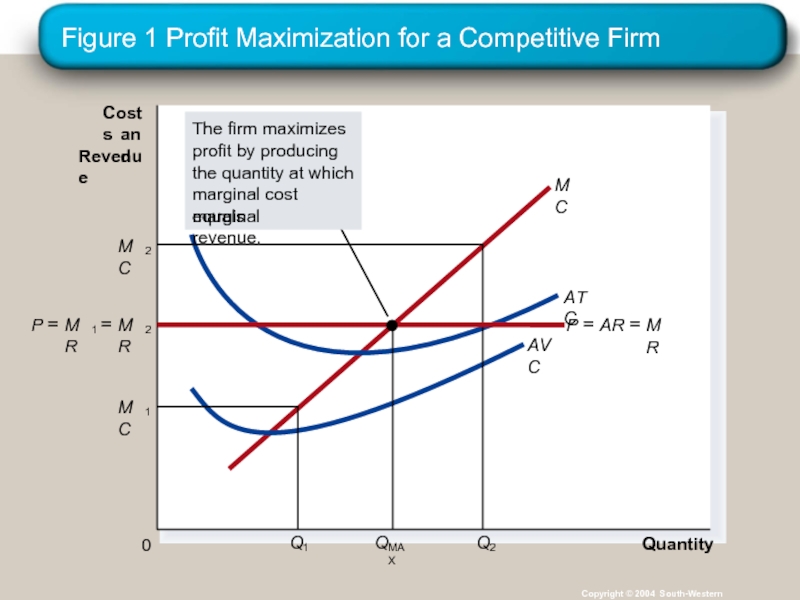

Слайд 14Figure 1 Profit Maximization for a Competitive Firm

Copyright © 2004 South-Western

Quantity

0

Costs

and

Revenue

Слайд 15PROFIT MAXIMIZATION AND THE COMPETITIVE FIRM’S SUPPLY CURVE

Profit maximization occurs at

Слайд 16PROFIT MAXIMIZATION AND THE COMPETITIVE FIRM’S SUPPLY CURVE

When MR > MC

When MR < MC - decrease Q

When MR = MC - Profit is maximized.

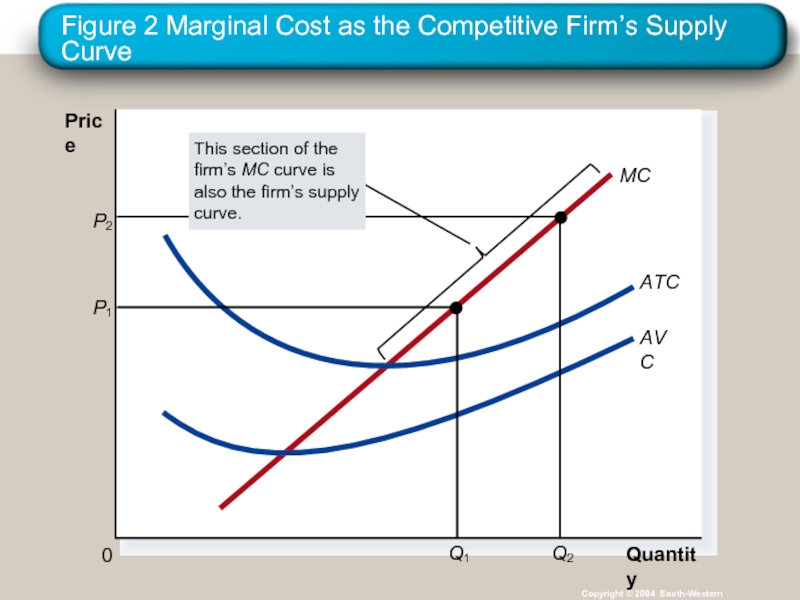

Слайд 17Figure 2 Marginal Cost as the Competitive Firm’s Supply Curve

Copyright ©

Quantity

0

Price

Слайд 18The Firm’s Short-Run Decision to Shut Down

A shutdown refers to a

Exit refers to a long-run decision to leave the market.

Слайд 19The Firm’s Short-Run Decision to Shut Down

The firm considers its sunk

Sunk costs are costs that have already been committed and cannot be recovered.

Слайд 20The Firm’s Short-Run Decision to Shut Down

The firm shuts down if

Shut down if TR < VC

Shut down if TR/Q < VC/Q

Shut down if P < AVC

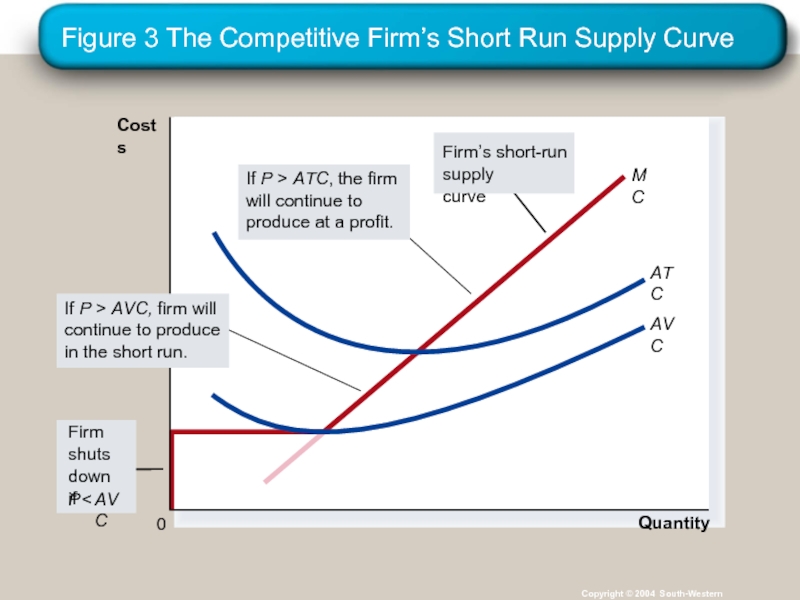

Слайд 21Figure 3 The Competitive Firm’s Short Run Supply Curve

Copyright © 2004

Quantity

0

Costs

Слайд 22The Firm’s Short-Run Decision to Shut Down

The portion of the marginal-cost

Слайд 23The Firm’s Long-Run Decision to Exit or Enter a Market

In the

Exit if TR < TC

Exit if TR/Q < TC/Q

Exit if P < ATC

Слайд 24The Firm’s Long-Run Decision to Exit or Enter a Market

A firm

Enter if TR > TC

Enter if TR/Q > TC/Q

Enter if P > ATC

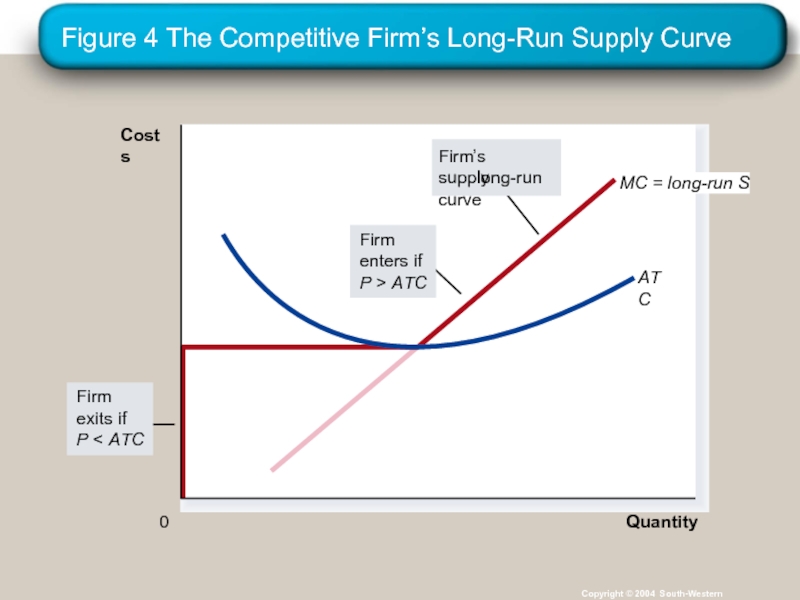

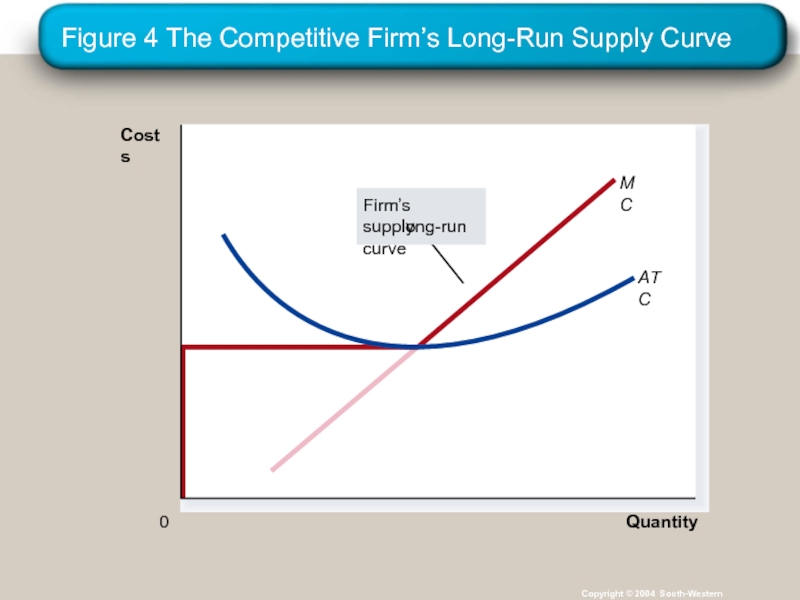

Слайд 25Figure 4 The Competitive Firm’s Long-Run Supply Curve

Copyright © 2004 South-Western

Quantity

0

Costs

Слайд 26THE SUPPLY CURVE IN A COMPETITIVE MARKET

The competitive firm’s long-run supply

Слайд 27Figure 4 The Competitive Firm’s Long-Run Supply Curve

Copyright © 2004 South-Western

Quantity

0

Costs

Слайд 28THE SUPPLY CURVE IN A COMPETITIVE MARKET

Short-Run Supply Curve

The portion of

Long-Run Supply Curve

The marginal cost curve above the minimum point of its average total cost curve.

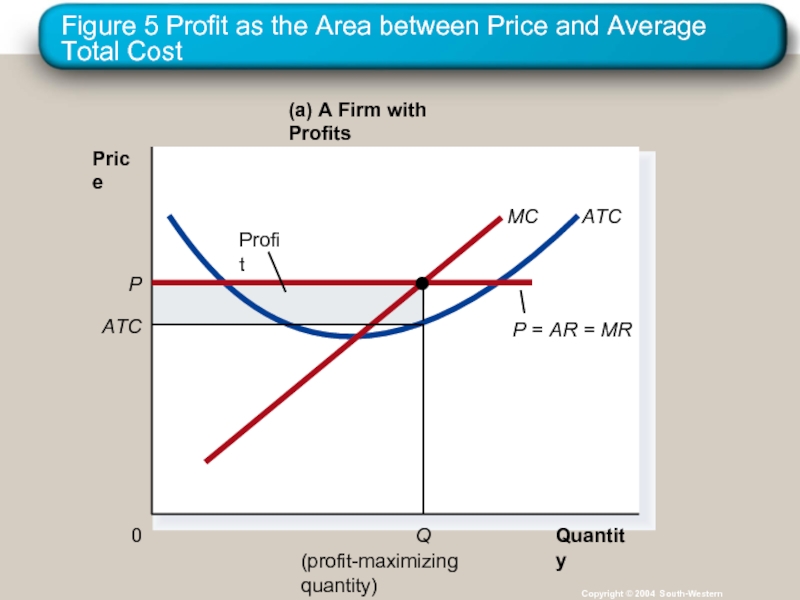

Слайд 29Figure 5 Profit as the Area between Price and Average Total

Copyright © 2004 South-Western

(a) A Firm with Profits

Quantity

0

Price

(profit-maximizing quantity)

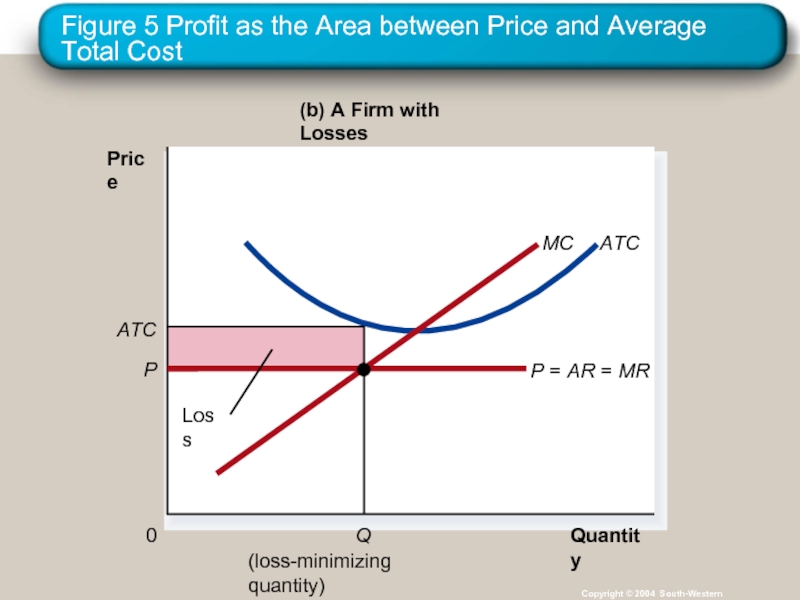

Слайд 30Figure 5 Profit as the Area between Price and Average Total

Copyright © 2004 South-Western

(b) A Firm with Losses

Quantity

0

Price

(loss-minimizing quantity)

Слайд 31THE SUPPLY CURVE IN A COMPETITIVE MARKET

Market supply equals the sum

Слайд 32The Short Run: Market Supply with a Fixed Number of Firms

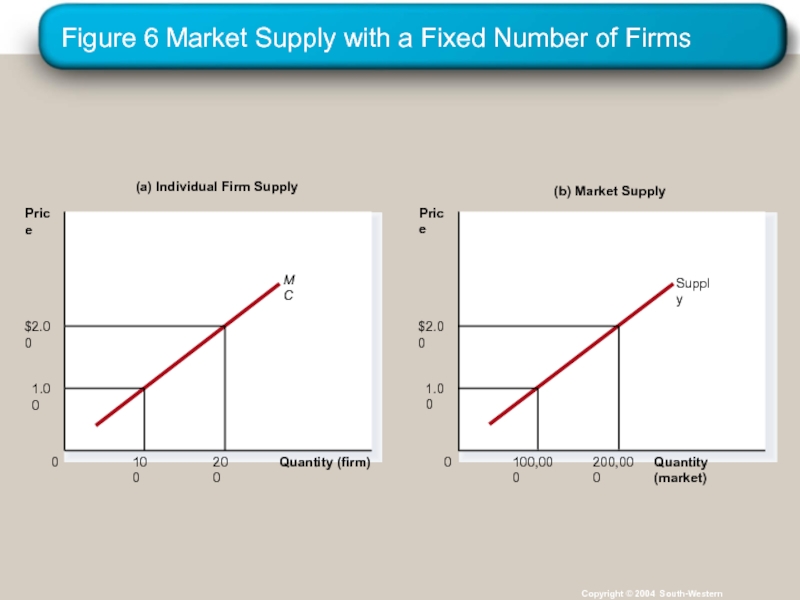

For

The market supply curve reflects the individual firms’ marginal cost curves.

Слайд 33Figure 6 Market Supply with a Fixed Number of Firms

Copyright ©

(a) Individual Firm Supply

Quantity (firm)

0

Price

(b) Market Supply

Quantity (market)

0

Price

Слайд 34The Long Run: Market Supply with Entry and Exit

Firms will enter

In the long run, price equals the minimum of average total cost.

The long-run market supply curve is horizontal at this price.

Слайд 35Figure 7 Market Supply with Entry and Exit

Copyright © 2004 South-Western

(a)

’

s Zero-Profit Condition

Quantity (firm)

0

Price

(b) Market Supply

Quantity (market)

Price

0

Слайд 36The Long Run: Market Supply with Entry and Exit

At the end

The process of entry and exit ends only when price and average total cost are driven to equality.

Long-run equilibrium must have firms operating at their efficient scale.

Слайд 37Why Do Competitive Firms Stay in Business If They Make Zero

Profit equals total revenue minus total cost.

Total cost includes all the opportunity costs of the firm.

In the zero-profit equilibrium, the firm’s revenue compensates the owners for the time and money they expend to keep the business going.

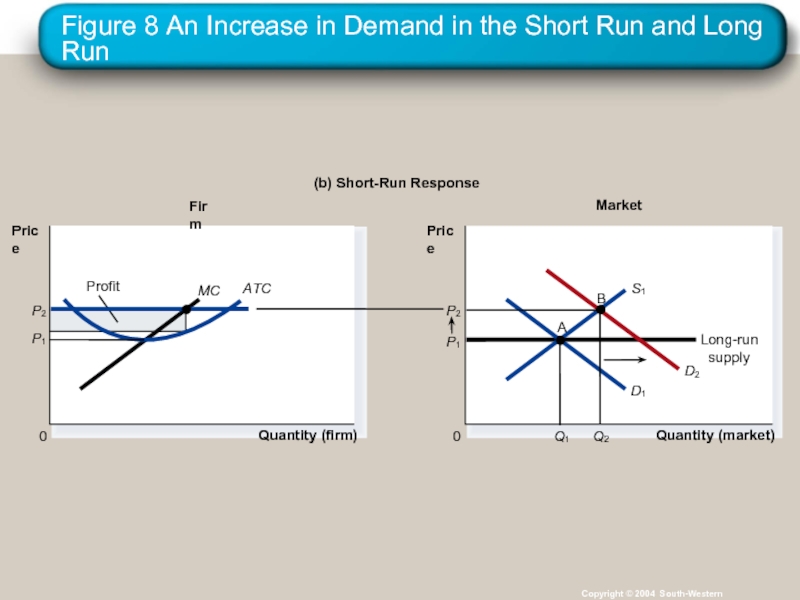

Слайд 38A Shift in Demand in the Short Run and

Long Run

An

Firms earn profits because price now exceeds average total cost.

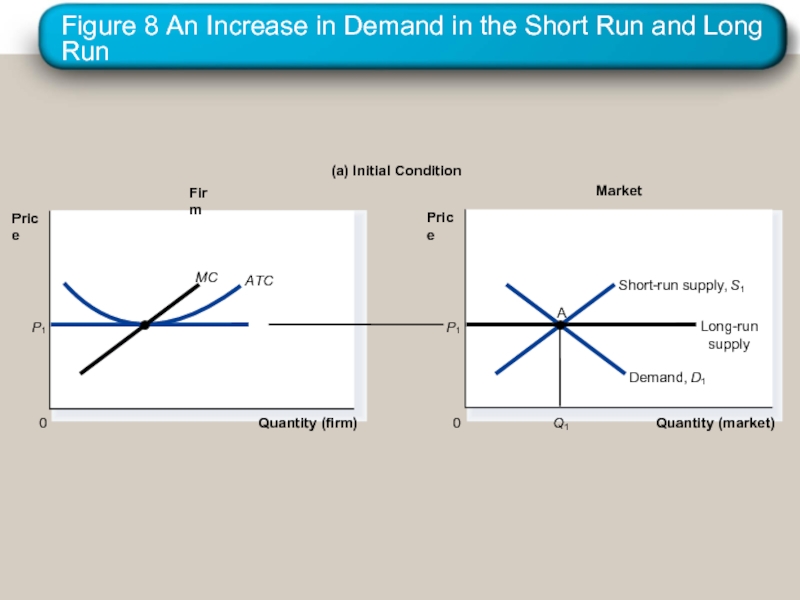

Слайд 39Figure 8 An Increase in Demand in the Short Run and

Firm

(a) Initial Condition

Quantity (firm)

0

Price

Market

Quantity (market)

Price

0

Слайд 40Figure 8 An Increase in Demand in the Short Run and

Copyright © 2004 South-Western

Market

Firm

(b) Short-Run Response

Quantity (firm)

0

Price

Quantity (market)

Long-run

supply

Price

0

P

1

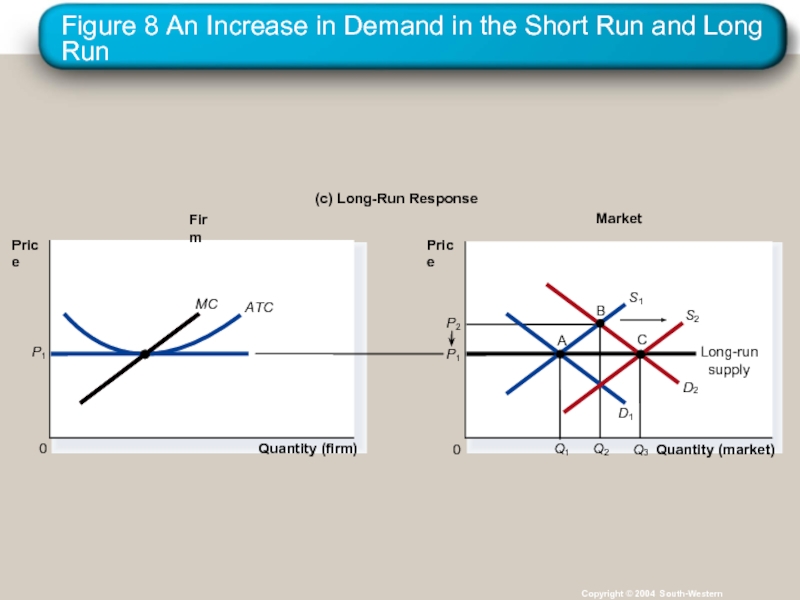

Слайд 41Figure 8 An Increase in Demand in the Short Run and

Copyright © 2004 South-Western

P

1

Firm

(c) Long-Run Response

Quantity (firm)

0

Price

MC

ATC

Market

Quantity (market)

Price

0

P

1

P

2

Q

1

Q

2

Long-run

supply

B

D

1

S

1

A

Слайд 42Why the Long-Run Supply Curve Might Slope Upward

Some resources used in

Firms may have different costs.

Слайд 43Why the Long-Run Supply Curve Might Slope Upward

Marginal Firm

The marginal

Слайд 44Summary

Because a competitive firm is a price taker, its revenue is

The price of the good equals both the firm’s average revenue and its marginal revenue.

Слайд 45Summary

To maximize profit, a firm chooses the quantity of output such

This is also the quantity at which price equals marginal cost.

Therefore, the firm’s marginal cost curve is its supply curve.

Слайд 46Summary

In the short run, when a firm cannot recover its fixed

In the long run, when the firm can recover both fixed and variable costs, it will choose to exit if the price is less than average total cost.

Слайд 47Summary

In a market with free entry and exit, profits are driven

Changes in demand have different effects over different time horizons.

In the long run, the number of firms adjusts to drive the market back to the zero-profit equilibrium.