By Sean O’Reilly

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

5 Things You Need to Know About AB InBev's Acquisition of SABMiller презентация

Содержание

- 1. 5 Things You Need to Know About AB InBev's Acquisition of SABMiller

- 2. 1. $100 Billion Mergers Don’t Happen Everyday

- 3. 2. A Giant is Born Both companies

- 4. 2. A Giant is Born AB InBev

- 5. 3. Antitrust Concerns Acquisition likely to attract

- 6. 3. Antitrust Concerns U.S. Justice Department judges

- 7. 3. Antitrust Concerns Anticipating U.S. Justice

- 8. 4. Why Merge? Merger has considerable benefits,

- 9. 5. Likely Outcomes Preliminary sale of

- 10. The next billion-dollar iSecret The

Слайд 21. $100 Billion Mergers Don’t Happen Everyday

Proposed acquisition of SABMiller by

AB InBev comes with a hefty $107 billion price tag.

Would rank as 4th biggest acquisition of all time, just ahead of Pfizer’s $90 billion purchase of Warner-Lambert, if completed.

Combined entity would be the world’s largest brewer by multiples.

Would rank as 4th biggest acquisition of all time, just ahead of Pfizer’s $90 billion purchase of Warner-Lambert, if completed.

Combined entity would be the world’s largest brewer by multiples.

Слайд 32. A Giant is Born

Both companies are no strangers to huge

mergers:

AB InBev is the product of a succession of mergers, starting with Dutch brewer Interbrew’s 2004 acquisition of Brazilian AmBev

SABMiller was created when South African Breweries purchased Miller Brewing in 2002.

Even as separate entities, both are enormous enterprises

AB InBev is the product of a succession of mergers, starting with Dutch brewer Interbrew’s 2004 acquisition of Brazilian AmBev

SABMiller was created when South African Breweries purchased Miller Brewing in 2002.

Even as separate entities, both are enormous enterprises

Слайд 42. A Giant is Born

AB InBev is the world’s largest brewer

already, with over 200 brands and a presence in over 30 countries

Global market market share of approximately 21%

SABMiller is the world’s second largest brewer

Dominant in Africa and South America

Strong presence in U.S. through 58% ownership of MillerCoors

10% Global market share

Global market market share of approximately 21%

SABMiller is the world’s second largest brewer

Dominant in Africa and South America

Strong presence in U.S. through 58% ownership of MillerCoors

10% Global market share

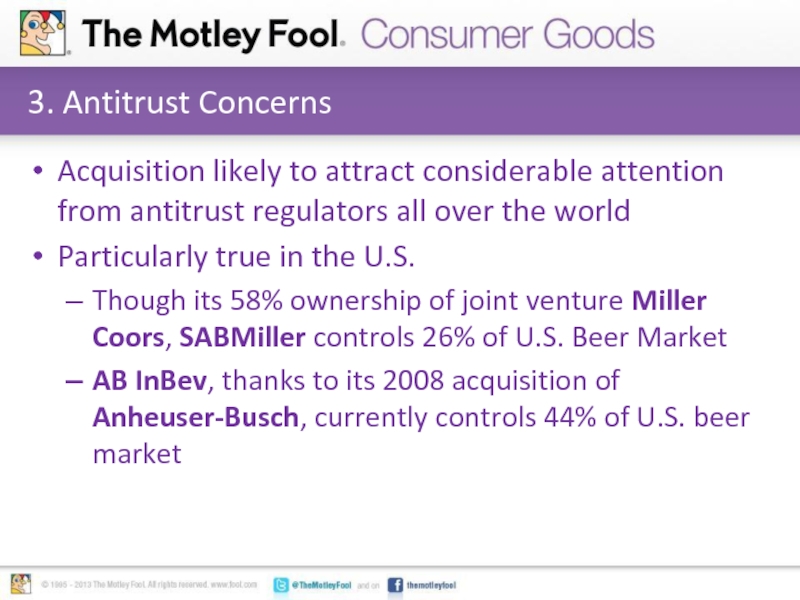

Слайд 53. Antitrust Concerns

Acquisition likely to attract considerable attention from antitrust regulators

all over the world

Particularly true in the U.S.

Though its 58% ownership of joint venture Miller Coors, SABMiller controls 26% of U.S. Beer Market

AB InBev, thanks to its 2008 acquisition of Anheuser-Busch, currently controls 44% of U.S. beer market

Particularly true in the U.S.

Though its 58% ownership of joint venture Miller Coors, SABMiller controls 26% of U.S. Beer Market

AB InBev, thanks to its 2008 acquisition of Anheuser-Busch, currently controls 44% of U.S. beer market

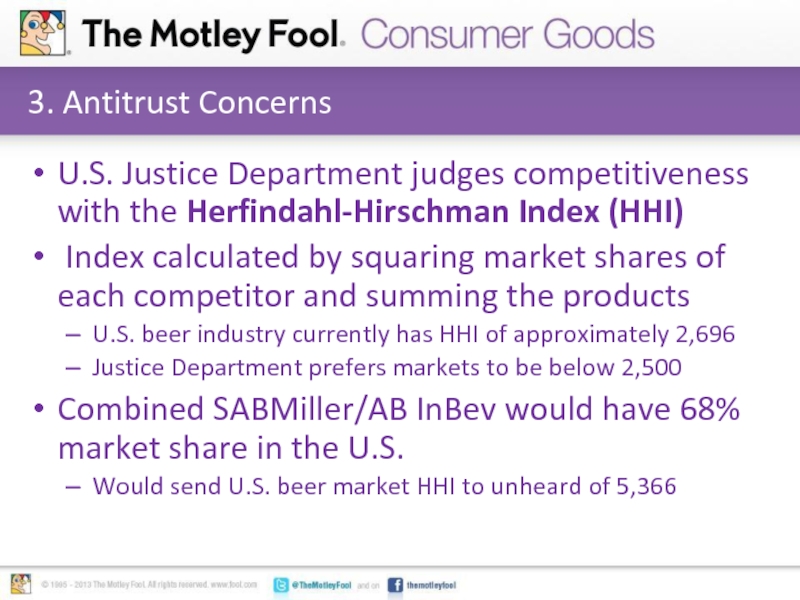

Слайд 63. Antitrust Concerns

U.S. Justice Department judges competitiveness with the Herfindahl-Hirschman Index

(HHI)

Index calculated by squaring market shares of each competitor and summing the products

U.S. beer industry currently has HHI of approximately 2,696

Justice Department prefers markets to be below 2,500

Combined SABMiller/AB InBev would have 68% market share in the U.S.

Would send U.S. beer market HHI to unheard of 5,366

Index calculated by squaring market shares of each competitor and summing the products

U.S. beer industry currently has HHI of approximately 2,696

Justice Department prefers markets to be below 2,500

Combined SABMiller/AB InBev would have 68% market share in the U.S.

Would send U.S. beer market HHI to unheard of 5,366

Слайд 73. Antitrust Concerns

Anticipating U.S. Justice Department objections of acquisition, company plans

to sell 58% stake in Miller Coors to Molson Coors Brewing for approximately $10 billion

Selling SABMiller’s entire U.S. operation points investors to real reason for this merger

Selling SABMiller’s entire U.S. operation points investors to real reason for this merger

Слайд 84. Why Merge?

Merger has considerable benefits, shifting focus of both companies

further towards emerging markets

AB InBev distributes beer in over 100 countires and has bottling operations in 25

Notable Markets: The United States, China, Brazil, Europe, and Mexico

SABMiller sells beer in over 80 countries

Dominant in Africa with strong South American and Asian presence

AB InBev distributes beer in over 100 countires and has bottling operations in 25

Notable Markets: The United States, China, Brazil, Europe, and Mexico

SABMiller sells beer in over 80 countries

Dominant in Africa with strong South American and Asian presence

Слайд 95. Likely Outcomes

Preliminary sale of 58% stake in Miller Coors to

Molson Coors recently announced

Eliminates major antitrust objections from U.S. Justice Department

Formal acquisition announced on November 11, 2015

Deal likely to pass with regulators due to lack of overlap in specific markets

Eliminates major antitrust objections from U.S. Justice Department

Formal acquisition announced on November 11, 2015

Deal likely to pass with regulators due to lack of overlap in specific markets

Слайд 10The next billion-dollar iSecret

The world's biggest tech company forgot to show

you something at its recent event, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early-in-the-know investors! To be one of them, just click here.