- Главная

- Разное

- Дизайн

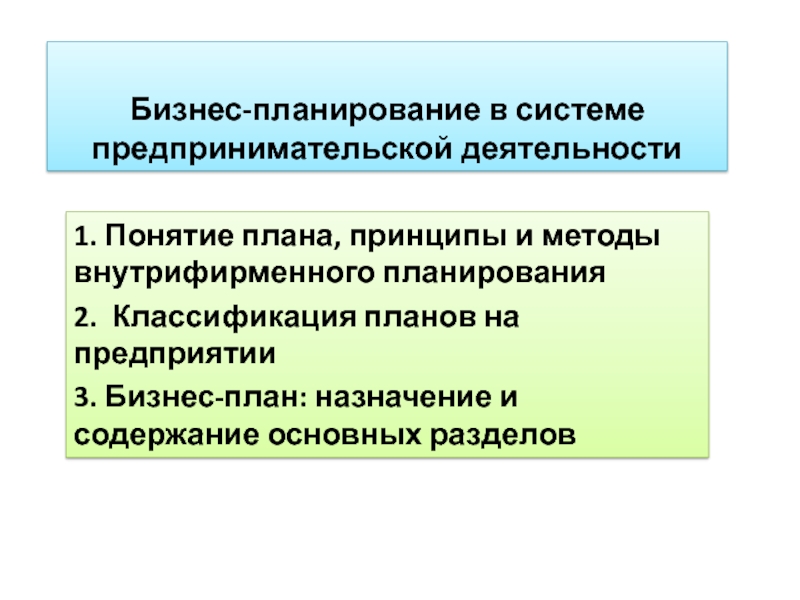

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Photo by Amyn Kassam - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/27482923@N03 презентация

Содержание

- 1. Photo by Amyn Kassam - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/27482923@N03

- 2. Presented By: Rob Misheloff Smarter Finance USA www.SmarterFinanceUSA.com

- 3. Photo by Werner Kunz - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/35375520@N07 Created with Haiku Deck

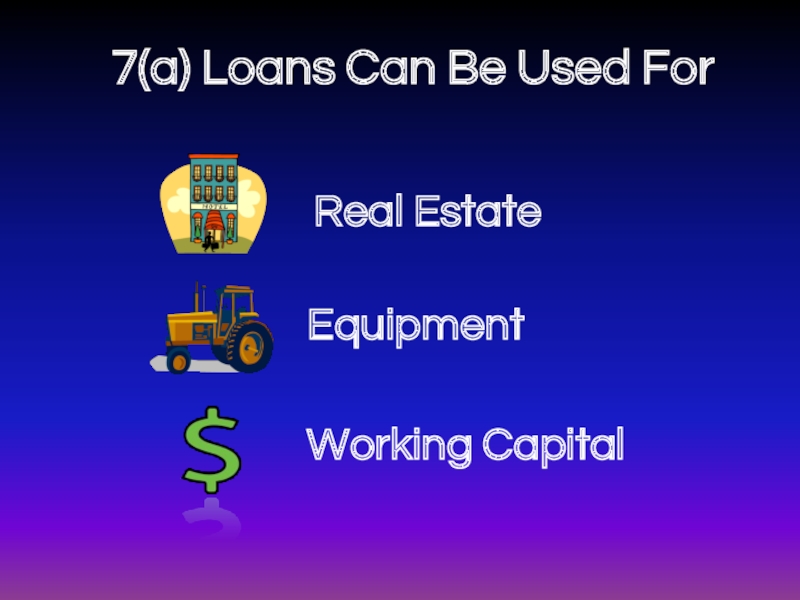

- 4. 7(a) Loans Can Be Used For Real Estate Working Capital Equipment

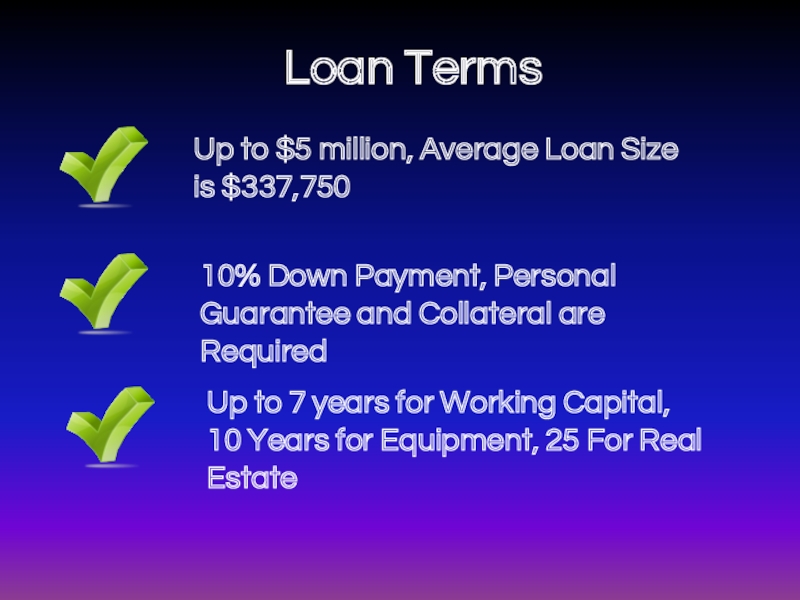

- 5. Loan Terms Up to $5 million, Average

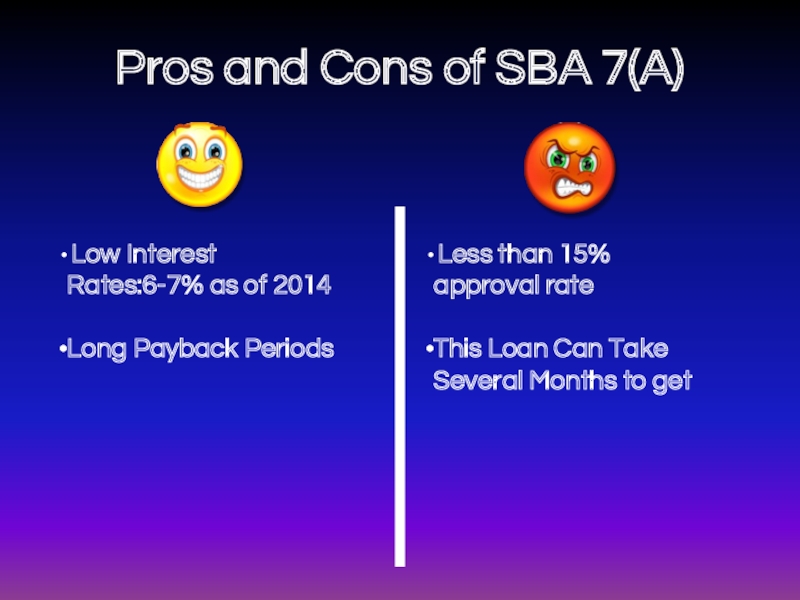

- 6. Pros and Cons of SBA 7(A)

- 7. Photo by Pete Zarria - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/98019953@N00 Created with Haiku Deck

- 8. SBA 504 Loans Can Be Used For Real Estate Equipment

- 9. SBA 504 Loan Terms Up to $5

- 10. Pros and Cons of SBA 504 Loans

- 11. Photo by alphatrek - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/66825505@N00 Created with Haiku Deck

- 12. SBA MicroLoans Can Be Used For Real Estate Working Capital Equipment

- 13. SBA Microloan Terms Up to $50,000 with

- 14. Pros and Cons of SBA Microloans

- 15. Photo by AZso - Creative Commons Attribution-NonCommercial License https://www.flickr.com/photos/15887936@N00 Created with Haiku Deck

- 16. Shelf Corporations A sometimes used trick for

- 17. How Can a Shelf Corporation Get You

- 18. Pros and Cons of Shelf Corporations

- 19. Photo by enriqueburgosgarcia - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/36001761@N02 Created with Haiku Deck

- 20. Peer 2 Peer Lending Startups Can Access

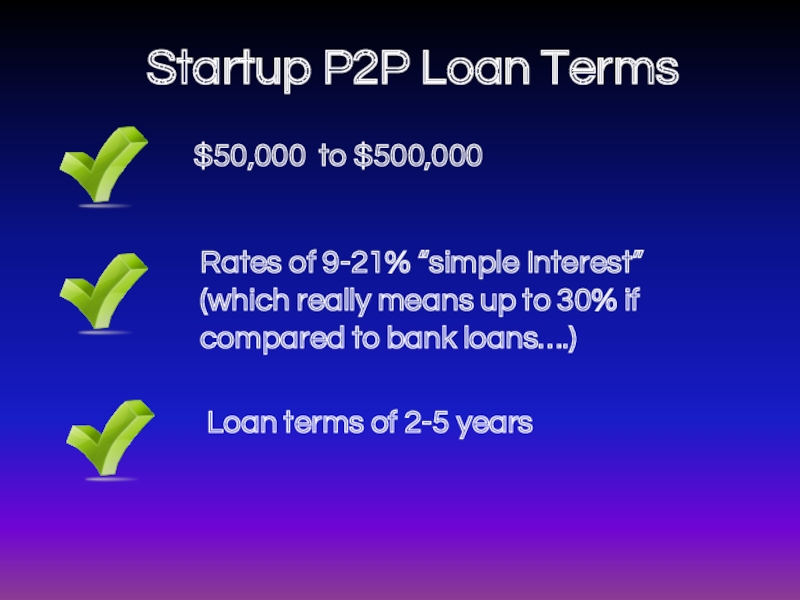

- 21. Startup P2P Loan Terms $50,000 to $500,000

- 22. Pros and Cons of P2P For Startups

- 23. Photo by RyanP77 - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/20723636@N03 Created with Haiku Deck

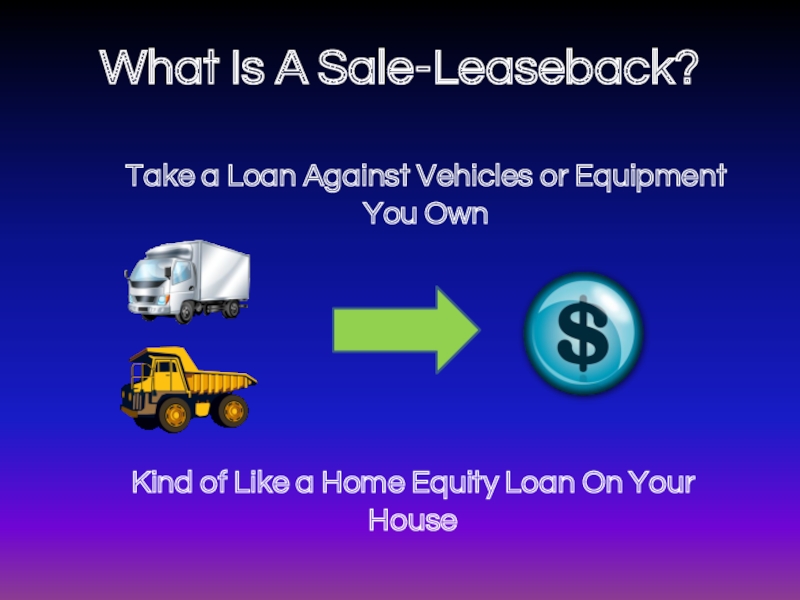

- 24. What Is A Sale-Leaseback? Kind of Like

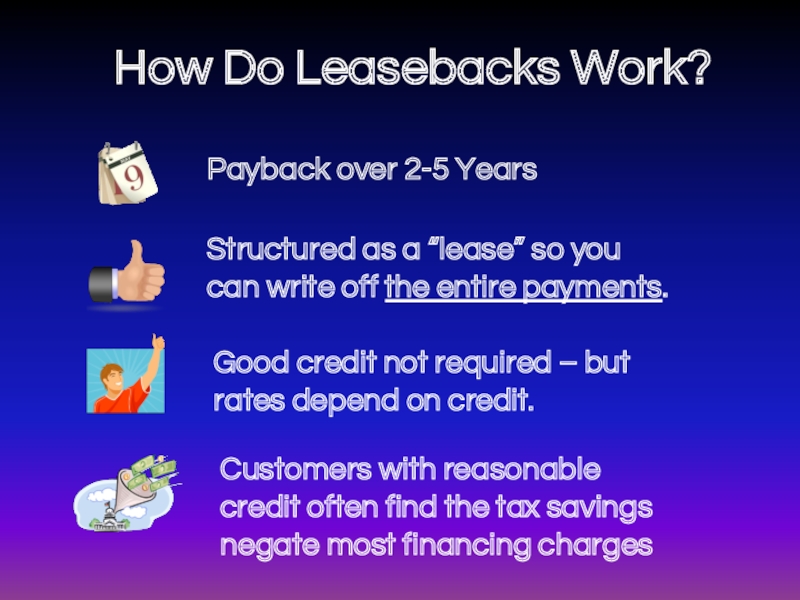

- 25. How Do Leasebacks Work? Payback over 2-5

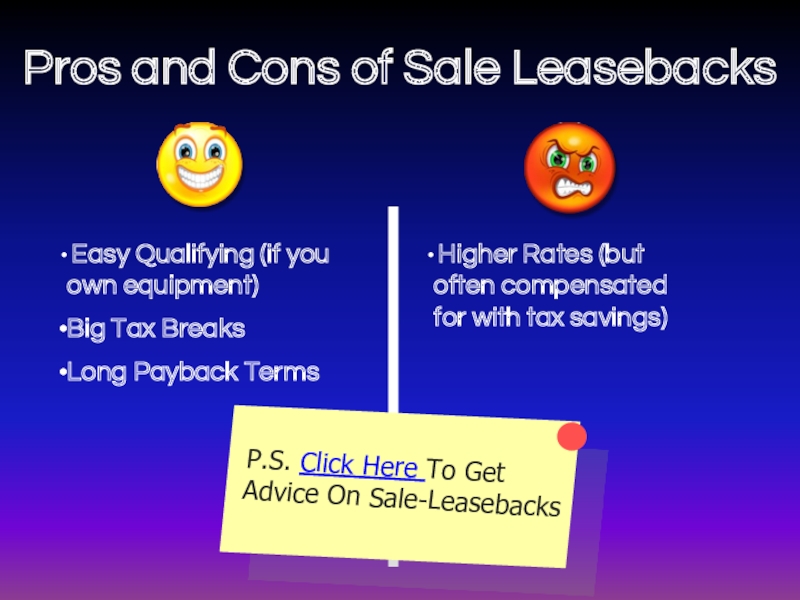

- 26. Pros and Cons of Sale Leasebacks

- 27. Photo by Minneapolis Institute of Arts -

- 28. Problems With Borrowing From Friends and Family?

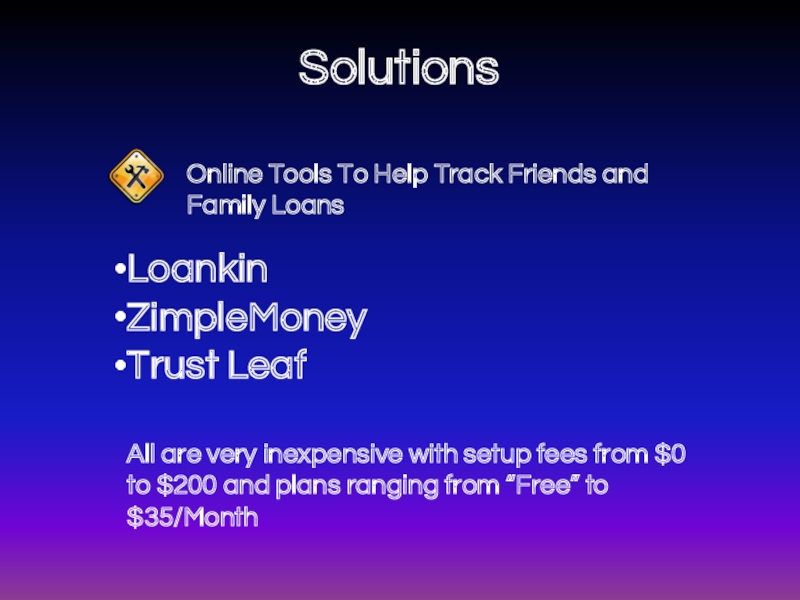

- 29. Solutions Online Tools To Help Track Friends

- 30. Photo by Pure Metal Cards - Creative

- 31. Why Not Just Fund Your Business With

- 32. - But - Don’t max out

- 33. Photo by Doha Sam - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/46575101@N00 Created with Haiku Deck

- 34. Pros and Cons of Equipment Leasing

- 35. Photo by kenteegardin - Creative Commons Attribution-ShareAlike License https://www.flickr.com/photos/26373139@N08 Created with Haiku Deck

- 36. Should You Borrow From Your 401(K)? Your

- 37. Photo by danielmoyle - Creative Commons Attribution License https://www.flickr.com/photos/56844027@N05 Created with Haiku Deck

- 38. You Can Borrow From Life Insurance? You

- 39. Photo by camies - Creative Commons Attribution-NonCommercial License https://www.flickr.com/photos/16156673@N00 Created with Haiku Deck

- 40. Hard Money? What Is That? If You

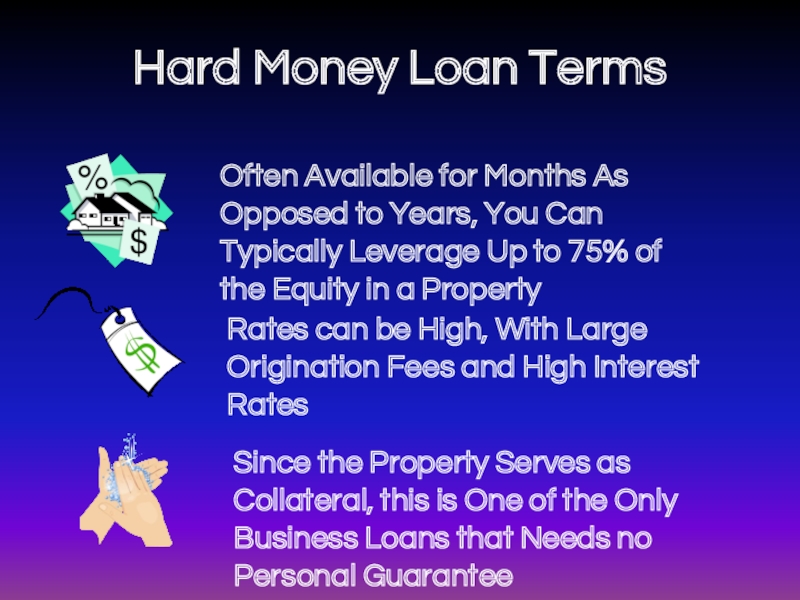

- 41. Hard Money Loan Terms Often Available for

- 42. Photo by Amir Kuckovic - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/12389767@N04 Created with Haiku Deck

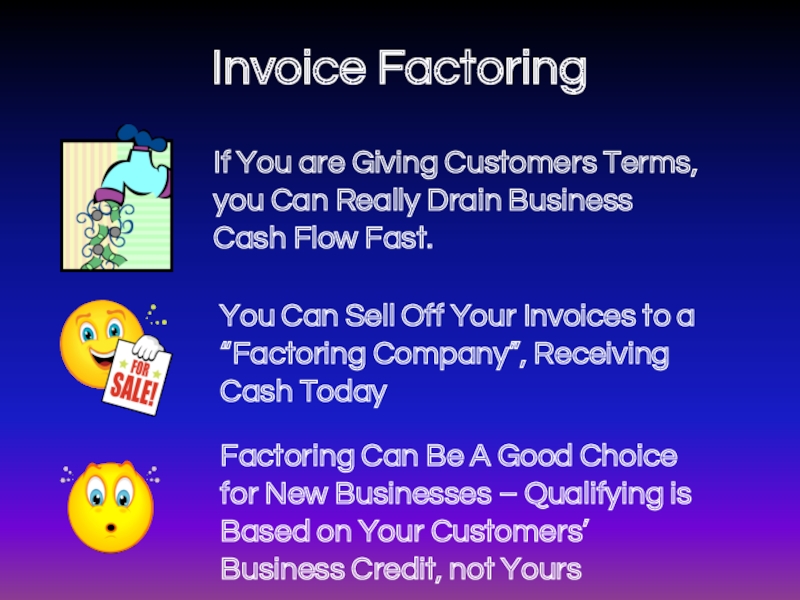

- 43. Invoice Factoring If You are Giving Customers

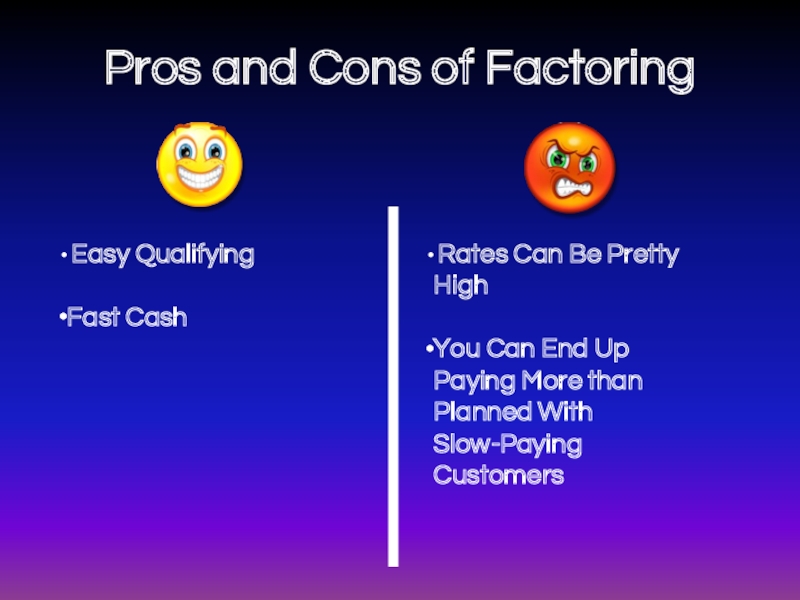

- 44. Pros and Cons of Factoring Easy

- 45. Photo by tsuna72 - Creative Commons Attribution License https://www.flickr.com/photos/60132504@N08 Created with Haiku Deck

- 46. Purchase Order Financing Very Similar To Factoring,

- 47. Photo by theqspeaks - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/83261600@N00 Created with Haiku Deck

- 48. Crowdfunding? A Relatively New Concept –

- 49. Bonus: For More In Depth Information,

Слайд 1Photo by Amyn Kassam - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/27482923@N03

Created with

Слайд 3Photo by Werner Kunz - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/35375520@N07

Created with

Слайд 5Loan Terms

Up to $5 million, Average Loan Size is $337,750

10% Down

Up to 7 years for Working Capital, 10 Years for Equipment, 25 For Real Estate

Слайд 6Pros and Cons of SBA 7(A)

Low Interest Rates:6-7% as of

Long Payback Periods

Less than 15% approval rate

This Loan Can Take Several Months to get

Слайд 7Photo by Pete Zarria - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/98019953@N00

Created with

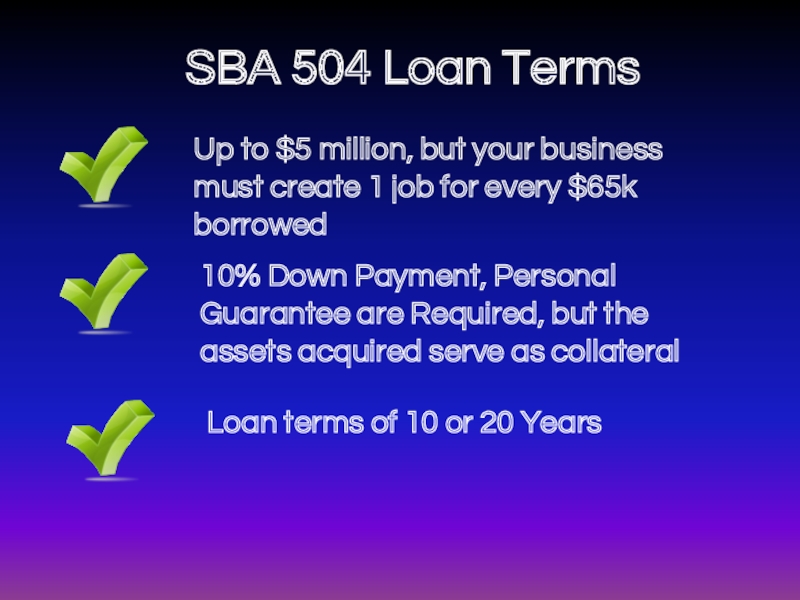

Слайд 9SBA 504 Loan Terms

Up to $5 million, but your business must

10% Down Payment, Personal Guarantee are Required, but the assets acquired serve as collateral

Loan terms of 10 or 20 Years

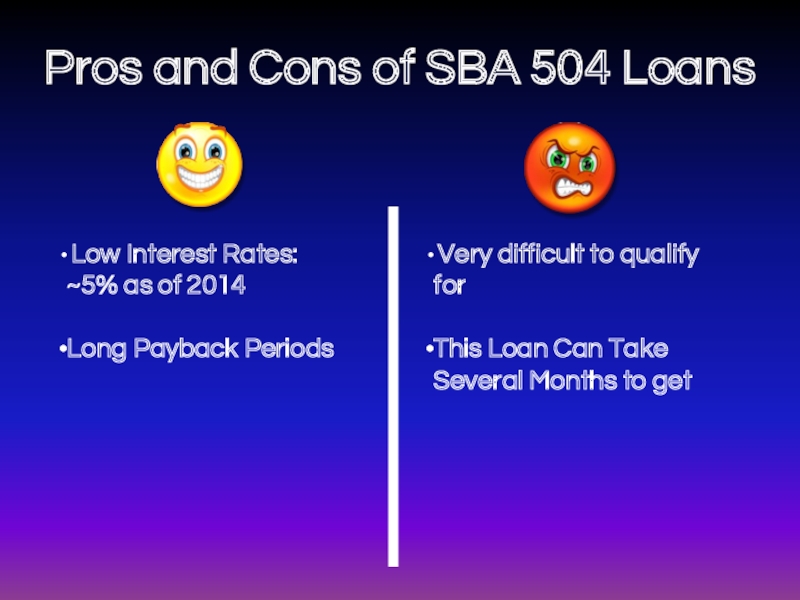

Слайд 10Pros and Cons of SBA 504 Loans

Low Interest Rates: ~5%

Long Payback Periods

Very difficult to qualify for

This Loan Can Take Several Months to get

Слайд 11Photo by alphatrek - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/66825505@N00

Created with Haiku

Слайд 13SBA Microloan Terms

Up to $50,000 with average loan amounts around $13,000

Personal

Loan terms of up to 6 Years

Слайд 14Pros and Cons of SBA Microloans

Reasonable interest rates from 8-13%

Payback

You have to take classes first and submit a business plan

This Loan Can Take Several Months to get

Слайд 15Photo by AZso - Creative Commons Attribution-NonCommercial License https://www.flickr.com/photos/15887936@N00

Created with Haiku

Слайд 16Shelf Corporations

A sometimes used trick for startup owners with great credit

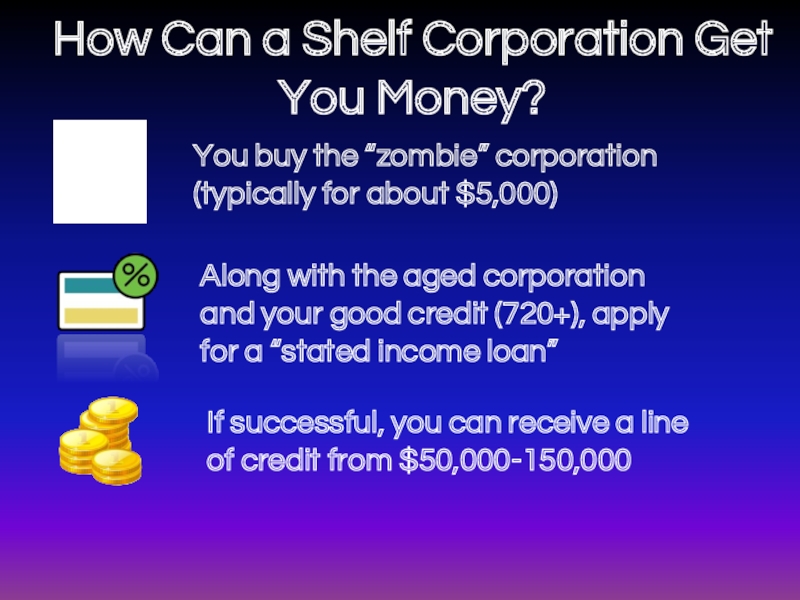

Слайд 17How Can a Shelf Corporation Get You Money?

You buy the “zombie”

Along with the aged corporation and your good credit (720+), apply for a “stated income loan”

If successful, you can receive a line of credit from $50,000-150,000

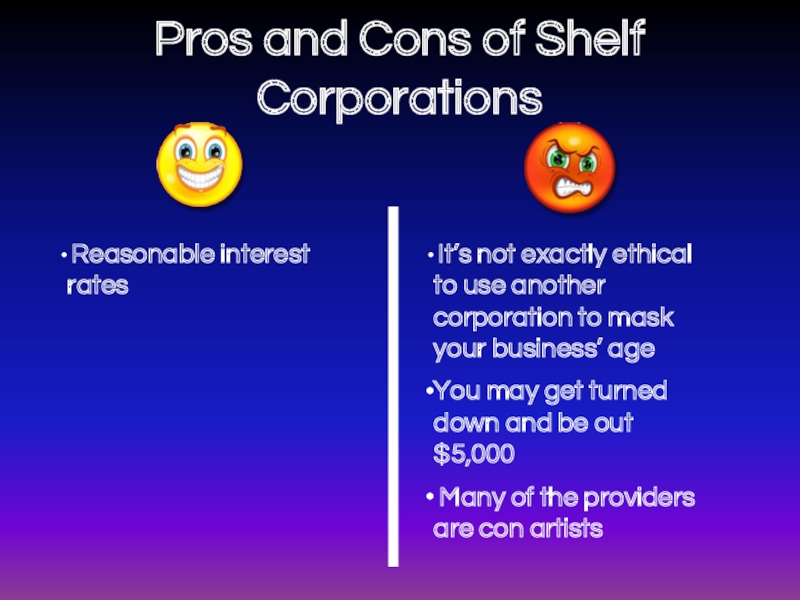

Слайд 18Pros and Cons of Shelf Corporations

Reasonable interest rates

It’s not

You may get turned down and be out $5,000

Many of the providers are con artists

Слайд 19Photo by enriqueburgosgarcia - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/36001761@N02

Created with Haiku

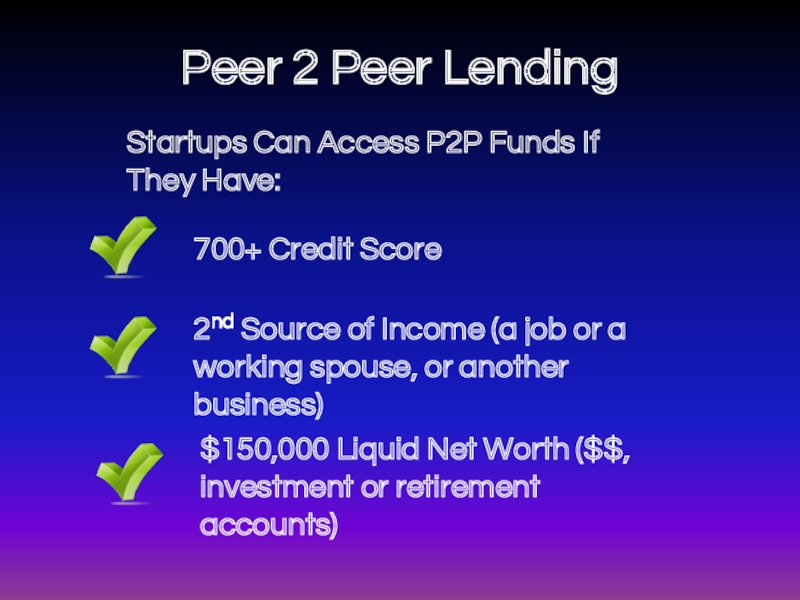

Слайд 20Peer 2 Peer Lending

Startups Can Access P2P Funds If They Have:

700+

2nd Source of Income (a job or a working spouse, or another business)

$150,000 Liquid Net Worth ($$, investment or retirement accounts)

Слайд 21Startup P2P Loan Terms

$50,000 to $500,000

Rates of 9-21% “simple Interest” (which

Loan terms of 2-5 years

Слайд 23Photo by RyanP77 - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/20723636@N03

Created with Haiku

Слайд 24What Is A Sale-Leaseback?

Kind of Like a Home Equity Loan On

Take a Loan Against Vehicles or Equipment You Own

Слайд 25How Do Leasebacks Work?

Payback over 2-5 Years

Structured as a “lease” so

Good credit not required – but rates depend on credit.

Customers with reasonable credit often find the tax savings negate most financing charges

Слайд 26Pros and Cons of Sale Leasebacks

Easy Qualifying (if you own

Big Tax Breaks

Long Payback Terms

Higher Rates (but often compensated for with tax savings)

Слайд 27Photo by Minneapolis Institute of Arts - Creative Commons Attribution-NonCommercial-ShareAlike License

Created with Haiku Deck

Слайд 28Problems With Borrowing From Friends and Family?

It’s easy to screw up

You may not know how to amortize a loan properly

This could cost you relationships!

Слайд 29Solutions

Online Tools To Help Track Friends and Family Loans

Loankin

ZimpleMoney

Trust Leaf

All are very inexpensive with setup fees from $0 to $200 and plans ranging from “Free” to $35/Month

Слайд 30Photo by Pure Metal Cards - Creative Commons Attribution-NonCommercial License https://www.flickr.com/photos/65778504@N03

Created

Слайд 31Why Not Just Fund Your Business With Plastic?

If You Have Large

Have Multiple Cards? Do the Credit Card Shuffle, and Get Zero Percent Financing (You’ll pay 4% each time)

Слайд 32 - But -

Don’t max out your cards – this will

You may be warned against this – people that don’t understand finance might think it’s risky

(Let’s be serious, anyone lending money to a startup is going to ask for a personal guarantee, so how would using your credit cards be more risky than anything else?)

Слайд 33Photo by Doha Sam - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/46575101@N00

Created with

Слайд 34Pros and Cons of Equipment Leasing

Easier to Get Than Most

Big Tax Breaks

Long Payback Terms

Higher Rates (but often compensated for with tax savings)

Слайд 35Photo by kenteegardin - Creative Commons Attribution-ShareAlike License https://www.flickr.com/photos/26373139@N08

Created with Haiku

Слайд 36Should You Borrow From Your 401(K)?

Your Financial Advisor Would Advise Against

The One Good Thing is You are Paying Interest to Yourself

If You (or Your Spouse) Leaves the Employer at Which the Funds are Held, the Loan will be Due in 60 Days.

Слайд 37Photo by danielmoyle - Creative Commons Attribution License https://www.flickr.com/photos/56844027@N05

Created with Haiku

Слайд 38You Can Borrow From Life Insurance?

You can Typically Borrow up to

NEVER do this Without Talking to Your Accountant First. Taxation Rules on this Can be Tricky.

Слайд 39Photo by camies - Creative Commons Attribution-NonCommercial License https://www.flickr.com/photos/16156673@N00

Created with Haiku

Слайд 40Hard Money? What Is That?

If You own Real Estate (other than

Hard Money is Often Referred to as a Type of “Bridge Financing” as it is Best as a Shorter-Term Funding Option

Слайд 41Hard Money Loan Terms

Often Available for Months As Opposed to Years,

Rates can be High, With Large Origination Fees and High Interest Rates

Since the Property Serves as Collateral, this is One of the Only Business Loans that Needs no Personal Guarantee

Слайд 42Photo by Amir Kuckovic - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/12389767@N04

Created with

Слайд 43Invoice Factoring

If You are Giving Customers Terms, you Can Really Drain

You Can Sell Off Your Invoices to a “Factoring Company”, Receiving Cash Today

Factoring Can Be A Good Choice for New Businesses – Qualifying is Based on Your Customers’ Business Credit, not Yours

Слайд 44Pros and Cons of Factoring

Easy Qualifying

Fast Cash

Rates Can Be

You Can End Up Paying More than Planned With Slow-Paying Customers

Слайд 45Photo by tsuna72 - Creative Commons Attribution License https://www.flickr.com/photos/60132504@N08

Created with Haiku

Слайд 46Purchase Order Financing

Very Similar To Factoring, Rates Can Be Expensive, but

If You Have Orders to Fulfill, but Not the Capital To Buy Materials, You Can Finance Against Purchase Orders

Слайд 47Photo by theqspeaks - Creative Commons Attribution-NonCommercial-ShareAlike License https://www.flickr.com/photos/83261600@N00

Created with Haiku

Слайд 48Crowdfunding?

A Relatively New Concept – Startups Have Recently Been Turning

Kickstarter.com has been a popular platform, with several startups finding hundreds of thousand (or even millions) of dollars in seed funding.

Слайд 49

Bonus: For More In Depth Information, Including 3 Startup Funding Strategies

Click Here