- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

USA Insider Trading Law: Recent DevelopmentsStephen BainbridgeUCLA School of LawUniversity of Auckland Faculty of Law презентация

Содержание

- 1. USA Insider Trading Law: Recent DevelopmentsStephen BainbridgeUCLA School of LawUniversity of Auckland Faculty of Law

- 2. USA Insider Trading Prosecutions: Early

- 3. Who Regulates Insider Trading?

- 4. Overview of USA Insider Trading Laws

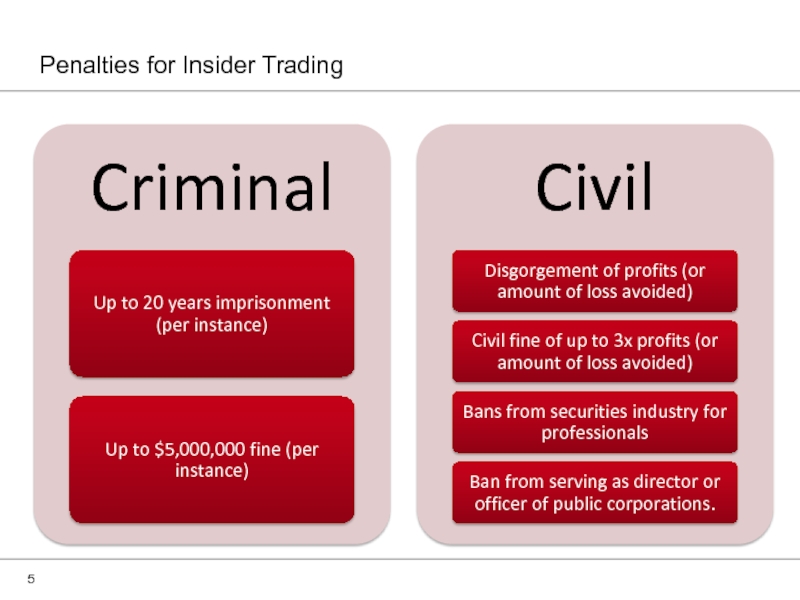

- 5. Penalties for Insider Trading

- 6. Market surveillance techniques: The SEC and all

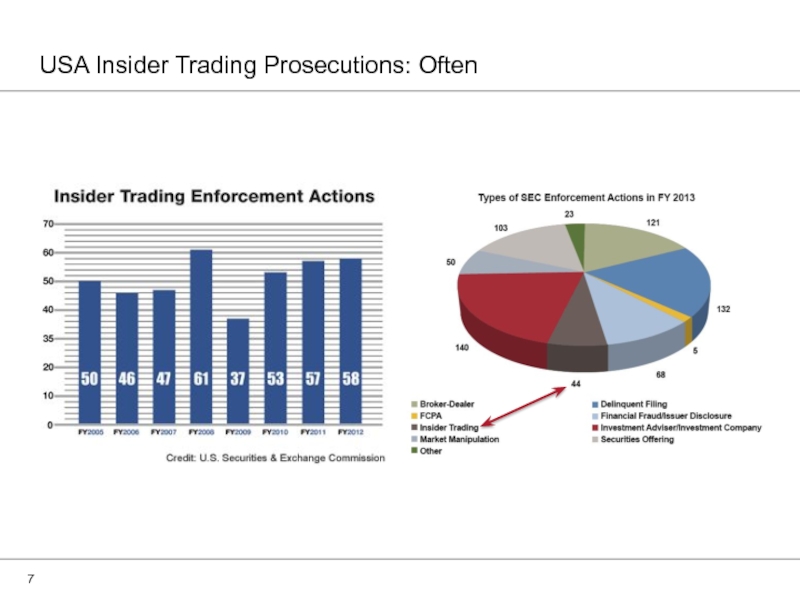

- 7. USA Insider Trading Prosecutions: Often

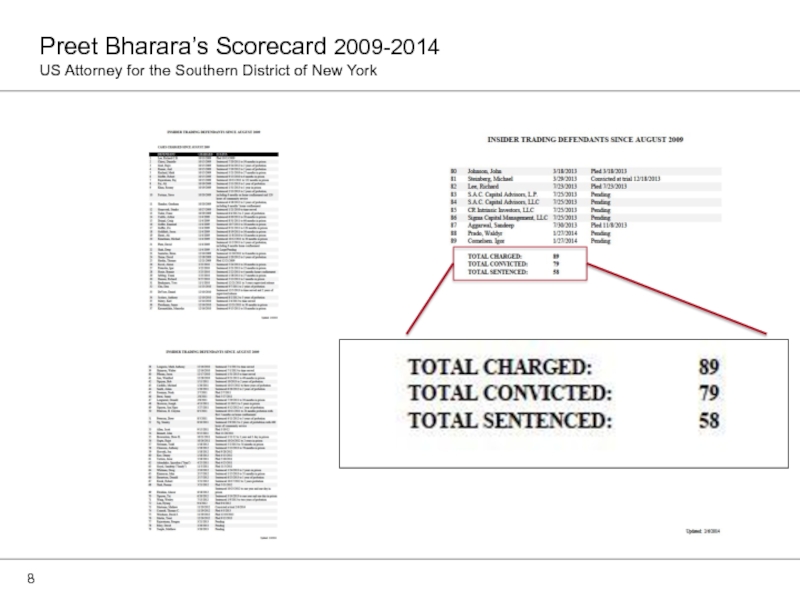

- 8. Preet Bharara’s Scorecard 2009-2014 US Attorney for the Southern District of New York

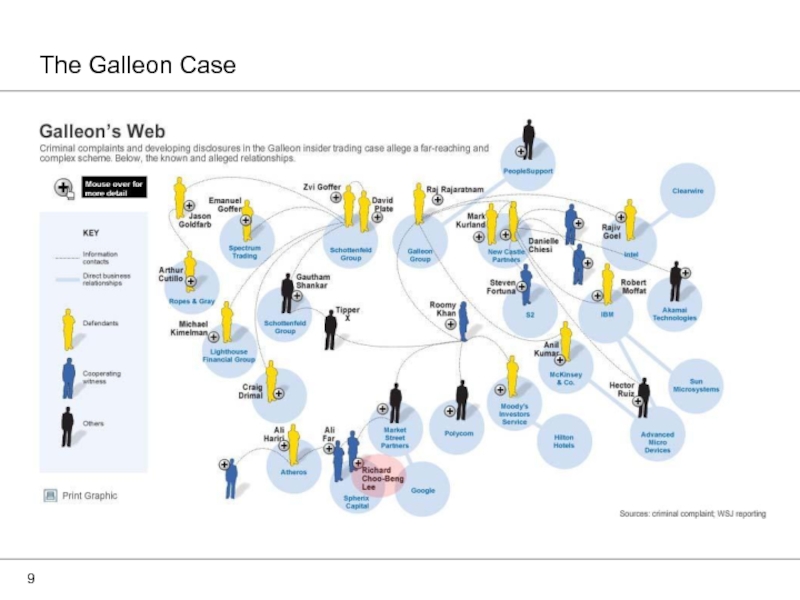

- 9. The Galleon Case

- 10. Securities Exchange Act § 10(b) SEC Rule

- 11. United States v. O’Hagan, 521 U.S. 642

- 12. United States v. O’Hagan, 521 U.S. 642

- 13. United States v. O’Hagan, 521 U.S. 642

- 14. Tipping If a corporate insider or misappropriator

- 15. Application to typical recent hedge fund

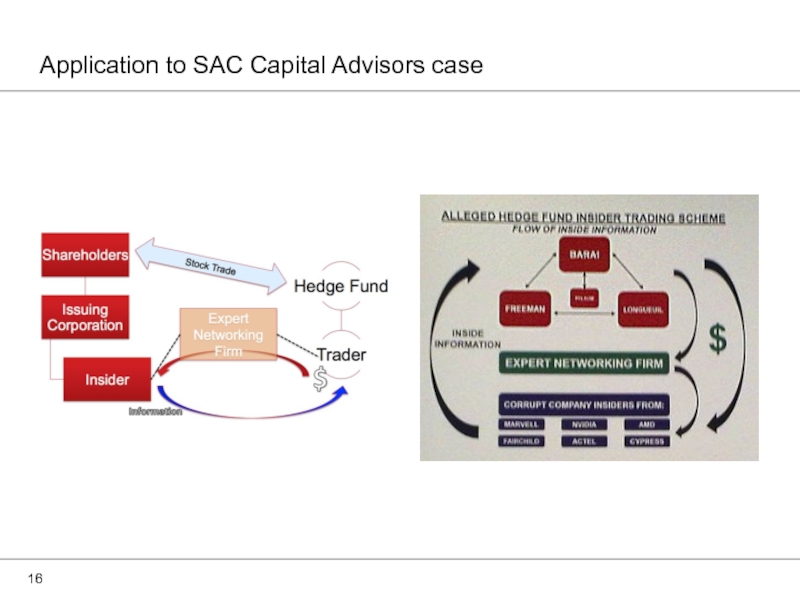

- 16. Application to SAC Capital Advisors case

- 17. Application to typical recent hedge fund case

- 18. Definition Examples Information is material if there

- 19. Mosaic Theory Application in Raj Rajaratnam’s (Galleon)

- 20. Tipping chain liability: Can government prove

- 21. The tippee must know that the tipper

- 22. For more information Insider Trading Law and

Слайд 1May 15, 2014

USA Insider Trading Law: Recent Developments

Stephen Bainbridge

UCLA School of

Слайд 6Market surveillance techniques:

The SEC and all of the major markets have

FINRA: An “artificial intelligence” surveillance application -- the Securities Observation, News Analysis and Regulation (SONAR) system -- to detect suspicious patterns. Regardless, insider trading enforcement remains difficult.

The SEC receives roughly 700,000 tips per year from informants:

The SEC can pay bounties to informants.

US Attorneys can get wiretaps, confidential informants, and other criminal investigation techniques.

Detecting Insider Trading

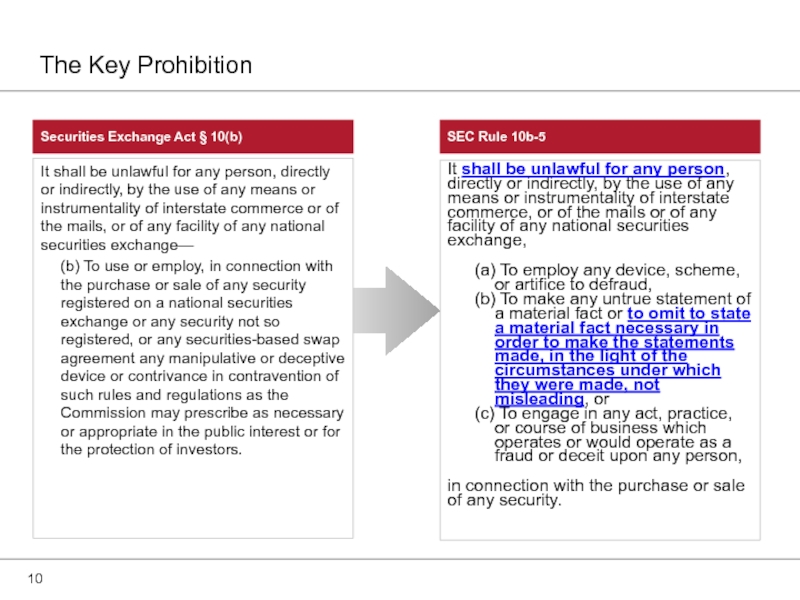

Слайд 10Securities Exchange Act § 10(b)

SEC Rule 10b-5

It shall be unlawful for

(b) To use or employ, in connection with the purchase or sale of any security registered on a national securities exchange or any security not so registered, or any securities-based swap agreement any manipulative or deceptive device or contrivance in contravention of such rules and regulations as the Commission may prescribe as necessary or appropriate in the public interest or for the protection of investors.

It shall be unlawful for any person, directly or indirectly, by the use of any means or instrumentality of interstate commerce, or of the mails or of any facility of any national securities exchange,

(a) To employ any device, scheme, or artifice to defraud,

(b) To make any untrue statement of a material fact or to omit to state a material fact necessary in order to make the statements made, in the light of the circumstances under which they were made, not misleading, or

(c) To engage in any act, practice, or course of business which operates or would operate as a fraud or deceit upon any person,

in connection with the purchase or sale of any security.

The Key Prohibition

Слайд 11United States v. O’Hagan, 521 U.S. 642 (1997)

Under the “traditional” or

Trading on such information qualifies as a “deceptive device” under § 10(b), we have affirmed, because “a relationship of trust and confidence [exists] between the shareholders of a corporation and those insiders who have obtained confidential information by reason of their position with that corporation.” Chiarella v. United States, 445 U.S. 222, 228 (1980).

That relationship, we recognized, “gives rise to a duty to disclose [or to abstain from trading] because of the ‘necessity of preventing a corporate insider from ... taking unfair advantage of ... uninformed ... stockholders.’ “ Id., at 228-229 (citation omitted). The classical theory applies not only to officers, directors, and other permanent insiders of a corporation, but also to attorneys, accountants, consultants, and others who temporarily become fiduciaries of a corporation.

Rule 10b-5: Disclose or Abstain Theory of Liability

Слайд 12United States v. O’Hagan, 521 U.S. 642 (1997)

The “misappropriation theory” holds

Under this theory, a fiduciary’s undisclosed, self‑serving use of a principal’s information to purchase or sell securities, in breach of a duty of loyalty and confidentiality, defrauds the principal of the exclusive use of that information.

In lieu of premising liability on a fiduciary relationship between company insider and purchaser or seller of the company’s stock, the misappropriation theory premises liability on a fiduciary‑turned‑trader’s deception of those who entrusted him with access to confidential information.

Rule 10b-5: Misappropriation Theory of Liability

Слайд 13United States v. O’Hagan, 521 U.S. 642 (1997)

The two theories are

The classical theory targets a corporate insider’s breach of duty to shareholders with whom the insider transacts; the misappropriation theory outlaws trading on the basis of nonpublic information by a corporate “outsider” in breach of a duty owed not to a trading party, but to the source of the information.

The misappropriation theory is thus designed to “protect the integrity of the securities markets against abuses by ‘outsiders’ to a corporation who have access to confidential information that will affect the corporation’s security price when revealed, but who owe no fiduciary or other duty to that corporation’s shareholders.”

Rule 10b-5: Relationship

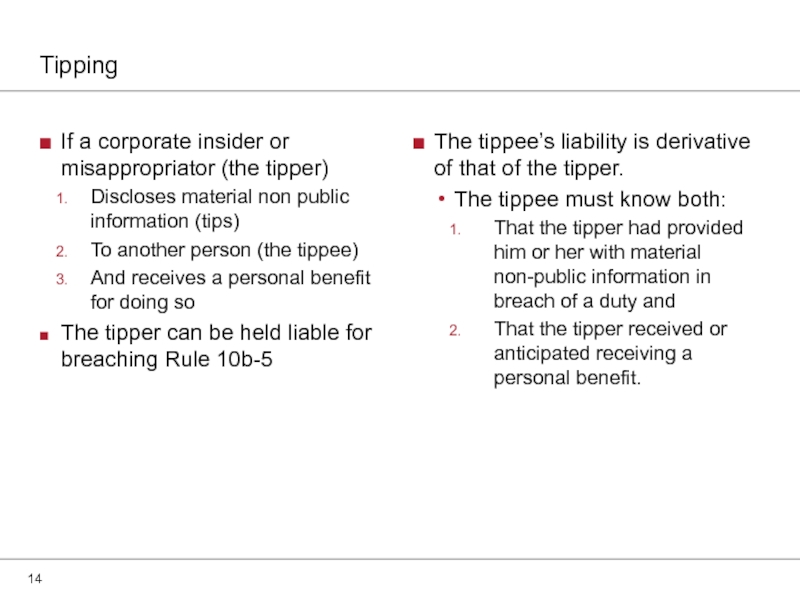

Слайд 14Tipping

If a corporate insider or misappropriator (the tipper)

Discloses material non public

To another person (the tippee)

And receives a personal benefit for doing so

The tipper can be held liable for breaching Rule 10b-5

The tippee’s liability is derivative of that of the tipper.

The tippee must know both:

That the tipper had provided him or her with material non-public information in breach of a duty and

That the tipper received or anticipated receiving a personal benefit.

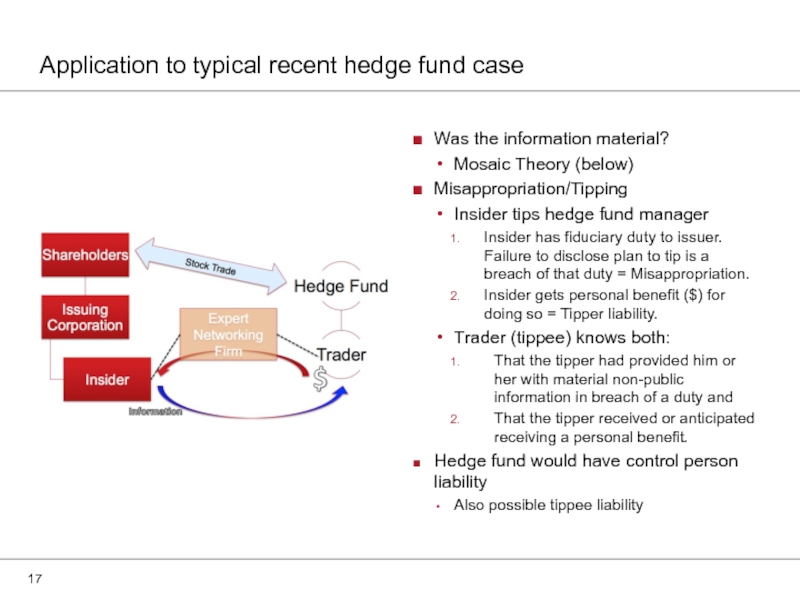

Слайд 17Application to typical recent hedge fund case

Was the information material?

Mosaic Theory

Misappropriation/Tipping

Insider tips hedge fund manager

Insider has fiduciary duty to issuer. Failure to disclose plan to tip is a breach of that duty = Misappropriation.

Insider gets personal benefit ($) for doing so = Tipper liability.

Trader (tippee) knows both:

That the tipper had provided him or her with material non-public information in breach of a duty and

That the tipper received or anticipated receiving a personal benefit.

Hedge fund would have control person liability

Also possible tippee liability

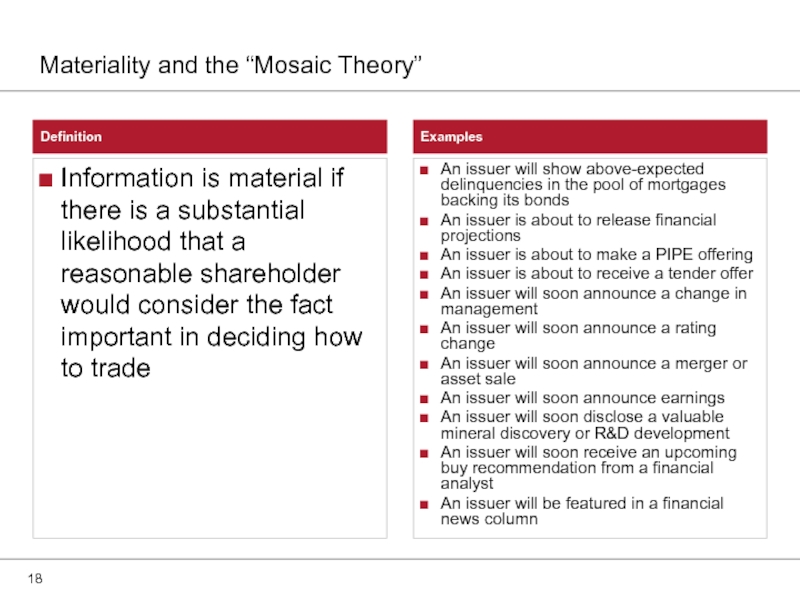

Слайд 18Definition

Examples

Information is material if there is a substantial likelihood that a

An issuer will show above-expected delinquencies in the pool of mortgages backing its bonds

An issuer is about to release financial projections

An issuer is about to make a PIPE offering

An issuer is about to receive a tender offer

An issuer will soon announce a change in management

An issuer will soon announce a rating change

An issuer will soon announce a merger or asset sale

An issuer will soon announce earnings

An issuer will soon disclose a valuable mineral discovery or R&D development

An issuer will soon receive an upcoming buy recommendation from a financial analyst

An issuer will be featured in a financial news column

Materiality and the “Mosaic Theory”

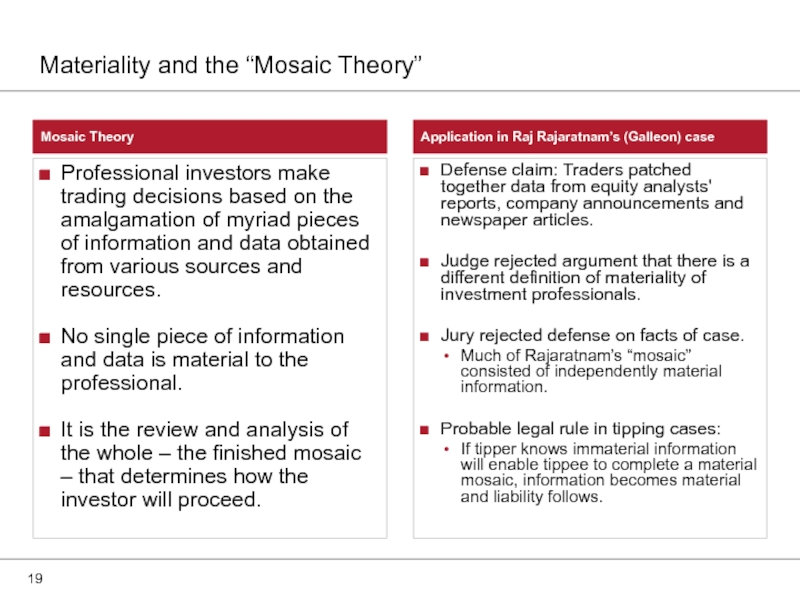

Слайд 19Mosaic Theory

Application in Raj Rajaratnam’s (Galleon) case

Professional investors make trading decisions

No single piece of information and data is material to the professional.

It is the review and analysis of the whole – the finished mosaic – that determines how the investor will proceed.

Defense claim: Traders patched together data from equity analysts' reports, company announcements and newspaper articles.

Judge rejected argument that there is a different definition of materiality of investment professionals.

Jury rejected defense on facts of case.

Much of Rajaratnam’s “mosaic” consisted of independently material information.

Probable legal rule in tipping cases:

If tipper knows immaterial information will enable tippee to complete a material mosaic, information becomes material and liability follows.

Materiality and the “Mosaic Theory”

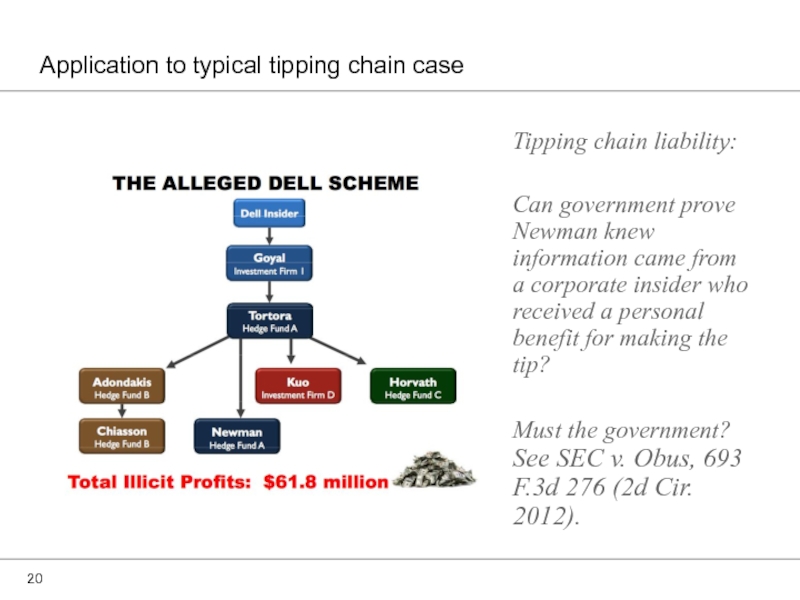

Слайд 20Tipping chain liability:

Can government prove Newman knew information came from a

Must the government? See SEC v. Obus, 693 F.3d 276 (2d Cir. 2012).

Application to typical tipping chain case

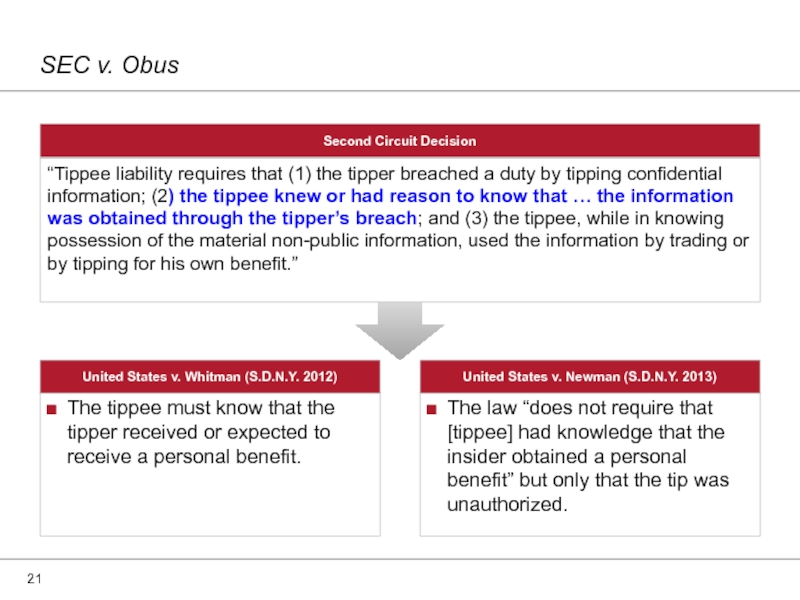

Слайд 21The tippee must know that the tipper received or expected to

The law “does not require that [tippee] had knowledge that the insider obtained a personal benefit” but only that the tip was unauthorized.

“Tippee liability requires that (1) the tipper breached a duty by tipping confidential information; (2) the tippee knew or had reason to know that … the information was obtained through the tipper’s breach; and (3) the tippee, while in knowing possession of the material non-public information, used the information by trading or by tipping for his own benefit.”

Second Circuit Decision

United States v. Whitman (S.D.N.Y. 2012)

United States v. Newman (S.D.N.Y. 2013)

SEC v. Obus

Слайд 22For more information

Insider Trading Law and Policy (Foundation Press Concepts and

Stephen M. Bainbridge