- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

VALUATION презентация

Содержание

- 1. VALUATION

- 2. INTRODUCTION: DUDE, DON'T FREAK

- 3. I KNOW WHAT YOU ARE SAYING…

- 4. I KNOW WHAT YOU ARE SAYING… OH GOD. ANYTHING BUT FINANCE.

- 5. BUT, SERIOUSLY. DON'T SWEAT IT. I

- 6. BUT, SERIOUSLY. DON'T SWEAT IT. I

- 7. BUT, SERIOUSLY. DON'T SWEAT IT. I

- 8. AND YOU CAN'T AVOID IT.

- 9. AND YOU CAN'T AVOID IT. BECAUSE IF YOU LOOK WEAK

- 10. AND YOU CAN'T AVOID IT. BECAUSE IF

- 11. AND YOU CAN'T AVOID IT. BECAUSE IF

- 12. SO LET'S TALK ABOUT VALUATION

- 13. SO LET'S TALK ABOUT VALUATION SINCE YOU CAN’T AVOID IT

- 14. SO LET'S TALK ABOUT VALUATION SINCE YOU

- 15. SO LET'S TALK ABOUT VALUATION SINCE IT'S

- 16. VALUATION IS THE PROCESS OF DEFINING WHAT YOUR START-UP IS WORTH! DEFINITION

- 17. DEFINITION VALUATION IS THE PROCESS OF DEFINING

- 18. DEFINITION VALUATION IS THE PROCESS OF DEFINING

- 19. DEFINITION VALUATION IS THE PROCESS OF DEFINING

- 20. DEFINITION VALUATION IS THE PROCESS OF DEFINING

- 21. LET'S GO THROUGH EACH OF THOSE…

- 22. PART 1

- 23. VALUATION BASED ON ACTUAL ASSETS IS PROBABLY THE SIMPLEST AND MOST INTUITIVE

- 24. YOU ARE WORTH EXACTLY HOW MUCH YOU

- 25. ACTUALLY, WHAT YOU’RE WORTH RIGHT NOW CAN BE DIVIDED INTO 2 MAJOR CATEGORIES OF VALUE

- 26. TANGIBLE ASSETS INTANGIBLE ASSETS INVENTORY CASH OR

- 27. SO THE FIRST THING YOU NEED TO

- 28. BUT…

- 29. YOU’LL PROBABLY ALSO HAVE SOME LIABILITIES TOO

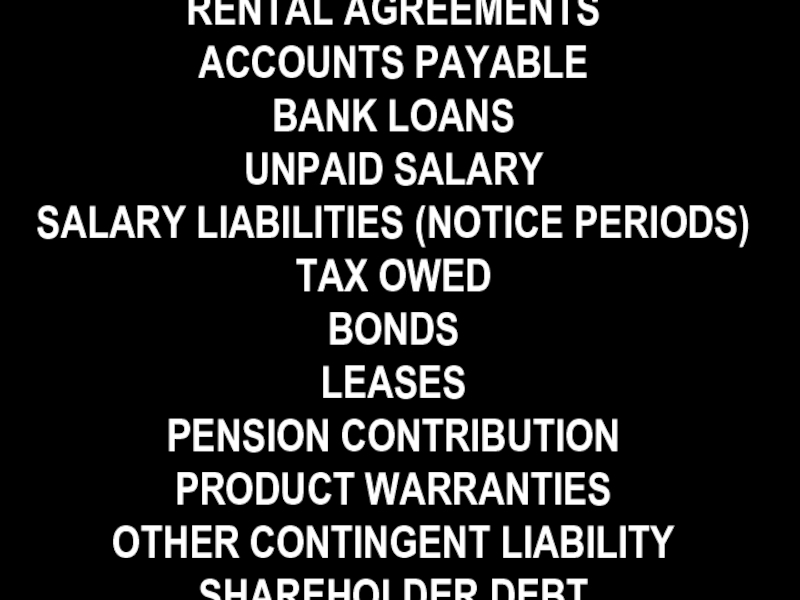

- 30. RENTAL AGREEMENTS ACCOUNTS PAYABLE BANK LOANS

- 31. YOU NEED TO SUM UP ALL THESE LIABILITIES AS WELL

- 32. AND WHEN YOU DO THAT, YOU’RE READY

- 33. SIMPLE RIGHT?

- 34. WELL SIMPLE COMES AT A COST

- 35. OF THE 3 METHODS, THIS RESULTS IN THE LOWEST VALUATION

- 36. WHICH IS WHY, IT IS REALLY ONLY USED DURING LIQUIDATIONS

- 37. PART 2

- 38. OF COURSE THE ASSETS & LIABILITIES METHOD

- 39. BECAUSE YOU HAVE NO ASSETS

- 40. IN THAT CASE, WE NEED TO VALUE

- 41. BUT WAIT? WHY WOULD ANYONE PLACE A VALUE ON POSSIBLE FUTURE MONEY

- 42. WELL IT TURNS OUT THAT POSSIBLE FUTURE MONEY DOES HAVE VALUE

- 43. DEPENDING ON HOW POSSIBLE, AND HOW MUCH FUTURE MONEY WE’RE TALKING ABOUT

- 44. THINK OF IT THIS WAY

- 45. IF YOUR MOTHER TOLD YOU SHE’D GIVE

- 46. SURE YOU WOULD

- 47. WHAT A GOOD CHILD

- 48. YOU TRUST MOM. YOU NEED THE DOUGH TOMORROW. SO YOU’LL PAY IN ADVANCE

- 49. YOU SEE. PROMISED FUTURE MONEY DOES HAVE VALUE TODAY

- 50. HOW ABOUT IF A BANK TOLD YOU

- 51. SURE YOU WOULD

- 52. THE POINT IS THAT THERE IS DEFINITELY VALUE TODAY FOR FUTURE MONEY

- 53. HOWEVER, THERE IS A LIMIT

- 54. THE VALUE OF FUTURE MONEY AND THE VALUE OF MONEY TODAY IS NOT EQUAL

- 55. WOULD YOU PAY ME 100 DOLLARS TODAY

- 56. COME ON…YOU CAN TRUST ME. I’LL PM YOU MY BANK DETAILS

- 57. NO, OF COURSE NOT

- 58. FIRST, IF YOU DEPOSITED THE 100 BUCKS

- 59. IN OTHER WORDS, THE VALUATION OF FUTURE PROMISED MONEY IS AFFECTED BY OPPORTUNITY COST

- 60. SECOND, WHO’S TO SAY THAT I WON’T

- 61. SO NOT ONLY MUST WE CONSIDER OPPORTUNITY COSTS, WE MUST ALSO CONSIDER RISKS

- 62. IN OTHER WORDS, FUTURE PROMISED MONEY HAS

- 63. FUTURE PROMISED MONEY IS WORTH LESS THAN THE SAME MONEY RIGHT NOW.

- 64. IN OTHER WORDS, FUTURE MONEY NEEDS TO BE DISCOUNTED

- 65. FORTUNATELY, AN ARMY OF MATHEMATICIANS WORKED THEIR

- 66. INTERNAL RATE OF RETURN (IRR) AND

- 67. THESE FORMULAS LOOK AT YOUR FUTURE PROMISED

- 68. IT IS NOT ACTUALLY HARD MATH, BUT

- 69. FORTUNATELY, BILL’S BOYS IN THE MS EXCEL

- 70. THE FORMULA IS: =NPV (DISCOUNT RATE, CASH FLOW1, CASH FLOW 2,…)

- 71. =NPV (DISCOUNT RATE, CASH FLOW1, CASH FLOW

- 72. =NPV (DISCOUNT RATE, CASH FLOW1, CASH FLOW 2,…) GETTING FUTURE CASH FLOWS IS EASY

- 73. YOU JUST GRAB THE PROFIT (NOT REVENUE)

- 74. CHOOSING THE DISCOUNT RATE HOWEVER, IS SLIGHTLY

- 75. THE DISCOUNT RATE IS A NUMBER FROM

- 76. SO A DISCOUNT RATE OF .2 (20%)

- 77. THE DISCOUNT RATE IS ACTUALLY CALCULATED BASED

- 78. FOR EXAMPLE… =NPV (DISCOUNT RATE, CASH FLOW1, CASH FLOW 2,…)

- 79. RISK HOW CONFIDENT IS THE INVESTOR ABOUT

- 80. OPPORTUNITY COSTS HOW MUCH MONEY WOULD THE

- 81. MARKET NORMS THE DISCOUNT RATE WILL ALSO

- 82. HOWEVER, HERE IS MY PERSONAL INVESTING RULE

- 83. =NPV (DISCOUNT RATE, CASH FLOW1, CASH FLOW 2,…)

- 84. IN OTHER WORDS, IF YOU ARE USING

- 85. BECAUSE THERE IS JUST SO MUCH DAMN

- 86. AS I NEGOTIATE YOUR DISCOUNT RATE WITH

- 87. HISTORY OF STABLE GROWTH AND PROFITS

- 88. SO, BY WAY OF EXAMPLE…IMAGINE A FRESH

- 89. USING EXCEL, TODAY’S VALUE OF THIS FIRM’S

- 90. OK, THAT'S NPV LET ME

- 91. AS WE MENTIONED BEFORE, INTERNAL RATE OF

- 92. THE IRR IS THE DISCOUNT RATE THAT

- 93. AGAIN, BILL'S BOYS CAME TO THE RESCUE

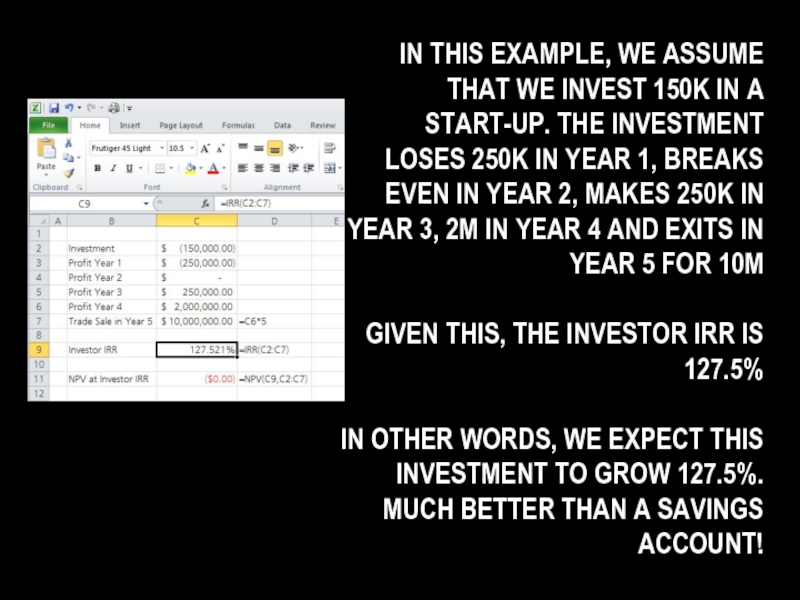

- 94. IN THIS EXAMPLE, WE ASSUME THAT WE

- 95. SO….UH…WHICH DO YOU USE: IRR OR NPV?

- 96. HONESTLY, IT DEPENDS ON THE AUDIENCE USE WHATEVER THE AUDIENCE PREFERS

- 97. THAT SAID, WHILE IRR IS GREAT FOR

- 98. TO ME, IRR WORKS BEST WHEN COMPARING

- 99. IT IS GREAT FOR A BIG FIRM

- 100. BUT IMHO, IT IS NOT SO USEFUL

- 101. THERE IS ONE LAST THING I WANT TO ADD

- 102. IN AN ACQUISITION SITUATION, RATHER THAN AN

- 103. WHICH MEANS THAT PART OF THE VALUE

- 104. WHETHER THIS CAN BE ADDED TO THE

- 105. PART 3

- 106. THE FINAL METHOD OF VALUATION LEVERAGES THE WISDOM OF CROWDS

- 107. SPECIFICALLY, YOUR VALUE SHOULD BE SIMILAR TO

- 108. BASICALLY, YOUR VALUE IS THE VALUE THAT THE INVISIBLE HAND OF THE MARKET GIVES YOU

- 109. THE MOST COMMON WAY TO GUESTIMATE MARKET

- 110. AND SINCE NO COMPANY IS JUST LIKE

- 111. THIS IS USUALLY DONE WITH P/E RATIO

- 112. P/E STANDS FOR PRICE /

- 113. SO IF A FIRM’S VALUE IS 8

- 114. WE REFER TO THE VALUE OF 4 AS “THE MULTIPLE”

- 115. TO GET A VALUE FOR YOU, WE

- 116. WITH THE MULTIPLE AND YOUR PROFIT THIS YEAR, WE CAN REVERSE CALCULATE YOUR PRICE (VALUATION)

- 117. IF THE MULTIPLE IS 4 AND YOUR

- 118. THIS MAGICAL MULTIPLE IS NOT AN ABSOLUTE NUMBER OF COURSE

- 119. THE P/E RATIO CAN CHANGE DRAMATICALLY FROM

- 120. BECAUSE LIKE ANY WISDOM OF CROWDS, IT IS SENSITIVE TO MARKET SENTIMENT

- 121. AND MARKET SENTIMENT IS FICKLE, IRRATIONAL, UNINFORMED,

- 122. DURING THE DOT.COM BUBBLE, I SAW TECH

- 123. THE VALUE OF THESE COMPANIES DID NOT CHANGE

- 124. WHAT CHANGED WAS THE HYPE SURROUNDING THE MARKET

- 125. SUMMARY

- 126. THANKS FOR READING. I TOLD YOU IT WASN’T ALL THAT HARD

- 127. HERE’S WHAT YOU NEED TO REMEMBER

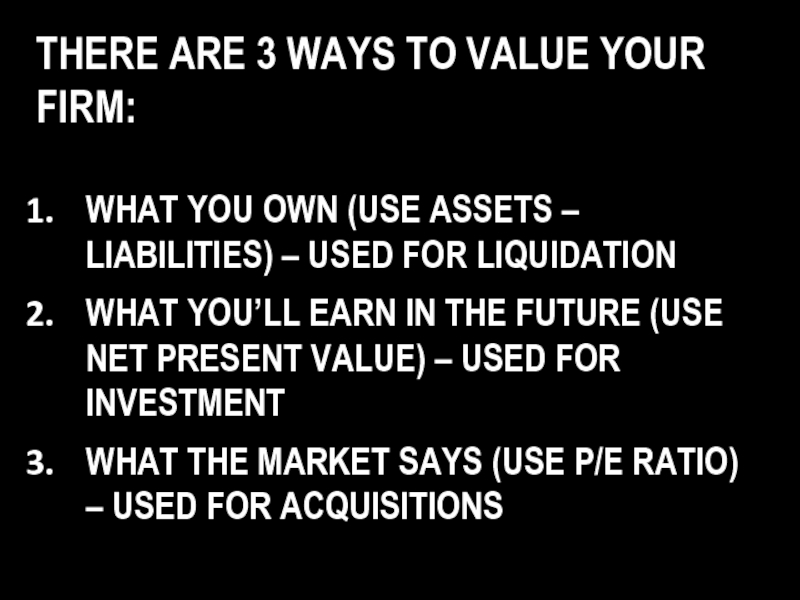

- 128. THERE ARE 3 WAYS TO VALUE YOUR

- 129. SHARE THIS DECK & FOLLOW ME (please-oh-please-oh-please-oh-please)

- 130. CLICK HERE FOR MORE!!!!

- 131. CREATIVE COMMONS ATTRIBUTIONS Dr. Evil: http://www.flickr.com/photos/bpage/ Attribution

Слайд 6BUT, SERIOUSLY. DON'T SWEAT IT.

I KNOW WHAT YOU ARE SAYING…

OH

FINANCE IS ACTUALLY QUITE SIMPLE

Слайд 7BUT, SERIOUSLY. DON'T SWEAT IT.

I KNOW WHAT YOU ARE SAYING…

OH

FINANCE IS ACTUALLY QUITE SIMPLE

WHEN YOU FOCUS ON WHAT MATTERS.

Слайд 11AND YOU CAN'T AVOID IT.

BECAUSE IF YOU LOOK WEAK

IF YOU ACTUALLY

THEN YOU'LL BE ON YOUR ASS

Слайд 15SO LET'S TALK ABOUT VALUATION

SINCE IT'S NOT ACTUALLY THAT HARD

AND SINCE

SINCE YOU CAN’T AVOID IT

Слайд 17DEFINITION

VALUATION IS THE PROCESS OF DEFINING WHAT YOUR START-UP IS WORTH!

YOU

Слайд 18DEFINITION

VALUATION IS THE PROCESS OF DEFINING WHAT YOUR START-UP IS WORTH!

YOU

YOU'RE WORTH WHAT YOU OWN

Слайд 19DEFINITION

VALUATION IS THE PROCESS OF DEFINING WHAT YOUR START-UP IS WORTH!

YOU

YOU'RE WORTH WHAT YOU OWN

YOU'RE WORTH WHAT YOU CAN EARN IN THE FUTURE

Слайд 20DEFINITION

VALUATION IS THE PROCESS OF DEFINING WHAT YOUR START-UP IS WORTH!

YOU

YOU'RE WORTH WHAT YOU OWN

YOU'RE WORTH WHAT YOU CAN EARN IN THE FUTURE

YOU'RE WORTH WHAT THE MARKET SAYS YOU'RE WORTH

Слайд 24YOU ARE WORTH EXACTLY HOW MUCH YOU HAVE IN YOUR POCKET!

*

Слайд 26TANGIBLE ASSETS

INTANGIBLE ASSETS

INVENTORY

CASH OR FINANCIAL ASSETS

BUILDINGS, LAND, VEHICLES,

COMPUTERS, DESKS,

CHAIRS (ANYTHING YOU

CAN HOCK)

ACCOUNTS RECEIVABLE

(WHAT PEOPLE OWE YOU)

AGREEMENTS THAT

COULD BE NOVATED

(FRANCHIZE OR

DISTRIBUTION

AGREEMENTS)

COPYRIGHTS

PATENTS

TRADEMARKS

TRADE SECRETS

BRAND / REPUTATION

UNIQUE KNOWLEDGE

Слайд 27SO THE FIRST THING YOU NEED TO DO IS FIGURE OUT

Слайд 30RENTAL AGREEMENTS

ACCOUNTS PAYABLE

BANK LOANS

UNPAID SALARY

SALARY LIABILITIES (NOTICE PERIODS)

TAX OWED

BONDS

LEASES

PENSION CONTRIBUTION

PRODUCT

OTHER CONTINGENT LIABILITY

SHAREHOLDER DEBT

Слайд 32AND WHEN YOU DO THAT, YOU’RE READY TO VALUE YOUR FIRM:

FIRM

(TANGIBLE + INTANGIBLE ASSETS) - LIABILITIES

Слайд 38OF COURSE THE ASSETS & LIABILITIES METHOD DOES NOT WORK WELL

Слайд 45IF YOUR MOTHER TOLD YOU SHE’D GIVE YOU 20 DOLLARS TOMORROW

Слайд 50HOW ABOUT IF A BANK TOLD YOU THAT THEY’D GIVE YOU

Слайд 58FIRST, IF YOU DEPOSITED THE 100 BUCKS IN A BANK, YOU’D

(WELL MAYBE NOT MUCH MORE)

Слайд 65FORTUNATELY, AN ARMY OF MATHEMATICIANS WORKED THEIR MAGIC AND CAME UP

Слайд 66INTERNAL RATE OF RETURN (IRR)

AND

NET PRESENT VALUE (NPV)

(ACTUALLY, IT’S

Слайд 67THESE FORMULAS LOOK AT YOUR FUTURE PROMISED CASH FLOWS, AND DISCOUNT

(SOMETIMES WE CALL THIS DISCOUNTED CASH FLOW)

Слайд 68IT IS NOT ACTUALLY HARD MATH, BUT IT ISN’T EASY MATH

(UNLESS YOU ARE FROM ANYWHERE OUTSIDE OF THE US, IN WHICH CASE, IT IS EASY)

Слайд 69FORTUNATELY, BILL’S BOYS IN THE MS EXCEL TEAM HAVE TAKEN THAT

Слайд 71=NPV (DISCOUNT RATE, CASH FLOW1, CASH FLOW 2,…)

SO, IN ORDER TO

WHAT IS THE DISCOUNT RATE

WHAT ARE THE FUTURE CASH FLOWS

Слайд 73YOU JUST GRAB THE PROFIT (NOT REVENUE) LINE FOR YOUR NEXT

(YOU GET THAT IN YOUR PRO-FORMA P&L)

(NOTE FOR ADVANCED USERS: I AM NOT A FAN OF TERMINAL VALUE FOR START-UPS, SO I WON’T COVER IT HERE. I’M ALSO NOT CONSIDERING DEBT SINCE IT IS A START-UP. CORPORATE TREASURERS NEED TO READ SOMETHING MORE ADVANCED THAN THIS DECK, AS I’M SURE YOU REALIZED ALREADY)

=NPV (DISCOUNT RATE, CASH FLOW1, CASH FLOW 2,…)

Слайд 74CHOOSING THE DISCOUNT RATE HOWEVER, IS SLIGHTLY HARDER

=NPV (DISCOUNT RATE, CASH

(SOMETIMES PEOPLE REFER TO DISCOUNT RATE AS WEIGHTED AVERAGE COST OF CAPITAL OR WACC)

Слайд 75THE DISCOUNT RATE IS A NUMBER FROM 0 TO 1.

THE

=NPV (DISCOUNT RATE, CASH FLOW1, CASH FLOW 2,…)

Слайд 76SO A DISCOUNT RATE OF .2 (20%) IS NOT VERY RISKY

=NPV (DISCOUNT RATE, CASH FLOW1, CASH FLOW 2,…)

Слайд 77THE DISCOUNT RATE IS ACTUALLY CALCULATED BASED ON MANY CRITERIA

=NPV (DISCOUNT

Слайд 79RISK

HOW CONFIDENT IS THE INVESTOR ABOUT THE LIKELIHOOD THE PROFIT YOU

=NPV (DISCOUNT RATE, CASH FLOW1, CASH FLOW 2,…)

Слайд 80OPPORTUNITY COSTS

HOW MUCH MONEY WOULD THE INVESTOR MAKE IF SHE INVESTED

=NPV (DISCOUNT RATE, CASH FLOW1, CASH FLOW 2,…)

Слайд 81MARKET NORMS

THE DISCOUNT RATE WILL ALSO VARY FROM MARKET TO MARKET

(IE: PHARMA RATES ARE DIFFERENT FROM E-COMMERCE PORTAL RATES)

=NPV (DISCOUNT RATE, CASH FLOW1, CASH FLOW 2,…)

Слайд 82HOWEVER, HERE IS MY PERSONAL INVESTING RULE OF THUMB, GENERICALLY

=NPV (DISCOUNT

Слайд 84IN OTHER WORDS, IF YOU ARE USING A DISCOUNT RATE OF

=NPV (DISCOUNT RATE, CASH FLOW1, CASH FLOW 2,…)

Слайд 85BECAUSE THERE IS JUST SO MUCH DAMN RISK THAT YOUR FORECASTS

=NPV (DISCOUNT RATE, CASH FLOW1, CASH FLOW 2,…)

Слайд 86AS I NEGOTIATE YOUR DISCOUNT RATE WITH YOU, I’D ALSO BE

=NPV (DISCOUNT RATE, CASH FLOW1, CASH FLOW 2,…)

Слайд 87HISTORY OF STABLE GROWTH AND PROFITS

PRODUCT CYCLE POINT

SIZE MARKET

INDUSTRY

CUSTOMER BASE -DIVERSIFICATION

GROWTH POTENTIAL-TOPLINE AND BOTTOM LINE TRENDS

COMPETITIVE POSITIONING

PRODUCT MIX

UNIQUENESS

THE VALUE OF SIMILAR COMPANIES

STRATEGY FOR CONTINUED GROWTH AND PROFITABILITY

TIMING

Слайд 88SO, BY WAY OF EXAMPLE…IMAGINE A FRESH START-UP THAT EXPECTS TO

=NPV (DISCOUNT RATE, CASH FLOW1, CASH FLOW 2,…)

Слайд 89USING EXCEL, TODAY’S VALUE OF THIS FIRM’S FUTURE, PROMISED PROFIT IS

THAT MEANS, IF I INVESTED $150K TODAY, I’D GET ~25% OF THE FIRM

(WHICH MEANS 2.5M RETURN IN YEAR 5 IF WE DISTRIBUTE THE YEAR 5 PROFIT AND I GET MY 25%)

Слайд 91AS WE MENTIONED BEFORE, INTERNAL RATE OF RETURN (IRR) IS LIKE

Слайд 92THE IRR IS THE DISCOUNT RATE THAT WOULD MAKE THE NPV

OR, IN OTHER WORDS, THE IRR IS THE RATE OF EXPECTED GROWTH

THE HIGHER THE IRR, THE BETTER THE INVESTMENT

Слайд 94IN THIS EXAMPLE, WE ASSUME THAT WE INVEST 150K IN A

GIVEN THIS, THE INVESTOR IRR IS 127.5%

IN OTHER WORDS, WE EXPECT THIS INVESTMENT TO GROW 127.5%. MUCH BETTER THAN A SAVINGS ACCOUNT!

Слайд 97THAT SAID, WHILE IRR IS GREAT FOR GIANT MULTI-NATIONAL FIRMS, I

Слайд 98TO ME, IRR WORKS BEST WHEN COMPARING PROJECTS OF EQUAL RISK

Слайд 99IT IS GREAT FOR A BIG FIRM TRYING TO COMPARE WHETHER

Слайд 100BUT IMHO, IT IS NOT SO USEFUL AT COMPARING WHETHER TO

Слайд 102IN AN ACQUISITION SITUATION, RATHER THAN AN INVESTOR SITUATION, HOPEFULLY THERE

Слайд 103WHICH MEANS THAT PART OF THE VALUE OF THE DEAL IS

Слайд 104WHETHER THIS CAN BE ADDED TO THE BASE VALUATION IS UP

Слайд 107SPECIFICALLY, YOUR VALUE SHOULD BE SIMILAR TO THE VALUE OF SIMILAR

Слайд 109THE MOST COMMON WAY TO GUESTIMATE MARKET VALUE IS TO LOOK

Слайд 110AND SINCE NO COMPANY IS JUST LIKE YOURS, YOU NEED TO

Слайд 111THIS IS USUALLY DONE WITH P/E RATIO

ACTUALLY, YOU CAN SOMETIMES ALSO

Слайд 112P/E STANDS FOR

PRICE / EARNINGS

(THINK OF PRICE AS SYNONYMOUS WITH

Слайд 113SO IF A FIRM’S VALUE IS 8 MILLION AND THEIR EARNINGS

8 / 2 = 4

Слайд 115TO GET A VALUE FOR YOU, WE NEED TO USE THE

LET’S ASSUME FOR NOW, THAT THE AVERAGE MULTIPLE TURNED OUT TO BE 4

Слайд 116WITH THE MULTIPLE AND YOUR PROFIT THIS YEAR, WE CAN REVERSE

Слайд 117IF THE MULTIPLE IS 4

AND YOUR PROFIT WAS 500K, THEN YOUR

PRICE / EARNINGS = MULTIPLE

PRICE = MULTIPLE X EARNINGS

2M = 4 X 500K

Слайд 119THE P/E RATIO CAN CHANGE DRAMATICALLY FROM INDUSTRY TO INDUSTRY AND

Слайд 121AND MARKET SENTIMENT IS FICKLE, IRRATIONAL, UNINFORMED, AND FULL OF EMOTIONS

*(HEY

Слайд 122DURING THE DOT.COM BUBBLE, I SAW TECH VALUATIONS OF 15X IN

Слайд 128THERE ARE 3 WAYS TO VALUE YOUR FIRM:

WHAT YOU OWN (USE

WHAT YOU’LL EARN IN THE FUTURE (USE NET PRESENT VALUE) – USED FOR INVESTMENT

WHAT THE MARKET SAYS (USE P/E RATIO) – USED FOR ACQUISITIONS

Слайд 129SHARE THIS DECK & FOLLOW ME

(please-oh-please-oh-please-oh-please)

stay up to date with my

http://www.slideshare.net/selenasol/presentations

https://twitter.com/eric_tachibana

http://www.linkedin.com/pub/eric-tachibana/0/33/b53