- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Forms of business. Ownership презентация

Содержание

- 1. Forms of business. Ownership

- 2. Introduction A business is always owned

- 3. Key Learning Points What are

- 4. Main types of business organisation

- 5. Sole Trader A sole trader is a

- 6. Examples of sole traders Small shops Small

- 7. Advantages of a Sole Trader Cheap and

- 8. Disadvantages of a Sole Trader Unlimited

- 9. Partnership Business where there are two or

- 10. Advantages of a Partnership Spreads

- 11. Disadvantages of a Partnership Have

- 12. Limited Company Business owned

- 13. Private Limited Company (Ltd.) A private limited

- 14. Advantages of a Private Limited Company Shareholders

- 15. Disadvantages of a Private Limited Company

- 16. Public Limited Company (Plc) Business owned by

- 17. Advantages of a Public Limited Company The

- 18. Disadvantages of a Public Limited Company Costly

Слайд 2

Introduction

A business is always owned by someone. This can just be

one person, or thousands. So a business can have a number of different types of ownership depending on the aims and objectives of the owners.

Most businesses aim to make profit for their owners. Profits may not be the major objective, but in order to survive a business will need make a profit in the long term.

Some organisations however will be ‘not-for-profit’, such as charities or government-run corporations.

Most businesses aim to make profit for their owners. Profits may not be the major objective, but in order to survive a business will need make a profit in the long term.

Some organisations however will be ‘not-for-profit’, such as charities or government-run corporations.

Слайд 3

Key Learning Points

What are the different types of business organisation?

What are

the advantages and disadvantages of each type?

What are the implications of the choice of business organisation on key issues such as:

Ability to raise finance

Control of the business

Business aims and objectives

What are the implications of the choice of business organisation on key issues such as:

Ability to raise finance

Control of the business

Business aims and objectives

Слайд 4

Main types of business organisation

Sole trader

Partnership

Private Limited Company (“Ltd”)

Public Limited Company

(“plc”)

Слайд 5Sole Trader

A sole trader is a business owned by one person

The

owner makes all the decisions about how the business is run

The owner keeps all the profit, but also suffers all the losses of the business

The owner keeps all the profit, but also suffers all the losses of the business

Слайд 7Advantages of a Sole Trader

Cheap and easy to set up

Keep

all the profits

Make all the decisions

Personal contact with customers

Make all the decisions

Personal contact with customers

Слайд 8Disadvantages of a

Sole Trader

Unlimited liability (this means that the owner

is responsible for all of the debts of the business)

Lack of capital can prevent expansion

Suffer all losses yourself

Business ends when the owner dies

Lack of capital can prevent expansion

Suffer all losses yourself

Business ends when the owner dies

Слайд 9Partnership

Business where there are two or more owners of the enterprise

Most

partnerships have between two and twenty members though there are examples like the major accountancy firms where there are hundreds of partners

Слайд 10

Advantages of a Partnership

Spreads the risk across more people, so if

the business gets into difficulty then the are more people to share the burden of debt

Partner may bring money and resources to the business

Partner may bring other skills and ideas to the business, complementing the work already done by the original partner

Partner may bring money and resources to the business

Partner may bring other skills and ideas to the business, complementing the work already done by the original partner

Слайд 11

Disadvantages of a Partnership

Have to share profits

Less control of business for

individual

Disputes over workload

Problems if partners disagree over of direction of business

Disputes over workload

Problems if partners disagree over of direction of business

Слайд 12

Limited Company

Business owned by shareholders

Run by directors (who may also be

shareholders)

Liability is limited (important)

Liability is limited (important)

Слайд 13Private Limited Company (Ltd.)

A private limited company is where between one

and ninety nine people come together and form a business

The owners are called shareholders and they invest money in the company

The profit is divided up among the shareholders and distributed in the form of dividends

“Ltd.” is written after the name of the company

The annual accounts are sent to the Registrar of Companies - they are not published

The owners are called shareholders and they invest money in the company

The profit is divided up among the shareholders and distributed in the form of dividends

“Ltd.” is written after the name of the company

The annual accounts are sent to the Registrar of Companies - they are not published

Слайд 14Advantages of a Private Limited Company

Shareholders have limited liability: If the

business fails you can only lose the money that you invested in the company. Your own personal wealth cannot be touched.

Easier to raise finance

Business continues to exist even when an owner dies

Easier to raise finance

Business continues to exist even when an owner dies

Слайд 15Disadvantages of a Private Limited Company

Costly to set up

A lot

of legal requirements when forming a company

Shares cannot be transferred to the general public

Shares cannot be transferred to the general public

Слайд 16Public Limited Company (Plc)

Business owned by shareholders

Run by directors (who may

also be shareholders)

Liability is limited

Liability is limited

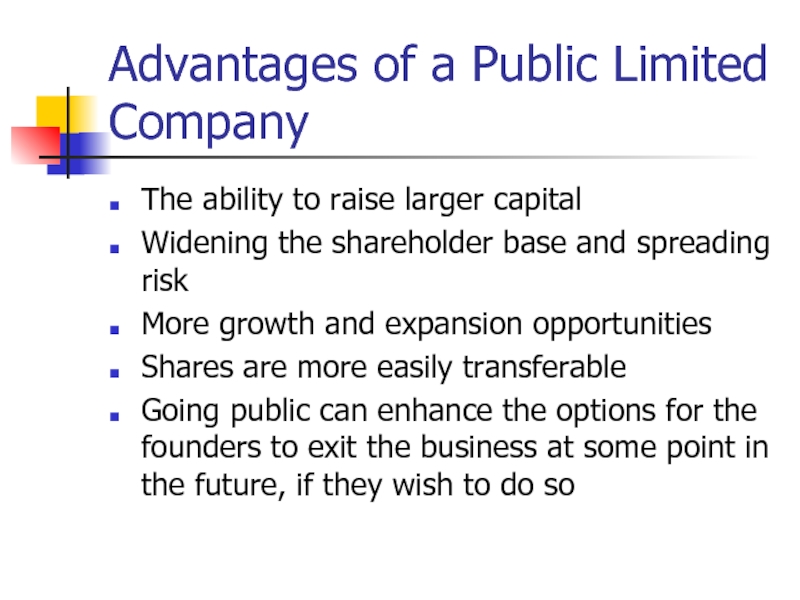

Слайд 17Advantages of a Public Limited Company

The ability to raise larger capital

Widening

the shareholder base and spreading risk

More growth and expansion opportunities

Shares are more easily transferable

Going public can enhance the options for the founders to exit the business at some point in the future, if they wish to do so

More growth and expansion opportunities

Shares are more easily transferable

Going public can enhance the options for the founders to exit the business at some point in the future, if they wish to do so

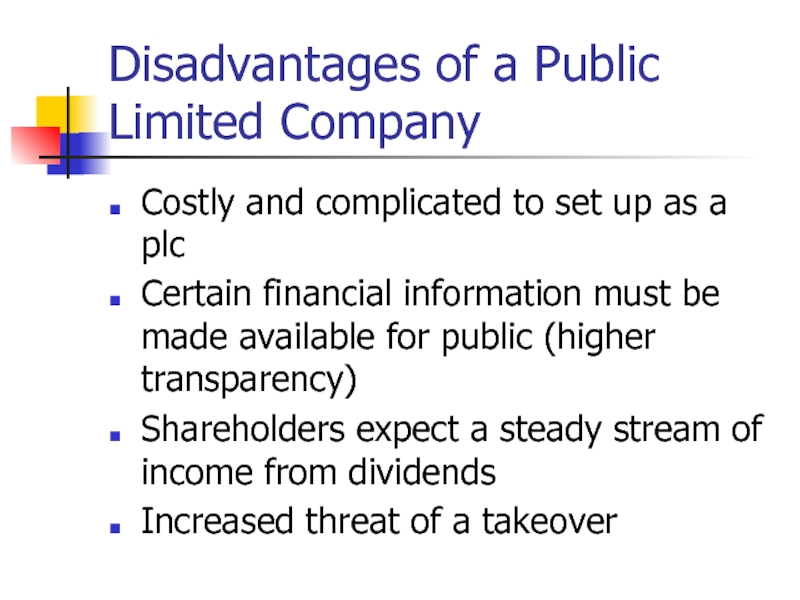

Слайд 18Disadvantages of a Public Limited Company

Costly and complicated to set up

as a plc

Certain financial information must be made available for public (higher transparency)

Shareholders expect a steady stream of income from dividends

Increased threat of a takeover

Certain financial information must be made available for public (higher transparency)

Shareholders expect a steady stream of income from dividends

Increased threat of a takeover