- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

The Price of Climate Risks - Bob Litterman презентация

Содержание

- 2. Bob Litterman May 2014 The Price of Climate Risk

- 3. Climate Change: Some questions Is climate change

- 4. Stranded Assets GtCO2 Equivalent Carbon budget 2000

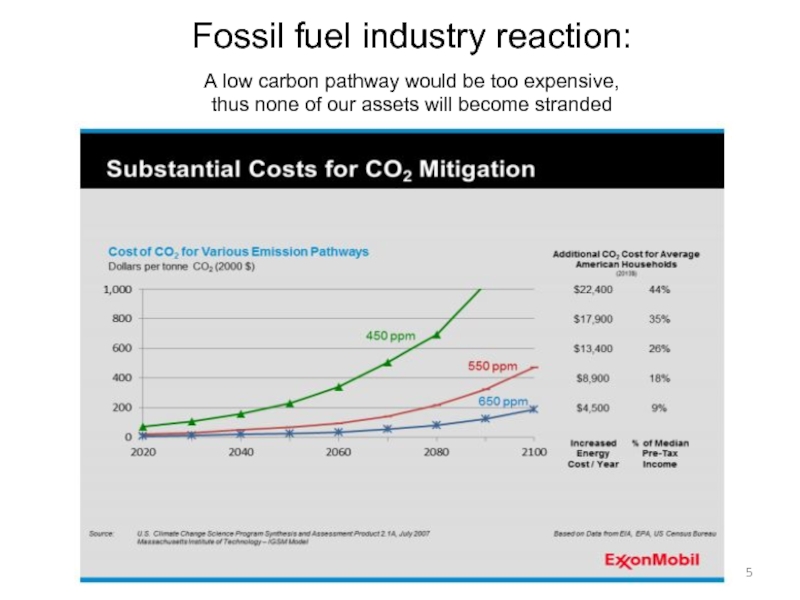

- 5. Fossil fuel industry reaction: A low carbon

- 6. Think about dynamic optimization With Uncertainty, Tipping Points And Nonlinear Responses

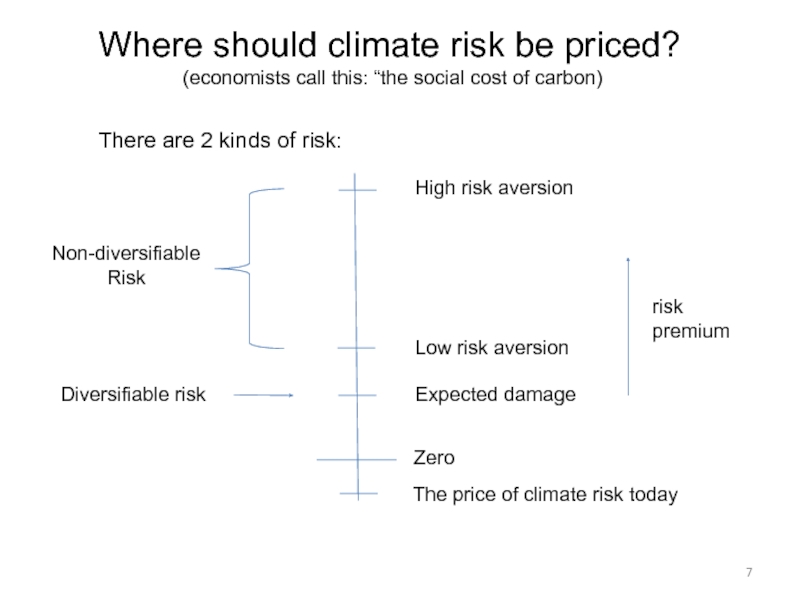

- 7. Where should climate risk be priced? (economists

- 8. The Equity Risk Premium US Historical

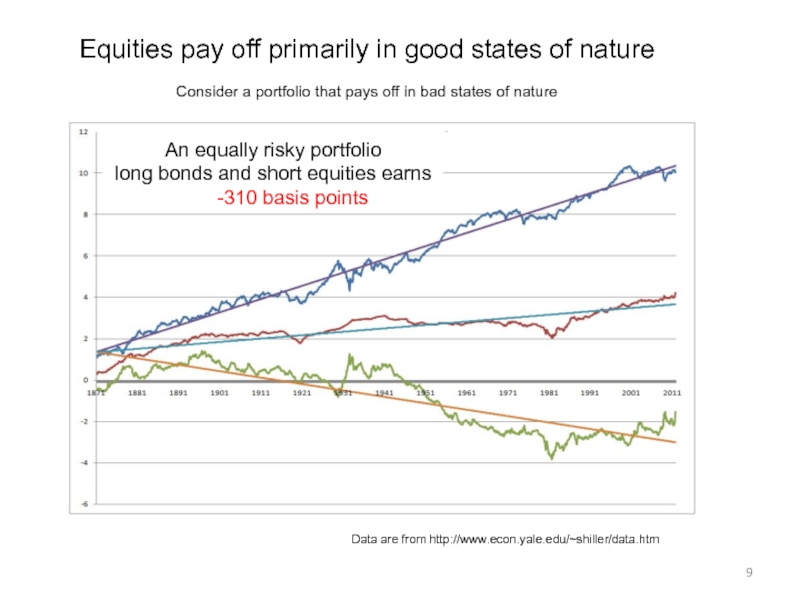

- 9. Equities pay off primarily in good states

- 10. What does the Equity Risk Premium have

- 11. Economic impacts depend on future temperatures which are very uncertain Science: 25 March 2012

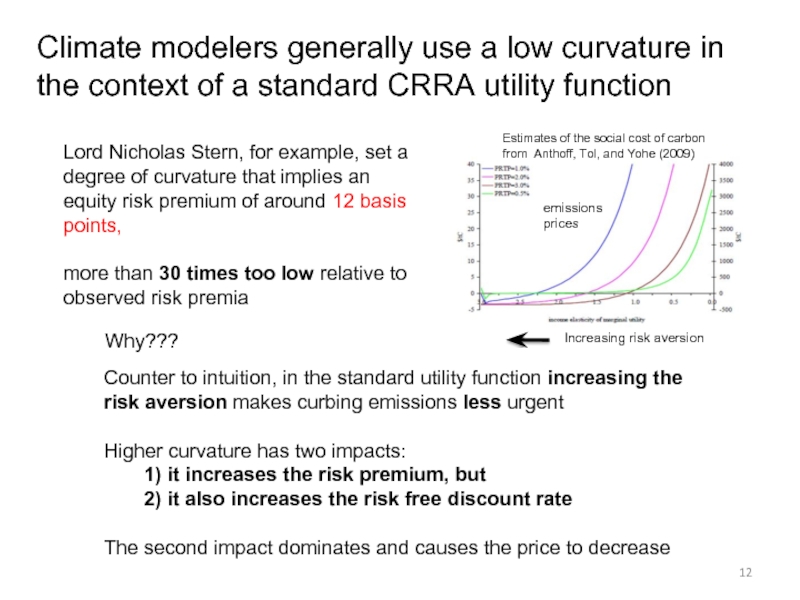

- 12. Climate modelers generally use a low curvature

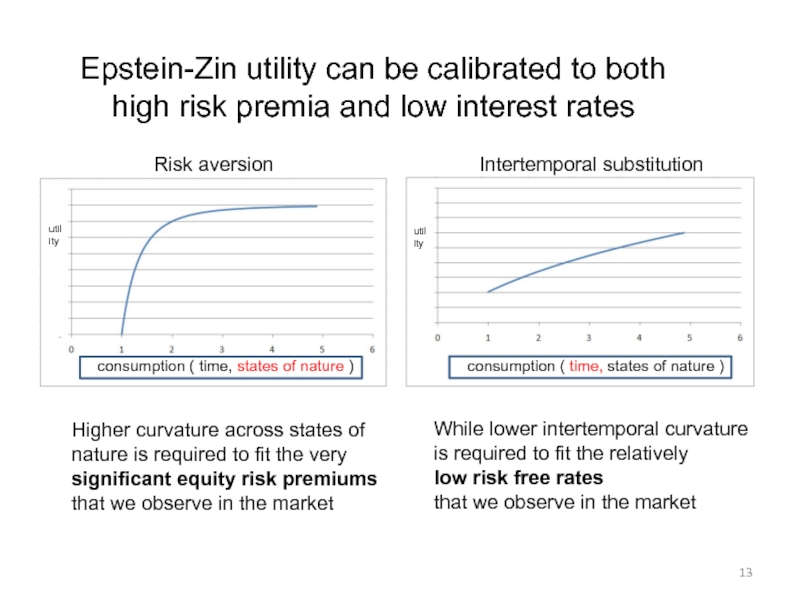

- 13. Higher curvature across states of nature

- 14. The rigidity of standard utility functions explains

- 15. The Appropriate Price for Carbon Emissions

- 16. One cost of delay is higher future

- 17. Higher societal risk aversion shifts the appropriate

- 18. Investors have exposure to emissions price risk

- 19. “Stranded assets” (any asset whose value

- 20. Stranded Assets Total Return Swap WWF Deutsche

- 21. Stranded Assets Total Return Swap Negative correlation

- 22. Governance example: Aviation Aviation has promised:

- 23. Questions?

Слайд 3Climate Change: Some questions

Is climate change real?

Is uncertainty about climate change

Is a devastating natural disaster outside the realm of possibility?

When, where, or how might a global catastrophe occur?

Does it matter how much carbon dioxide we put into the atmosphere?

Should adding emissions to the atmosphere be priced appropriately?

What is the appropriate price for emissions?

Слайд 4Stranded Assets

GtCO2 Equivalent

Carbon budget 2000 - 2050

Carbon used 2000 - 2010

Remaining

Coal

Coal +

Oil

Coal +

Oil + Gas

Proven Reserves

Stranded assets 2230

Source: Carbon Tracker Initiative

Слайд 5Fossil fuel industry reaction:

A low carbon pathway would be too expensive,

thus

Слайд 7Where should climate risk be priced?

(economists call this: “the social cost

There are 2 kinds of risk:

High risk aversion

Low risk aversion

Zero

The price of climate risk today

Non-diversifiable

Risk

Diversifiable risk

Expected damage

risk

premium

Слайд 8The Equity Risk Premium

US Historical Real Returns

Data are from http://www.econ.yale.edu/~shiller/data.htm

ERP

Stock real return = 6.4%

Bond real return = 1.6%

A consistent 475 basis points per year for the last 140 years

Слайд 9Equities pay off primarily in good states of nature

Consider a portfolio

Data are from http://www.econ.yale.edu/~shiller/data.htm

An equally risky portfolio

long bonds and short equities earns

-310 basis points

Слайд 10What does the Equity Risk Premium have

to do with Pricing Climate

Pricing carbon emissions is a risk management problem involving trade-offs between consumption today and potential bad outcomes in the distant future

This trade-off depends crucially on the degree of societal risk aversion

Societal risk aversion can be calibrated to the equity risk premium

Слайд 11Economic impacts depend on future

temperatures which are very uncertain

Science: 25 March

Слайд 12Climate modelers generally use a low curvature in the context of

Counter to intuition, in the standard utility function increasing the risk aversion makes curbing emissions less urgent

Higher curvature has two impacts:

1) it increases the risk premium, but

2) it also increases the risk free discount rate

The second impact dominates and causes the price to decrease

Lord Nicholas Stern, for example, set a degree of curvature that implies an equity risk premium of around 12 basis points,

more than 30 times too low relative to observed risk premia

Estimates of the social cost of carbon

from Anthoff, Tol, and Yohe (2009)

emissions

prices

Increasing risk aversion

Why???

Слайд 13Higher curvature across states of

nature is required to fit the

significant equity risk premiums

that we observe in the market

While lower intertemporal curvature

is required to fit the relatively

low risk free rates

that we observe in the market

Risk aversion

Intertemporal substitution

Epstein-Zin utility can be calibrated to both

high risk premia and low interest rates

consumption ( time, states of nature )

consumption ( time, states of nature )

utility

utility

Слайд 14The rigidity of standard utility functions explains why in most climate

risk aversion lowers the price of emissions

Слайд 15The Appropriate Price for Carbon Emissions

Is Part of an Optimal

The Appropriate Price

Trades off current consumption against future damages

Recognizes unknown impacts, and the potential for time compression and catastrophic outcomes

Builds in a margin of safety

Anticipates risk reduction over time

Higher Risk Aversion

Increases the risk premium

Lowers the discount rate for future damages

Raises the price today and potentially lowers the expected future price

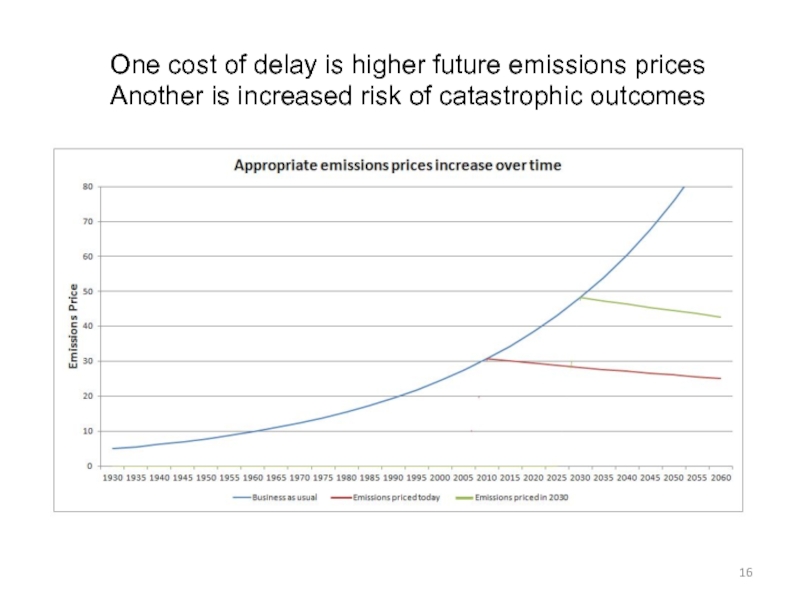

Слайд 16One cost of delay is higher future emissions prices

Another is increased

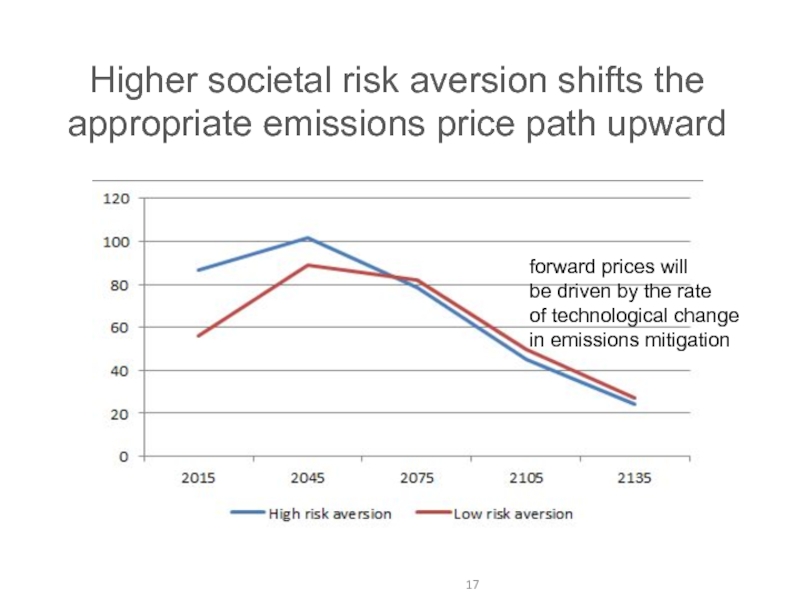

Слайд 17Higher societal risk aversion shifts the appropriate emissions price path upward

forward prices will

be driven by the rate

of technological change

in emissions mitigation

Слайд 18Investors have exposure to emissions price risk

Portfolio construction

Tilt away from stranded

Governance

Appropriate, transparent business plan assumptions about future emissions prices

Markets

Hedging requires a forward market in emissions prices

This recognition has implications for:

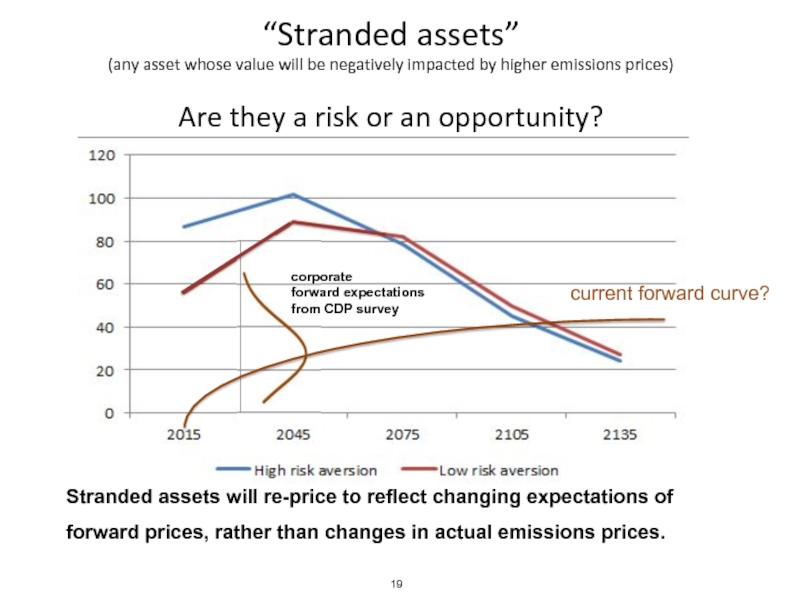

Слайд 19“Stranded assets”

(any asset whose value will be negatively impacted by

Are they a risk or an opportunity?

Stranded assets will re-price to reflect changing expectations of forward prices, rather than changes in actual emissions prices.

corporate

forward expectations

from CDP survey

current forward curve?

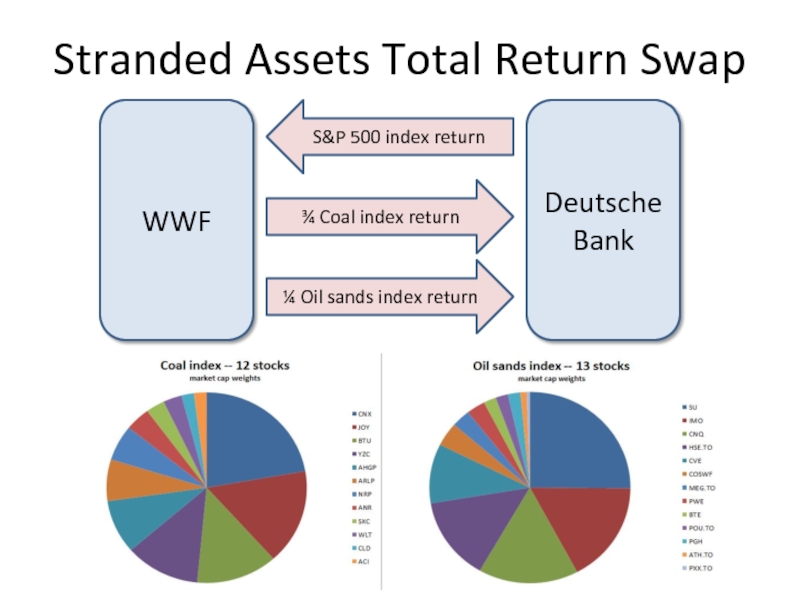

Слайд 20Stranded Assets Total Return Swap

WWF

Deutsche

Bank

¾ Coal index return

¼ Oil sands index

S&P 500 index return

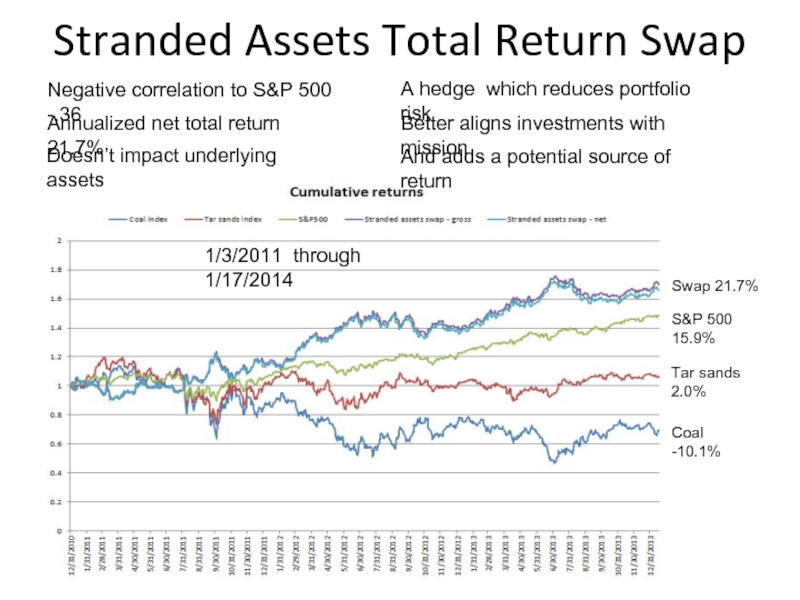

Слайд 21Stranded Assets Total Return Swap

Negative correlation to S&P 500 -.36

Annualized

1/3/2011 through 1/17/2014

Swap 21.7%

S&P 500 15.9%

Tar sands 2.0%

Coal -10.1%

A hedge which reduces portfolio risk

And adds a potential source of return

Better aligns investments with mission

Doesn’t impact underlying assets

Слайд 22Governance example: Aviation

Aviation has promised:

a “market-based measure” to reduce emissions

but

Aviation will need capacity to create emissions

requires high energy content of liquid fuel for takeoff and ascent

atmosphere’s capacity to safely absorb emissions is limited

thus aviation has a special incentive to lead on this issue

Owners of aviation shares have an important role to play

management often focuses too much on short term profits

long-term owners have longer term priorities, such as creating appropriate global incentives to reduce emissions