Moves This Week

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Why Northern Tier Energy, CONSOL Energy, and Peabody Energy Made Huge Moves This Week презентация

Содержание

- 1. Why Northern Tier Energy, CONSOL Energy, and Peabody Energy Made Huge Moves This Week

- 2. This was another busy week for

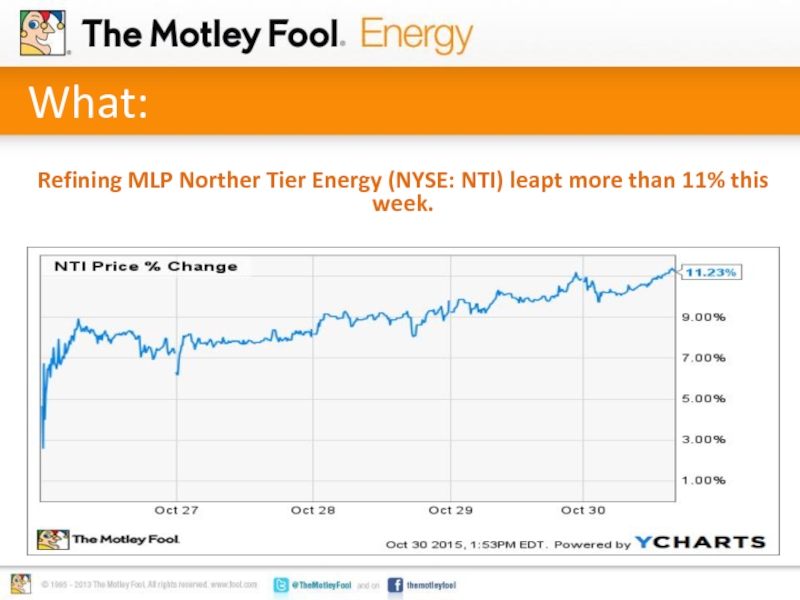

- 3. What: Refining MLP Norther Tier Energy (NYSE: NTI) leapt more than 11% this week.

- 4. So What: Key driver: Western Refining offered

- 5. Now What: Western Refining sees the deal

- 6. What: Natural gas and coal producer CONSOL

- 7. So What: Key driver: CONSOL reported a

- 8. Now What: The company’s coal business didn’t

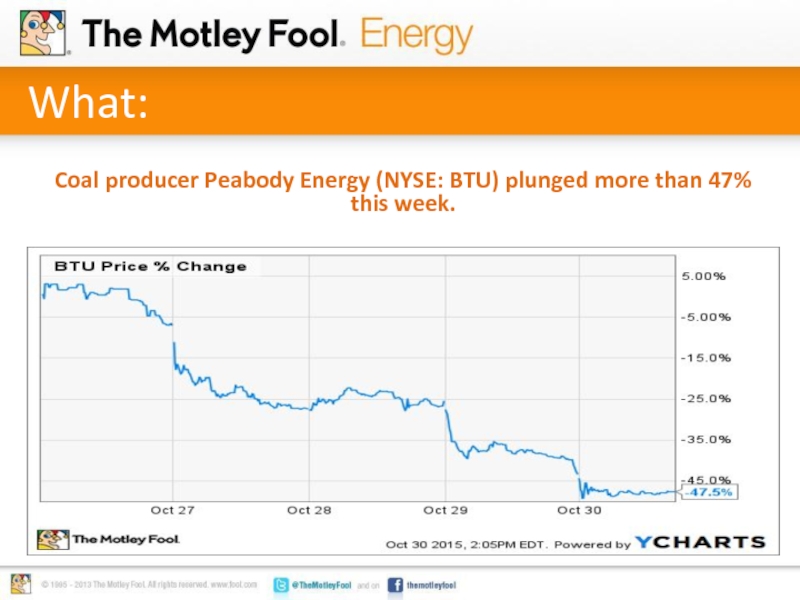

- 9. What: Coal producer Peabody Energy (NYSE: BTU) plunged more than 47% this week.

- 10. So What: Key driver: Peabody reported an

- 11. Now What: Making matters even worse, a

- 12. This could be the next billion-dollar iSecret

Слайд 2

This was another busy week for the market, with earnings season

overflowing a seemingly unending torrent of news to digest. That earnings news was a key fuel behind the biggest stock moves in the energy sector. The biggest movers, according to S&P Capital IQ data, were Northern Tier Energy (NYSE: NTI), CONSOL Energy (NYSE: CNX), and Peabody Energy (NYSE: BTU).

Слайд 4So What:

Key driver: Western Refining offered to buy all of the

outstanding units of Northern Tier Energy that it doesn’t already own in a $2.5 billion deal

Western Refining currently owns 38% of NTI’s common units and 100% of its General Partner

Western Refining currently owns 38% of NTI’s common units and 100% of its General Partner

Слайд 5Now What:

Western Refining sees the deal simplifying its corporate structure while

also enhancing value for investors in both companies

Key takeaway: Given that Western Refining already owns a large stake in NTI, this deal is likely as good as done

Key takeaway: Given that Western Refining already owns a large stake in NTI, this deal is likely as good as done

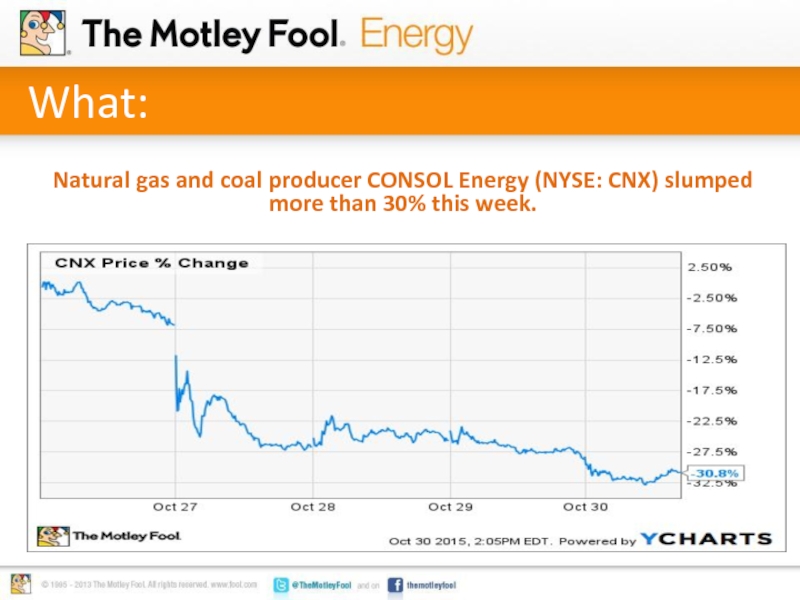

Слайд 6What:

Natural gas and coal producer CONSOL Energy (NYSE: CNX) slumped more

than 30% this week.

Слайд 7So What:

Key driver: CONSOL reported a much wider-than-expected loss of $0.28

per share, missing the consensus estimate by $0.23 per share

CONSOL’s natural gas business struggled amid low gas prices

CONSOL’s natural gas business struggled amid low gas prices

Слайд 8Now What:

The company’s coal business didn’t fare much better, with weak

demand for coal persisting

Key takeaway: With both of its key commodities under pressure, investors had no reason to stick around

Key takeaway: With both of its key commodities under pressure, investors had no reason to stick around

Слайд 10So What:

Key driver: Peabody reported an abysmal quarter, losing $8.13 per

share

On top of that, the company now anticipates an even weaker outlook for the coal market

On top of that, the company now anticipates an even weaker outlook for the coal market

Слайд 11Now What:

Making matters even worse, a rival coal producer terminated its

debt swap deal, likely sending it into bankruptcy

Key takeaway: Investors are beginning to realize that Peabody’s only way out might be through bankruptcy, rendering its stock worthless

Key takeaway: Investors are beginning to realize that Peabody’s only way out might be through bankruptcy, rendering its stock worthless