- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Raising Funds from Silicon Valley презентация

Содержание

- 1. Raising Funds from Silicon Valley

- 2. Advantages for Polish Startups

- 3. Why Me? 14+ Years of Top-Notch Experience

- 4. Why Me?

- 5. Why Me?

- 6. Why Me?

- 7. Why Me?

- 8. Average investor spends 3m:44s on a

- 9. Recommended Deck Ordering

- 10. How long does it take; Seed

- 11. Darwinian Survival of Fundraising

- 12. In a great market — a

- 13. Retention is the single most important

- 14. Scale – $1Bn+ market cap potential

- 15. One of the most common types

- 16. Pricing before product – plan distribution

- 17. Startup probabilities of success where cofounders

- 18. Globalization means copying things that work… There

- 19. When you are starting a startup

- 20. If you’re going

- 21. Passion versus Pain

- 22. How to Pick Investors?

- 23. How to Pick

- 24. HOW DOES A POLISH COMPANY RAISE

- 25. Team Leadership skills, operating knowhow and

- 26. Look at their portfolio list …

- 27. Never been easier to start a

- 28. What about the Silicon Valley funding

- 29. It’s become 2x more expensive to

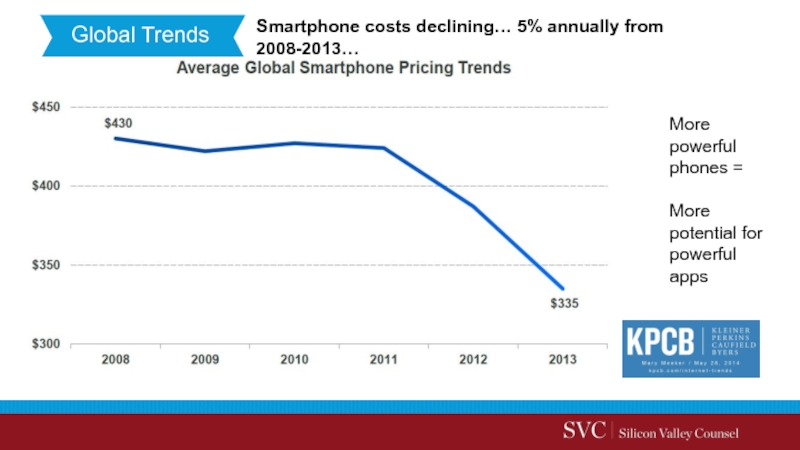

- 30. More powerful phones =

- 31. Global Trends Bandwidth

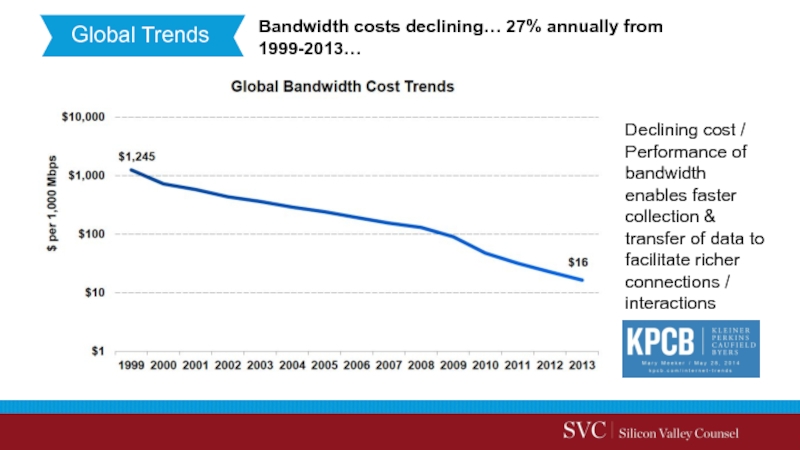

- 32. Global Trends Compute

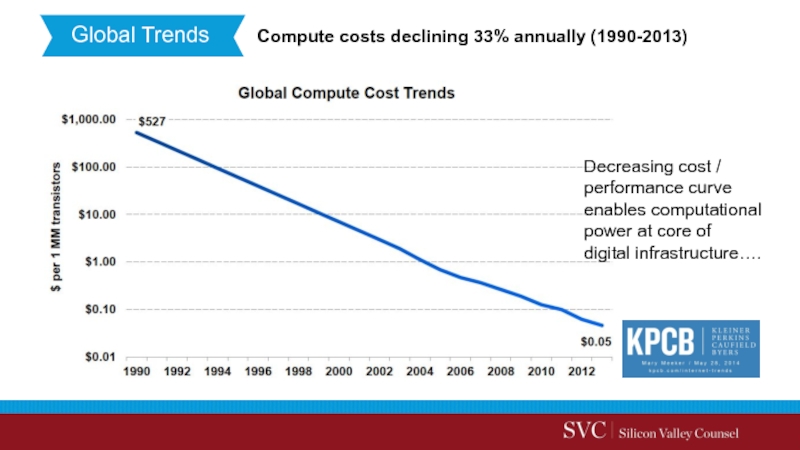

- 33. Each new computing cycle typically generates

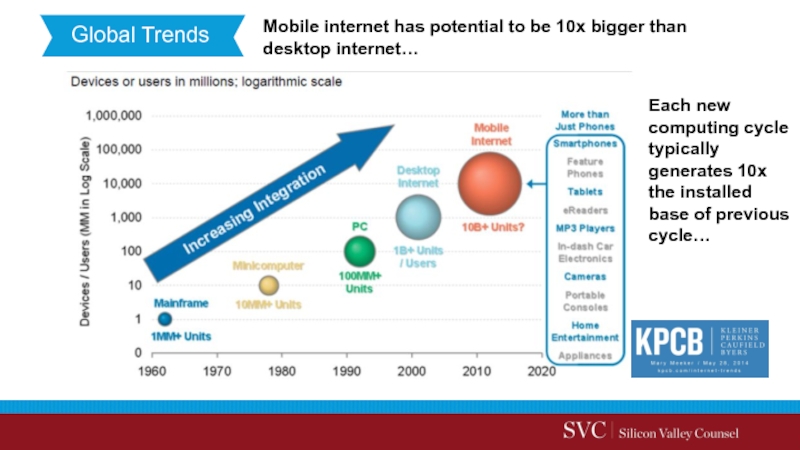

- 34. Global Trends

- 35. Global Trends

- 36. Global Trends

- 37. Global Trends

- 38. Global Trends

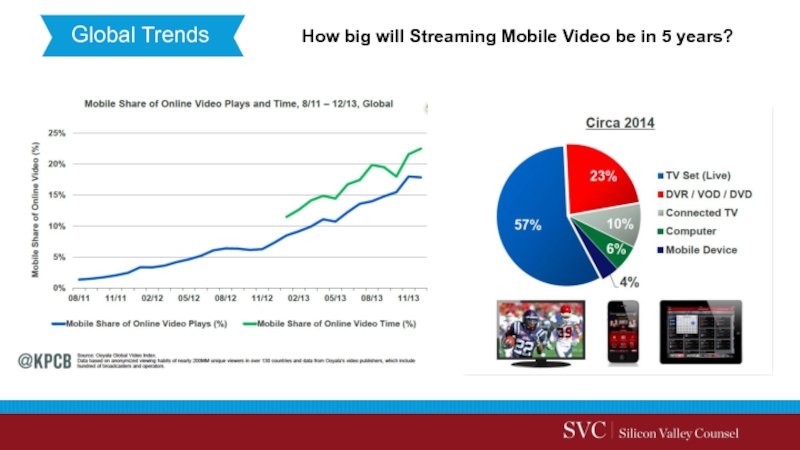

- 39. How big will Streaming Mobile Video

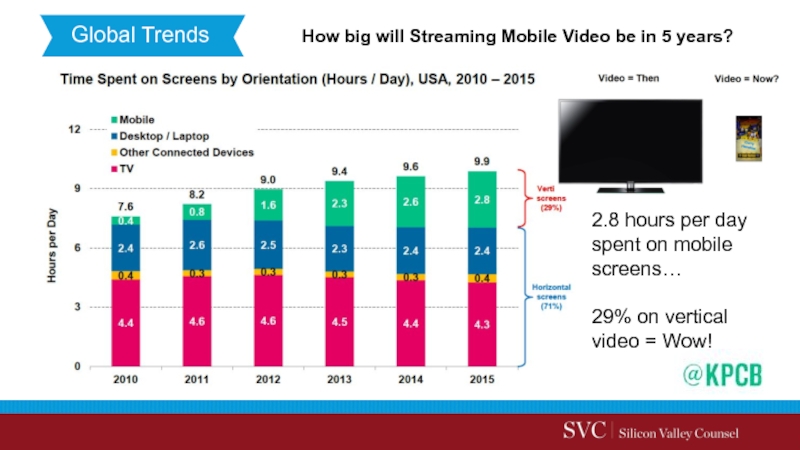

- 40. How big will Streaming Mobile Video

- 41. Global Trends Cloud Technology/Apps Challenging Physical Products Pain Points

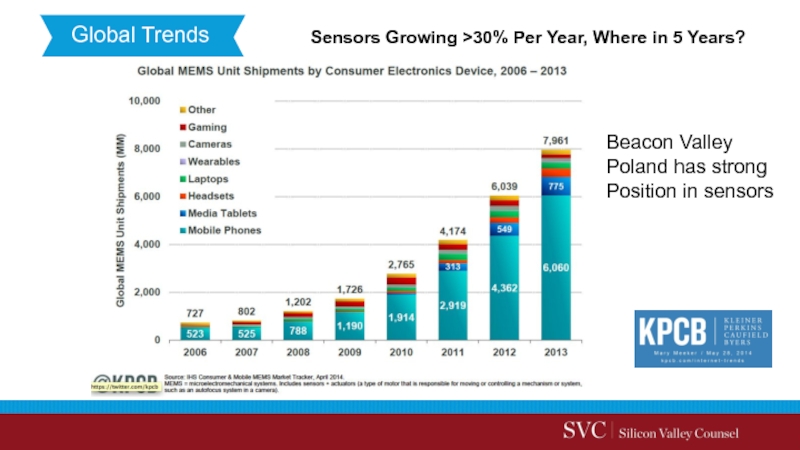

- 42. Global Trends Sensors

- 43. Global Trends User

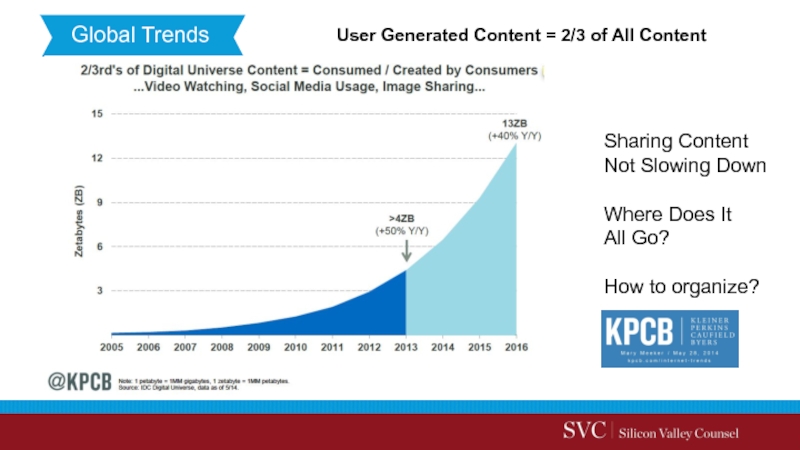

- 44. Global Trends User

- 45. Global Trends Which

- 46. Global Trends What

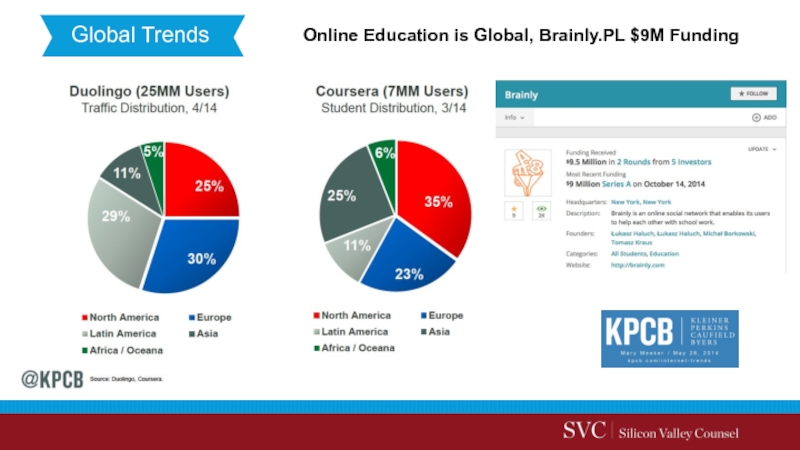

- 47. Global Trends Online Education is Global, Brainly.PL $9M Funding

- 48. Global Trends Changing Global Workforce Brings Tides of Change

- 49. Global Trends Changing

- 50. Global Trends Evolution

- 51. Global Trends What

- 52. Global Trends www.SiliconValleyCounsel.com

- 53. Global Trends Technology

- 54. Global Trends For

- 55. Let’s Connect Find

- 56. Raising Funds from Silicon Valley

Слайд 2

Advantages for Polish Startups & Entrepreneurs?

WHY ME?

HOW TO PICK AN

FOLLOW UP DISCUSSION:

Quick Introduction

What I am doing in Poland

Ten Factors Silicon Valley VC Investors Look For

SILICON VALLEY FUNDING

Introduction

- From Wroclaw University of Technology, Jun and Oct 2014

- From Warsaw School of Economics, May 2015

Structuring Polish-US investor companies

Слайд 5

Why Me?

Polish companies are already being funded

Why Poland?

Brainly, DocPlanner, UXPin,

MATTERMARK

MULTIPLE $M FINANCINGS

527 PL startups listed

ANGEL LIST

1,835 PL startups at pre-funding thru growth funding

2,624 PL founder-CEOs (out of 1,560,000 PL professionals on LI)

LINKEDIN

Слайд 6

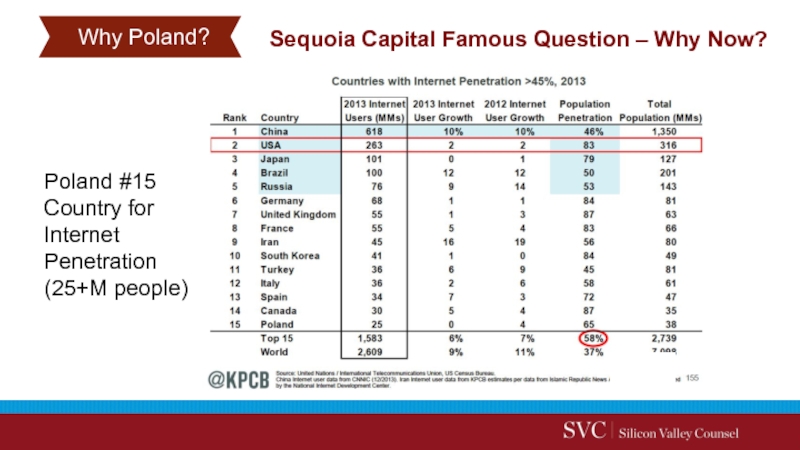

Why Me?

Sequoia Capital Famous Question – Why Now?

Why Poland?

Poland #15

Country for

Internet

Penetration

(25+M people)

Слайд 7

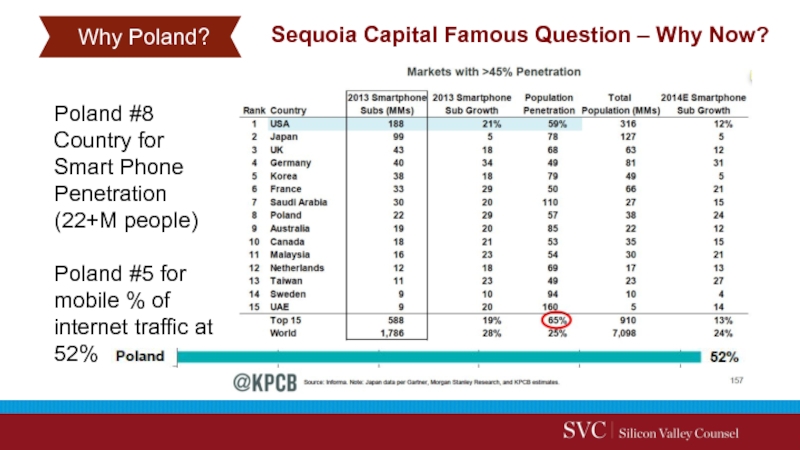

Why Me?

Sequoia Capital Famous Question – Why Now?

Why Poland?

Poland #8

Country for

Smart Phone

Penetration

(22+M people)

Poland #5 for mobile % of internet traffic at 52%

Слайд 8

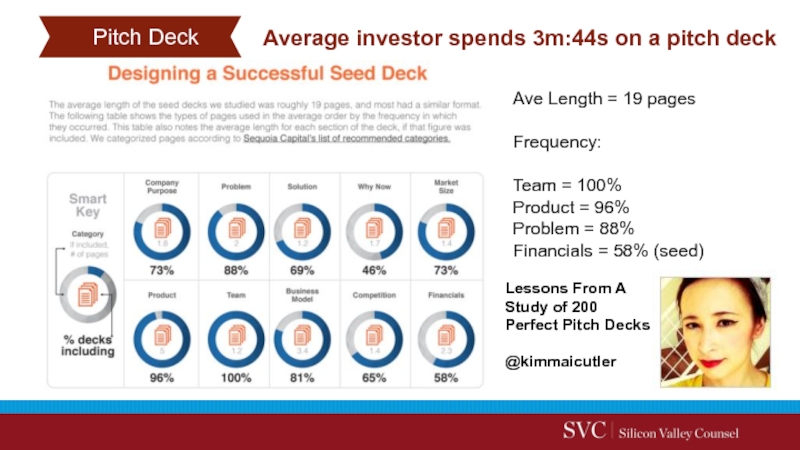

Average investor spends 3m:44s on a pitch deck

Pitch Deck

Lessons From A

Perfect Pitch Decks

@kimmaicutler

Ave Length = 19 pages

Frequency:

Team = 100%

Product = 96%

Problem = 88%

Financials = 58% (seed)

Слайд 9

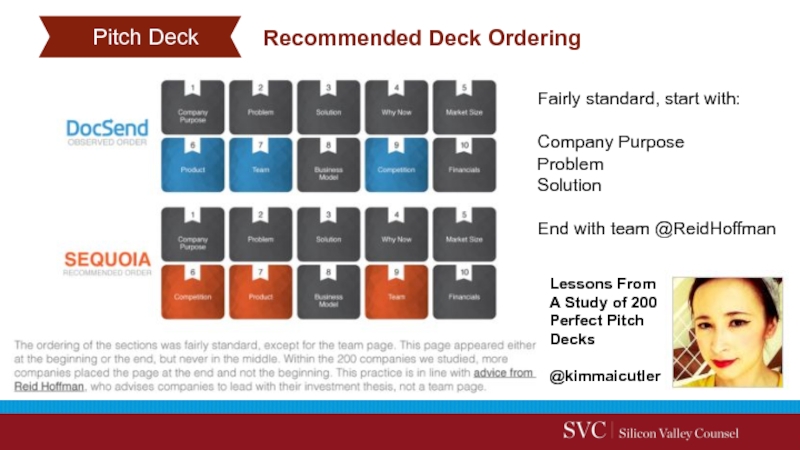

Recommended Deck Ordering

Pitch Deck

Lessons From A Study of 200

Perfect Pitch Decks

@kimmaicutler

Fairly

Company Purpose

Problem

Solution

End with team @ReidHoffman

Слайд 10

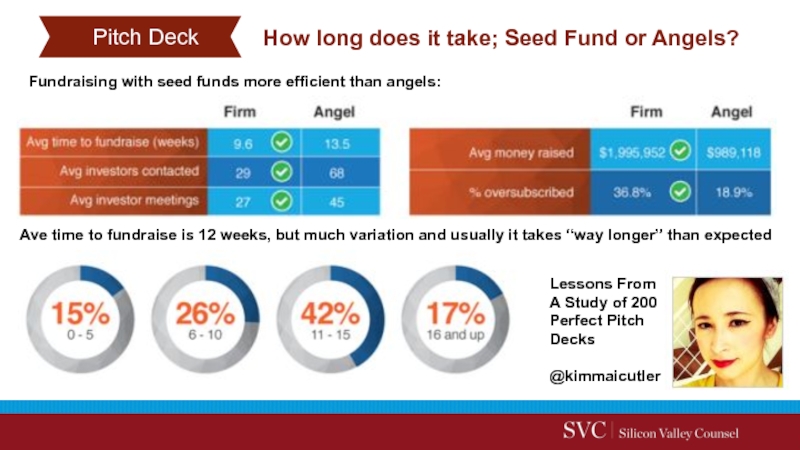

How long does it take; Seed Fund or Angels?

Pitch Deck

Lessons From

Perfect Pitch Decks

@kimmaicutler

Ave time to fundraise is 12 weeks, but much variation and usually it takes “way longer” than expected

Fundraising with seed funds more efficient than angels:

Слайд 11

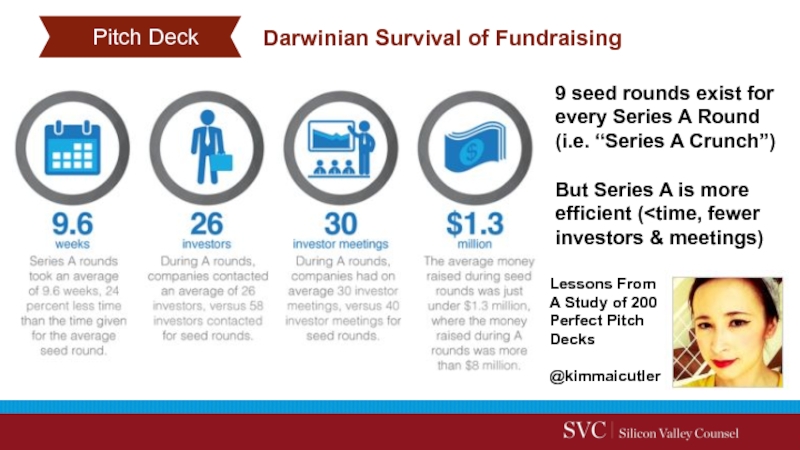

Darwinian Survival of Fundraising

Pitch Deck

Lessons From A Study of 200

Perfect Pitch

@kimmaicutler

9 seed rounds exist for every Series A Round (i.e. “Series A Crunch”)

But Series A is more efficient (

Слайд 12

In a great market — a market with lots of real

The Market – Existing, Quantifiable, And Proven Ability To Execute In It

Conversely, in a terrible market, you can have the best product in the world and an absolutely killer team, and it doesn't matter — you're going to fail.

10 Factors

1

Слайд 13

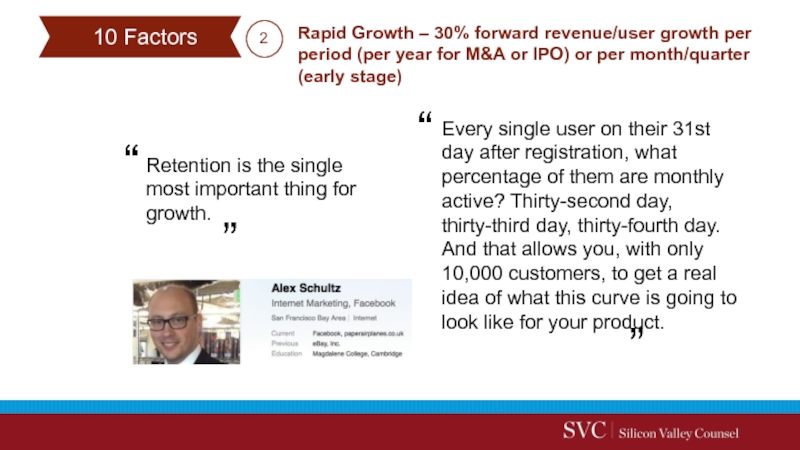

Retention is the single most important thing for growth.

Rapid Growth –

Every single user on their 31st day after registration, what percentage of them are monthly active? Thirty-second day, thirty-third day, thirty-fourth day. And that allows you, with only 10,000 customers, to get a real idea of what this curve is going to look like for your product.

2

10 Factors

Слайд 14

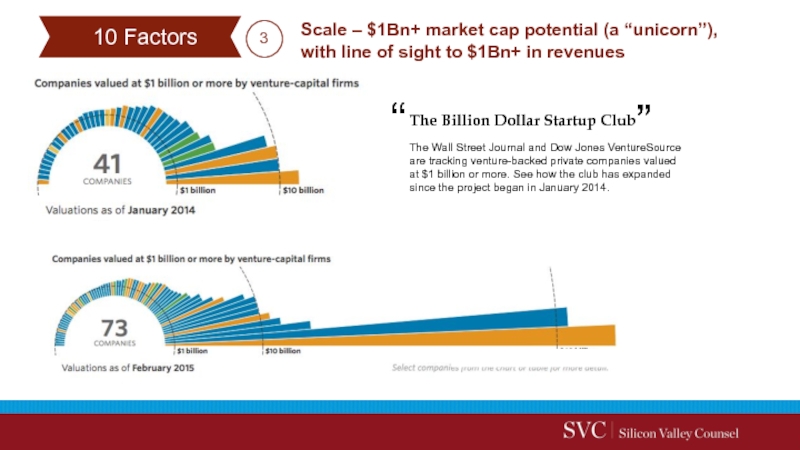

Scale – $1Bn+ market cap potential (a “unicorn”), with line of

The Wall Street Journal and Dow Jones VentureSource are tracking venture-backed private companies valued at $1 billion or more. See how the club has expanded since the project began in January 2014.

The Billion Dollar Startup Club

10 Factors

3

Слайд 15

One of the most common types of advice we give at

Predictability – Recurring and visible revenue streams / user growth (lifetime return customers)

The most common unscalable thing founders have to do at the start is to recruit users manually… founders ignore this path because the absolute numbers seem so small at first.

The mistake they make is to underestimate the power of compound growth. We encourage every startup to measure their progress by weekly growth rate. If you have 100 users, you need to get 10 more next week to grow 10% a week.” (that’s 14,000 users in Y1 and 2 million users in Y2)

10 Factors

4

Слайд 16

Pricing before product – plan distribution first; is your pricing scalable?

Product

Uncontrolled distribution leads to all manner of head-ache and profit-bleeding.”.

It’s possible to niche market and mass sell… Whether Apple or Estee Lauder, sustainable high-profit brands usually begin with controlled distribution. Remember that more customers isn’t the goal; more sustained profit is.

5

10 Factors

Слайд 17

Startup probabilities of success where cofounders don't have a long history

A bad early hire can kill a company; in the early days the goal is to not hire and stay small as long as possible…

Be proud of how much can be done with fewer employees; more equals high burn rate, complexity & slower decisions…

Founders underestimate how hard it is to recruit; the best employees have options; mission belief is the differentiator.

Proven Management Team – Track record managing growth increases investor confidence in execution

10 Factors

6

Слайд 18Globalization means copying things that work… There is no innovation; you

Weak Competitive Landscape – Emerging leader taking share from legacy vendors unable to respond (new and disruptive)

Technologization / technology, by contrast, involves doing new things… True technology companies—Palantir, SpaceX—involve going from 0 to 1. This means going from typewriters to word processors.

10 Factors

7

Слайд 19

When you are starting a startup you need revenue. You need

Strong Economic Model – Quantifiable and proven inputs for unit cost of customer acquisition, revenues, margins and contributions over time

Two things you should be doing when you're starting your company: talking to your users (selling) or building your product. As a founder, you have some unique advantages that make it possible for you to be really, really good at sales: passion for the product and your knowledge of the industry and the problem that you're solving.

10 Factors

8

Слайд 20

If you’re going to spend the best years of your life

The Elevator Pitch – One Summary that Describes it All

10 Factors

Frequency, Density, and Pain are three variables to analyze almost any problem.

Frequency: Does the problem you’re solving occur often?

Density: Do a lot of people face this problem?

Pain: Is the problem just an annoyance, or something you absolutely must resolve?

9

Слайд 23

How to Pick Investors?

One of the really cool things that's happening

MORE OPTIONS THAN EVER TO GET A NEW COMPANY FUNDED:

— Aaron Harris, a partner at Y Combinator

Слайд 24

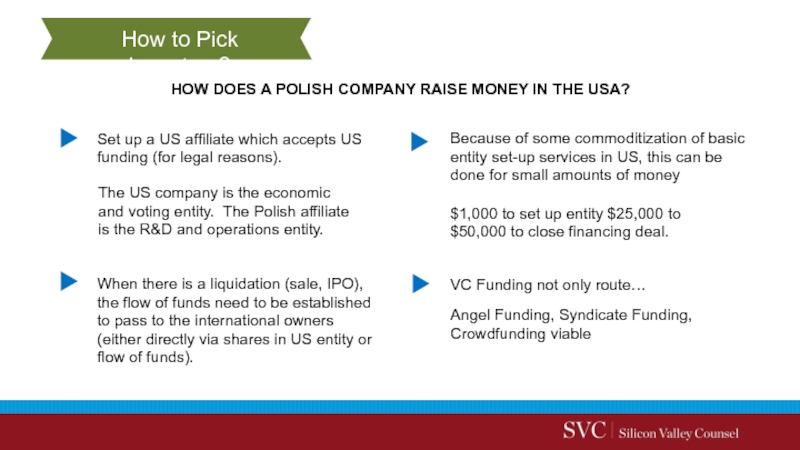

HOW DOES A POLISH COMPANY RAISE MONEY IN THE USA?

VC Funding

Set up a US affiliate which accepts US funding (for legal reasons).

When there is a liquidation (sale, IPO), the flow of funds need to be established to pass to the international owners (either directly via shares in US entity or flow of funds).

Because of some commoditization of basic entity set-up services in US, this can be done for small amounts of money

The US company is the economic and voting entity. The Polish affiliate is the R&D and operations entity.

$1,000 to set up entity $25,000 to $50,000 to close financing deal.

Angel Funding, Syndicate Funding, Crowdfunding viable

How to Pick Investors?

Слайд 25

Team Leadership skills, operating knowhow and industry knowledge are all tremendously

How to Pick Investors?

Слайд 26

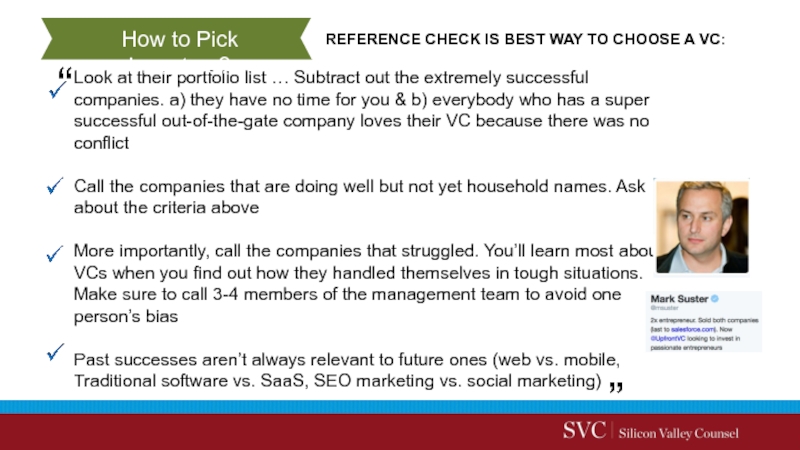

Look at their portfolio list … Subtract out the extremely successful

Call the companies that are doing well but not yet household names. Ask about the criteria above

More importantly, call the companies that struggled. You’ll learn most about VCs when you find out how they handled themselves in tough situations. Make sure to call 3-4 members of the management team to avoid one person’s bias

Past successes aren’t always relevant to future ones (web vs. mobile, Traditional software vs. SaaS, SEO marketing vs. social marketing)

REFERENCE CHECK IS BEST WAY TO CHOOSE A VC:

How to Pick Investors?

Слайд 27

Never been easier to start a technology company…

In the USA or

Why?... Decreasing costs, market factors…

On the other hand… Silicon Valley is very expensive…

Global Trends

Слайд 28

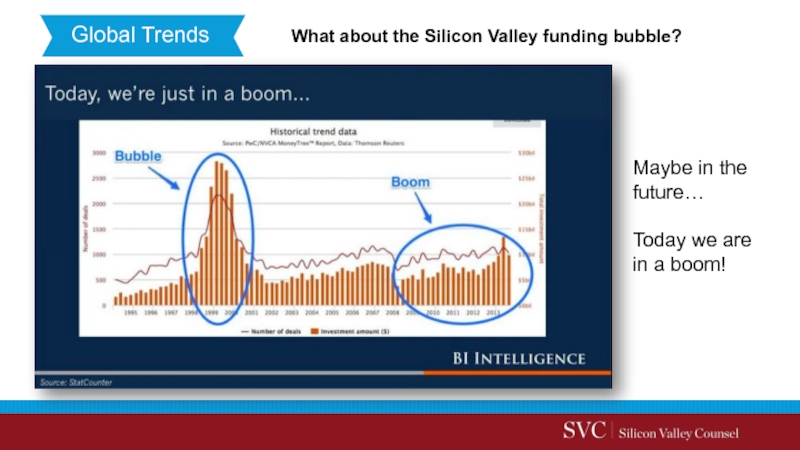

What about the Silicon Valley funding bubble?

Global Trends

Maybe in the future…

Today we are in a boom!

Слайд 29

It’s become 2x more expensive to scale a startup in Silicon

The combined inflation of real estate and wage costs in Silicon Valley have a dramatic impact of the operating expenses of startups. This chart compares the op-ex (excluding marketing spend) of a hypothetical 20 person Series A startup and a hypothetical 80 person Series B startup over the past five years in Silicon Valley. In both cases, the op-ex figures double from $2.5M to $5.0M and from $7.9M to $15.6M respectively.

Global Trends

Слайд 30

More powerful phones =

More potential for powerful apps

Global Trends

Smartphone costs

Слайд 31

Global Trends

Bandwidth costs declining… 27% annually from 1999-2013…

Declining cost / Performance

Слайд 32

Global Trends

Compute costs declining 33% annually (1990-2013)

Decreasing cost / performance curve

Слайд 33

Each new computing cycle typically generates 10x the installed base of

Global Trends

Mobile internet has potential to be 10x bigger than desktop internet…

Слайд 34

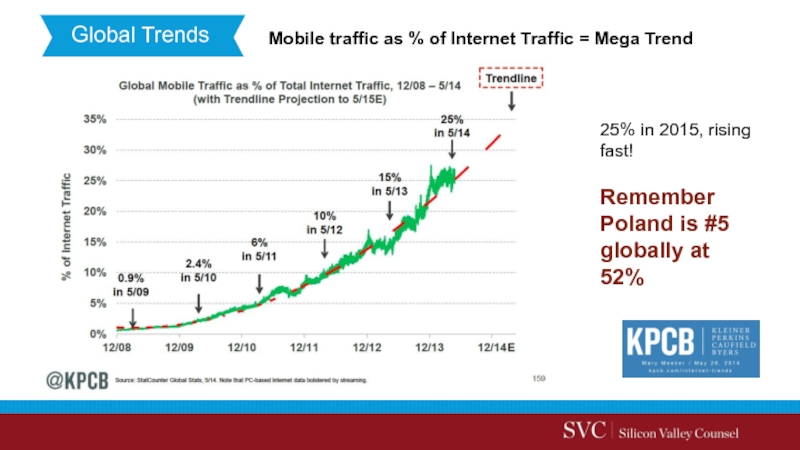

Global Trends

Mobile traffic as % of Internet Traffic = Mega Trend

25%

Remember Poland is #5 globally at 52%

Слайд 35

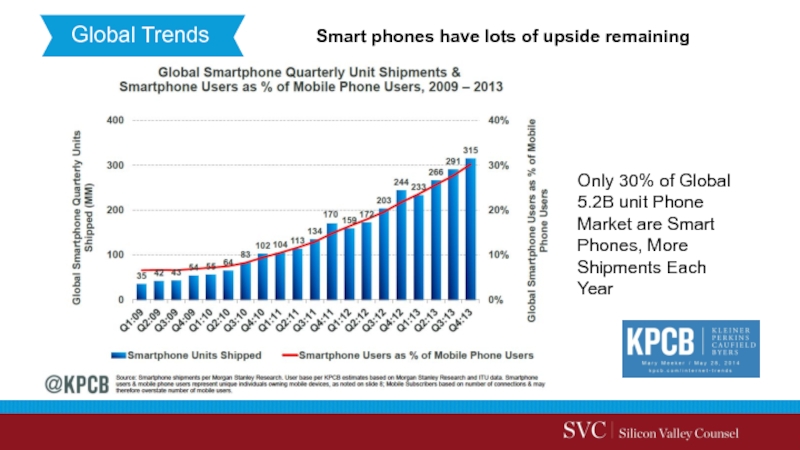

Global Trends

Smart phones have lots of upside remaining

Only 30% of Global

5.2B unit Phone

Market are Smart

Phones, More

Shipments Each

Year

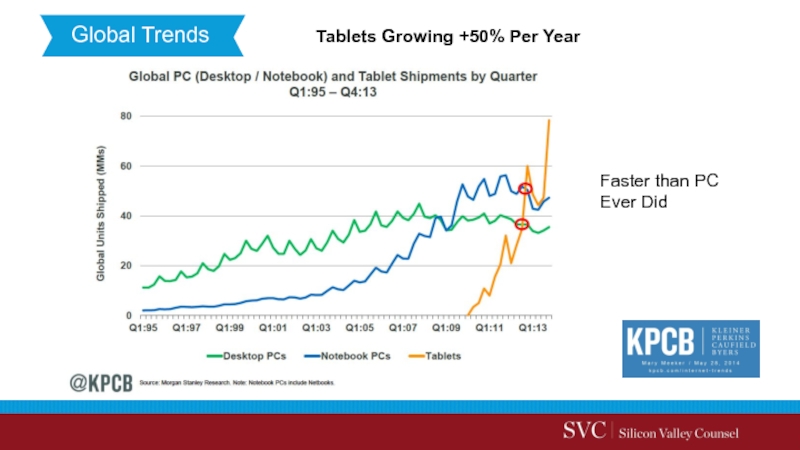

Слайд 36

Global Trends

Mobile is constantly changing

Global smartphone

Operating System is

97% Different Than

10 Years

Слайд 38

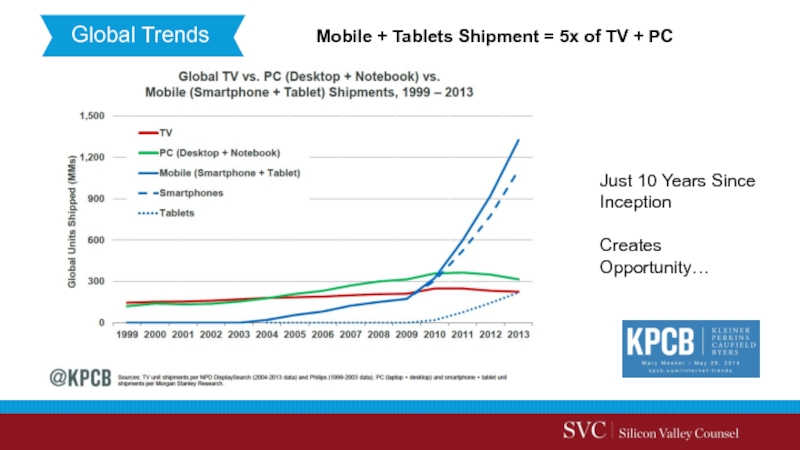

Global Trends

Mobile + Tablets Shipment = 5x of TV + PC

Just

Creates Opportunity…

Слайд 40

How big will Streaming Mobile Video be in 5 years?

Global Trends

2.8

29% on vertical video = Wow!

Слайд 42

Global Trends

Sensors Growing >30% Per Year, Where in 5 Years?

Beacon Valley

Poland

Position in sensors

Слайд 43

Global Trends

User Generated Content = 2/3 of All Content

Sharing Content

Not

Where Does It

All Go?

How to organize?

Слайд 44

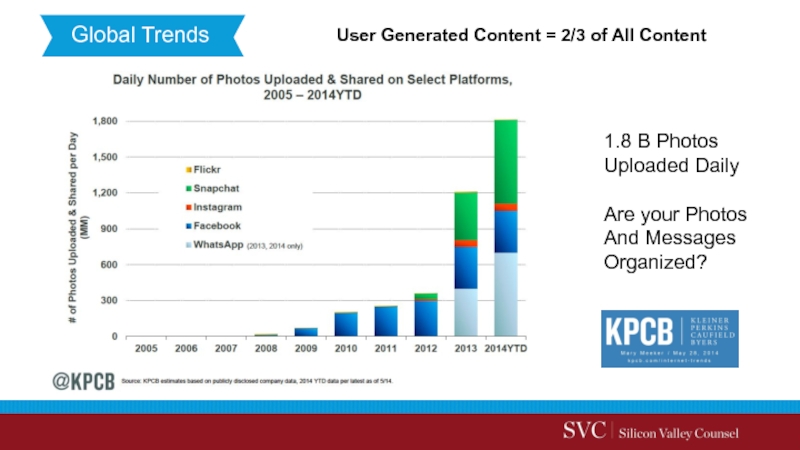

Global Trends

User Generated Content = 2/3 of All Content

1.8 B

Uploaded Daily

Are your Photos

And Messages

Organized?

Слайд 45

Global Trends

Which Way Are Mobile Apps Moving?

Sharing with Friends

And Finding New

Friends…

Not Researching

Information…

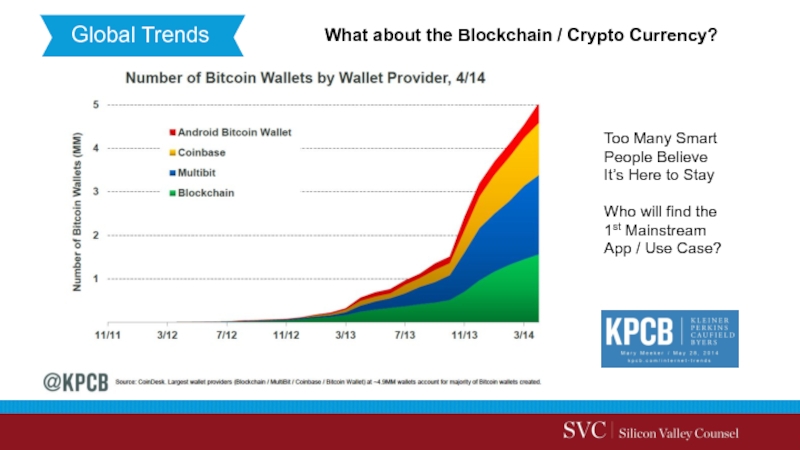

Слайд 46

Global Trends

What about the Blockchain / Crypto Currency?

Too Many Smart

People Believe

It’s

Who will find the

1st Mainstream

App / Use Case?

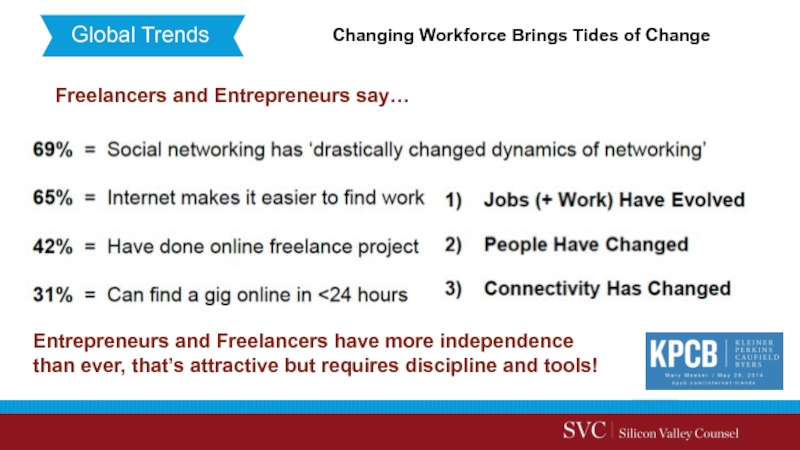

Слайд 49

Global Trends

Changing Workforce Brings Tides of Change

Entrepreneurs and Freelancers have more

Freelancers and Entrepreneurs say…

Слайд 50

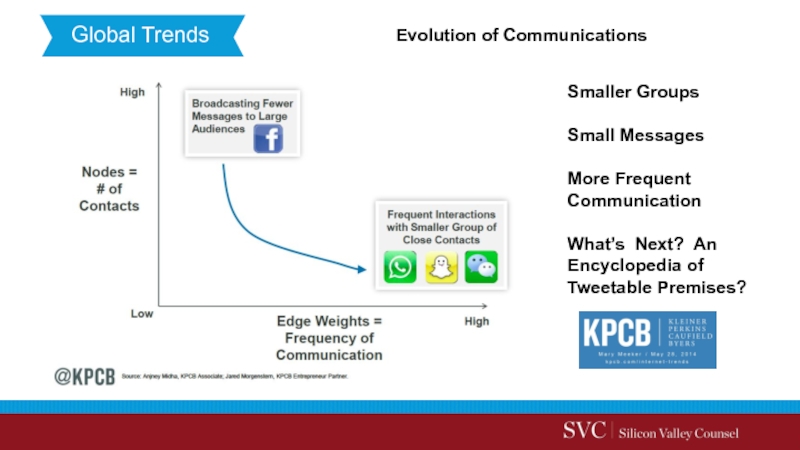

Global Trends

Evolution of Communications

Smaller Groups

Small Messages

More Frequent

Communication

What’s Next? An

Encyclopedia of

Tweetable Premises?

Слайд 51

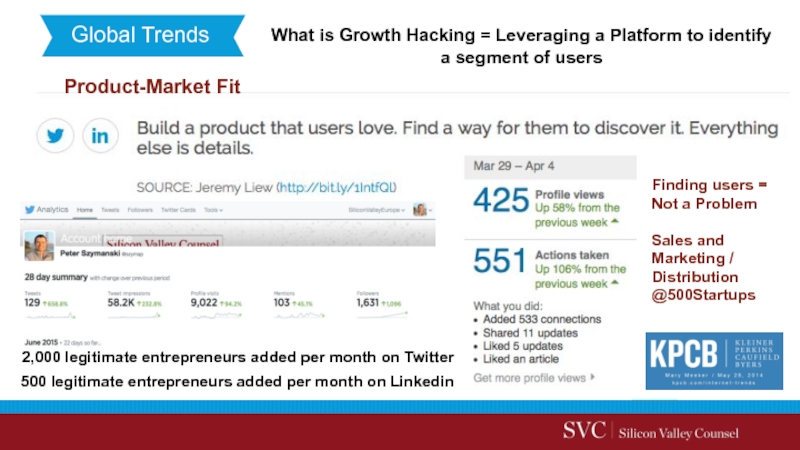

Global Trends

What is Growth Hacking = Leveraging a Platform to identify

Product-Market Fit

2,000 legitimate entrepreneurs added per month on Twitter

500 legitimate entrepreneurs added per month on Linkedin

Finding users =

Not a Problem

Sales and Marketing /

Distribution @500Startups

Слайд 52

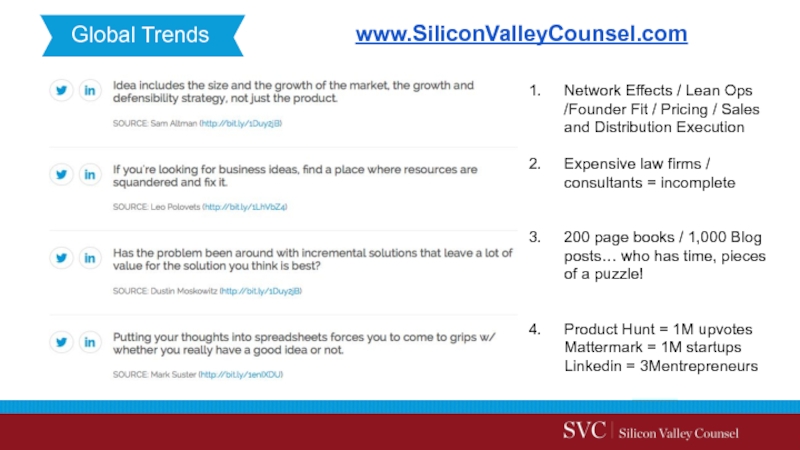

Global Trends

www.SiliconValleyCounsel.com

Network Effects / Lean Ops /Founder Fit / Pricing /

Expensive law firms / consultants = incomplete

200 page books / 1,000 Blog posts… who has time, pieces of a puzzle!

Product Hunt = 1M upvotes

Mattermark = 1M startups

Linkedin = 3Mentrepreneurs

Слайд 53

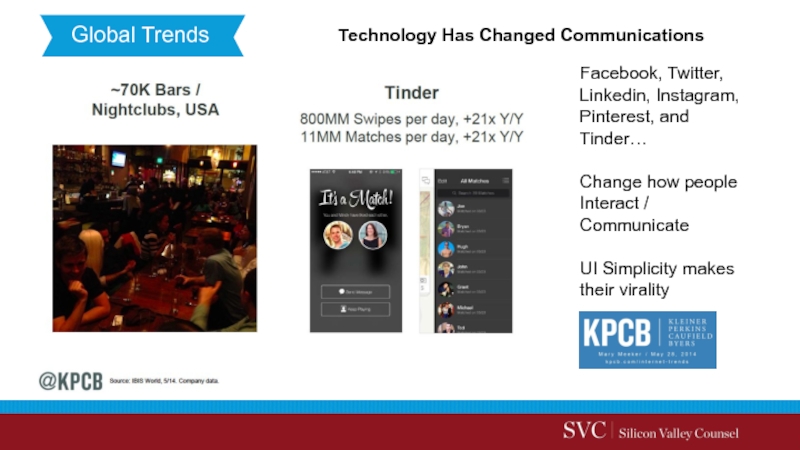

Global Trends

Technology Has Changed Communications

Facebook, Twitter,

Linkedin, Instagram,

Pinterest, and Tinder…

Change how people

Interact

UI Simplicity makes their virality

Слайд 54

Global Trends

For Apps, User Interface Needs to Be Super Simple

Hypothesis/Assumptions:

The Ultimate

Press 1 Button

To Get Instant

Gratification

Entrepreneurs love

Short form bullet

Points

Слайд 55

Let’s Connect

Find the info you need for your startup questions right

Linkedin: Peter Szymanski

Twitter: @szymap and @SiliconVCounsel

www.SiliconValleyCounsel.com