taxes and taxation.

The tax system of RK: stages of development and contemporary conditions.

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Economic nature of taxes презентация

Содержание

- 1. Economic nature of taxes

- 2. Basic terminology tax agent — a

- 3. Basic terminology A tax can be

- 4. Basic terminology A taxpayer is any

- 5. Income tax incidence Government G imposes

- 6. The Relationship between Base, Rate, and Revenue

- 7. The Relationship between Base, Rate, and Revenue

- 8. Standards for good taxes Theorists maintain

- 9. Sufficiency The first standard by which to

- 10. Sufficiency What is the consequence of an

- 11. Sufficiency Another option is for governments to

- 12. TAXES SHOULD BE CONVENIENT Our second standard

- 13. TAXES SHOULD BE CONVENIENT From the taxpayer's

- 14. TAXES SHOULD BE EFFICIENT Our third standard

- 15. The Classical Standard of Efficiency The classical

- 16. The Classical Standard of Efficiency The laissez-faire

- 17. Taxes as an Instrument of Fiscal Policy

- 18. Taxes as an Instrument of Fiscal Policy

- 19. Taxes as an Instrument of Fiscal Policy

- 20. Taxes as an Instrument of Fiscal Policy

- 21. Taxes and Behavior Modification Modern governments use

- 22. Taxes and Behavior Modification Some of the

- 23. Income Tax Preferences Provisions in the federal

- 24. Taxes should be fair Ability to

- 25. Taxes should be fair For instance, income

- 26. Horizontal equity If a tax is

- 27. Vertical Equity A tax system is vertically

- 28. The classification of taxes Mainly the

- 29. The classification of taxes Depending on

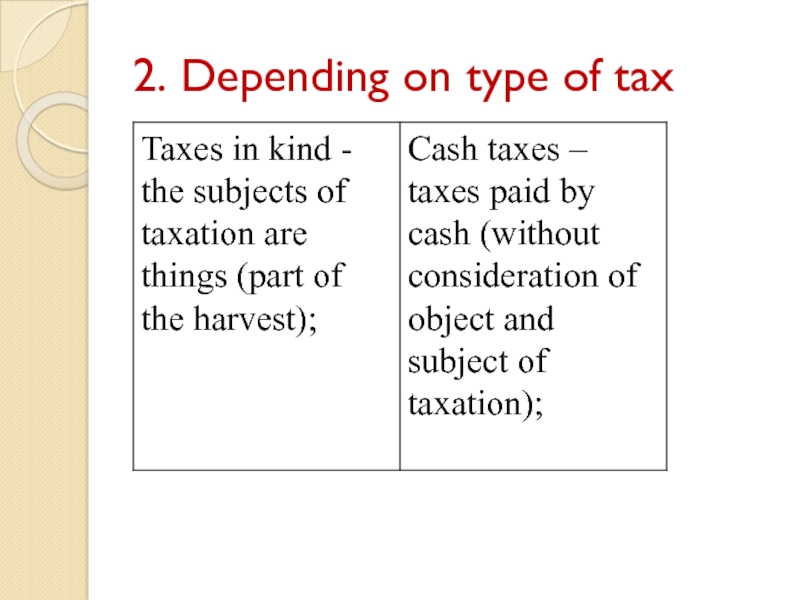

- 30. 2. Depending on type of tax

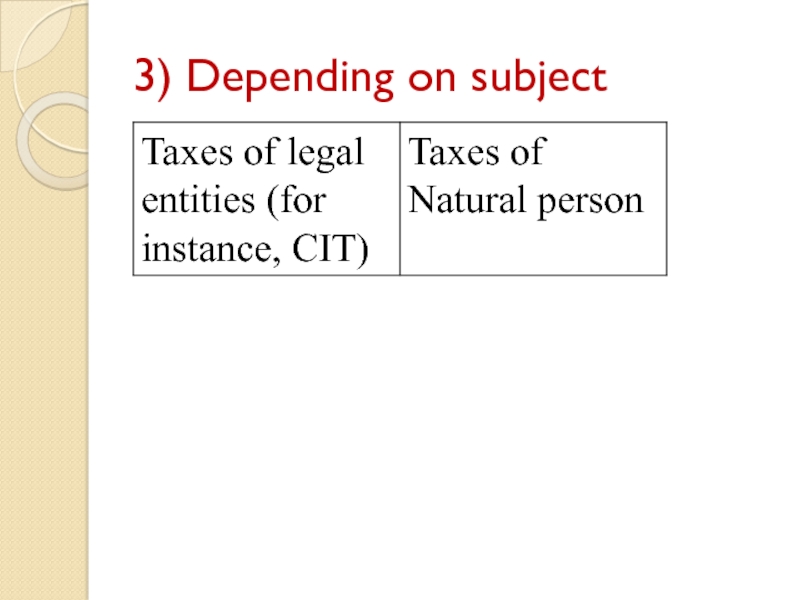

- 31. 3) Depending on subject

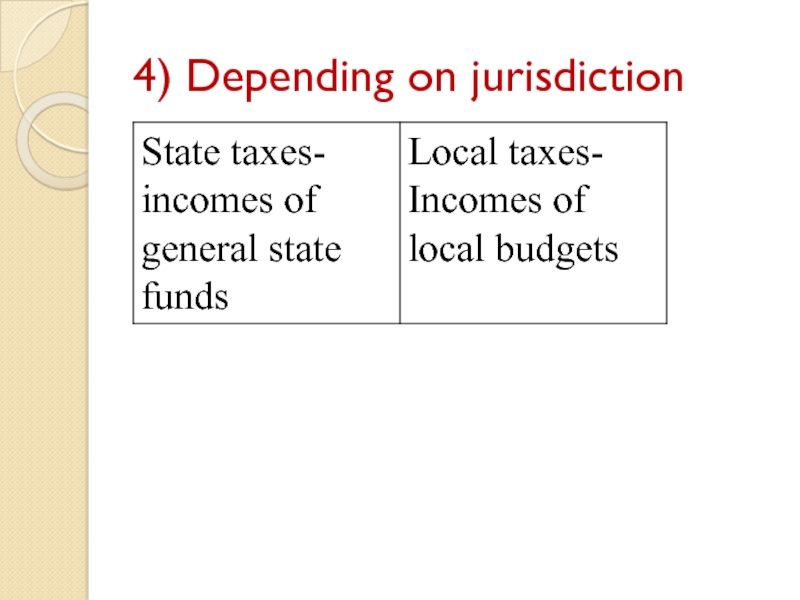

- 32. 4) Depending on jurisdiction

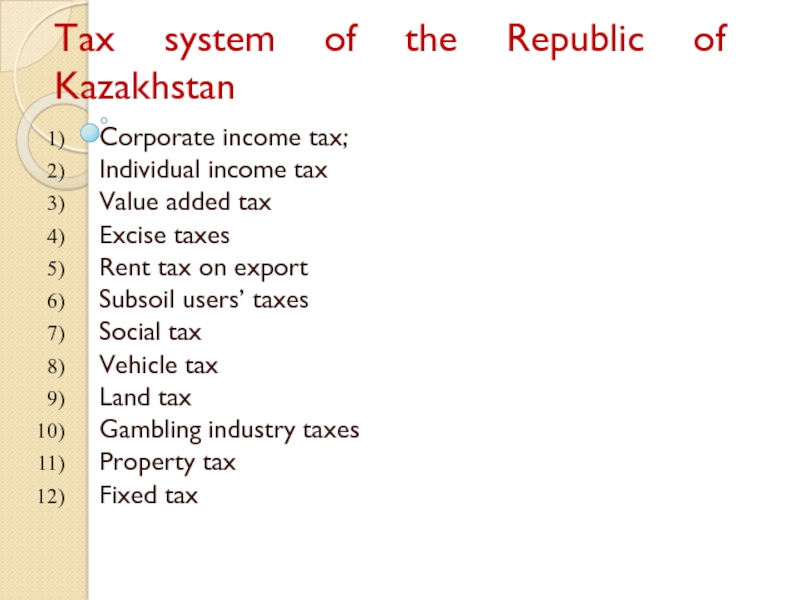

- 33. Tax system of the Republic of Kazakhstan

- 34. The Taxation Principles in the Republic of

- 35. The Principle of the Obligatory Nature of

- 36. The Principle of Certainty of Taxation Taxes

- 37. The Principle of Fairness of Taxation 1.

- 38. The Principle of Unity of the Tax

- 39. The Principle of Publicity of Tax Legislation

- 40. Contemporary conditions At February 6, 2008,

- 41. Contemporary conditions As a result of

- 42. Contemporary conditions In the light of

- 43. Thank you for your attention!!!

Слайд 2Basic terminology

tax agent — a person who in accordance with

this Code is entrusted with the duty of assessment, withholding and transfer of taxes withheld at source of payment;

taxes — obligatory monetary payments to the budget as established by the state through legislation in a unilateral procedure, except for the cases specified in this Code, which are paid in certain amounts, which are irrevocable and non-refundable

taxes — obligatory monetary payments to the budget as established by the state through legislation in a unilateral procedure, except for the cases specified in this Code, which are paid in certain amounts, which are irrevocable and non-refundable

Слайд 3Basic terminology

A tax can be defined as a payment to

support the cost of government. A tax differs from a fine or penalty imposed by a government because a tax is not intended to deter or punish unacceptable behavior. On the other hand, taxes are compulsory rather than voluntary on the part of the payer.

A tax differs from a user's fee because the payment of a tax does not entitle the payer to a specific good or service in return. In the abstract, citizens receive any number of government benefits for their tax dollars. Nevertheless, the value of government benefits received by any particular person is not correlated to the tax that person must pay.

A tax differs from a user's fee because the payment of a tax does not entitle the payer to a specific good or service in return. In the abstract, citizens receive any number of government benefits for their tax dollars. Nevertheless, the value of government benefits received by any particular person is not correlated to the tax that person must pay.

Слайд 4Basic terminology

A taxpayer is any person or organization required by

law to pay a tax to a governmental authority. In our country, the term person refers to both natural persons (individuals) and corporations. Corporations are entities organized under the laws. These corporate entities generally enjoy the same legal rights, privileges, and protections as individuals.

The incidence of a tax refers to the ultimate economic burden represented by the tax. Most people jump to the conclusion that the person or organization who makes a direct tax payment to the government bears the incidence of such tax. But in some cases, the payer can shift the incidence to a third party. Consider the following examples.

The incidence of a tax refers to the ultimate economic burden represented by the tax. Most people jump to the conclusion that the person or organization who makes a direct tax payment to the government bears the incidence of such tax. But in some cases, the payer can shift the incidence to a third party. Consider the following examples.

Слайд 5Income tax incidence

Government G imposes a new tax on corporate

business profits. A manufacturing corporation with monopoly on a product in great demand by the public responds to the new tax by increasing the retail price at which it sells the product. In this case, the corporation is nominally the taxpayer and must remit the new tax to the government. The economic burden of the tax falls on the corporation's customers who are indirectly paying the tax in the form of a higher price for the same product.

Слайд 6The Relationship between Base, Rate, and Revenue

Taxes are usually characterized by

reference to their base. A tax base is an item, occurrence, transaction, or activity with respect to which a tax is levied. Tax bases are usually expressed in monetary terms. For instance, real property taxes are levied on the ownership of land and buildings, and the dollar value of the property is the tax base. When designing a tax, governments try to identify tax bases that taxpayers cannot easily avoid or conceal. In this respect, real property is an excellent tax base because it cannot be moved or hidden, and its ownership is a matter of public record.

Слайд 7The Relationship between Base, Rate, and Revenue

The amount of a tax

is calculated by multiplying the base by a tax rate, which is usually expressed as a percentage. This relationship is expressed by the following formula.

Tax (T) = Rate (r) X Base (B)

A single percentage that applies to the entire tax base is described as a flat rate. Many types of taxes use a graduated rate structure consisting of multiple percentages that apply to specified portions or brackets of the tax base.

Tax (T) = Rate (r) X Base (B)

A single percentage that applies to the entire tax base is described as a flat rate. Many types of taxes use a graduated rate structure consisting of multiple percentages that apply to specified portions or brackets of the tax base.

Слайд 8Standards for good taxes

Theorists maintain that every tax can and

should be evaluated on certain basic standards. These standards can be summarized as follows:

A good tax should be sufficient to raise the necessary government revenues.

A good tax should be convenient for the government to administer and for people to pay.

A good tax should be efficient in economic terms.

A good tax should be fair.

A good tax should be sufficient to raise the necessary government revenues.

A good tax should be convenient for the government to administer and for people to pay.

A good tax should be efficient in economic terms.

A good tax should be fair.

Слайд 9Sufficiency

The first standard by which to evaluate a tax is its

sufficiency as a revenue raiser. A tax is sufficient if it generates enough funds to pay for the public goods and services provided by the government. After all, the reason that governments tax their citizens in the first place is to raise revenues needed for specific purposes. If a tax (or combination of taxes) is sufficient, a government can balance its budget. Tax revenues equal government spending, and the government has no need to raise additional funds.

Слайд 10Sufficiency

What is the consequence of an insufficient tax system? The government

must make up its revenue shortfall (the excess of current spending over tax receipts) from some other source. We know that state governments now depend heavily on legalized gambling as an alternative source of funds. Governments may own assets or property rights that they can lease or sell to raise money.

Слайд 11Sufficiency

Another option is for governments to borrow money to finance their

operating deficits

Debt financing is not a permanent solution to an insufficient tax system. Like other debtors, governments must pay interest on borrowed funds. As the public debt increases, so does the annual interest burden. At some point, a government may find itself in the untenable position of borrowing new money not to provide more public goods and services but merely to pay the interest on existing debt.

Debt financing is not a permanent solution to an insufficient tax system. Like other debtors, governments must pay interest on borrowed funds. As the public debt increases, so does the annual interest burden. At some point, a government may find itself in the untenable position of borrowing new money not to provide more public goods and services but merely to pay the interest on existing debt.

Слайд 12TAXES SHOULD BE CONVENIENT

Our second standard for evaluating a tax is

convenience. From the government's viewpoint, a good tax should be convenient to administer. Specifically, the government should have a method for collecting the tax that most taxpayers understand and with which they routinely cooperate. The collection method should not overly intrude on taxpayers' privacy but should offer minimal opportunity for noncompliance.

A good tax should be economical for the government. The administrative cost of collecting and enforcing the tax should be reasonable in comparison with the total revenue generated.

A good tax should be economical for the government. The administrative cost of collecting and enforcing the tax should be reasonable in comparison with the total revenue generated.

Слайд 13TAXES SHOULD BE CONVENIENT

From the taxpayer's viewpoint, a good tax should

be convenient to pay. The convenience standard suggests that people can compute their tax with reasonable certainty. Moreover, they do not have to devote undue time or incur undue costs in complying with the tax law. A retail sales tax receives high marks when judged by these criteria. People can easily compute the sales tax on a purchase and can pay the tax as part of the purchase price with no effort whatsoever!

Слайд 14TAXES SHOULD BE EFFICIENT

Our third standard for a good tax is

economic efficiency. Tax policymakers use the term :

efficiency in two different ways. Sometimes the term describes a tax that does not interfere with or influence taxpayers' economic behavior. At other times, policymakers describe a tax as efficient when individuals or organizations react to the tax by deliberately changing their economic behavior.

Слайд 15The Classical Standard of Efficiency

The classical economist Adam Smith believed that

taxes should have as little effect as possible on the economy. In his 1776 masterwork, The Wealth of Nations, Smith concluded the following:

A tax ... may obstruct the industry of the people, and discourage them from applying to certain branches of business which might give maintenance and employment to great multitudes. While it obliges the people to pay, it may thus diminish, or perhaps destroy, some of the funds which might enable them more easily to do so.

A tax ... may obstruct the industry of the people, and discourage them from applying to certain branches of business which might give maintenance and employment to great multitudes. While it obliges the people to pay, it may thus diminish, or perhaps destroy, some of the funds which might enable them more easily to do so.

Слайд 16The Classical Standard of Efficiency

The laissez-faire system favored by Adam Smith

theoretically creates a level playing field on which individuals and organizations, operating in their own self-interest, freely compete. When governments interfere with the system by taxing certain economic activities, the playing field tilts against the competitors engaging in those activities. The capitalistic game is disrupted, and the outcome may no longer be the best for society.

Of course, every modern economy has a tax system, and firms functioning within the economy must adapt to that system. Business managers become familiar with the existing tax laws and make decisions based on those laws. To return to the sports metaphor, these managers have adjusted their game plan to suit the present contours of the economic playing field.

Of course, every modern economy has a tax system, and firms functioning within the economy must adapt to that system. Business managers become familiar with the existing tax laws and make decisions based on those laws. To return to the sports metaphor, these managers have adjusted their game plan to suit the present contours of the economic playing field.

Слайд 17Taxes as an Instrument of Fiscal Policy

The British economist John Maynard

Keynes disagreed with the classical notion that a good tax should be neutral. Keynes believed that free markets are effective in organizing production and allocating scarce resources but lack adequate self-regulating mechanisms for maintaining economic stability. According to Keynes, governments should protect their citizens and institutions against the inherent instability of capitalism.

Слайд 18Taxes as an Instrument of Fiscal Policy

Historically, this instability caused cycles

of high unemployment, severe fluctuations in prices (inflation or deflation), and uneven economic growth. Lord Keynes believed that governments could counteract these problems through fiscal policies to promote full employment, price-level stability, and a steady rate of economic growth.

Слайд 19Taxes as an Instrument of Fiscal Policy

In the Keynesian schema, tax

systems are a primary tool of fiscal policy. Rather than trying to design a neutral tax system, governments should deliberately use taxes to move the economy in the desired direction. If an economy is suffering from sluggish growth and high unemployment, the government could reduce taxes to transfer funds from the public to the private sector

Слайд 20Taxes as an Instrument of Fiscal Policy

The tax cut should both

stimulate demand for consumer goods and services and increase private investment. As a result, the economy should expand and new jobs should be created. Conversely, if an economy is overheated so that wages and prices are in

an inflationary spiral, the government could raise taxes. People will have less money to spend, the demand for consumer and investment goods should soften, and the upward pressure on wages and prices should be relieved.

Слайд 21Taxes and Behavior Modification

Modern governments use their tax systems to address

not only macroeconomic concerns but also social problems. Many such problems could be alleviated if people or institutions could be persuaded to alter their behavior. Governments can promote behavioral change by writing tax laws to penalize undesirable behavior or reward desirable behavior. The penalty takes the form of a higher tax burden, while the reward is some type of tax relief.

Слайд 22Taxes and Behavior Modification

Some of the social problems that the federal

income tax system tries to remedy are byproducts of the free enterprise system, which economists refer to as negative externalities. One of the most widely recognized is environmental pollution. The tax system contains provisions that either pressure or entice companies to clean up their act, so to speak.

Слайд 23Income Tax Preferences

Provisions in the federal income tax system designed as

incentives for certain behaviors or as subsidies for targeted activities are described as tax preferences. These provisions do not contribute to the accurate measurement of the tax base or the correct calculation of the tax. Tax preferences do not support the primary function of the law, which is to raise revenues. In fact, tax preferences do just the opposite. Because they allow certain persons or organizations to pay less tax, preferences lose money for the Treasury. In this respect, preferences are indirect government expenditures.

Слайд 24Taxes should be fair

Ability to pay

A useful was to

begin our discussion of equity is with the proposition that each person’s contribution to the support of the government should reflect that person’s ability to pay.

In the tax policy literature, ability to pay refers to the economic resources under person’s control. Each of the major taxes is based on some dimension of ability to pay.

In the tax policy literature, ability to pay refers to the economic resources under person’s control. Each of the major taxes is based on some dimension of ability to pay.

Слайд 25Taxes should be fair

For instance, income taxes are based on the

person’s inflow of economic resources during the year;

Sales and excise taxes are based on a different dimension of ability to pay: a person’s consumption of resources represented by purchase of goods and services

Real and personal property taxes complement income and sale taxes by focusing on the third dimension of ability to pay: a person’s accumulation of resources in the form of property

Sales and excise taxes are based on a different dimension of ability to pay: a person’s consumption of resources represented by purchase of goods and services

Real and personal property taxes complement income and sale taxes by focusing on the third dimension of ability to pay: a person’s accumulation of resources in the form of property

Слайд 26Horizontal equity

If a tax is designed so that persons with

the same ability to pay (as measured by the tax base) owe the same amount of tax, that system can be described as horizontally equitable. The structure of certain taxes guarantees their horizontal equity.

Слайд 27Vertical Equity

A tax system is vertically equitable if persons with a

greater ability to pay owe more tax than persons with a lesser ability to pay. While horizontal equity is concerned with a rational and impartial measurement of the tax base, vertical equity is concerned with a fair rate structure by which to calculate the tax.

Слайд 28The classification of taxes

Mainly the taxes can be classified based

on different conditions:

Depending on the burden of the tax payer;

Depending on the type of a tax ;

Depending on subject of tax;

Depending on jurisdictions;

Depending on the burden of the tax payer;

Depending on the type of a tax ;

Depending on subject of tax;

Depending on jurisdictions;

Слайд 33Tax system of the Republic of Kazakhstan

Corporate income tax;

Individual income

tax

Value added tax

Excise taxes

Rent tax on export

Subsoil users’ taxes

Social tax

Vehicle tax

Land tax

Gambling industry taxes

Property tax

Fixed tax

Value added tax

Excise taxes

Rent tax on export

Subsoil users’ taxes

Social tax

Vehicle tax

Land tax

Gambling industry taxes

Property tax

Fixed tax

Слайд 34The Taxation Principles in the Republic of Kazakhstan

The tax legislation of

the Republic of Kazakhstan shall be based upon the taxation principles. The principles of the obligatory nature, of the certainty, fairness of taxation, unity of the tax system and publicity of the tax legislation of the Republic of Kazakhstan shall be recognised as the taxation principles.

Слайд 35The Principle of the Obligatory Nature of Taxation

The taxpayers shall be

obliged to perform tax obligations, the tax agents — the obligation of the assessment, withholding and transferring taxes in accordance with the tax legislation of the Republic of Kazakhstan in full volume and within established time.

Слайд 36The Principle of Certainty of Taxation

Taxes and other obligatory payments to

the budget of the Republic of Kazakhstan must be well-defined. The certainty of taxation shall be understood as establishing in the tax legislation of the Republic of Kazakhstan of all reasons and procedure for the emergence, implementation and termination of tax obligations of taxpayers, duties of tax agents with regard to the assessment, withholding and transfer of taxes.

Слайд 37The Principle of Fairness of Taxation

1. Taxation in the Republic of

Kazakhstan shall be universal and obligatory.

2. It shall be prohibited to grant tax privileges of individual nature.

2. It shall be prohibited to grant tax privileges of individual nature.

Слайд 38The Principle of Unity of the Tax System

The tax system of

the Republic of Kazakhstan shall be uniform in the entire territory of the Republic of Kazakhstan with regard to all taxpayers (tax agents).

Слайд 39The Principle of Publicity of Tax Legislation of the Republic of

Kazakhstan

Regulatory legal acts which regulate issues of taxation shall be subject to obligatory publication in official publications.

Слайд 40Contemporary conditions

At February 6, 2008, the President of Kazakhstan assigned

to the government of the Republic of Kazakhstan to establish new tax code. In his speech to the nation, the President outlined such main objective as to update tax system in accordance with new stage of development of Kazakhstan, facilitate diversification and modernization of the economy and reduce tax pressure on non-industrial sectors of the economy.

Слайд 41Contemporary conditions

As a result of the outlined objectives, the working

group was established by the decree of the Prime Minister to create new tax code.

At August 2008, the draft of the new tax code was presented to the Mazhylis of the Republic of Kazakhstan. It was signed by the President of Kazakhstan at December 10, 2008.

At August 2008, the draft of the new tax code was presented to the Mazhylis of the Republic of Kazakhstan. It was signed by the President of Kazakhstan at December 10, 2008.

Слайд 42Contemporary conditions

In the light of these changes, it is planned

to reduce gradually the rate of Corporate income tax; from January 2009 up to 20%, from 2010 up to 17,5%, and in 2011 up to 15%.

The new tax code excludes payments in advance for small and medium businesses

The rate of Value added tax was established at the rate of 12 %. This is one of the lowest VAT rates in the world.

The tax reform also considered the simplification of the methods of tax computation.

The new tax code excludes payments in advance for small and medium businesses

The rate of Value added tax was established at the rate of 12 %. This is one of the lowest VAT rates in the world.

The tax reform also considered the simplification of the methods of tax computation.