O’Reilly

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

5 Things Investors Need to Know About J.C. Penney's Turnaround презентация

Содержание

- 1. 5 Things Investors Need to Know About J.C. Penney's Turnaround

- 2. 1. J.C. Penney Got Itself Into Trouble

- 3. 1. J.C. Penney Got Itself Into Trouble

- 4. 2. Former CEO Came to the Rescue

- 5. 3. Gross Margins Have Bounced Back

- 6. 3. Gross Margins Have Bounced Back Cont.

- 7. 4. Customers Are Slowly Coming Back Same-store

- 8. 5. Full Recovery Is Years Away Despite

- 9. 5. Full Recovery Is Years Away Cont.

- 10. Foolish bottom line Thanks to the return

Слайд 21. J.C. Penney Got Itself Into Trouble

Trouble began in 2011 when

Ron Johnson, creator of the Apple Store, was brought in as CEO to revamp the brand by activist investor Bill Ackman

Hiring Johnson was an attempt to bring the 100 year-old department store into the 21st century

However, rebranding efforts alienated customers

Hiring Johnson was an attempt to bring the 100 year-old department store into the 21st century

However, rebranding efforts alienated customers

Слайд 31. J.C. Penney Got Itself Into Trouble Cont.

Revenue fell 33.2% to

$11.86 billion from FY 2011 through FY 2014

Profits over this period swung from $389 million to ($1.4) billion

Situation became so desperate that the company had to raise capital via a share offering in October 2013

Profits over this period swung from $389 million to ($1.4) billion

Situation became so desperate that the company had to raise capital via a share offering in October 2013

Слайд 42. Former CEO Came to the Rescue

In April 2013, Myron “Mike”

Ullman, Ron Johnson’s predecessor, came out of retirement and took the helm

Whereas Johnson sought to change the retailer’s DNA, Ullman focused on the basics

Over 90 store closures were announced

Eliminated practically all of Johnson’s initiatives

Whereas Johnson sought to change the retailer’s DNA, Ullman focused on the basics

Over 90 store closures were announced

Eliminated practically all of Johnson’s initiatives

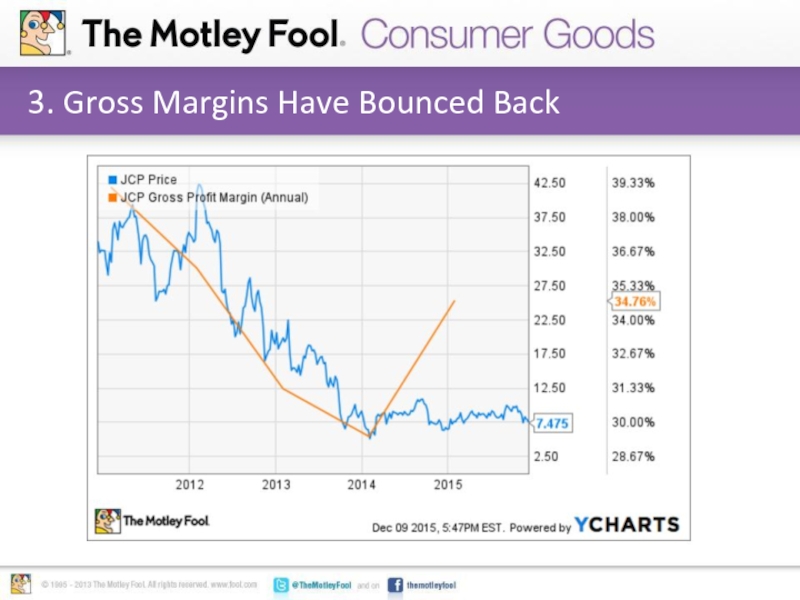

Слайд 63. Gross Margins Have Bounced Back Cont.

Gross margins bottomed out in

the quarter ended February 2, 2014 at 23.8%

Largely the result of inventory markdowns on merchandise accumulated during Johnsons’ tenure

Highest gross margins generated by JCP were in FY 2010 at 39.4%

This is important, because JCP is attracting customers back without drastic markdowns

Largely the result of inventory markdowns on merchandise accumulated during Johnsons’ tenure

Highest gross margins generated by JCP were in FY 2010 at 39.4%

This is important, because JCP is attracting customers back without drastic markdowns

Слайд 74. Customers Are Slowly Coming Back

Same-store sales growth in current fiscal

year has been robust

Q1 growth of 7.4%

Q2 growth of 6.0%

Q3 growth of 6.4%

Company expects to be free cash flow neutral this year

Q1 growth of 7.4%

Q2 growth of 6.0%

Q3 growth of 6.4%

Company expects to be free cash flow neutral this year

Слайд 85. Full Recovery Is Years Away

Despite performance this year, JCP isn’t

out of the woods yet

Sales are still well below their peak:

Sales are still well below their peak:

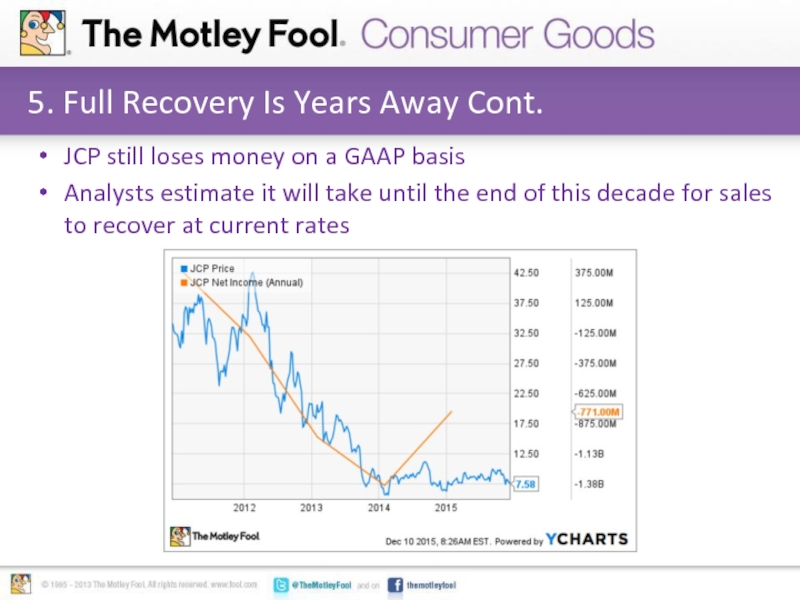

Слайд 95. Full Recovery Is Years Away Cont.

JCP still loses money on

a GAAP basis

Analysts estimate it will take until the end of this decade for sales to recover at current rates

Analysts estimate it will take until the end of this decade for sales to recover at current rates

Слайд 10Foolish bottom line

Thanks to the return of CEO Myron “Mike” Ullman,

J.C. Penney has managed to stop the hemorrhaging

JCP expects to be free cash flow neutral in current fiscal year

Company generating strong same-store sales growth

Full recovery, if it happens, will take at least another three to four years

JCP expects to be free cash flow neutral in current fiscal year

Company generating strong same-store sales growth

Full recovery, if it happens, will take at least another three to four years