- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Unlocking Value in Rwanda’s Extractive Industries Sappera презентация

Содержание

- 1. Unlocking Value in Rwanda’s Extractive Industries Sappera

- 2. Table of Contents Highlights Sappera’s

- 3. Highlights Building value through Rwanda’s mineral

- 4. Sappera’s Strategy for the 3T’s &

- 5. The Business Today Positioned for growth

- 6. Management Capable of managing growth, experienced in

- 7. Processing & Production Simple materials handling

- 8. Mineral Purchase & Supply Flow Disciplined

- 9. Human Resources Capable team focussed on

- 10. Sappera Customers Large diversified

- 11. Trading & Shipment Activity Diverse

- 12. Why Rwanda Significant supplier of 3T’s

- 13. Tungsten Strategic Metal with Attractive Market

- 14. Tantalum Key metal for Sappera to

- 15. Tantalum’s Market Presence Widely used across

- 16. Tin Stable Component of Rwanda’s Mineral Exports

- 17. Rwanda Production Figures Rwanda has

- 18. Funding Requirement Driven by the Payment

- 19. Pro Forma Financials Strong cash

- 20. Facility Drawdown & Repayment Strong cash

- 21. Trading Risk Management Contracts structured to

Слайд 2

Table of Contents

Highlights Sappera’s Strategy The Business Today Sappera Customers

Trading &

The 3T’s

Rwanda Production Figures Funding & Financials Trading Risk Management

3

4

5

10

11

12

13

17

18

21

Слайд 3

Highlights

Building value through Rwanda’s mineral supply chain

•

Rwanda and the Great Lakes

•

Tungsten, Tin & Tantalum (the 3T’s) constitute essential inputs for the electronics and specialist steel making sectors

•

Sappera participates in the trading of Rwanda’s 3T’s to major global trading houses and end users

•

Well positioned for growth and local value enhancement

•

Sappera (“the Company”) has an established presence in Kigali including:

Scalable modern warehouse facility

Secure premises with 24 hr armed security and CCTV

Minerals processing “line” to concentrate and package minerals

•

•

•

•

•

•

Developed clear processes for mineral export including iTSCi approval Completed 8 trades to date

Validated business model to investors

Negotiated clear “off-take” agreements with a major international trading house as well as direct channels to other potential partners and/or end users

Along with principal capital, structured trade finance facility with local bank Positioned for growth with the ability to achieve high returns on capital employed

Spanning the supply chain from extraction to high end electronics’ applications

Слайд 4

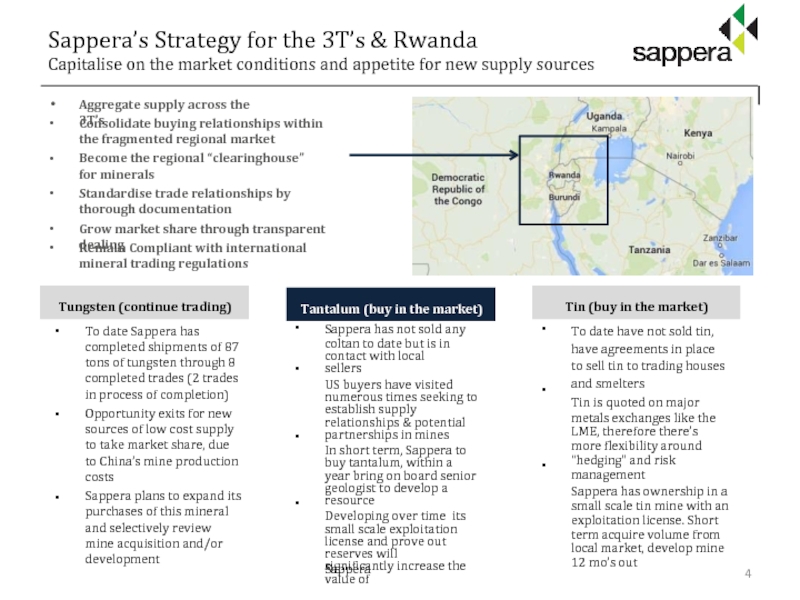

Sappera’s Strategy for the 3T’s & Rwanda

Capitalise on the market conditions

Tungsten (continue trading)

•

•

•

To date Sappera has completed shipments of 87 tons of tungsten through 8 completed trades (2 trades in process of completion)

Opportunity exits for new sources of low cost supply to take market share, due to China’s mine production costs

Sappera plans to expand its purchases of this mineral and selectively review mine acquisition and/or development

Tantalum (buy in the market)

•

•

•

•

Sappera has not sold any

coltan to date but is in contact with local sellers

US buyers have visited numerous times seeking to establish supply relationships & potential partnerships in mines

In short term, Sappera to buy tantalum, within a year bring on board senior geologist to develop a resource

Developing over time its small scale exploitation license and prove out reserves will significantly increase the value of

Tin (buy in the market)

•

•

•

To date have not sold tin, have agreements in place to sell tin to trading houses and smelters

Tin is quoted on major metals exchanges like the LME, therefore there’s more flexibility around “hedging” and risk management

Sappera has ownership in a small scale tin mine with an exploitation license. Short term acquire volume from local market, develop mine 12 mo’s out

Aggregate supply across the 3T’s

•

•

•

Consolidate buying relationships within the fragmented regional market

Become the regional “clearinghouse” for minerals

Standardise trade relationships by thorough documentation

Grow market share through transparent dealing

•

•

Remain Compliant with international mineral trading regulations

Sappera

Слайд 5

The Business Today

Positioned for growth & value enhancement to customers

•

Simply put,

•

Facilities capable of up to 25 MT production per day

•

Risk management achieved through:

Professionalism of logistics company

Insurance

Bonded warehouse at final destination from which ownership transfer takes place

•

Clear payment terms are contractually governed with Sappera’s buyer

•

Sappera generally receives payment within 8 days of cargo being shipped from Kigali

•

•

Sappera Limited (“Sappera or the Company”) was stablished in June 2013 in Kigali, Rwanda

To date the Company has achieved the following:

Renovated warehouse and production facilities

Acquired necessary plant and equipment to concentrate products

Built relationships with global trading partners as product “off- takers”

•

•

From October 2014 through February 2105 the Company completed 8 tungsten trades with Noble Group and demonstrated the profitability of its trading cycle

Mining titles and properties have also been acquired. Today the Company has a controlling interest in 16 titles, two have a degree of small scale activity and small scale exploitation licenses are in place

Слайд 6Management

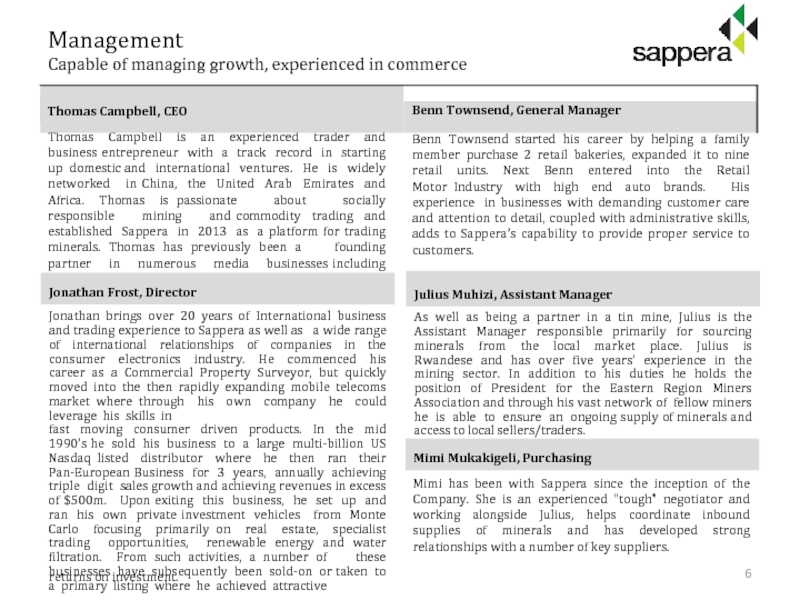

Capable of managing growth, experienced in commerce

Thomas Campbell is an experienced

6

returns on investment.

Jonathan Frost, Director

Jonathan brings over 20 years of International business and trading experience to Sappera as well as a wide range of international relationships of companies in the consumer electronics industry. He commenced his career as a Commercial Property Surveyor, but quickly moved into the then rapidly expanding mobile telecoms market where through his own company he could leverage his skills in

fast moving consumer driven products. In the mid 1990’s he sold his business to a large multi-billion US Nasdaq listed distributor where he then ran their Pan-European Business for 3 years, annually achieving triple digit sales growth and achieving revenues in excess of $500m. Upon exiting this business, he set up and ran his own private investment vehicles from Monte Carlo focusing primarily on real estate, specialist trading opportunities, renewable energy and water filtration. From such activities, a number of these businesses have subsequently been sold-on or taken to a primary listing where he achieved attractive

Julius Muhizi, Assistant Manager

As well as being a partner in a tin mine, Julius is the Assistant Manager responsible primarily for sourcing minerals from the local market place. Julius is Rwandese and has over five years’ experience in the mining sector. In addition to his duties he holds the position of President for the Eastern Region Miners Association and through his vast network of fellow miners he is able to ensure an ongoing supply of minerals and access to local sellers/traders.

Benn Townsend started his career by helping a family member purchase 2 retail bakeries, expanded it to nine retail units. Next Benn entered into the Retail Motor Industry with high end auto brands. His experience in businesses with demanding customer care and attention to detail, coupled with administrative skills, adds to Sappera’s capability to provide proper service to customers.

Mimi Mukakigeli, Purchasing

Mimi has been with Sappera since the inception of the Company. She is an experienced "tough" negotiator and working alongside Julius, helps coordinate inbound supplies of minerals and has developed strong relationships with a number of key suppliers.

Слайд 7

Processing & Production

Simple materials handling & disciplined approach to documentation

•

Alex Stuart

•

Transparent and quick payment for suppliers of minerals

•

Documentation and rigid back office administration is key the following:

Meeting government export and taxation requirements

Performing to international best practices for export of minerals (iTSCi req’s)

Invoicing Sappera’s Buyer

Releasing bank funding for purchases of minerals

Miners deliver mineral to Sappera warehouse

Alex Stuart assays & defines purity

Price agreed

Miner paid

Milling of minerals within Sappera’s secure facilities

Plant & Equipment standard & easy to operate, maintain & repair

Minerals blended and concentrated, products bagged

Final Assay done by ASIR

Tagging overseen by GMD inspector

Step 1

Step 2

Step 3

ASIR issue and document Container Inspection Certificate

Paperwork completed

Shipment from site to bonded warehouse in Dar es-Salam

Step 4

Слайд 8

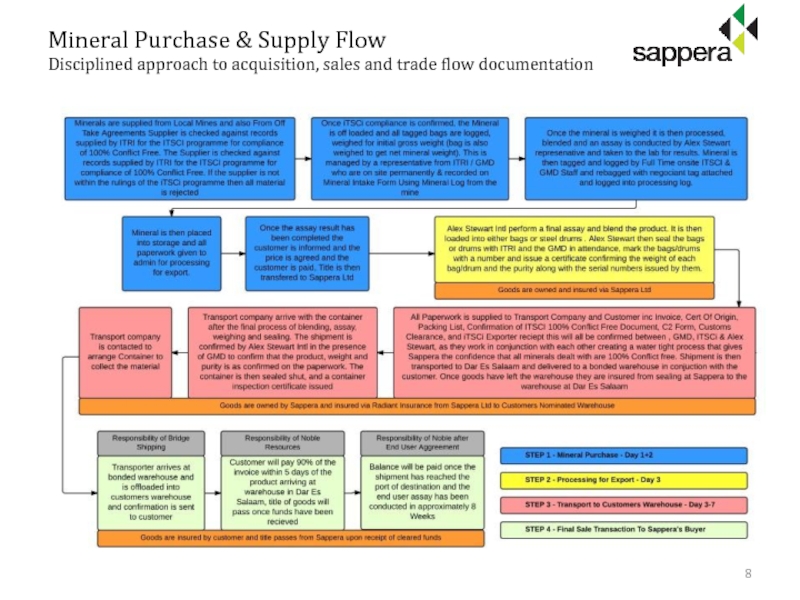

Mineral Purchase & Supply Flow

Disciplined approach to acquisition, sales and trade

Слайд 9

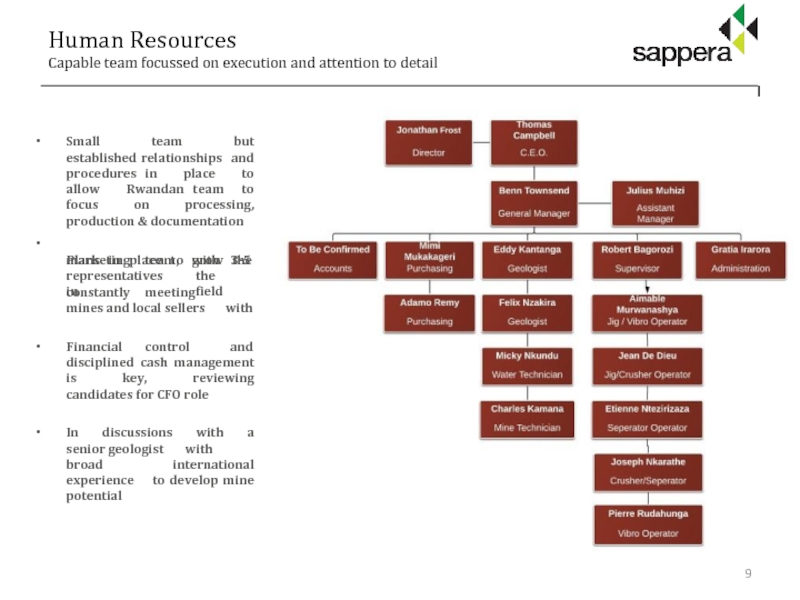

Human Resources

Capable team focussed on execution and attention to detail

•

•

Small

Plans in place to grow the

marketing team, representatives in

with 3-5 the field

with

•

constantly meeting mines and local sellers

Financial control

and

disciplined cash management is key, reviewing candidates for CFO role

•

In discussions with a senior geologist with broad international experience to develop mine potential

Слайд 10

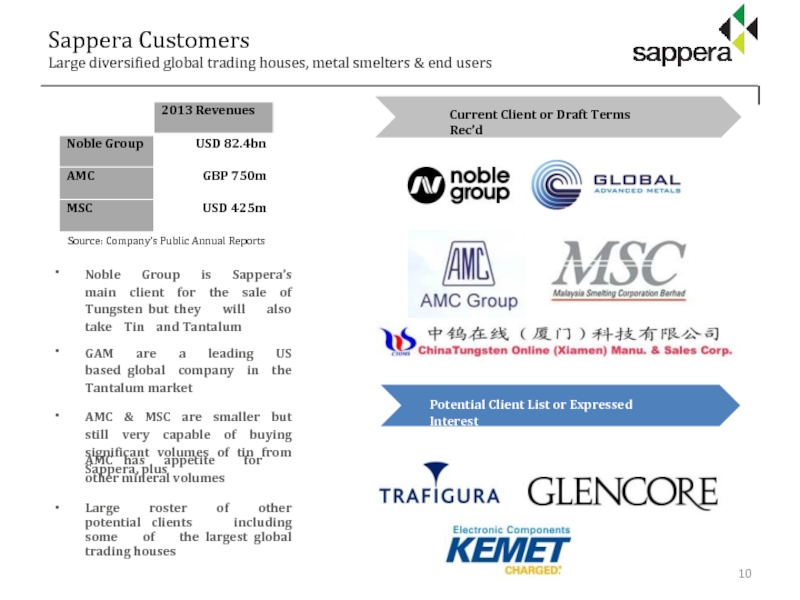

Sappera Customers

Large diversified global trading houses, metal smelters & end users

Current

Potential Client List or Expressed Interest

10

•

Noble Group is Sappera’s main client for the sale of Tungsten but they will also take Tin and Tantalum

•

GAM are a leading US based global company in the Tantalum market

•

AMC & MSC are smaller but still very capable of buying significant volumes of tin from Sappera, plus

AMC has appetite for other mineral volumes

•

Large roster of other potential clients including some of the largest global trading houses

Source: Company’s Public Annual Reports

Слайд 11

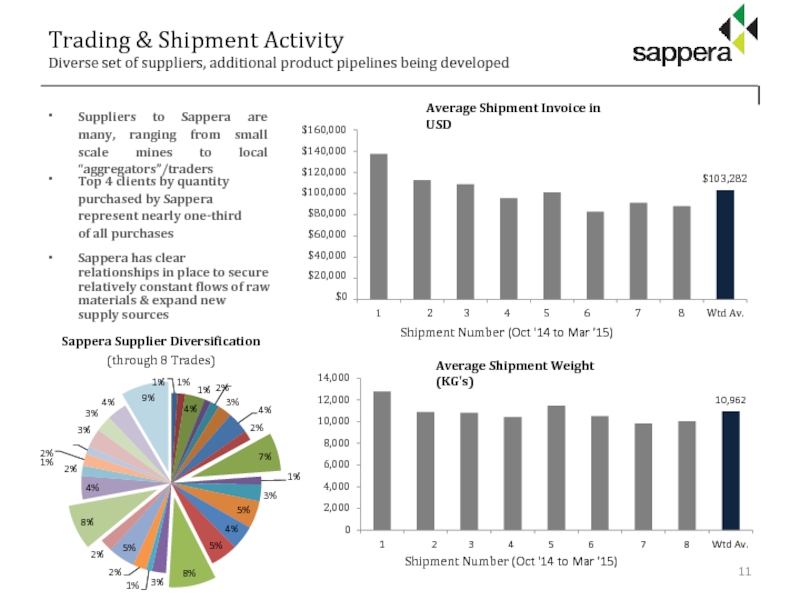

Trading & Shipment Activity

Diverse set of suppliers, additional product pipelines being

•

Suppliers to Sappera are many, ranging from small scale mines to local “aggregators”/traders

•

Top 4 clients by quantity purchased by Sappera represent nearly one-third of all purchases

•

Sappera has clear relationships in place to secure relatively constant flows of raw materials & expand new supply sources

$103,282

$160,000

$140,000

$120,000

$100,000

$80,000

$60,000

$40,000

$20,000

$0

1

7

8

Wtd Av.

Average Shipment Invoice in USD

2 3 4 5 6

Shipment Number (Oct '14 to Mar '15)

10,962

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

1

7

8

Wtd Av.

Average Shipment Weight (KG's)

2 3 4 5 6

Shipment Number (Oct '14 to Mar '15)

4%

1%

1% 2%

3%

4%

2%

7%

1%

3%

5%

4%

5%

8%

3%

1%

2%

5%

2%

8%

4%

2%

2% 1%

3%

3%

4%

9%

Sappera Supplier Diversification

(through 8 Trades)

1%

11

Слайд 12

Why Rwanda

Significant supplier of 3T’s to the world’s steel & electronics

•

It has the 3T’s – tungsten, tantalum & tin

•

Stable government and business friendly

•

Fragmented market with only a few large players

•

Opportunity to aggregate supply as well as develop over time own sources from mining concessions

•

Platform for Sappera to leverage its market position and access in Rwanda to provide buyers with new channels and secure supplies of strategic metals

•

As Central Africa becomes a more accepted source of the 3T’s, the major trading houses and end users are directly seeking to acquire and if possible, lock in and secure, exclusive sources of supply

•

Recently there has been some funding activity taking place in Rwanda where major trading houses have provided production loans to tin miners in order to secure a greater volume of supply, this has also been the case in the DRC

•

We believe that the trend for trading houses, as is evidenced by the likes of Glencore, will be to financially engineer ownership and/or rights to reliable sources of Rare Earths and strategic metals

•

Although global GDP growth has impacted the global economy, in particular noticed in China’s raw materials consumption patterns, Chinese mills and smelters still neeed access to specialty metals

•

Along with the sale to the traditional Asian smelters, the markets in the EU and North America are buyers and help provide client diversification for companies with the right international market connections.

•

Rwanda forms the right platform for Sappera to develop Rwanda as a hub for the aggregation of legally supplied product from the surrounding countries of Central Africa due to its positioning and direct road access to East African ports

Слайд 13

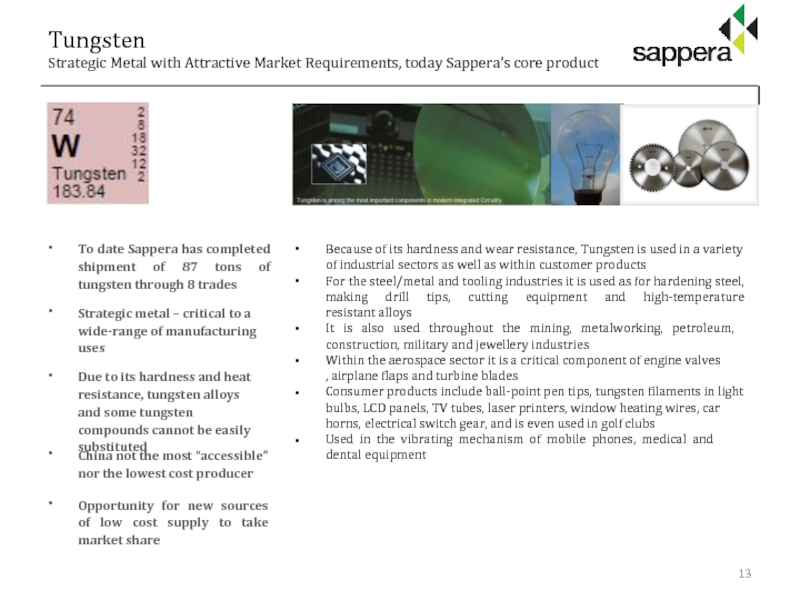

Tungsten

Strategic Metal with Attractive Market Requirements, today Sappera’s core product

•

To date

•

Strategic metal – critical to a wide-range of manufacturing uses

•

Due to its hardness and heat resistance, tungsten alloys and some tungsten compounds cannot be easily substituted

•

China not the most “accessible” nor the lowest cost producer

•

Opportunity for new sources of low cost supply to take market share

•

•

•

•

•

•

Because of its hardness and wear resistance, Tungsten is used in a variety of industrial sectors as well as within customer products

For the steel/metal and tooling industries it is used as for hardening steel, making drill tips, cutting equipment and high-temperature resistant alloys

It is also used throughout the mining, metalworking, petroleum, construction, military and jewellery industries

Within the aerospace sector it is a critical component of engine valves , airplane flaps and turbine blades

Consumer products include ball-point pen tips, tungsten filaments in light bulbs, LCD panels, TV tubes, laser printers, window heating wires, car horns, electrical switch gear, and is even used in golf clubs

Used in the vibrating mechanism of mobile phones, medical and dental equipment

Слайд 14

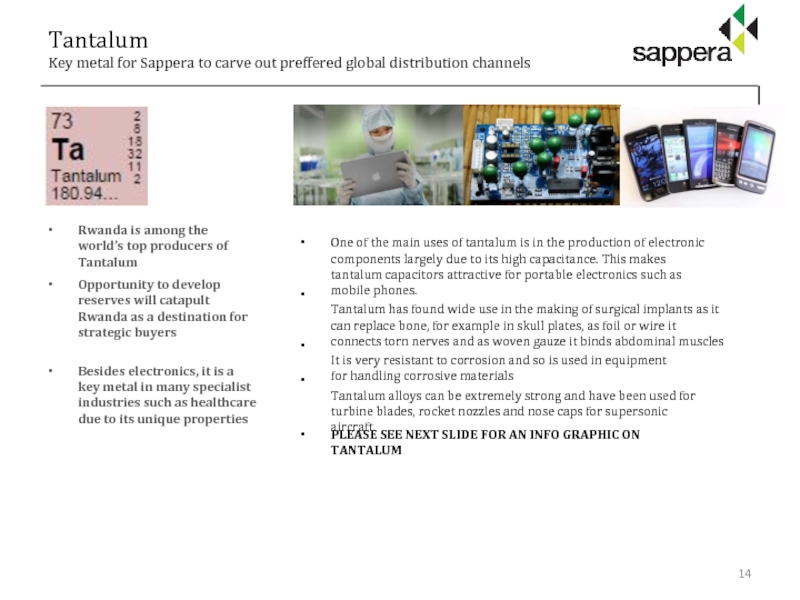

Tantalum

Key metal for Sappera to carve out preffered global distribution channels

•

Rwanda

•

Opportunity to develop reserves will catapult Rwanda as a destination for strategic buyers

•

Besides electronics, it is a key metal in many specialist industries such as healthcare due to its unique properties

•

•

•

•

One of the main uses of tantalum is in the production of electronic components largely due to its high capacitance. This makes tantalum capacitors attractive for portable electronics such as mobile phones.

Tantalum has found wide use in the making of surgical implants as it can replace bone, for example in skull plates, as foil or wire it connects torn nerves and as woven gauze it binds abdominal muscles

It is very resistant to corrosion and so is used in equipment for handling corrosive materials

Tantalum alloys can be extremely strong and have been used for turbine blades, rocket nozzles and nose caps for supersonic aircraft.

•

PLEASE SEE NEXT SLIDE FOR AN INFO GRAPHIC ON TANTALUM

Слайд 15

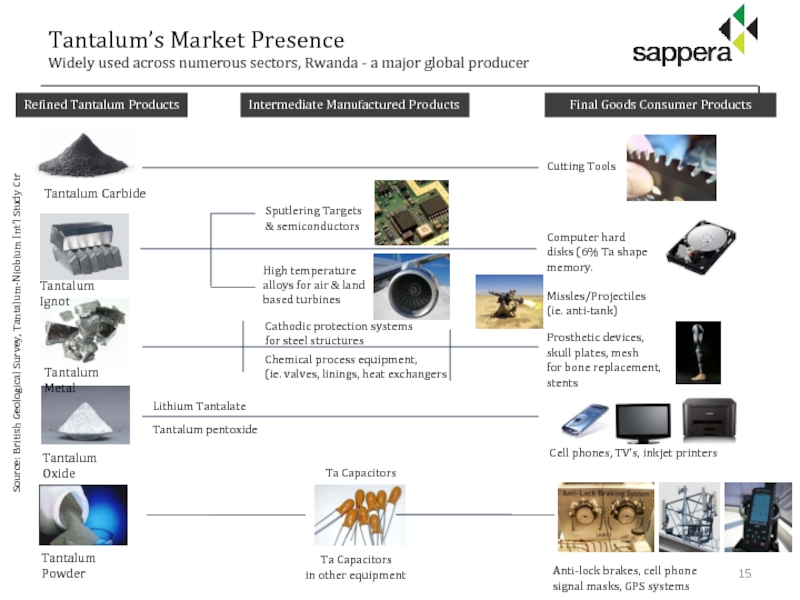

Tantalum’s Market Presence

Widely used across numerous sectors, Rwanda - a major

Refined Tantalum Products

Intermediate Manufactured Products

Final Goods Consumer Products

Tantalum Ignot

Tantalum Metal

Tantalum Oxide

Tantalum Powder

Cutting Tools

Tantalum Carbide

Sputlering Targets

& semiconductors

High temperature alloys for air & land

based turbines

Computer hard disks (6% Ta shape memory.

Missles/Projectiles (ie. anti-tank)

Prosthetic devices, skull plates, mesh for bone replacement, stents

Cathodic protection systems

for steel structures

Chemical process equipment,

(ie. valves, linings, heat exchangers

Lithium Tantalate

Tantalum pentoxide

Cell phones, TV’s, inkjet printers

Ta Capacitors

Ta Capacitors

Source: British Geological Survey, Tantalum-Niobium Int’l Study Ctr

Anti-lock brakes, cell phone

signal masks, GPS systems

in other equipment

Слайд 16Tin

Stable Component of Rwanda’s Mineral Exports

•

Tin is an important metal used

•

Rwanda and the DRC clearly have tin reserves but there is little available information

•

Rwanda has a few tin mines of a commercial scale and calibre as most are artisanal mined, certain trading groups are working to lock-in supply

•

iTSCi has been active in creating transparency around certain conflict minerals and working with smelters and other groups to promote the trading of “conflict free” minerals

•

•

•

•

•

Tin has been a metal used by man for many centuries and are a par of our everyday life, tin cans have, in 200 years, changed the way the world eats

Today, households in Europe and the US alone get through 40 billion cans of food a year, according to the Can Manufacturers Institute in Washington DC.

Tin has many uses. It takes a high polish and is used to coat other metals to prevent corrosion.

Alloys of tin are important, such as soft solder, pewter, bronze and phosphor bronze. A niobium-tin alloy is used for superconducting magnets.

Most window glass is made by floating molten glass on molten tin to produce a flat surface. Tin salts sprayed onto glass are used to produce electrically conductive coatings.

Слайд 17

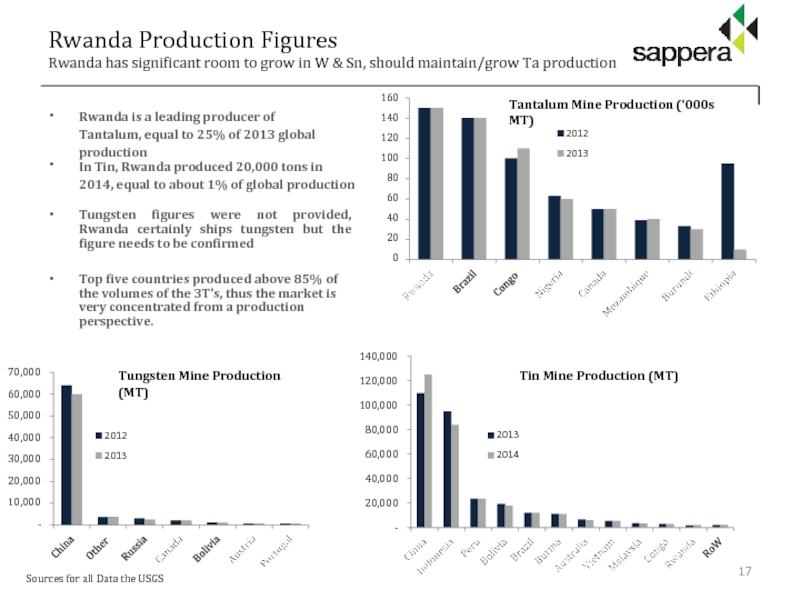

Rwanda Production Figures

Rwanda has significant room to grow in W &

•

Rwanda is a leading producer of Tantalum, equal to 25% of 2013 global production

•

In Tin, Rwanda produced 20,000 tons in 2014, equal to about 1% of global production

•

Tungsten figures were not provided, Rwanda certainly ships tungsten but the figure needs to be confirmed

•

Top five countries produced above 85% of the volumes of the 3T’s, thus the market is very concentrated from a production perspective.

-

20,000

40,000

60,000

80,000

100,000

120,000

140,000

2013

2014

140

120

100

80

60

40

20

0

160

2012

2013

70,000

60,000

50,000

40,000

30,000

20,000

10,000

-

2012

2013

Sources for all Data the USGS

Tungsten Mine Production (MT)

Tantalum Mine Production (‘000s MT)

Tin Mine Production (MT)

17

Слайд 18

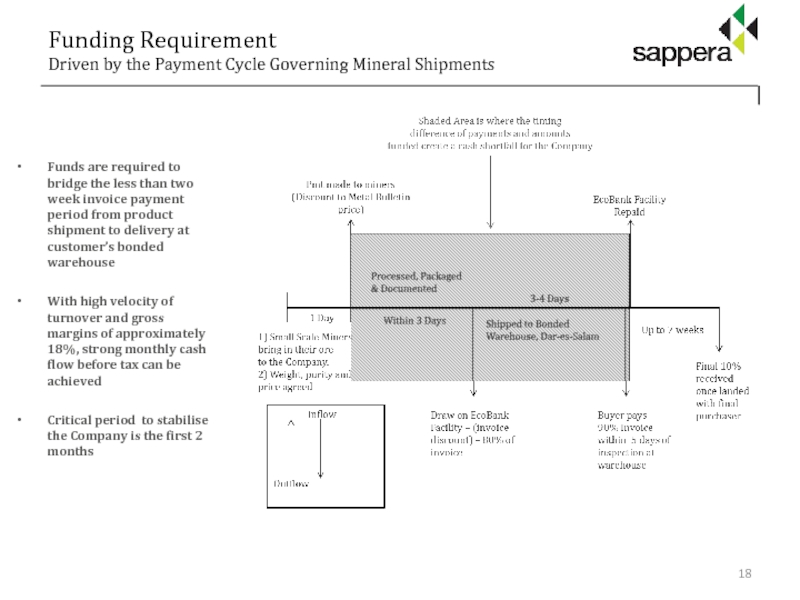

Funding Requirement

Driven by the Payment Cycle Governing Mineral Shipments

•

Funds are required

•

With high velocity of turnover and gross margins of approximately 18%, strong monthly cash flow before tax can be achieved

•

Critical period to stabilise the Company is the first 2 months

Слайд 19

Pro Forma Financials

Strong cash flow generation relative to capital employed

•

Based on

•

The cash flows indicated require $1.6m in total funding by the third month

•

Investor IRR’s, due to recycling of capital, are in excess of 30%

•

The Pro Forma Income Statement for the first 12 mo’s ramps up trading volumes to 20 tpw, 10 tpw & 20 tpw of tungsten, tantalum & tin respectively

18.3%

35.0%

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

1

2

3

4

5

6

7

8

Wtd Av.

Gross Margin - Sappera Tungsten Shipments

Pro Forma Income Statement - 12 mo's

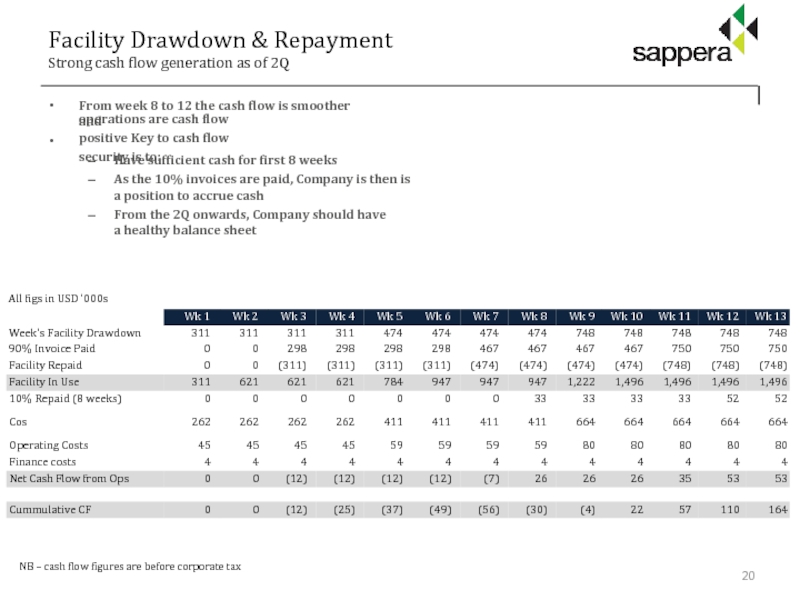

Слайд 20

Facility Drawdown & Repayment

Strong cash flow generation as of 2Q

20

•

From week

•

operations are cash flow positive Key to cash flow security is to:

Have sufficient cash for first 8 weeks

As the 10% invoices are paid, Company is then is a position to accrue cash

From the 2Q onwards, Company should have a healthy balance sheet

NB – cash flow figures are before corporate tax

Слайд 21

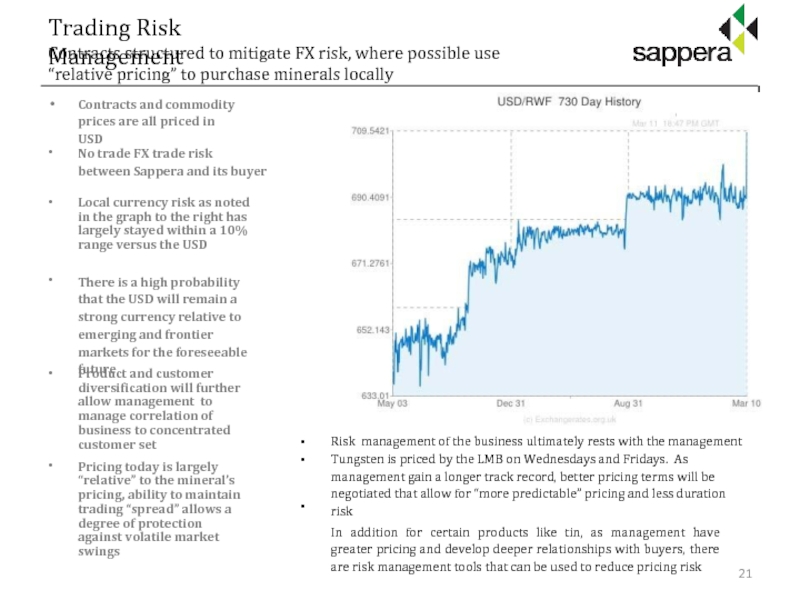

Trading Risk Management

Contracts structured to mitigate FX risk, where possible use

Contracts and commodity prices are all priced in USD

•

No trade FX trade risk between Sappera and its buyer

•

Local currency risk as noted in the graph to the right has largely stayed within a 10% range versus the USD

•

There is a high probability that the USD will remain a strong currency relative to emerging and frontier markets for the foreseeable future

•

Product and customer diversification will further allow management to manage correlation of business to concentrated customer set

•

Pricing today is largely “relative” to the mineral’s pricing, ability to maintain trading “spread” allows a degree of protection against volatile market swings

•

•

•

Risk management of the business ultimately rests with the management Tungsten is priced by the LMB on Wednesdays and Fridays. As

management gain a longer track record, better pricing terms will be negotiated that allow for “more predictable” pricing and less duration risk

In addition for certain products like tin, as management have greater pricing and develop deeper relationships with buyers, there are risk management tools that can be used to reduce pricing risk

21