- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

5 Major Acquisitions in October презентация

Содержание

- 1. 5 Major Acquisitions in October

- 2. Pandora Acquires Ticketfly The Deal Internet radio

- 3. Dell Acquires EMC The Deal PC maker

- 4. Western Digital Acquires SanDisk The Deal Hard

- 5. Walgreens Acquires Rite Aid The Deal Drug

- 6. Snyder’s-Lance Acquires Diamond Foods The Deal Snack

- 7. You may also enjoy… 3 Companies

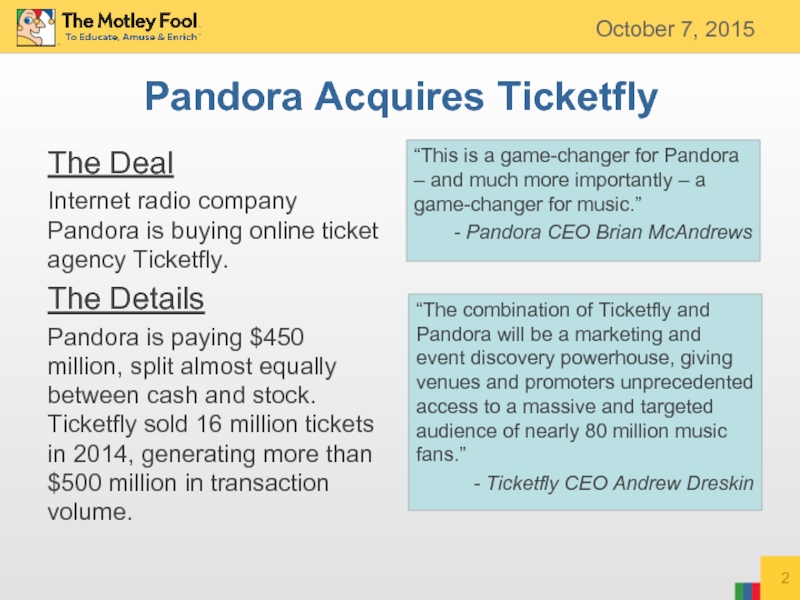

Слайд 2Pandora Acquires Ticketfly

The Deal

Internet radio company Pandora is buying online ticket

The Details

Pandora is paying $450 million, split almost equally between cash and stock. Ticketfly sold 16 million tickets in 2014, generating more than $500 million in transaction volume.

“This is a game-changer for Pandora – and much more importantly – a game-changer for music.”

- Pandora CEO Brian McAndrews

“The combination of Ticketfly and Pandora will be a marketing and event discovery powerhouse, giving venues and promoters unprecedented access to a massive and targeted audience of nearly 80 million music fans.”

- Ticketfly CEO Andrew Dreskin

October 7, 2015

Слайд 3Dell Acquires EMC

The Deal

PC maker Dell is buying enterprise IT company

The Details

Dell is paying $67 billion, or $33.15 per share. EMC shareholders will receive $24.05 per share in cash, as well as new tracking stock related to EMC’s stake in VMware.

“The combination of Dell and EMC creates an enterprise solutions powerhouse bringing our customers industry leading innovation across their entire technology environment.”

- Dell CEO Michael Dell

“We believe the strategic integration of EMC and Dell will generate unparalleled depth and breadth across servers, storage, virtualization and the next era of converged infrastructure, creating a global technology platform poised for sustained long term growth and innovation in the years to come.”

- Egon Durban of Silver Lake

October 12, 2015

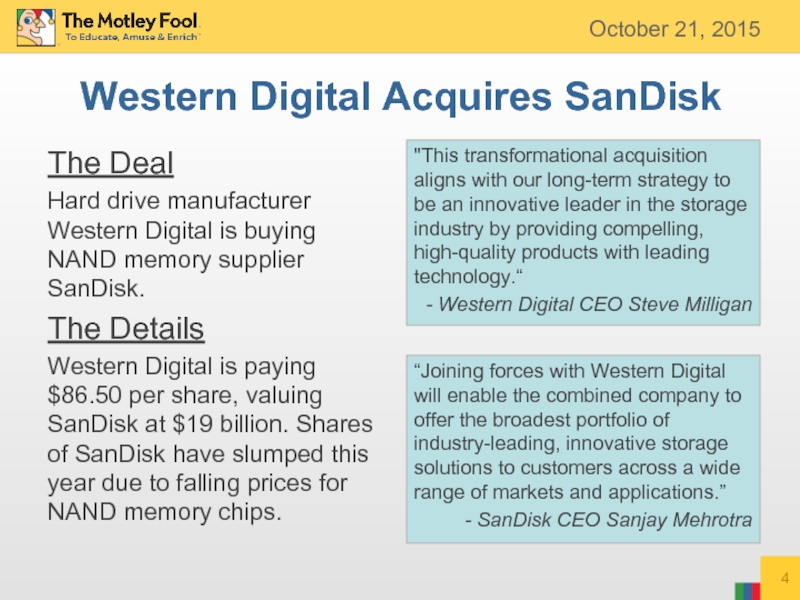

Слайд 4Western Digital Acquires SanDisk

The Deal

Hard drive manufacturer Western Digital is buying

The Details

Western Digital is paying $86.50 per share, valuing SanDisk at $19 billion. Shares of SanDisk have slumped this year due to falling prices for NAND memory chips.

"This transformational acquisition aligns with our long-term strategy to be an innovative leader in the storage industry by providing compelling, high-quality products with leading technology.“

- Western Digital CEO Steve Milligan

“Joining forces with Western Digital will enable the combined company to offer the broadest portfolio of industry-leading, innovative storage solutions to customers across a wide range of markets and applications.”

- SanDisk CEO Sanjay Mehrotra

October 21, 2015

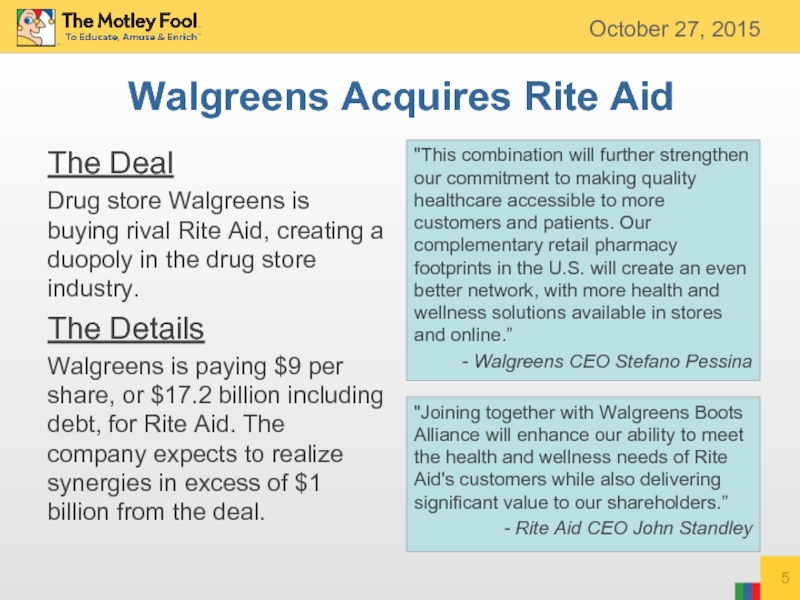

Слайд 5Walgreens Acquires Rite Aid

The Deal

Drug store Walgreens is buying rival Rite

The Details

Walgreens is paying $9 per share, or $17.2 billion including debt, for Rite Aid. The company expects to realize synergies in excess of $1 billion from the deal.

"This combination will further strengthen our commitment to making quality healthcare accessible to more customers and patients. Our complementary retail pharmacy footprints in the U.S. will create an even better network, with more health and wellness solutions available in stores and online.”

- Walgreens CEO Stefano Pessina

"Joining together with Walgreens Boots Alliance will enhance our ability to meet the health and wellness needs of Rite Aid's customers while also delivering significant value to our shareholders.”

- Rite Aid CEO John Standley

October 27, 2015

Слайд 6Snyder’s-Lance Acquires Diamond Foods

The Deal

Snack company Snyder’s-Lance is buying fellow snack

The Details

Snyder’s is paying $1.91 billion for Diamond Foods, a deal that will create a company with $2.6 billion of annual revenue. Food giant Kellogg was reportedly interested in Diamond Foods as well.

“We plan to take full advantage of the combined sales forces of Snyder's-Lance and Diamond to drive stronger top line growth than either company could achieve alone.”

- Snyder’s CEO Carl E. Lee Jr.

"The combination of Diamond and Snyder's-Lance provides the opportunity to create significant value for our stockholders and offers immediate benefits for consumers.”

- Diamond Foods’ CEO Brian Driscoll

October 28, 2015