- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

ALTERNATIVES TO AN IPO презентация

Содержание

- 2. Is going public right for your company?

- 3. Is going public right for your company?

- 4. Get the full report Is going

- 5. There may be a better way.

- 6. Alternatives to an IPO

- 7. Alternatives to an IPO

- 8. Alternatives to an IPO

- 9. Alternatives to an IPO

- 10. Is going public right for your company?

- 11. Grant Thornton International Ltd is one of

Слайд 2Is going public

right for your company?

Maybe.

Going public can be a defining

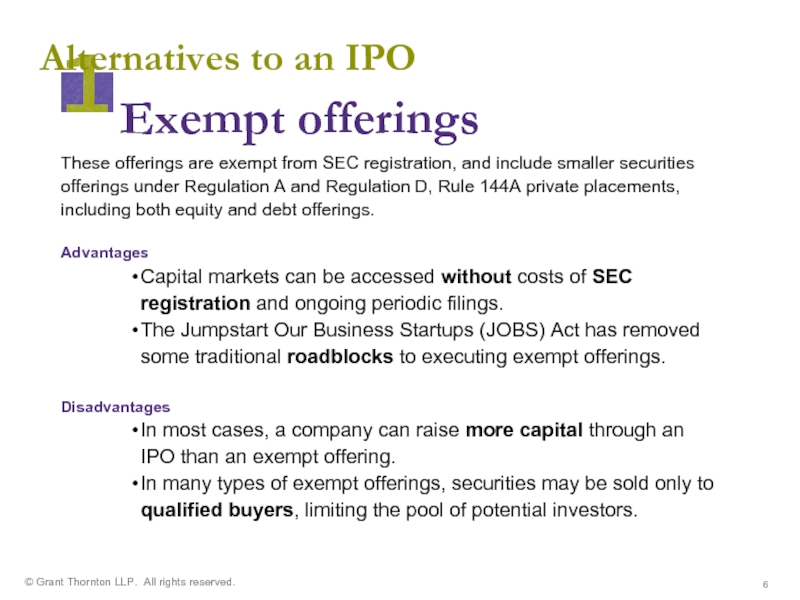

Слайд 6Alternatives to an IPO

These offerings are exempt from SEC registration, and include smaller securities offerings under Regulation A and Regulation D, Rule 144A private placements, including both equity and debt offerings.

Advantages

Capital markets can be accessed without costs of SEC registration and ongoing periodic filings.

The Jumpstart Our Business Startups (JOBS) Act has removed some traditional roadblocks to executing exempt offerings.

Disadvantages

In most cases, a company can raise more capital through an IPO than an exempt offering.

In many types of exempt offerings, securities may be sold only to qualified buyers, limiting the pool of potential investors.

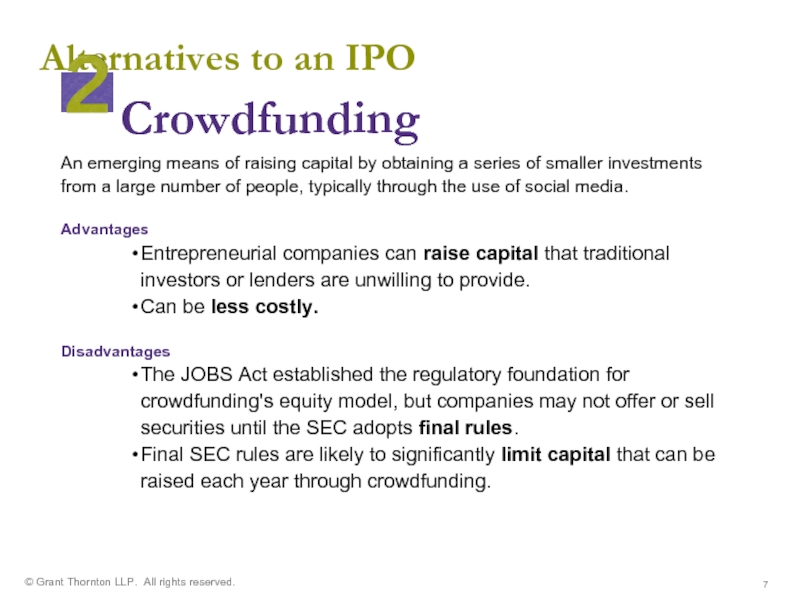

Слайд 7Alternatives to an IPO

An emerging means of raising capital by obtaining a series of smaller investments from a large number of people, typically through the use of social media.

Advantages

Entrepreneurial companies can raise capital that traditional investors or lenders are unwilling to provide.

Can be less costly.

Disadvantages

The JOBS Act established the regulatory foundation for crowdfunding's equity model, but companies may not offer or sell securities until the SEC adopts final rules.

Final SEC rules are likely to significantly limit capital that can be raised each year through crowdfunding.

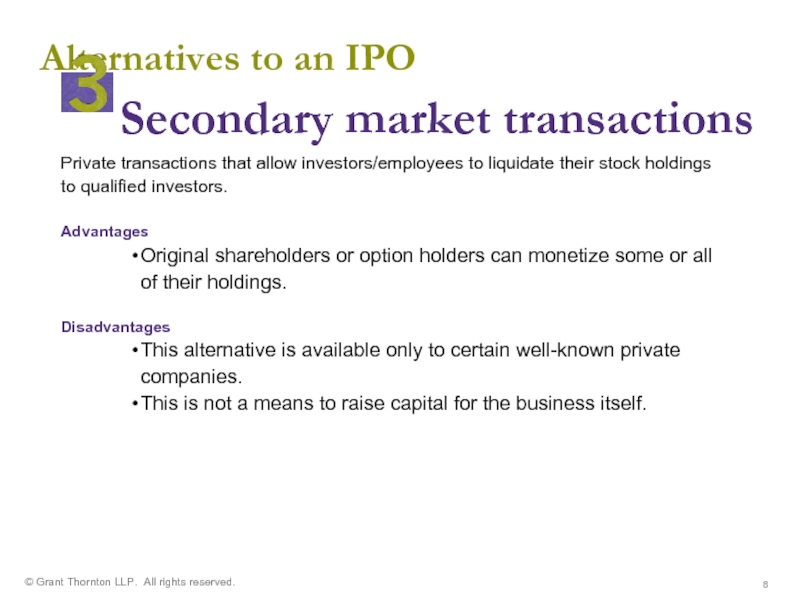

Слайд 8Alternatives to an IPO

Private transactions that allow investors/employees to liquidate their stock holdings to qualified investors.

Advantages

Original shareholders or option holders can monetize some or all of their holdings.

Disadvantages

This alternative is available only to certain well-known private companies.

This is not a means to raise capital for the business itself.

8

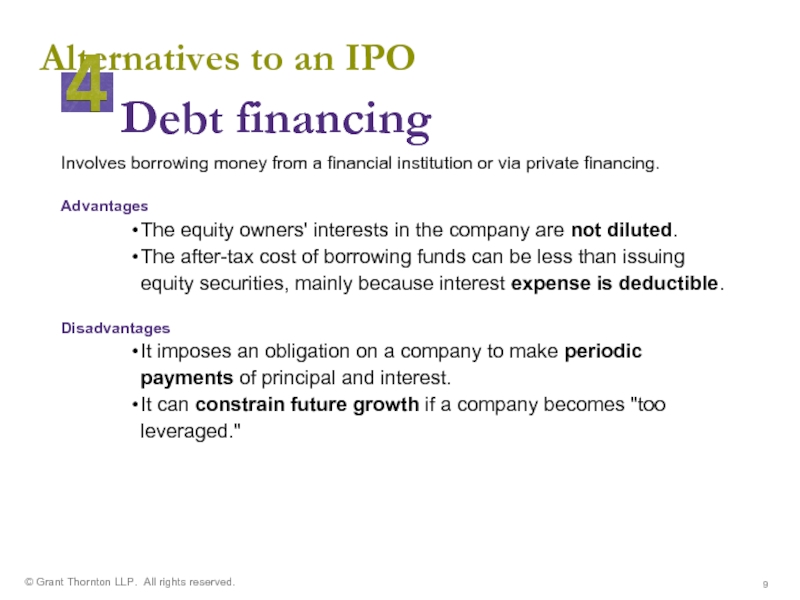

Слайд 9Alternatives to an IPO

Involves borrowing money from a financial institution or via private financing.

Advantages

The equity owners' interests in the company are not diluted.

The after-tax cost of borrowing funds can be less than issuing equity securities, mainly because interest expense is deductible.

Disadvantages

It imposes an obligation on a company to make periodic payments of principal and interest.

It can constrain future growth if a company becomes "too leveraged."

Слайд 10Is going public right for your company?

Every business must reach

Слайд 11Grant Thornton International Ltd is one of the world’s leading organizations

About us

Grant Thornton is one of the world’s leading organizations of independent audit, tax and advisory firms. These firms help dynamic organizations unlock their potential for growth by providing meaningful, forward-looking advice. Proactive teams, led by approachable partners in these firms, use insights, experience and instinct to understand complex issues faced by privately owned, publicly listed and public sector clients and help them to find solutions. Over 35,000 Grant Thornton people in more than 100 countries are focused on making a difference to clients, colleagues and the communities in which we live and work.

In the United States, visit Grant Thornton LLP at www.GrantThornton.com.