- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Aggregate Demand I. Building the IS–LM Model презентация

Содержание

- 1. Aggregate Demand I. Building the IS–LM Model

- 2. 11-1 The Goods Market and the IS

- 3. Aggregate Demand I: Building the IS–LM Model

- 4. Aggregate Demand I: Building the IS–LM Model

- 5. Aggregate Demand I: Building the IS–LM Model

- 6. The two parts of the

- 7. The IS curve plots the relationship between

- 8. 11-1 The Goods Market and the IS

- 9. 11-1 The Goods Market and the IS

- 10. Planned Expenditure as a Function of Income

- 11. 11-1 The Goods Market and the IS

- 12. The Keynesian Cross The equilibrium in

- 13. The Adjustment to Equilibrium in the Keynesian

- 14. Fiscal Policy and the Multiplier: Government Purchases

- 15. An Increase in Government Purchases in the

- 16. How big is the multiplier? we trace

- 17. The Keynesian Cross The Interest Rate,

- 18. Fiscal Policy and the Multiplier: Taxes

- 19. A Decrease in Taxes in the

- 20. John F. Kennedy became president of the

- 21. When President Barack Obama took office in

- 22. The KС explains the economy’s AD

- 23. Deriving the IS Curve Panel (a)

- 24. The IS curve shows us, for

- 25. An Increase in Government Purchases Shifts the

- 26. 11-2 The Money Market and the

- 27. The Theory of Liquidity Preference The S&D

- 28. A Reduction in the Money Supply

- 29. Does a Monetary Tightening Raise or Lower Interest Rates?

- 30. 11-2 The Money Market and the

- 31. Deriving the LM Curve Panel

- 32. The LM curve shows the combinations of

- 34. We now have all the pieces of

- 35. The intersection of the IS and

- 36. The Theory of Short-Run Fluctuations

Слайд 211-1 The Goods Market and the IS Curve

11-2 The Money

11-3 Conclusion: The Short-Run Equilibrium

Слайд 3Aggregate Demand I: Building the IS–LM Model

Classical theory (Ch.3-7) seemed incapable

national Y depends on factor supplies and the available technology,

neither of which changed substantially from 1929 to 1933.

A new model was needed.

In 1936 the British economist John Maynard Keynes revolutionized economics with his book The General Theory of Employment, Interest, and Money.

Keynes proposed that

↓ AD is responsible for the ↓ Y & ↑ U that characterize economic ↘.

He criticized classical theory for assuming that AS alone determines Y.

Economists today reconcile these 2 views with the model of AD&AS (Ch.10)

In the LR, Ps are flexible, and AS determines Y.

In the SR, Ps are sticky, so changes in AD influence Y.

Слайд 4Aggregate Demand I: Building the IS–LM Model

Our goal is

to identify

to examine the tools policymakers can use toﬧ A D .

(Ch. 10) We showed that monetary policy can shift the AD curve.

(this Ch.) We see that the government can ﬧAD with both

monetary and fiscal policy.

IS–LM model,

is the leading interpretation of Keynes’s theory.

The goal of the model is to show what determines national Y for a given P.

We can view the IS–LM model as showing what causes

Y to change in the SR when the P is fixed because all Ps are sticky

the AD curve to shift.

Слайд 5Aggregate Demand I: Building the IS–LM Model

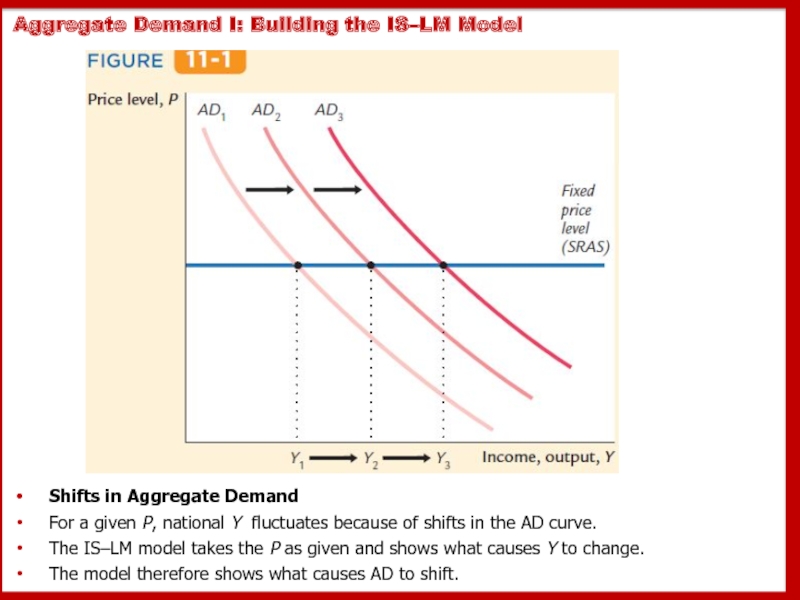

Shifts in Aggregate Demand

For a

The IS–LM model takes the P as given and shows what causes Y to change.

The model therefore shows what causes AD to shift.

Слайд 6

The two parts of the IS–LM model

the IS curve

stands for “investment’’ and “saving,’’

represents what’s going on in the market for G&S (Ch. 3).

The LM curve

stands for “liquidity’’ and “money,’’

Represents what’s happening to the S&D for money (Ch. 5).

The r ﬧ both I & money demand, →

it is the variable that links the 2 halves of the IS–LM model.

The model shows

how interactions between the G & money markets determine

the position and slope of the AD curve and

→ the level of national Y in the SR.

Слайд 7The IS curve plots the relationship between the r & the

that arises in the market for G&Ss.

To develop this relationship, we start with the Keynesian cross –

It shows how national Y is determined and

It is block for the IS–LM model.

In The General Theory Keynes proposed that

an economy’s total Y is, in the SR, determined largely by the spending plans of H, B, and G.

> people want to spend →

> G&S firms can sell →

> Y they will choose to produce →

> workers they will choose to hire.

Keynes believed that the problem during recessions and depressions is inadequate spending.

The KC is an attempt to model this insight.

11-1 The Goods Market and the IS Curve

The Keynesian Cross

The Interest Rate, Investment, and the IS Curve

How Fiscal Policy Shifts the IS Curve

Слайд 811-1 The Goods Market and the IS Curve

The Keynesian Cross

The Interest Rate, Investment, and the IS Curve

How Fiscal Policy Shifts the IS Curve

Planned Expenditure

Let us draw a distinction between actual & planned expenditure.

Actual expenditure

is the amount Hs, Fs, & the G spend on G&S(Ch.2), it = the economy’s GDP.

Planned expenditure

is the amount Hs, Fs, & the G would like to spend on G&S.

Why would AE ever differ from PE?

The answer is that

firms might engage in unplanned inventory investment because their sales do not meet their expectations.

When Fs sell < of their product than they planned,

their stock of inventories automatically r↑;

When Fs sell > than planned,

their stock of inventories f↓.

These unplanned changes in inventory are counted

as INVESTMENT spending by Fs,

→ AE can be either ͞ or _͟ PE .

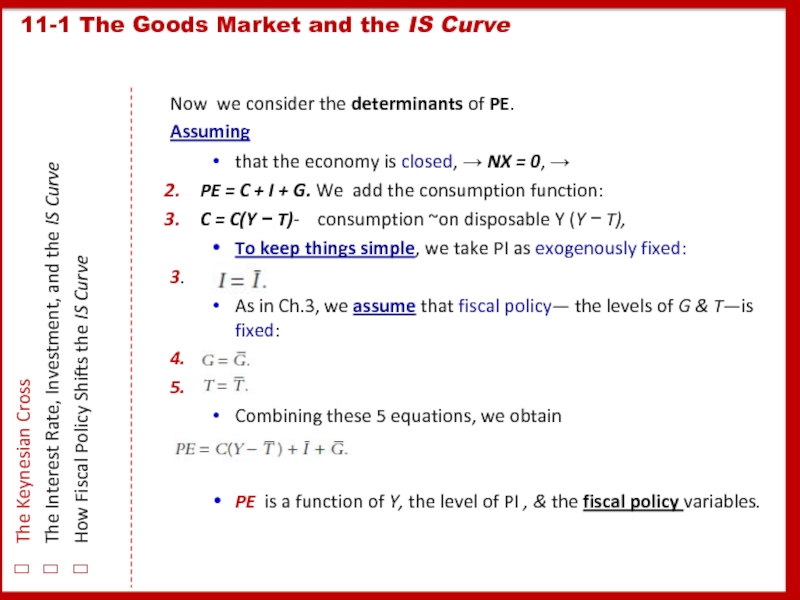

Слайд 911-1 The Goods Market and the IS Curve

The Keynesian Cross

The Interest Rate, Investment, and the IS Curve

How Fiscal Policy Shifts the IS Curve

Now we consider the determinants of PE.

Assuming

that the economy is closed, → NX = 0, →

PE = C + I + G. We add the consumption function:

C = C(Y − T)- consumption ~on disposable Y (Y − T),

To keep things simple, we take PI as exogenously fixed:

3.

As in Ch.3, we assume that fiscal policy— the levels of G & T—is fixed:

4.

5.

Combining these 5 equations, we obtain

PE is a function of Y, the level of PI , & the fiscal policy variables.

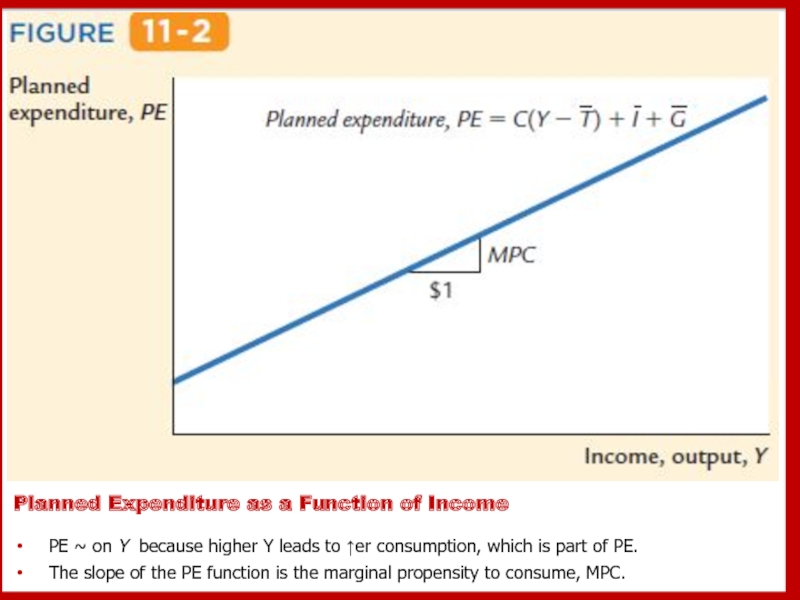

Слайд 10Planned Expenditure as a Function of Income

PE ~ on Y because

The slope of the PE function is the marginal propensity to consume, MPC.

Слайд 1111-1 The Goods Market and the IS Curve

The Keynesian Cross

The Interest Rate, Investment, and the IS Curve

How Fiscal Policy Shifts the IS Curve

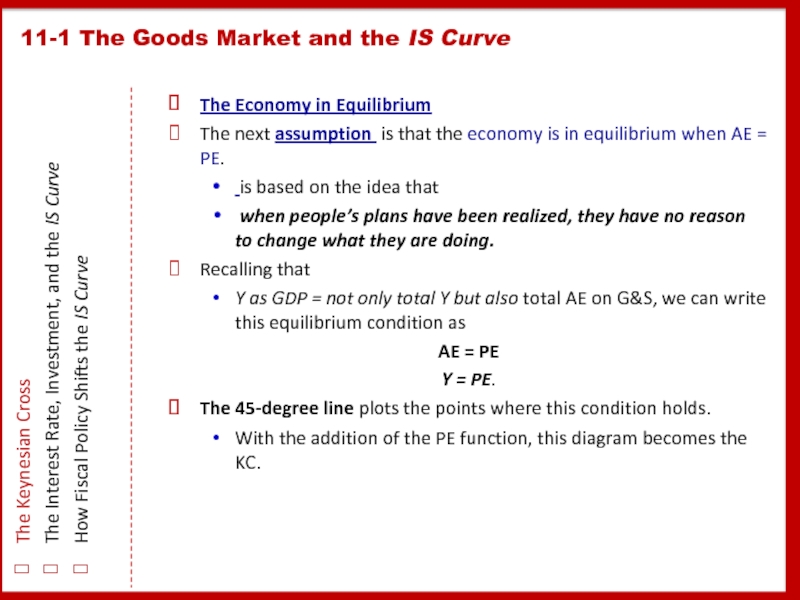

The Economy in Equilibrium

The next assumption is that the economy is in equilibrium when AE = PE.

is based on the idea that

when people’s plans have been realized, they have no reason to change what they are doing.

Recalling that

Y as GDP = not only total Y but also total AE on G&S, we can write this equilibrium condition as

AE = PE

Y = PE.

The 45-degree line plots the points where this condition holds.

With the addition of the PE function, this diagram becomes the KC.

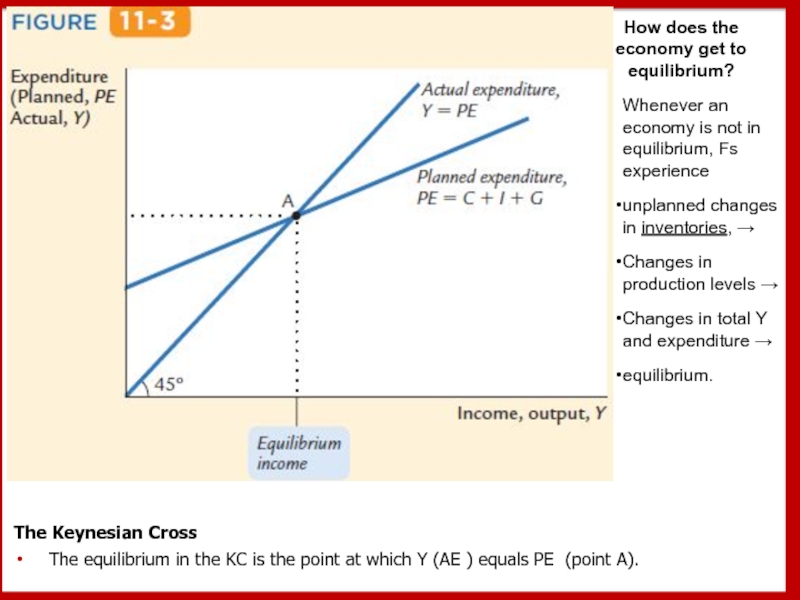

Слайд 12The Keynesian Cross

The equilibrium in the KC is the point

How does the economy get to equilibrium?

Whenever an economy is not in equilibrium, Fs experience

unplanned changes in inventories, →

Changes in production levels →

Changes in total Y and expenditure →

equilibrium.

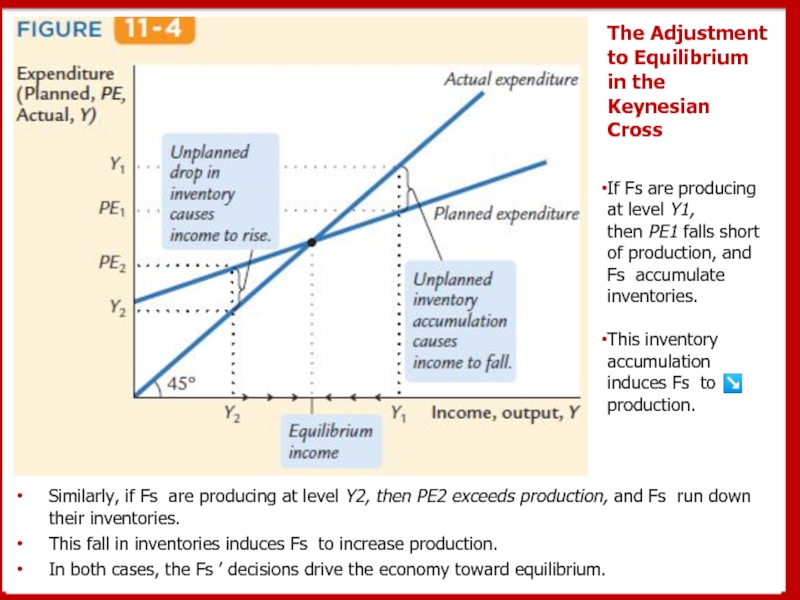

Слайд 13The Adjustment to Equilibrium in the Keynesian Cross

Similarly, if Fs

This fall in inventories induces Fs to increase production.

In both cases, the Fs ’ decisions drive the economy toward equilibrium.

If Fs are producing at level Y1,

then PE1 falls short of production, and Fs accumulate inventories.

This inventory accumulation induces Fs to ↘ production.

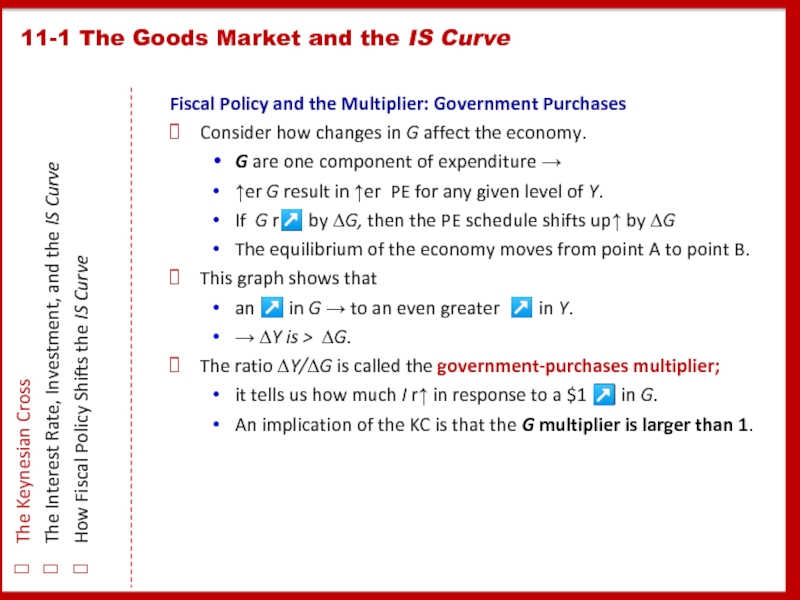

Слайд 14Fiscal Policy and the Multiplier: Government Purchases

Consider how changes in

G are one component of expenditure →

↑er G result in ↑er PE for any given level of Y.

If G r↗ by ∆G, then the PE schedule shifts up↑ by ∆G

The equilibrium of the economy moves from point A to point B.

This graph shows that

an ↗ in G → to an even greater ↗ in Y.

→ ∆Y is > ∆G.

The ratio ∆Y/∆G is called the government-purchases multiplier;

it tells us how much I r↑ in response to a $1 ↗ in G.

An implication of the KC is that the G multiplier is larger than 1.

The Keynesian Cross

The Interest Rate, Investment, and the IS Curve

How Fiscal Policy Shifts the IS Curve

11-1 The Goods Market and the IS Curve

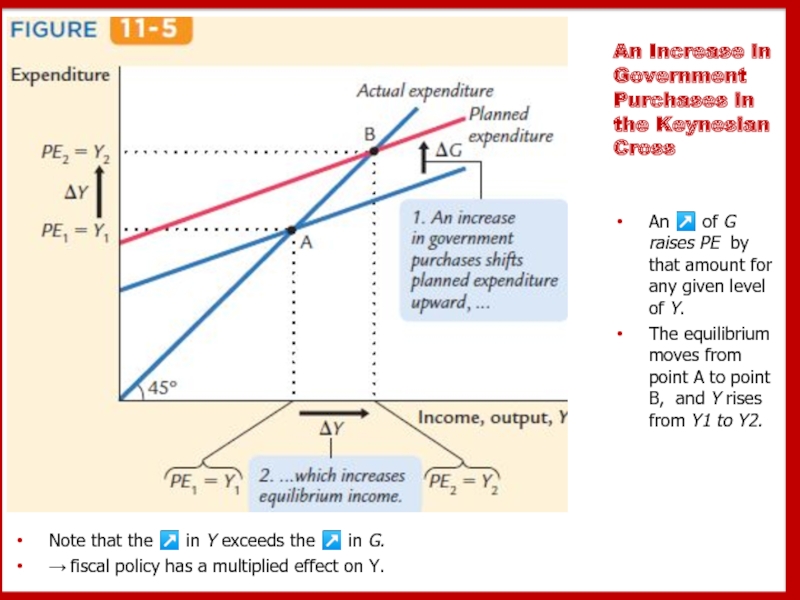

Слайд 15An Increase in Government Purchases in the Keynesian Cross

Note that the

→ fiscal policy has a multiplied effect on Y.

An ↗ of G raises PE by that amount for any given level of Y.

The equilibrium moves from point A to point B, and Y rises from Y1 to Y2.

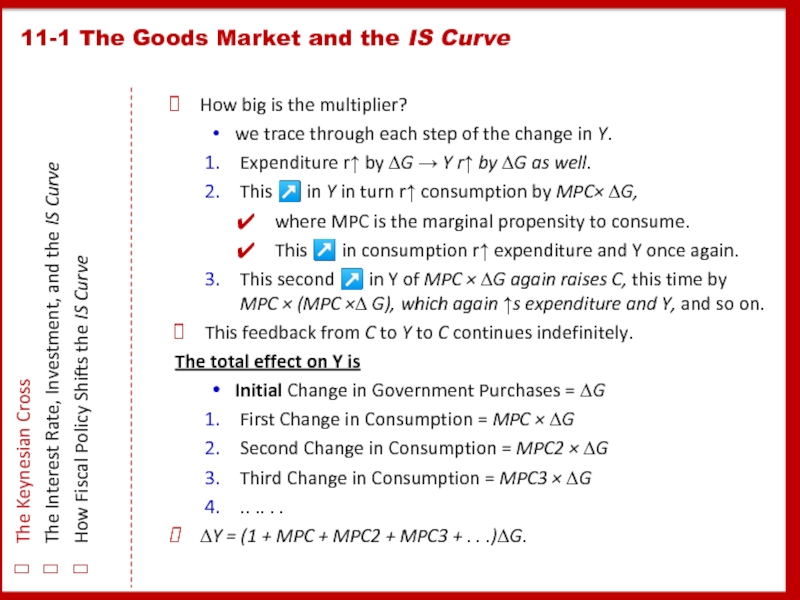

Слайд 16How big is the multiplier?

we trace through each step of the

Expenditure r↑ by ∆G → Y r↑ by ∆G as well.

This ↗ in Y in turn r↑ consumption by MPC× ∆G,

where MPC is the marginal propensity to consume.

This ↗ in consumption r↑ expenditure and Y once again.

This second ↗ in Y of MPC × ∆G again raises C, this time by MPC × (MPC ×∆ G), which again ↑s expenditure and Y, and so on.

This feedback from C to Y to C continues indefinitely.

The total effect on Y is

Initial Change in Government Purchases = ∆G

First Change in Consumption = MPC × ∆G

Second Change in Consumption = MPC2 × ∆G

Third Change in Consumption = MPC3 × ∆G

.. .. . .

∆Y = (1 + MPC + MPC2 + MPC3 + . . .)∆G.

The Keynesian Cross

The Interest Rate, Investment, and the IS Curve

How Fiscal Policy Shifts the IS Curve

11-1 The Goods Market and the IS Curve

Слайд 17The Keynesian Cross

The Interest Rate, Investment, and the IS Curve

How Fiscal Policy Shifts the IS Curve

11-1 The Goods Market and the IS Curve

The G multiplier is Y/G = 1 + MPC + MPC2 + MPC3 + . . .

This expression for the multiplier is an example of an infinite geometric series.

A result from algebra allows us to write the multiplier as

Y/G = 1/(1 − MPC).

For example, if the MPC is 0.6, the multiplier is

Y/G = 1 + 0.6 + 0.62 + 0.63 + . . .= 1/(1 − 0.6) = 2.5.

In this case, a $1.00 increase in government purchases raises equilibrium income by $2.50.3

Слайд 18Fiscal Policy and the Multiplier: Taxes

A ↘in T of

↗ consumption by MPC × T.

For any given level of Y, PE is now ↑er.

The PE schedule shifts up↑ by MPC × T.

The equilibrium of the economy moves from point A to point B.

Just as an ↗ in G has a multiplied effect on Y, → does a ↘ in Ts.

As before, the initial change in expenditure,

now MPC × T, is multiplied by 1/(1 − MPC).

The overall effect on Y of the change in Ts is Y/T = −MPC/(1 − MPC).

This expression is the tax multiplier,

the amount Y changes in response to a $1 change in Ts.

The “-” sign indicates that Y moves in the opposite direction from Ts.

For example,

if the marginal propensity to consume is 0.6, then

the tax multiplier is Y/T = −0.6/(1 − 0.6) = −1.5.

A $1.00 cut in taxes r↑s equilibrium Y by $1.50.

The Keynesian Cross

The Interest Rate, Investment, and the IS Curve

How Fiscal Policy Shifts the IS Curve

11-1 The Goods Market and the IS Curve

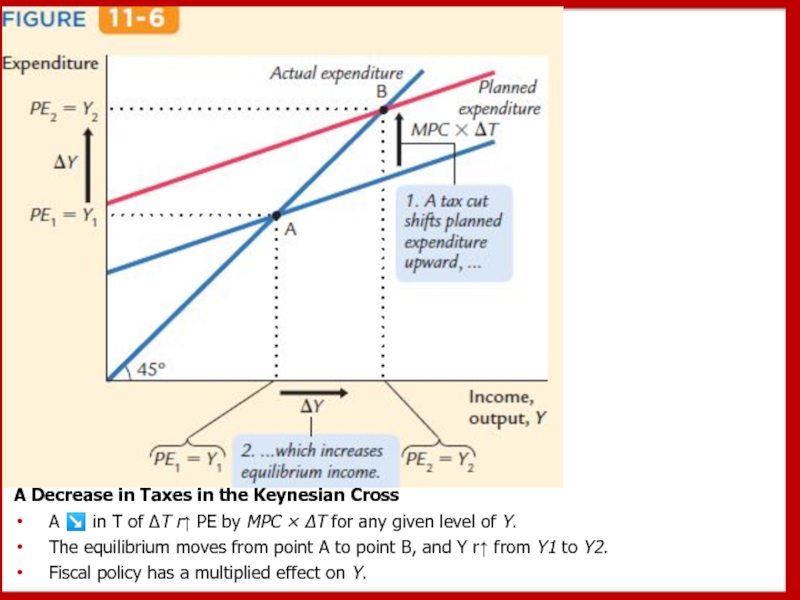

Слайд 19

A Decrease in Taxes in the Keynesian Cross

A ↘ in

The equilibrium moves from point A to point B, and Y r↑ from Y1 to Y2.

Fiscal policy has a multiplied effect on Y.

Слайд 20John F. Kennedy became president of the United States in 1961.

One

Tax cuts stimulate aggregate supply by improving workers’ incentives and expand AD by raising households’ disposable Y.

GDP ↗, U ↘

George W. Bush was elected president in 2000, a major element of his platform was a cut in Y taxes.

Bush used both supply-side and Keynesian rhetoric to make the case for their policy.

When people have more M., they can spend it on G&S.

When they demand an additional G&S, somebody will produce the G or S.

When somebody produces that G&S, it means somebody is more likely to be able to find a job.

GDP ↗, U ↘

Cutting Taxes to Stimulate the Economy: The Kennedy and Bush Tax Cuts

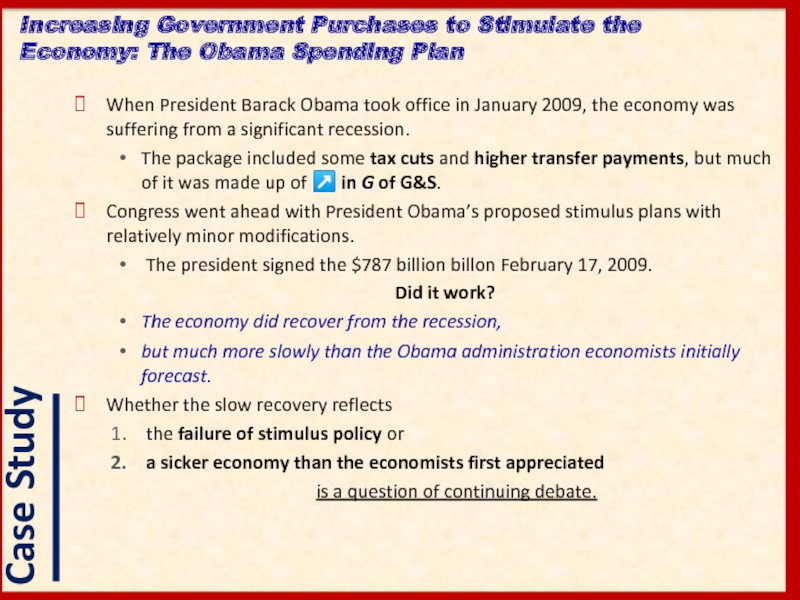

Слайд 21When President Barack Obama took office in January 2009, the economy

The package included some tax cuts and higher transfer payments, but much of it was made up of ↗ in G of G&S.

Congress went ahead with President Obama’s proposed stimulus plans with relatively minor modifications.

The president signed the $787 billion billon February 17, 2009.

Did it work?

The economy did recover from the recession,

but much more slowly than the Obama administration economists initially forecast.

Whether the slow recovery reflects

the failure of stimulus policy or

a sicker economy than the economists first appreciated

is a question of continuing debate.

Increasing Government Purchases to Stimulate the Economy: The Obama Spending Plan

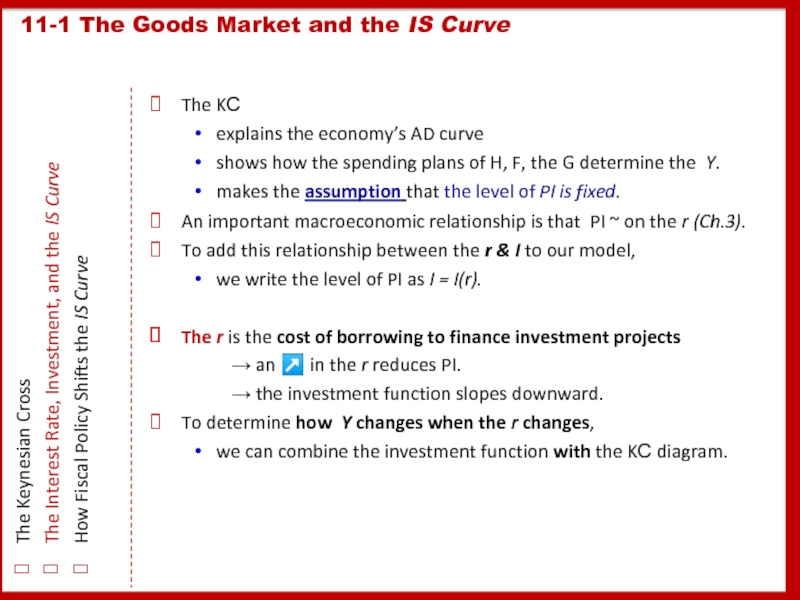

Слайд 22The KС

explains the economy’s AD curve

shows how the spending plans

makes the assumption that the level of PI is fixed.

An important macroeconomic relationship is that PI ~ on the r (Ch.3).

To add this relationship between the r & I to our model,

we write the level of PI as I = I(r).

The r is the cost of borrowing to finance investment projects

→ an ↗ in the r reduces PI.

→ the investment function slopes downward.

To determine how Y changes when the r changes,

we can combine the investment function with the KС diagram.

11-1 The Goods Market and the IS Curve

The Keynesian Cross

The Interest Rate, Investment, and the IS Curve

How Fiscal Policy Shifts the IS Curve

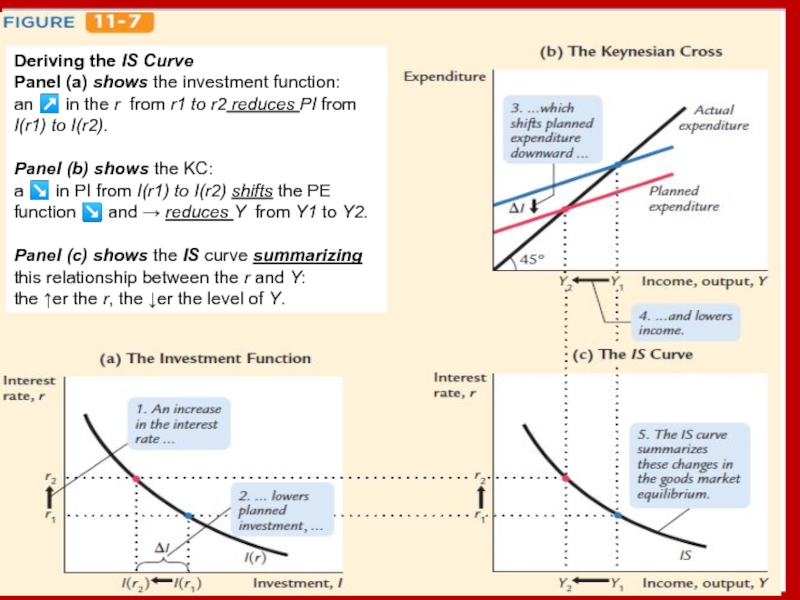

Слайд 23Deriving the IS Curve

Panel (a) shows the investment function:

an

Panel (b) shows the KC:

a ↘ in PI from I(r1) to I(r2) shifts the PE function ↘ and → reduces Y from Y1 to Y2.

Panel (c) shows the IS curve summarizing

this relationship between the r and Y:

the ↑er the r, the ↓er the level of Y.

Слайд 24The IS curve shows us,

for any given r, the level

As we learned from the KC,

the equilibrium level of Y also ~on Gnt spending G and taxes T.

The IS curve is drawn for a given FP; that is,

when we construct the IS curve, we hold G and T fixed.

When FP changes, the IS curve shifts.

Changes in FP that

r↑ the demand for G&S shift the IS curve to the right.

r↓ the demand for G&S shift the IS curve to the left.

11-1 The Goods Market and the IS Curve

The Keynesian Cross

The Interest Rate, Investment, and the IS Curve

How Fiscal Policy Shifts the IS Curve

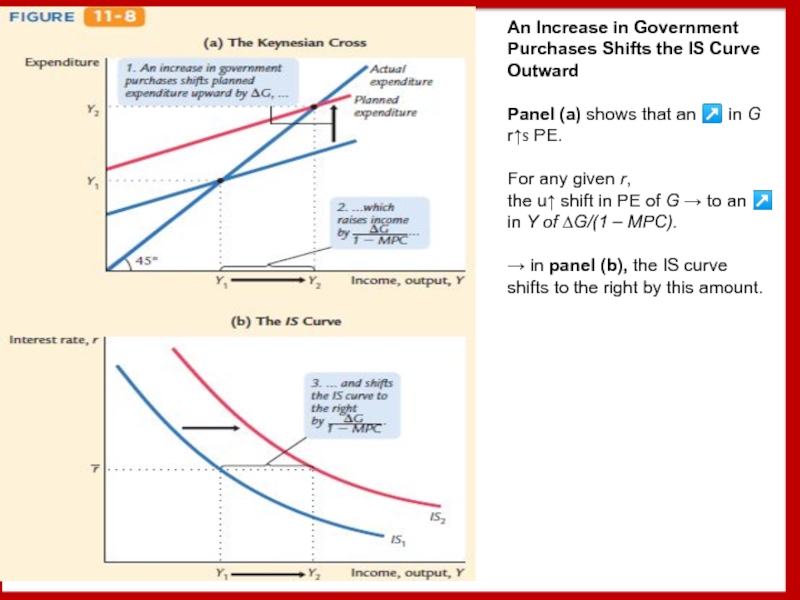

Слайд 25An Increase in Government Purchases Shifts the IS Curve Outward

Panel

For any given r,

the u↑ shift in PE of G → to an ↗ in Y of ∆G/(1 – MPC).

→ in panel (b), the IS curve shifts to the right by this amount.

Слайд 26

11-2 The Money Market and the LM Curve

The Theory of Liquidity

Income, Money Demand, and the LM Curve

How Monetary Policy Shifts the LM Curve

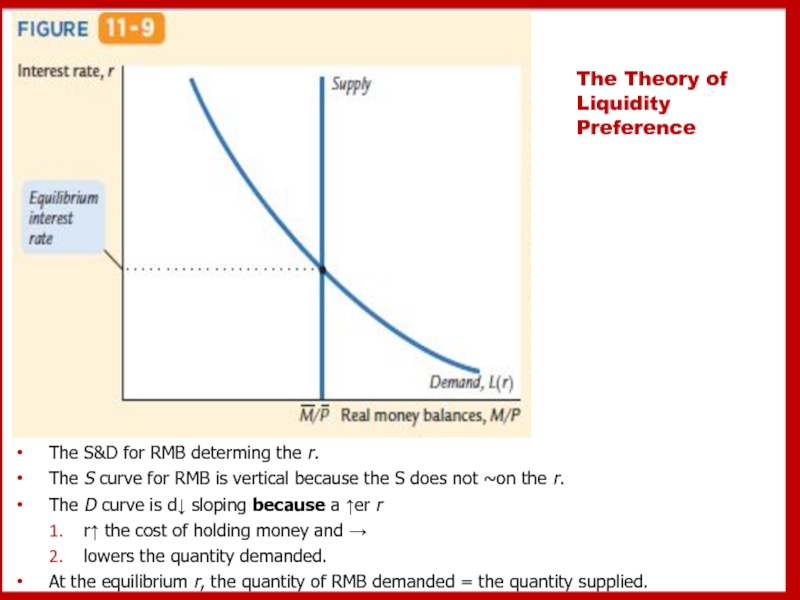

Слайд 27The Theory of Liquidity Preference

The S&D for RMB determing the r.

The

The D curve is d↓ sloping because a ↑er r

r↑ the cost of holding money and →

lowers the quantity demanded.

At the equilibrium r, the quantity of RMB demanded = the quantity supplied.

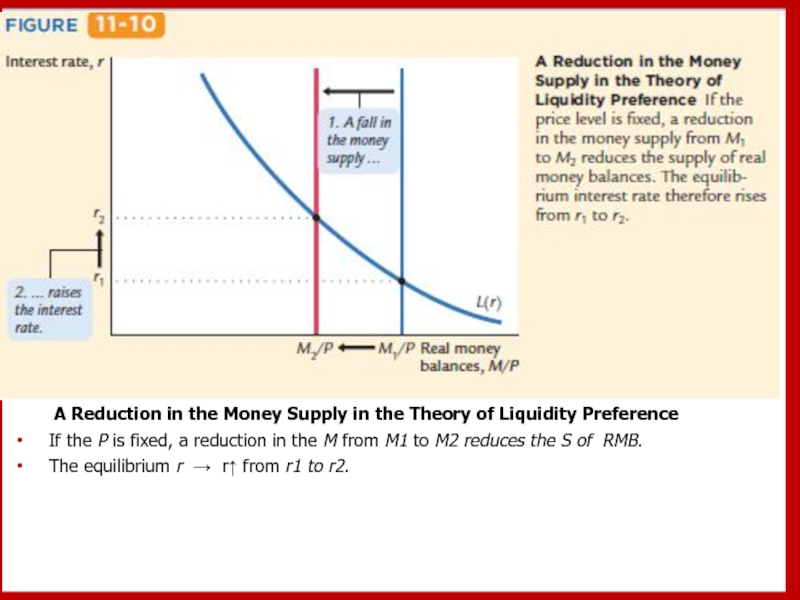

Слайд 28

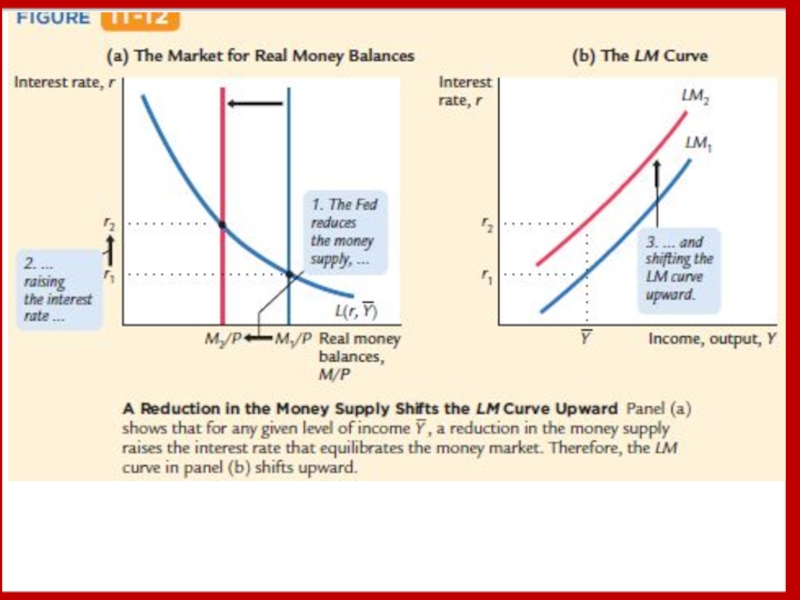

A Reduction in the Money Supply in the Theory of Liquidity

If the P is fixed, a reduction in the M from M1 to M2 reduces the S of RMB.

The equilibrium r → r↑ from r1 to r2.

Слайд 30

11-2 The Money Market and the LM Curve

The Theory of Liquidity

Income, Money Demand, and the LM Curve

How Monetary Policy Shifts the LM Curve

Слайд 31

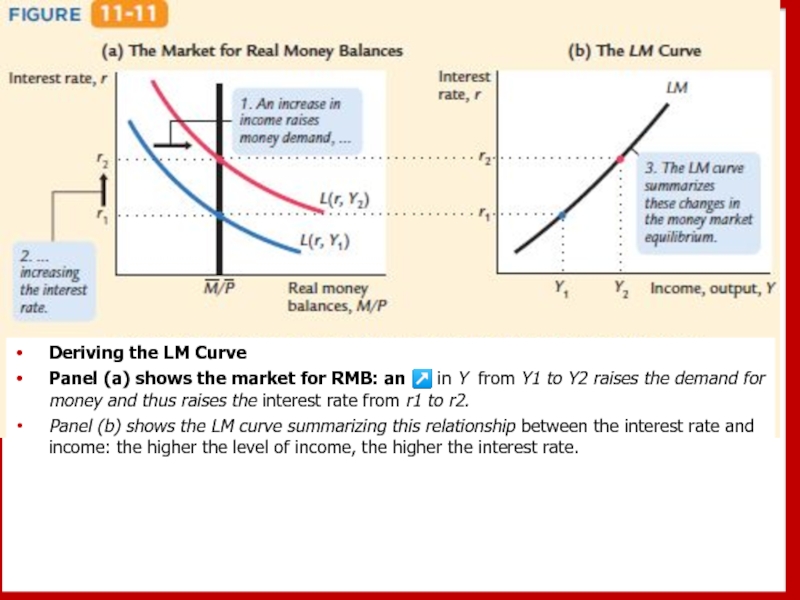

Deriving the LM Curve

Panel (a) shows the market for RMB:

Panel (b) shows the LM curve summarizing this relationship between the interest rate and income: the higher the level of income, the higher the interest rate.

Слайд 32The LM curve shows the combinations of the interest rate and

The LM curve is drawn for a given supply of RMB.

↘ in the supply of RMB shift the LM curve u↑.

↗in the supply of RMB shift the LM curve d↓.

11-2 The Money Market and the LM Curve

The Theory of Liquidity Preference

Income, Money Demand, and the LM Curve

How Monetary Policy Shifts the LM Curve

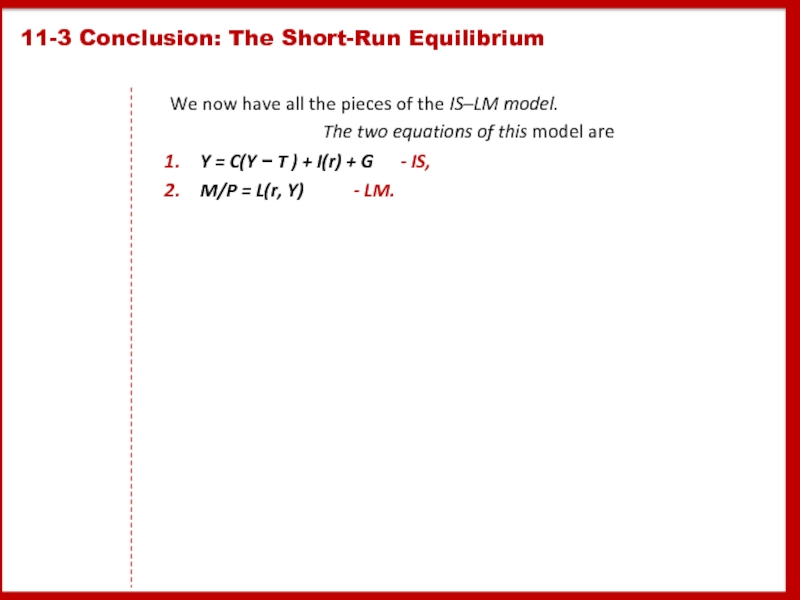

Слайд 34We now have all the pieces of the IS–LM model.

The

Y = C(Y − T ) + I(r) + G - IS,

M/P = L(r, Y) - LM.

11-3 Conclusion: The Short-Run Equilibrium

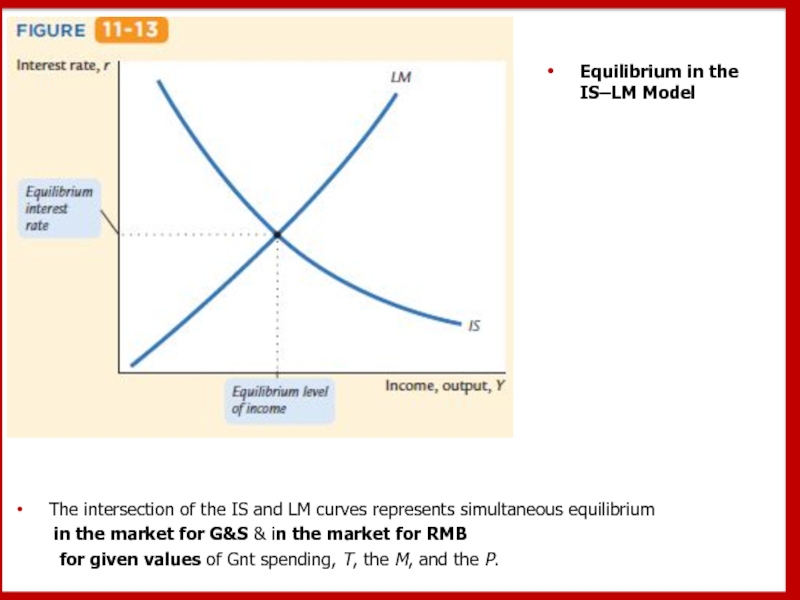

Слайд 35

The intersection of the IS and LM curves represents simultaneous equilibrium

in the market for G&S & in the market for RMB

for given values of Gnt spending, T, the M, and the P.

Equilibrium in the IS–LM Model

Слайд 36

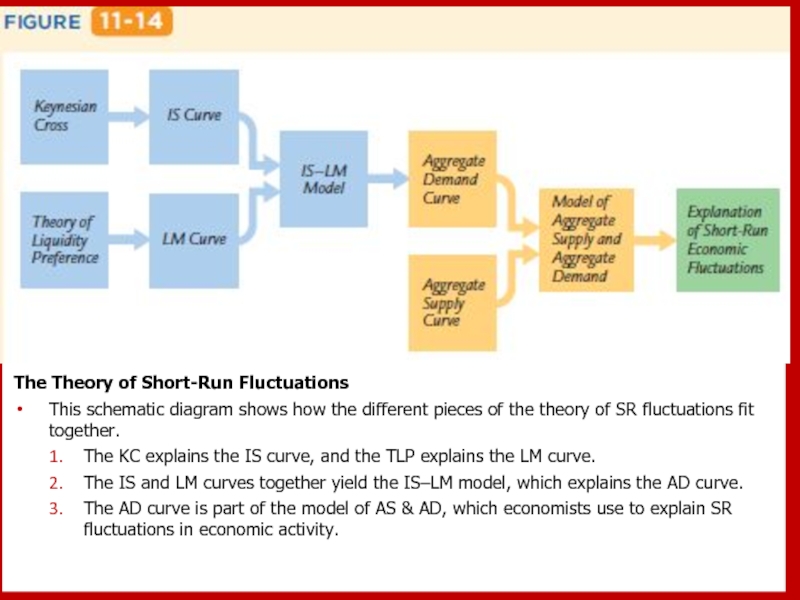

The Theory of Short-Run Fluctuations

This schematic diagram shows how the

The KC explains the IS curve, and the TLP explains the LM curve.

The IS and LM curves together yield the IS–LM model, which explains the AD curve.

The AD curve is part of the model of AS & AD, which economists use to explain SR fluctuations in economic activity.