- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

BY ROBERT J. LONGSTREET, ATTORNEY AT LAW презентация

Содержание

- 1. BY ROBERT J. LONGSTREET, ATTORNEY AT LAW

- 2. MEDICAID VS. MEDICARE MEDICAID IS A LARGE

- 3. MEDICAID In Michigan, Medicaid implemented by county

- 4. MEDICAID DOES PAY FOR LONG TERM NURSING

- 5. WHY DO WE CARE ABOUT MEDICAID ELIBILITY?

- 6. MEDICAID QUALIFICATION REQUIREMENTS Must be 65 years

- 7. AND IF YOU QUALIFY… The nursing home

- 8. THIS SOUNDS HORRIBLE!!!!

- 9. SOME GOOD NEWS NOT ALL ASSETS ARE

- 10. HOMESTEAD EXEMPTION

- 11. OF ANY VALUE ONE AUTOMOBILE

- 12. PERSONAL PROPERTY CLOTHING JEWELRY HOME APPLIANCES FURNITURE

- 13. PRE-PAID FUNERAL CONTRACTS MUST BE IRREVOCABLE FOR

- 14. EVERYTHING ELSE IS A “COUNTABLE ASSET”

- 15. VALUING COUNTABLE ASSETS Joint Assets Joint

- 16. Valuing Countable Assets Retirement Funds and Annuities

- 17. EXTRA EXEMPTION FOR “COMMUNITY” SPOUSE OF REMAINING

- 18. EXAMPLE: Mr. Brown is entering a long

- 19. IF MR. BROWN APPLIED FOR MEDICAID: MR.

- 20. WHAT ABOUT INCOME? MR. BROWN GETS TO

- 21. WHAT ABOUT THE REMAINING $80,000 THE BROWNS OWN?

- 22. WHAT ABOUT THE REMAINING $80,000 THE BROWNS

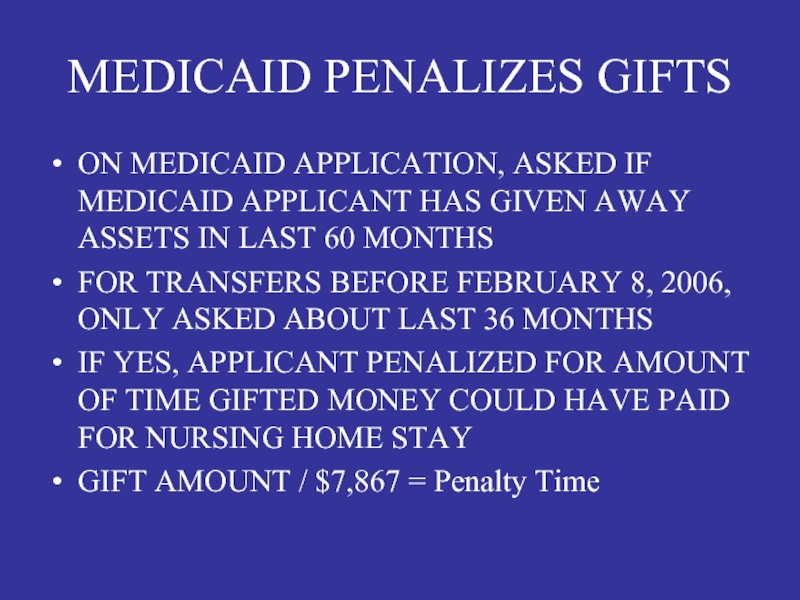

- 23. MEDICAID PENALIZES GIFTS ON MEDICAID APPLICATION, ASKED

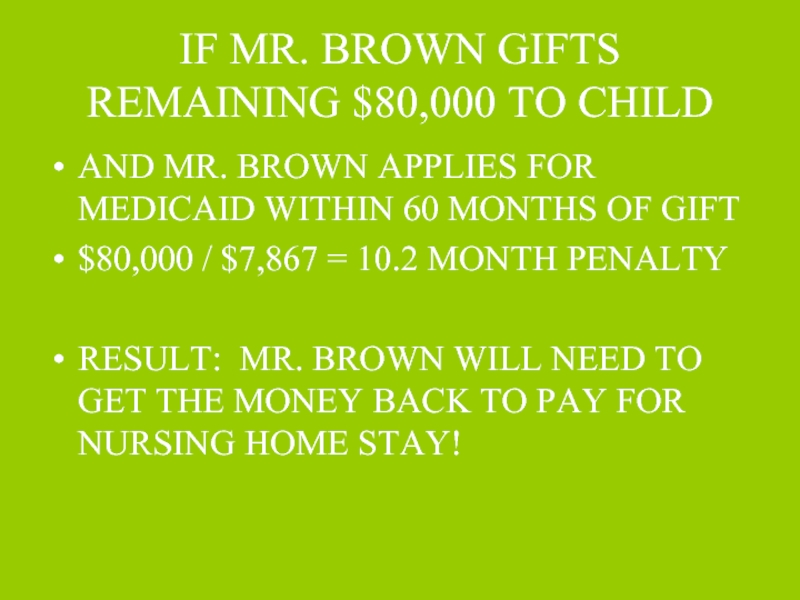

- 24. IF MR. BROWN GIFTS REMAINING $80,000 TO

- 25. SO WHAT IS LEFT FOR CLIENTS TO

- 26. FOR A SINGLE CLIENT “HALF-A-LOAF” METHOD GIFT

- 27. FOR MARRIED CLIENT TAKE ADVANTAGE OF FULL

- 28. AS A REVIEW… REMEMBER MR. AND MRS. BROWN?

- 29. EXAMPLE: Mr. Brown is entering a long

- 30. Mr. Brown is Medicaid Eligible MR. BROWN

- 31. MRS. BROWN HOUSE, CAR, PRE-PAID FUNERAL AND

- 32. POST PLANNING IS KEY FOR MRS. BROWN…

- 33. Estate Recovery Only applies to: Persons on

- 34. Estate Recovery Normally talking about the house,

- 35. Estate Recovery Every state is different. 2007

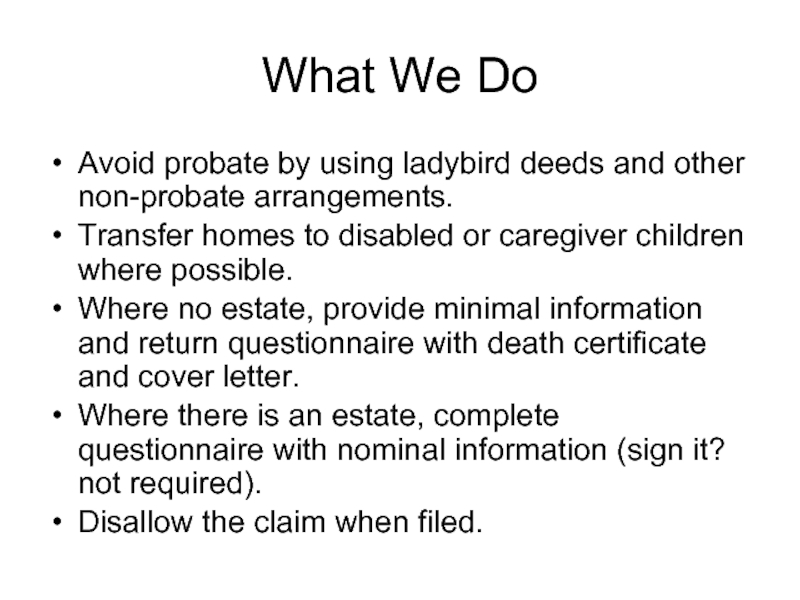

- 36. What We Do Avoid probate by using

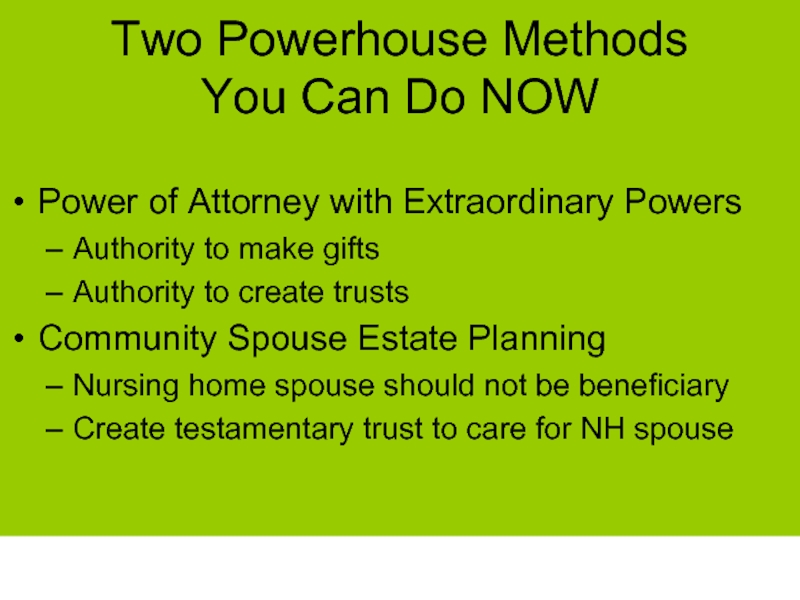

- 37. Two Powerhouse Methods You Can Do NOW

- 38. IF YOU HAVE A NURSING HOME ISSUE….

Слайд 2MEDICAID VS. MEDICARE

MEDICAID IS A LARGE GOVERNMENT HEALTH INSURANCE PROGRAM

DIFFERENT FROM

COOPERATIVE FEDERAL & STATE PROGRAM

FEDERAL LAW PROVIDES BROAD PARAMETERS, STATE PROVIDES SPECIFIC RULES AND ADMINISTERS ELIGIBILITY

Слайд 3MEDICAID

In Michigan, Medicaid implemented by county DHS (Department of Human Services)

Many Medicaid Programs for various populations.

Medicaid Long Term Care Programs:

Nursing Home (NH) Medicaid

MI Choice Waiver

Слайд 4MEDICAID DOES PAY FOR LONG TERM NURSING HOME STAYS FOR SENIORS

BUT MEDICAID IS ‘MEANS TESTED’, MEANING THE STATE WILL LOOK AT ASSETS AND INCOME

(FOUR TESTS TO PASS… WE’LL DISCUSS IN A FEW MINUTES)

Слайд 5WHY DO WE CARE ABOUT MEDICAID ELIBILITY?

0ver 6,000 people turn 65

The average cost in 2014 for 1 month in a nursing home in the State of Michigan?

$7,867.00

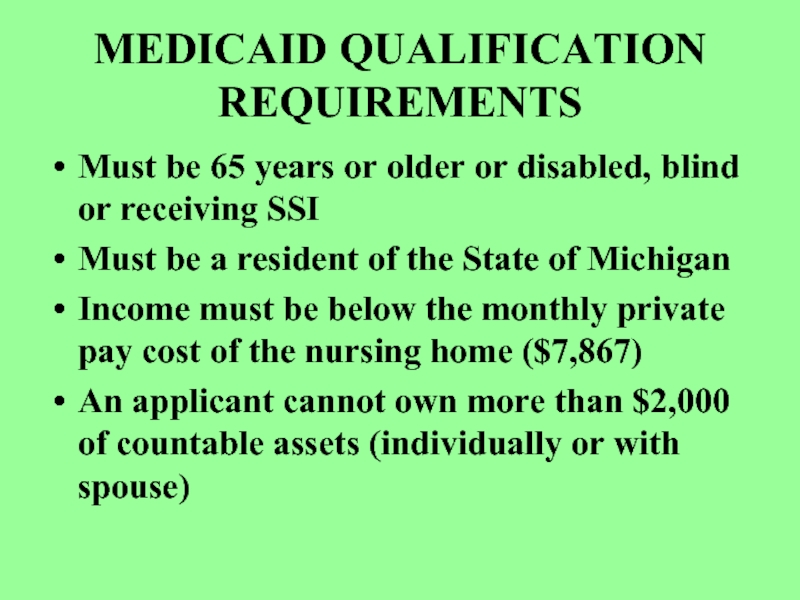

Слайд 6MEDICAID QUALIFICATION REQUIREMENTS

Must be 65 years or older or disabled, blind

Must be a resident of the State of Michigan

Income must be below the monthly private pay cost of the nursing home ($7,867)

An applicant cannot own more than $2,000 of countable assets (individually or with spouse)

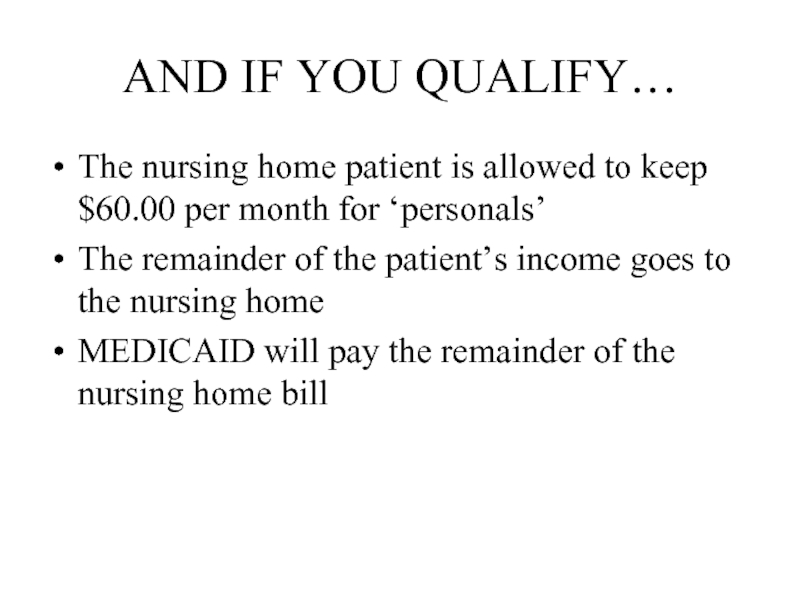

Слайд 7AND IF YOU QUALIFY…

The nursing home patient is allowed to keep

The remainder of the patient’s income goes to the nursing home

MEDICAID will pay the remainder of the nursing home bill

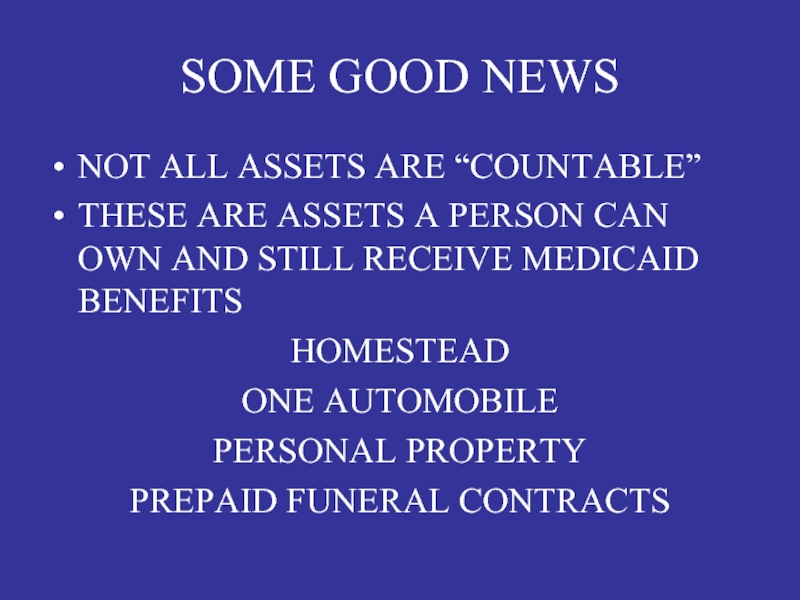

Слайд 9SOME GOOD NEWS

NOT ALL ASSETS ARE “COUNTABLE”

THESE ARE ASSETS A PERSON

HOMESTEAD

ONE AUTOMOBILE

PERSONAL PROPERTY

PREPAID FUNERAL CONTRACTS

Слайд 10

HOMESTEAD EXEMPTION

HOMESTEAD INCLUDES HOME AND ANY CONTIGUOUS LAND

CAN BE SEPARATED BY

NEED NOT BE IN MICHIGAN

FOR A SINGLE PERSON: LESS THAN $536,000 IN EQUITY VALUE

NO VALUE CAP IF OCCUPIED BY SPOUSE, DISABLED CHILD, OR CHILD UNDER 21.

Слайд 13PRE-PAID FUNERAL

CONTRACTS

MUST BE IRREVOCABLE

FOR HUSBAND AND WIFE

CAN INCLUDE BURIAL PLOTS

FOR ENTIRE

Слайд 14EVERYTHING ELSE IS A “COUNTABLE ASSET”

CHECKING ACCOUNTS

SAVINGS ACCOUNTS

CERTIFICATE OF DEPOSITS

OTHER REAL

STOCKS, BONDS, ETC.

Слайд 15VALUING COUNTABLE ASSETS

Joint Assets

Joint with Spouse = All counts

Joint

For Bank Accounts = All counts unless demonstrate contribution

Real Estate, Stocks and Mutual Funds = valued in proportion to ownership

Слайд 16Valuing Countable Assets

Retirement Funds and Annuities

If the owner can make a

Annuity in pay status or pension that pay monthly benefit (with no right of withdrawal) in treated as income.

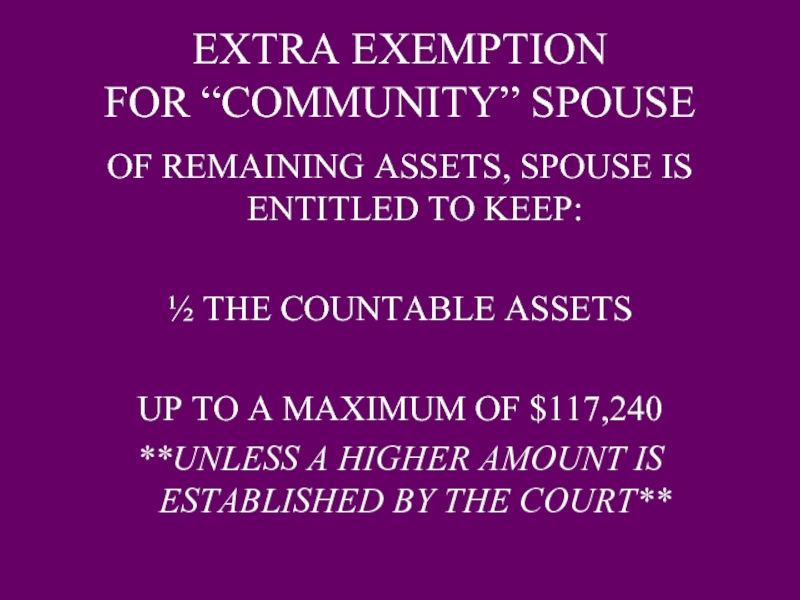

Слайд 17EXTRA EXEMPTION

FOR “COMMUNITY” SPOUSE

OF REMAINING ASSETS, SPOUSE IS ENTITLED TO KEEP:

½

UP TO A MAXIMUM OF $117,240

**UNLESS A HIGHER AMOUNT IS ESTABLISHED BY THE COURT**

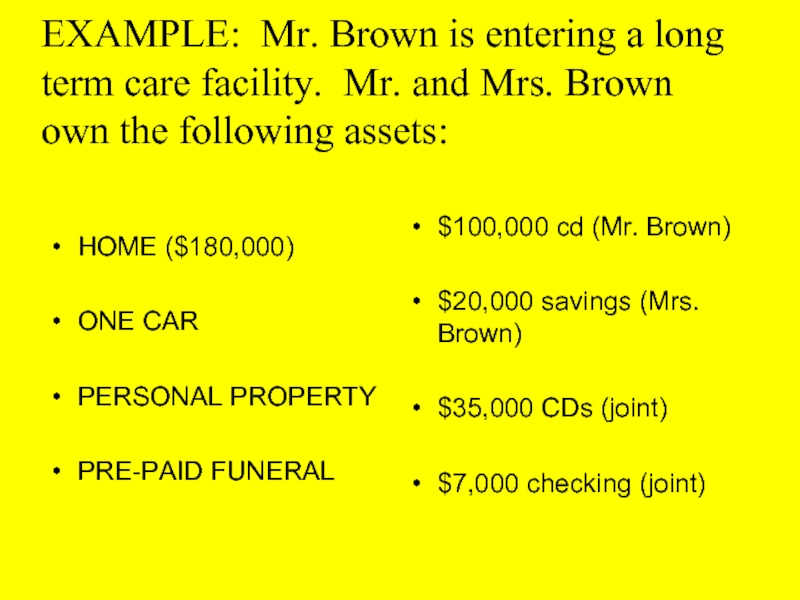

Слайд 18EXAMPLE: Mr. Brown is entering a long term care facility. Mr.

HOME ($180,000)

ONE CAR

PERSONAL PROPERTY

PRE-PAID FUNERAL

$100,000 cd (Mr. Brown)

$20,000 savings (Mrs. Brown)

$35,000 CDs (joint)

$7,000 checking (joint)

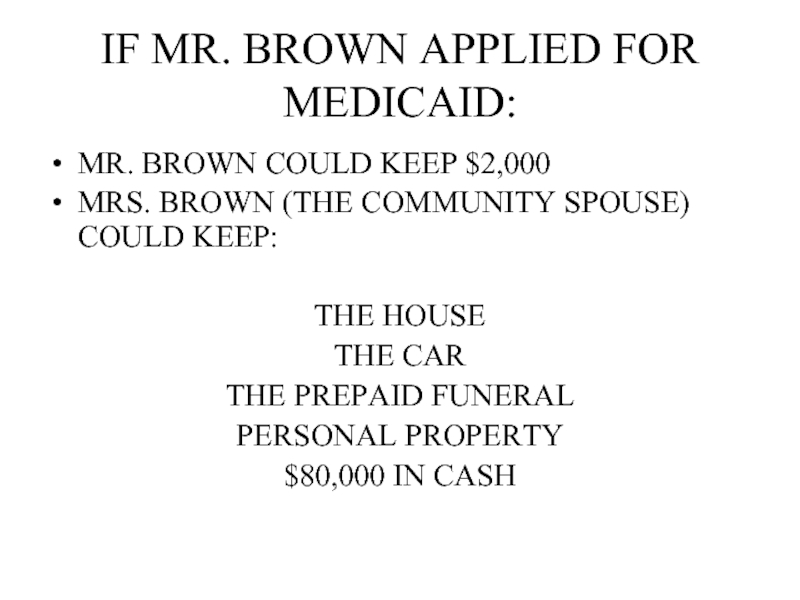

Слайд 19IF MR. BROWN APPLIED FOR MEDICAID:

MR. BROWN COULD KEEP $2,000

MRS. BROWN

THE HOUSE

THE CAR

THE PREPAID FUNERAL

PERSONAL PROPERTY

$80,000 IN CASH

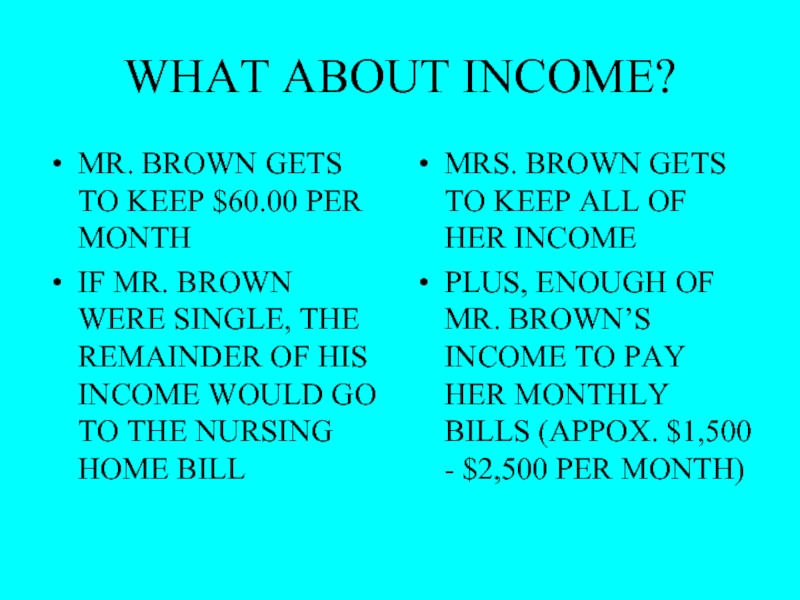

Слайд 20WHAT ABOUT INCOME?

MR. BROWN GETS TO KEEP $60.00 PER MONTH

IF

MRS. BROWN GETS TO KEEP ALL OF HER INCOME

PLUS, ENOUGH OF MR. BROWN’S INCOME TO PAY HER MONTHLY BILLS (APPOX. $1,500 - $2,500 PER MONTH)

Слайд 22WHAT ABOUT THE REMAINING $80,000 THE BROWNS OWN?

THEY COULD SPEND IT

OR THEY MIGHT BE TEMPTED TO GIFT THE MONEY TO RELATIVES…..

Слайд 23MEDICAID PENALIZES GIFTS

ON MEDICAID APPLICATION, ASKED IF MEDICAID APPLICANT HAS GIVEN

FOR TRANSFERS BEFORE FEBRUARY 8, 2006, ONLY ASKED ABOUT LAST 36 MONTHS

IF YES, APPLICANT PENALIZED FOR AMOUNT OF TIME GIFTED MONEY COULD HAVE PAID FOR NURSING HOME STAY

GIFT AMOUNT / $7,867 = Penalty Time

Слайд 24IF MR. BROWN GIFTS REMAINING $80,000 TO CHILD

AND MR. BROWN APPLIES

$80,000 / $7,867 = 10.2 MONTH PENALTY

RESULT: MR. BROWN WILL NEED TO GET THE MONEY BACK TO PAY FOR NURSING HOME STAY!

Слайд 25SO WHAT IS LEFT FOR CLIENTS TO DO?

FOR A SINGLE CLIENT

CONVERSION:

EX: Purchase a pre-paid funeral.

TRANSFER TO DISABLED CHILD:

A transfer to a *disabled individual* is not a “divestment.” **interestingly, MI does not distinguish between child and individual**

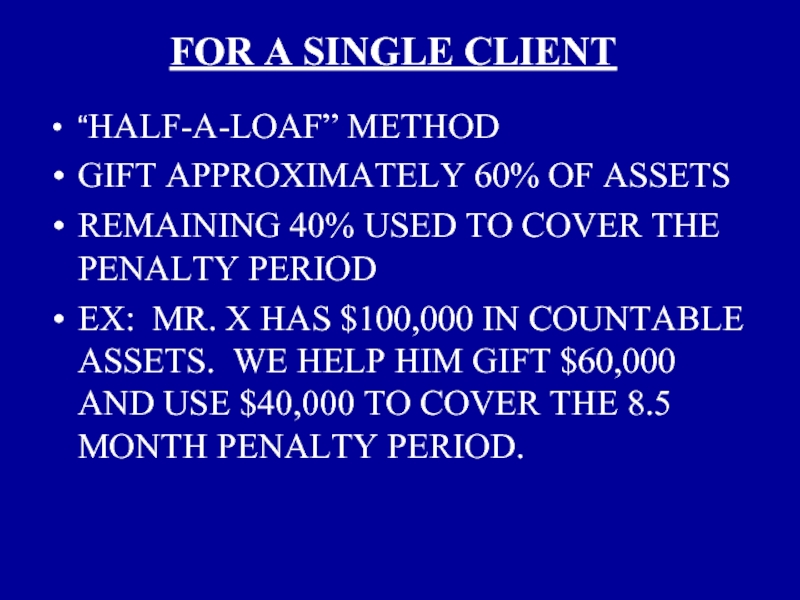

Слайд 26FOR A SINGLE CLIENT

“HALF-A-LOAF” METHOD

GIFT APPROXIMATELY 60% OF ASSETS

REMAINING 40% USED

EX: MR. X HAS $100,000 IN COUNTABLE ASSETS. WE HELP HIM GIFT $60,000 AND USE $40,000 TO COVER THE 8.5 MONTH PENALTY PERIOD.

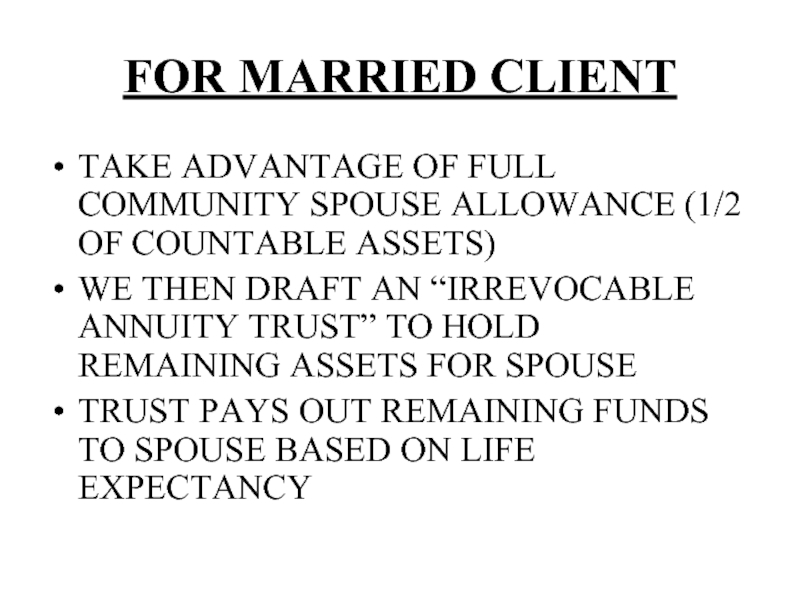

Слайд 27FOR MARRIED CLIENT

TAKE ADVANTAGE OF FULL COMMUNITY SPOUSE ALLOWANCE (1/2 OF

WE THEN DRAFT AN “IRREVOCABLE ANNUITY TRUST” TO HOLD REMAINING ASSETS FOR SPOUSE

TRUST PAYS OUT REMAINING FUNDS TO SPOUSE BASED ON LIFE EXPECTANCY

Слайд 29EXAMPLE: Mr. Brown is entering a long term care facility. Mr.

HOME ($180,000)

ONE CAR

PERSONAL PROPERTY

PRE-PAID FUNERAL

$100,000 cd (Mr. Brown)

$20,000 savings (Mrs. Brown)

$35,000 CDs (Jointly)

$7,000 checking (Jointly)

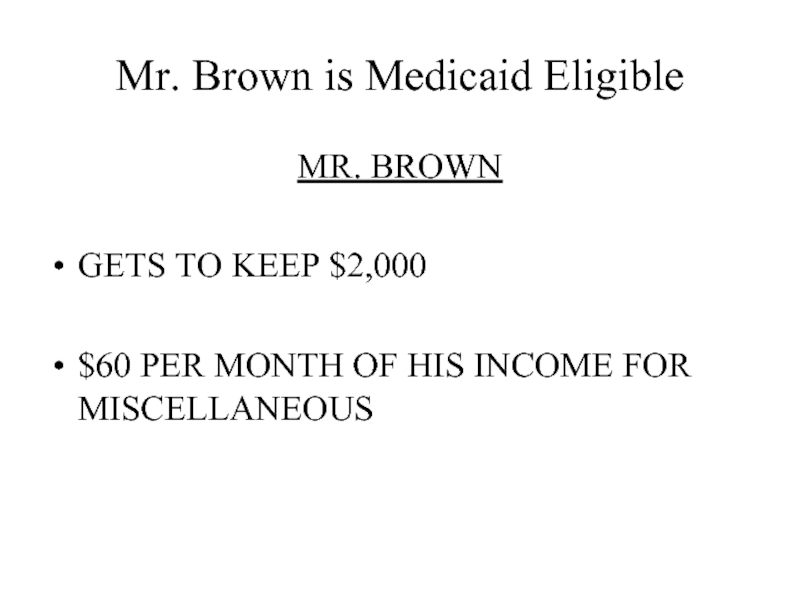

Слайд 30Mr. Brown is Medicaid Eligible

MR. BROWN

GETS TO KEEP $2,000

$60 PER

Слайд 31MRS. BROWN

HOUSE, CAR, PRE-PAID FUNERAL AND PERSONAL PROPERTY

COMMUNITY SPOUSE ALLOWANCE (1/2

REMAINING $80,000 IN IRREVOCABLE TRUST PAID TO HER ANNUITY STYLE

ALL OF HER INCOME, PLUS ENOUGH OF MR. BROWN’S INCOME TO PAY MONTHLY BILLS

Слайд 32POST PLANNING IS KEY FOR MRS. BROWN…

HER ESTATE PLAN NEEDS TO

Community Spouse Trust

Testamentary Trust

Слайд 33Estate Recovery

Only applies to:

Persons on Medicaid in Nursing Homes or receiving

MI Choice Waiver Services

Home Help

Home Health

PACE

Over the age of 55

Слайд 34Estate Recovery

Normally talking about the house, as that is typically the

Слайд 35Estate Recovery

Every state is different.

2007 Michigan law provides favorable exceptions:

Only applies

Exclude 50% of average value of home in the county.

Spouse or disabled child residing in home delays implementation.

Caregiver relative residing in home delays implementation.

Слайд 36What We Do

Avoid probate by using ladybird deeds and other non-probate

Transfer homes to disabled or caregiver children where possible.

Where no estate, provide minimal information and return questionnaire with death certificate and cover letter.

Where there is an estate, complete questionnaire with nominal information (sign it? not required).

Disallow the claim when filed.

Слайд 37Two Powerhouse Methods

You Can Do NOW

Power of Attorney with Extraordinary Powers

Authority

Authority to create trusts

Community Spouse Estate Planning

Nursing home spouse should not be beneficiary

Create testamentary trust to care for NH spouse

Слайд 38IF YOU HAVE A NURSING HOME ISSUE….

ROBERT J. LONGSTREET

GEE & LONGSTREET,

269-945-3495

607 N. BROADWAY

HASTINGS

rlongstreet@geelongstreetlaw.com

www.longstreetlegalservices.com

LongstreetElderLaw.com

(269) 945-3495