- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

4 High-Yielding Alternative Energy Investments презентация

Содержание

- 1. 4 High-Yielding Alternative Energy Investments

- 2. Pattern Energy Group Inc Sponsor: Pattern Energy

- 3. Wind Energy Portfolio 11 projects in 7

- 4. Near Term Growth Catalyst Pattern Energy Group

- 5. Long-Term Growth Catalyst Pattern Energy has 3

- 6. Risks Conversion of class B shares in

- 7. Pattern Energy Group Inc Bottom Line Strong

- 8. NextEra Energy NextEra Energy, one of the

- 9. NextEra Energy Partners: Strong Sponsor=strong growth NextEra

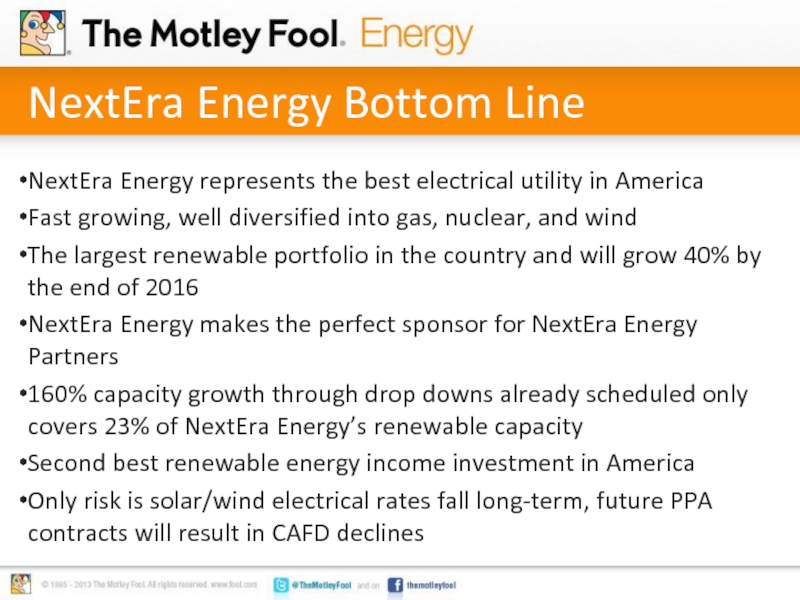

- 10. NextEra Energy Bottom Line NextEra Energy represents

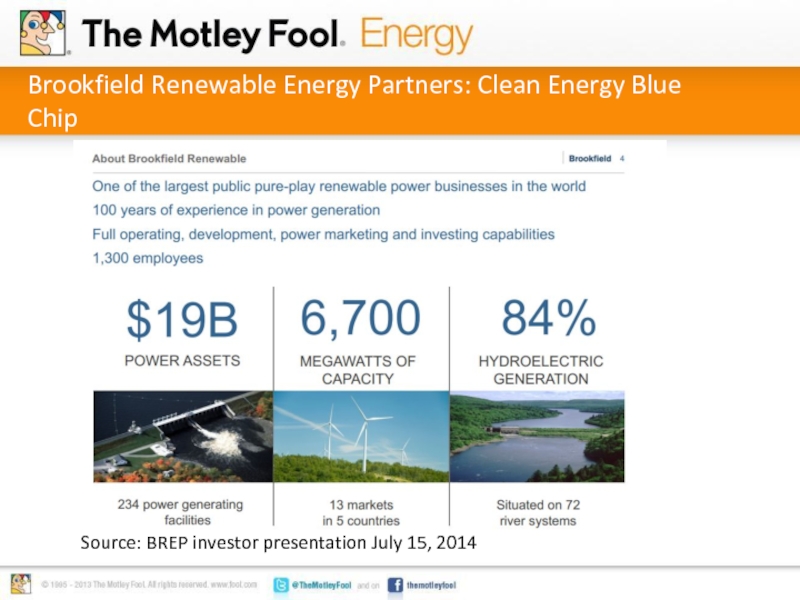

- 11. Brookfield Renewable Energy Partners: Clean Energy Blue Chip Source: BREP investor presentation July 15, 2014

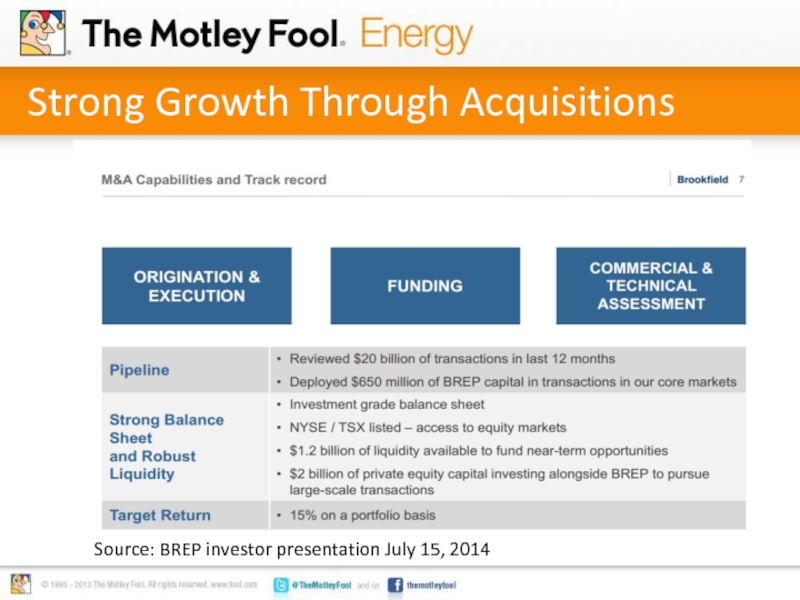

- 12. Strong Growth Through Acquisitions Source: BREP investor presentation July 15, 2014

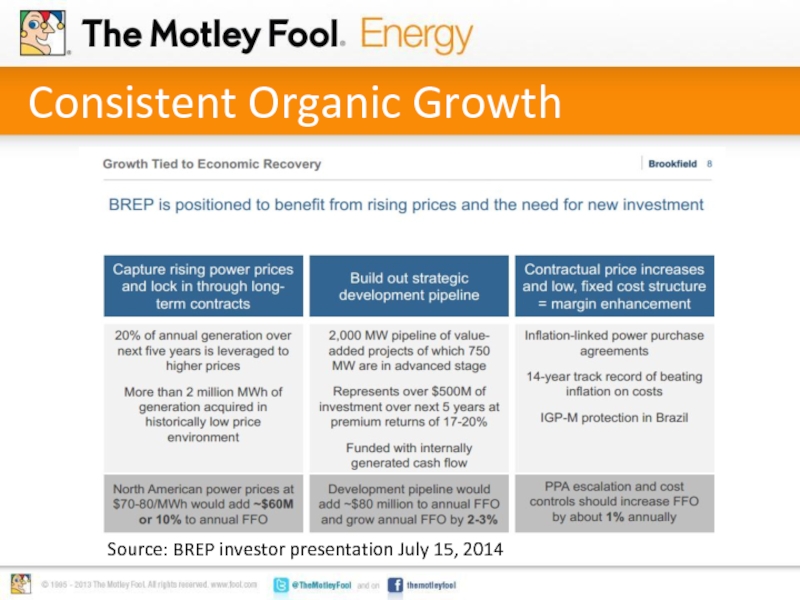

- 13. Consistent Organic Growth Source: BREP investor presentation July 15, 2014

- 14. International Diversification of Hydro, Solar, and Wind

- 15. Highest, Safest, Most Reliable Yield in Renewable

- 16. Brookfield Renewable Energy Partners Bottom Line Best

- 17. The Future Of Renewable Energy Income Investing

- 18. Try our FREE report on the top income stocks in the energy sector.

Слайд 2Pattern Energy Group Inc

Sponsor: Pattern Energy Group LP, established by Riverstone,

a private equity firm that runs the world’s largest renewable energy fund

Has constructed, managed 3 GW of wind power since 2003

Management: CEO Mike Garland, 25 years experience financing, building energy infrastructure projects

Ran Babcock & Brown's North American Infrastructure Group, grew it to $12 billion in assets under management in just 5 years

Has constructed, managed 3 GW of wind power since 2003

Management: CEO Mike Garland, 25 years experience financing, building energy infrastructure projects

Ran Babcock & Brown's North American Infrastructure Group, grew it to $12 billion in assets under management in just 5 years

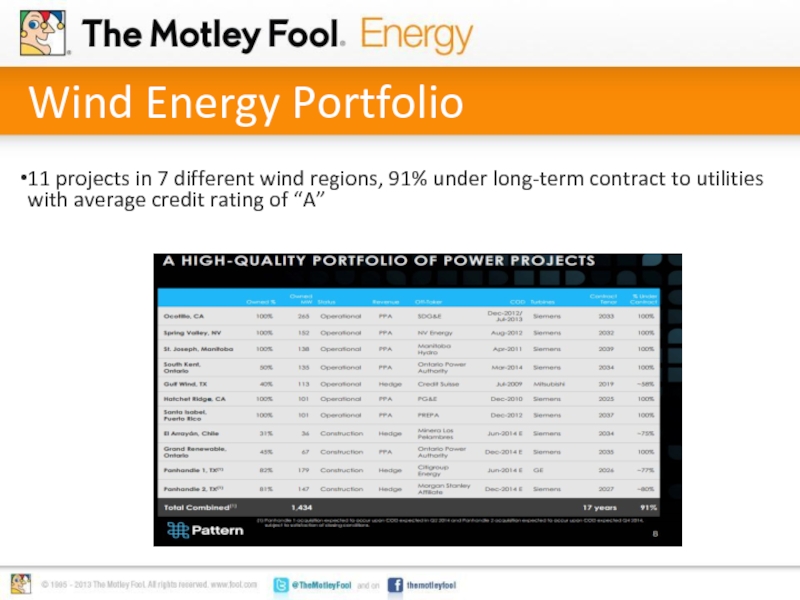

Слайд 3Wind Energy Portfolio

11 projects in 7 different wind regions, 91% under

long-term contract to utilities with average credit rating of “A”

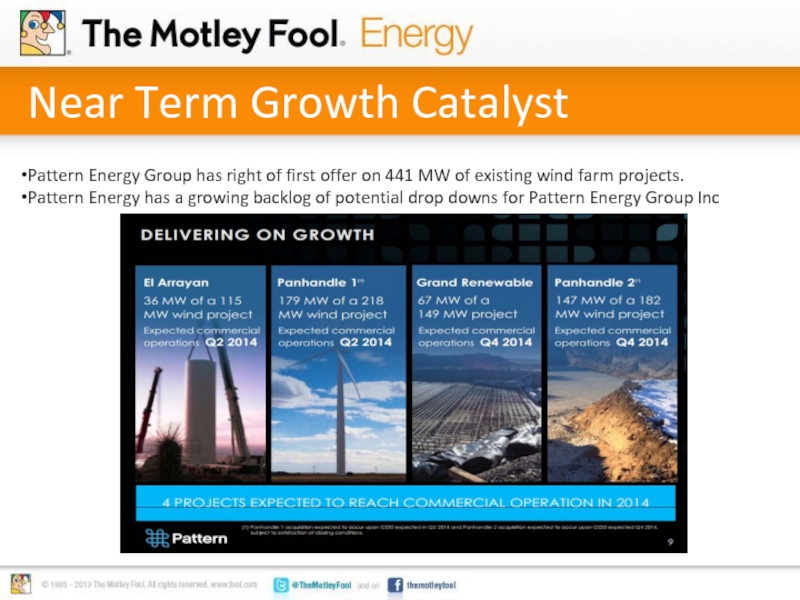

Слайд 4Near Term Growth Catalyst

Pattern Energy Group has right of first offer

on 441 MW of existing wind farm projects.

Pattern Energy has a growing backlog of potential drop downs for Pattern Energy Group Inc

Pattern Energy has a growing backlog of potential drop downs for Pattern Energy Group Inc

Слайд 5Long-Term Growth Catalyst

Pattern Energy has 3 GW of projects in its

pipeline

International diversification into Caribbean and Chile

Potentially longer contracts, 185 MW project to be completed 2016 has 25 year PPA

International diversification into Caribbean and Chile

Potentially longer contracts, 185 MW project to be completed 2016 has 25 year PPA

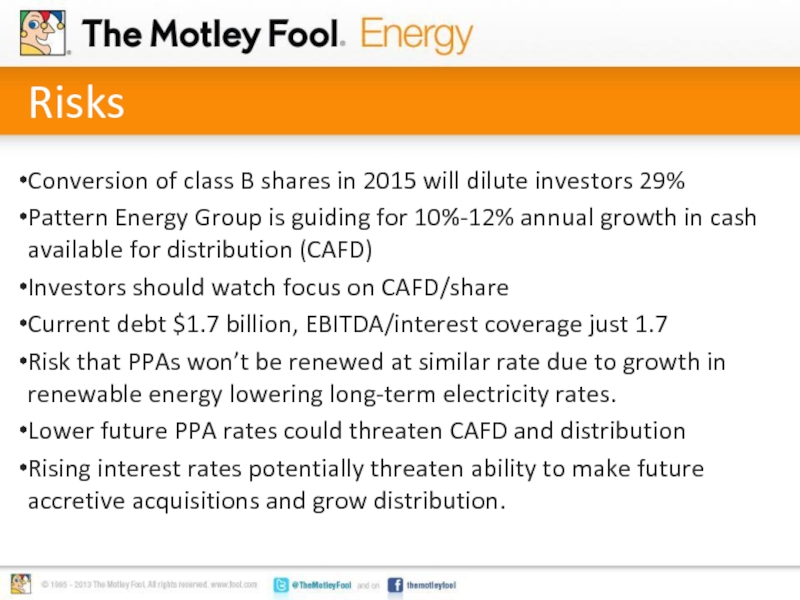

Слайд 6Risks

Conversion of class B shares in 2015 will dilute investors 29%

Pattern

Energy Group is guiding for 10%-12% annual growth in cash available for distribution (CAFD)

Investors should watch focus on CAFD/share

Current debt $1.7 billion, EBITDA/interest coverage just 1.7

Risk that PPAs won’t be renewed at similar rate due to growth in renewable energy lowering long-term electricity rates.

Lower future PPA rates could threaten CAFD and distribution

Rising interest rates potentially threaten ability to make future accretive acquisitions and grow distribution.

Investors should watch focus on CAFD/share

Current debt $1.7 billion, EBITDA/interest coverage just 1.7

Risk that PPAs won’t be renewed at similar rate due to growth in renewable energy lowering long-term electricity rates.

Lower future PPA rates could threaten CAFD and distribution

Rising interest rates potentially threaten ability to make future accretive acquisitions and grow distribution.

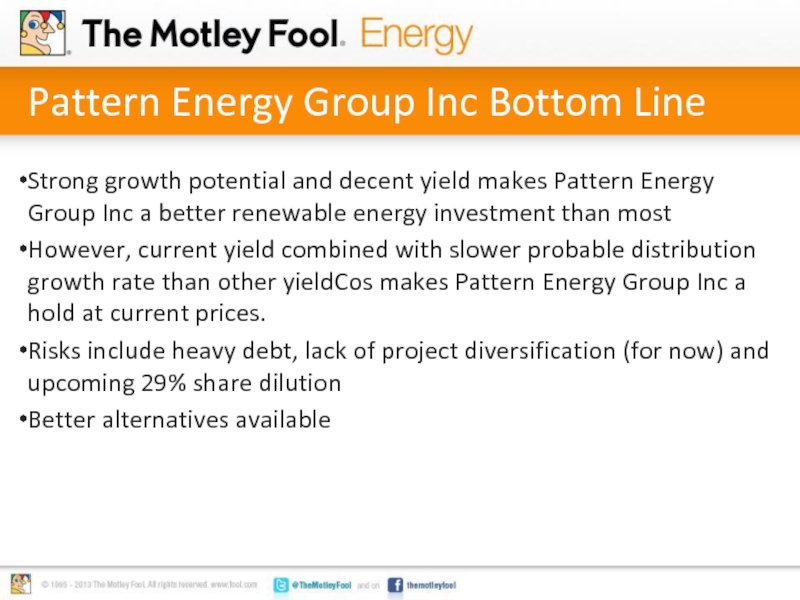

Слайд 7Pattern Energy Group Inc Bottom Line

Strong growth potential and decent yield

makes Pattern Energy Group Inc a better renewable energy investment than most

However, current yield combined with slower probable distribution growth rate than other yieldCos makes Pattern Energy Group Inc a hold at current prices.

Risks include heavy debt, lack of project diversification (for now) and upcoming 29% share dilution

Better alternatives available

However, current yield combined with slower probable distribution growth rate than other yieldCos makes Pattern Energy Group Inc a hold at current prices.

Risks include heavy debt, lack of project diversification (for now) and upcoming 29% share dilution

Better alternatives available

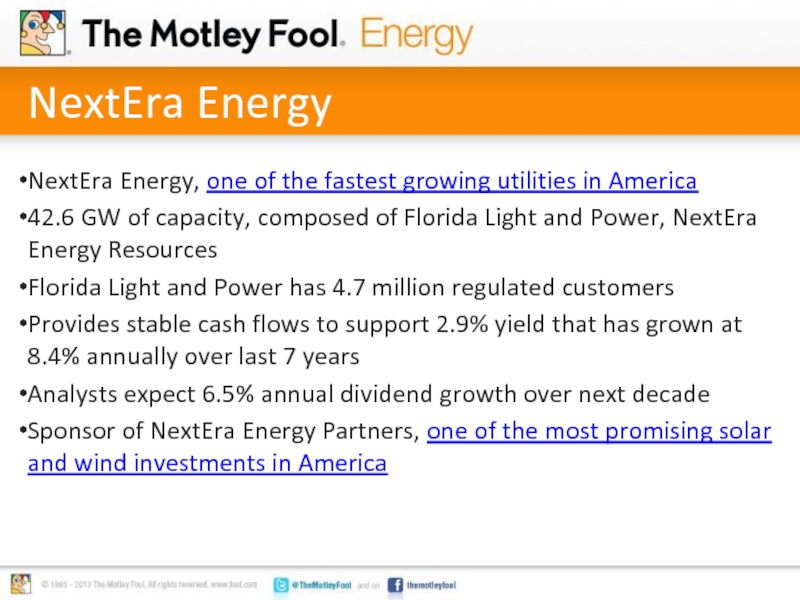

Слайд 8NextEra Energy

NextEra Energy, one of the fastest growing utilities in America

42.6

GW of capacity, composed of Florida Light and Power, NextEra Energy Resources

Florida Light and Power has 4.7 million regulated customers

Provides stable cash flows to support 2.9% yield that has grown at 8.4% annually over last 7 years

Analysts expect 6.5% annual dividend growth over next decade

Sponsor of NextEra Energy Partners, one of the most promising solar and wind investments in America

Florida Light and Power has 4.7 million regulated customers

Provides stable cash flows to support 2.9% yield that has grown at 8.4% annually over last 7 years

Analysts expect 6.5% annual dividend growth over next decade

Sponsor of NextEra Energy Partners, one of the most promising solar and wind investments in America

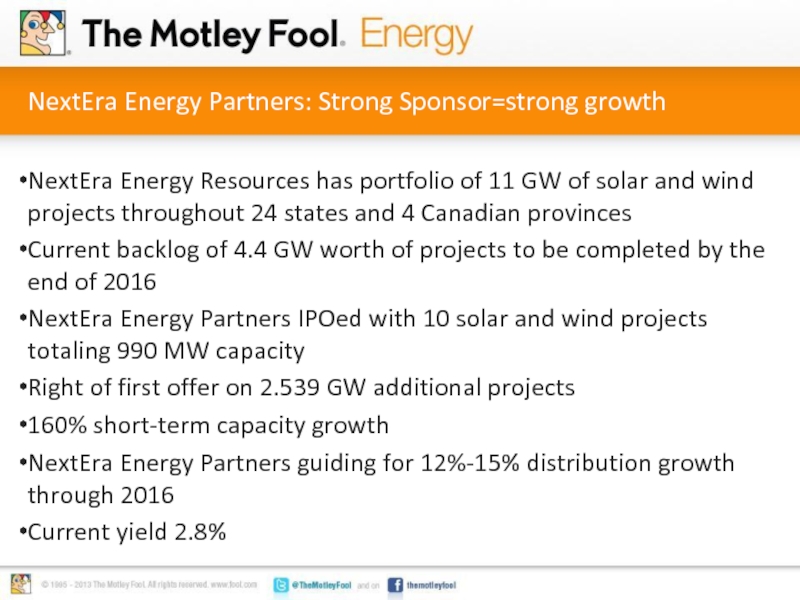

Слайд 9NextEra Energy Partners: Strong Sponsor=strong growth

NextEra Energy Resources has portfolio of

11 GW of solar and wind projects throughout 24 states and 4 Canadian provinces

Current backlog of 4.4 GW worth of projects to be completed by the end of 2016

NextEra Energy Partners IPOed with 10 solar and wind projects totaling 990 MW capacity

Right of first offer on 2.539 GW additional projects

160% short-term capacity growth

NextEra Energy Partners guiding for 12%-15% distribution growth through 2016

Current yield 2.8%

Current backlog of 4.4 GW worth of projects to be completed by the end of 2016

NextEra Energy Partners IPOed with 10 solar and wind projects totaling 990 MW capacity

Right of first offer on 2.539 GW additional projects

160% short-term capacity growth

NextEra Energy Partners guiding for 12%-15% distribution growth through 2016

Current yield 2.8%

Слайд 10NextEra Energy Bottom Line

NextEra Energy represents the best electrical utility in

America

Fast growing, well diversified into gas, nuclear, and wind

The largest renewable portfolio in the country and will grow 40% by the end of 2016

NextEra Energy makes the perfect sponsor for NextEra Energy Partners

160% capacity growth through drop downs already scheduled only covers 23% of NextEra Energy’s renewable capacity

Second best renewable energy income investment in America

Only risk is solar/wind electrical rates fall long-term, future PPA contracts will result in CAFD declines

Fast growing, well diversified into gas, nuclear, and wind

The largest renewable portfolio in the country and will grow 40% by the end of 2016

NextEra Energy makes the perfect sponsor for NextEra Energy Partners

160% capacity growth through drop downs already scheduled only covers 23% of NextEra Energy’s renewable capacity

Second best renewable energy income investment in America

Only risk is solar/wind electrical rates fall long-term, future PPA contracts will result in CAFD declines

Слайд 11Brookfield Renewable Energy Partners: Clean Energy Blue Chip

Source: BREP investor presentation

July 15, 2014

Слайд 14International Diversification of Hydro, Solar, and Wind Power

30% capacity growth

through project backlog

Targeting North America, Europe, and South America

84% of cash flows from Hydro power, solar and wind major growth catalysts

93% of cash flows contracted to inflation indexed PPAs, weighted average length remaining 17 years

Unlike solar and wind, who have inherent PPA risk (falling rates results in future contracts locked in at far lower prices) Hydro has limited supply and steadier long-term prices.

Highest (5.3%), safest, (60%-70% payout ratio) and most reliable yield makes Brookfield Renewable Energy Partners the best renewable energy income investment in America.

Targeting North America, Europe, and South America

84% of cash flows from Hydro power, solar and wind major growth catalysts

93% of cash flows contracted to inflation indexed PPAs, weighted average length remaining 17 years

Unlike solar and wind, who have inherent PPA risk (falling rates results in future contracts locked in at far lower prices) Hydro has limited supply and steadier long-term prices.

Highest (5.3%), safest, (60%-70% payout ratio) and most reliable yield makes Brookfield Renewable Energy Partners the best renewable energy income investment in America.

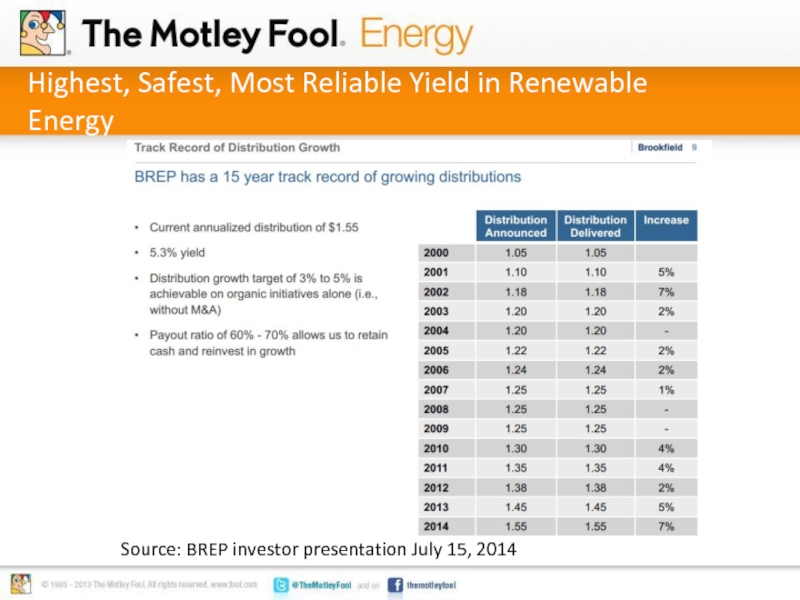

Слайд 15Highest, Safest, Most Reliable Yield in Renewable Energy

Source: BREP investor presentation

July 15, 2014

Слайд 16Brookfield Renewable Energy Partners Bottom Line

Best managed renewable energy income investment

in America

Brookfield Asset Management, over 100 years experience managing real estate, utilities. and infrastructure

$175 billion under management

Largest, most diversified asset base in its industry

High yield, consistent 5% distribution growth and average distribution coverage ratio of 1.53 makes Brookfield Renewable Energy Partners a “buy and hold forever” investment.

Long-term total return target 10% (5% yield+5% distribution growth) vs market’s 1873-2013 compound annual total return of 9.2%

Market beating total returns with 57% less volatility (beta .43)

Brookfield Asset Management, over 100 years experience managing real estate, utilities. and infrastructure

$175 billion under management

Largest, most diversified asset base in its industry

High yield, consistent 5% distribution growth and average distribution coverage ratio of 1.53 makes Brookfield Renewable Energy Partners a “buy and hold forever” investment.

Long-term total return target 10% (5% yield+5% distribution growth) vs market’s 1873-2013 compound annual total return of 9.2%

Market beating total returns with 57% less volatility (beta .43)

Слайд 17The Future Of Renewable Energy Income Investing is Bright

Boom in renewable

energy is causing more capacity builders to retain projects and consider yieldCos

Especially true in Solar industry

SunEdison has IPOed TerraForm Power

SunPower has retained 517 MW of solar projects and is considering a yieldCo to help finance additional growth

First Solar, Jinko Solar, and Canadian Solar all considering yieldCos

Pure Solar yieldCos are higher risk than wind, hydro or hybrid structured yieldCos.

Especially true in Solar industry

SunEdison has IPOed TerraForm Power

SunPower has retained 517 MW of solar projects and is considering a yieldCo to help finance additional growth

First Solar, Jinko Solar, and Canadian Solar all considering yieldCos

Pure Solar yieldCos are higher risk than wind, hydro or hybrid structured yieldCos.