- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Banking on Big Data: Harnessing Big Data to drive valuable BigDecisions презентация

Содержание

- 1. Banking on Big Data: Harnessing Big Data to drive valuable BigDecisions

- 2. Key Discussion Points

- 3. Cognizant From internal consulting unit to a

- 4. Emergence of Big Data and Analytics Increasing

- 5. Big Data and Analytics drive business value

- 6. Corporate Listening - Voice of our customers

- 7. Big Data & Analytics can be leveraged

- 8. The Data You Need is Everywhere Around You! Big Data and Analytics Opportunity in Banking

- 9. Big Data and Analytics Opportunity

- 10. Changing Regulatory Environment Financial organisations’ leverage Big

- 11. Risk Management Office (RMO)

- 12. Risk Profiling

- 13. Introducing BigDecisions2.0TM

- 14. BigDecisions2.0 Business Solution Platform Components providing agile

- 15. BigDecisions2.0 Business Solution Platform A new paradigm

- 16. Business App | Risk, Fraud & Compliance

- 17. Representative Experiences Fraud

- 18. In Summary BigDecisions Business

- 19. BigDecisionsTM Business Solution Platform http://www.cognizant.com/enterprise-analytics/big-data Thank You

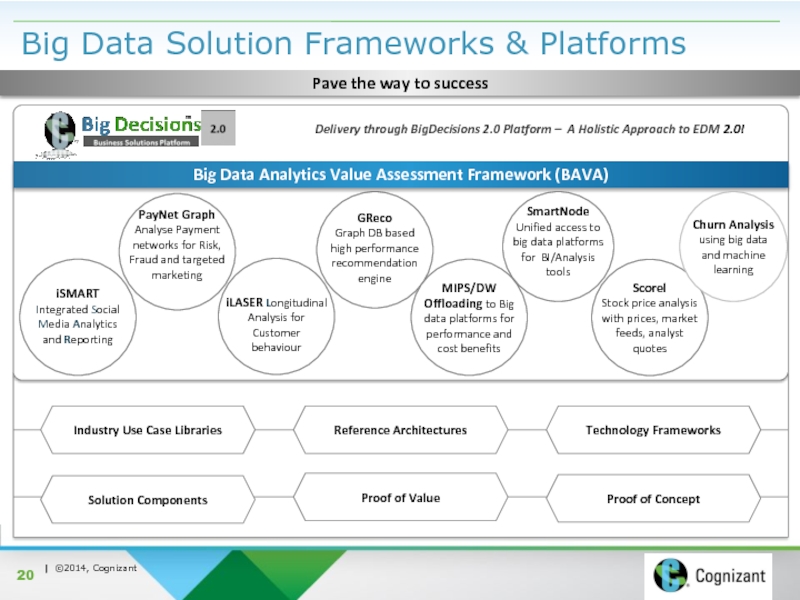

- 20. Big Data Solution Frameworks & Platforms Pave the way to success

Слайд 1Banking on Big Data:

Harnessing Big Data to drive valuable BigDecisions

Ian

Head of Enterprise Information Management

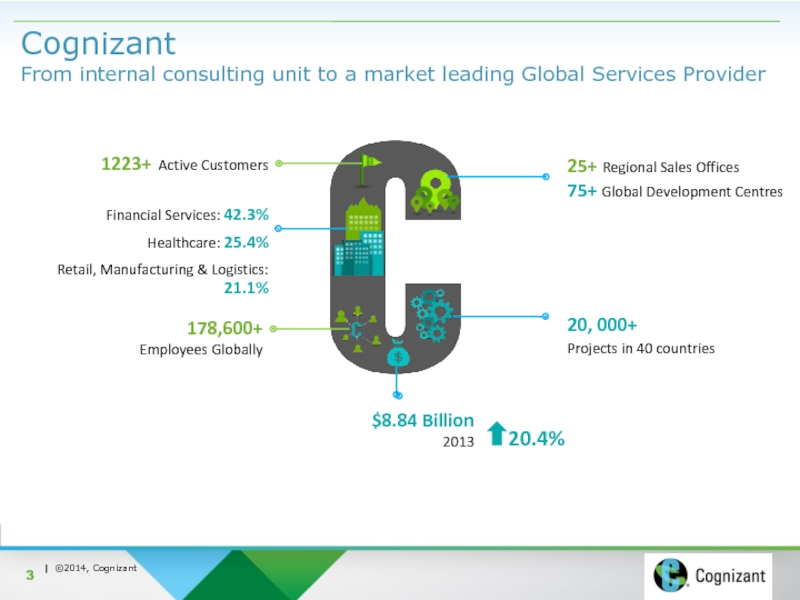

Слайд 3Cognizant

From internal consulting unit to a market leading Global Services Provider

1223+

$8.84 Billion

2013

178,600+

Employees Globally

20, 000+

Projects in 40 countries

25+ Regional Sales Offices

75+ Global Development Centres

Financial Services: 42.3%

Healthcare: 25.4%

Retail, Manufacturing & Logistics: 21.1%

20.4%

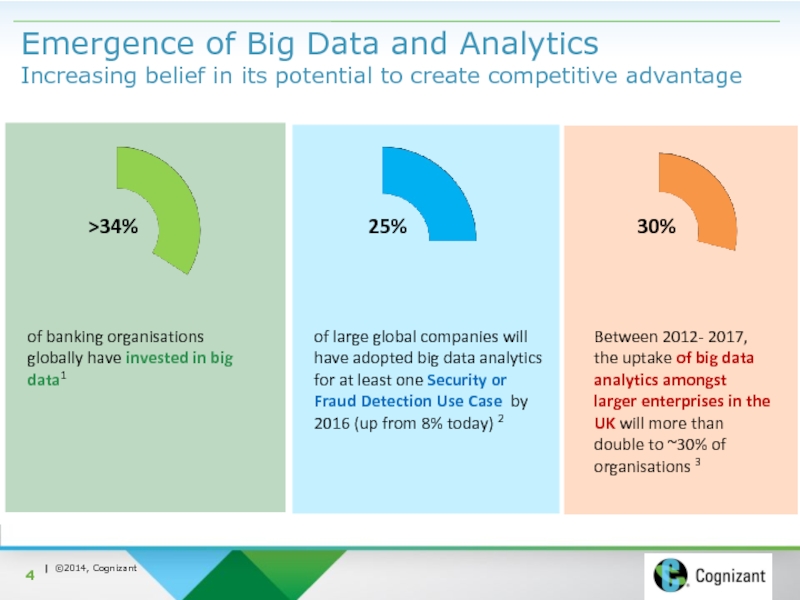

Слайд 4Emergence of Big Data and Analytics Increasing belief in its potential to

of banking organisations globally have invested in big data1

>34%

Between 2012- 2017, the uptake of big data analytics amongst

larger enterprises in the UK will more than double to ~30% of organisations 3

30%

of large global companies will have adopted big data analytics for at least one Security or Fraud Detection Use Case by 2016 (up from 8% today) 2

25%

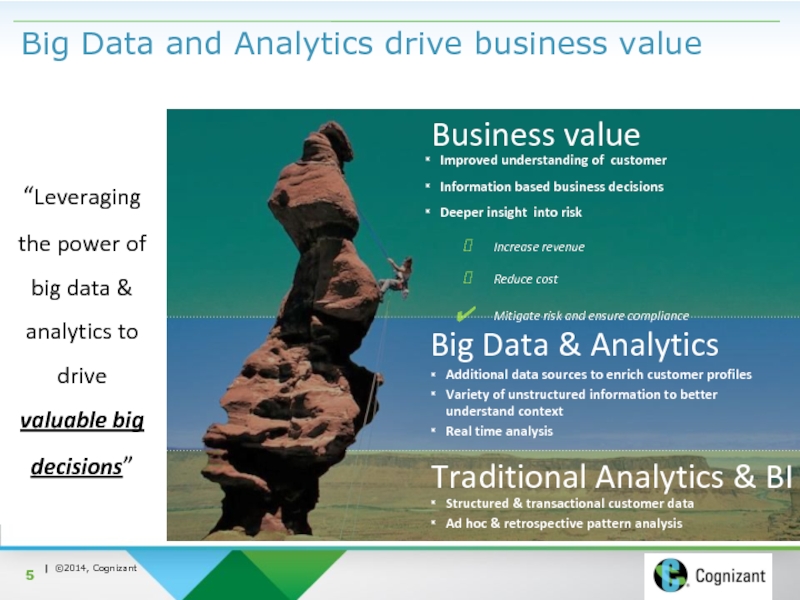

Слайд 5Big Data and Analytics drive business value

“Leveraging the power of big

Business value

Big Data & Analytics

Traditional Analytics & BI

Improved understanding of customer

Information based business decisions

Deeper insight into risk

Increase revenue

Reduce cost

Mitigate risk and ensure compliance

Additional data sources to enrich customer profiles

Variety of unstructured information to better understand context

Real time analysis

Structured & transactional customer data

Ad hoc & retrospective pattern analysis

Слайд 6Corporate Listening - Voice of our customers

Identify the right customer for

Deal with aggressive and innovative non-bank competitors by leveraging data as an asset

Develop new and reliable sources of revenue & increase business value of customer relationship through analytics

Incorporate mobile banking as a regular delivery channel & develop a strategy around social media to personalise engagement with customers

Achieve & monitor regulatory compliance across Line of Businesses and Business Functions

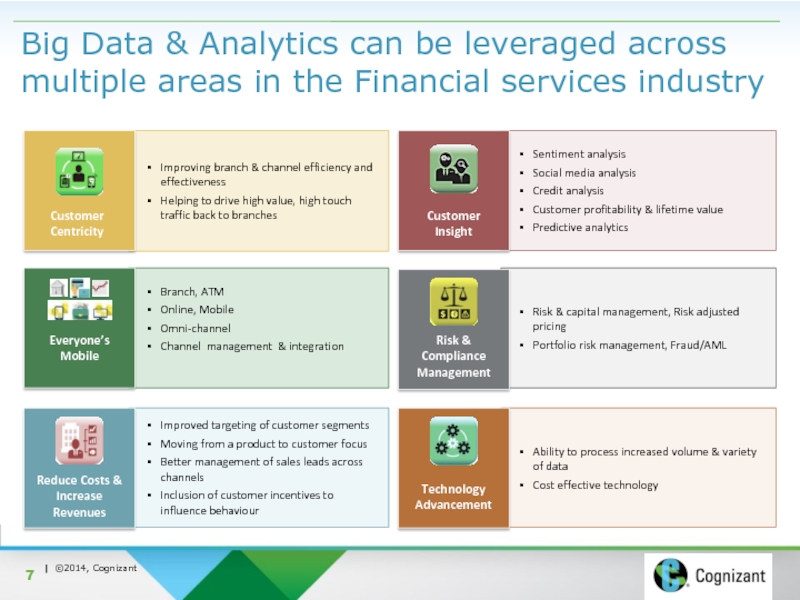

Слайд 7Big Data & Analytics can be leveraged across multiple areas in

Improving branch & channel efficiency and effectiveness

Helping to drive high value, high touch traffic back to branches

Customer

Centricity

Improved targeting of customer segments

Moving from a product to customer focus

Better management of sales leads across channels

Inclusion of customer incentives to influence behaviour

Reduce Costs &

Increase Revenues

Branch, ATM

Online, Mobile

Omni-channel

Channel management & integration

Everyone’s Mobile

Sentiment analysis

Social media analysis

Credit analysis

Customer profitability & lifetime value

Predictive analytics

Customer

Insight

Ability to process increased volume & variety of data

Cost effective technology

Technology Advancement

Risk & capital management, Risk adjusted pricing

Portfolio risk management, Fraud/AML

Risk & Compliance Management

Слайд 9

Big Data and Analytics Opportunity in Retail Banking Breaking Siloes and

Example Outcomes

Profile

Contact History

Transaction

Models

Big Data Analytics

Customer View

Integrated Web Intelligence

The Web Visit

What searches?

How did they get you?

Page navigation

Research

What do they look at?

What do they search?

Do they dig deeper?

Purchase Path

Which product?

How far into the process?

What’s looked at during purchase?

Social Media

Verbatim

Blogs

Tweets

Postings

Reviews

Internal Text Data

Research

Verbatim

Ad-hoc

Longitudinal studies

NPS/Satisfaction

Other Direct Contact

Branch interview Records

Branch Enquiries

Manger Notes

E-Mails

Call Center

Queries

Complaints

Service issues

Micro-segmentation

Higher Quality Leads

Better Fraud Detection

More accurate Propensity Models

Multi-channel Customer Sentiment

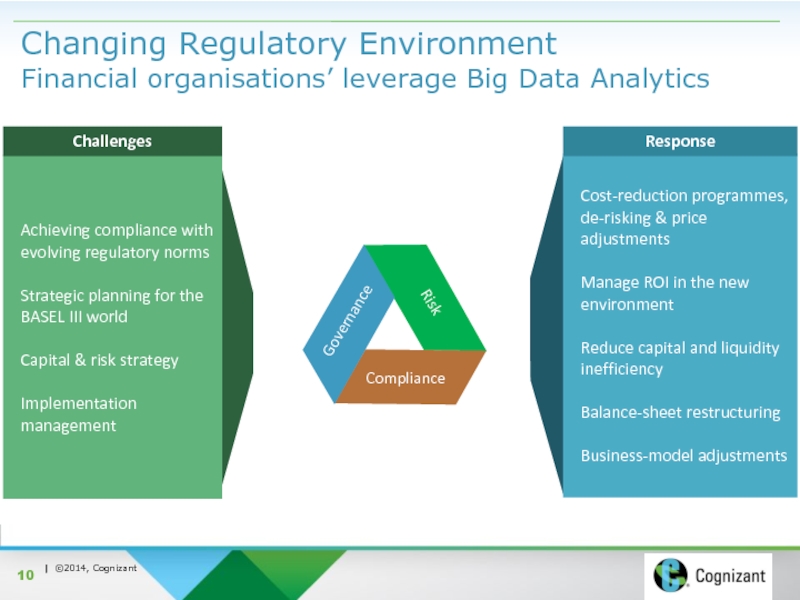

Слайд 10Changing Regulatory Environment

Financial organisations’ leverage Big Data Analytics

Cost-reduction programmes, de-risking &

Manage ROI in the new environment

Reduce capital and liquidity inefficiency

Balance-sheet restructuring

Business-model adjustments

Achieving compliance with evolving regulatory norms

Strategic planning for the BASEL III world

Capital & risk strategy

Implementation management

Challenges

Response

Слайд 11Risk Management Office (RMO)

RMO - One stop shop for risk

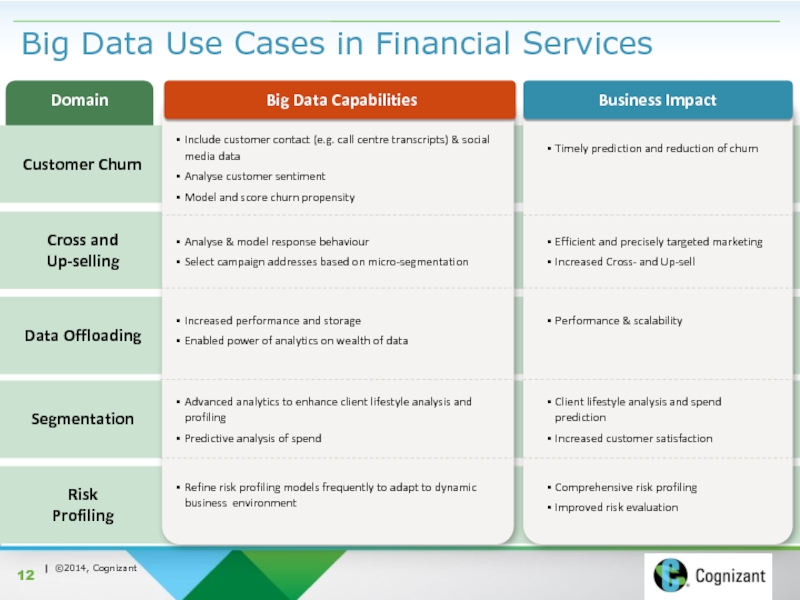

Слайд 12

Risk

Profiling

Big Data Use Cases in Financial Services

Business Impact

Big Data Capabilities

Customer

Timely prediction and reduction of churn

Include customer contact (e.g. call centre transcripts) & social media data

Analyse customer sentiment

Model and score churn propensity

Cross and

Up-selling

Efficient and precisely targeted marketing

Increased Cross- and Up-sell

Analyse & model response behaviour

Select campaign addresses based on micro-segmentation

Data Offloading

Performance & scalability

Increased performance and storage

Enabled power of analytics on wealth of data

Segmentation

Client lifestyle analysis and spend prediction

Increased customer satisfaction

Advanced analytics to enhance client lifestyle analysis and profiling

Predictive analysis of spend

Domain

Comprehensive risk profiling

Improved risk evaluation

Refine risk profiling models frequently to adapt to dynamic business environment

Слайд 14BigDecisions2.0 Business Solution Platform

Components providing agile delivery through focused business apps

Robust

Acquire, Manage and Use Any-Data

Rapid Value Delivery

Flexible, Agile & Economical

Relevant Business Apps

Intuitive, Focused and Bite-size BI & Analytics

Слайд 15BigDecisions2.0 Business Solution Platform A new paradigm for seamless, end-to-end information management

Sophisticated BI & Analytics

Leverage Universal Data

Select proven Technologies

Agility for Business Change

Easy to Build and Manage

Spend time on BI & Analytics, where it matters most (not on building infrastructure)

Manage all-structures of data with Universal Data Management

Deliver subject areas in weeks, not in months or years

Faster business value realisation with proven set of technology options

Install, configure & customize, don’t develop

Слайд 16Business App | Risk, Fraud & Compliance

Executive Dashboards around BASEL II/III

Machine-learning modules for fraud detection and to strengthen entry to the real-time analytics market

Predictive analytics and new features to cover areas in risk and governance prediction

Smarter fraud detection capabilities reduce losses and improve recoveries

Direct fulfillment of all CRO needs, providing them with business discovery tools and services

Proactive risk management across LoBs and product lifecycles with stress testing and scenario analysis

RFC Data and Analytics Platform

Flexible systems and processes to accommodate changing regulatory requirement

Holistic risk assessment, fraud detection and compliance application that ensures adherence to constantly changing regulatory requirement

What?

App Features

Benefits

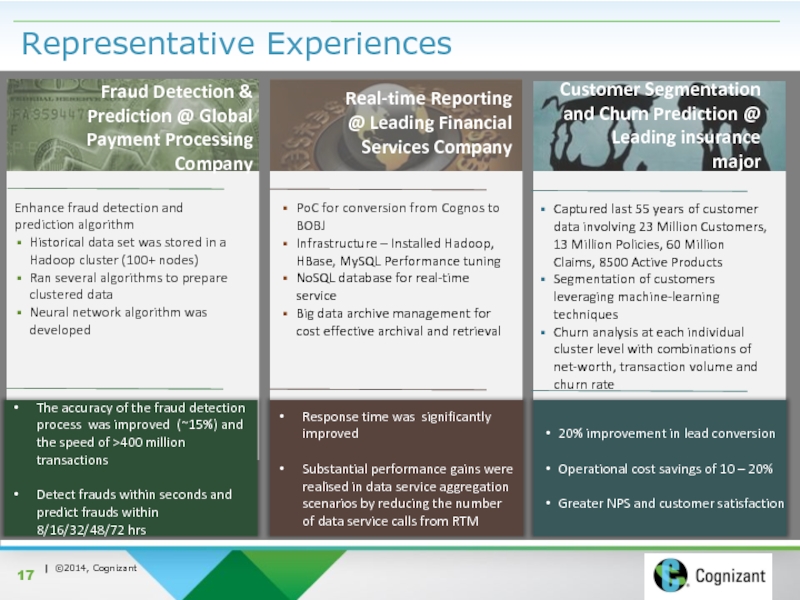

Слайд 17Representative Experiences

Fraud Detection & Prediction @ Global Payment Processing Company

The accuracy

Detect frauds within seconds and predict frauds within 8/16/32/48/72 hrs

Enhance fraud detection and prediction algorithm

Historical data set was stored in a Hadoop cluster (100+ nodes)

Ran several algorithms to prepare clustered data

Neural network algorithm was developed

Real-time Reporting @ Leading Financial Services Company

Response time was significantly improved

Substantial performance gains were realised in data service aggregation scenarios by reducing the number of data service calls from RTM

PoC for conversion from Cognos to BOBJ

Infrastructure – Installed Hadoop, HBase, MySQL Performance tuning

NoSQL database for real-time service

Big data archive management for cost effective archival and retrieval

20% improvement in lead conversion

Operational cost savings of 10 – 20%

Greater NPS and customer satisfaction

Captured last 55 years of customer data involving 23 Million Customers, 13 Million Policies, 60 Million Claims, 8500 Active Products

Segmentation of customers leveraging machine-learning techniques

Churn analysis at each individual cluster level with combinations of net-worth, transaction volume and churn rate

Customer Segmentation and Churn Prediction @ Leading insurance major

Слайд 18In Summary

BigDecisions Business Solution Platform: A platform-based approach to Universal Data

✓

✓

Big Data and Analytics is a key driver in the financial services sector to help businesses run better & run different

✓

Start small, think big. ROI on Big Data and Analytics is often too big to ignore