- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Merchandising Activities презентация

Содержание

- 1. Merchandising Activities

- 2. Comparing Merchandising Activities with Manufacturing Activities Merchandising

- 3. Operating Cycle of a Merchandising Company 1.

- 4. Retailers and Wholesalers Retailers sell merchandise directly

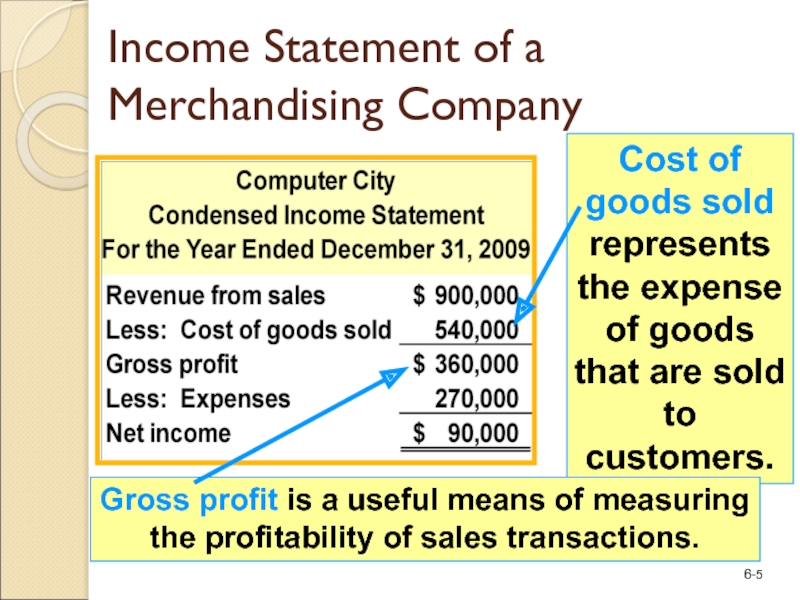

- 5. Income Statement of a Merchandising Company

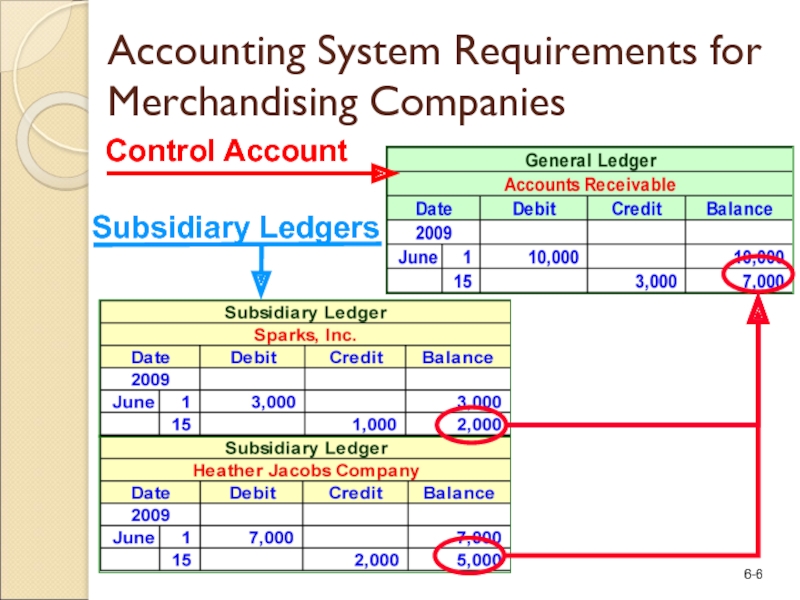

- 6. Accounting System Requirements for Merchandising Companies Control Account

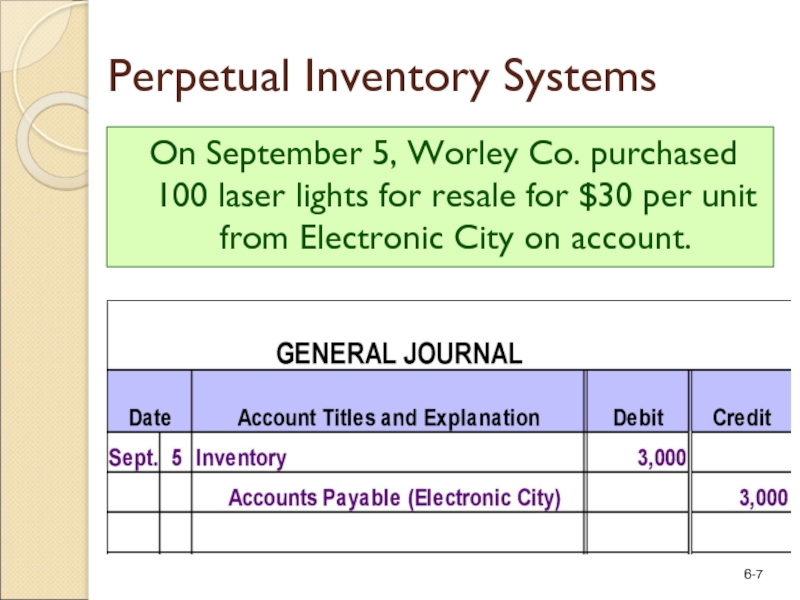

- 7. On September 5, Worley Co. purchased 100

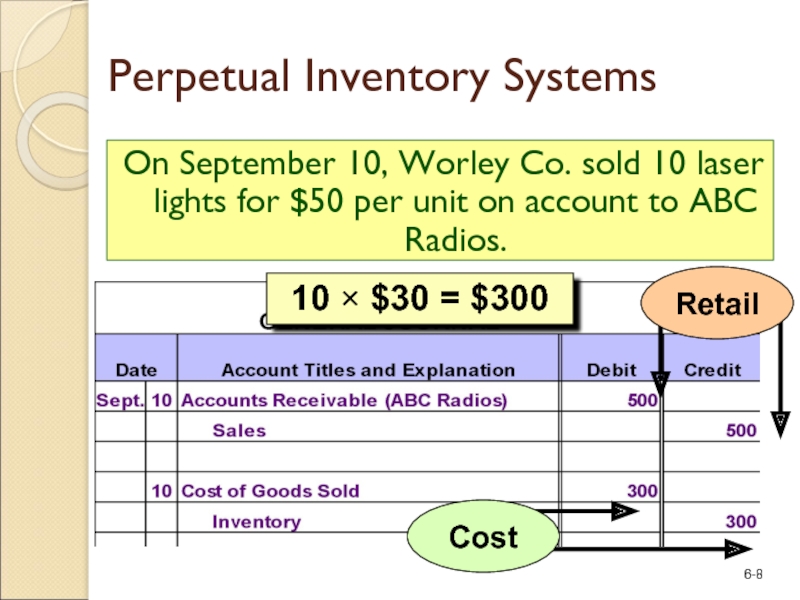

- 8. On September 10, Worley Co. sold 10

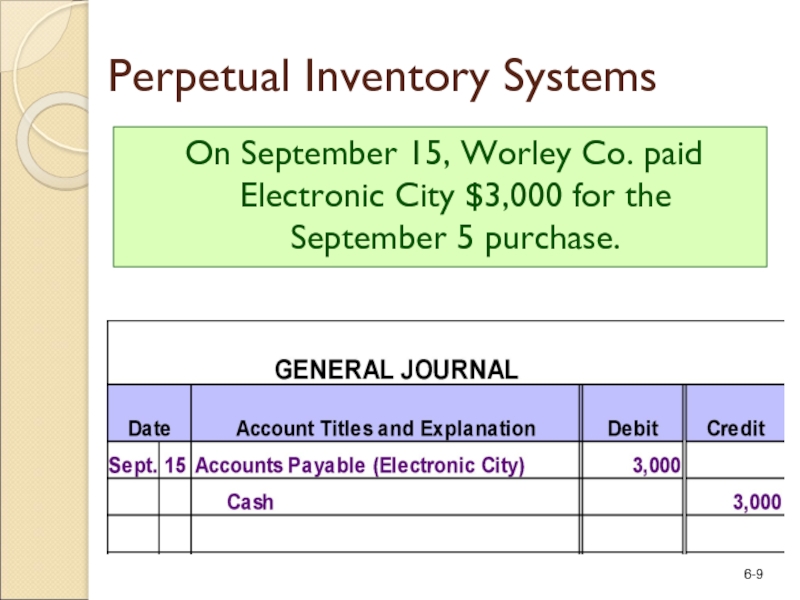

- 9. On September 15, Worley Co. paid Electronic

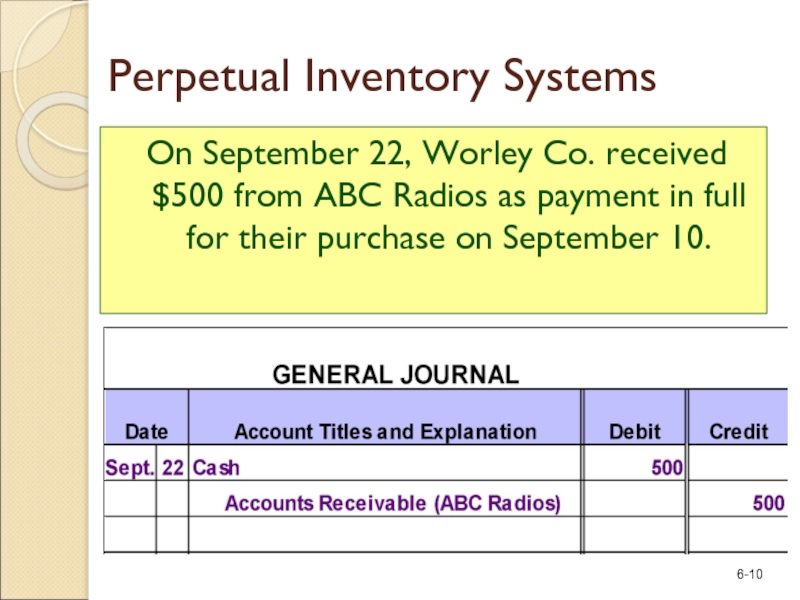

- 10. On September 22, Worley Co. received $500

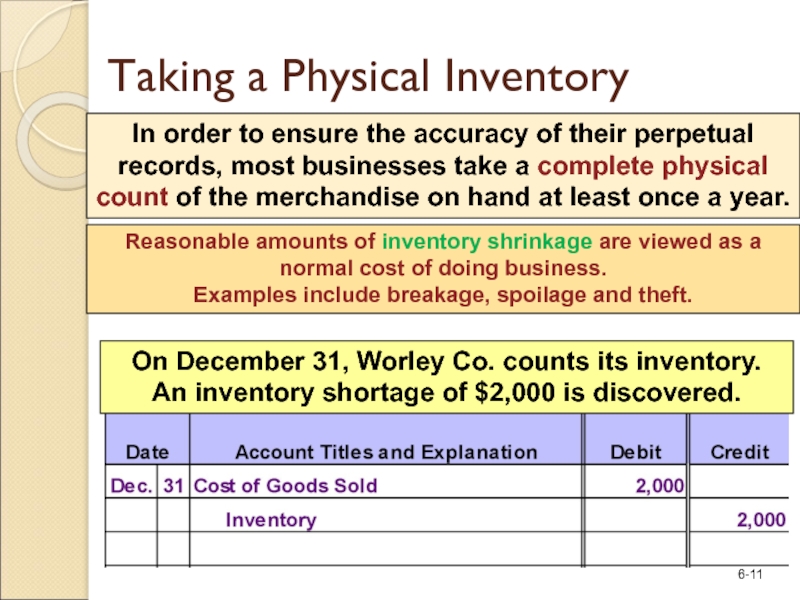

- 11. In order to ensure the accuracy of

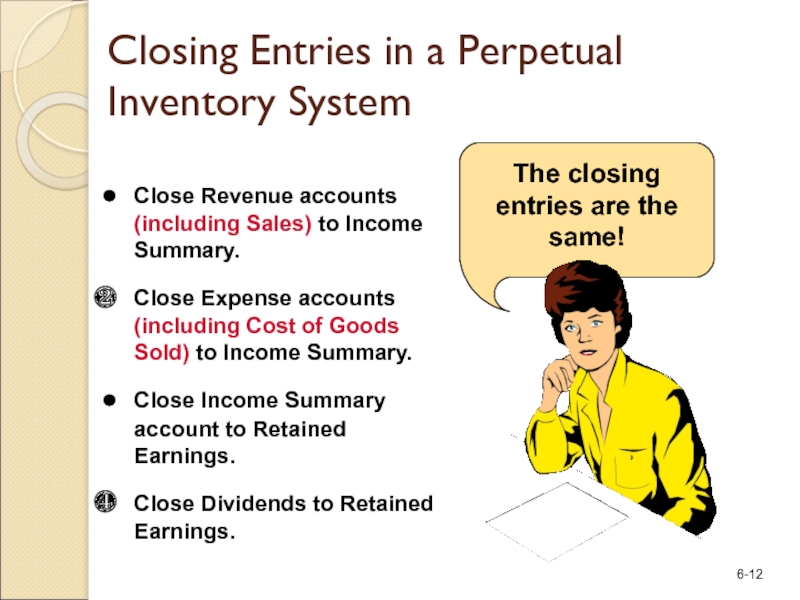

- 12. Closing Entries in a Perpetual Inventory

- 13. On September 5, Worley Co. purchased 100

- 14. On September 10, Worley Co. sold 10

- 15. On September 15, Worley Co. paid Electronic

- 16. On September 22, Worley Co. received $500

- 17. Computing Cost of Goods Sold The accounting

- 18. Creating a Cost of Goods Sold Account

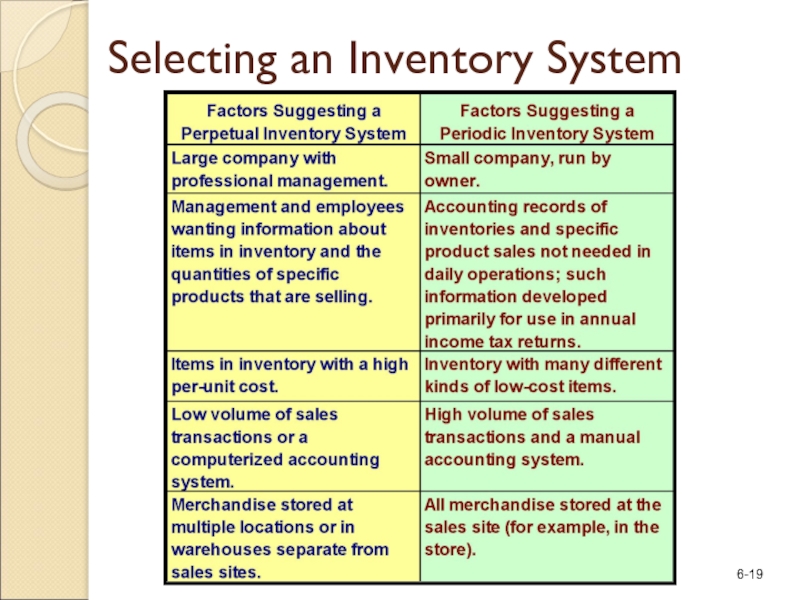

- 19. Selecting an Inventory System

- 20. Credit Terms and Cash Discounts 2/10, n/30

- 21. Recording Purchases at Net Cost $4,000 ×

- 22. On July 15, Jack & Jill, Inc.

- 23. Now, assume that Jack & Jill, Inc.

- 24. Recording Purchases at Gross Invoice Price On

- 25. On July 15, Jack & Jill, Inc.

- 26. Now, assume that Jack & Jill, Inc.

- 27. $500 × 98% = $490 On August

- 28. Transportation costs related to the acquisition of

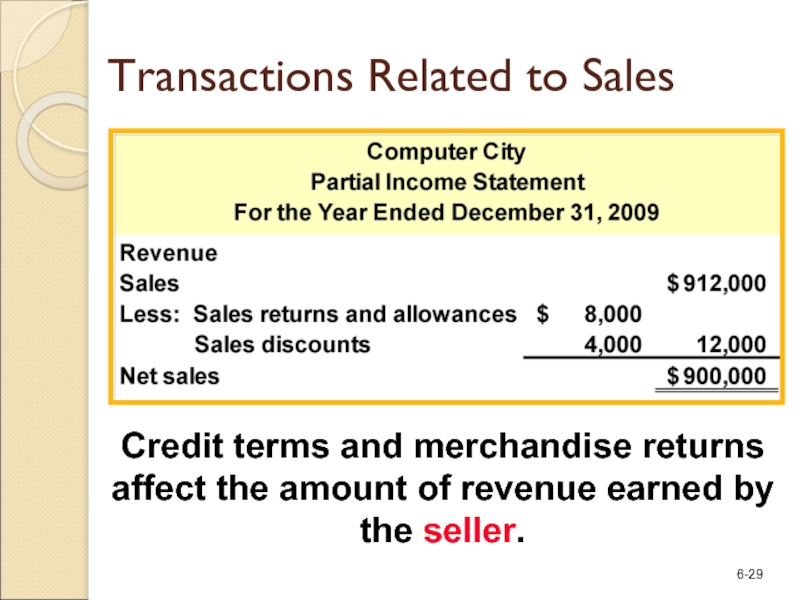

- 29. Credit terms and merchandise returns affect the

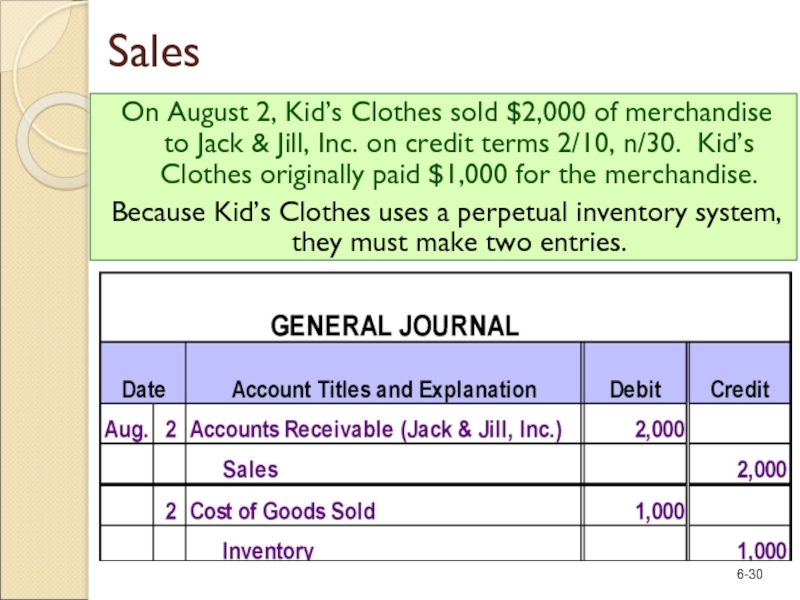

- 30. On August 2, Kid’s Clothes sold $2,000

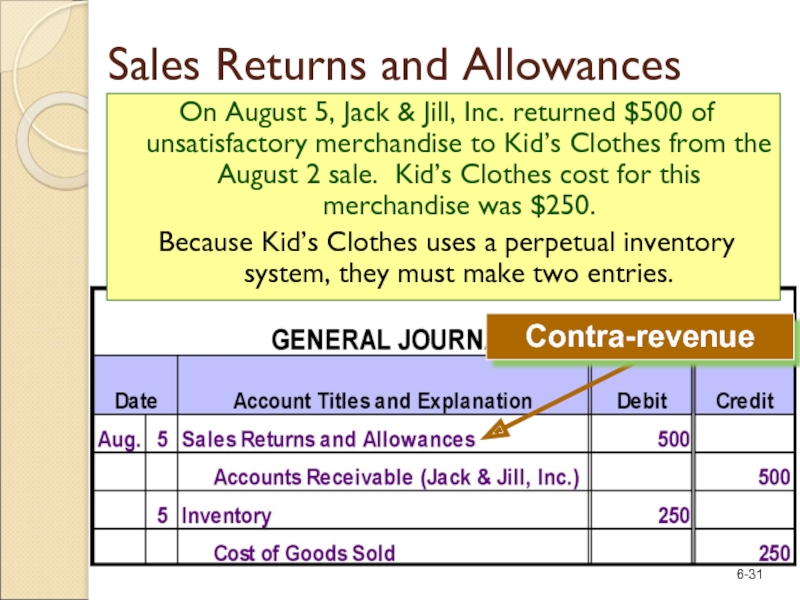

- 31. Contra-revenue On August 5, Jack & Jill,

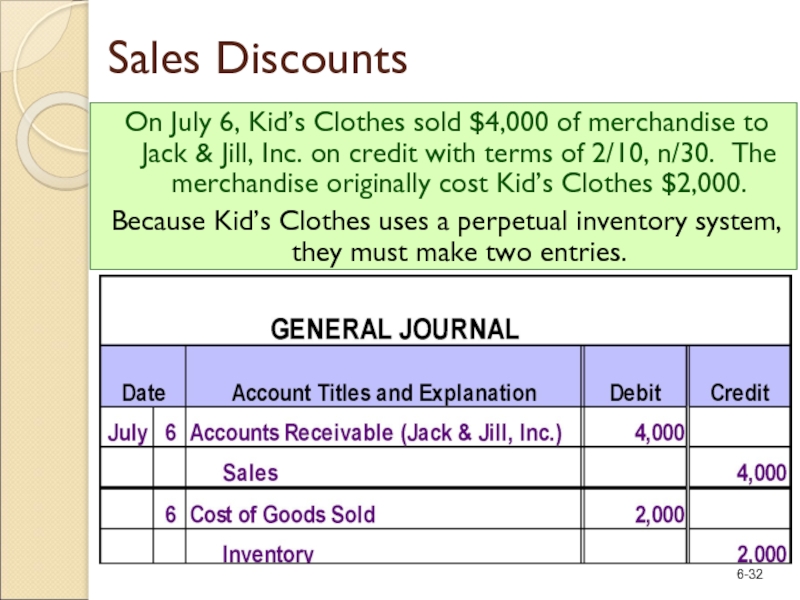

- 32. On July 6, Kid’s Clothes sold $4,000

- 33. On July 15, Kid’s Clothes receives the

- 34. Now, assume that it wasn’t until July

- 35. Delivery costs incurred by sellers are debited to Delivery Expense, an operating expense. Delivery Expenses

- 36. Businesses collect sales tax at the point

- 37. Modifying an Accounting System Most businesses use

- 38. Financial Analysis Net Sales Gross Profit Margins

- 39. Ethics, Fraud, and Corporate Governance Sales discounts

- 40. End of Chapter 6

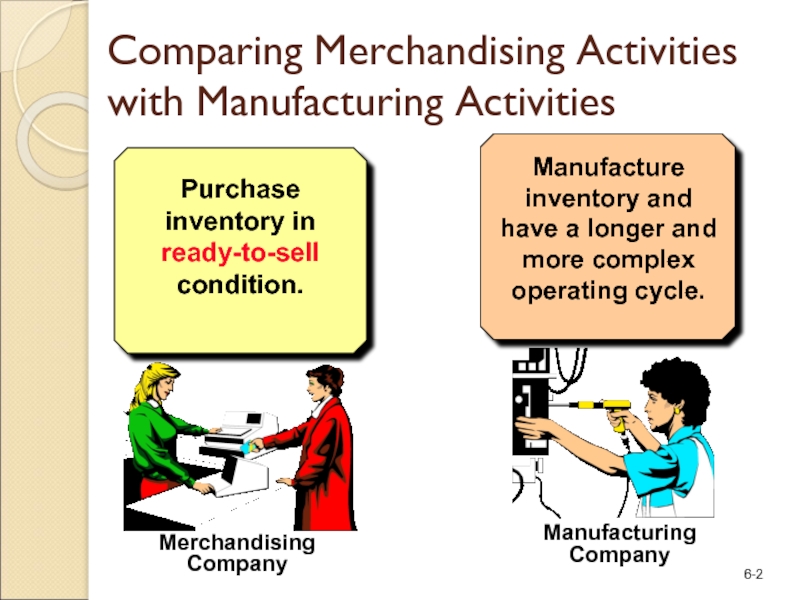

Слайд 2Comparing Merchandising Activities with Manufacturing Activities

Merchandising Company

Purchase inventory in ready-to-sell condition.

Manufacturing

Company

Manufacture inventory and have a longer and more complex operating cycle.

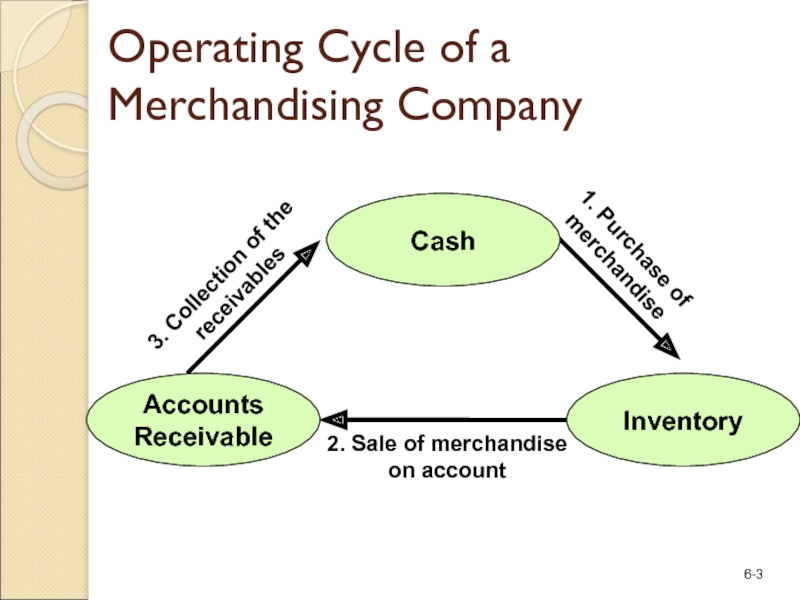

Слайд 3Operating Cycle of a Merchandising Company

1. Purchase of merchandise

3. Collection of

2. Sale of merchandise on account

Cash

Inventory

Accounts Receivable

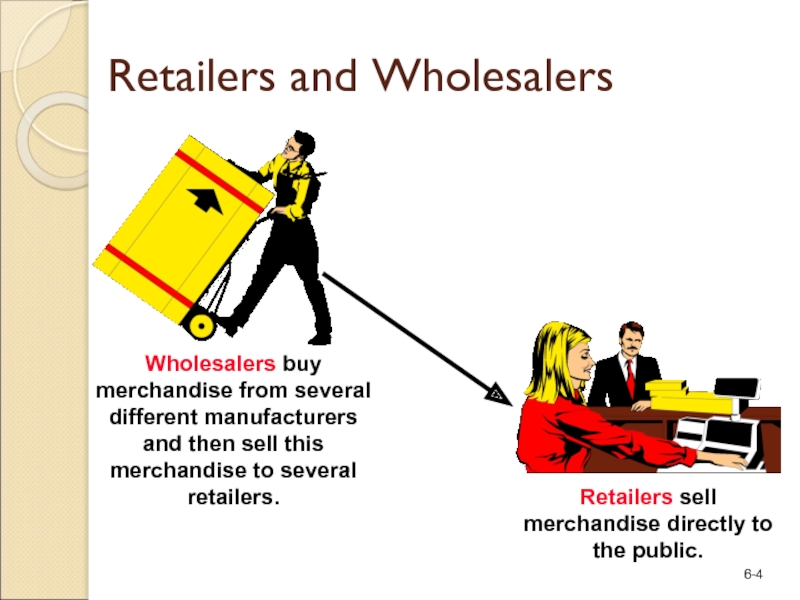

Слайд 4Retailers and Wholesalers

Retailers sell merchandise directly to the public.

Wholesalers buy merchandise

Слайд 7On September 5, Worley Co. purchased 100 laser lights for resale

Perpetual Inventory Systems

Слайд 8On September 10, Worley Co. sold 10 laser lights for $50

10 × $30 = $300

Perpetual Inventory Systems

Слайд 9On September 15, Worley Co. paid Electronic City $3,000 for the

Perpetual Inventory Systems

Слайд 10On September 22, Worley Co. received $500 from ABC Radios as

Perpetual Inventory Systems

Слайд 11In order to ensure the accuracy of their perpetual records, most

Taking a Physical Inventory

Reasonable amounts of inventory shrinkage are viewed as a normal cost of doing business.

Examples include breakage, spoilage and theft.

Слайд 12

Closing Entries in a Perpetual Inventory System

Close Revenue accounts (including Sales)

Close Expense accounts (including Cost of Goods Sold) to Income Summary.

Close Income Summary account to Retained Earnings.

Close Dividends to Retained Earnings.

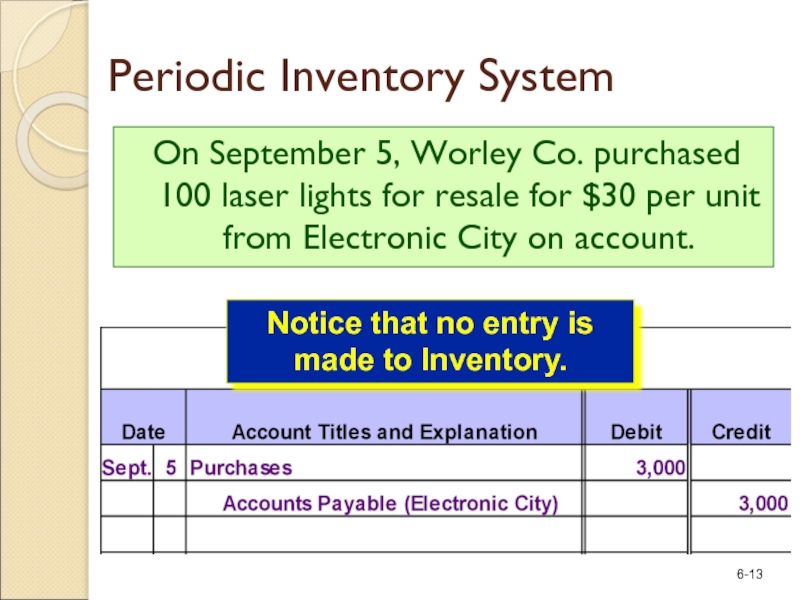

Слайд 13On September 5, Worley Co. purchased 100 laser lights for resale

Notice that no entry is made to Inventory.

Periodic Inventory System

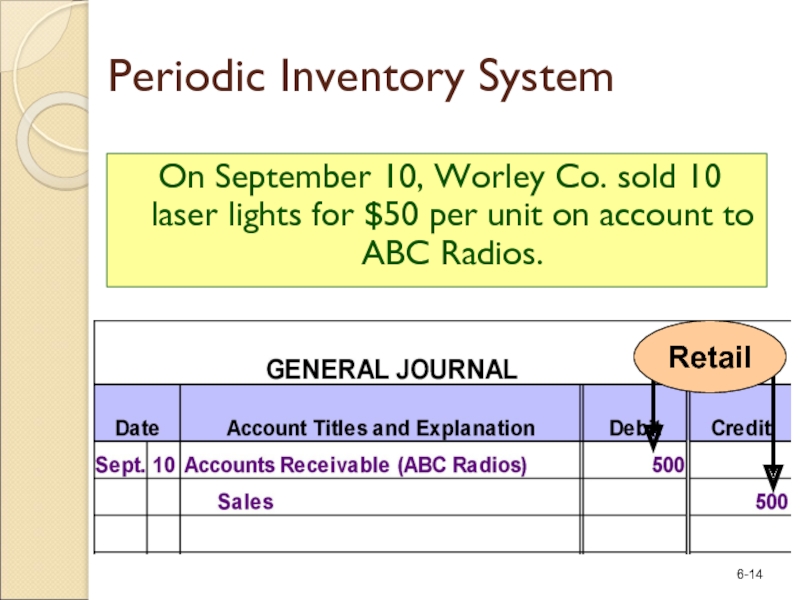

Слайд 14On September 10, Worley Co. sold 10 laser lights for $50

Retail

Periodic Inventory System

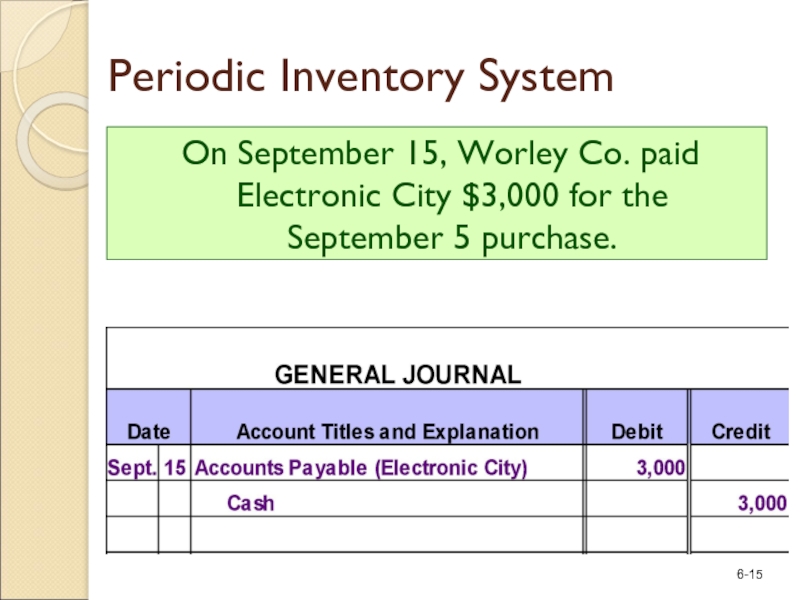

Слайд 15On September 15, Worley Co. paid Electronic City $3,000 for the

Periodic Inventory System

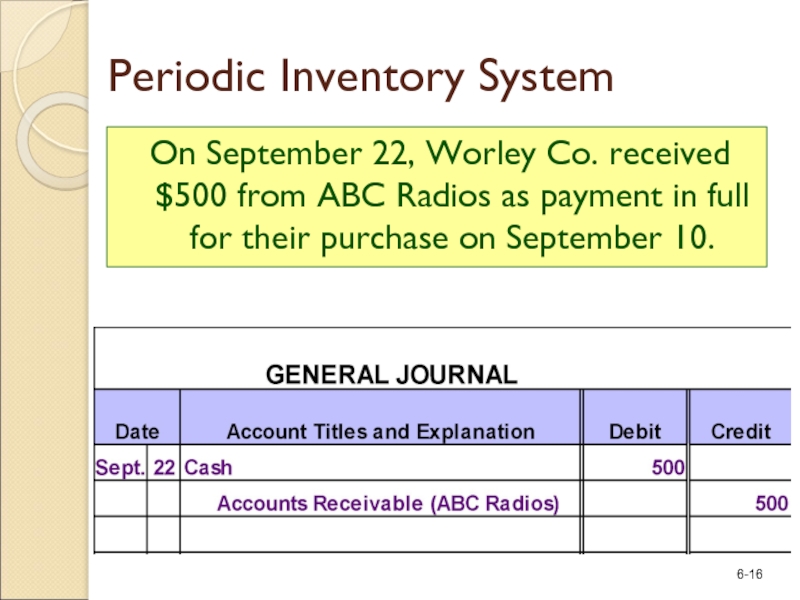

Слайд 16On September 22, Worley Co. received $500 from ABC Radios as

Periodic Inventory System

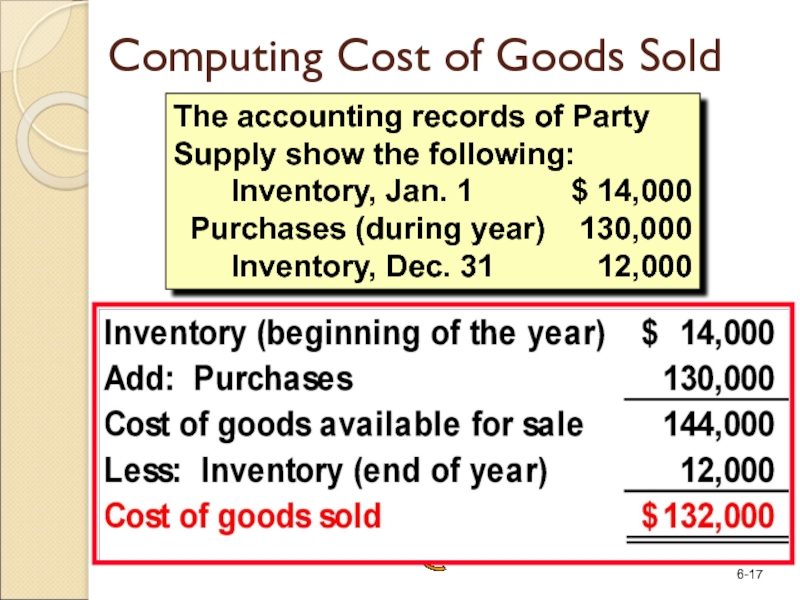

Слайд 17Computing Cost of Goods Sold

The accounting records of Party Supply show

Inventory, Jan. 1 $ 14,000

Purchases (during year) 130,000

Inventory, Dec. 31 12,000

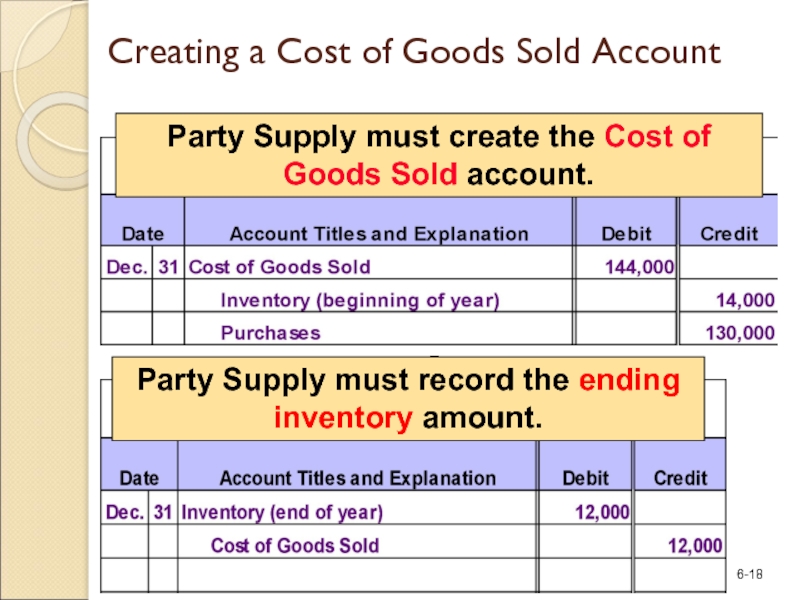

Слайд 18Creating a Cost of Goods Sold Account

Party Supply must create the

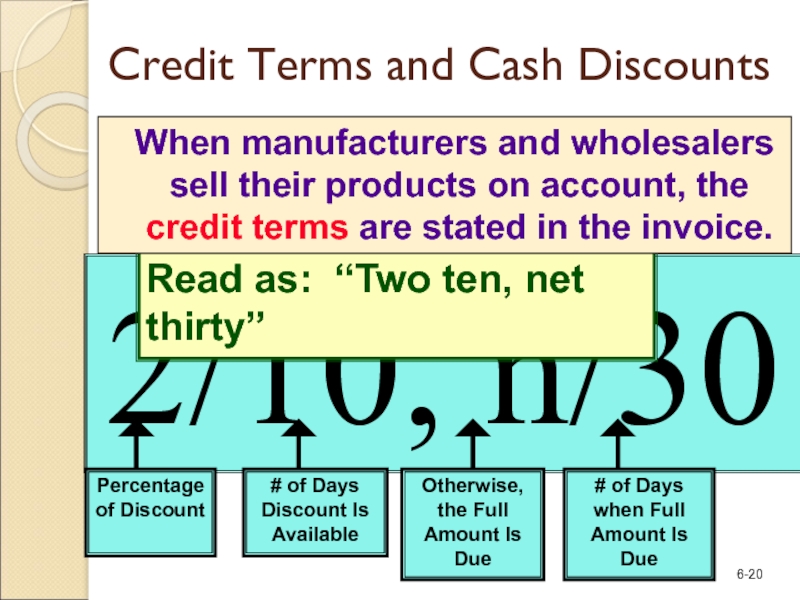

Слайд 20Credit Terms and Cash Discounts

2/10, n/30

When manufacturers and wholesalers sell

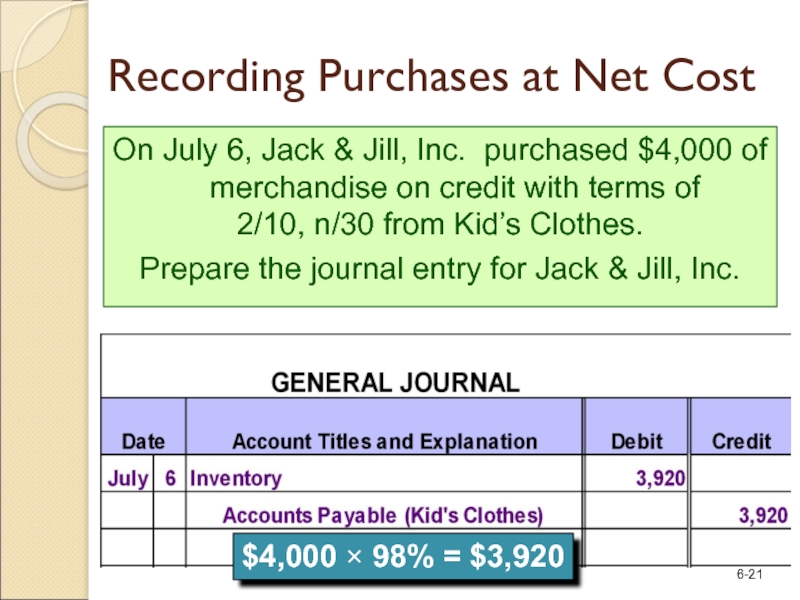

Слайд 21Recording Purchases at Net Cost

$4,000 × 98% = $3,920

On July 6,

2/10, n/30 from Kid’s Clothes.

Prepare the journal entry for Jack & Jill, Inc.

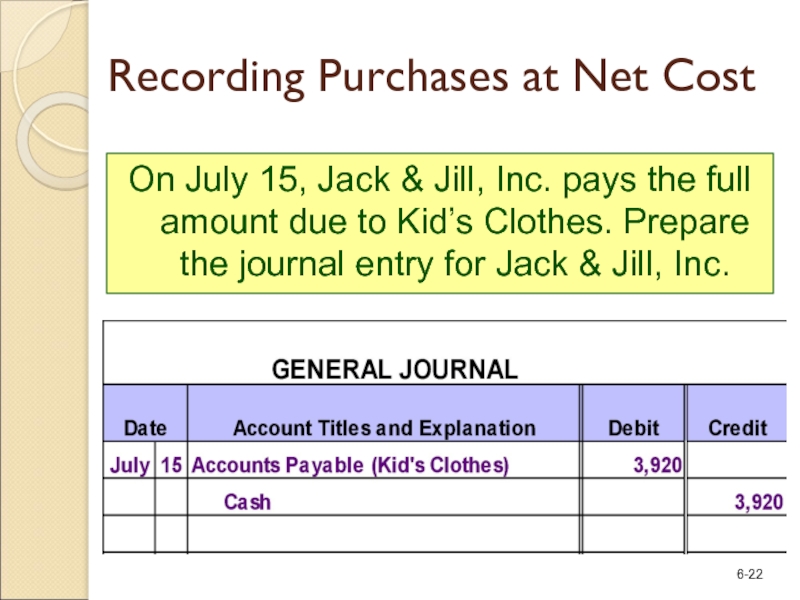

Слайд 22On July 15, Jack & Jill, Inc. pays the full amount

Recording Purchases at Net Cost

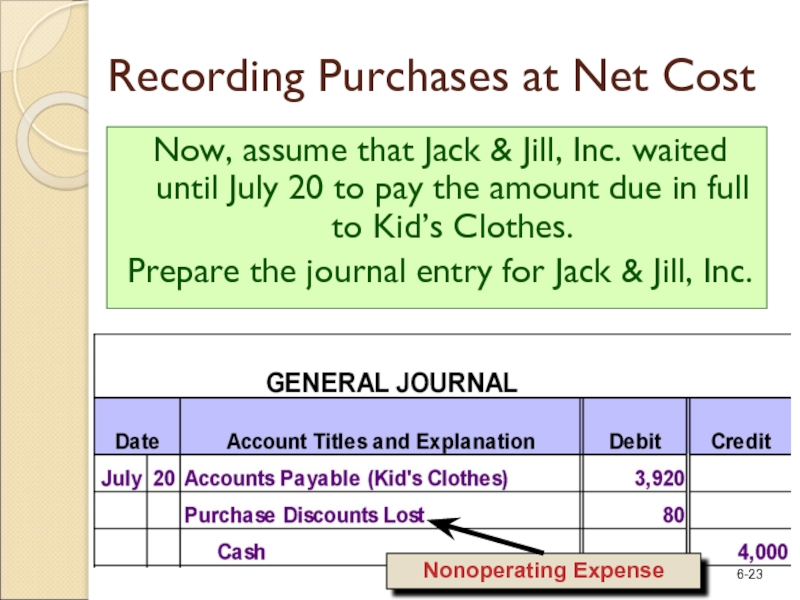

Слайд 23Now, assume that Jack & Jill, Inc. waited until July 20

Prepare the journal entry for Jack & Jill, Inc.

Recording Purchases at Net Cost

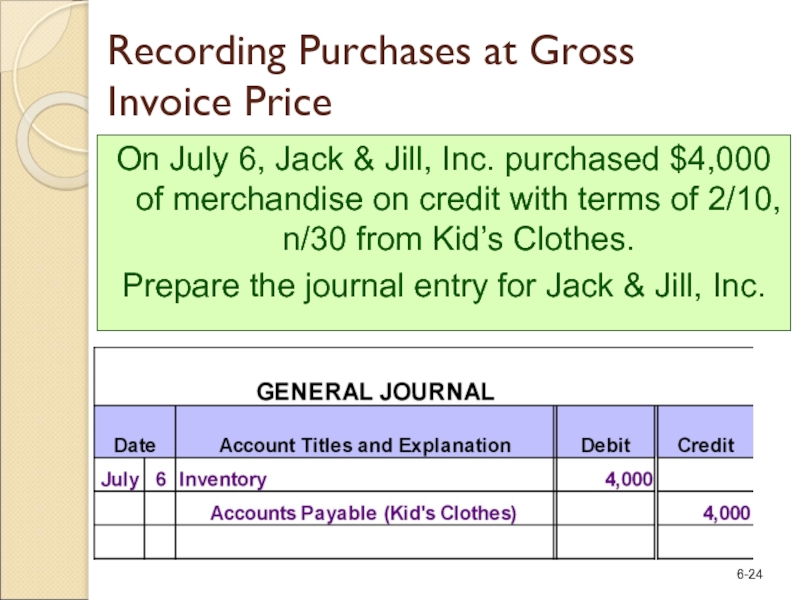

Слайд 24Recording Purchases at Gross Invoice Price

On July 6, Jack & Jill,

Prepare the journal entry for Jack & Jill, Inc.

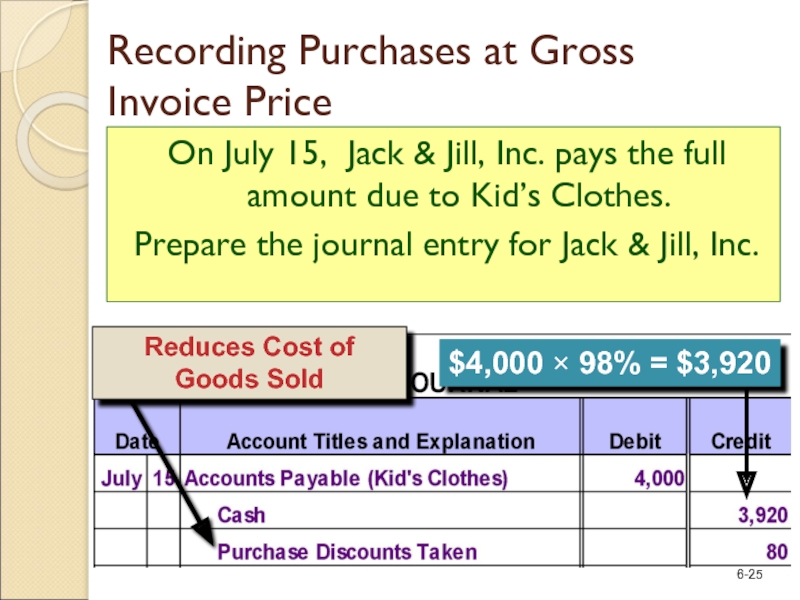

Слайд 25On July 15, Jack & Jill, Inc. pays the full amount

Prepare the journal entry for Jack & Jill, Inc.

Recording Purchases at Gross Invoice Price

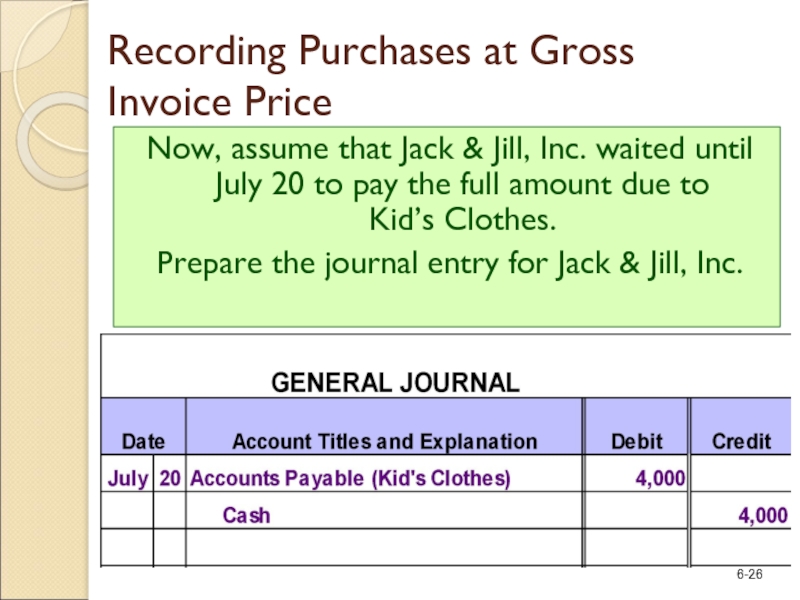

Слайд 26Now, assume that Jack & Jill, Inc. waited until July 20

Prepare the journal entry for Jack & Jill, Inc.

Recording Purchases at Gross Invoice Price

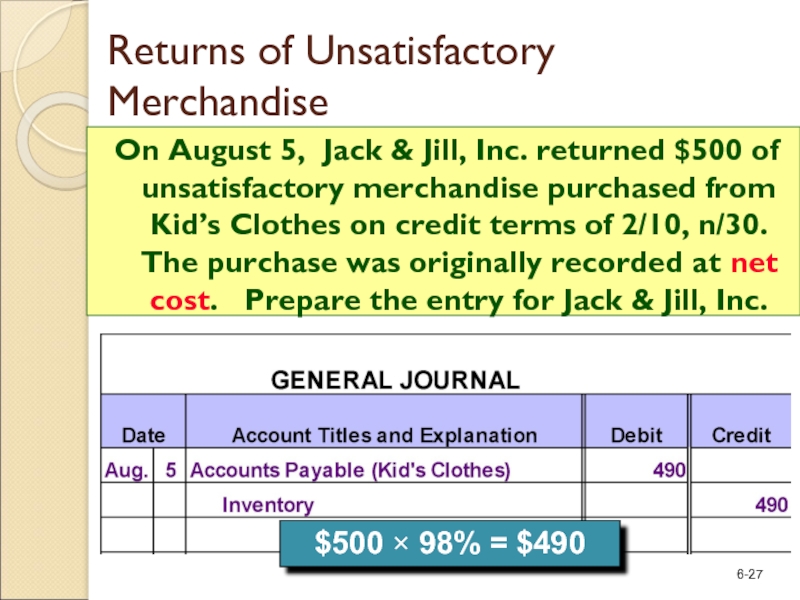

Слайд 27$500 × 98% = $490

On August 5, Jack & Jill, Inc.

Returns of Unsatisfactory Merchandise

Слайд 28Transportation costs related to the acquisition of assets are part of

Transportation Costs on Purchases

Слайд 29Credit terms and merchandise returns affect the amount of revenue earned

Transactions Related to Sales

Слайд 30On August 2, Kid’s Clothes sold $2,000 of merchandise to Jack

Because Kid’s Clothes uses a perpetual inventory system, they must make two entries.

Sales

Слайд 31Contra-revenue

On August 5, Jack & Jill, Inc. returned $500 of unsatisfactory

Because Kid’s Clothes uses a perpetual inventory system, they must make two entries.

Sales Returns and Allowances

Слайд 32On July 6, Kid’s Clothes sold $4,000 of merchandise to Jack

Because Kid’s Clothes uses a perpetual inventory system, they must make two entries.

Sales Discounts

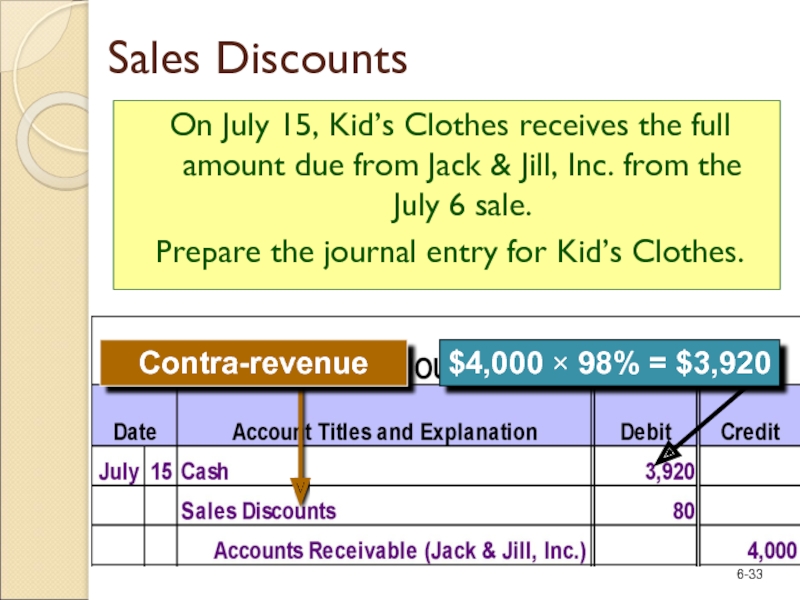

Слайд 33On July 15, Kid’s Clothes receives the full amount due from

Prepare the journal entry for Kid’s Clothes.

Sales Discounts

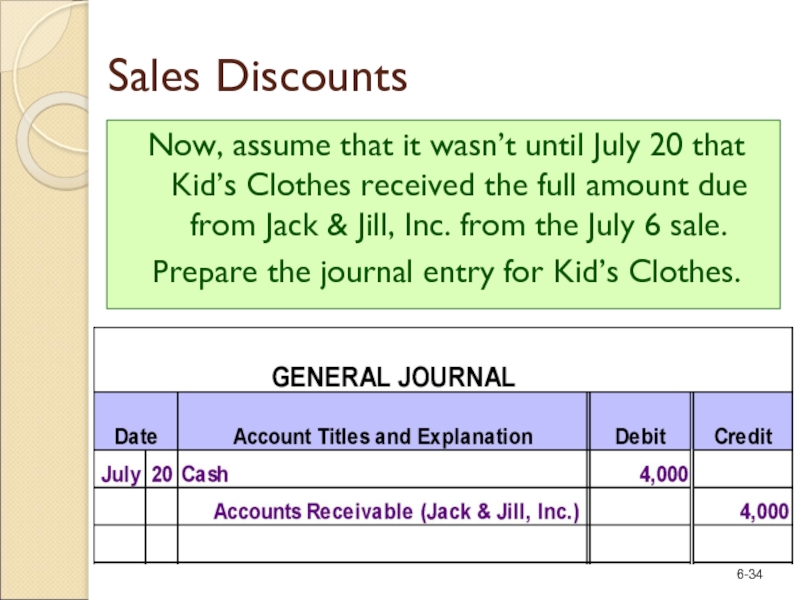

Слайд 34Now, assume that it wasn’t until July 20 that Kid’s Clothes

Prepare the journal entry for Kid’s Clothes.

Sales Discounts

Слайд 35Delivery costs incurred by sellers are debited to Delivery Expense, an

Delivery Expenses

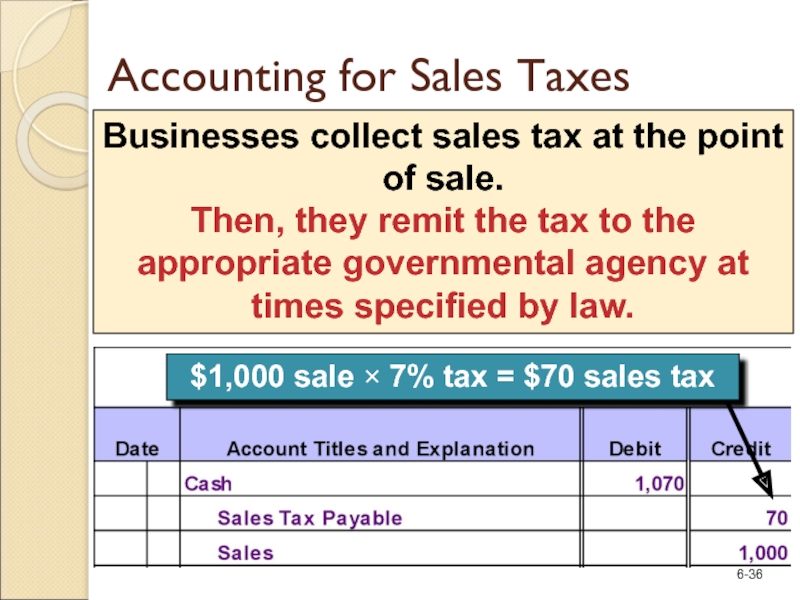

Слайд 36Businesses collect sales tax at the point of sale.

Then, they remit

$1,000 sale × 7% tax = $70 sales tax

Accounting for Sales Taxes

Слайд 37Modifying an Accounting System

Most businesses use special journals rather than a

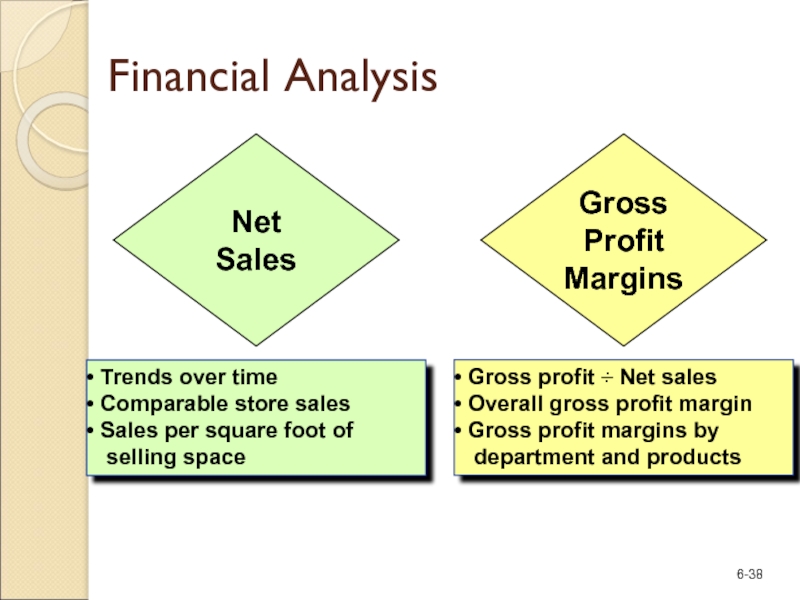

Слайд 38Financial Analysis

Net Sales

Gross Profit Margins

Trends over time

Comparable store sales

Gross profit ÷ Net sales

Overall gross profit margin

Gross profit margins by

department and products

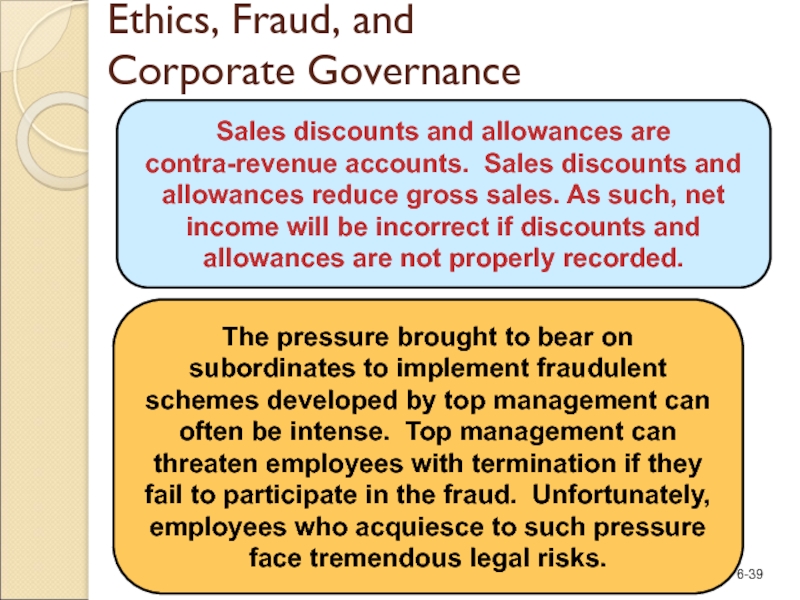

Слайд 39Ethics, Fraud, and

Corporate Governance

Sales discounts and allowances are contra-revenue accounts. Sales

The pressure brought to bear on subordinates to implement fraudulent schemes developed by top management can often be intense. Top management can threaten employees with termination if they fail to participate in the fraud. Unfortunately, employees who acquiesce to such pressure face tremendous legal risks.