MBA

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Tax Law in the Philippines презентация

Содержание

- 1. Tax Law in the Philippines

- 2. Objectives Identify the purpose of enacting a

- 3. Objective of enacting tax law The primary

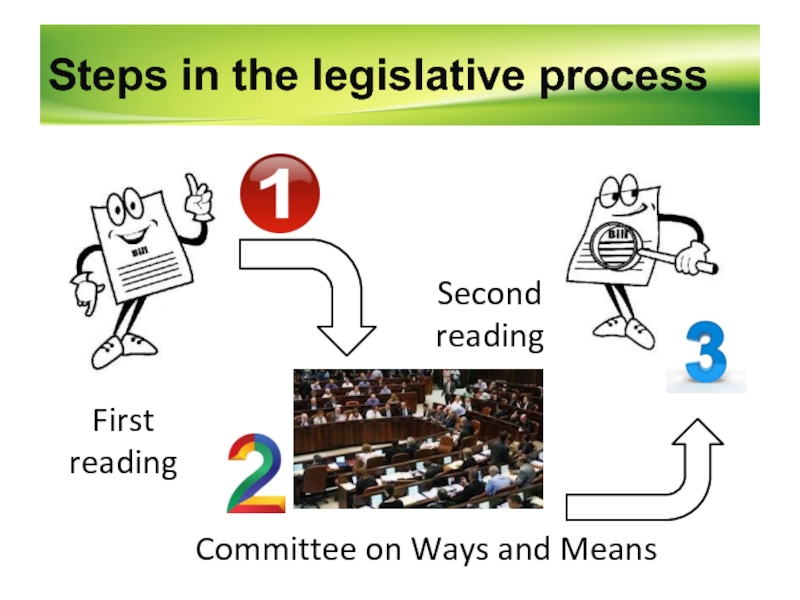

- 4. Steps in the legislative process First reading

- 5. Steps in the legislative process Public hearing Difference Senate 2nd reading

- 6. Steps in the legislative process Bicameral Reconciliation

- 7. Sources of tax law Constitution Statutory enactments Administrative rulings and regulations Judicial decisions

- 8. Sources of tax law Constitution The power

- 9. Sources of tax law Administrative rulings Administrative

- 10. Sources of tax law Administrative regulations These

- 11. Sources of tax law Judicial decisions These

- 12. Interpretation of tax laws Always in favor

Слайд 2Objectives

Identify the purpose of enacting a tax law.

Illustrate the steps in

the legislative process.

Explain the sources of tax laws.

Discuss the instances when taxation favors the government and strictly against the taxpayer.

Explain the sources of tax laws.

Discuss the instances when taxation favors the government and strictly against the taxpayer.

Слайд 3Objective of enacting tax law

The primary objective of the government in

enacting a tax law is to raise revenues for government operations.

Слайд 6Steps in the legislative process

Bicameral

Reconciliation

Senate 3rd reading

Senate approval

Tax law

Слайд 7Sources of tax law

Constitution

Statutory enactments

Administrative rulings and regulations

Judicial decisions

Слайд 8Sources of tax law

Constitution

The power of taxation is merely regulated by

the Constitution.

Taxation can be exercised even without the Constitution.

Statutory enactments

Tax laws passed by the Congress.

National Internal Revenue Code (NIRC).

Taxation can be exercised even without the Constitution.

Statutory enactments

Tax laws passed by the Congress.

National Internal Revenue Code (NIRC).

Слайд 9Sources of tax law

Administrative rulings

Administrative rulings refers to less general interpretation

of tax laws issued on a timely basis by the Commissioner of the Bureau of Internal Revenue (BIR).

Issued by request of the taxpayer to clarify certain provisions of a tax law.

BIR Rulings.

Issued by request of the taxpayer to clarify certain provisions of a tax law.

BIR Rulings.

Слайд 10Sources of tax law

Administrative regulations

These are intended to clarify or explain

the law and carry into effect its general provisions by providing details of administration and procedure.

Issued by the Secretary of Finance upon the recommendation of the Commissioner of the BIR.

Revenue Regulations.

Issued by the Secretary of Finance upon the recommendation of the Commissioner of the BIR.

Revenue Regulations.

Слайд 11Sources of tax law

Judicial decisions

These refers to the decisions of the

Court of Tax appeals and the Supreme Court applying or interpreting tax laws.

Part of the jurisprudence on taxation and the legal system of the Philippines.

Appealable to the Supreme Court.

Part of the jurisprudence on taxation and the legal system of the Philippines.

Appealable to the Supreme Court.

Слайд 12Interpretation of tax laws

Always in favor of the taxpayer and against

the government except:

When the statutes granting exemptions provides for liberal construction thereof;

Exemptions in favor of the government, political subdivisions or instrumentalities;

Exemptions in favor of exemptees traditionally exempt such as churches and educational institution; and

Special circumstances of persons such as the granting of exemptions to victims of calamities.

When the statutes granting exemptions provides for liberal construction thereof;

Exemptions in favor of the government, political subdivisions or instrumentalities;

Exemptions in favor of exemptees traditionally exempt such as churches and educational institution; and

Special circumstances of persons such as the granting of exemptions to victims of calamities.